Set your retirement goals years in advance. Give yourself five full years to focus on executing your plan. Fine-tune your strategy and begin checking off your list of things to accomplish within that five years. Remember that goal; “Retirement in five years: Don’t fail to plan now”. If you have been putting it off, put a note on that refrigerator: “Retirement in 2027” (or later if you are more than five years out). You are preparing for your golden years as some call them. A lot of people wait until a few months before they tell the boss, “I am retiring”.

Let’s go through the process so you understand what I am suggesting. Assume that you are in your 50s when you read this. What will trigger your retirement date? Will it be the day you turn 67 for full retirement or 70 for the big Social Security bonus? Perhaps you have a defined benefit plan and that date will be when you have 30 years with the employer. You should select a target date well in advance of retirement e.g when you are in your 50s.

If you are older for example in your 60s, some options are already gone e.g. time value of money. If you failed to save because you did not have a retirement savings plan when you were in your 50s, make the adjustments now. Set that calendar year when you think you will be ready for retirement. Go through your list of qualifiers and select a year. You can set the date when you start your five-year plan.

Start the clock

I will go through some areas you need to consider before the start of the five-year clock and then refine them after you start the clock. There is much to do before the start of your five-year count down such as reviewing your financial situation. Determine your monthly income after retirement. How much will you get as Social Security income as well?

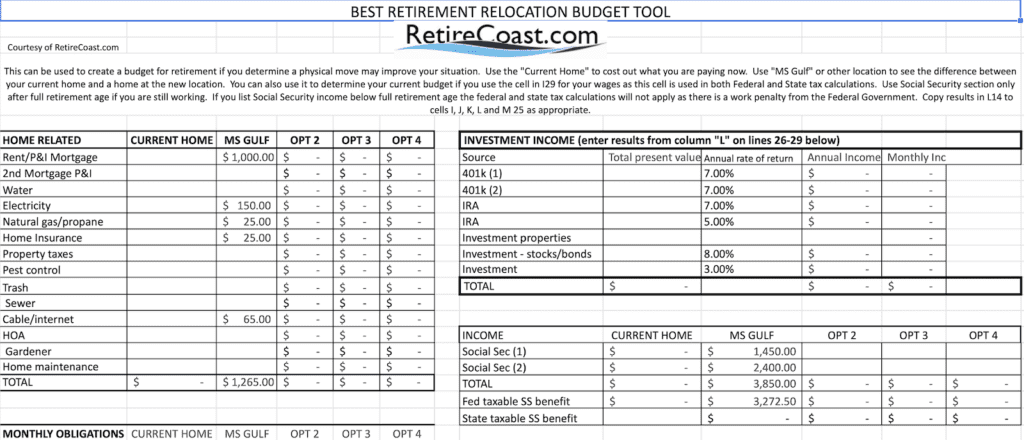

I strongly suggest that you begin the early process of creating a retirement budget. Click here to use the free retirement budget. The article will fully explain how to use it. This is one of the most critical first steps you can take.

The best retirement plans start with a retirement budget. The best budget begins with accurate information. For example, check with your employer if you have a defined benefit plan and get all of the details about your retirement plan. Enter the data into the budget. Check with Social Security about your Social Security payments. Ultimately you need to reach a conclusion on a sustainable withdrawal rate from investment income along with other sources. The budget will tell you how much you spend and how much you earn then show the variance.

Part of this pre-five-year work is determining your retirement lifestyle. This will be based on many factors such as income streams, debt, and expenses. Determine what investment options and pre-retirement income you need to earn during those years before the start of your five-year period. If you want a secure retirement, you will put some energy into this process. Do everything you can to increase your current take-home pay for all of the years you have left before your retirement date.

Let’s go through this process of your five-year plan:

Starting with your income. If you are truly prepared. You should have income from 401k dividends, brokerage account dividends, and perhaps a rental property or two with Social Security benefits as a backup. Do not assume that your costs will go down in retirement, they will go up with inflation alone. The factor is that even your monthly payments on your mortgage will be adjusted upward for insurance and tax increases.

