Last updated on December 28th, 2025 at 04:52 pm

Introduction

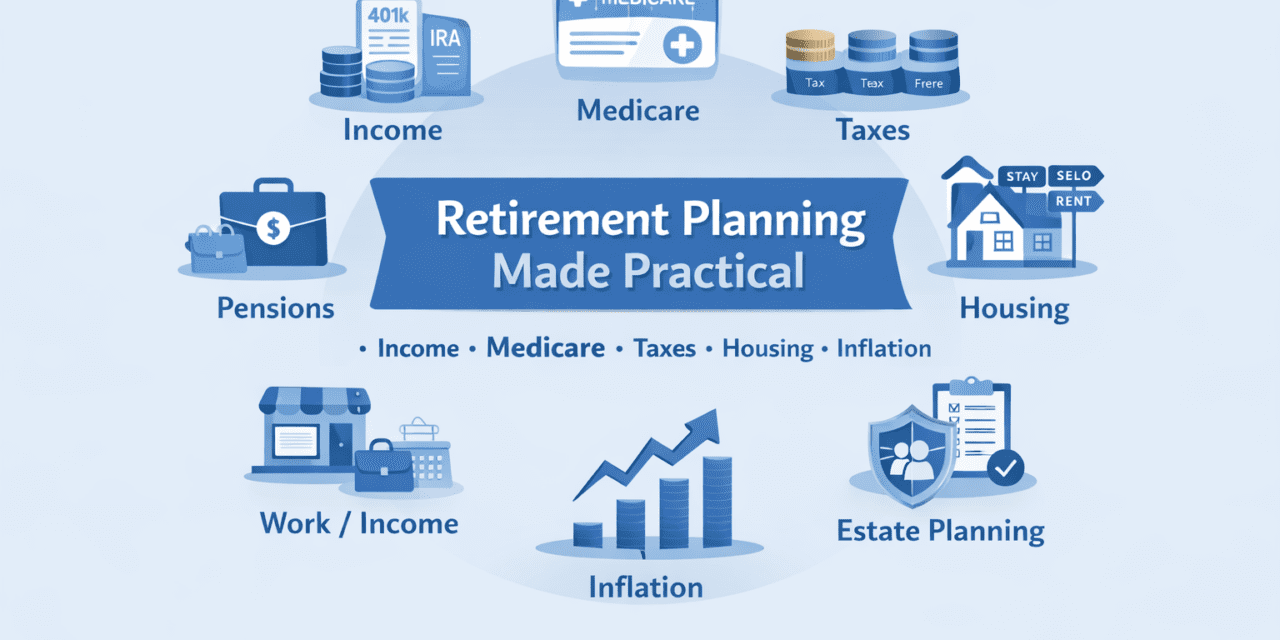

Practical retirement planning made simple starts with understanding how real decisions affect your money over time. Retirement isn’t just about how much you saved—it’s about how income, Medicare timing, taxes, inflation, investing after retirement, and work or second-act decisions interact once paychecks stop.

This guide focuses on the pressure points that most retirees and Gen-X households actually face. Instead of theory, you’ll find clear explanations, calculators, checklists, and real-world case studies designed to help you manage income reliably, avoid costly Medicare and tax mistakes, protect purchasing power from inflation, and make smarter investing and work decisions in retirement.

Whether you are approaching retirement, already retired, or planning a working or partial retirement, this article is designed to help you understand the numbers behind your choices and apply practical retirement planning strategies you can revisit as life and rules change.

- Introduction

- Section I – Your Retirement Income Reality Check

- Section II: Medicare and the Age-65 Cliff

- Section III: Taxes Don’t Retire When You Do

- Practical Checklist

- Section IV: Inflation Is Cumulative — and It Changes Everything

- Practical checklist

- Section V: Investing After Accumulation — Managing Risk and Income

- Section VI: Work, Business, and Partial Retirement

- Practical checklist

- Section VII: Pulling It All Together — Your Practical Retirement Planning System

- Once-a-Year” review checklist

- FAQ

Section I – Your Retirement Income Reality Check

Practical retirement planning is not about chasing perfect forecasts or complex strategies—it’s about making clear, informed decisions that hold up as life changes. This guide focuses on the real pressure points retirees and Gen-X face, including income reliability, Medicare timing, taxes, inflation, investing after retirement, and decisions about working longer or starting a second act. The goal is to help you understand what actually matters, run the right numbers, and avoid common mistakes before they become expensive.

