Last updated on November 25th, 2025 at 12:04 am

Many people ask: “I’m retired — will I still owe taxes in retirement?” The short answer is: it depends, but for most retirees the answer is yes, though the 2025 reforms mean your liability may now be much smaller. Even if you’ve stopped working, your Social Security benefits, pensions, and retirement account withdrawals can still create taxable income under IRS rules (IRS – Taxable Social Security Benefits, IRS – Retirement Income).

There were rumors that President Roosevelt stated that Social Security would not be taxed, that is not true. In 1984, Congress allowed taxation on up to 50% of benefits and later raised the ceiling to 85% of benefits. The intention was to help shore up Social Security. (Kiplinger – Social Security Taxes).

🎬 Video: Franklin D. Roosevelt Signs the Social Security Act of 1935

Why This Matters:

This video captures the moment in 1935 when President Franklin D. Roosevelt officially signed the Social Security Act into law. It’s a powerful primary source that shows the origins of the U.S. Social Security program—one of the most significant federal social welfare laws in American history.

Even though the idea that Social Security benefits would never be taxed has become popular, this video is important because it helps ground what we do know in official record. FDR’s speech confirms the intent behind the law at its signing, and sets the stage for later debates about taxation of benefits—debates that evolved over time with added legislation and amendments.

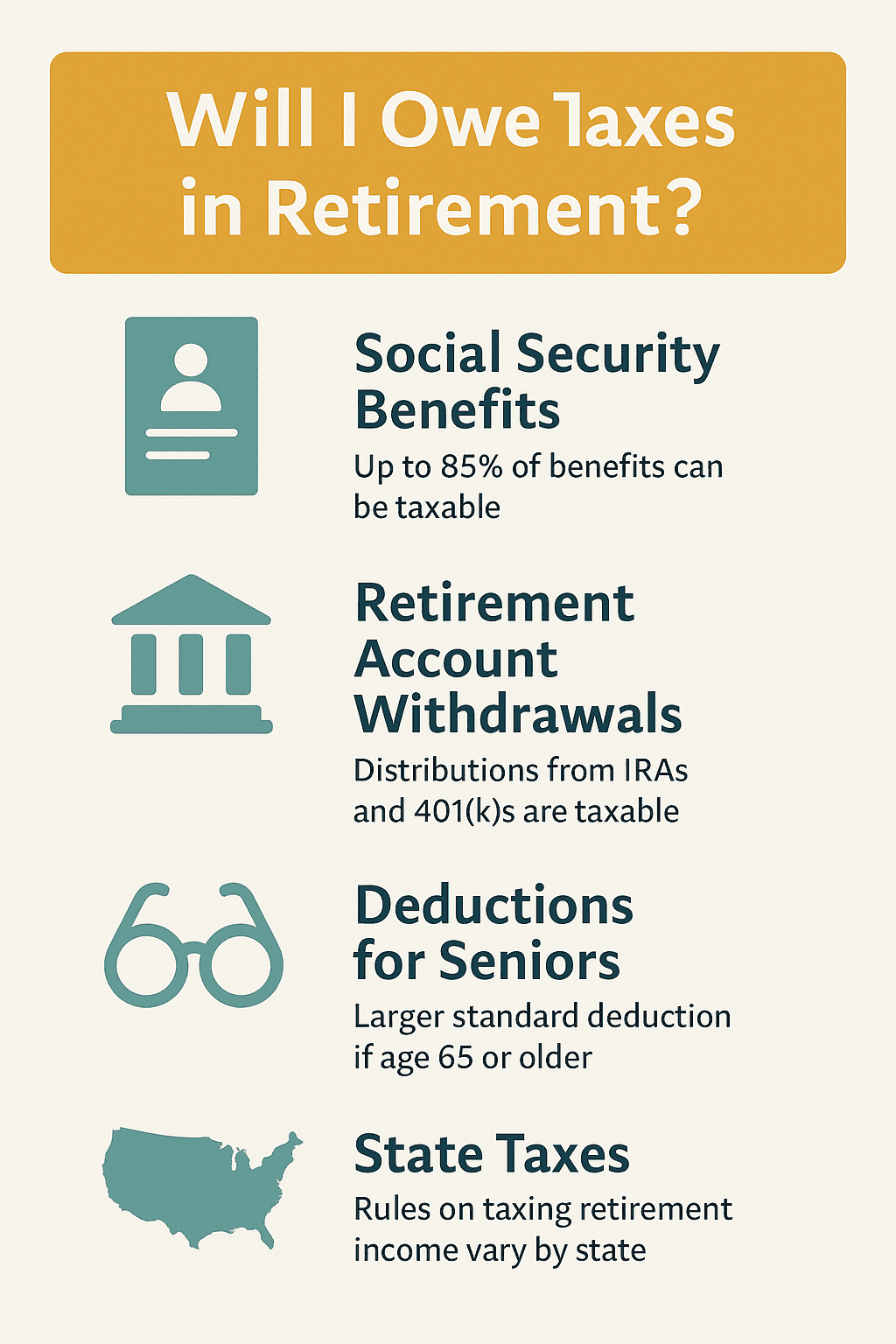

How Social Security Is Taxed

Whether your Social Security benefits are taxed depends on your combined income:

- Adjusted gross income (AGI)

- Nontaxable interest

- One-half of your Social Security benefits

If your combined income is above certain thresholds, you may pay tax on up to 85% of your benefits.

Example:

- Social Security: $28,000

- IRA withdrawal: $20,000

- Dividends/interest: $5,000

- Combined income = $39,000

At that level, most of the Social Security benefit becomes taxable.

The 2025 Reform Attempt