Break down the various parts of your financial life. Credit cards should be paid off. Do not run up credit card debt in retirement, you may no longer have earned income subject to annual increases to pay off that debt. You will probably be living on a fixed income unless you have rental income which should adjust with inflation.

Pay off high-interest-rate loans

Pay off any high-interest items such as an RV or anything that is costing you more in interest than you can earn with the same money elsewhere. As an example, if you have a $20,000 balance on an RV at 7% interest, pay it off if you can earn more on that $20,000 than 7% such as 10% on another investment. Focus on your investment returns.

Apply for credit cards well before you retire. Accumulate sufficient cards to have a total of available credit of more than $50,000 ($100,000 is better). The point here is not to use the cards to run up balances it is to help improve your credit score and give you some room to use cards in an emergency.

If you were thinking of relocating after you are retired, consider buying a home before you retire. You can obtain a loan after you are retired but you have much more flexibility with a W2 annual income while working. Loans are easier to obtain if you have a full-time job.

Also, your debt-to-income ratios will change when you retire and a lender may not count some of your income sources. Your retirement accounts can be considered when you buy a house but they will help improve your chances if you also have some positive cash flow from a W2 job.

You can buy a second home with favorable financing

You can buy a second home and receive favorable financing. This second home will become your permanent home when you retire. You may even want to hire a management company to rent it while you are away. The management fees are a small price to pay for the additional cash flow. The point is that owning your permanent retirement home in advance can substantially reduce your stress level. If you decide to buy a second home, consider the state tax where you may relocate to. Some states have no or low taxes on retirement income.

Is time to take a good hard look at what your financial security will look like in five years. If you have been paying on insurance policies that you no longer need, it’s time to get rid of them. Retirement planning means cleaning house both the actual house and the financial house. Check your health insurance coverage. Be prepared to sign up for Medicare at age 65. Be sure you have the insurance products you need and nothing more.

Clean out the garage, sell or give away

Should you decide to relocate, clean out the garage and house well in advance of putting your current home on the market. Sell everything you do not need. If you are going to hire a household goods company to move, you will save lots by eliminating excess weight. Those things you never use, time to let them go. Give them away or sell them. As part of my planning, I asked my daughter to come over and have a garage sale. What was not given to the family was sold or given to neighbors. It seems that everyone we know wanted something.

One thing I learned while considering this process of downsizing the garage and house was that the cost to move items is based on weight. Some things that I had would have cost as much to move as to buy new. We decided to buy a few appliances at the new location giving us new items for the same cost as moving the old item. This process of shedding items that you don’t need is hard for most of us. Ask family members, friends, and neighbors to help you. They can push you to get rid of items that you just want to keep for sentimental reasons.

A good reason to start this process five years out is to reduce stress. By taking baby steps during the five years, you can be fully ready to make the transition seamlessly. One day you are at the office, and the next you are leaving for a long vacation. I advise most of my clients not to pay off their house if they plan to retire in it. My reasoning is simple. Many people have refinanced their homes at rates lower than 3%. Many investments pay much more than 3%. If you can afford the monthly payment, save the money you were going to use to pay off the mortgage.

Cash is king

Cash is king. The last few years have been tough on many households. Riots, political turmoil, high prices, inflation, etc. You never know when you will need enough money for something. I do not mean that you should put cash under the mattress. You must have liquid assets e.g. money market fund, ROTH IRA, etc where you can obtain funds if you are in need. If you retire before you reach the age of Medicare eligibility you may have health care expenses that you are not currently aware of.

You are getting older, there will be medical expenses. Be prepared for doctor’s visits with co-pays, prescriptions, long-term care, and other things e.g. a walker. In your early years perhaps you will not spend much on medical care but be prepared to in later years. Consider your life expectancy based on your family medical history. All of this must be included in your plan. Consider the years of retirement and what will happen to the surviving spouse.

The home you live in may need some changes to accommodate a wheelchair or a handhold in the bathroom. Some of these costs are low but some may be a burden. I only mention these things because you should do your planning with your eyes wide open to possibilities.