Before you think about strategies, timing, or optimization, you need a clear picture of where your income will actually come from and how reliable each source is.

Most retirees draw income from a combination of the following:

- Social Security – A foundational income source, but rarely enough on its own

- Pensions – Increasingly rare, but valuable if you have one

- 401(k) and IRA withdrawals – Flexible, taxable, and often misunderstood (read more)

- Rental or investment income – Can be reliable, but not passive in the early years

- Work or business income – Part-time, consulting, or phased retirement work

The most common mistake is assuming these income sources behave the same way. They don’t.

Some are indexed for inflation, some are fixed. Some are taxed heavily, others are tax-free. Some last for life, others depend entirely on market performance and withdrawal decisions.

What matters most is cash flow, not account balances.

A six-figure retirement account does not guarantee six-figure income. Likewise, a modest account combined with stable income sources can support a comfortable retirement if expenses are realistic.

Before moving on, ask yourself:

- Do I know every source of income I expect in retirement?

- Which sources are guaranteed, and which are not?

- How much income is taxable?

- Which income sources stop if I stop working?

- Do my monthly expenses align with reliable income?

If you can’t answer these questions confidently, this is the right place to slow down.

What Income Sources Do I Actually Have?

(Use this as a working checklist—write the answers down.)

- Income source: Social Security, pension, 401(k)/IRA withdrawals, rental income, business income, part-time work

- Who controls it: Government, employer, market performance, tenant, me

- Monthly amount (today’s dollars): $__________

- Guaranteed or variable: Guaranteed / Market-based / Conditional

- Adjusted for inflation (COLA): Yes / No / Uncertain

- Tax treatment: Fully taxable / Partially taxable / Tax-free

- When it starts: Age ______

- When it ends: Never / At a specific age / When funds are depleted

- What could interrupt it: Market downturn, health, vacancy, policy changes

This worksheet also includes a Social Security timing calculator to help you compare claiming ages in the context of your overall retirement income plan.

RetireCoast Tip:

If you cannot confidently fill in every line for an income source, treat it as unreliable until proven otherwise.

Our article about planning for retirement can be found here.

Once you understand where your income comes from, the next risk is often healthcare costs—especially the decisions you make around Medicare at age 65.

Section II: Medicare and the Age-65 Cliff

Medicare and Social Security are different programs, but they collide at the same point in life—age 65—and that’s where costly mistakes happen.

Here’s the most important fact: you can enroll in Medicare at age 65 whether or not you start your Social Security benefit. Many people delay Social Security for a higher monthly benefit, but Medicare timing works on its own schedule.

If you miss certain Medicare enrollment windows, you can face late enrollment penalties and coverage gaps. Those penalties can last for years, and in some situations they can follow you for life. That’s why Medicare deserves its own planning moment—separate from your Social Security decision.

If you decide to stay on your employer’s health plan after turning 65, you must still pay close attention to Medicare timing. In many cases, you do not have to enroll in Medicare Part B immediately, but you must preserve your original eligibility so you can transition smoothly later.

- Assuming employer coverage automatically replaces Medicare requirements

- Failing to document creditable coverage before leaving a job

- Waiting until coverage ends to start the Medicare enrollment process

- Missing the Special Enrollment Period window

- Assuming there will be no penalties because coverage was “good enough”

When you eventually leave your employer’s plan, Medicare will require documentation showing you had creditable employer coverage. Your employer completes CMS Form L564 (Request for Employment Information), which verifies that your coverage qualified you for a Special Enrollment Period and helps you avoid late-enrollment penalties.

About one month before leaving your employer, confirm the current Medicare transition process and paperwork requirements. Rules and procedures can change, and waiting until coverage ends can create gaps or delays. Planning the transition in advance is the best way to avoid penalties, lapses in coverage, or unexpected medical bills.

The goal in this section is not to turn you into a Medicare expert. The goal is to make sure you understand the timing, triggers, and risk points so you don’t accidentally pay more for the rest of your retirement.

👉 Read the companion guide: Medicare Premiums, Gaps, Prescriptions, and Long-Term Care

https://retirecoast.com/medicare-premiums-gaps-prescriptions-long-term-care/

Authoritative references:

- Medicare enrollment rules: https://www.medicare.gov

- How Medicare and Social Security work together: https://www.ssa.gov

Why these sources matter:

RetireCoast focuses on explaining the practical consequences of Medicare and Social Security decisions—areas that often fall between the cracks and prompt people to search the internet for answers that don’t reliably appear on government sites.

