Last updated on December 9th, 2025 at 05:09 am

Introduction: Why Credit Matters More Than Ever

In 2026, buying a home is about more than finding the right property — it’s about proving to lenders that you’re financially ready. Your credit score is the single most important factor in whether you qualify for a home loan and what mortgage rate you receive.Improve credit score for mortgage 2026

This article is part of a larger series on home buying, tied together by our Complete Guide to Home Buying Costs, Tax Benefits, and Mortgage Readiness. That pillar guide provides an overview of closing costs, tax advantages of homeownership, and steps to prepare for a mortgage. Here at RetireCoast.com, we go deeper into each topic with focused articles like this one so you can make smarter financial decisions on your path to homeownership.

Even a 20-point increase in your score can save you thousands in interest and reduce your overall loan cost over the life of a mortgage.

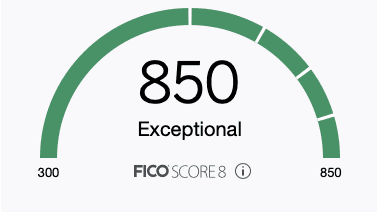

For FICO® Scores (range 300–850), a good credit score starts around 670, while 740+ is considered very good. The highest credit score possible is 850. The closer you are to the top tiers, the better chance you’ll have at securing lower interest rates, reduced closing costs, and stronger long-term financial stability.

According to Experian, the national average credit score in 2024 was 715. The average borrower getting a purchase loan in April 2025 had a score of 737. That’s the level most lenders now expect for the best deals.

Mortgage Credit Score Requirements in 2026

| Type of Loan | Minimum Credit Score |

|---|---|

| Conventional | 620 |

| Jumbo | 700 |

| FHA | 580 (or 500 with 10% down) |

| VA | 620* (no VA minimum, but lenders set theirs) |

| USDA | 640 |

Tip: While these are minimums, most approved borrowers score much higher. Lenders reward strong credit with lower interest rates, better terms, and higher approval odds.

