Last updated on September 26th, 2025 at 04:32 am

You’re not alone. Many first-time investors are drawn to the idea of owning rental properties—and for good reason. It’s a proven way to build wealth over time. Most beginners start with residential rentals like single-family homes, duplexes, triplexes, or four-plexes.

In this post, we’ll walk through the pros and cons of each type to help you figure out which might be the best fit for your goals. Sure, there are also commercial properties like large apartment buildings and office spaces, but if you’re just getting started, keeping it simple is key.

Our advice? Start with one manageable property, learn the business, and grow from there. Let’s dive in.

What Type of Property Should You Buy First? A Breakdown for First-Time Investors

If you’re a first-time buyer looking for your first investment property or you are Unretiring (see this article), you’re probably wondering where to start. Should you buy a single-family home, a duplex, a triplex, or even a four-plex? Each type of property has its pros and cons, and the first step is understanding which fits your financial situation, investment strategy, and long-term investment goals.

Single-Family Homes (House, Condo, or Townhome)

A single-family home is often the first property purchased by first-time investors. It’s familiar, straightforward, and usually the easiest real estate investment to manage.

Pros:

- Lower purchase price and easier to finance with conventional loans, FHA loans, or VA loans—especially if it’s your first home or primary residence.

- Often located in neighborhoods with strong rental demand.

- Easier to sell or refinance later to build home equity.

Cons:

- If the home is part of an HOA, expect rules that could limit rental income from short-term rentals.

- If the tenant leaves, you lose 100% of your monthly rent.

- Limited cash flow compared to multifamily investment properties.

Financing Tip: Programs from Fannie Mae, Freddie Mac, and the Federal Housing Administration (FHA) can help you qualify for an investment loan with a lower down payment—as long as you plan to live in the property for at least the first year.

Duplexes, Triplexes, and Four-Plexes

These rental properties offer the perfect balance for a new investor—you live in one unit as your primary residenceand rent out the others for passive income. This is known as house hacking and is a good idea if your goal is to generate rental income while keeping your monthly mortgage payment low.

Pros:

- You can finance up to 4 units using FHA loans, VA loans, or conventional loans—as long as you live in one unit.

- More cash flow potential than a single-family home.

- Lower vacancy rate risk, since multiple tenants provide more consistent income.

- You can build a small portfolio of properties under one roof.

Cons:

- Higher maintenance costs, property taxes, and possibly higher interest rates.

- Fewer available properties on the market.

- May require more time and attention if you handle your own management instead of using a property manager or property management company.

Regulation Advantage: By purchasing a rental home with four or fewer units, you avoid the governance structure and stricter regulations that apply to commercial properties (5+ units). This makes these properties a great starting point for first-time investors.

Short-term or Long-term Rentals

There are two distinctly different uses for your property. If the property is located in a tourist-type area or somewhere where there are a lot of visitors, consider short-term. If you want more financial security, a long-term rental may be best. I recommend you take this course to learn more about the entire process.

Define Your Investment Goals Before You Go Further

Before we dive deeper into the world of residential rental properties, take a moment to ask yourself a key question: What do you actually want to accomplish by owning a rental property?

Are you looking for passive income? Long-term financial freedom? Building equity to pass on to future generations? Or maybe you’re hoping to scale into a full portfolio of properties?

Whatever your reason, your investment goals should guide every decision you make—starting with your return expectations.

For example, if you plan to pull funds from an investment account currently earning 7% annually, you’ll want your cash-on-cash return from real estate to match or exceed that. Why take on the extra effort and risk of real estate investing if it performs worse than your existing, likely more passive and diversified investment?

This is why defining your desired return upfront is one of the most important factors in your investing journey.

Once you have that target in mind, you’ll be in a much stronger position when it comes time to analyze properties. It will give you a clear benchmark—making it easier to spot opportunities that meet your standards and pass on the ones that don’t.