We help fill that gap with context and plain-language guidance, but we do not replace the official, up-to-date information provided by Medicare and Social Security. For current rules, enrollment requirements, and official updates, those sites remain the authoritative sources.

Section III: Taxes Don’t Retire When You Do

Many people expect their taxes to drop in retirement. Sometimes they do—but often they don’t, and in some cases they rise.

The reason is not the tax rate itself, but how and when retirement income becomes taxable. Withdrawals from traditional 401(k)s and IRAs are taxed as ordinary income. Social Security may be partially taxable depending on your total income.

Required Minimum Distributions can force income you don’t actually need and push you into higher tax brackets later in retirement.

What surprises most retirees isn’t how much they saved—it’s the timing of withdrawals. The order in which you draw income before Social Security, after Medicare, and before RMDs begin can matter more than the account balance.

The objective is not to eliminate taxes. It is to avoid unnecessary ones and protect spendable income.

Practical Checklist

Retirement Tax Reality Check

- I know which income sources are fully taxable, partially taxable, or tax-free.

- I understand how Social Security taxation works with my other income.

- I know when Required Minimum Distributions begin and how they affect my taxes.

- I have a withdrawal plan for the years before RMDs start.

- I have evaluated whether Roth conversions make sense before income peaks.

- Waiting until RMDs begin to think about taxes

- Ignoring how Social Security becomes taxable

- Withdrawing from accounts without bracket awareness

- Assuming retirement income is automatically taxed at lower rates

- Missing planning opportunities before Medicare and Social Security overlap

Running the numbers ahead of time helps prevent surprises when Required Minimum Distributions and Social Security income overlap later in retirement.

👉 Read the companion guide:

Tax Planning for Gen X and Retirees

Section IV: Inflation Is Cumulative — and It Changes Everything

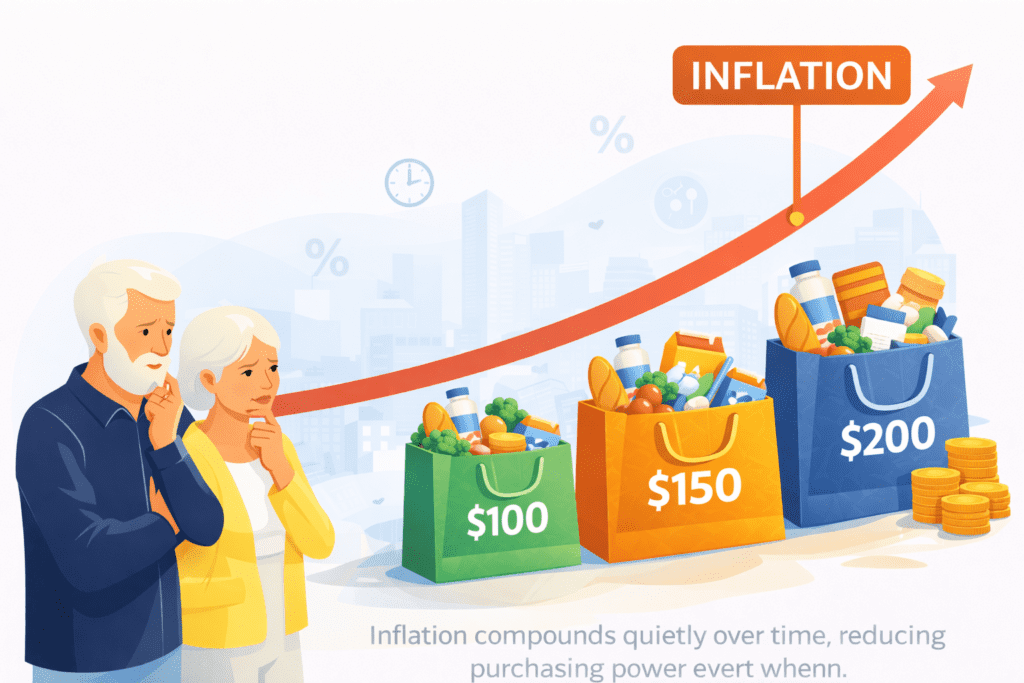

Inflation is often underestimated because it doesn’t arrive all at once. It accumulates quietly, year after year, and gradually erodes purchasing power—even in retirement.

A common planning mistake is assuming a flat cost of living. In reality, prices rise unevenly. Healthcare, insurance, utilities, food, and property-related costs often increase faster than general inflation. Even modest annual increases compound into meaningful pressure over a 20–30 year retirement.

