Last updated on September 25th, 2025 at 05:08 am

Flood and Wind Insurance for Coastal Homeowners is more than just an extra expense—it’s a necessity for anyone living near the water or in hurricane-prone regions. While most inland homeowners never worry about separate policies for wind or flood, those of us on the Mississippi Gulf Coast know that lenders, insurers, and FEMA maps make these coverages unavoidable. Understanding how these policies work, what they cover, and how FEMA’s Risk Rating 2.0 impacts premiums can save you money, protect your home, and help you avoid unpleasant surprises when buying or selling property.

How Do I Know if Wind Hazard or Flood Insurance Is Required?

Flood: Listings sometimes show “flood insurance required” or simply check a box “subject to survey.” In practice, the listing agent (or your lender) will pull the FEMA flood map. If any portion of the lot is in AE or VE (velocity) zones, lenders require flood insurance. Even a tiny corner counts. (Replace the placeholder link with your preferred FEMA map link: FEMA Flood Map Service Center.)

Wind: Wind requirements aren’t dictated by a federal map. Along the Mississippi Gulf Coast, standard homeowners policies usually exclude wind, so you’ll need a separate wind & hail policy (or a homeowners policy that includes it, when available). Underwriting rules vary by carrier and distance from the shoreline—your local broker will know who’s writing.

Do All Insurance Companies Offer Wind, Hail, and Flood Insurance?

