SECTION 1 – Understanding Your Retirement Gap

1.1 What Is a “Retirement Gap”?

A retirement gap is the distance between what you will realistically have at retirement and what you will realistically need. For many Gen Xers, this gap grows quietly over time due to inconsistent saving, unexpected financial setbacks, or periods of high household expenses. A gap doesn’t mean failure — it simply means there’s a measurable shortfall that can still be corrected with strategic planning. This page focuses on fixing retirement gaps for Gen X, helping you understand why the gap exists, how to measure it, and the practical steps you can take to close it before retirement.

Whether the challenges stem from high debt, late saving, market volatility, or supporting aging parents or adult children, Gen X still has time to correct course and build a stable, confident retirement.Many Gen Xers are also concerned about financial longevity, which we address in our companion article,

“Gen X Fear: Running Out of Money”:

https://retirecoast.com/gen-x-fear-running-out-of-money/.

Common contributors to a retirement gap include:

- Saving too little during your 30s and early 40s

- Borrowing from workplace retirement plans

- Carrying high-interest debt late in life

- Pausing retirement contributions during job changes

- Underestimating healthcare, long-term care, and inflation

- Paying off adult children’s college loans, a major issue discussed in several of our Gen X planning guides such as

https://retirecoast.com/gen-x-retirement-guide/.

Recognizing the gap is the first step toward fixing retirement gaps for Gen X in a meaningful and sustainable way.

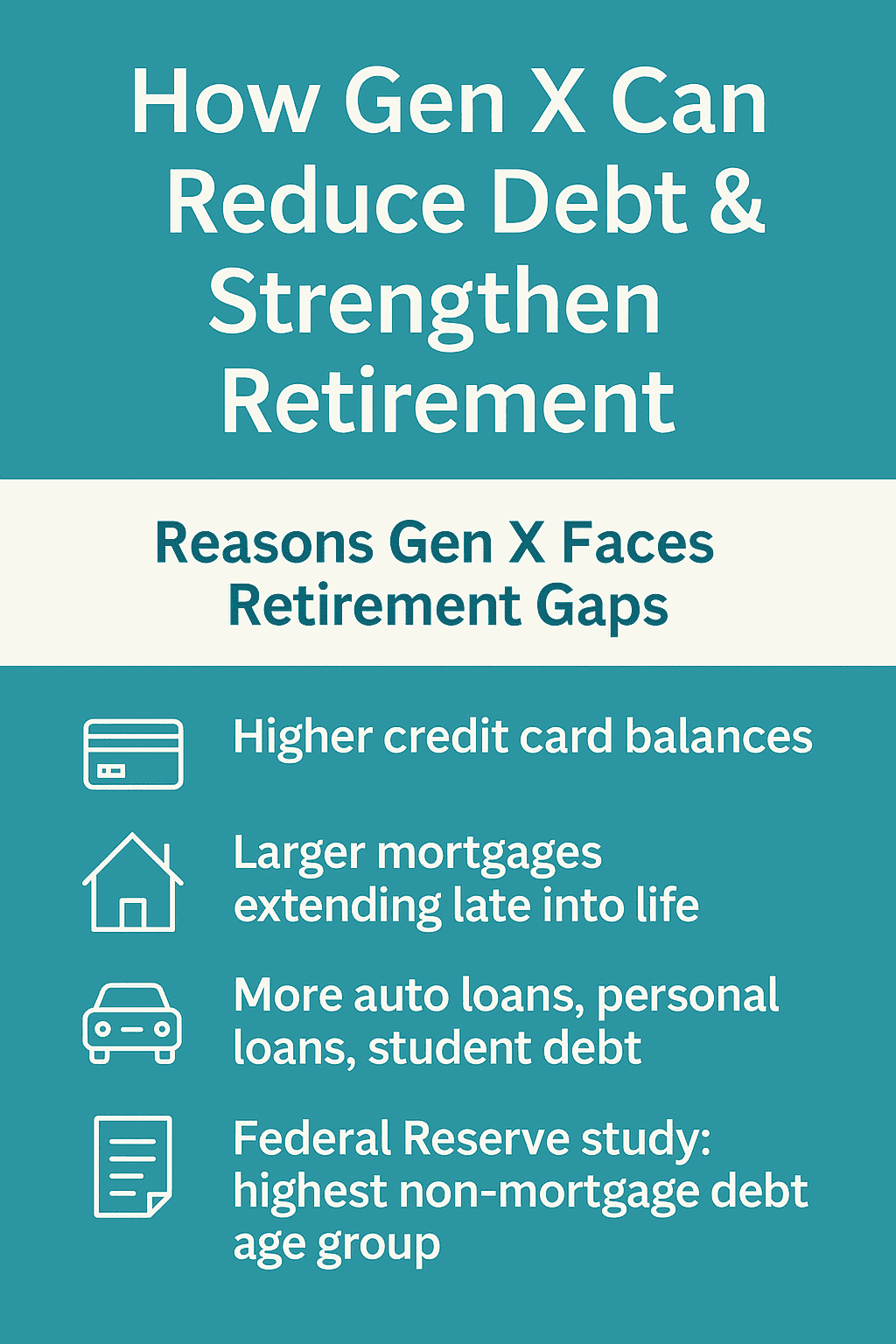

1.2 Why Gen X Is More Likely to Have a Gap

Generation X entered adulthood during economic instability — recessions, layoffs, the dot-com collapse, the Great Recession, and rapidly rising living costs. They shoulder the responsibilities of raising children and supporting aging parents while trying to save for retirement.

Additional reasons Gen X faces a higher likelihood of retirement shortfalls include:

- Having children later in life, which pushes college costs and major expenses closer to their mid-50s — discussed further in

https://retirecoast.com/how-gen-xers-can-build-wealth-through-homeownership-vs-renting/. - Late entry into peak earning years due to economic downturns

- Higher debt loads, including mortgages, student loans, and medical debt

- Being the “sandwich generation” — supporting both children and aging parents

- Longer expected lifespans requiring more savings

- Shifting retirement responsibility as pensions disappeared in favor of self-funded plans

For a broader overview of these trends, see our foundation article:

https://retirecoast.com/gen-x-only-20-years-to-retirement-get-planning-now/

1.3 How to Assess Your Personal Situation

Fixing a retirement gap begins with clearly understanding where you stand today. Start with a simple financial inventory:

Review your current retirement savings

- Tally 401(k), 403(b), 457, IRA, HSA, and brokerage accounts

- Review current contribution rates

- Determine whether catch-up contributions are being used (indexed annually by IRS)

- Review asset allocation for age and risk appropriateness

For deeper guidance on 401(k) planning strategies, see:

https://retirecoast.com/the-best-gen-x-retirement-guide-for-401k-planning-strategies/.

Evaluate your debt

- List all debts with balances, terms, and interest rates

- Prioritize high-interest consumer debt

- Consider structured payoff strategies that free up funds for investing

Estimate your future retirement income

- Create an SSA account to review Social Security estimates

- Include pensions

- Consider rental income, business income, or “second-act” careers

- If you plan to work for yourself, this guide helps:

https://retirecoast.com/best-gen-x-playbook-for-building-your-second-act-business/.

Also bookmark:

https://retirecoast.com/how-can-i-maximum-earnings-for-gen-x-social-security/

Run retirement projections

Use tools and calculators to visualize your retirement path:

- Social Security Break-Even Calculator

- Home Affordability Calculator

- Rental Property Cash Flow Calculator

- DSCR and cap-rate tools

- For a tailored Gen X guide:

https://retirecoast.com/gen-x-retirement-guide/.

Use Our Gen X Budget Tool to Map Your Retirement Plan

Start organizing your income, expenses, debts, and retirement investments in our dedicated Gen X Budget & Retirement Planner. This tool helps you see your real retirement gap and test different savings and catch-up strategies.

Open the Gen X Budget Planning ToolAdditional Gen X resources to bookmark as you assess your situation

- FAQ for Gen X retirement planning

https://retirecoast.com/gen-x-faq/ - Gen X homeownership strategies

https://retirecoast.com/gen-x-20-year-retirement-homeowners-dream-home/ - The best self-employed retirement plans for Gen X

https://retirecoast.com/the-best-self-employed-retirement-plans-for-gen-xers-2023/

SECTION 2 – Reducing Debt to Boost Retirement Security

For Gen X, reducing debt is one of the most powerful ways to close a retirement gap. With fewer years left to save, high-interest payments and large monthly obligations steal money that could otherwise grow through retirement contributions, investment income, or home equity.

Multiple government studies confirm that adults approaching retirement age are carrying more debt than at any point in modern history. According to the Consumer Financial Protection Bureau (CFPB), older Americans now carry significantly higher credit card and mortgage balances than previous generations — dramatically reducing their ability to save for retirement:

https://www.consumerfinance.gov/data-research/research-reports/consumer-debt-older-americans/?utm_source=chatgpt.com

Similarly, the U.S. Department of Labor (DOL) notes in its “Savings Fitness” guide that high debt directly reduces retirement preparedness, because money spent on interest cannot be invested for long-term growth:

https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/publications/savings-fitness?utm_source=chatgpt.com

This makes debt reduction a foundational part of fixing retirement gaps for Gen X.

2.1 Why Debt Reduction Is Critical for Gen X

Debt is not just a monthly expense — it’s a retirement plan disruptor. Gen X carries:

- Higher credit card balances

- Larger mortgages extending late into life

- More auto loans

- Personal loans

- Student debt for themselves or their adult children

A Federal Reserve study confirms that Americans ages 45–64 hold the highest median non-mortgage debt of any age cohort:

https://www.federalreserve.gov/consumerscommunities/shed.htm?utm_source=chatgpt.com

And a Government Accountability Office (GAO) report shows that debt carried into older age is linked to greater financial insecurity and higher default risk:

https://www.gao.gov/assets/gao-21-170.pdf?utm_source=chatgpt.com

If these pressures have caused fear of outliving your money, read our related article:

https://retirecoast.com/gen-x-fear-running-out-of-money/

2.2 Smart Strategies to Pay Down Debt Faster

Clearing debt is not simply about paying bills — it is about turning those freed-up dollars into accelerated retirement savings. Gen Xers can use several evidence-based strategies to eliminate debt efficiently.

