Before the 2017 tax law changes, many people considered buying a home primarily for the tax benefits. The mortgage interest deduction and property tax write-offs were once the main financial incentives for becoming a homeowner. Those days are mostly behind us. With the higher standard deduction, far fewer households itemize, which means the old “buy for the tax savings” logic no longer applies to most buyers.

That doesn’t mean there are no tax benefits of owning a home in 2025. On a holistic basis, homeownership still provides meaningful financial advantages — from deductions some households still qualify for, to the powerful capital gains exclusion when you sell. This article breaks down the most relevant homeowner deductions, explains where tax savings from homeownership still matter, and helps you see the bigger financial picture.

This article is part of a larger series on home buying, tied together by our Complete Guide to Home Buying Costs, Tax Benefits, and Mortgage Readiness. That pillar guide provides an overview of closing costs, tax advantages of homeownership, and steps to prepare for a mortgage. Here at RetireCoast.com, we go deeper into each topic with focused articles like this one so you can make smarter financial decisions on your path to homeownership.

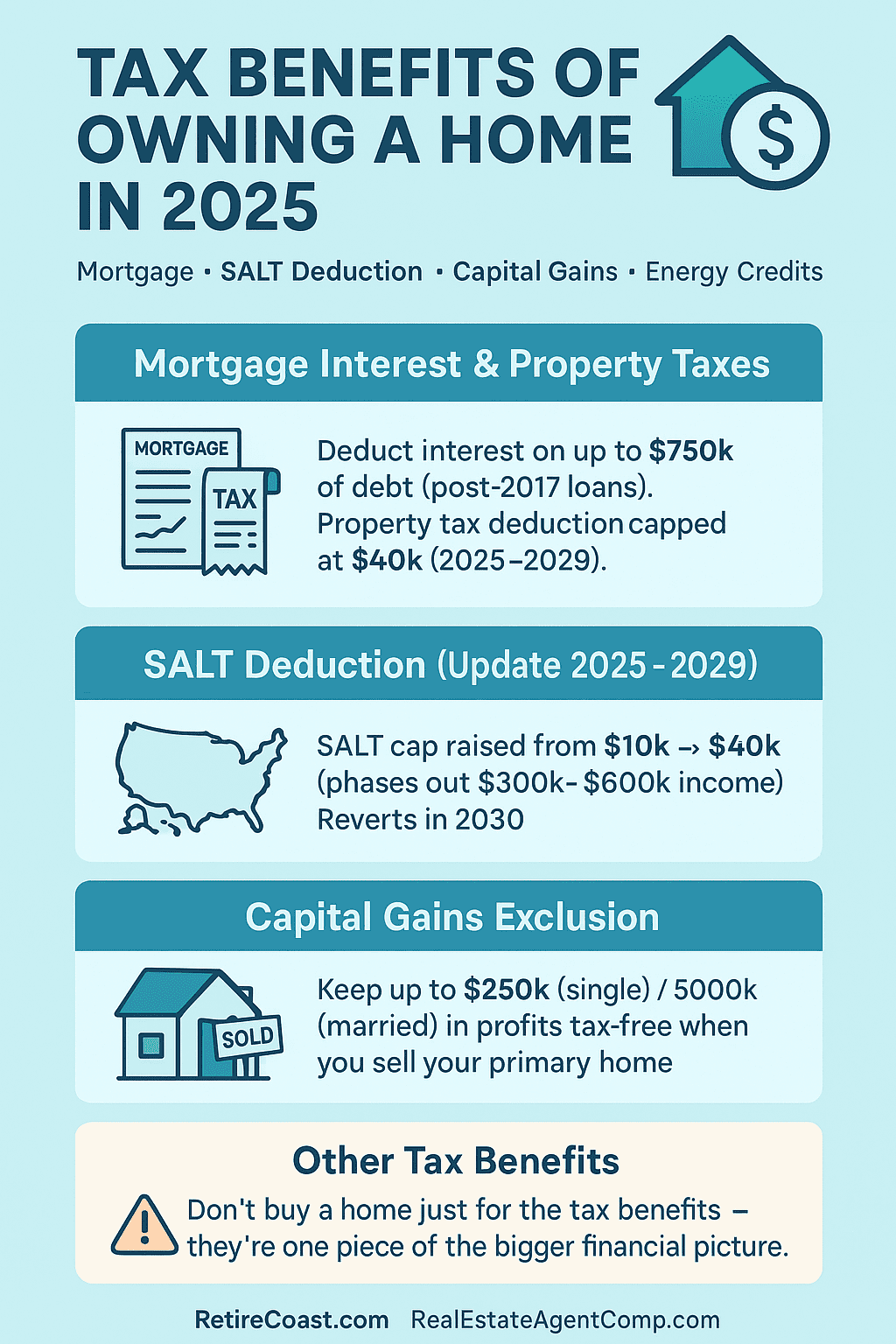

Mortgage Interest and Property Tax Deductions in 2025

The most common homeowner tax benefits come from two itemized deductions: mortgage interest and property taxes. 👉 Learn more from the IRS overview of the SALT Deduction

Mortgage Interest Deduction

- Homeowners who itemize can deduct mortgage interest on qualifying loans.

- For mortgages taken after December 15, 2017, interest is deductible on up to $750,000 of debt ($375,000 if married filing separately).

- For older loans, the cap may still be $1 million.

- This deduction is most valuable in the early years of a mortgage when interest payments are highest.

Property Tax Deduction and SALT Cap Rules

- Homeowners may also deduct state and local property taxes as part of their itemized deductions.

- From 2017 through 2024, this was capped at $10,000 under the SALT (State and Local Tax) limit.

- In July 2025, Congress temporarily raised the cap to $40,000 for tax years 2025–2029.

- Full $40,000 cap available for households with income under $500,000.

- Phases out between $500,000–$600,000.

- Reverts back to $10,000 in 2030 unless extended.