Thoughts for First-Time Investors

Whether you’re using Simple Mortgage Online, or other lender, choosing the right property is one of the most important factors in your real estate journey. Be sure to conduct thorough due diligence, including a home inspection, review of tax returns, and consultations with a financial advisor or registered tax agent for professional tax advice.

Don’t forget to consider ongoing expenses like snow removal, property management, and security deposits, all of which affect your monthly payments and bottom line. Create a budget, and read this article.

With careful planning and guidance from a knowledgeable real estate agent, your first rental property can lead to long-term financial freedom and a steady stream of rental income.

Managing Your First Rental Property: Why Hiring a Property Manager Is a Smart Move

Now that you’ve chosen the type of property for your first investment, it’s time to talk about one of the most important decisions you’ll make: how to manage the property.

We’ll get into the details of finding the right property, working with a real estate agent, and navigating the buying process soon—but first, let’s focus on something just as critical: property management.

Whether your rental is across the country or just down the street, we strongly recommend hiring a property manager for your first rental property—even if you live only a mile away.

Why Use a Property Manager?

If you’re like most first-time investors, you probably have a full-time job or other responsibilities. The last thing you need is a call at 10:00 AM—right before a big meeting—saying the plumbing is leaking or the heat isn’t working.

A property manager can save you time, stress, and money while helping you learn the ropes of rental real estate. Here’s why bringing in a professional early on is a good idea:

- You’ll learn how to manage rental properties by observing how it’s done right.

- You’ll avoid the emotional strain of tenant issues, maintenance emergencies, and lease enforcement.

- You’ll be able to focus on your day job, family, and future investment goals.

- You’ll have more time to plan your investment strategy and work on scaling your portfolio of properties.

Common Issues Property Managers Handle:

- Emergency maintenance calls (like broken pipes or no heat)

- New tenant screening and background checks

- Collecting monthly rent and security deposits

- Coordinating repairs, snow removal, and landscaping

- Enforcing lease terms and handling evictions

- Keeping records for tax returns and tax deductions

- Navigating local landlord-tenant laws and regulations

Learning how to manage properties is essential for long-term success in real estate investing, but that doesn’t mean you need to go it alone on day one. Think of your first property management company as both a partner and a teacher.

And don’t worry—we’ll also show you how to evaluate the profitability of any investment property, including how to factor in the cost of a property manager. Knowing your numbers up front is one of the most important factors in building a successful real estate investment business.

How to Start Your Search for the Right Property Manager

So, how do you actually find a reliable property manager—someone who’s a good fit for your goals and who can help you grow your real estate investment portfolio? Here’s a practical way to start your search, especially if you’re investing in a market that’s new to you.

1. Use Zillow or Realtor.com to Scope Out the Area

Begin by visiting sites like Zillow or Realtor.com and searching for rental properties in the area where you’re considering buying. Look for properties that match the type you’re targeting—single-family homes, duplexes, or small multifamily units. Some of these may also be listed for sale, which gives you a head start on evaluating options.

(We’ll get into how to analyze profitability, cash flow, and other financial metrics soon.)

2. Identify the Property Manager

Once you’ve found a few listings that match your criteria, check to see if a property management company is handling them. If so, reach out. Ask some questions about the property, the local rental demand, and what services they provide.

You may come across individual landlords who manage their own properties. For now, keep moving until you find companies with established property management services. You want professionals with systems and support—not someone managing part-time from a spreadsheet.

3. Pay Attention to First Impressions

This part is simple but powerful: Do you like talking to them?

Ask yourself:

- Is this someone I feel comfortable with?

- Do they sound knowledgeable about the local rental real estate market?

- Are they articulate and confident?

- Are you speaking with someone who has decision-making authority within the company?

If you’re impressed, let them know you’ll be following up. No need to commit just yet.

4. Do Your Research

Before moving forward, search for the company online. Look at their website. Are they active on social media? Do they seem professional and transparent? Check Google reviews and other feedback. Look for red flags, but also pay attention to consistent positive themes.

Are other rental property owners happy with their service? Do they offer full-service management, and is their pricing model clearly outlined?