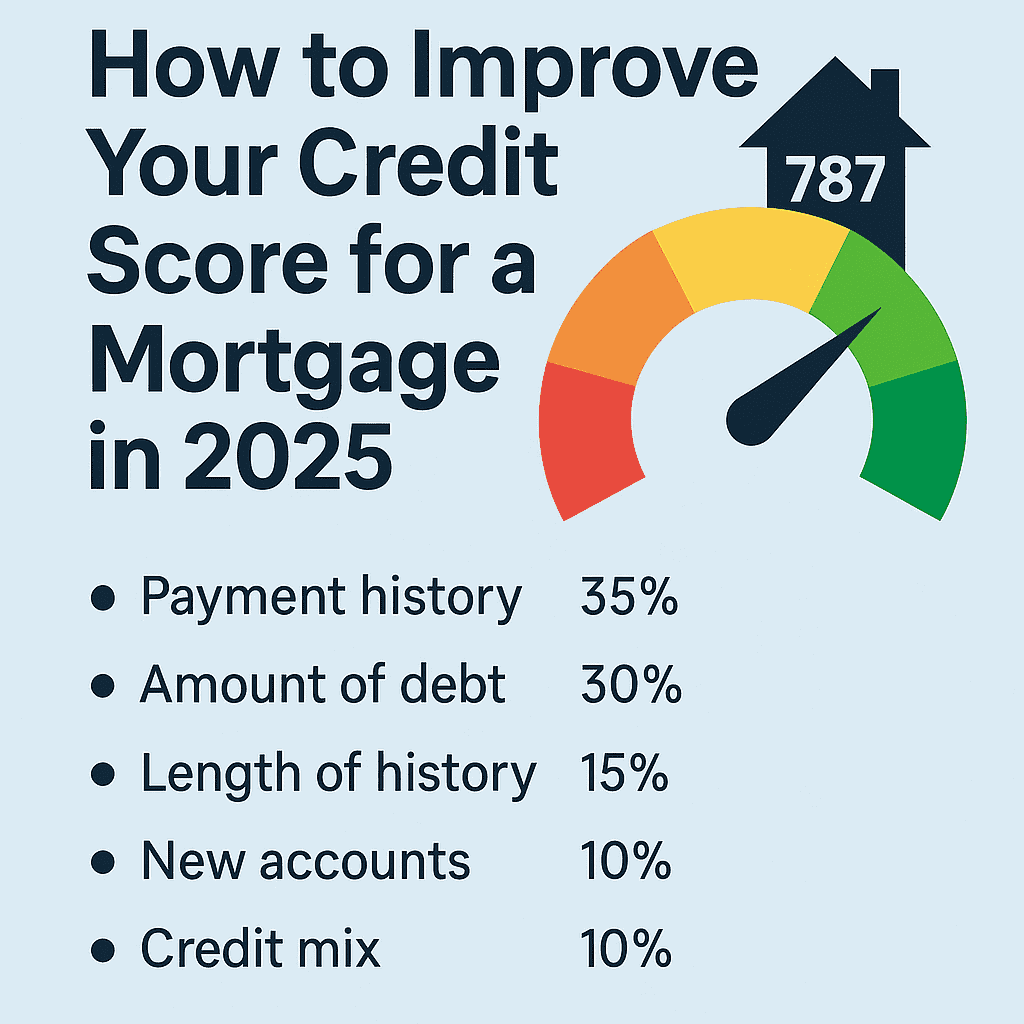

How Credit Scores Are Calculated

Your FICO® Score is made up of five weighted factors. Here’s the breakdown:

- Payment history (35%) — On-time vs late payments on credit card bills, mortgages, and loans.

- Amounts owed (30%) — Your credit utilization ratio (balances vs total available credit).

- Length of history (15%) — Long-standing accounts carry more weight.

- New accounts (10%) — Too many hard inquiries or new credit accounts signal risk.

- Credit mix (10%) — A variety of credit cards, auto loans, student loans, and personal loans builds trust.

25 Ways to Improve Your Credit Score in 2026

- Pay bills on time — use autopay to avoid late fees.

- Apply windfalls or refunds to high-interest debt.

- Reduce credit utilization — keep balances under 30%.

- Pay off balances monthly.

- Handle debt in collections — settle or dispute.

- Dispute credit report errors at AnnualCreditReport.com.

- Add alternative payments with tools like Experian Boost.

- Keep old accounts open for history and higher limits.

- Limit new accounts before applying for a mortgage.

- Apply for loans within two weeks to group inquiries.

- Try a credit-builder loan at a credit union.

- Use a secured credit card to rebuild history.

- Become an authorized user on a trusted card.

- Track your credit score through your issuer.

- Protect against identity theft with fraud alerts.

- Use side income to pay down debt faster.

- Work with a certified nonprofit credit counselor.

- Avoid credit repair scams — no one can erase accurate data.

- Report rent payments for positive history.

- Budget carefully to manage monthly payments.

- Build a mix of credit (cards, loans, mortgages).

- Use a cosigner if necessary, but with caution.

- Apply your tax refund strategically toward debt.

- Ask for a credit limit increase without overspending.

- Have patience — excellent credit takes time.

The Hard Facts About a Bad Credit Score

- You failed to pay on time — even one 30+ day late hurts.

- Lenders see you as too risky for normal terms.

- You signed an agreement to pay on time — no excuses.

- You spent more than you can repay.

- You may have unpaid obligations (child support, etc.).

- A court judgment may be on your record.

- You relied on credit cards to cover lost income.

Bottom line: Own it. Most score damage comes from habits — which means you can change them.

How to Start Rebuilding Credit

- Always pay on time. Set up autopay or reminders.

- Call lenders immediately if you lose income — don’t wait.

- Avoid unnecessary purchases that rack up interest.

- Use credit lightly. Keep usage under 10–15% of your limit.

