Last updated on January 2nd, 2022 at 04:28 pm

You can avoid high taxes-relocate.. Oliver Wendell Holmes said that tax avoidance is perfectly legal, you have the right to structure your own affairs to pay the least amount of tax possible. You have a right to live in a high tax state such as California. You also have a right to move to a low tax state as well.

If you live in a high tax state such as California, New York, Illinois, and others your federal income tax bill has increased effective in 2018 (part of the new federal tax reform act).

New Federal Tax Changes

New federal tax law changes will harm wealth in high tax areas for some middle income and most upper-middle-income people. If you live in an area with high property and local and state income taxes, you will probably pay more on your 2018 and 2019 tax returns to the IRS than in previous years.

Boiling this down, high tax cities and states have suggested that since their income and property taxes are deductible on federal returns, the higher tax rates they charge are somewhat mitigated.

The 2018 tax law is basically simple. Married couples filing jointly get a flat $24,000 deduction. Unless your itemized deductions can exceed the new standard deduction, you should consider filing the short form. If in previous years you claimed tens of thousands in state and local income taxes and property taxes plus interest paid on a HELOC, think again. Your maximum deduction for all taxes is $10,000. Forget HELOC, that’s gone (unless all of the funds go into the home, no paying off bills).

Is your property tax rate reasonable?

You may believe that your property tax rate is reasonable e.g. 1% however, if the value of your home creates a large tax bill then you are in the same situation with people who are paying a high property tax rate. Those of you who have a second home will understand that the $10,000 total all taxes deduction cap includes your primary and secondary residence real estate taxes.

So why relocate? There are perhaps many reasons that come to mind such as downsizing, retiring, need a house with an office to work from home etc. Many people are fleeing high tax areas for lower cost homes that provide as many or more benefits as staying put.

Basically, elected officials in some areas have decided that they need your money more than you do and that perhaps your money should be spread around to others. In your decision making, you should consider the total tax burden and the prevailing “tax and spend culture” in the area you are considering a move to.

Relocate to another area to escape unreasonable taxes

Why relocate to another area to escape unreasonable taxes just to find that politicians there have caught up with you and decided that they want to copy the tax policy of the area you came from. A common statement is “California does it, so why don’t we?”.

Sounds depressing right? There is a solution. Consider going to a state with a history of avoiding new taxes. A state that has a low state income tax rate and zero income taxes on ALL retirement income. How about a state that has no state tax included in the price of gasoline.

So you found this low tax state. What about the area in the state? Will the City or County tax you to death? There are areas where taxes are reasonable and the “tax and spend” culture is a foreign language to elected officials.

Some taxes are necessary

Some taxes are necessary, that’s a given. There are necessary taxes and then there are taxes that stretch beyond the bounds of reason.

So back to the primary topic, “tax avoidance”. Everyone should have a tax “avoidance” strategy in place. “Avoidance is not the same as “evasion”. To clarify, avoiding taxes is legal, evading taxes is illegal.

It seems everyone is moving to Austin

There are states and local areas where taxes are considered a necessary evil and not to be raised under the pain of losing your elected position. I found such an area and it’s not Texas. So why did I mention Texas? Because it seems that “everyone” is moving to Austin. Austin is the new California. Texas has no state income tax which is good. It does have a hefty property tax upwards of 2%.

The issue with Texas is retirement. Since your income in retirement will be reduced and not taxed in Texas, that compares with other states that do not tax retirement income. So no benefit here for retirees.

Property taxes are there to stay

Property taxes are one of those taxes that cannot be eliminated, they are here to stay. In retirement, high property taxes in Texas can be a significant burden. Also, Austin for example is one of those places where Californians are moving to in large numbers. They want everything that they are leaving California for. Home prices are way up and increasing. Roads and highways are crowded as are stores and services.

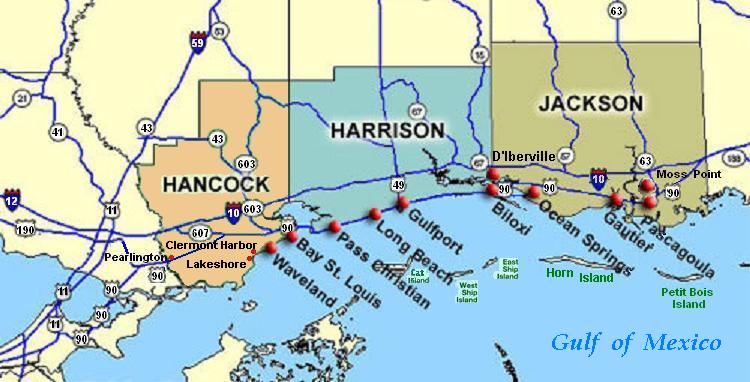

Wow, if you cannot relocate to Texas and beat the taxman where can you go? How about Mississippi. Here are a few benefits:

- No income tax on ANY retirement income

- State income tax 5% or less

- Property taxes about 1% of the purchase price of a home

- $75,000 deduction in assessed value for those 65 and over

- 5% sales tax on vehicles after deducting the value of trade-in

- Home prices at or near the lowest of any state (less than half of CA prices as a rule)

Mississippi Gulf Coast has beaches, warm weather …….

You can have beaches, warm weather, trees, a pond, a larger lot in development, and more. If you love outdoor sports e.g. fishing, hunting, boating, etc., the Gulf Coast is a paradise.

So if the price of a home is for example half of what you are paying, then the total property tax cost will be much lower in the Gulf Coast. Some people in high-cost states have sold their properties there and paid cash to buy a similar home on the Gulf.

Some results of relocating to the Mississippi Gulf Coast can be:

- Zero or very small mortgage payment

- Substantially lower property taxes

- Lower-income state taxes (except for states with zero state income tax)

- Sales tax 7%

- Zero state tax on all retirement income including IRA’s and 401k withdrawals and pensions.

- Lowest or nearly lowest gas prices in the nation

- Far less traffic, shorter lines at stores (less crowding)

There are college courses on the subject of tax avoidance and the ethics thereof. Many wealthy people relocate their homes to other countries for more favorable tax treatment. If it works for them, why not consider moving to the Mississippi Gulf Coast, a lot closer than moving to a Pacific island to avoid taxes.

photo courtesy of Pixabay.com and Needpix.com

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

![The Best Places to Buy Property for Airbnb Rental [2023]](https://retirecoast.com/wp-content/uploads/2022/06/best-places-to-buy-property-1-1-440x264.png)