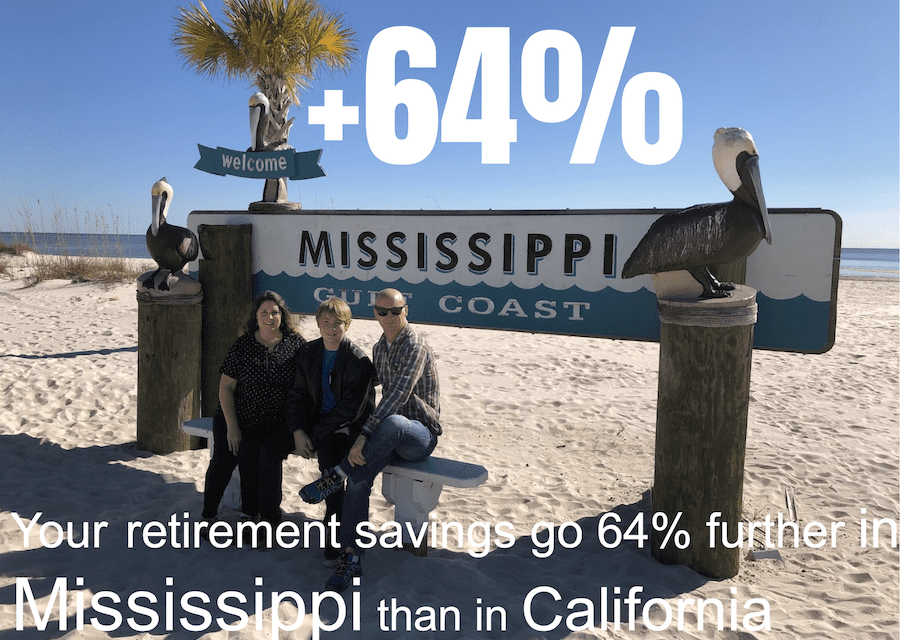

You worked hard to save $500,000 for retirement. Move to Mississippi, the best state to retire with $500,000 where your money will last longer. The time it will take to eat through that savings depends upon where you live. Retire at age 70 in California and your savings will be gone like a puff of smoke in 6 years, 11 months, and 18 days. Your fund will last longer in Oregon, 7, years 10 months, and 7 days. It’s painful to go further until I get to the best news, if you retire in Mississippi on the Gulf Coast, your retirement savings will last 11 years, 3 months, and 12 days.

$500,000 Goes further in the state of Mississippi, according to GoBankingRates.com than in any other state. This data has been used to compare how long your $500k savings would last in some of the “popular” destination states. Don’t panic yet, read this article, there is a way to feel good about your retirement nest egg.

You may or may not need $500,000 to retire. $500,000 is just a number. We could have used $300,000 or a higher number like $1,000,000. Everyone is different, has different needs and situations. Don’t focus on the money for now or even the years above. Inflation will change these numbers but they are relative. Meaning, that the comparison will remain the same or widen over time.

Who wants to move to Mississippi?

This is not the first article that looked at a variety of costs in arriving at this conclusion (see list of sources below). Typically surveys look at the highest cost for most people which is usually housing. You say, “Who wants to move to Mississippi when I can move to Las Vegas or Denver or even Austin where I can buy a Starbucks coffee?”

You also say “Just because moving to the Mississippi Gulf Coast can extend my money by about five years (moving from CA), I can move to one of the other “popular” states”.

According to the data used in this study, you will need $44,319 per year in Mississippi vs $71,746 in California to cover the costs of retirement. You will spend $54,600 in Florida. You do not even what to know how few years your funds will last in New York. Consider what you are spending now before you retire. Are these amounts reasonable?

Rather than reducing the qualify of your life

Rather than try to reduce the quality of your life by staying in a high-cost area in retirement, consider relocation and reducing your need for more money. Not everyone can move before they retire but if you have a portable job, consider how much more you will save by moving now rather than later.

Here is the news: The Mississippi Gulf Coast has a lower cost of living and has more to offer than most of the “popular” destination states. Beaches, beautiful rivers and bays, fishing, entertainment (casinos), and a warm climate among many others. Even better, the Mississippi Gulf Coast still is mostly undiscovered. People migrating to the “popular” states are overwhelming the area infrastructure, pushing housing and other prices to new highs.

Too late, as they say, that ship sailed. I wrote this article originally several years ago and even though there has been an erosion in the value of $500,000, the most expensive states remain the same. Before you head to Florida, you should know that you will have 9 years, three months, and 29 days, not the best value.

