As tax time rolls around each year, our short-term rental property owners’ clients begin to ask questions about what they can and can not deduct from their tax returns. If you are considering buying a vacation home, second home, or short-term rental, there are tax issues you need to consider. So what is and is not a business expense? When is the income generated from my vacation home considered taxable income? To be clear, I am not a CPA, tax professional, or an accountant. I am however an investor, owner of full-time short-term rental properties, and a property manager.

After working with a CPA for decades on rental properties, I have learned a few things about how to manage the business side of investment property even when that property is primarily for personal use. Keep in mind that the information provided here is for your enlightenment.

This means that rental tax deductions you may be in doubt about taking would be best discussed with your CPA. Articles about tax issues on the web are a great first start, understanding the primary issues will reduce the time you need to spend with your CPA at tax time and increase the legal tax benefits you are eligible for. Our list of 16 most important tax deductions for vacation rentals starts now:

The 14 day rule

IRS rule on personal use of income property

1. Personal Use of your Vacation Property/Rental

The IRS has established rules which are part of the tax code that states your property is considered a residence when you stay there for more than 14 days per year or more than 10% of the total rental days in a year. The following is directly from the IRS:

A day of personal use of a dwelling unit is any day that the unit is used by:

- You or any other person who has an interest in it, unless you rent your interest to another owner as their main home and the other owner pays a fair rental price under a shared equity financing agreement

- A member of your family or of a family of any other person who has an interest in it, unless the family member uses it as their main home and pays a fair rental price

- Anyone under an agreement that lets you use some other dwelling unit

- Anyone at less than fair rental price

I wanted you to see their exact wording so that there would be no misunderstanding. I doubt that many fully understand these rules on deductibility. When you permit the family to use the property, you can reduce your ability to fully deduct expenses for the property. This also applies to friends that you have allowed to stay at a discount or no charge.

This is something to consider when you decide to buy a vacation property. Keep something in mind. You are not permitted to stay a your property more than 36 days per year without losing deductions. That is 10% of 365 rental days. The longer you stay relative to the number of rentals, the lower the percentage of expenses that are deductible.

Not all is lost however, you may still deduct real costs such as utilities used by paying guests and other expenses as a percentage of the annual total. For example, the property rents for 40 days per year and you stay there 40 days per year. In theory, you can deduct 1/2 of the costs.

The IRS makes a statement that again, I want you to read from their website:

You won’t be able to deduct your rental expense over the gross rental income limitation (your gross rental income less the rental portion of mortgage interest, real estate taxes, casualty losses, and rental expenses like realtors’ fees and advertising costs). However, you may be able to carry forward some of these rental expenses to the next year, subject to the gross rental income limitation for that year.

Without getting too complicated, even when something is deductible, there are limitations based on your income and other factors. The important thing is what you can not deduct in a year can be carried forward until you have a year when it can be used or when the property is sold. When you are setting up your account with the CPA, she/he can explain how this works for you.

2. Income

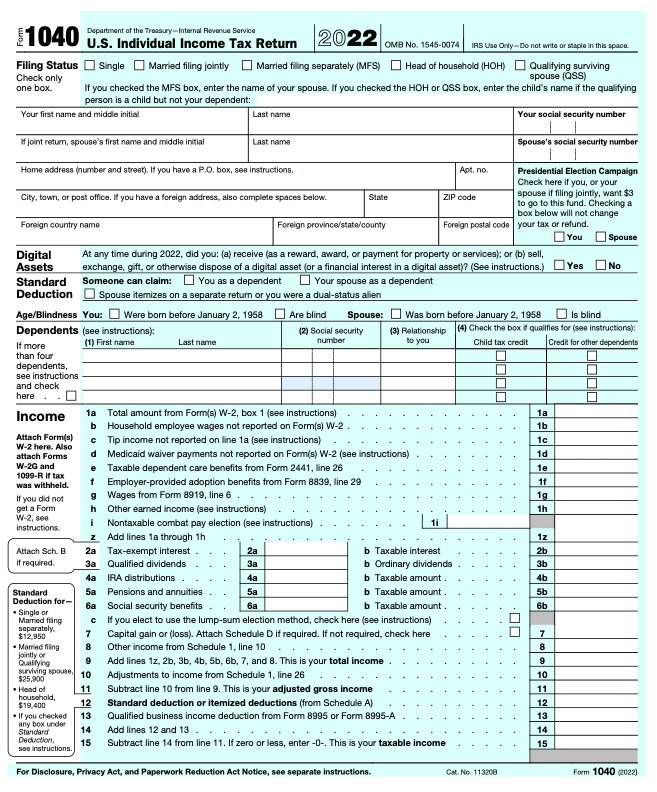

If you rent your property less than 14 days in a year, you are not required to report the income to the IRS. Your state may have other rules. If you put your property on the vacation rental market in for example November and it rented for 14 days before January 1, you do not have to report the income. Most of my clients want to rent their properties for more than 14 days per year and would be required to report income using the 1099 form that they are provided.

