A Thoughtful Transition for Older Adults and Their Families

Selling a home to move into senior living is one of the most significant decisions many older adults and their families will ever make. It is rarely just a real estate transaction. More often, it is part of a broader life transition shaped by health considerations, financial planning, emotional attachment, and the desire for a lifestyle that feels supportive and connected.

For many people, the family home has been their current house for a long time — sometimes decades. Letting go can feel overwhelming, even when the decision is clearly the right one. Whether you are the homeowner or one of the adult children helping a parent through this process, understanding why the move makes sense is often just as important as understanding how the sale will happen.

- A Thoughtful Transition for Older Adults and Their Families

- Case Study: Paula and Dave — Planning Ahead for the Next Chapter

- Why Selling the Family Home Often Becomes the Right Next Step

- Why Selling a Home to Move Into Senior Living Is Often the Turning Point

- Stages of Retirement: How Life Evolves Over Time

- Planning the Transition: When Life Stages Meet Real-World Timing

- Planning the Transition: When Life Stages Meet Real-World Timing

- Choosing the Right Real Estate Agent for This Stage of Life

- Podcast

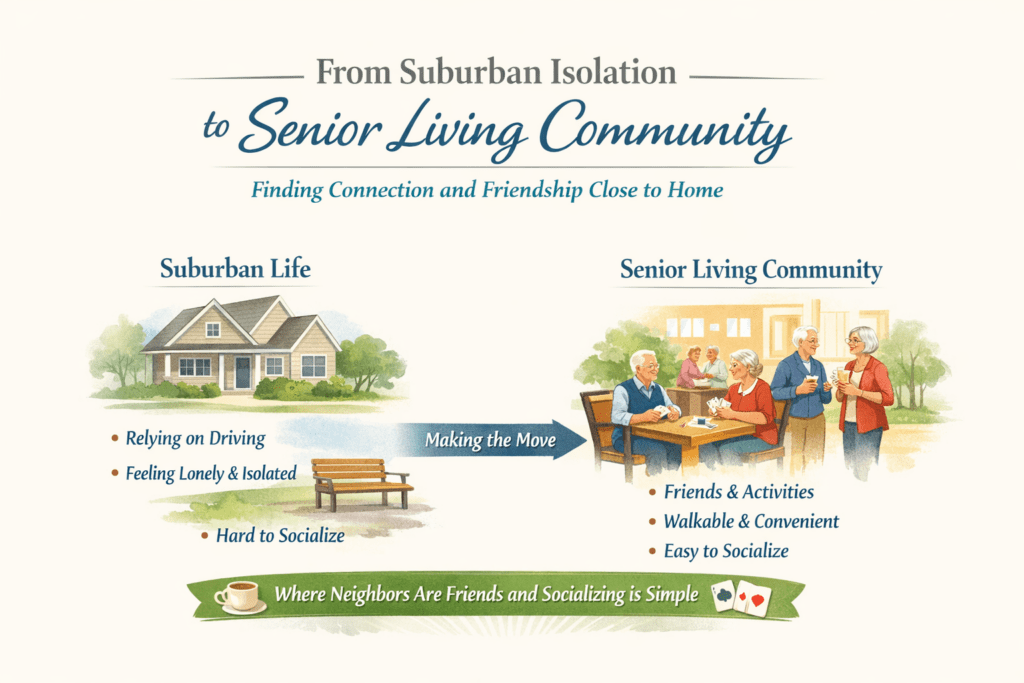

For many older adults, the reason begins with something fundamental: connection.

Most Baby Boomers and Gen X adults spent much of their lives in suburban neighborhoods designed around driving. While those communities offered privacy and space, they often made everyday social interaction difficult. Unlike densely populated cities where people can walk to cafés, parks, or neighborhood gathering places and naturally get to know their neighbors, suburban living typically requires getting in a car for nearly everything.

Over time — especially as driving becomes less comfortable or practical — this lifestyle can become isolating. Relying on family members, close friends, or scheduled transportation to socialize can quietly limit independence. Even when support is available, the effort required to connect with others can reduce spontaneity and shrink daily social life.