👉 Tip: Add up your eligible itemized deductions (mortgage interest + property taxes + other deductions). If they don’t exceed your standard deduction, the standard deduction is usually the better choice.

Call-Out: Why I Took the Standard Deduction

Last year, I calculated the amount of property taxes and mortgage interest I paid. Because I live in a low-tax, low cost-of-living state, my allowed deductions totaled far less than the standard deduction.

As a senior, my standard deduction for my wife and me in 2025 was $33,100. I opted for the standard deduction rather than itemizing my taxes.

👉 Tip: Add up your eligible itemized deductions (mortgage interest + property taxes + other deductions). If they don’t exceed your standard deduction, the standard deduction is usually the better choice.

Capital Gains Exclusion on Home Sales

While deductions for mortgage interest and property taxes don’t benefit everyone, the capital gains exclusion remains one of the most powerful tax benefits of homeownership.

How It Works

- If you sell your primary residence after living in it for at least two of the last five years, you can exclude a large portion of your profit from federal capital gains taxes.

- The limits are:

- $250,000 for an individual taxpayer

- $500,000 for a married couple filing jointly

💡 Tax & Finance Resources

Looking for more expert insight? Start with the Consumer Financial Protection Bureau for mortgage basics, check the latest market stats from the National Association of Realtors, and explore financial strategies in the Investopedia Home Buying Guide.

Why It Matters

This exclusion allows many homeowners to walk away from a home sale with hundreds of thousands of dollars in tax-free profit.

- Case 1 (Individual): Buy for $200,000 → Sell for $425,000 → Profit $225,000 → Tax owed = $0.

- Case 2 (Married couple): Buy for $300,000 → Sell for $800,000 → Profit $500,000 → Tax owed = $0.

👉 This is a terrific advantage not extended to real estate investors. Investors must pay capital gains tax on profits from a property sale, unless they use strategies like a 1031 exchange to defer taxes. Homeowners, by contrast, can exclude up to $250,000–$500,000 outright.

Bottom line: The capital gains exclusion is one of the most generous breaks in the tax code, making homeownership a powerful wealth-building tool.

Other Tax Benefits of Owning a Home in 2025

Energy Efficiency Tax Credits

- Credits for solar panels, new HVAC systems, windows, insulation, and other upgrades.

- Worth up to 30% of qualifying costs.