In 2025, Congress passed what many called the “big beautiful bill,” which attempted to eliminate taxation on Social Security. While the complete repeal failed, lawmakers introduced an allowance that shields more benefits from tax.

- Lower- and middle-income retirees receive the greatest relief.

- High-income retirees still see little change.

- Millions of retirees, however, will benefit from reduced taxation of their Social Security checks.

This reform was a step forward, even if it fell short of a full repeal.

Bigger Deductions for Seniors

Another highlight of the 2025 legislation was the expansion of the standard deduction and the senior-specific deduction.

For 2025:

- $15,750 for single filers

- $31,500 for married couples filing jointly

- Plus $1,600 per spouse over age 65 ($2,000 if filing single/head of household)

- Plus a temporary “bonus” deduction of $6,000 per senior ($12,000 per couple), available 2025–2028, phasing out at higher incomes (Fidelity – Standard Deduction Updates).

Example

A married couple where both spouses are over 65 could claim:

- $31,500 (base) + $3,200 (age 65+) + $12,000 (bonus)

- Total = $46,700 deduction

That’s powerful. For many retirees with only Social Security and a small pension, their taxable income drops to zero.

The 2025 reforms mean that for many retirees without wage income and with only modest withdrawals from retirement accounts, the likelihood of paying federal taxes is now much lower.

Retirement Account Withdrawals

One area that still creates surprises is retirement accounts:

- Withdrawals from traditional IRAs and 401(k)s are fully taxable.

- Taking out $10,000 increases your AGI by $10,000 and may trigger taxation of Social Security.

Careful planning — such as spreading withdrawals across years or making Roth conversions — can lower your lifetime tax burden and will I pay tax in retirement?

For more on smart retirement withdrawals, see our RetireCoast guide:

Pensions and Other Income

Not all pensions are taxed the same way:

- Private pensions are usually taxable at the federal and sometimes state level.

- Military and government pensions may have partial or full exemptions depending on state law.

Add in investment income, capital gains, or rental income, and the tax picture becomes more complex.