Years ago, my brothers, sister, and I began to worry about our mother. She could no longer drive, and most days she sat alone in front of the television while my sister was at work. Our father had passed years earlier, and although we visited as often as we could, it became clear that something important was missing.

Our mother had always been a social person. She loved to talk, share stories, and connect with others—especially about things that were familiar to her. Without regular companionship, she became quieter and, over time, clearly depressed. It wasn’t because she lacked care or love from her family; it was because she lacked daily connection.

As a family, we came to the conclusion that helping our mother move to a senior living community would give her something we could not provide on our own: constant opportunities to be around others, to talk, to laugh, and to feel engaged again.

We found the perfect location near my sister’s home. The move itself was surprisingly easy. Once she settled in, everything changed. She became busy, social, and genuinely happy. We visited often, grandchildren included, and instead of worrying about her being alone, we saw her thriving.

Looking back, the move wasn’t about taking something away. It was about giving her back the life she loved—one filled with people, conversation, and purpose.

Senior living communities change that dynamic.

At places like Summerfield Senior Living of Gulfport, residents live in close proximity to people with similar backgrounds, shared life experiences, and familiar rhythms. Socializing no longer requires planning or travel. Conversations happen naturally. Meals in a shared dining room become daily opportunities to connect. Activities and events make it easy to meet new friends and maintain an active, engaged lifestyle.

For many residents, this everyday sense of connection becomes one of the most meaningful improvements in quality of life. It is often the moment when moving to senior living no longer feels like giving something up — but rather like choosing a lifestyle that supports comfort, independence, and peace of mind.

That realization often leads to the next important step: thoughtfully planning the sale of a long-time family home in a way that protects both financial security and emotional well-being.

Case Study: Paula and Dave — Planning Ahead for the Next Chapter

Paula and Dave used to joke that they were “just kids” when they turned 60. But even then, they understood something many people don’t fully appreciate until much later: retirement doesn’t happen all at once. It unfolds in stages, and the decisions made early on can dramatically shape the quality of life in later years.

Paula built a successful career as a CPA, while Dave managed a portfolio of apartment communities. Both were disciplined planners. Early in their 60s, they made a conscious decision to work until age 70, allowing them to maximize their Social Security benefits and continue building retirement savings. They also committed to fully funding their 401(k) plans throughout their remaining working years.

At the same time, they began thinking beyond finances. They toured several senior living communities and identified one they felt strongly about—one that offered social connection, independence, and a lifestyle that aligned with how they envisioned their later years.

Putting the Plan Into Motion

Ten years later, just as they had envisioned, Paula and Dave felt ready. They were healthy, active, and financially prepared. The next step was selling their long-time home.

Rather than rushing the process, they took time to find a real estate agent with experience working with retirees—someone they trusted and who understood both the emotional and financial dimensions of selling a home after decades of ownership. With thoughtful preparation and realistic pricing, their home went on the market and sold successfully.

Because there was a waiting list at their chosen senior community, Paula and Dave made a strategic interim move into a nearby apartment. This gave them flexibility, reduced stress during the sale, and allowed them to move forward without pressure.

A Smooth Transition

When an opening became available at the senior community, the transition was seamless. Thanks to careful planning earlier in life, they could comfortably afford the monthly costs. The equity from their home sale, combined with well-funded retirement accounts, provided both security and peace of mind.

Because they were still active and independent, Paula and Dave added a new dimension to their retirement lifestyle: travel. They purchased an RV and began exploring the country, often returning to their community to reconnect with neighbors and friends. Their days were filled with a balance of adventure, routine, and social engagement.

Family remained central to their lives. Their children and grandchildren visited often, and Paula and Dave traveled to see them as well—on their own terms, without the burden of maintaining a large home.

Looking Back — and Forward

Reflecting on the transition, Dave summed it up simply:

“This new chapter in our lives may be the best one yet.”

Their story highlights an important truth: successful retirement transitions rarely happen by accident. They are the result of purposeful planning, realistic expectations, and the willingness to adapt as life evolves. By thinking ahead, Paula and Dave didn’t just move into senior living—they moved into a lifestyle that supported connection, freedom, and lasting fulfillment.