- These energy efficiency tax credits directly reduce taxes owed.

- 👉 See details on Tax Credits for Energy Efficiency at Energy.gov.

Home Office Deduction

- Available for self-employed individuals who use part of their home regularly and exclusively for business.

- Not available to W-2 employees working remotely.

Medical Home Modifications

- Modifications such as ramps, lifts, or widened doors can qualify as medical deductions if medically necessary.

- Helps reduce taxable income when medical expenses exceed thresholds.

Estate Planning and Trusts

- Additional tax advantages can be achieved through estate planning.

- By creating certain types of trusts, you can pass your property to family members in a way that minimizes or avoids estate taxes and capital gains.

- ⚠️ This area is complex. Laws vary by state and can change over time. Always consult a qualified tax professional or estate attorney before setting up a trust.

⚠️ Call-Out: Don’t Buy a Home Just for the Tax Benefits Tax benefits are just one reason to buy a home. They can help, but the bigger picture is about building equity, securing long-term stability, and creating a place to live that fits your lifestyle.

Generational Perspectives: Gen X and Millennials

Millennials: Building Equity and First-Time Ownership

- Largest group of first-time buyers.

- Less likely to itemize, so mortgage interest and property tax deductions may not apply.

- Biggest advantage: long-term capital gains exclusion when they eventually sell.

- Strong interest in energy efficiency credits tied to sustainability.

Gen X: Balancing Homeownership with Retirement Planning

- In peak earning years, they are more likely to itemize.

- Benefit significantly from the temporary $40,000 SALT deduction cap (2025–2029).

- With retirement on the horizon, the capital gains exclusion is key when downsizing or relocating.

FAQs: Tax Benefits of Homeownership in 2025

1. Do all homeowners get tax breaks in 2025?

No. Most households now use the standard deduction, so only some benefit from itemized deductions.

2. How much can I save with the mortgage interest deduction in 2025?

It depends on your loan size and whether you itemize. For many, the standard deduction is larger.

3. What are the current property tax deduction rules?

From 2025 through 2029, the SALT deduction cap is $40,000 (phased out above $500k income). After 2029, it reverts to $10,000.

4. Do I pay taxes when I sell my house?

Not if your profit is under $250,000 (single) or $500,000 (married). The capital gains exclusion makes that profit tax-free.

5. Do investors get the same break on property sales?

No. Investors must pay capital gains tax on profits unless they use a 1031 exchange to defer.

6. Can trusts really help reduce homeownership taxes?

Yes, in some cases. Estate planning with trusts can help heirs acquire property tax-efficiently, but it requires professional legal guidance.

Calculators to help understand this article

Mortgage Interest & Itemized vs Standard Deduction

SALT Deduction Estimator (Property + State/Local Taxes)

Capital Gains Exclusion — Primary Residence

Energy Efficiency / Solar Tax Credit (Estimate)

Related Articles in This Series

Want to explore the full picture of home buying costs and benefits? Check out the rest of our series:

- How Much Are Closing Costs? A Buyer’s Guide in 2025 — Learn what to expect at the closing table and how much you’ll need to budget.

- What Are the Tax Benefits of Owning a Home in 2025? — Understand deductions, exemptions, and long-term tax savings for homeowners.

- The Complete Guide to Home Buying Costs, Tax Benefits, and Mortgage Readiness — Our comprehensive pillar article that ties everything together.

Conclusion + Call to Action

The tax benefits of owning a home in 2025 aren’t as broad as they were before 2017, but they remain meaningful. The mortgage interest deduction and property tax deduction rules benefit some, while the capital gains exclusion offers one of the strongest wealth-building opportunities in the tax code. Add in targeted credits for energy efficiency, home office use, and estate planning tools, and the savings can add up. Check out our article on refinancing your house here.

Remember: don’t buy a home for the tax benefits alone. Buy for the equity, stability, and long-term financial security, with tax perks as an added bonus.

📌 Next steps:

- Learn more about closing costs in 2025

- Improve your credit score for a mortgage

- Explore our Complete Guide to Home Buying Costs, Tax Benefits, and Mortgage Readiness

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.