- Create and stick to a budget. Track every monthly payment.

Remember: It took time to damage your credit; it will take time to rebuild — but steady habits win.

📖 Real Story: How a Business Credit Card Saved a Credit Score

A friend asked me about his credit situation. He was using his personal credit card to buy equipment for his small business, nearly maxing it out. His credit utilization ratio spiked, his credit score fell, and his finance company raised his interest rate.

The solution? He opened a business credit card, paid off his personal balance, and separated business from personal expenses. His personal credit score quickly rose, and his business had its own line of credit.

Lesson: Keep business and personal credit separate, and never let personal utilization exceed 10%.

📖 Real Story: The Car Loan That Killed a Mortgage

A client couple had pre-approval and were just one week from closing. Then the lender pulled their credit again — and denied the loan.

They had bought a car on credit, which pushed their debt-to-income ratio too high. The deal collapsed.

Lesson: Never take on new debt before closing — even one loan can torpedo your mortgage.

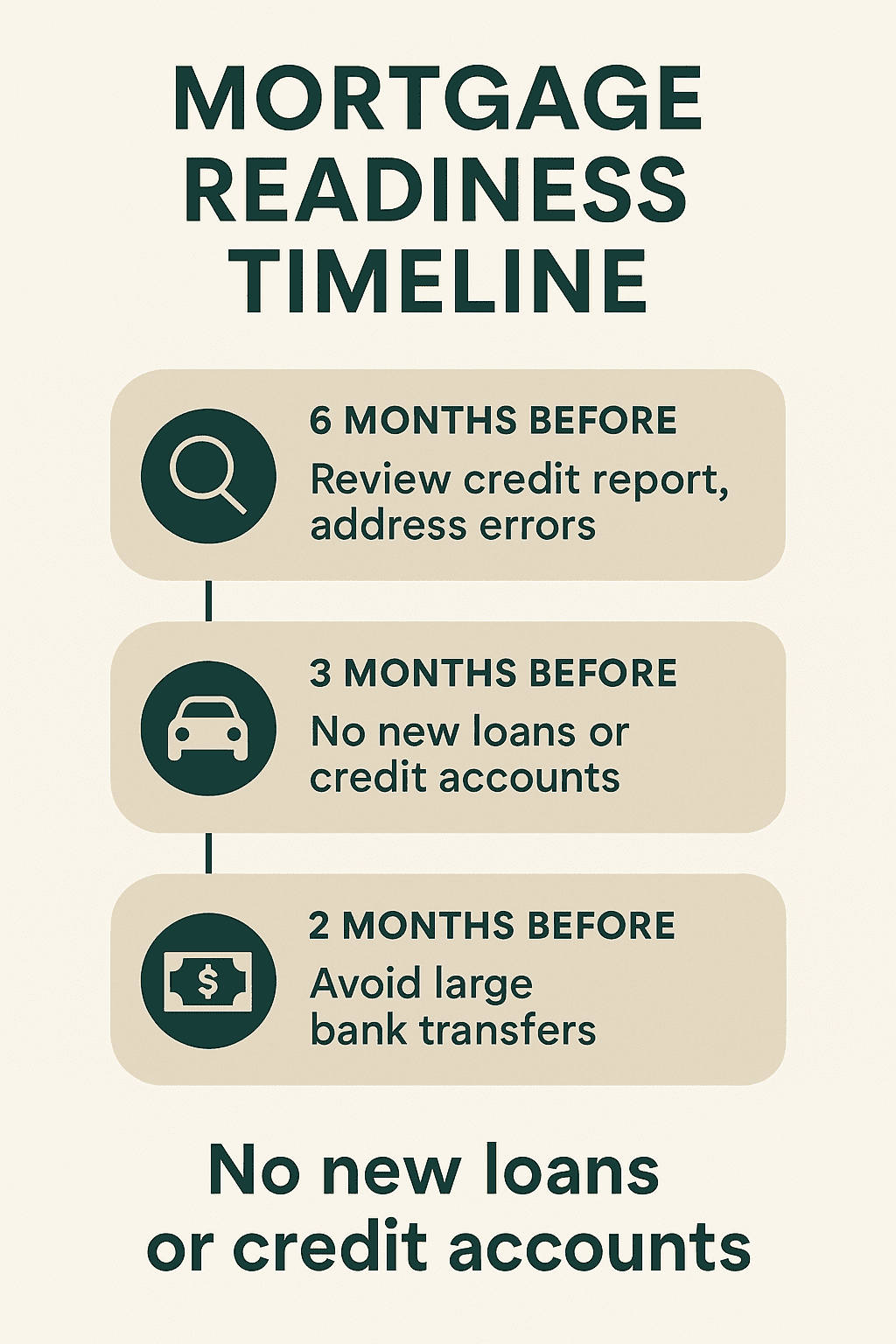

Mortgage Readiness Timeline

6 Months Before

- Pull credit reports at AnnualCreditReport.com.

- Dispute errors, pay bills on time, lower balances.

- If your score is under 720, identify issues and correct them.

3 Months Before

- No cars, loans, or new credit cards.

- Keep credit card balances steady.

- Do not co-sign for anyone.

2 Months Before

- Do not move large sums in or out of bank accounts.

- Deposit gift funds early.

- Keep bank statements clean and simple.

Why a Higher Credit Score Saves You Money

Even a small score improvement can change your mortgage rate.

Example: On a $300,000 home, 3% down:

- 6.875% → $2,176 monthly

- 7.0% → $2,200 monthly

- Savings: $8,000+ over 30 years

📊 Mortgage Credit Score Impact Calculator

See how raising your credit score (and lowering your mortgage rate) can save you money.

Generational Perspective: Gen X vs Millennials

Millennials: Often juggle student loans and shorter histories. Best strategies: secured cards, rent reporting, lowering utilization.