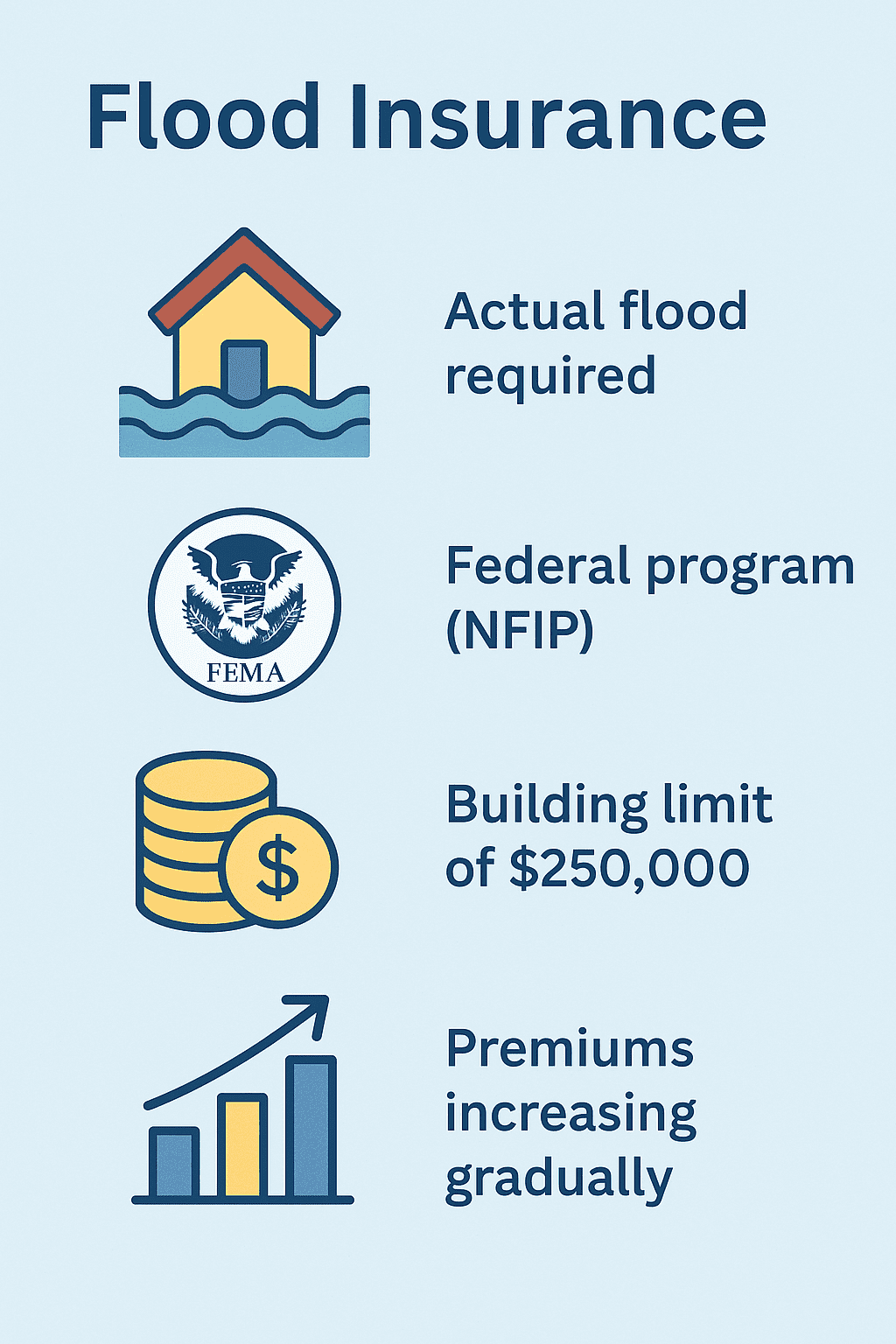

No. Flood insurance is a separate purchase. FEMA provides it through the National Flood Insurance Program (NFIP), and some private carriers write their own flood policies.

https://msplans.comFor wind & hail, many national brands (e.g., USAA, Farmers, sometimes State Farm in certain coastal ZIP codes) exclude wind on the coast. That’s where a local independent broker is invaluable. If private carriers won’t write it, Mississippi’s state wind pool—the Mississippi Windstorm Underwriting Association (MWUA)—acts as an insurer of last resort for the six coastal counties (Hancock, Harrison, Jackson, Pearl River, Stone, George). Flood and Wind Insurance for Coastal Homeowners.