For Gen X readers, Paula and Dave’s experience offers an important reminder: the most successful retirement transitions don’t begin at retirement—they begin years earlier. Thoughtful planning reduces stress later, not only for parents, but for the entire family.

- Planning ahead creates choices instead of last-minute decisions.

- Understanding housing options early helps avoid crisis-driven moves.

- Protecting home equity and retirement savings supports lifestyle flexibility.

- Clear planning allows adult children to focus on support—not emergency problem-solving.

For Gen X, the lesson is clear: the decisions you make today may one day make your role as a son or daughter much easier—and your parents’ later years far more secure and fulfilling.

Why Selling the Family Home Often Becomes the Right Next Step

Once the decision to move into a senior living community feels settled, attention naturally turns to the family home. For many older adults, this has been their current house for a long time — sometimes decades — and deciding what to do with it can feel like one of the most difficult decisions in the entire process.

While some families initially consider keeping the home, many ultimately decide that selling it best supports the goals that led them to senior living in the first place: simplicity, flexibility, and peace of mind.

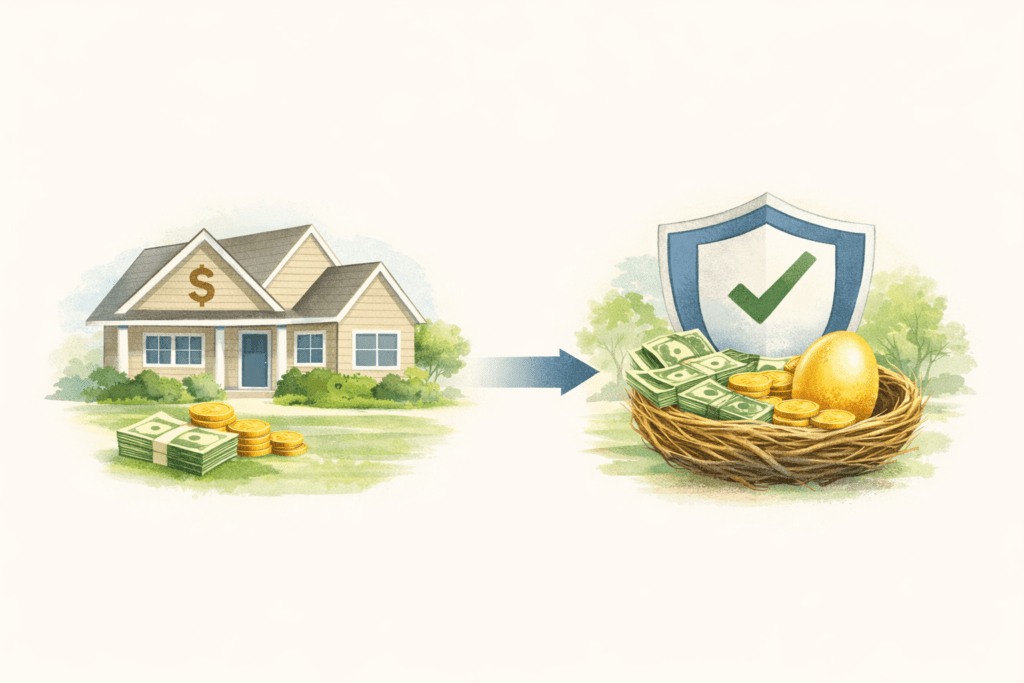

Turning a Long-Time Home into Financial Security

For many retirees, the family home represents their largest financial asset. Over time, mortgage balances may have been reduced or eliminated, and the home’s value may have increased significantly. Selling the home converts that value into accessible funds that can be used intentionally.

Proceeds from the sale of your home are commonly used to:

- Help cover senior living expenses and ongoing monthly costs

- Reduce financial uncertainty during major life transitions

- Support healthcare needs and future planning

- Create flexibility for family support or gifting

Understanding how this income may be taxed is an important part of the decision-making process. These resources can help clarify what to expect:

- Will I Owe Taxes Now That I’m Retired?

https://retirecoast.com/i-am-retired-will-i-owe-taxes/ - Senior Income Tax Planning for 2026

https://retirecoast.com/senior-income-tax-2026/ - Tax-Free Retirement Withdrawal Calculator

https://retirecoast.com/tax-free-retirement-withdrawal-calculator/

Many families find that reviewing these topics with a financial advisor or other financial expert before listing the home provides reassurance and prevents surprises later.