5. Circle Back to Our Evaluation Checklist

Once you’ve narrowed your list, compare the companies you’re considering using the criteria we laid out earlier:

- Do they provide end-to-end services?

- Are their fees reasonable?

- Do they have experience with your type of property?

- Do they have local market expertise?

- Can they help with both long-term and short-term rentals?

Taking the time to find the right property manager up front can save you countless headaches down the road—and possibly help you spot your first investment property before it even hits the market.

How to Run a Property Analysis (Without Getting Overwhelmed)

Now that you’ve found some potential investment properties and maybe even connected with a few property managers, it’s time to figure out whether a property is actually worth buying. This is where a property analysis comes in—and yes, it’s absolutely essential.

The good news? You don’t have to be a math wizard or spend hours buried in spreadsheets. With the right approach—and the right tool—you can evaluate a property’s potential cash flow, monthly payments, and return on investment in no time.

The Basics of Property Analysis

Here are the key numbers you need to evaluate before making any offer:

- Purchase Price – What you’ll pay for the property.

- Down Payment – Usually 3.5% (FHA), 0% (VA), or 20 %+ (conventional).

- Loan Terms – Mortgage loan amount, interest rate, loan type (FHA, VA, conventional, etc.).

- Monthly Rent – Estimated rent based on comps or info from your property manager.

- Vacancy Rate – Plan for some turnover; 5–10% is a common buffer.

- Property Taxes – Varies by area; check the county assessor’s site.

- Insurance – Budget appropriately based on location and property type.

- Maintenance Costs – Estimate 1–2% of property value per year.

- Property Management Fees – Typically 8–12% of monthly rent (if you’re using a property management company).

- HOA Fees – If buying a condo or townhome.

- Utilities & Services – Snow removal, trash, landscaping (if paid by owner).

- Tax Deductions – Don’t forget the potential tax benefits that offset expenses.

Save Time with DealCheck.io

If this sounds like a lot to track manually—it is. That’s why we highly recommend using DealCheck.io. It’s one of the best tools available for real estate investors, especially if you’re analyzing multiple properties or just getting started.

Here’s what DealCheck can do for you:

- Quickly input property data to calculate cash flow, ROI, and cap rate.

- Automatically pull comps, rent estimates, and neighborhood statistics.

- Help you compare deals side-by-side to choose the best investment property.

- Include property management, vacancy rate, and repair estimates in projections.

- Generate professional reports to share with your mortgage lender, real estate agent, or financial advisor.

By using DealCheck, you’ll cut hours of guesswork and be able to make more confident decisions with less stress.

Don’t Skip the Math

It may be tempting to fall in love with a property based on looks or location—but smart real estate investing starts with numbers, not emotions. A great-looking home can still be a bad investment if it doesn’t generate positive cash flow or align with your investment strategy.

Run the numbers, verify with your property manager, and if it all checks out—you’ll know you’re moving forward with a solid deal.

Sample Deal: Running the Numbers with DealCheck.io

To bring this all together, let’s walk through a basic example of how to analyze a potential first investment property using DealCheck.io. This will show you just how easy it is to run the numbers and spot a good deal.

🏠 Sample Property:

- Type: Duplex

- Location: Gulfport, MS

- Purchase Price: $225,000

- Down Payment: 20% ($45,000)

- Loan Type: Conventional 30-year fixed

- Interest Rate: 7%

- Estimated Monthly Rent (Total): $2,400 ($1,200 per unit)

- Property Taxes: $2,200/year

- Insurance: $1,200/year

- Property Management Fee: 10%

- Vacancy Rate: 5%

- Maintenance Reserve: 5% of rent

- HOA Fees: $0

- Utilities Covered by Owner: None

✅ Step 1: Enter Property Info in DealCheck.io

Head to DealCheck.io, create a free account, and click “Add Property.” Enter the basics like address, purchase price, and estimated rent. Then go to the “Purchase” tab to input your down payment, loan type, interest rate, and loan term.