Move to the popular location and see what happens to taxes

Everyone knows about the “popular” destinations and prices for homes have leaped and are on a significant incline. As a result, long-time residents have trouble affording homes and paying their bills. In a few years, the new location may seem much like the old one, with higher costs, taxes, crowding, etc. This is what happens when something becomes “popular”.

Those who got in early will benefit the most. Perhaps a new destination, one that is not on everyone’s radar may be the best choice. A place like the Mississippi Gulf Coast.

Lowest 10 Cost of Living States

| Rank | State | Cost of Living Index | Average Monthly Rent |

|---|---|---|---|

| 1 | Mississippi | 85 | $729 |

| 2 | Oklahoma | 85.8 | $744 |

| 3 | Kansas | 87.5 | $769 |

| 4 | Alabama | 88.1 | $784 |

| 5 | Georgia | 88.6 | $809 |

| 6 | Missouri | 89.1 | $824 |

| 7 | Iowa | 89.2 | $839 |

| 8 | Indiana | 89.9 | $854 |

| 9 | West Virginia | 90 | $869 |

| 10 | Tennessee | 90.2 | $884 |

While the cost to buy or rent a home along the Mississippi Gulf Coast is reasonable in the extreme, medical costs, food expenses, and others are also in line to be the lowest generally found anywhere.

Most of the high-cost states continue to increase their tax rates. Californians for example have passed more bond measures, and sales taxes and income taxes continue to increase Furthermore, the analysis above does not include new tax burdens such as reparations and fossil fuel taxes.

Retirement funds are not taxed by the state

As a result of these new taxes and those to come in the future, your $500k will go further in Mississippi at an accelerated rate. You were probably unaware that many states charge income taxes on pension plans and retirement accounts and that 401(k) plans are considered types of retirement income and taxable income. Reducing your net income by paying lots of state-based taxes is not the path to a comfortable retirement.

New ESG rules being implemented as state laws will, over time erode even further monthly income for all, not just retirees. We should expect to see the highest-cost states eat through $500,000 must faster in the next decade. State income tax will have a negative impact on many retirement plans.

Many people are moving from the highest-cost states where $500,000 will eventually last only a few years as the race to be the first to eliminate energy sources well ahead of the infrastructure’s ability to cope continues.

Want bags at the grocery store for free

During the past few years, tens of thousands of people have left their high-cost states for lower-cost states. Not only did they save money in the process but they escaped the never ending of what citizens can’t do in the state. How about Mississippi grocery stores still give free bags.

A good place for retirement is not just about money although money is very important, it’s about older households surviving the onslaught of new social rules. A good example is that California has banned so many things that are available in other states at a lower cost e.g. BBQs, anything that uses fossil fuel including your lawn mower.

People are not happy with all of the nanny regulations coming out on a regular basis. No gas stoves, must include solar panels in new homes and more.

10 Highest Cost of Living States

| Rank | State | Cost of Living Index | Avg. Rent |

|---|---|---|---|

| 1 | Hawaii | 184 | $2,700 |

| 2 | Massachusetts | 149.7 | $2,100 |

| 3 | California | 137.6 | $2,000 |

| 4 | New York | 134.5 | $2,200 |

| 5 | Alaska | 126.6 | $1,800 |

| 6 | Maryland | 124 | $1,900 |

| 7 | Oregon | 121.2 | $1,800 |

| 8 | Connecticut | 116.8 | $1,900 |

| 9 | New Hampshire | 116.1 | $1,700 |

| 10 | Vermont | 115.9 | $1,600 |

By the way, the good news is based upon the average life expectancy, if you live on the Mississippi Gulf Coast, Social Security payments will supplement your $500,000. Between the two sources of income, you may have enough money to fulfill your retirement goals.

Mississippi does not like new taxes

Mississippi is one of a handful of states that are not known for creating new state taxes in search of a place to spend them. One reason I believe costs are lower in Mississippi is that the legislature is part-time. This lowers the cost of government to taxpayers and reduces idle time to create more laws and increase taxes.

If you live in one of those higher-cost states consider improving your quality of life by relocating. Pick a state on the list in the article that will not take your last dime just to fill your tank of gas (if you can buy gas in the future). Last year Mississippi lowered state income taxes which were already low and Seniors receive a substantial discount on their property taxes.

According to the Tax Foundation, the total tax burden is increasing for states in the next ten years. Mississippi will increase its tax burden by about 4/10th of a percent. California will increase theirs by 7/10th of a percent continuing the acceleration of tax rates. It’s important to see where your state is going before committing on retiring there.

No expensive social programs

If you want to keep more of what you do receive in Social Security benefits and income from investments, move to a state with a proven record of keeping taxes low. Expensive social programs such as paying the costs for housing thousands of immigrants and offering reparations is passed along to retired persons.