The Avalanche Method (Best Financial Impact)

Pay off debts with the highest interest rate first.

CFPB research shows this method produces the lowest total interest cost and fastest payoff timeline:

https://www.consumerfinance.gov/consumer-tools/debt/?utm_source=chatgpt.com

The Snowball Method (Best for Motivation)

Pay off the smallest balance first to build momentum.

The National Foundation for Credit Counseling (NFCC) recommends this for those who need early wins to stay committed:

https://www.nfcc.org/resources/?utm_source=chatgpt.com

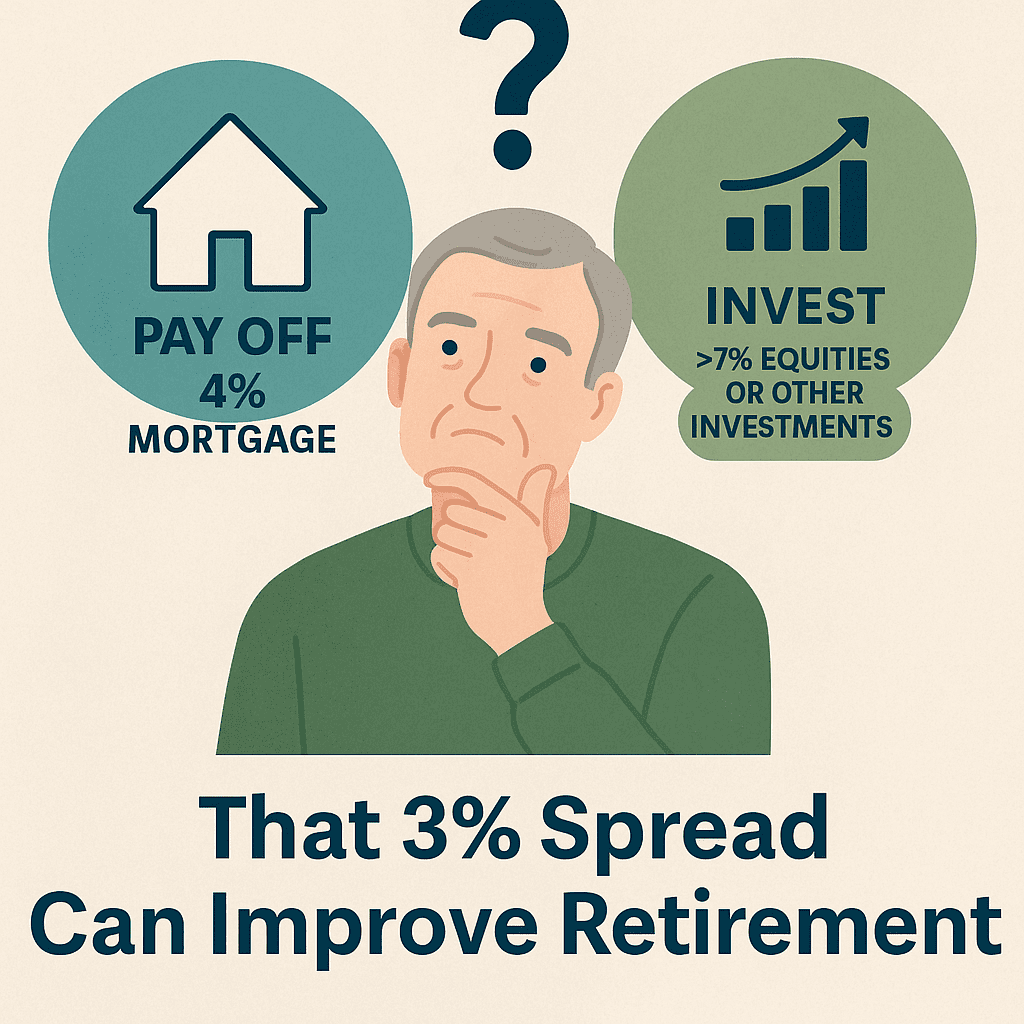

Mortgage Restructuring or Term Adjustments

Mortgage decisions require a long-term view. Rates fluctuate; what matters is how your mortgage supports your retirement timeline.

Sometimes a longer term reduces monthly payments enough to boost retirement contributions or support catch-up limits indexed by the IRS.

For data on mortgage market trends, see the Federal Housing Finance Agency (FHFA):

https://www.fhfa.gov/DataTools/Downloads?utm_source=chatgpt.com

Important: Don’t feel pressured to pay off your home before retirement.

Many Gen Xers prioritize a mortgage payoff even when it’s not financially optimal. Review this before making that decision:

https://retirecoast.com/retiring-with-mortgage-debt/

For building wealth through homeownership, see:

https://retirecoast.com/how-gen-xers-can-build-wealth-through-homeownership-vs-renting/

Consolidation and Structured Repayment (Used Carefully)

The Federal Trade Commission (FTC) warns that consolidation only helps if the new loan truly lowers interest costs and shortens payoff time:

https://consumer.ftc.gov/articles/how-manage-your-debt?utm_source=chatgpt.com

The Department of Education also provides guidance for borrowers paying student loans for themselves or their children:

https://studentaid.gov/manage-loans/repayment?utm_source=chatgpt.com

Use the RetireCoast Calculators Hub

RetireCoast provides free calculators to help you model payoff timelines, test scenarios, and visualize the retirement impact of eliminating debt.

Explore the full calculators hub:

https://retirecoast.com/calculators-hub/

Home Ownership Builds Wealth

The equity in your home at retirement is often tax free, does not affect Social Security, and may continue to grow throughout your retirement years. Your home remains one of the most stable wealth-building tools available to Gen X—both before and after you stop working.

2.3 Lifestyle Adjustments That Speed Up Debt Payoff

Lifestyle changes often deliver faster progress than income increases — and Gen X can benefit from even modest reductions.

The Bureau of Labor Statistics (BLS) confirms that Americans aged 45–64 have the highest spending levels in several categories, especially housing, transportation, and discretionary items:

https://www.bls.gov/cex/?utm_source=chatgpt.com

Downsizing or Rightsizing Your Home

Lower mortgage payments, taxes, and utilities can accelerate debt payoff and increase retirement contributions.

The HUD Office of Policy Development & Research outlines how home equity is a long-term stabilizer for older households:

https://www.huduser.gov/portal/home.html?utm_source=chatgpt.com

Cutting Discretionary Spending

Reducing travel, dining out, subscriptions, and entertainment frees cash quickly.

Eliminating High-Fee Services

Unused subscriptions, gym memberships, or bundled phone/internet packages can redirect hundreds per month toward debt.

Using Found Money

Tax refunds, bonuses, commissions, or windfalls can dramatically shorten payoff timelines.

Lifestyle adjustments fit into the broader Gen X planning strategy:

https://retirecoast.com/gen-x-only-20-years-to-retirement-get-planning-now/

SECTION 3 – Maximizing Workplace Retirement Plans

For Gen X, workplace retirement plans such as 401(k), 403(b), and 457 accounts remain the most powerful tools for accelerating retirement savings. These plans offer automated contributions, employer matching, tax advantages, and investment growth — all essential ingredients for fixing retirement gaps for Gen X.

Because most Gen Xers do not have pensions, strengthening workplace contributions has become a critical component of building a secure retirement before age 60.

3.1 Why Workplace Plans Matter for Gen X

Gen X began saving during economic uncertainty — recessions, wage stagnation, rising housing costs, and the shift from pensions to individual retirement accounts. This makes maximizing workplace plans especially important.

The U.S. Department of Labor (EBSA) confirms that consistent contributions to workplace plans are among the strongest predictors of retirement readiness:

https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/publications?utm_source=chatgpt.com

The IRS also indexes contribution limits annually, giving those age 50+ access to additional catch-up contributions — a key tool for late savers:

https://www.irs.gov/retirement-plans?utm_source=chatgpt.com

For deep strategy guidance, see:

https://retirecoast.com/the-best-gen-x-retirement-guide-for-401k-planning-strategies/

3.2 Increasing Your Contribution Rate

Small, steady increases to your contribution rate can dramatically improve retirement outcomes — especially when combined with employer matching. Many workplace plans allow automatic annual increases of 1–2%.

Ways to increase contributions effectively:

- Raise your rate with every promotion or raise

- Set an annual automatic escalation

- Reallocate savings from debt payoff into retirement

- Revisit your allocation once a year

To see how contribution changes affect long-term projections, explore the RetireCoast Calculators Hub:

https://retirecoast.com/calculators-hub/

FREE MONEY: Don’t Miss Your Employer Match

When your employer matches a portion of your monthly 401(k) or Roth workplace contribution, it’s literally free money. At the minimum, every Gen X worker should strive to contribute at least enough to receive the full employer match—often around 6%, depending on your plan.

Want to know more about maximizing your match and boosting your retirement savings? Read our guide on Gen X and smart 401(k) planning:

Read the Gen X 401(k) Strategy Guide3.3 Using Catch-Up Contributions (Without Quoting Dollar Amounts)

Once you reach age 50, the IRS allows additional “catch-up” contributions to retirement plans. These limits increase annually with inflation.