For many retirees, selling a long-time home can simplify life and provide financial flexibility, while renting may offer income but requires ongoing management. Choosing the right path depends on lifestyle goals, health, and the desire for peace of mind.

Selling vs. Renting: Choosing the Path That Simplifies Life

Some families explore renting the home instead of selling it, either as a short-term rental or a longer-term income property. While this approach can make sense in limited situations, it often requires ongoing attention that works against the goal of simplifying life.

Renting typically involves:

- Managing maintenance and repairs

- Handling tenants or property managers

- Staying current with property taxes and insurance

- Coordinating yard work and unexpected issues

For many older adults, these responsibilities can become burdensome — particularly when health, mobility, or distance are factors. A detailed comparison is available here:

- Selling vs. Renting in Retirement

https://retirecoast.com/selling-vs-renting-in-retirement/

For those seeking fewer obligations and more predictability, selling the home is often the better choice.

Aligning the Home Sale With the Purpose of the Move

One of the most important considerations is that the sale of the home should support the purpose of the move — not complicate it. Senior living is often chosen to reduce responsibility, create social opportunities, and make daily life easier.

When handled thoughtfully, selling the family home becomes an extension of that goal: converting a long-time property into a resource that supports independence, comfort, and confidence in the next chapter.

For families looking for broader planning tools and checklists that support this transition, RetireCoast’s Practical Retirement Guides provide step-by-step insights across housing, finances, and lifestyle planning:

https://retirecoast.com/practical-retirement-guides/

With this foundation in place, the next step is planning how and when the sale should happen.

Many adult children notice something before a parent ever says it out loud: the days get quieter. A parent who used to be social starts spending long stretches alone. If they can’t drive, even simple things—coffee with a friend, a quick errand, attending church or a community event—can become difficult without help.

This kind of isolation isn’t always dramatic. It can look like more television, fewer phone calls, less interest in hobbies, or a reluctance to “be a bother.” And even if you visit often, it may still feel like you’re trying to replace a daily social world that used to happen naturally.

One of the most effective changes isn’t simply increasing check-ins—it’s changing the environment. In a senior living community, connection is built into the day: people are nearby, meals are shared, and activities create easy conversation. The goal isn’t to take independence away; it’s to give your parent a setting where companionship is accessible again.

If you’re exploring this option, look for a community close enough to visit regularly. Many families find that once a parent settles in, they become more engaged, more confident, and noticeably happier—because companionship isn’t scheduled, it’s simply part of everyday life.

- They rarely leave the house unless you drive them

- They seem less talkative or less interested in routines

- They say “I’m fine” but your gut says they’re not thriving

- They mention feeling like a burden or not wanting to ask for help

Why Selling a Home to Move Into Senior Living Is Often the Turning Point

After families come to terms with the emotional side of the transition, attention usually shifts to the practical reality: selling a home to move into senior living. This step is often the true turning point in the process, because it connects lifestyle goals with financial security.

For many older adults, the family home has served its purpose well for a long time. It provided space, stability, and independence during years of active life. But when daily routines change, maintaining that home can become more work than benefit. At that stage, selling a home to move into senior living is less about giving something up and more about aligning resources with current needs.

Selling a Home to Support the Next Chapter

One of the most important reasons families choose selling a home to move into senior living is financial clarity. The equity built up over many years can be redirected to support:

- Senior living expenses and predictable monthly costs

- Healthcare and future care needs

- Reduced financial stress during major life transitions

- Greater flexibility and peace of mind for both seniors and adult children

Instead of worrying about repairs, property taxes, insurance, and upkeep, families often find relief in knowing that selling a home to move into senior living simplifies both finances and daily responsibilities.

Why Timing Matters When Selling a Home to Move Into Senior Living

Timing plays a major role in whether selling a home to move into senior living feels stressful or manageable. The ideal scenario allows the move to happen without rushing the sale or settling for less than the home’s value.