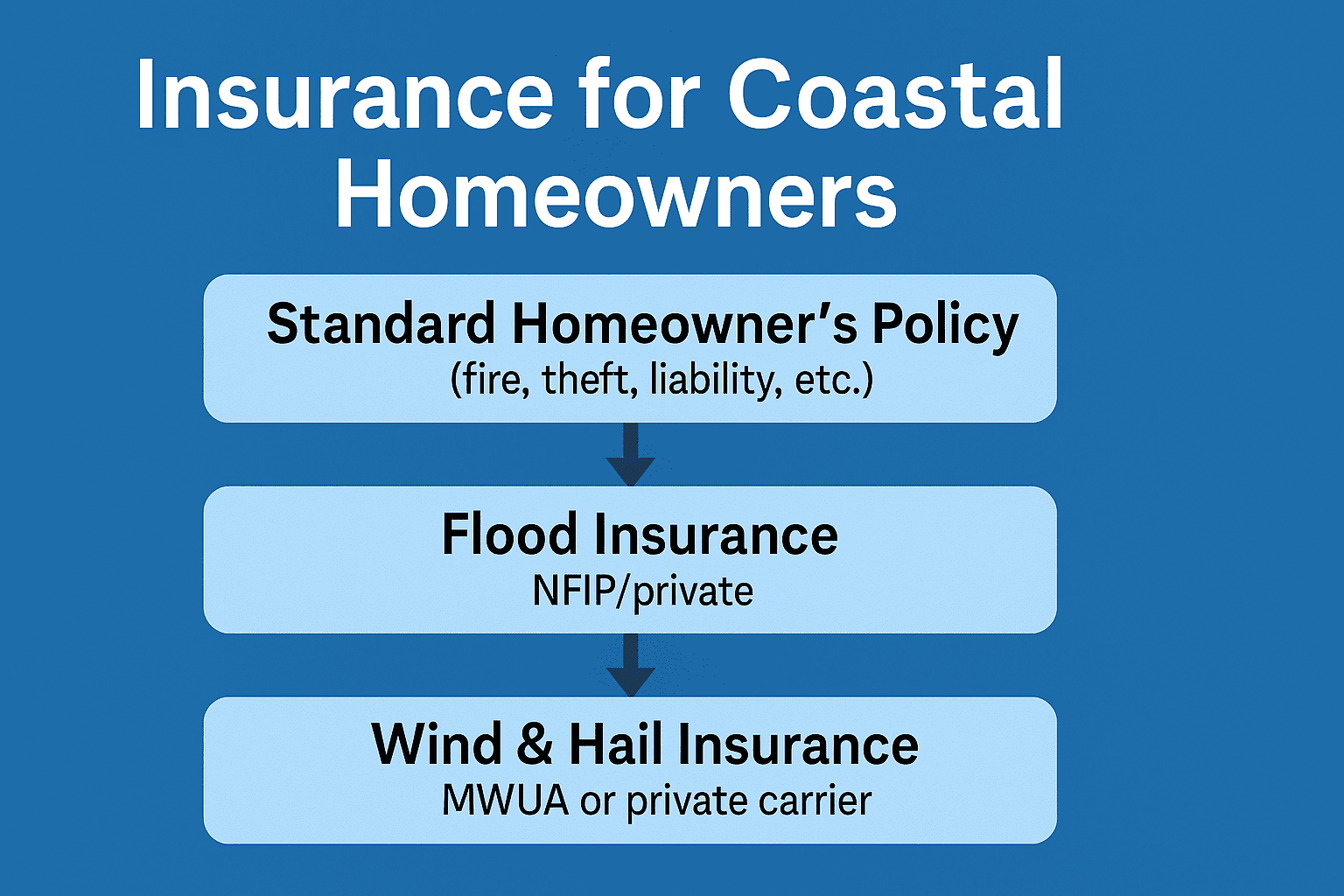

Typical stack for coastal owners:

- Standard homeowners policy (fire/theft/liability).

- Separate wind & hail (private carrier or MWUA).

- Flood insurance (NFIP or private).

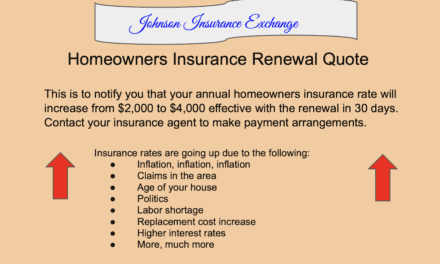

Read this article about insurance rates.

Don’t Rely on Others to Keep Your Policies Current

I’ve seen policies lapse because an escrow didn’t pay on time, an agent didn’t transmit the invoice, or an address was wrong. Track your renewal dates, broker contact, and (if escrowed) confirm payments posted. If a storm is named and within a defined distance of the coast, carriers often stop binding new policies until after landfall—sometimes for up to 10 days. Don’t get caught uncovered.

Flood Insurance (NFIP & Private)

- What it covers: “True flood”—rising surface water from storm surge, rivers, lakes, levee/dam failures. Not burst pipes or roof leaks (homeowners/wind policies handle those).

- Who needs it: Lenders require it for AE or VE zones. In Zone X it’s optional but may still be smart if you’re near water.

- NFIP limits: Generally up to $250,000 for the building and $100,000 for contents (primary residences). High-value homes often supplement with private or excess flood.