What makes inflation especially dangerous is that most retirement income streams do not adjust fully for rising costs. Some income is fixed. Some adjusts slowly. Others don’t adjust at all.

The result isn’t an immediate crisis—it’s a gradual squeeze on cash flow that shows up later, when flexibility is lower and options are fewer.

Practical checklist

Inflation Reality Check

- I understand that inflation compounds year after year.

- I know which of my income sources adjust for inflation and which do not.

- I have identified expenses likely to rise faster than average inflation.

- I have flexibility in spending if costs rise unexpectedly.

- I have reviewed whether my income growth keeps pace with rising expenses.

- Assuming a fixed retirement budget will hold over decades

- Underestimating healthcare and insurance cost growth

- Overestimating inflation protection from income sources

- Failing to revisit spending assumptions periodically

- Ignoring how inflation compounds over long retirements

Inflation compounds quietly over time, reducing purchasing power even when income stays the same

Source: Consumer Price Index (CPI-U), Federal Reserve Bank of St. Louis (FRED). This chart shows how the cost of living rises over time.

Section V: Investing After Accumulation — Managing Risk and Income

The shift from accumulation to retirement requires a different mindset, and this is where practical retirement planning becomes critical. Strategies that worked well while you were saving can create problems once withdrawals begin.

During your working years, market volatility is uncomfortable but often manageable because time is on your side. After retirement, sequence-of-returns risk becomes a real concern. Poor market performance early in retirement—combined with withdrawals—can permanently reduce portfolio longevity. Practical retirement planning accounts for this risk before it shows up in monthly cash flow.

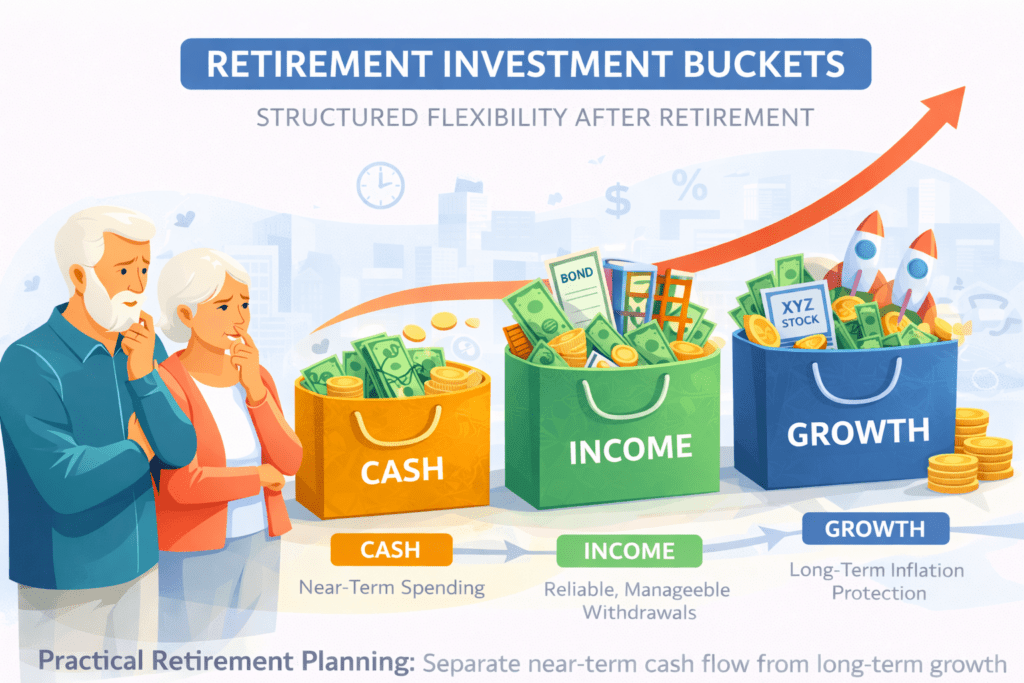

This doesn’t mean growth no longer matters. It means growth must be intentional and balanced against the need for reliable income. A well-structured approach separates assets meant for near-term spending from those intended for longer-term growth, allowing retirees to avoid selling investments at the wrong time.

Many retirees struggle here not because they took too much risk, but because they lacked a withdrawal plan tied to their investment strategy. Practical retirement planning connects investing decisions to income needs, tax timing, and inflation—rather than treating them as separate problems.

The goal is not to eliminate market risk. The goal is to manage it in a way that supports sustainable income and long-term flexibility throughout retirement.