It’s actually possible to retire on Social Security Benefits alone on the Mississippi Gulf Coast. This assumes you will receive larger Social Security benefits, above the average for most beneficiaries.

Living on Social Security alone in many states will be impossible without supplemental income from your $500,000 or another amount financial planning dictates you need. The high cost of complying with new environmental laws such as electric cars will put a large burden on retirement benefits.

Your $500k goes 64% further in Mississippi than it does in California. It’s no accident that your $500k will go further in Mississippi than California. The general cost of living is lower in Mississippi than in other states. People living along the Gulf Coast who work hard at fast food and convenience stores can live here without resorting to government handouts.

Cost of living on the Mississippi Gulf Coast

| Category | Jackson County | Harrison County | Hancock County | National Average |

|---|---|---|---|---|

| Housing | 69.5% | 68.8% | 68.8% | 100% |

| Food | 91.7% | 91.5% | 91.5% | 100% |

| Transportation | 92.8% | 92.6% | 92.6% | 100% |

| Healthcare | 88.2% | 88.1% | 88.1% | 100% |

| Utilities | 95.6% | 95.4% | 95.4% | 100% |

| Miscellaneous | 91.3% | 91.1% | 91.1% | 100% |

| Overall | 85.8% | 84.7% | 84.7% | 100% |

And by the way, they are not expecting them either. There is a spirit of independence along the Gulf Coast where family comes first and being kind to your neighbor is just a fact of life.

Mortgage payments can be lower than rent payments

If this article and the source material do not at least cause you to pause and wonder then perhaps you have no issues with paying more and getting less. The following is an example of how $500k goes further in Mississippi. Consider this;

Assume you live in a 2,000 sq ft home in a high-cost state where you are paying, for example, $3,800 per month on a mortgage payment.

You decide to move to the Mississippi Gulf, perhaps Gulfport or Biloxi. You buy a new 2,000 sq ft home fully landscaped with 20% down and an all-in monthly payment of about $1,700. Your monthly savings by moving to the Mississippi Gulf Coast would be about $2,100 per month x 12 months = $25,200 per year. You could use the savings in your retirement years.

The total tax burden in Mississippi from 2003-2023 for Age 65+

Decreased by 1.4% from 7.2% to 5.8% Tax burden

same period in california increased by 1.1% to 6.4% Tax burden will increase 0.4% in mississippi and .07% in california next 10 years

Would you take $25,200, stack it up and burn it? The savings on your home is just a place to start. Recall above that the original data supported lower costs in other areas as well. How about being close to the beach, casinos, entertainment, fishing, and much more?

The cost of real estate (housing costs) is a key driver for making an area liveable in retirement. It’s not the only thing, transportation costs such as fuel, health care, food, and other expenses must also be lower. The least expensive states offer lower costs for a wide range of things not just real estate.

If you want to live a comfortable life in retirement it’s important to control your annual expenses. The best way to do this is to create a budget, click here to read our article about budget and use the budget tool in the article. This article is about how far $500,000 will go but you do not necessarily need $500,000 to retire comfortably.

Stay within your budget cut down on red tape

The results of your budget will indicate what you actually need to set aside for retirement. Consider the years of retirement as you are creating your budget. The annual expenditure estimates above are probably not accurate for you. That budget will tell you what your actual expenditures will be.

Financial planners can help guide you but in the end, it’s your budget and ability to stay within the budget that will make your retirement comfortable.

The following are some sources that indicate the statements above about Mississippi being the lowest-cost state are accurate.

1. U.S. News & World Report – “10 States With the Lowest Cost of Living in the U.S.” (www.usnews.com)

2. Kiplinger – “10 Cheapest States to Live In” (www.kiplinger.com)

3. SmartAsset – “The Most Affordable States in America” (smartasset.com)

4. CNBC – “Here are the 10 states with the lowest cost of living” (www.cnbc.com)

5. The Balance – “Cheapest States to Live in the U.S.” (www.thebalance.com)

Read similar articles on this site

You have reached this website because you found the title of this article interesting. Two of our most popular articles are on the same topic, I suggest you give them a read by clicking on their titles: “Why you need to Retire on the Mississippi Gulf Coast” and “Why I decided to Retire in Ocean Springs, Mississippi”.

One of our latest articles Best Places Now to Live on the Gulf Coast

Should you be interested in exploring housing on the Mississippi Gulf Coast, I suggest that you go to Logan-Anderson, Gulf Coastal Realty website where you can find more articles about the area and relocation.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

Good article