Catch-up contributions allow Gen Xers to:

- Close retirement gaps faster

- Reduce taxable income (Traditional)

- Build tax-free retirement income (Roth)

- Maximize final-decade earning power

IRS catch-up information:

https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-catch-up-contributions?utm_source=chatgpt.com

For side-business catch-up contribution opportunities, see:

https://retirecoast.com/the-best-self-employed-retirement-plans-for-gen-xers-2023/

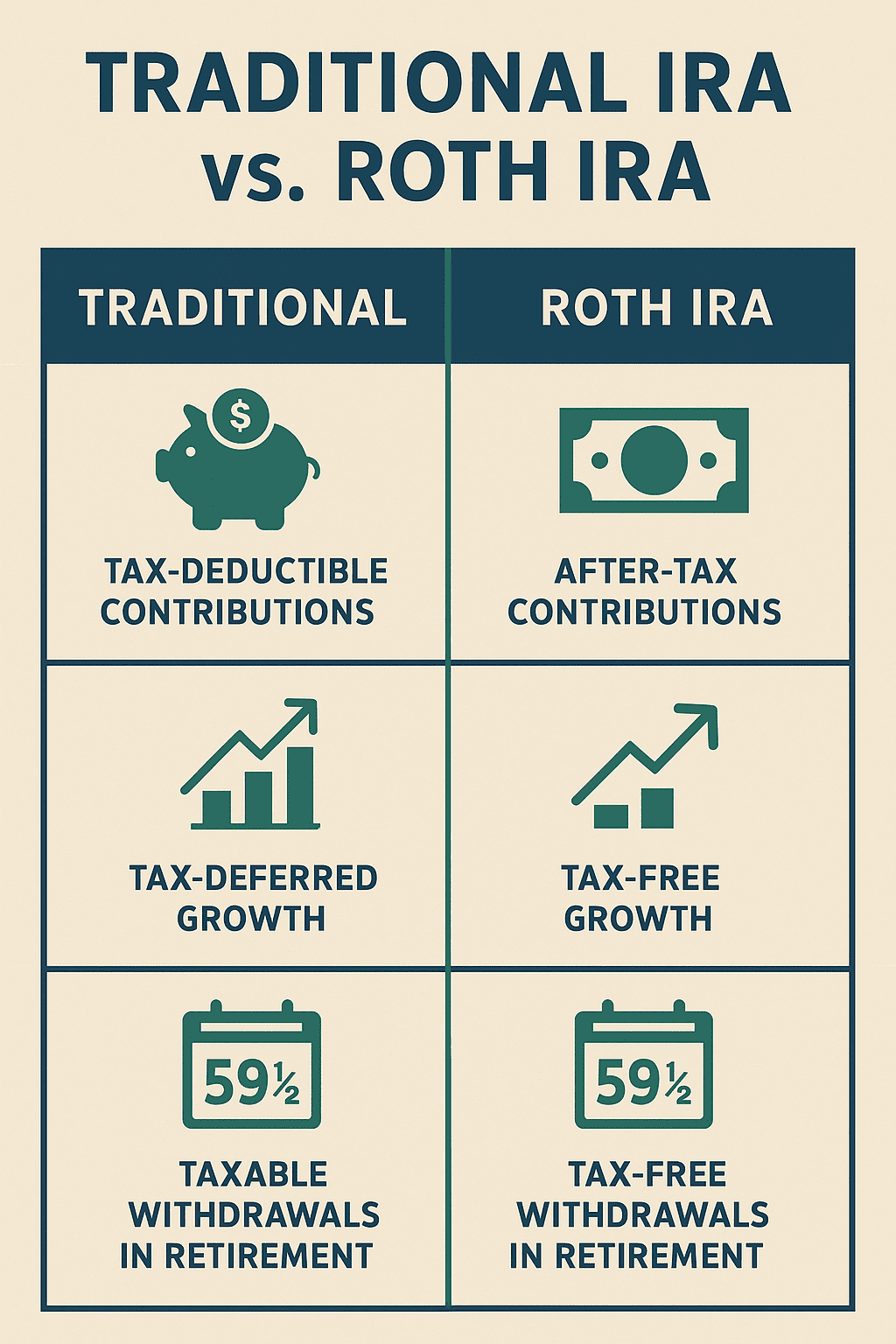

3.4 Roth vs. Traditional Workplace Plans

Choosing between Roth and Traditional contributions shapes both tax strategy and future income flexibility.

Traditional 401(k) / 403(b)

- Lowers taxable income today

- Useful for high earners or those balancing debt reduction

Roth 401(k)

- Retirement withdrawals are tax-free

- Ideal for expected higher future tax rates

- Helps diversify retirement tax exposure

The U.S. Treasury provides guidance on tax-advantaged accounts:

https://home.treasury.gov/policy-issues/taxes?utm_source=chatgpt.com

Practical Strategy I Personally Followed

A powerful approach — and one I used for years — is:

- Contribute to your 401(k) up to the employer match (mine was 6%),

- Switch to funding your Roth IRA until you reach the IRS annual limit,

- Then return to your 401(k) and continue contributing until you hit the IRS maximum for the year.

Pro Tip:

If you receive a large bonus early in the year, ask your employer to temporarily increase your 401(k) withholding so you max out your annual limit early. This gives your contributions more time to grow throughout the year — a strategy that significantly boosted my own retirement savings.

3.5 Avoiding Common Workplace Retirement Mistakes

Gen Xers can lose valuable compounding time by making these common mistakes:

- Failing to get the full employer match

- Choosing overly conservative or overly aggressive allocations

- Borrowing from workplace plans

- Halting contributions during financial stress

- Not revisiting investment choices regularly

FINRA offers guidance for evaluating retirement decisions:

https://www.finra.org/investors?utm_source=chatgpt.com

STOP! Don’t Withdraw Funds From Your 401(k)

This is your future self speaking: “Think of me 20 years later, struggling to pay bills because you depleted the 401(k). That account was our lifeline! Please don’t take money out unless it’s an absolute emergency.”

3.6 Strengthening Retirement Flexibility Through Workplace Savings

Workplace retirement plans make it possible to:

- Retire earlier

- Reduce reliance on Social Security

- Build tax diversification

- Take advantage of rising contribution limits

- Create flexible income strategies

For Social Security optimization guidance:

https://retirecoast.com/how-can-i-maximum-earnings-for-gen-x-social-security/

3.7 Why Workplace Plans Are Essential to Closing Gen X Retirement Gaps

Workplace plans combine consistency, tax deferral, employer support, and long-term investment growth — exactly what Gen X needs to accelerate progress before age 60.

3.8 Self-Employment Retirement Savings Options

Many Gen Xers operate side businesses, real estate ventures, or full-time self-employment — opening doors to powerful, tax-advantaged retirement savings tools.

Solo 401(k)

- Employee + employer contributions

- Higher IRS-indexed limits

- Roth and Traditional options

SEP IRA

- High employer contribution limits

- Simple setup

- Ideal for independent contractors and real estate agents

SIMPLE IRA

- Low-cost option for small businesses

- Employer and employee contributions

Full guide:

https://retirecoast.com/the-best-self-employed-retirement-plans-for-gen-xers-2023/

Don’t Mishandle Your Old 401(k) When You Become Self-Employed

Many people leave traditional employment to start their own business, but fail to properly transfer their old 401(k) into a new tax-advantaged account. Be sure to contact your former employer for rollover instructions after you have opened a new account with a reputable provider such as Charles Schwab or Fidelity.

Important: Never take possession of the funds yourself. That can trigger taxes and penalties. Allow your former employer and your new investment company to complete a direct rollover so your retirement dollars stay protected.

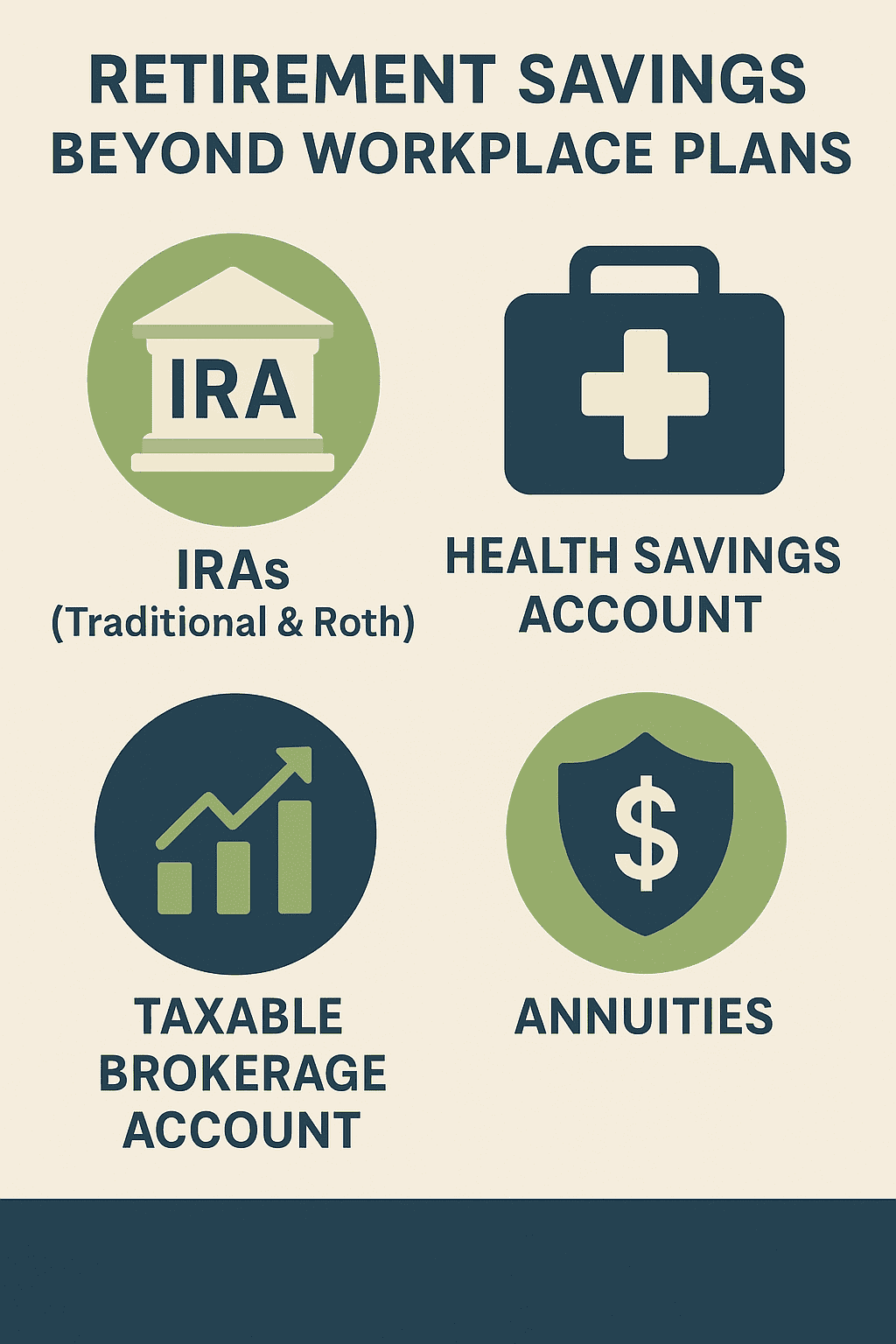

SECTION 4 – Strengthening Retirement Plans Beyond the Workplace

Workplace retirement plans are essential for Gen X, but they should never be the only strategy. True retirement security comes from layering additional accounts — IRAs, HSAs, brokerage accounts, and optional guaranteed income tools — to build flexibility, tax diversification, and long-term stability.