If you are using a property management company, income would be reported to the IRS on the 1099. Even if you rented your property for less than 14 days per year, if the amount paid to you is greater than $600, the property management company would be required to report it to the IRS.

There are two types of income, passive income and active income. To determine if you qualify for one or the other, you should have a conversation with your CPA or tax advisor. You must obtain tax advice on this topic as it can be a challenge to qualify as an active investor. A tax expert will do the math and tell you where you stand. This can make a big difference in what and when you can deduct.

3. Expenses

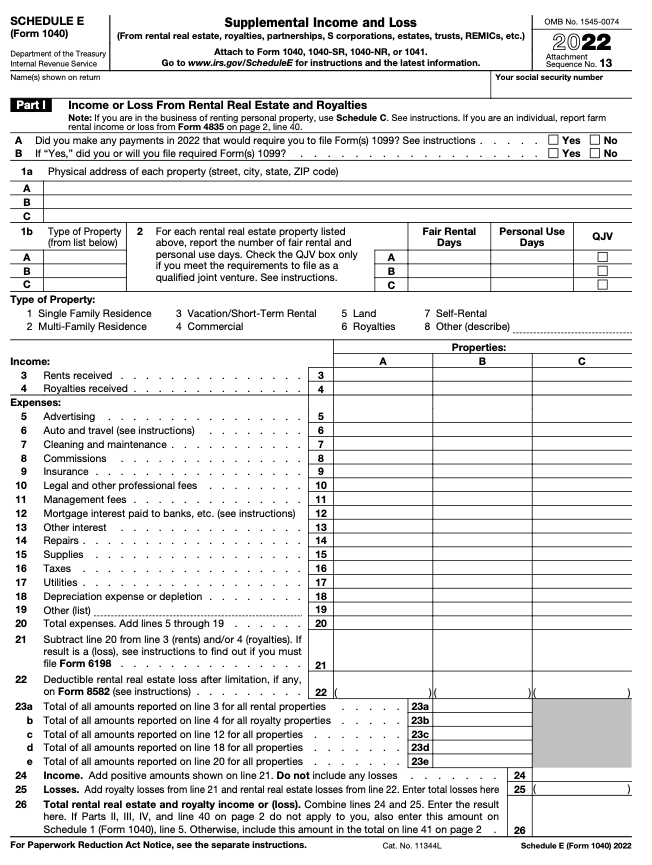

You may have purchased your property as a real second home meaning that the intent was to use it as a retreat away from your primary residence. You would be entitled to deduct property taxes and mortgage interest as you would with the primary residence. The IRS permits deductions on a second home, not a third, etc. on Schedule C or Schedule E.

Expenses such as household insurance are not deductable neither are utilities on your primary or second home. The idea that some expenses could be tax deductible is part of the reason why some second homeowners have decided to consider their property in the category of vacation homes.

Using your second home for rental use does present the opportunity to consider deductible expenses. You need to follow the basic rules as indicated above in that 14-day rule. Assuming that at least part of your property is eligible for things like maintenance costs and travel expenses, let’s discuss the what and how of these categories of rental property tax deductions.

4. Personal expenses – related to rental

What is personal and what is an eligible business deduction? The IRS uses a basic rule that requires you to track personal use of any business asset such as a mobile phone. At this point, I can not stress more that you need to retain excellent records. Use an accounting program and retain receipts in paper or electronic form to back up your assertions. The moment that you move from strictly personal use of your property to the vacation rental business, things change on the tax front.

A basic rule of thumb – If you use anything you want to deduct for your personal use, determine the percent for personal and the percent for business. Document the business part of the expenses; what, when, where, why, and how. Details, lots of details. There are some ways to “hack” the basic IRS rule and while I am passing this along, you should confirm with your CPA.

Every time you decide to stay at your home assuming that it will be rented for more than 14 days per year, make reservations on the property management website. Pay 100% of the rate that anyone else would pay. This exempts that stay as a personal stay since you paid as a guest and you paid the market rate for your stay. So your next question is where does that money go?