Some families choose to move first, then sell. Others prefer to sell first and use the proceeds to fund the transition. Both approaches can work, especially when guided by an experienced real estate agent who understands the local market and the unique needs of seniors.

In either case, the goal of selling a home to move into senior living is the same: create a smooth journey that protects health, finances, and dignity.

Selling a Home to Move Into Senior Living Is About Simplification

At its core, selling a home to move into senior living is about simplifying life. Senior living communities are designed to remove daily burdens—maintenance, isolation, and logistical challenges—so residents can focus on connection, comfort, and independence.

When the home sale is handled thoughtfully, it becomes an extension of that same philosophy. Selling the home reduces responsibility, unlocks resources, and allows older adults to fully embrace the benefits of their new environment.

For many families, this is the moment when everything begins to feel aligned. The move makes sense. The numbers work. And the next chapter no longer feels uncertain—it feels intentional.

Stages of Retirement: How Life Evolves Over Time

As the graphic above illustrates, retirement is not a single chapter—it unfolds in stages. Depending on how young you are when you retire and, most importantly, your health, there may be three or even four distinct phases. Understanding these stages can help you make thoughtful decisions that protect both independence and quality of life.

Stage One: Early Retirement — Active and Engaged

When you first retire, many retirees are healthy, with only minor issues, and can do almost anything they want to do. This stage is often filled with energy and curiosity. Most people choose to stay busy by starting a business after retirement, volunteering at places like the zoo or a local school, mentoring others, or pursuing hobbies such as woodworking, gardening, or even selling items online.

During this phase, retirees typically remain independent drivers. They balance projects and passions with travel, RV trips, and regular visits with children and grandchildren. Life feels full, flexible, and largely self-directed.

Stage Two: Simplifying — Focusing on Comfort and Connection

The next stage often arrives quietly. One day you decide to slow down. You may want to reduce your activity schedule or step away from physically demanding tasks such as working around the house, fixing a sink, or maintaining a car.

Time with family becomes more important. Travel may continue, but on a more limited basis. Many people at this stage strongly consider selling the house and either renting an apartment near the beach or moving to a senior living community where daily life is easier and social interaction is built in.

One common trigger during this phase is the loss of a spouse. The need for emotional support, companionship, and peers who understand life’s transitions becomes more important than ever. This part of life can be just as rewarding as any other—if you embrace it.

Stage Three: More Support — Planning for Health Changes

The next stage often begins when health issues emerge. Poor eyesight may make driving difficult or impossible. Mobility challenges or medical conditions may require help from outside professional providers.

At this point, many people consider moving into an assisted living environment where support is available as needed. Some communities, such as Summerfield Senior Living of Gulfport, offer full-service living for healthy adults age 55, with the ability to transition seamlessly into higher levels of care later on.

In these communities, a move during the second stage can be a smart long-term decision. You enjoy independence now, with the reassurance that additional care is available later—without needing another disruptive move.

Most of these facilities operate on a rental or lease basis, meaning there is no need to purchase another home. For many retirees, this flexibility makes the second and third phases of life more predictable and far less stressful.

Ultimately, every stage of retirement is about the same goal: quality of life.

A personal reflection on recognizing the stages of retirement and why planning for each phase—before you need it—can make all the difference.

Planning the Transition: When Life Stages Meet Real-World Timing

Once you recognize which stage of retirement you’re in, the next step is planning the transition in a way that supports your health, finances, and peace of mind. This is where many families begin to feel uncertain—not because they don’t know what they want to do, but because they’re unsure when and how everything should happen.

Selling a long-time home and moving into senior living is rarely a single event. It is a process that unfolds over time, shaped by personal readiness, family considerations, and practical realities.

Why Timing Feels So Complicated

Several factors often overlap at this point:

- Health changes that make waiting uncomfortable or risky

- Emotional readiness to leave a long-time home

- Move-in availability at a senior living community

- Conditions in the housing market

- The need to coordinate with adult children or other family members

It’s common for retirees to feel pressure to “get it right.” But there is no single perfect timeline—only a thoughtful one that reflects your current stage of life.