For Gen X, strengthening retirement outside the workplace is how you fill gaps, control taxes, prepare for healthcare costs, and create income options that work before and after age 59½. These tools complement the 401(k) and help you build a resilient, multi-source retirement plan.

4.1 Individual Retirement Accounts (IRAs)

IRAs are one of the most versatile retirement tools available to Gen X. The IRS adjusts contribution limits and catch-up amounts annually, making IRAs a natural extension once you maximize workplace plans or if you want more control over investment choices.

🔷 Traditional IRA

- Contributions may be tax-deductible

- Growth is tax-deferred

- Withdrawals taxed in retirement

- Useful for high earners managing current tax brackets

🔷 Roth IRA

- Contributions made with after-tax income

- Growth and withdrawals are tax-free

- Ideal if you expect higher taxes later or want tax-free income in retirement

- Supports multi-bucket tax diversification

IRS IRA overview:

https://www.irs.gov/retirement-plans/individual-retirement-arrangements-iras?utm_source=chatgpt.com

For Gen X–specific strategies, see:

https://retirecoast.com/the-best-self-employed-retirement-plans-for-gen-xers-2023/

4.2 Health Savings Accounts (HSAs): The Triple-Tax Advantage

If you’re eligible for a High-Deductible Health Plan (HDHP), an HSA is arguably the most tax-efficient retirement toolavailable. The IRS calls this a “triple-tax advantaged” account because it offers:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

And after age 65, HSA withdrawals for any purpose are allowed (taxed like a Traditional IRA if non-medical), making the HSA a powerful hybrid retirement account.

Why HSAs matter for Gen X:

- Healthcare will likely be one of your biggest retirement expenses

- Funds roll over for life — no forfeiture

- Catch-up contributions begin at age 55

- Many providers allow your HSA to be invested in ETFs or mutual funds

Government resources:

https://www.healthcare.gov/high-deductible-health-plan/?utm_source=chatgpt.com

https://www.irs.gov/publications/p969?utm_source=chatgpt.com

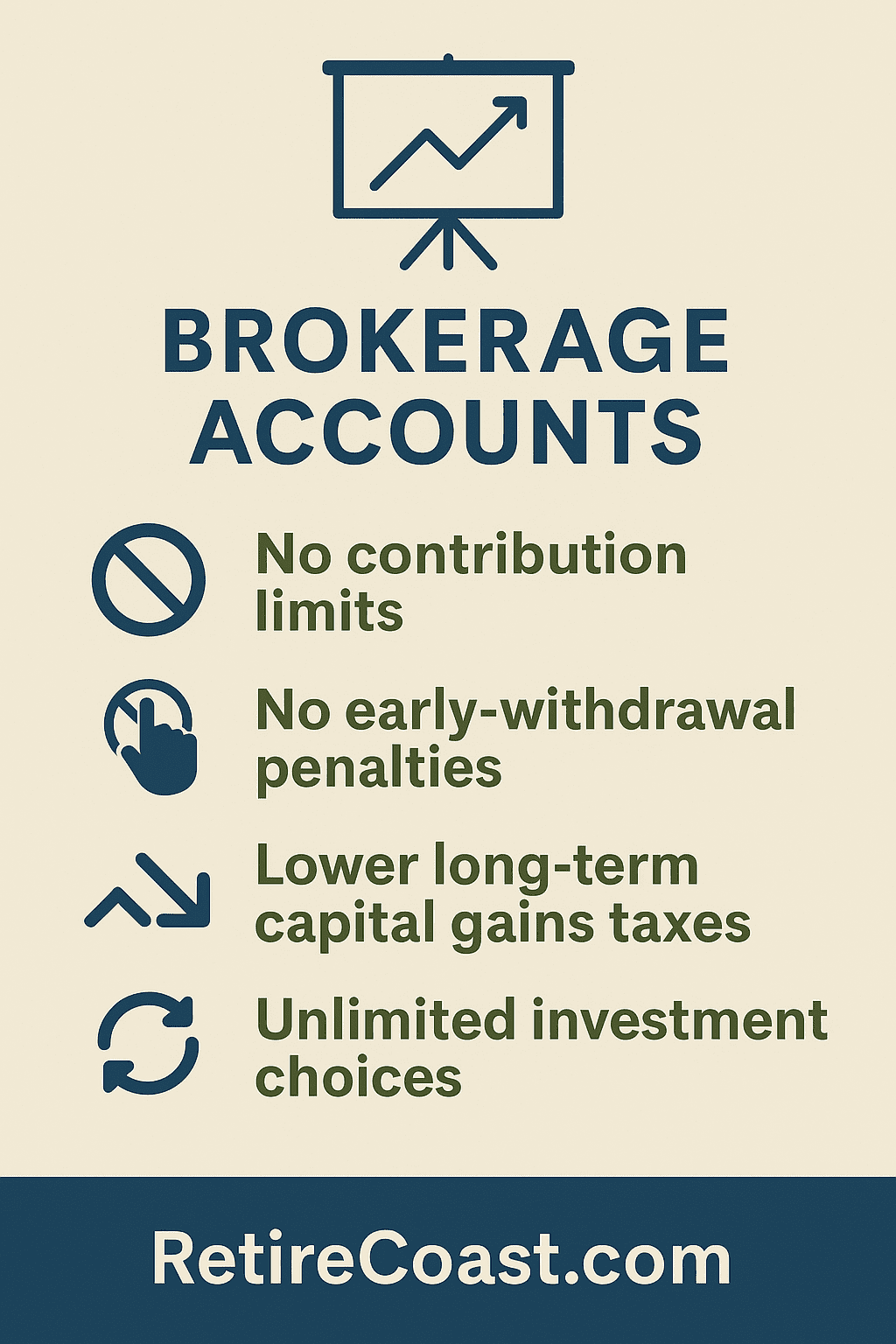

4.3 Taxable Brokerage Accounts: Your Flexible Retirement Engine

After workplace plans and IRAs, a taxable brokerage account offers unparalleled flexibility. It is often the best tool for:

- Early retirement (before age 59½)

- Travel or lifestyle spending

- Reducing reliance on Social Security

- Starting a business in your 50s or 60s

- Building long-term investment income

Unlike IRAs and 401(k)s, brokerage accounts have:

- No contribution limits

- No early-withdrawal penalties

- Lower long-term capital gains taxes

- Unlimited investment choices

This makes brokerage accounts ideal for Gen Xers who finish maxing out workplace plans mid-year or those who need flexible access to investments.

Learn how taxable investing ties into homeownership and wealth-building:

https://retirecoast.com/how-gen-xers-can-build-wealth-through-homeownership-vs-renting/

4.4 Annuities and Guaranteed Income Options

While not right for everyone, annuities can serve as a stabilizer for Gen Xers who:

- Worry about outliving their money

- Want guaranteed monthly income

- Prefer to secure a pension-like stream

- Seek downside protection

Types include:

- Fixed annuities — predictable payments

- Indexed annuities — market-linked growth with protection

- Longevity annuities — income beginning at advanced ages

CFPB’s objective guide to annuities:

https://www.consumerfinance.gov/ask-cfpb/category-annuities/?utm_source=chatgpt.com

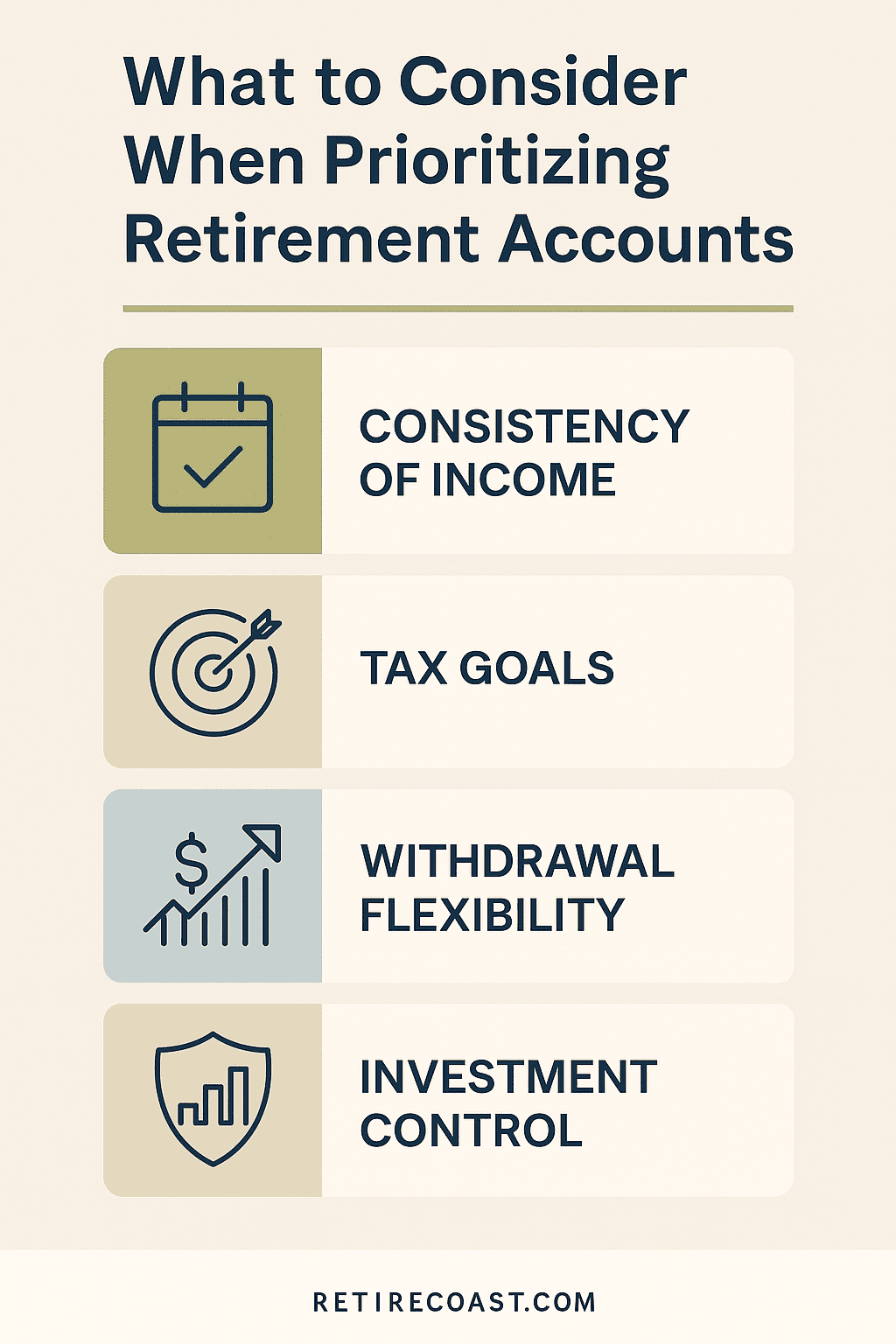

4.5 Diversifying Tax Buckets for Maximum Flexibility

A strong retirement plan balances three different tax buckets:

🟧 1. Tax-Deferred Accounts

(Traditional 401(k), 403(b), Traditional IRA)

- Lower taxes today

- Higher taxable income later

🟩 2. Tax-Free Accounts

(Roth IRA, Roth 401(k), HSA)

- Withdrawals are tax-free

- Most valuable for long-term planning

🟦 3. Taxable Accounts

(Brokerage accounts, dividend portfolios, rental income)

- Flexible access at any age

- Taxed only on gains, not contributions

This balance helps Gen X:

- Control tax brackets during retirement

- Minimize Required Minimum Distributions (RMDs)

- Manage Medicare premium brackets

- Optimize Social Security timing strategies

Explore a full Social Security strategy for Gen X here:

https://retirecoast.com/how-can-i-maximum-earnings-for-gen-x-social-security/

Pro Tip: Your 401(k) Is a “Qualified Plan” — And It’s Protected

Did you know that your 401(k) and many employer-sponsored retirement plans are considered “Qualified Plans” under IRS rules and ERISA? This means that — in most cases — your 401(k) is protected from creditors and cannot be seized to satisfy most types of judgments or debts.

ERISA offers some of the strongest financial protections under U.S. law. Courts generally cannot award qualified-plan assets to creditors, debt collectors, or lawsuits. This protection applies whether you’re employed or retired.

Important Exceptions

- Spouses — Courts may award part of your plan to a spouse or former spouse under a Qualified Domestic Relations Order (QDRO).

- IRS levies — The IRS may levy qualified plans for unpaid federal taxes.

- Federal criminal restitution — Rare but possible in limited circumstances.

For most Gen X savers, this makes the 401(k) one of the safest places to store long-term retirement money — and a critical asset to protect as you build financial security.

4.6 Using Multiple Accounts to Close Your Retirement Gap

Layering accounts gives you far more control than relying only on a 401(k). By combining:

- Workplace plans

- IRAs

- HSAs

- Brokerage accounts

- Optional guaranteed income

Gen Xers create a retirement strategy that is:

- Tax-efficient

- Flexible

- Resilient during market cycles

- Able to support early retirement

- Adaptable to changing goals

This approach ensures you always have the right account available for the right purpose at the right time.

For a broader Gen X roadmap, see:

https://retirecoast.com/gen-x-retirement-guide/

4.7 Summary: Why Strengthening Non-Workplace Accounts Matters

A complete Gen X retirement strategy goes far beyond the 401(k).

By adding IRAs, HSAs, taxable investing, and income tools, you gain:

- Tax diversification

- Withdrawal flexibility

- Better healthcare planning

- Lower long-term tax burdens

- Multiple income sources

- Far greater financial control

Strengthening these accounts now ensures a smoother, more secure retirement later — even if you’re starting behind schedule.

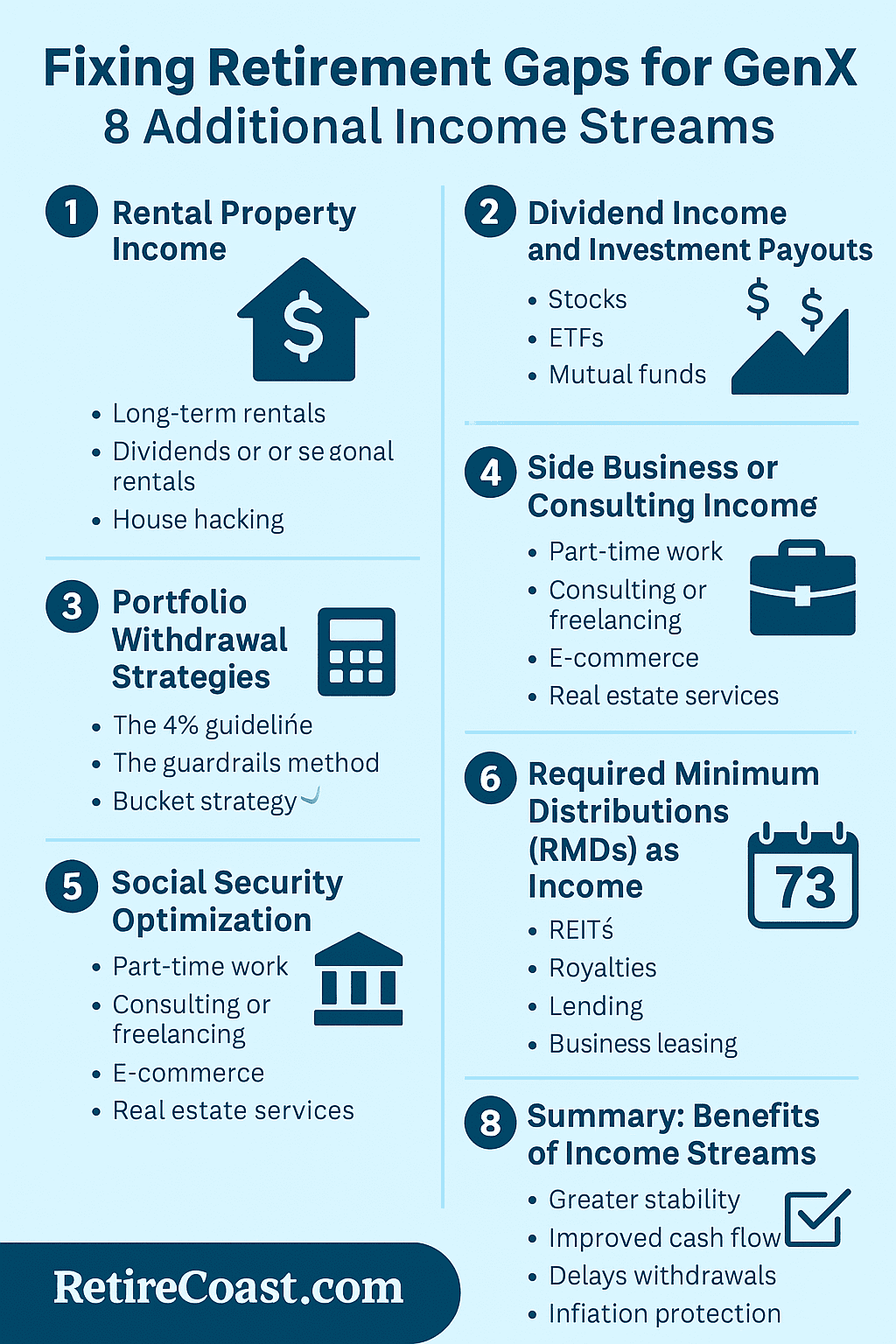

SECTION 5 – Building Additional Retirement Income Streams

For many mid-career workers, especially Gen X, creating additional income sources is one of the most effective strategies for fixing retirement gaps for Gen X. Savings alone often cannot close the gap fast enough, particularly for those who started late or experienced financial setbacks. Building income streams that grow, adjust with inflation, and diversify risk helps ensure long-term stability and reduces pressure on retirement accounts.

Below are the most powerful income-building avenues Gen Xers can use to strengthen retirement readiness.

5.1 Rental Property Income: A Path Toward Fixing Retirement Gaps for Gen X

Real estate continues to be one of the most accessible and effective ways to generate retirement income. It provides predictable cash flow, tax advantages, appreciation, and the ability to leverage borrowed funds. For those focused on fixing retirement gaps for Gen X, rental properties offer both short-term and long-term benefits.

Types of Rental Income Streams

Long-Term Rentals

- Consistent, predictable monthly income

- Lower turnover and fewer management demands

- Ideal for those who want passive income with less hands-on work

Short-Term or Seasonal Rentals

- Higher nightly rates

- Ideal for coastal, tourist, or seasonal markets

- More active management or use of a professional property manager

House Hacking

- Rent out a portion of your home

- Reduce the cost of your own housing

- Ideal for rising-cost markets

For Gen Xers comparing the wealth-building power of owning vs. renting:

https://retirecoast.com/how-gen-xers-can-build-wealth-through-homeownership-vs-renting/

5.2 Dividend Income and Investment Payouts

Dividend-focused portfolios—whether through dividend-paying stocks, ETFs, or mutual funds—are an excellent way to generate retirement income without drawing down principal.

Benefits include:

- Regular cash flow

- Preferential tax treatment (long-term capital gains rates)

- Growth potential through reinvestment

- Ability to access income at any age

Dividend income is especially useful for Gen Xers planning a phased or early retirement or for those who need predictable monthly income.

More planning strategies here:

https://retirecoast.com/gen-x-retirement-guide/

⭐ Case Study: How Erica Turned Brokerage Savings Into a Vacation Home and Retirement Asset

Erica is a disciplined saver in her early 50s. After maximizing her employer-sponsored retirement plan each year, she realized she still had room in her budget to set aside more money. Instead of letting that excess sit idle in a bank account, she began depositing a fixed amount each month into her brokerage account, gradually building a diversified portfolio.