✅ Step 2: Add Operating Expenses

Under the “Expenses” tab, input:

- Taxes and Insurance (monthly equivalent)

- Maintenance Costs (can set this as a percentage of rent)

- Property Management Fee (10% of rent)

- Vacancy Rate (DealCheck will automatically adjust your income)

This step gives you a realistic view of your monthly cash flow and your total monthly mortgage payment (principal + interest + expenses).

✅ Step 3: Review Cash Flow & ROI

Once everything is entered, DealCheck instantly shows:

- Cash Flow: How much profit you’ll make each month after expenses

- Cash-on-Cash Return: Annual return based on your out-of-pocket investment

- Cap Rate: Net income as a percentage of the purchase price

- 5-Year Financial Projection: Including equity, appreciation, and loan payoff

📌 A Note on the 1% Rule:

Many real estate investors use the 1% Rule as a quick screening tool. It suggests that a property should rent for at least 1% of the purchase price per month to be worth considering (e.g., $2,000/month on a $200,000 property).

However, this rule was much more reliable when interest rates, insurance, and property taxes were lower. In today’s market, the 1% Rule often doesn’t hold up—especially in areas with rising costs. That’s why doing a full analysis using DealCheck is more important than ever. It helps you factor in actual expenses like maintenance costs, vacancy rate, and property management fees to get a clear picture of your monthly cash flow.

In our sample deal:

- Monthly Cash Flow: ~$450

- Cash-on-Cash Return: ~12%

- Cap Rate: ~7.8%

- 5-Year Return: Strong potential for building equity and passive income

Why This Matters

These numbers help you decide if a property meets your investment goals and works within your personal finance limits. Plus, DealCheck lets you create a printable deal report—great for sharing with a mortgage lender, registered tax agent, or real estate agent to get feedback.

Instead of guessing, you’re working with real numbers—and that’s how successful rental property owners operate.

Time to Talk Taxes: What You Need to Know About Rental Property and Passive Income

At this point, you’ve learned how to evaluate deals, run the numbers, and understand the potential return on a rental property. Now let’s address a topic that’s often misunderstood—taxes.

Many new investors assume that owning an investment property automatically comes with amazing tax breaks. And yes, there are some great tax benefits, but it’s important to understand how they really work—especially when it comes to your status as an investor.

Passive Income vs. Active Income

Rental income is classified as passive income by the IRS, which means it’s treated differently than the active income you earn from a job or business. Because of this classification, the IRS limits your ability to deduct certain investment losses—especially against your regular ordinary income.

Here’s a simplified breakdown of how it works:

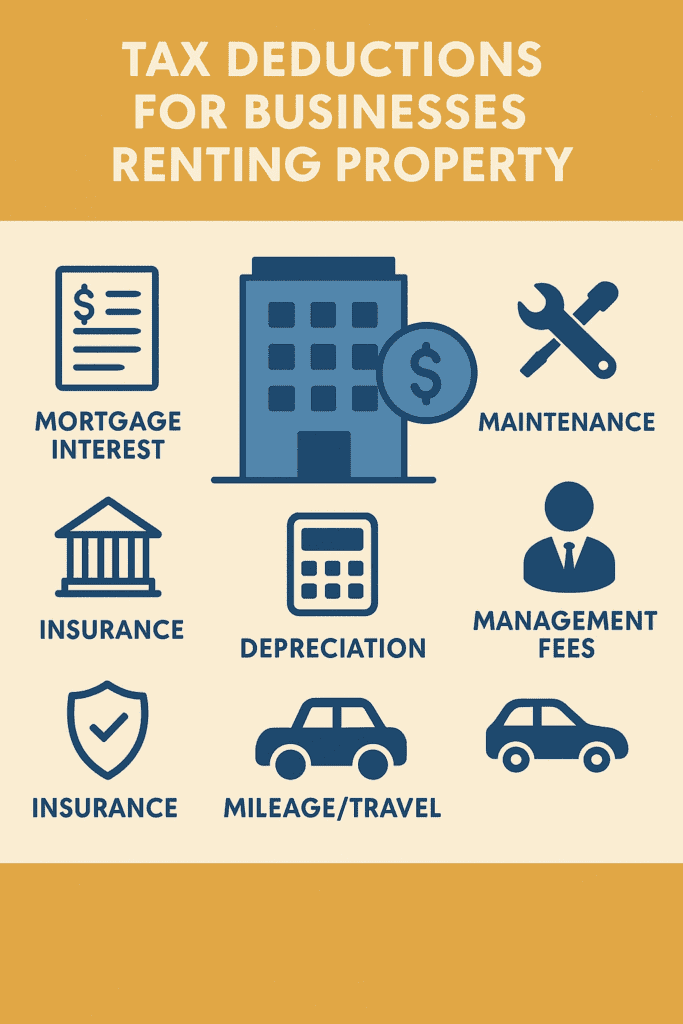

- Rental income is taxed, but you can reduce it with qualified expenses, such as:

- Mortgage interest

- Property taxes

- Insurance

- Maintenance and repairs

- Property management fees

- Depreciation

- However, if your expenses exceed your rental income (i.e., you show a loss), you may not be able to deduct the full amount on your tax returns unless:

- You are considered an active participant and meet income requirements

- You qualify as a real estate professional (based on hours worked and role in managing the properties)

- You have suspended losses that can be carried forward to future years or used when you sell the property

So while you might think you’re getting massive write-offs, your actual ability to use those losses depends on your total income and your role in managing the property.

What You Can Deduct as a Rental Property Owner

Even though you may not be able to deduct all losses against your active income, there are still several valuable tax deductions available to rental property owners. These can reduce your taxable rental income and improve your overall return.

Here are some of the most common deductions:

✅ Mortgage Interest

If you have a mortgage loan, the interest portion of your monthly mortgage payment is deductible.

✅ Property Taxes

Local and state property taxes are fully deductible against your rental income.

✅ Insurance Premiums

This includes hazard insurance, landlord coverage, and even umbrella liability insurance if used for your rental home.

✅ Maintenance & Repairs

You can deduct routine repairs and maintenance costs—everything from fixing a leaky faucet to snow removal and landscaping. Just make sure these are considered necessary and ordinary expenses.

✅ Property Management Fees

If you use a property management company, the fees you pay are deductible, including leasing, maintenance coordination, and monthly rent collection.

✅ Utilities Paid by the Owner

If you cover utilities (water, trash, electricity, etc.), these can be written off as operating expenses.