Selling First or Moving First: Two Valid Paths

Families typically consider one of two approaches.

Some choose to sell the home first, using the proceeds to fund the move and eliminate uncertainty. This approach can feel clean and decisive, especially when the housing market is favorable.

Others move first, then sell the home once they are settled. This can be especially helpful when health issues make daily upkeep difficult or when showings would be disruptive. In these cases, having the home vacant or lightly staged can actually make it easier for buyers to visualize the space.

Both paths can work well. The key is choosing the one that best supports your comfort and dignity during the transition.

Coordinating With Family Without Losing Independence

Adult children are often deeply involved at this stage, helping with logistics, research, and decision-making. Their support can be invaluable—but it’s important that the process still reflects the wishes and priorities of the person making the move.

Clear communication helps avoid misunderstandings and reduces stress for everyone involved. When expectations are aligned early, families are better able to move forward together with confidence.

A Transition, Not a Deadline

One of the most important mindset shifts is letting go of the idea that this move must happen all at once. Retirement transitions are not emergencies—they are evolutions.

When planned thoughtfully, selling a home and moving into senior living becomes a steady, manageable journey rather than a rushed event. That perspective alone can make the process feel far less overwhelming.

With a realistic timeline in mind, the next critical decision is choosing the right professional to guide the sale.

- ☐ I feel less comfortable keeping up with home maintenance, repairs, or yard work.

- ☐ I no longer enjoy managing a large home and would prefer a simpler living arrangement.

- ☐ Driving is becoming difficult, stressful, or something I avoid when possible.

- ☐ I spend more time alone than I’d like and would benefit from daily social interaction.

- ☐ I want to be closer to family, or in a setting where help is available if needed.

- ☐ I like the idea of selling my home to reduce financial uncertainty and free up equity.

- ☐ I would feel more comfortable knowing additional care options are available in the future.

- ☐ I’m open to exploring senior living now, rather than waiting for a crisis to force a move.

There’s no “right” number of checkmarks. This list is meant to start a conversation—with yourself, with family members, or with trusted professionals—about what kind of living arrangement best supports your quality of life today and in the years ahead.

Years ago, my brothers, sister, and I began to worry about our mother. She could no longer drive, and most days she sat alone in front of the television while my sister was at work. Our father had passed years earlier, and although we visited as often as we could, it became clear that something important was missing.

Our mother had always been a social person. She loved to talk, share stories, and connect with others—especially about things that were familiar to her. Without regular companionship, she became quieter and, over time, clearly depressed. It wasn’t because she lacked care or love from her family; it was because she lacked daily connection.

As a family, we came to the conclusion that helping our mother move to a senior living community would give her something we could not provide on our own: constant opportunities to be around others, to talk, to laugh, and to feel engaged again.

We found the perfect location near my sister’s home. The move itself was surprisingly easy. Once she settled in, everything changed. She became busy, social, and genuinely happy. We visited often, grandchildren included, and instead of worrying about her being alone, we saw her thriving.

Looking back, the move wasn’t about taking something away. It was about giving her back the life she loved—one filled with people, conversation, and purpose.