During a financial review a few years later, Erica made a surprising discovery:

She had accumulated enough in her brokerage account to make a down payment on a second home—something she had dreamed about for years.

She always loved the coast and wanted a place where her family could unwind, recharge, and enjoy extended weekends. At the same time, she wondered whether she could turn the property into a short-term rental when not in use. She began researching the idea and came across several articles on RetireCoast about:

- Short-term rental markets

- Second-home income opportunities

- Mississippi Gulf Coast real estate

- The benefits of owning a property near the beach

Encouraged by what she learned, Erica contacted both a local real estate agent and a property manager in the area she was considering.

Step 1: Evaluate the Investment

The real estate agent found several properties that fit her budget and ideal location. The property manager reviewed them with her and identified one in particular that:

- Had year-round rental potential

- Could generate enough income to cover taxes, insurance, and utilities

- Required minimal updates to begin renting

- Was located in an area with strong tourism demand

Step 2: Recognize the Three Major Benefits

Erica realized she wasn’t just buying a vacation home — she was making a long-term retirement investment. The benefits included:

1. Personal Use

She would have a free place to stay anytime she wanted a vacation, long weekend, or even a midweek reset by the beach.

2. Mortgage Principal = Forced Savings

A portion of every mortgage payment went toward principal.

Her CPA explained that paying down principal is the same as earning income, because it increases her equity every month.

3. Appreciation & Potential Rental Income

- Property values were trending upward in the area

- Seasonal rentals could generate supplemental income

- Future resale could provide a substantial gain

After reviewing the numbers, she felt confident she was making both an emotional and financial investment in her future.

Step 3: Protect the Investment

After closing on the property, Erica formed an LLC to hold title for liability protection. She then hired a CPA who reviewed her situation and explained two important tax benefits:

- With rental activity, she could claim small annual deductions for certain expenses

- When she eventually sells the property, she may qualify for favorable capital gains treatment, especially if she uses tax-planning strategies common for real estate investors

The CPA also confirmed that Erica’s decision to purchase the property through her brokerage account savings — rather than tapping retirement accounts — preserved her tax advantages and avoided penalties.

⭐ The Outcome

Today, Erica enjoys:

- A place for her and her family to relax

- Steady equity growth through her mortgage payments

- Property appreciation that increases her long-term net worth

- Occasional rental income that offsets ownership costs

- A future retirement asset that may produce income or be sold for profit

Erica often tells friends:

“I thought my brokerage account was just a place for extra savings. I didn’t realize it could help me build a second home and a retirement income stream.”

5.3 Portfolio Withdrawal Strategies for Fixing Retirement Gaps for Gen X

A strong retirement plan includes knowing how to withdraw funds safely. Structured portfolio withdrawal strategies help ensure your money lasts throughout retirement. These strategies are particularly critical for fixing retirement gaps for Gen X, when sequence-of-returns risk (bad investment years early in retirement) can jeopardize long-term stability.

Popular Withdrawal Methods

The 4% Guideline

Withdraw 4% of your portfolio in year one, then adjust for inflation.

The Guardrails Method

Withdraw more in strong markets, less in weak markets.

The Bucket Strategy

Divide savings into:

- Short-term bucket: cash + 1–3 years of living expenses

- Medium-term bucket: bonds, fixed income

- Long-term bucket: equities for growth

Bureau of Labor Statistics retirement spending data:

https://www.bls.gov/cex/?utm_source=chatgpt.com

5.4 Side Business or Consulting Income

Many Gen Xers build “second-act” careers—flexible, part-time, or passion-focused. This additional income can reduce withdrawals, increase savings, and help extend the life of retirement accounts.

Popular Gen X income ideas include:

- Consulting or coaching

- Freelance technical or creative work

- Seasonal hospitality or tourism work

- E-commerce or online stores

- Real estate services

- Handyman, repair, design, or local business offerings

Small income streams can produce major long-term impact.

Explore second-act business ideas here:

https://retirecoast.com/best-gen-x-playbook-for-building-your-second-act-business/

⭐ Case Study: How Daniel, a Self-Employed Gen Xer, Built His Own Retirement Plan

Daniel is a 49-year-old self-employed contractor who runs a small home-repair business. Like many self-employed Gen Xers, he spent most of his career focused on work, raising kids, and covering monthly expenses — not on building retirement savings.

For years he assumed retirement planning was something “corporate people did.” But as he approached age 50, he began to realize:

- There is no employer match coming

- There are no built-in benefits

- There’s no HR department watching his back

- Retirement will depend entirely on his own decisions

He decided to meet with a financial adviser who understood the challenges of self-employment. Daniel walked in with inconsistent income, a business that fluctuated seasonally, and no meaningful retirement savings. He walked out with one of the clearest, simplest plans of his life.

Step 1: Pick the Right Self-Employed Retirement Plan

His adviser explained the retirement options available to him:

- SEP-IRA

- Solo 401(k)

- Traditional and Roth IRAs

- Taxable brokerage account

- HSA (if eligible)

Based on his income and desire to “catch up fast,” they chose a Solo 401(k) because:

- It allows employer + employee contributions

- Contribution limits are higher than a Traditional IRA

- Catch-up contributions are allowed at age 50+

- The plan can be opened easily at Charles Schwab, Fidelity, or Vanguard

Daniel liked that he could contribute during strong months and scale back during slow seasons.

Step 2: Automate IRA Contributions for Consistency

Although the Solo 401(k) would allow large contributions later in the year, his adviser encouraged him to automate a small, steady monthly contribution into a Roth IRA.

This gave Daniel:

- Tax-free growth

- A disciplined saving routine

- A way to build retirement even when business fluctuated

For the first time, Daniel felt like he finally had a “base layer” of retirement savings.

Step 3: Use a Brokerage Account During High-Income Months

Because his income jumps during spring and summer, Daniel opened a taxable brokerage account where he could deposit:

- Extra earnings

- Unexpected profits

- Off-season cash reserves

He placed most deposits in a low-cost index fund and left other funds in a money market account for short-term needs.

His adviser explained:

“Your brokerage account is your flexible engine. No penalties, no limits, and ideal for early retirement or business reinvestment.”

That resonated with Daniel.

Step 4: Add a Second Income Stream With a Small Rental Property

Six months later, Daniel felt more confident and bought a modest duplex in a neighborhood with strong rental demand. One unit was rented full-time; the other became his workshop and storage space — reducing business expenses and generating income.

His CPA explained that:

- Depreciation

- Interest

- Repairs

- Utilities

- A portion of vehicle mileage

were all deductible, lowering his tax bill significantly.

Daniel used the rental profits to help fund his Solo 401(k).

Step 5: Protect the Business and the Future

Daniel made two important moves:

🔹 Established an LLC

This separated business liability from personal assets.

🔹 Hired a CPA

His CPA helped him structure:

- Quarterly estimated taxes

- Retirement contributions timing

- Equipment write-offs

- SEP/Solo 401(k) strategies

For the first time, Daniel felt like his money was working as hard as he was.

⭐ Daniel’s Results 18 Months Later

At age 50½, Daniel now has:

- A fully functioning Solo 401(k)

- Growing Roth IRA contributions

- A flexible brokerage account

- Rental income covering the duplex mortgage

- A business structure that protects his assets

- A long-term tax strategy

- Confidence he never had before

Daniel often says:

“Being self-employed used to scare me when I thought about retirement. Now it gives me freedom — because I built my own plan.”

5.5 Social Security Optimization as an Income Stream

Social Security is a guaranteed, inflation-adjusted income source for life. Optimizing when and how to claim it can add tens of thousands of dollars to lifetime benefits.

Key strategies include:

- Delaying benefits to increase monthly payments

- Coordinating spousal benefits

- Using Roth withdrawals to support delays

- Managing income to reduce taxation of Social Security

- Evaluating survivor benefit options

Full Gen X Social Security guide:

https://retirecoast.com/how-can-i-maximum-earnings-for-gen-x-social-security/

Government resource:

https://www.ssa.gov/myaccount/?utm_source=chatgpt.com

5.6 Required Minimum Distributions (RMDs) as Income

(Already updated with tax strategy and callout box)

(No changes made here to preserve your detailed content.)