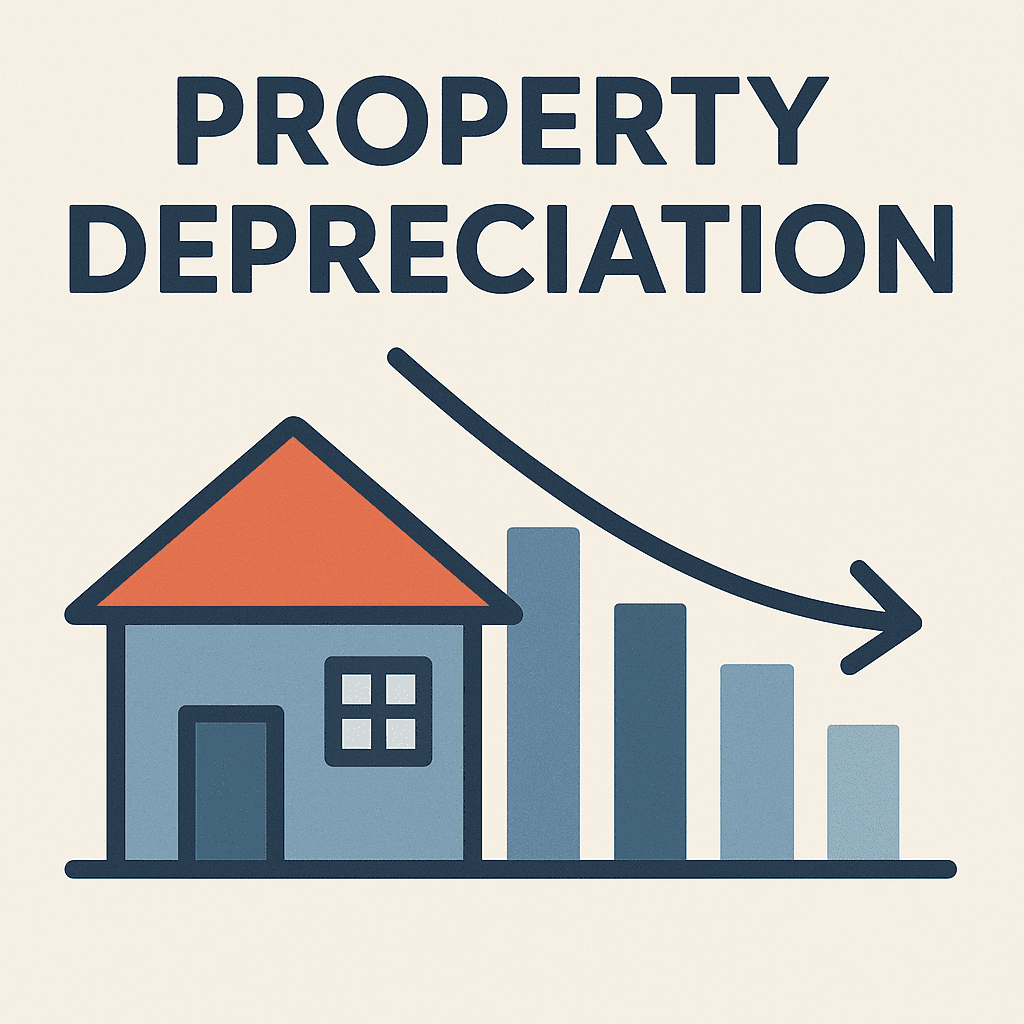

Understanding Depreciation: A Hidden Tax Benefit

One of the biggest tax advantages of owning investment property is depreciation. The IRS allows you to depreciate the structure (not the land) over 27.5 years, which means you can deduct a portion of the property’s value every year—even if the property is increasing in market value.

Example:

If the building value (not including land) is $200,000, your annual depreciation deduction would be approximately $7,273.

Depreciation is a non-cash deduction, meaning it reduces your taxable income without affecting your monthly cash flow—a big win for real estate investors.

Why You Should Work with a Tax Professional

The U.S. tax code is complex, and real estate tax laws are no exception. That’s why it’s critical to work with a qualified registered tax agent, CPA, or tax advisor who understands rental real estate, especially if you plan to build a portfolio of properties or invest through a separate legal entity like an LLC.

A good advisor can:

- Maximize your tax deductions

- Help you understand carryforward losses

- Guide you on when you can deduct losses against active income

- Advise on the best governance structure and legal protections

- Ensure you’re complying with the Tax Agent Services Act (if applicable in your country)

In short, taxes on rental income can be complicated—but they also provide some of the most powerful advantages in real estate investing when used properly.

Let’s Recap What You’ve Learned So Far

If you’ve made it this far, congratulations—you’re already ahead of most first-time investors. You now have a solid foundation to make smart decisions as you move forward in your real estate investing journey.

Here’s a quick summary of what we’ve covered:

1. Set Your Goals

You clarified what you want to achieve—whether it’s cash flow, long-term wealth, or a path to financial freedom.

2. Choose the Right Type of Property

You learned the pros and cons of single-family homes, duplexes, triplexes, and four-plexes, and how to choose the right property for your goals and financial situation.

3. Consider Hiring a Property Manager

Even if you live nearby, a property management company can save time and teach you how to manage effectively—especially on your first rental property.

4. Learn How to Find the Right Property Manager

You discovered how to start your search using Zillow and Realtor.com, and by evaluating professionalism, reputation, and services offered.

5. Run a Property Analysis

You saw how to gather important financial data and calculate returns like cash flow, cap rate, and cash-on-cash return.