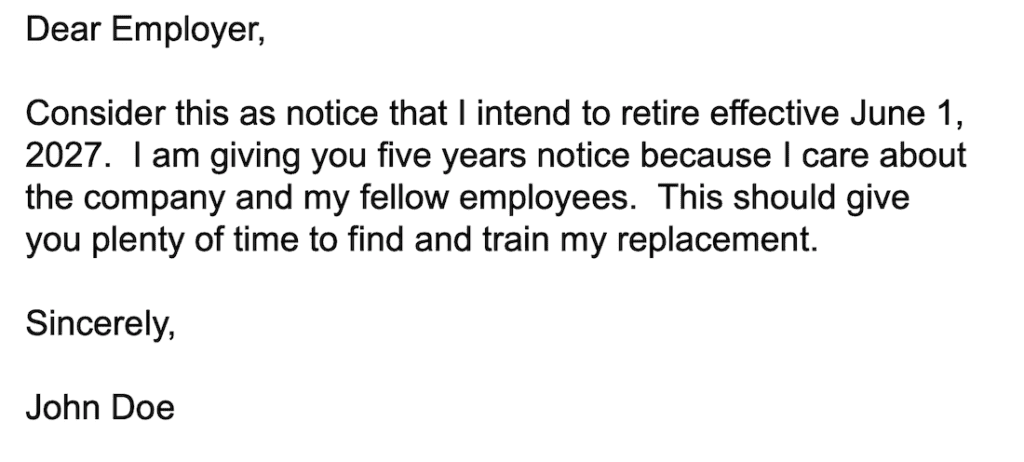

Decide when to inform your employer

Decide when to let your employer know that you intend to retire. Some employers would like two weeks’ notice, others would like a year or longer to find your replacement so you can train that person. Don’t worry about being forced out, when you announce your retirement, it is difficult for an employer to “make” anyone leave early. Some laws protect older workers. I remember many years ago that I had decided to resign from my management job at a large retailer.

At that time, I did not consider the time that I had already invested into the retirement program. Back most defined benefit plans required at least ten years of service. The law has since changed to five years. I left two days short of ten years. This was very bad and lack of planning will cost me. My excuse was that I was only 28 but even at that age one should be thinking of the future.

Be sure you fully understand the terms and conditions of your retirement plans. Perhaps you have a traditional ira, 401k, life insurance, mutual funds, or some other plan in place of a defined benefit plan. Regardless, obtain all of the rules about withdrawals. Understand the taxable income issues with Social Security and other investment income during retirement. If you are in a defined benefit plan check the years of service requirement. Do not do what I did and leave too soon.

Your plan may include relocating

Your plan may include relocating after retirement. If this is the case and you purchased your retirement home a few years before you plan to retire, you will need time to visit the new home periodically and to work on the property. Everyone wants to customize their property. Plan for the cost to visit our property. This is a good time to start moving some items to the new place even if it is several states away. It’s a good idea to plan well in advance what you want to do to the property and budget for the changes in advance e.g. a swimming pool.

That retirement house should be large enough for family and friends to stay with you. The myth that people are downsizing is just that. Either people stay in their existing homes or they tend to buy three or four-bedroom houses. Most of my clients want a house large enough for a family.

Considering that only two people will be living there most of the year, they still want room for their family to stay. When you look for a house, consider this. Also, consider your physical condition later in life. Buy a single-story home to avoid stairs in later life.

Colleagues at work may ask why you purchased a home in another state for example (before you have announced your retirement). The subject may come up in conversation. You can tell the person asking that you wanted a vacation home and how you have one. An honest answer that just leaves off a key element. No need to give away that you are buying your retirement home that far in advance.

Are you planning to relocate?

Something to consider if you are planning to relocate. Sell your house to an investor and ask to rent it back for the last year or so. Renting back your current home leaves you in a great position to just leave on the appointed day without leaving a home behind. Or, you can pack up what is left of your property when you retire and just leave. Your realtor will sell the house when you are living in your new home. This avoids the stress of having to sell one before you can buy another.

Consult with your family about your plans. Explain to them how you have carefully planned out your retirement and how you will support yourself. Discuss what you plan to do with all of that time you will now have available. Perhaps retirement is a time to travel, take up a hobby, volunteer, or start a business. In a perfect world, your family will be supportive and help you with some decisions. If you will be living away from your family, arrange for them to visit and for you to visit them.