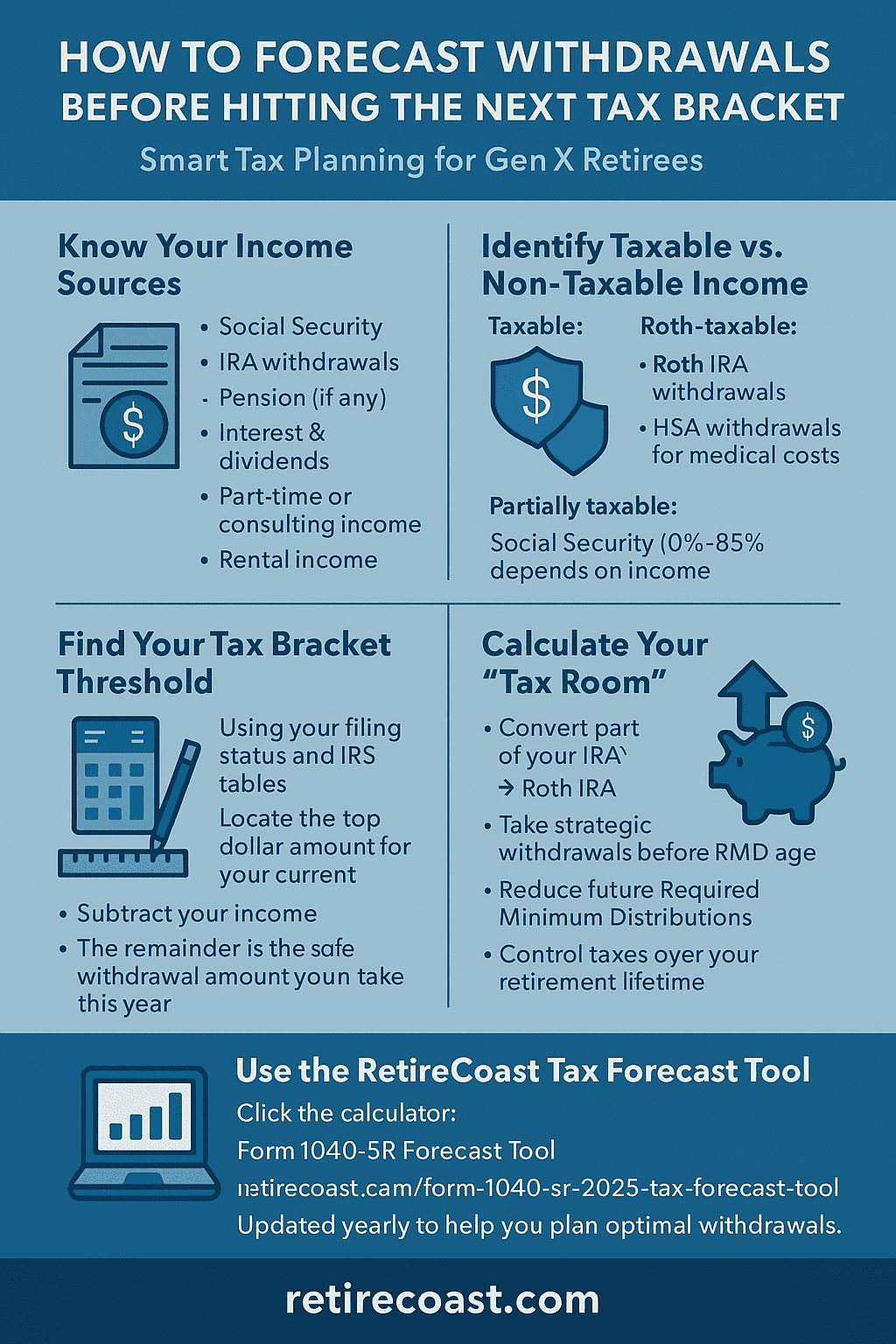

Use Our Forecast Calculator to Plan Your Withdrawals

Not sure how much you can withdraw or convert each year without moving into a higher tax bracket? Use our free income forecasting tool to calculate how much you can safely invest based on your income and expected retirement deductions.

Click here to use the Form 1040-SR Tax Forecast Tool. We update this tool every year so you always have the latest numbers.

5.7 Cash-Flowing Assets (Royalties, REITs, Lending, & More)

Beyond traditional investments, Gen Xers can build additional income streams from diversified, lower-maintenance options:

REITs (Real Estate Investment Trusts)

- Regular dividends

- Diversified property exposure

- No landlord responsibilities

Private Lending and Notes

- Monthly payments including principal + interest

- Higher yields depending on risk

Royalties

- Creative works

- Digital products

- Intellectual property

Equipment or Business Leasing

- Lease tools, vehicles, or equipment to local businesses

- Attractive for skilled trades

These sources improve diversification and strengthen retiree cash flow.

5.8 Summary: Why Multiple Income Streams Matter

Adding additional income sources reduces pressure on savings and provides a more resilient retirement plan. For those working on fixing retirement gaps for Gen X, these streams:

- Smooth out market volatility

- Delay or enhance Social Security benefits

- Reduce withdrawals from retirement accounts

- Provide inflation-protected income

- Support phased or partial retirement

- Improve long-term financial confidence

Even small amounts of new income can create major improvements in retirement stability.

SECTION 6 – Bringing It All Together: Your Complete Gen X Retirement Strategy

Fixing retirement gaps for Gen X requires more than saving money — it demands a coordinated strategy that brings together investing, tax planning, income diversification, Social Security timing, and disciplined annual review. While the earlier sections explain each component individually, Section 6 shows how Gen X can assemble those building blocks into one cohesive and resilient retirement plan.

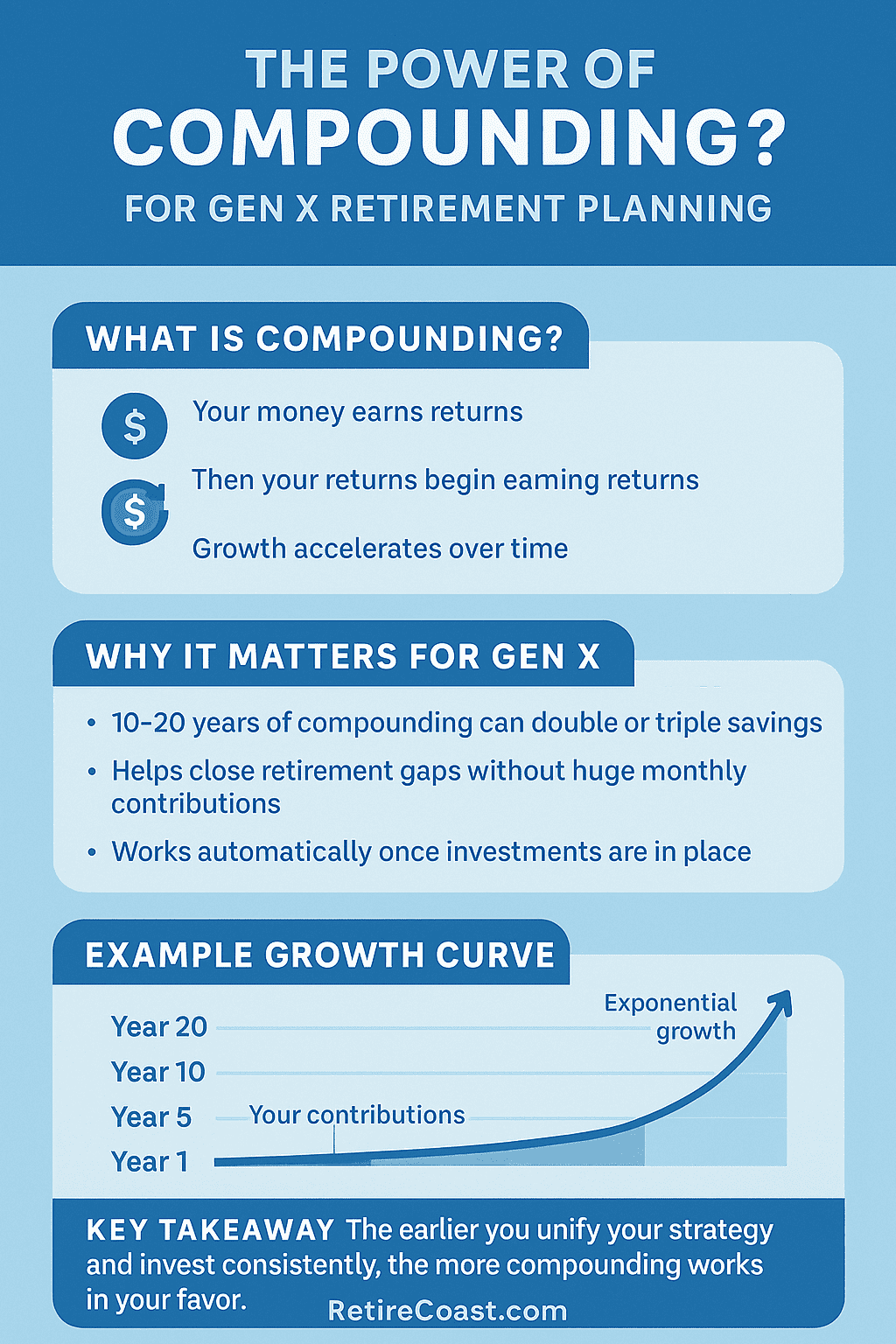

6.1 Build a Unified Plan Early to Maximize Compounding Power

A successful Gen X retirement plan begins with coordination. Too many people treat their accounts as separate silos — a 401(k) at work, an IRA on the side, an HSA they rarely think about, and a brokerage account used sporadically. The real power emerges when these accounts operate together.

A unified plan allows you to:

- Optimize taxes across decades

- Minimize future RMDs

- Time withdrawals to reduce penalties and taxation

- Balance growth investments and income sources

- Decide which account to tap first during retirement

Start Your Plan as Far From Retirement as Possible

The earlier Gen X begins coordinating accounts, the more powerful the results. That’s because compounding accelerates growth exponentially.

Compounding works by generating earnings on:

- Your contributions

- The growth those contributions generate

- The growth earned on prior growth

Starting early gives your money time to double — even multiple times — before retirement. For example, with a 7–8% return, money invested at age 50 can double by age 60 and potentially double again by age 70.

This is why time is such a critical factor in fixing retirement gaps for Gen X — early action magnifies every dollar invested.

6.2 Conduct an Annual Retirement Review (or After Major Life Events)

Retirement planning is not static. Markets shift, life changes, and financial priorities evolve. A structured annual review helps keep the plan aligned with your goals.

Each year, Gen Xers should revisit:

- Contribution levels

- Investment performance and risk allocation

- Tax brackets and forecasting

- Whether Roth conversions make sense

- Health insurance or long-term care considerations

- Real estate or rental opportunities

- Social Security claiming strategy

- Debt positioning and payoff timelines

Life events such as marriage, divorce, inheritance, job change, or business creation should trigger immediate review.

Consistent recalibration prevents small misalignments from becoming large setbacks later.

6.3 Use Planning Tools, Forecast Calculators & Professional Guidance

Gen X has unprecedented access to digital financial tools that simplify previously complicated retirement decisions. The RetireCoast 1040-SR Forecast Tool is a prime example — it helps estimate taxes, plan strategic withdrawals, and identify how much income can be taken before reaching a new tax bracket.

These tools support:

- Determining Roth conversion opportunities

- Calculating safe withdrawal limits

- Forecasting future tax liabilities

- Mapping Social Security timing

- Evaluating real estate cash flow

- Balancing growth vs. income

For those fixing retirement gaps for Gen X, digital forecasting tools provide direction, confidence, and data-driven clarity.

When appropriate, blend these tools with professional advice from a financial adviser, CPA, or estate-planning attorney who understands long-term retirement tax strategy.