This is an example of how it would be handled at ChristiesGulfBeachRentals.com. You decide to reserve your property for a visit in December. Starting with using the ChristiesGulfBeachRentals.com website, you find the property and make reservations with your credit card. This is what everyone else would do. This time you do not use the coupon code as an owner. Assuming the rate is posted at $200 per night and you stay 10 nights, you would pay $2,000. Sales taxes would be charged and a small fee for use of the credit card.

You get back most of the money you spent

After you leave the property and the accounting is completed, you will see income in your account less the sales tax and credit card fee. You will earn back most of what you paid in. The amount that you did not recover should be compared to the benefits of deducting all of the items that will be discussed below for an entire year. You should discuss this with your CPA or tax advisor, which is better, staying at zero cost or paying as a guest.

If you decide at some point to sell your property, any potential buyer would want to see the records. If you were paying as a guest, the income would be reflected in the records. This can be an advantage. You can also obtain travel insurance at a low cost as a guest, a potential benefit.

There are two other times when you can stay at your property without affecting the usage ratio. The first is if you are there to attend to maintenance on the property such as replacing flooring. Another time is if you are showing the property to potential buyers or meeting with your property manager. Even with these and similar exceptions, you must document the reasons, days, etc. If you want the tax breaks, you have to work for them.

5 Biggest Mistakes Vacation Property Owners Make with the IRS

- Failing to report rental income. This is the most common mistake rental property owners make, and it can have serious consequences. All rental income must be reported on your tax return, even if it’s just a few hundred dollars. If you don’t report your rental income, you could be penalized by the IRS.

- Neglecting depreciation expenses. Depreciation is the decline in the value of your property over time. It’s a deductible expense for rental property owners, so it’s important to take advantage of it. To claim depreciation, you’ll need to know the purchase price of your property and its estimated useful life.

- Misclassifying rental property expenses correctly. Not all rental property expenses are deductible. For example, personal expenses, such as mortgage interest on the portion of your vacation home that you use personally, are not deductible. It’s important to be careful about classifying your expenses so that you don’t claim any deductions that you’re not entitled to.

- Ignoring state and local tax requirements. In addition to federal taxes, vacation property owners may also be subject to state and local taxes. It’s important to check with your state and local tax authorities to find out what your tax obligations are.

- Not keeping good records. It’s important to keep good records of your rental income and expenses. This will help you to prepare your tax return accurately and to substantiate your deductions in the event of an audit.

5. Local taxes and licenses

Many cities and counties have created special rules about short-term rental business activities. They describe when your second home is a primary, secondary, or income-producing property. If you are required to pay fees, these will be deductible. Pay attention to their rules about residential rental property and the potential need for a permit.

Locals have rules about rentals under and over 30 days when your house is a personal residence and when it is an income property. These rules will probably not line up with IRS rules. As I mentioned, if you are required to pay fees they are probably deductible since they are exclusively based on your property and its income-producing ability.

6. Mortgage Interest Deduction

Loan interest is a key deduction for any business. The 2017 tax changes created some very good benefits for LLCs that own properties. If you have not formed an LLC to own your property, consider it. There is a massive deduction against income for LLCs who qualify. The same tax law changed standard deductions and if your vacation home was strictly used for your vacation, you may not benefit from all of the mortgage interest deductions available.

The reason is that the change in law permits not more than $10,000 for mortgage interest and that would include your primary and second residence. If you pay for example $10,000 for your primary and $3,000 for your second home, you would not be able to deduct the overage of $3,000.

If your second home was an income-generating vacation home as well and you treated it as a business and residence, you would be able to file a Schedule E. form. This shifts the asset from being personal to being business. Keep in mind that while this is done, you must pay attention at all times to the rule above. If you use the property 1/2 of the time then 1/2 of the mortgage interest deduction would be on your return and the balance on the schedule E. Some deduction is better than none.

7. Property Tax Deduction

Rental owners are entitled to deduct property taxes in the same manner as the mortgage interest deduction. Your rental home may be subject to different tax laws when it moves from being a personal residence to an income-generating property.

One local city has decided that earning $1 from the property exempts it from benefits given to residential property. Before you decide to offer your property for rent, consider how the change in property tax rate may affect your finances. Earning extra income is great as long as it is not eaten up by the difference in a higher property tax rate.