What will you do with your time?

Give some consideration about what you will do. I dislike the term “retirement” as most of us use it. use the word “retirement” because in our culture there is no alternative word to use. Some experience depression after they leave their full-time career. Depression can set in when you determine that you can sleep all day if you want to. Sometimes there are so many choices it’s hard to know where to start.

Work keeps up alert and our minds sharp. Work, after you leave your career, can be gardening, a hobby, traveling, going to college, etc. You may want to start a business or get a part-time job. The USO for example is a great place to volunteer.

There are so many possibilities

There are so many possibilities for enriching your life after retirement. Do some research, and think ahead. If you are going to have a hobby, acquire the equipment items needed while you are still working. Perhaps you have some projects in mind e.g an addition to the house etc.

Remember you will be retired for many years, the first years are generally your healthier years so if you plan to climb a mountain, do it early. If you have activities that are more sedentary such as working on the computer, you can do those a bit later in retirement. It’s all part of the planning process.

Plans can and do change, so what if you decide not to pursue that master’s degree and start beekeeping instead. You are entitled. It’s nice to have a whole list of things to consider as backups in case your primary idea fizzles out.

Back to the five-year plan

It’s easy to digress when it comes to thinking about the next phase in your life. Setting a date five years out gives you something to work towards. You will feel more confident that most things are planned for. Start your lists, create the plan and visit it often.

When it came to my career, I had sold my company to a larger company and they wanted me to work for them to ensure things went well. My new supervisor asked if I would give him two years if possible’ notice. He was given three years’ notice.

My plan was created when I was about five years out

I knew about five years out approximately when I would leave the company. As it happened, I planned to leave in March, I stayed until August. During those years, we prepared for the time when I would leave my employer and we would sell our house and relocate. My wife and I were not sure five years out where we wanted to retire but we started the process and by 4.5 years out, we had purchased our “retirement” home.

We visited our new home many times over the years and made several improvements while we were there. Some of those items in the garage and the house were moved every time we visited our future home. This gradual move was a labor of love. We enjoyed the trips in our motor home and when we flew. Who knew that a motor home can be used as a moving van. When the day came to move, we were completely ready. I followed my advice above and cleared out all of the “stuff” (junk) in advance.

I was able to put our home up for sale and move to our Ocean Springs, Mississippi home while still working for my employer. The company permitted working from home so that worked out very well for the month before my last day. My old home sold soon after we left California. The advice that I have provided above is from experience. Everything went to plan. A few modifications from time to time but it went well.

All of that time

The part about deciding what you want to do with your time. I created this blog site while I was still employed in anticipation of it growing over time. After we moved, I obtained a real estate license and created a brokerage with a partner. I worked with partners to acquire vacation rental properties and soon a vacation rental agency to manage them. I wanted to do something that I had a passion for. After spending decades with my own company, it was time to do something different. I loved real estate investment which was a pastime during the years that I managed my company.

I never had the time to do everything that I wanted to do with real estate investments while managing a business full time. Now there is time for all of my activities. Frankly, as my friends will tell you, I am as busy as I ever was managing my company. Who says that retirement means pleasure time? It means meaningful time to me. Then again, I am not retired.

My wife and I can take time to garden, travel, and do what we want. At the same time, I have created a second career that is fulfilling. I wanted to share this information in the blog with you as you are considering the prospect of retirement and how to plan for it.

Your next step should be to read the article on creating a budget and then start that process. Everything will flow from that. If you want a comfortable retirement, plan well in advance. This is your starting point.

There are some companion articles that may help as you start planning: Why I decided to retire in Ocean Springs Mississippi and Biloxi Mississippi a great place to live. If you are a veteran or military retiree, try this one

I decided to retire along the Mississippi Gulf Coast for many reasons not the least of which is that is affordable to retire here. Check out this article about how $500k goes further in Mississippi. If you would like to see what houses cost on the Mississippi Gulf Coast click here. If you want to visit the area, stay in a vacation home by clicking here

Please leave comments below and review other similar articles on this site. Thank you.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

Wonderful information for those who would not of thought they might be more successful knowing what you talked about in this blog.