6. Use Tools Like DealCheck.io

You walked through an example of using DealCheck to simplify the analysis process and evaluate whether a deal meets your criteria.

7. Understand How Taxes Work

You learned how passive income is treated differently and why you can’t always deduct losses from your regular income.

8. Know What You Can Deduct

We covered key deductions like mortgage interest, property taxes, insurance, repairs, and depreciation—plus why working with a registered tax agent is essential.

What’s Next: Let’s Talk About the Legal Side of Owning Rental Property

Before you go out and buy your first investment property, there are a few more things we need to cover—especially around how to legally protect yourself, structure your ownership, and comply with local laws.

In the next section, we’ll explore:

- Whether you should buy in your own name or through an LLC or a separate legal entity

- The basics of landlord-tenant law

- How to protect yourself with insurance, leases, and proper documentation

- And more…

Let’s dive into the legal side of becoming a successful, protected rental property owner.

One Last Thing—And It’s a Big One: Landlord-Tenant Law

Before you close on your first rental property, there’s one more topic we need to cover—and it’s critical to your success (and protection) as a property owner: landlord-tenant law.

Every state has its own regulations, and it doesn’t stop there. Cities, counties, and even homeowners associations (HOAs) may impose their own rules on rental properties. These rules can affect everything from security deposits and notice periods to whether you can even rent out your property at all.

This is a link to landlord/tenant law in Mississippi as an example.

.

Know the Local Climate

It’s not just about the laws—it’s about the political landscape. Ask yourself:

Does the area I’m buying in actually welcome rental properties?

Even if rentals are legal, your neighbors, HOA, or local government might not be supportive. In some areas, rental property owners face real pushback, even harassment. It’s essential to understand the tone and attitude of the community before you invest.

Understand the 30-Day Rule

Many municipalities distinguish between short-term and long-term rentals. The standard line is 30 days—anything rented for fewer than 30 days is usually considered a short-term rental, and it comes with very different rules, permits, and tax obligations.

In some areas, even 30 days isn’t enough. You may need to sign a minimum of 6-month leases just to comply with local regulations.

Rental vs. Lease Agreement

There’s also a difference between a rental agreement (typically month-to-month) and a lease agreement (fixed term, like 12 months). Each has different legal implications, renewal options, and termination requirements. Be sure to use the right one for your market and situation.

🔍 Not sure what these documents should include? Check out our resource library on RetireCoast.com, where we’ve published a sample lease and rental agreement you can review and use as a starting point.

Federal Rules Matter Too

Don’t forget—HUD (U.S. Department of Housing and Urban Development) enforces federal fair housing laws. This means you must fully understand:

- Protected classes

- Discrimination laws

- What you can and cannot say when marketing or screening tenants

A single misstep, even if unintentional, could open you up to lawsuits or investigations.

Why a Property Manager Can Be Your Best Defense

One of the best ways to avoid legal pitfalls—especially as a first-time landlord—is to work with an experienced property manager. They know the local rules, understand HUD guidelines, and can shield you from costly mistakes and tenant issues.

Final Thoughts: From First-Time Investor to Informed Property Owner

By now, you’ve gone from casually considering an investment property to understanding the real steps involved in building a successful rental property business. You’ve learned how to set goals, evaluate deals, find the right people to work with, and protect yourself legally and financially.

Owning rental property can absolutely lead to financial freedom—but only if you approach it with knowledge, planning, and the right support.

And that’s exactly why we created this guide.

At RetireCoast, we’re here to help you go beyond the basics. Whether you need help forming an LLC, creating an operating agreement, reviewing your tax strategy, or connecting with a trusted property manager, our resources are designed to make your journey smoother and more profitable.

✅ What’s next?

- Check out our “Starting a Business After Retirement” article series

- Download our FREE Rental Property Goals & Returns Planner

- Explore our sample lease and rental agreement templates

- Reach out if you’d like help with LLC formation, business insurance, or a custom plan for your first property

- Read more here about starting a business after retirement for real estate investing.