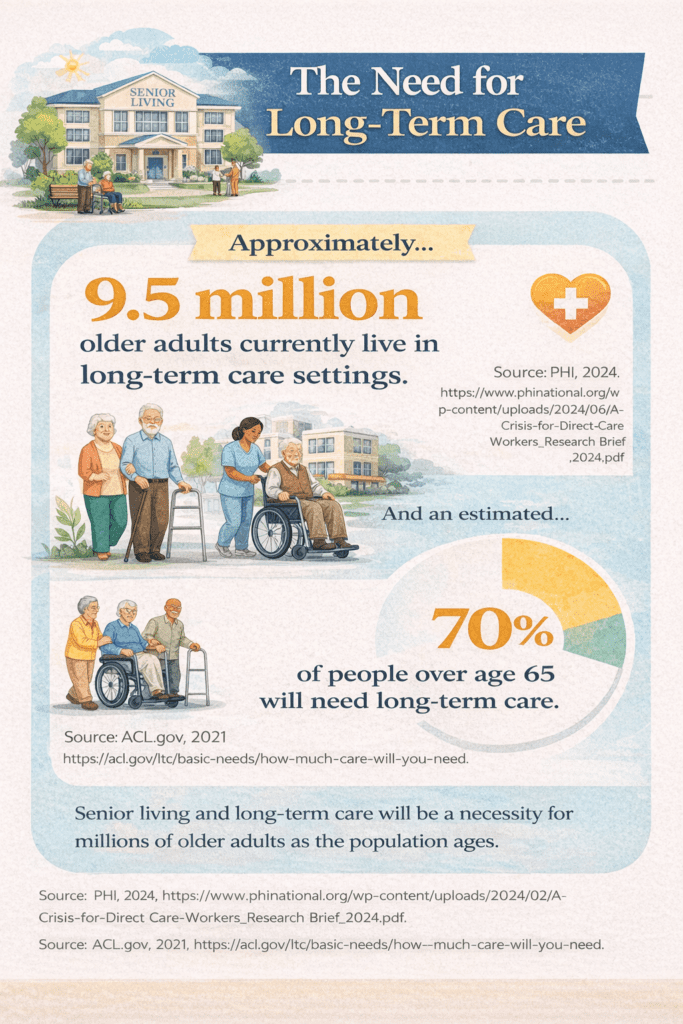

Growing demand for senior living and long-term care, based on data from PHI and the U.S. Administration for Community Living.

Planning the Transition: When Life Stages Meet Real-World Timing

Once you recognize which stage of retirement you’re in, the next step is planning the transition in a way that supports your health, finances, and peace of mind. This is where many families begin to feel uncertain—not because they don’t know what they want to do, but because they’re unsure when and how everything should happen.

Selling a long-time home and moving into senior living is rarely a single event. It is a process that unfolds over time, shaped by personal readiness, family considerations, and practical realities.

Why Timing Feels So Complicated

Several factors often overlap at this point:

- Health changes that make waiting uncomfortable or risky

- Emotional readiness to leave a long-time home

- Move-in availability at a senior living community

- Conditions in the housing market

- The need to coordinate with adult children or other family members

It’s common for retirees to feel pressure to “get it right.” But there is no single perfect timeline—only a thoughtful one that reflects your current stage of life.

Selling First or Moving First: Two Valid Paths

Families typically consider one of two approaches.

Some choose to sell the home first, using the proceeds to fund the move and eliminate uncertainty. This approach can feel clean and decisive, especially when the housing market is favorable.

Others move first, then sell the home once they are settled. This can be especially helpful when health issues make daily upkeep difficult or when showings would be disruptive. In these cases, having the home vacant or lightly staged can actually make it easier for buyers to visualize the space.

Both paths can work well. The key is choosing the one that best supports your comfort and dignity during the transition.

Coordinating With Family Without Losing Independence

Adult children are often deeply involved at this stage, helping with logistics, research, and decision-making. Their support can be invaluable—but it’s important that the process still reflects the wishes and priorities of the person making the move.

Clear communication helps avoid misunderstandings and reduces stress for everyone involved. When expectations are aligned early, families are better able to move forward together with confidence.

A Transition, Not a Deadline

One of the most important mindset shifts is letting go of the idea that this move must happen all at once. Retirement transitions are not emergencies—they are evolutions.

When planned thoughtfully, selling a home and moving into senior living becomes a steady, manageable journey rather than a rushed event. That perspective alone can make the process feel far less overwhelming.

With a realistic timeline in mind, the next critical decision is choosing the right professional to guide the sale.

- ☐ I feel less comfortable keeping up with home maintenance, repairs, or yard work.

- ☐ I no longer enjoy managing a large home and would prefer a simpler living arrangement.

- ☐ Driving is becoming difficult, stressful, or something I avoid when possible.

- ☐ I spend more time alone than I’d like and would benefit from daily social interaction.

- ☐ I want to be closer to family, or in a setting where help is available if needed.

- ☐ I like the idea of selling my home to reduce financial uncertainty and free up equity.

- ☐ I would feel more comfortable knowing additional care options are available in the future.

- ☐ I’m open to exploring senior living now, rather than waiting for a crisis to force a move.