Gen X: Higher incomes but often higher debts. Best strategies: pay down balances quickly, avoid new loans.

Next Steps in the Mortgage Process

- Gather documents: pay stubs, tax returns, bank statements.

- Shop around with at least 3 lenders for preapproval.

- Find a home and make an offer.

- Complete underwriting and lender checks.

- Close on the home and pay closing costs.

FAQs

Q: What’s the minimum credit score for a mortgage in 2025?

Conventional: 620 | Jumbo: 700 | FHA: 580 (500 w/10% down) | VA: 620 (varies) | USDA: 640

Q: How fast can I raise my score?

Quick fixes like lowering balances can help in a short time, but long-term gains take patience.

Q: Should I pay off debt or save for a down payment?

If debt hurts your score, pay it down first — a better score lowers borrowing costs.

Q: Can I get a mortgage with bad credit?

Yes, FHA and VA allow lower scores, but often at higher long-term cost.

Related Articles in This Series

Want to explore the full picture of home buying costs and benefits? Check out the rest of our series:

- How Much Are Closing Costs? A Buyer’s Guide in 2025 — Learn what to expect at the closing table and how much you’ll need to budget.

- What Are the Tax Benefits of Owning a Home in 2025? — Understand deductions, exemptions, and long-term tax savings for homeowners.

- The Complete Guide to Home Buying Costs, Tax Benefits, and Mortgage Readiness — Our comprehensive pillar article that ties everything together.

Conclusion

Improving your credit score is the best way to save money when buying a home. From reducing credit card debt and monitoring your Equifax credit report to avoiding new loans before closing, every decision matters.

Start early. Be consistent. And when you walk into your lender’s office, you’ll have a higher credit score, a better mortgage rate, and a much smoother path to homeownership.

📊 Improving Credit & Loan Readiness

Strengthen your mortgage prep with outside resources: the Consumer Financial Protection Bureau explains credit and mortgage rules, the National Association of Realtors highlights buyer trends, and Investopedia provides step-by-step home loan education.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.