- Want to speak to a property manager? Send us a note, and we can arrange an hour to talk about property management. Our fee for this consultation is $125. [email protected]

📩 Need help getting started?

We’re happy to answer questions or connect you with services that save you time, reduce risk, and help you succeed. Don’t forget to sign up to receive notices of future articles. The top right side of this article.

You’ve taken the first step—now let’s take the next one together.

FAQ: The Best Guide to Buying Your First Investment Property

1. What Is an Investment Property?

An investment property is real estate purchased primarily to generate income—either through rental payments, property appreciation, or both. Unlike a primary residence, investment properties are not used by the owner as a home.

2. Is Now a Good Time to Buy an Investment Property?

Timing depends on your local market conditions, interest rates, and personal financial situation. In general, buying during a buyer’s market or when rental demand is high can yield better returns.

3. How Much Money Do I Need to Buy My First Investment Property?

Expect to put down 15–25% for a conventional loan, plus additional funds for closing costs, initial repairs, and cash reserves. A solid budget is essential for investment success.

4. What’s the Difference Between Residential and Commercial Investment Properties?

Residential investment properties include single-family homes, condos, and small multifamily units (2–4 units). Commercial properties are 5+ units, retail, office, or industrial spaces, often requiring different financing and management approaches.

5. What’s the Best Type of Investment Property for Beginners?

First-time investors typically start with single-family homes or duplexes due to lower upfront costs and easier property management. These are easier to finance and attract a broader range of tenants.

6. Should I Use a Real Estate Agent to Buy an Investment Property?

Yes, a knowledgeable real estate agent can help you find deals, evaluate market trends, and navigate inspections and negotiations. Choose an agent who specializes in investment properties.

7. How Do I Know If a Property Is a Good Investment?

Analyze the cash flow, location, rental demand, cap rate, and potential for appreciation. A common rule of thumb is the 1% rule—rent should be at least 1% of the property price.

8. What Tax Deductions Can I Claim for an Investment Property?

Real estate investors can deduct mortgage interest, property taxes, insurance, repairs, maintenance, depreciation, management fees, and travel expenses related to the property.

9. Can I Get a Mortgage for an Investment Property?

Yes, but requirements are usually stricter than for primary residences. You’ll need a higher credit score, a larger down payment, and enough income to cover existing debts.

10. What Are the Risks of Owning an Investment Property?

Risks include vacancies, maintenance costs, tenant damage, legal liability, and market downturns. Mitigate risks with proper screening, reserves, and landlord insurance.

11. How Do I Find and Keep Good Tenants?

Screen tenants thoroughly—check credit, background, employment, and rental history. Offer a clean, well-maintained property and communicate clearly to retain quality renters.

12. Should I Hire a Property Manager or Self-Manage?

Self-managing saves money but can be time-consuming. Property managers handle everything from leasing to maintenance and are ideal for long-distance owners or those with multiple properties.

13. How Do I Calculate ROI on a Rental Property?

To calculate ROI (Return on Investment), use this formula:

ROI = (Annual Net Income ÷ Total Cash Invested) × 100

Use the DealCheck.io tool to quickly calculate ROI, cash flow, cap rate, and other key investment metrics to evaluate your property’s performance.

14. What Legal Responsibilities Do Landlords Have?

Landlords must comply with federal, state, and local laws regarding fair housing, security deposits, habitability, lease agreements, and eviction procedures. Consult a real estate attorney for your jurisdiction.

15. Should I Form an LLC to Buy My First Rental Property?

Forming an LLC can offer liability protection and potential tax advantages. However, it may also complicate financing. Consult with a real estate attorney or CPA to weigh the pros and cons of your situation.

Starting a Business After Retirement

This article has been included in our series Starting a Business After Retirement because one of the recommended businesses to start is property investment. We strongly recommend that you read all of our articles regardless of your status regarding retirement. Each of the articles covers key elements in developing a successful business. Investing in property is a business activity. Click the button below to see our series of articles located at our archive site: StartingaBusinessAfterRetirement.Com

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.