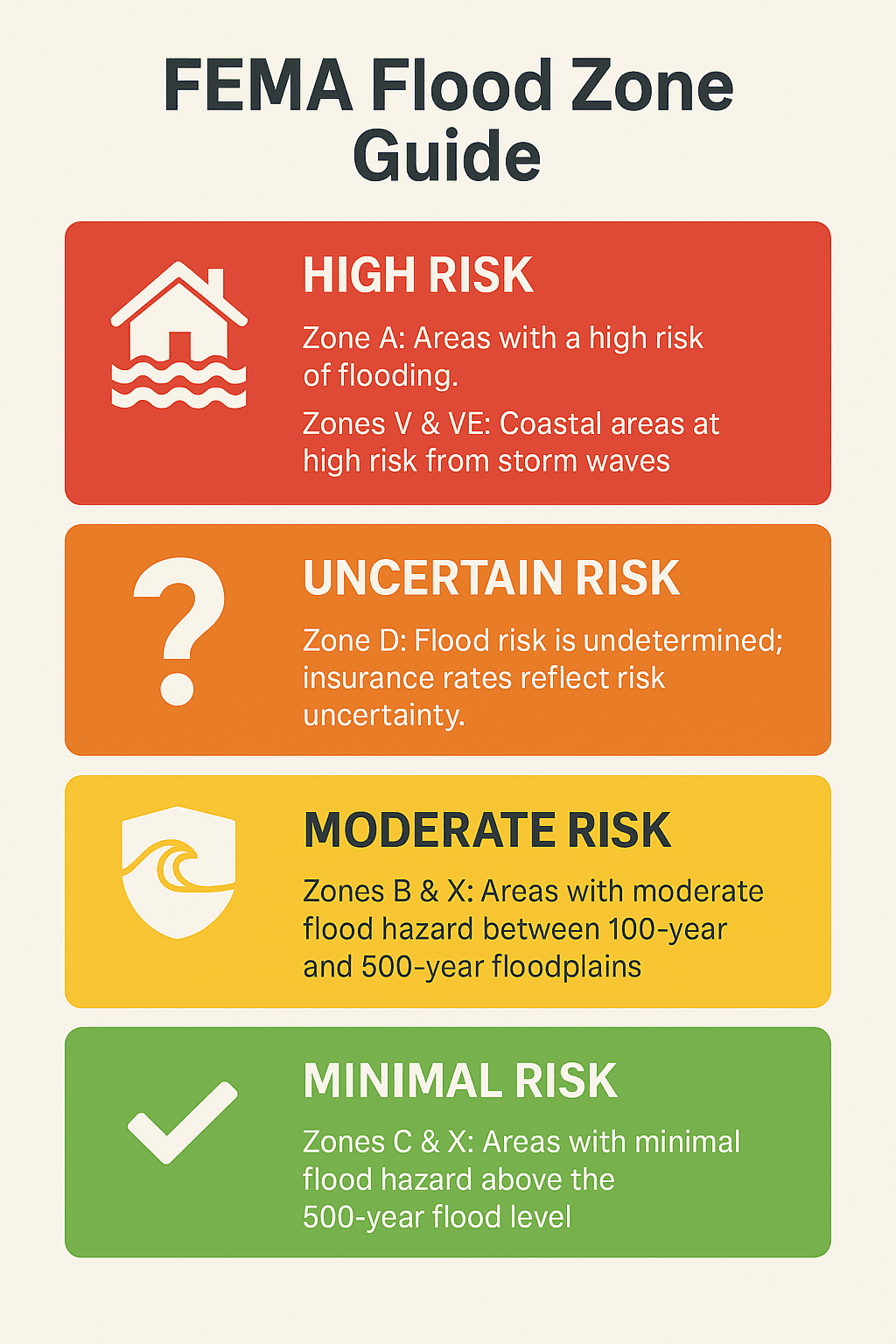

FEMA Flood Zones (Quick Read)

- Zone X: Minimal risk; lenders don’t require flood.

- Zone AE: Higher risk; insurance required; elevation standards for new builds.

- Zone VE: Coastal wave action/velocity zones—highest risk, highest premiums.

Elevation relative to Base Flood Elevation (BFE) drives pricing. A few feet above BFE can slash the premium; a few feet below can make it painful.

Risk Rating 2.0 (NFIP 2022+): What Changed and Why It Matters

Starting in late 2021 and fully effective in 2022, NFIP moved to Risk Rating 2.0, which prices individual property risk(distance to water, elevation, foundation type, replacement cost, etc.) instead of broad zone averages.

- Grandfathering largely ended; assumptions are limited.

- Premiums are phased in: annual increases are capped by law (generally up to 18% per year for most properties; some categories up to 25%).

- Check your declarations page: it often lists your eventual “full-risk” premium—the number you’ll reach over several renewals. For many coastal homes, it’s thousands per year.

Congress routinely extends the NFIP, but steady increases are the norm. Budget for them.