8. Insurance Premiums

Similar treatment as with mortgage interest and property taxes. Insurance premiums are deductible for a business. At this point, you should know that your regular homeowner’s policy will not cover the rental of your property for income. You should contact your insurance agent and ask for a quote on a “landlord” policy. This will protect you if there is a problem including providing for lost income should there be a fire etc. The basic rules here for deducting insurance are the same, use the percent of personal use vs. business use.

9. Depreciation

A business property is entitled to depreciation deductions based upon a formula of dividing the cost of the property by 27.5 years. For example, if you have purchased the property for $200,000, your annual depreciation would be $7,272. If your property was rented for 20% of the year, you would be entitled to 20% of $7,272 or $1,454. At the time of the sale, you have to perform a calculation based on the taxable income earned from the sale adding back the depreciation you have been deducting.

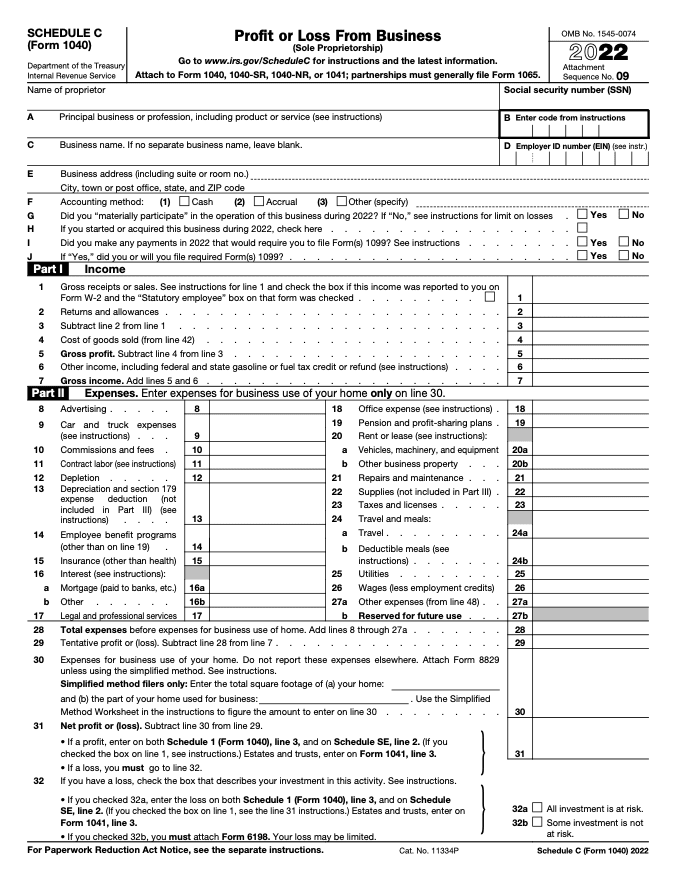

10. Property Management Fees

Any fees paid for property management are fully deductible against income. Generally, a property manager will charge a percentage of the total income earned as their fee. Additional fees may be charged including set-up, decorating, etc. All of these fees are deductible.

11. Property Maintenance

Any funds expended for business purposes can in theory be considered a deduction for your income taxes. Adding a new AC system or roof or even carpeting is deductible based upon your percent of use of the property. The good news is that almost anything you spend money on can be considered as a business expense as long as it is justified and documented.

Some have established a home office a their vacation home and work from there when they are visiting. The expenses involved with a computer, desk, printer, etc. are deductible against gross income.

As with all of the other categories above, it’s about personal use percent vs. business use percent. Document how you have determined the use on either side of the issue. You have just purchased a new iPhone 15 pro and want to deduct it. No problem but you need to get the percent right.

IRS may look at your call log to determine that most of your calls are business related for example. Use the same procedure to determine the amount of the monthly mobile phone bill that is deductible.

The tax law changes that went into effect in 2017 permit accelerated depreciation for some larger expenses which means you can deduct all of it in the year in which it was incurred. If you have large start-up charges to get your property ready to be rented, you can deduct the costs upfront. Check with your CPA about the actual amount you will be able to use by the end of the year. Some deductions will be pushed out to the future.

Buying a new electronic lock and electronic thermostat are requirements for many vacation rental properties and are considered necessary expenses. This is the way you need to document any expenses related to your property. Of course, that new roof would be considered.

12. Travel Expenses

There are a few reasons why you should travel to your vacation home at least once per year. You need to meet with the property manager and discuss pricing for the next year and general market conditions along with the condition of your property and any changes or repairs you want completed. This makes you a semi-active manager and may help with the determination of your tax status.