Common Post-Retirement Investing Mistakes

Many retirement investment problems stem from strategies that worked during accumulation but were never adapted for withdrawals and income needs.

- Withdrawing from volatile assets during market downturns.

- Becoming overly conservative too early

- Ignoring inflation risk in favor of short-term stability

- Lacking a clear withdrawal sequence

- Failing to rebalance as income needs change

Section VI: Work, Business, and Partial Retirement

For many people, retirement does not mean a complete stop to earned income. Instead, it becomes a transition—working less, working differently, or working on your own terms. This is where practical retirement planning often looks very different from the traditional “stop working at 65” model.

Part-time work, consulting, or starting a small business can provide more than extra income. It can reduce the need to draw from retirement accounts early, preserve Social Security benefits by allowing delayed claiming, and add flexibility when inflation or market conditions change. In practical retirement planning, earned income is often treated as a stabilizer, not a permanent obligation.

That said, work in retirement needs to be intentional. Earnings can affect Medicare premiums, Social Security taxation, and overall tax brackets. Without planning, extra income can quietly trigger higher costs elsewhere. The goal is not to replace a full-time job, but to use work strategically to improve long-term outcomes.

When done thoughtfully, partial retirement can extend portfolio longevity, reduce stress on investments, and provide a sense of purpose. Practical retirement planning weighs both the financial and lifestyle impacts before committing to ongoing work.

Practical checklist

Partial Retirement Reality Check

- I understand how additional income affects my taxes and Medicare Premiums.

- I know whether working impacts my Social Security benefits.

- I have limits on how much and how long I want to work.

- I’ve evaluated whether business or consulting income is worth the effort.

- I’ve considered lifestyle and health factors, not just income.

- Working without understanding tax and Medicare impacts

- Assuming extra income is always beneficial

- Overcommitting time and energy

- Ignoring burnout or health considerations

- Failing to reassess work plans over time

Many people choose a “working retirement,” meaning they leave a long-term career job and shift into work they genuinely enjoy. For some, this means part-time employment; for others, it means starting a small business built around interest rather than necessity. In practical retirement planning, this type of work is often used to supplement retirement savings and Social Security while maintaining flexibility and purpose.

However, it’s important to recognize that a working retirement often requires planning for a second retirement. As people age, physical limitations, health changes, or energy levels may eventually make continued work difficult or impossible. Practical retirement planning anticipates this reality early, rather than assuming work income will last indefinitely.

Section VII: Pulling It All Together — Your Practical Retirement Planning System

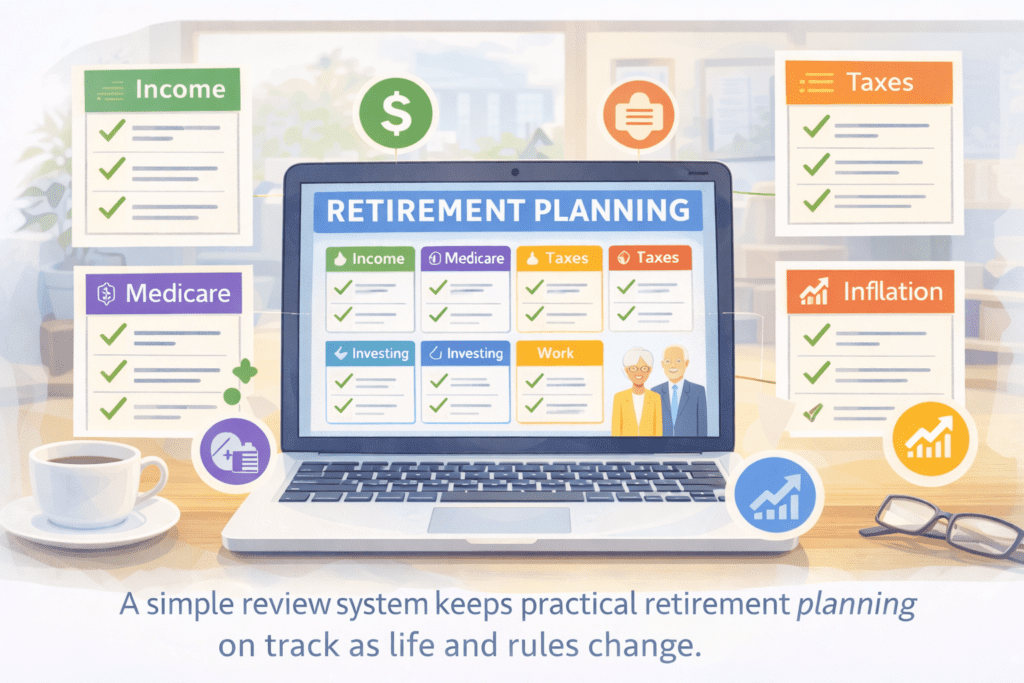

The best retirement plans are not “set it and forget it.” Life changes. Markets change. Healthcare costs change. Tax rules and program rules change. That’s why practical retirement planning is best treated as a simple system you revisit—rather than a one-time decision.