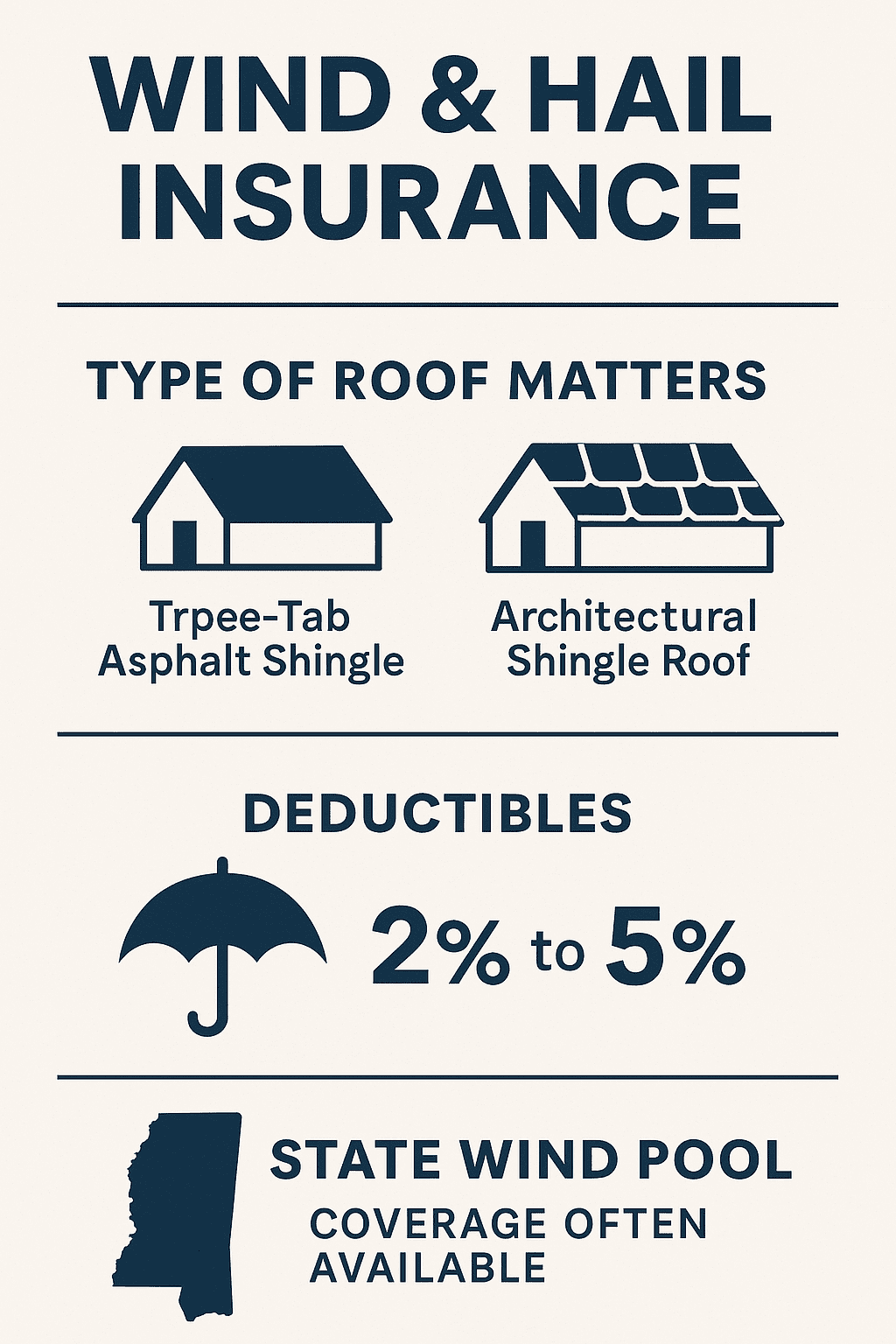

Wind & Hail Insurance (Private or MWUA)

After Katrina, most standard policies on the coast excluded wind. You’ll either buy a separate wind & hail policy or find a homeowners policy that includes it (less common).

- Roof age & type matter: Roofs >15 years can raise premiums/deductibles. Architectural shingles or metal roofswith higher wind ratings usually price better than 3-tab shingles.