State Income Taxes

Your federal tax bill is only half the story. States vary widely:

- No income tax states: Florida, Texas, South Dakota, Wyoming, Washington, Nevada, Alaska

- Tax-friendly states: Mississippi exempts Social Security, pensions, and retirement withdrawals — retirees there pay zero state tax on retirement income.

- High-tax states: California, New York, and others may tax pensions and retirement accounts heavily.

Relocating can be a powerful tax-planning strategy.

Avoiding Penalties

If you don’t have taxes withheld on pensions or withdrawals, you may need to make quarterly estimated payments via EFTPS.gov.

Failing to do so can result in penalties if you owe more than 10% of your total liability at tax time. Even one large withdrawal can trigger penalties if not handled properly.

My Editorial Take

In my view, Social Security should never have been taxed. It’s taken many years but now the President and congress agree. They made changes in the 2025 legislation.

The Bottom Line

So, will you owe taxes in retirement? For many, yes — but under the 2025 rules, far fewer retirees will face a federal tax bill if they keep withdrawals modest and rely primarily on Social Security. We hope that this article helps with “Will I owe taxes in retirement?”

Take advantage of our 2025 Tax Planning Tool here.

👉 Key takeaway: Don’t assume you’re tax-free just because you’re retired. Create a plan, use tools like EFTPS.gov, take advantage of the new deductions, and consider state tax rules. With the right planning, you can keep more of your retirement income.

Retirement Taxes: Frequently Asked Questions

1) Will I owe federal income tax if I’m retired?

Often, yes. It depends on your total taxable income: Social Security (portion), pensions, IRA/401(k) withdrawals, interest/dividends, and other earnings. Smart planning can reduce or eliminate what you owe.

2) How does the IRS decide whether my Social Security is taxed?

The IRS uses combined income: Adjusted Gross Income (AGI) + nontaxable interest + one-half of your Social Security benefits. If that total exceeds set thresholds, up to 85% of your benefits may be taxable.

3) Did the 2025 law eliminate taxes on Social Security?

No. The law attempted repeal but settled on an allowance that shields more benefits for many lower- and middle-income retirees. Higher-income retirees may see limited change.

4) What’s the current standard deduction for seniors and how does it help?

Seniors get the base standard deduction plus an additional age-65+ amount (and a temporary “bonus” under the 2025 law). The larger the deduction, the more likely your taxable income drops to zero—especially if you mainly live on Social Security and a small pension.

5) Do Roth IRA or Roth 401(k) withdrawals make my Social Security taxable?

Qualified Roth withdrawals are generally tax-free and do not increase AGI. That can help keep combined income lower and reduce taxation of Social Security.

6) How can I avoid IRS underpayment penalties in retirement?

Either have taxes withheld (from Social Security, pensions, or IRA withdrawals) or make quarterly estimated payments. You can schedule payments at EFTPS.gov.

7) I took a one-time large IRA withdrawal—what should I do?

Large withdrawals increase AGI and can trigger Social Security taxation. Consider withholding tax on the withdrawal, or immediately make an estimated payment to prevent penalties.

8) What is a Qualified Charitable Distribution (QCD)?

If you’re age 70½ or older, you can donate directly from a traditional IRA to a qualified charity. A QCD can count toward RMDs and keep the donated amount out of AGI—potentially lowering tax and reducing Social Security taxation.

9) Do all states tax retirement income?

No. Some have no income tax at all; others exempt Social Security and various retirement sources; a few tax most retirement income. Check your state’s rules—moving to a retiree-friendly state can meaningfully cut taxes.

10) What practical steps should I take right now?

- Estimate this year’s AGI and combined income to see if Social Security will be taxed.

- Right-size withdrawals (avoid big lump sums when possible).

- Turn on withholdings or set up quarterly payments via EFTPS.gov.

- Ask a CPA about Roth conversions, QCDs, and state-tax choices.

- Revisit your plan every fall before RMDs and year-end payouts.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.