You’ve now walked through the core pressure points that shape retirement outcomes: income sources, Medicare timing, taxes, inflation, investing after accumulation, and work/second-act income. The next step is turning those ideas into a repeatable routine that keeps you aligned over time.

The goal is not perfection. The goal is reducing preventable mistakes and staying flexible when something changes.

Once-a-Year” review checklist

Annual Practical Retirement Planning Review

- Update my list of retirement income sources and confirm what changed.

- Confirm Medicare coverage, prescriptions, and any upcoming transitions.

- Review taxes: expected taxable income, brackets, and withdrawal strategy.

- Update my inflation assumptions and re-check major expense categories.

- Review investment allocation and rebalance based on income needs.

- Re-check work or business income and confirm my exit plan (second retirement).

- Update beneficiaries, emergency contacts, and where key documents are stored.

“When to rerun this” checklist

Re-Run This Plan When Any of These Happen

- I retire (or semi-retire) or change employment status.

- I turn 65 or change health insurance coverage.

- I start Social Security, pension income, or begin taking withdrawals.

- I sell a home, buy a home, or move to a new state.

- My spouse/partner retires or income changes.

- A major health event changes costs or caregiving needs.

- Markets drop sharply and I’m considering changing investments.

Retirement planning doesn’t need to be overwhelming. The practical approach is to focus on the decisions that actually move the needle, run the numbers before committing, and revisit the plan regularly. That’s what turns uncertainty into control—and that’s what practical retirement planning is all about.

FAQ

- What is practical retirement planning?

Practical retirement planning is a decision-focused approach that helps you manage the real pressure points of retirement—income reliability, Medicare timing, taxes, inflation, investing, and work/second-act income—using clear steps and numbers instead of assumptions. - How do I figure out what income sources I’ll actually have in retirement?

Start by listing every income source (Social Security, pensions, part-time work, rental income, annuities, dividends/interest, IRA/401(k) withdrawals). Then note the start date, whether it is guaranteed, whether it adjusts for inflation, and whether it is taxable. - Do I have to take Social Security to enroll in Medicare at age 65?

No. You can enroll in Medicare at age 65 whether or not you claim Social Security. Medicare enrollment has its own rules and timing, so treat it as a separate decision. - If I stay on my employer health plan after 65, what should I do to avoid gaps later?

Confirm whether your employer coverage qualifies you for a Special Enrollment Period when you leave. Before you retire (about a month out), verify the current transition process and required documentation so you avoid delays or coverage gaps. - Why do taxes still matter so much in retirement?

Because many retirement income sources are taxable and the timing of withdrawals matters. Traditional IRA/401(k) withdrawals can raise taxable income, affect Social Security taxation, and later collide with required distributions. - What’s the biggest inflation mistake retirees make?

Assuming a retirement budget stays flat. Inflation compounds over time and certain costs—healthcare, insurance, utilities, and home maintenance—often rise faster than average inflation. - How should investing change after I retire?

After retirement, investing should balance income needs and risk management. A plan should account for withdrawals during downturns, inflation protection, and a structured approach instead of reacting emotionally to market swings. - Is a “working retirement” a smart strategy?

It can be—if it is planned. Work income can reduce withdrawals and add flexibility, but practical retirement planning assumes that work may end due to age or health, so you should also plan for a “second retirement.” - How often should I review my retirement plan?

At least once per year—and anytime something major changes (retirement date, health insurance, starting Social Security, a market drop, moving states, selling a home, or changes in a spouse’s income/health). - Where can I find calculators and deeper guides for these topics?

RetireCoast’s Calculator Hub includes retirement planning tools and continues to grow. For deeper reading, use the RetireCoast All Articles Index and search by “Gen X” or a topic like taxes, Medicare, or inflation.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

![The Best Places to Buy Property for Airbnb Rental [2023]](https://retirecoast.com/wp-content/uploads/2022/06/best-places-to-buy-property-1-1-440x264.png)