- Carrier capacity: Insurers cap exposure by county/ZIP. When they hit limits, they pause new business—another reason to use a broker who tracks openings.

- Check our article abbot replacing roofs if you live in a wind area

FEMA Flood Zones

| Flood Zone | Description |

|---|---|

| Zone A | Areas with a high risk of flooding. In NFIP-participating communities, homeowners and businesses with federally backed mortgages must purchase flood insurance. |

| Zones V & VE | High-risk coastal areas with added hazard from storm waves. These zones have a 26% chance of flooding during a 30-year mortgage. Flood insurance is mandatory for federally backed mortgages in NFIP communities. |

| Zone D | Areas where flood risk has not been determined and no flood hazard analysis has been conducted. Flood insurance rates reflect the uncertainty of the risk. |

| Zones B & X | Moderate flood hazard areas, typically between the 100-year and 500-year floodplains. Also used for areas with lesser hazards, such as those protected by levees or with shallow flooding under 1 foot. |

| Zones C & X | Minimal flood hazard areas, usually above the 500-year flood level. Zone C may have local drainage issues. Zone X is outside the 500-year floodplain and may be protected by levees. |

Deductibles (Pay Attention to the Math)

Wind deductibles are usually percentage-based (2%–5%, sometimes 10%) of the Coverage A dwelling limit. A 5% deductible on a $300,000 policy is $15,000 out of pocket before coverage pays. Flood deductibles are typically flat-dollar amounts.

Helpful Hints

- Inventory now: Photos of big-ticket items, a quick video walkthrough, and receipts—stored in the cloud.

- Mitigate early: If shingles blow off, tarp immediately and keep receipts; carriers usually reimburse reasonable mitigation.

- Know binding rules: Once a storm is named, new policies/changes are usually frozen until after the event.

- Ask about elevation: Sellers rarely highlight it, but elevation certificates can materially change your flood quote.

Final Thoughts

Coastal living is incredible—but it comes with unique insurance homework. Verify whether flood is required, line up wind & hail if your homeowners excludes it, and read your NFIP declarations to see where premiums are headed under Risk Rating 2.0. With the right stack—and a good local broker—you can protect your home and your budget.

Flood and Wind Insurance for Coastal Homeowners may seem complicated, but the peace of mind is worth it. From FEMA flood zones and NFIP premium increases to separate wind and hail policies through private carriers or the Mississippi Windstorm Underwriting Association, these coverages are the backbone of protecting coastal property.

If you plan to buy, sell, or maintain a home along the Gulf Coast, make sure you understand how these policies work together so your investment—and your future—are fully protected. For more practical tips, see our guide to buying property on the Mississippi Gulf Coast to better prepare for your next move.

Flood & Wind Insurance FAQ

1) If only a corner of my lot is in AE, do I still need flood insurance?

2) Does homeowners insurance cover wind damage on the coast?

3) What’s the NFIP building coverage limit?

4) What’s Risk Rating 2.0 in plain English?

5) How fast can my NFIP premium rise?

6) Can I assume a seller’s flood policy at their rate?

7) Who provides wind coverage if big carriers won’t?

8) Why is my wind deductible a percentage?

9) Does flood insurance cover water from a roof leak or burst pipe?

10) Can I buy or change coverage when a storm is approaching?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

![Biloxi Mississippi is a great place to live/visit [2025]](https://retirecoast.com/wp-content/uploads/2022/06/Biloxi-light-house-440x264.jpeg)

Great information. We are looking to buy a 2nd home in the Ocean Springs area and are finding information on insurance to be both confusions and seemingly contradictory at times. From your blog, it seems that reasonably priced insurance is available but so far the couple of quotes I have received for flood (yes, from USAA) were very expensive. However, I could not provide a certificate of elevation in either case.

We are flying down tomorrow from Colorado to look at a house in Gulf Hills. Would you care to meet for lunch on Wednesday?

Thanks for your comments. Buying insurance along the Gulf is a real task. Carriers who claim to cover flood and wind usually act as a broker because their own company does not cover these types of claims. I use Bishop Insurance, they have consistently found the lowest cost insurance and they really know the Gulf regarding risk. They have offices in several towns.