There’s no “right” number of checkmarks. This list is meant to start a conversation—with yourself, with family members, or with trusted professionals—about what kind of living arrangement best supports your quality of life today and in the years ahead.

Choosing the Right Real Estate Agent for This Stage of Life

Once the decision to sell begins to feel real, the next—and arguably most important—step is choosing the right real estate agent. At this stage of life, selling a home is not just about price. It is about trust, communication, and reducing stress for everyone involved.

Not every agent is well suited for this kind of transition.

Why Experience With Seniors Matters

Selling a long-time home later in life often comes with unique challenges:

- Health or mobility limitations

- Emotional attachment to the home

- Adult children helping from a distance

- The need for flexibility around timing and access

An agent who regularly works with older adults understands that this is not a typical transaction. They know how to slow the process down when needed, explain options clearly, and handle logistics without requiring constant involvement from the homeowner.

Many families look for an agent with experience as a Senior Real Estate Specialist (SRES®) or someone who has worked extensively with retirement-age sellers. While credentials matter, temperament and communication style matter just as much.

What a Good Agent Should Be Willing to Handle

A good agent at this stage should be comfortable managing much more than paperwork. This often includes:

- Coordinating inspections, minor repairs, and clean-up

- Advising on what truly needs fixing—and what does not

- Managing showings with minimal disruption

- Communicating regularly with adult children when appropriate

- Guiding decisions without pressure

In many cases, the best agent becomes a steady presence—someone who removes friction from the process rather than adding to it.

Before becoming a real estate broker, Bill served as president of a national company that worked directly with cities and three of the country’s largest senior living organizations, encompassing hundreds of living units, to help older adults safely remove unwanted and potentially hazardous materials from their homes.

Through those years, Bill gained valuable perspective into the practical and emotional challenges seniors face—mobility and safety concerns, decision-making with family members, and the strong emotional attachment many feel to a family home. He now applies that experience in his real estate practice, working with older adults, adult children, financial professionals, and senior living communities to ensure home sales are handled thoughtfully, respectfully, and with minimal stress.

Bill’s focus is not simply on selling homes, but on protecting dignity, preserving financial security, and creating smooth transitions that support quality of life in the next chapter.

Our conversation provided valuable perspective on the emotional, social, and practical considerations older adults face—particularly around independence, social connection, and continuity of care. Her insights helped inform several sections of this article and ensured the guidance reflects both lived experience and professional understanding of senior communities.

- National Institute on Aging (NIH) – Federal research and guidance on aging, health, and quality of life.

- Administration for Community Living (HHS) – Programs and services supporting older adults and caregivers.

- Medicare (Centers for Medicare & Medicaid Services) – Official information on Medicare coverage and eligibility.

- U.S. Department of Housing and Urban Development (HUD) – Seniors – Housing options, counseling, and programs for older adults.

- Social Security Administration – Retirement – Retirement benefits, eligibility, and planning tools.

- IRS Publication 523 – Selling Your Home – Capital gains exclusions and tax rules related to home sales.

- Consumer Financial Protection Bureau – Retirement – Practical financial tools and consumer guidance for retirees.

- U.S. Census Bureau – Housing Data – National housing statistics and demographic trends.

- Federal Reserve – Survey of Consumer Finances – Research on household wealth, home equity, and retirement savings.

- Cornell University Cooperative Extension – Aging at Home – University-based guidance on home safety, transitions, and aging in place.

Podcast

1) How do I know it’s the right time to sell my home and move to senior living?

2) Should I move first and sell later, or sell first and then move?

3) What is the first step I should take before selling?

4) How do I choose the best real estate agent for a senior move?

5) Do I need to remodel before selling?

6) What are the most important low-cost improvements before listing?

7) How do we declutter when there are decades of belongings?

8) How should we price the home if we need a fast sale?

9) What buyer incentives are most common today?

10) What happens after the inspection, and how do we avoid price reductions?

11) What should we do with the proceeds from the sale of the home?

12) Will I owe taxes on the sale of my home?

13) What legal documents should be updated after the sale?

14) How can adult children help without taking over?

15) Where can we search for senior living communities to compare options?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.