Another reason is that you can deduct the cost of the trip as long as you have documented the work you have performed while you are here. Perhaps you repaired a bathroom faucet, cut the grass, or painted a room. Prove to the IRS that this was not just a vacation at taxpayers’ expense.

Your airfare, gas, rental car, meals, and more can be eligible for a tax deduction. You need not stay at your property. Some of my clients stay at one of the casinos when they come to town (usually free rooms). This can allow them to come when the property is rented.

Document your trip.

13. Qualified Business Income (QBI) deduction

I briefly mentioned this above. It permits a pass-through deduction of up to 20% of qualified business income to be tax-free. This is an important change in the tax law. Your property could qualify for all or part of it depending upon the percent used for business. Your CPA will know how to apply this.

14. Savers Credit

The saver’s credit is a non-refundable tax credit that is available to low- and middle-income taxpayers who make contributions to retirement accounts, such as 401(k)s and IRAs. The credit is equal to 10% of up to $2,000 of contributions for single filers and $4,000 of contributions for married couples filing jointly.

Vacation rental property owners can qualify for the saver’s credit just like any other taxpayer. To qualify, they must meet the following income requirements:

- Single filers: Modified adjusted gross income (MAGI) of $33,500 or less

- Head of household: MAGI of $49,500 or less

- Married couples filing jointly: MAGI of $66,000 or less

- Qualifying widow(er): MAGI of $66,000 or less

If a vacation rental property owner qualifies for the saver’s credit, they can claim it on Schedule A of Form 1040. They will need to provide the following information:

- Their Social Security number

- The name of the financial institution where they made their retirement contributions

- The amount of their retirement contributions

The saver’s credit can be a valuable tax deduction for vacation rental property owners. It can help them reduce their taxable income and increase their cash flow.

Here is an example of how the saver’s credit works for a vacation rental property owner:

- Single taxpayer with a MAGI of $30,000

- Makes a $2,000 contribution to a retirement account

- Qualifies for the saver’s credit

- The saver’s credit will reduce their taxable income by $200

If the taxpayer’s tax rate is 25%, the saver’s credit will save them $50 in taxes.

Vacation rental property owners should consult with a tax advisor to determine if they qualify for the savings credit and how to claim it on their tax return.

15. Utilities Expenses

Utility costs are an important cost for a vacation property. Generally, they include water, sewer, trash, electricity, natural gas, cable, internet, and pest control. Even when the property is vacant, these costs will continue although at a lower rate. Utilities are subject to the same percentage calculation used for all other costs. If you stay there 1/2 of the time, you will be able to deduct the other 1/2 of the costs.

The best way to calculate these costs is to use the actual numbers. For example, the busy season for guests is June-July when the property is booked for 60 days. Use utility bills for these days rather than trying to average the bills across the year.

16. Landscaping Expenses

If you have grass or a garden, they will need care. If you live in an area without grass or weeds, your building may require pressure washing. The sidewalk may need care. If you have a garden, flowers must be trimmed and weeds pulled. Many of our clients hire someone to do this regularly. You can work out the deductions based on a formula that makes sense to the IRS and its new 84,000 agents. For example, if the costs are higher in the summer when most guests are there, use those numbers for your cost.

17. Accounting Expense

It takes time and resources to maintain records required by the IRS. These expenses are deductible. They include but are not limited to the following:

- Computer

- Printer

- Software or subscription

- Bank charges

- Interest paid on credit cards for the above and other items you use for the property

- Computer paper, supplies such as printer ink

- Part of the cost of the internet

- A portion of the cost of a mobile phone

- Certified Public Accountant fees

- Legal fees

- Creating an LLC expenses

- License fees

There are a wide variety of small costs that may go unrecorded if you do not pay attention. Record everything, your CPA may tell you that an item is deductible if you have the receipt. I usually recommend the use of WaveApps a free online accounting system that is easy to use even for a novice.

18. Purchase Expenses

When you purchase a property that is to become an income property even if only part-time, some of the purchase costs are deductible at least in part based upon the first rule. Title insurance, legal costs, and more may be eligible to be deducted in the year in which the purchase took place. Deductibility is based upon the use of the property and the cost. Some costs are pushed out into the future when you sell the property.

Please feel free to browse our other articles, leave comments, and sign up to be notified of new articles. Check out our Gen-X Only 20 Years to retirement series, it is enlightening and provides many tools to help with retirement planning.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

![The Best Places to Buy Property for Airbnb Rental [2023]](https://retirecoast.com/wp-content/uploads/2022/06/best-places-to-buy-property-1-1-440x264.png)