6.4 Emphasize Flexibility, Not Perfection

A perfect retirement plan doesn’t exist — but a flexible one can adapt to economic changes, life surprises, or shifting priorities. Flexibility reduces financial stress and supports a smoother transition into retirement.

A flexible Gen X retirement plan includes:

- Multiple income streams

- Balanced tax buckets (pre-tax, Roth, taxable)

- Growth-oriented investments

- Access to liquid funds

- Optional work or consulting income

- A thoughtful withdrawal strategy

- Space for market volatility

Flexibility is security — and it is one of the most reliable tools for fixing retirement gaps for Gen X.

The Rule of 72: Estimate How Fast Your Money Doubles

The Rule of 72 is a simple formula to estimate how long it takes for your money to double based on your annual rate of return. Just divide 72 by your expected return.

- 6% return → money doubles in about 12 years

- 8% return → money doubles in about 9 years

- 10% return → money doubles in about 7 years

This shows how powerful compounding can be when planning early—especially for Gen Xers working on fixing retirement gaps.

6.5 Gen X Still Has Time — But Only If You Start Now

Despite being closer to retirement than Millennials or Gen Z, Generation X still has some of its highest earning yearsahead. The combination of peak earnings plus compounding can dramatically reshape retirement readiness.

The final decade or two before retirement can often produce the most meaningful financial progress — but only if action is taken now. Whether the priority is catching up contributions, paying down debt, purchasing an investment property, optimizing Social Security, or building a brokerage portfolio, every step compounds into long-term security.

6.6 Final Thoughts

Gen X faces unique challenges: rising costs, market volatility, later-life child expenses, and shifting retirement rules. But the solutions are clear — and achievable. With the right blend of early planning, strategic investing, tax optimization, and diversified income streams, Gen X can build a retirement that is stable, flexible, and prosperous.

The tools exist. The strategies work. The time is now.

SECTION 7 – Conclusion: Your Path Forward Starts Today

Retirement planning for Generation X is more complicated than it was for older generations—but it is also far more empowering. With better tools, stronger incomes, decades of financial experience, and more control over investment choices, Gen X is uniquely positioned to build a stable, flexible, and resilient retirement.

Yet the most important lesson of this entire guide is simple:

You still have time.

But only if you use it.

Whether you’re catching up on savings, restructuring debt, evaluating tax strategies, or building additional income streams, every step moves you closer to a retirement you can confidently enjoy.

Fixing retirement gaps is absolutely achievable for Gen X—not by guessing, but by using a structured plan grounded in data, strategy, and consistent action.

7.1 Your Next Steps: Tools, Resources, and Guided Articles

You don’t need to figure this all out alone. RetireCoast has created a complete suite of tools and articles specifically tailored for Gen Xers preparing for retirement in the next 15–20 years.

Start Here — Reader Favorites for Gen X

- Gen X Fear: Running Out of Money

https://retirecoast.com/gen-x-fear-running-out-of-money/ - Gen X Retirement Guide

https://retirecoast.com/gen-x-retirement-guide/ - The Best Gen X 20-Year Retirement Homeowners Plan

https://retirecoast.com/gen-x-20-year-retirement-homeowners-dream-home/ - Catch-Up Savings and 401(k) Strategies for Gen X

https://retirecoast.com/the-best-gen-x-retirement-guide-for-401k-planning-strategies/ - Free Gen X Retirement Budget Tool

https://retirecoast.com/free-gen-x-retirement-budget-planning-tool-and-calculator/

And for those seeking second-act opportunities:

https://retirecoast.com/best-gen-x-playbook-for-building-your-second-act-business/

7.2 Use Our Free Calculators to Strengthen Your Plan

Your retirement decisions become significantly easier when backed by data.

Start with these powerful tools:

- Form 1040-SR Tax Forecast Tool

https://retirecoast.com/form-1040-sr-2025-tax-forecast-tool/ - Home Affordability Calculator

https://retirecoast.com/home-affordability-calculator/ - Rental Property Cash Flow Calculator

https://retirecoast.com/rental-property-cash-flow-calculator/ - Social Security Break-Even Calculator

https://retirecoast.com/social-security-break-even-calculator/ - Full Mortgage Calculator (includes insurance & taxes)

https://retirecoast.com/full-mortgage-calculator/

Using these tools helps you forecast taxes, evaluate investments, plan cash flow, and identify the best opportunities for growth.

7.3 A Final Word of Encouragement

Gen X is often called the “forgotten generation” in retirement planning, caught between caring for aging parents and supporting adult children. Yet your resilience, adaptability, and experience are unmatched.

You have:

- Time

- Tools

- Income

- Flexibility

- And the knowledge to act

The path forward is not about perfection—it’s about progress.

Small steps compound into large results.

ACTION is the difference-maker.

And you’ve already taken the most important one by being here.

7.4 Stay Connected With RetireCoast

We publish new Gen X retirement content, calculators, financial tools, and step-by-step guides regularly. Stay informed and build your plan with confidence.

Subscribe to our updates to receive new retirement resources as soon as they are published.

(If you’d like, I can also create a styled subscription box for this section.)

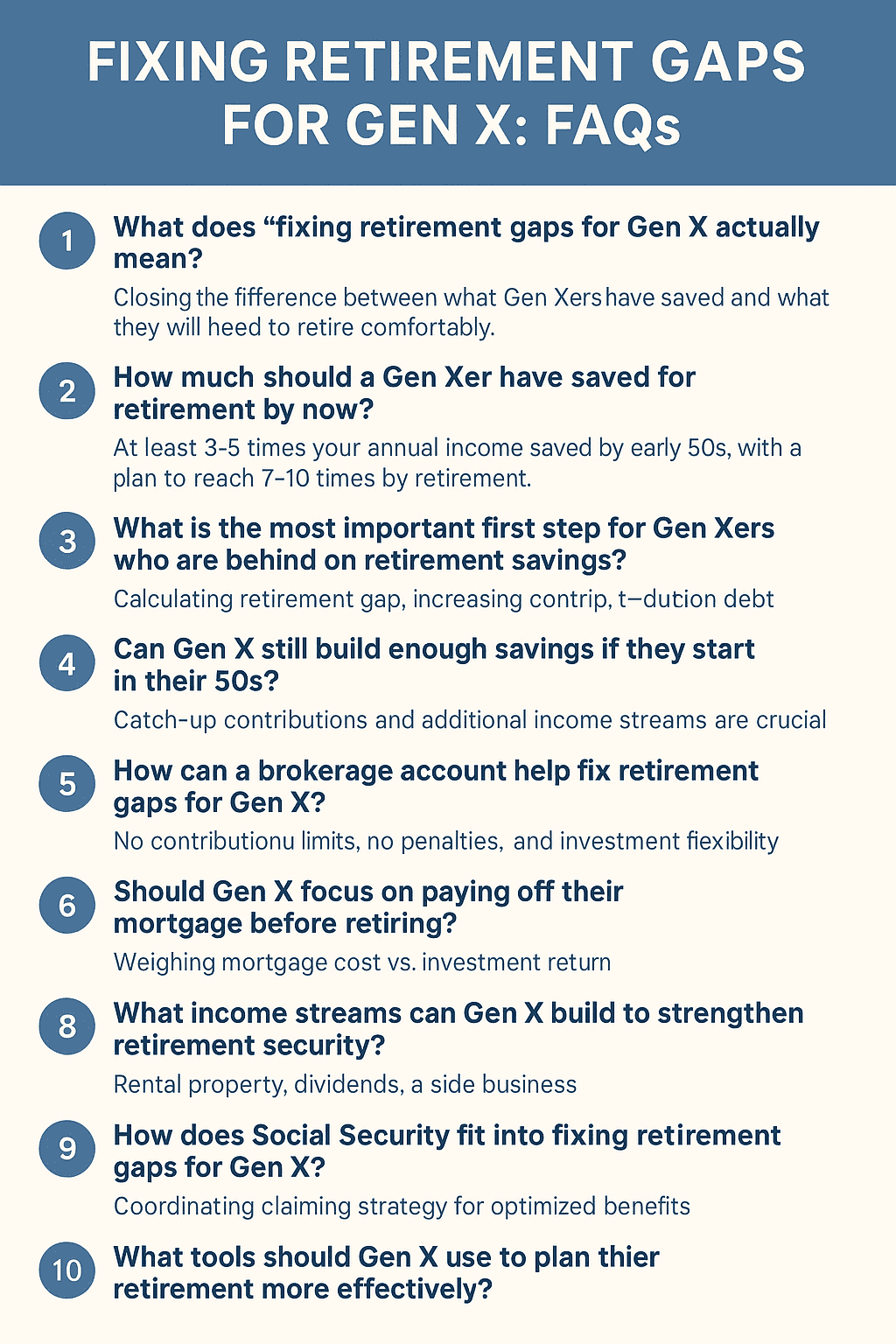

FAQ: Fixing Retirement Gaps for Gen X

These common questions and answers are designed to help Generation X understand the key steps to strengthen retirement planning, close savings shortfalls, and build multiple income streams.

1. What does “fixing retirement gaps for Gen X” actually mean?

2. How much should a Gen Xer have saved for retirement by now?

3. What is the most important first step for Gen Xers who are behind on retirement savings?

4. Can Gen X still build enough savings if they start in their 50s?

5. What tax strategies can help Gen X improve their retirement outlook?

- Using Roth conversions in lower-income years

- Planning withdrawals to stay below key tax bracket thresholds

- Using HSAs for tax-free medical spending

- Balancing taxable, tax-deferred, and tax-free accounts

- Coordinating withdrawals with Social Security timing

6. How can a brokerage account help fix retirement gaps for Gen X?

7. Should Gen X focus on paying off their mortgage before retiring?

8. What income streams can Gen X build to strengthen retirement security?

- Rental property income

- Dividend and interest income

- Side business or consulting income

- Royalties or digital product income

- RMD income from retirement accounts

- Optimized Social Security benefits

9. How does Social Security fit into fixing retirement gaps for Gen X?

10. What tools should Gen X use to plan their retirement more effectively?

- Form 1040-SR Tax Forecast Tool

- Social Security Break-Even Calculator

- Rental Property Cash Flow Calculator

- Home Affordability and Full Mortgage Calculators