Last updated on September 12th, 2025 at 04:07 am

This is the Best Step-by-Step Guide to Starting a Business After Retirement. Learn how to select a name for your business and check for availability in your state. This discusses registration of your new business with your state and all other tasks required to get going. The RetireCoast series on Starting a Business After Retirement includes articles devoted to a general discussion, choosing a type of business, creating a business plan, and financing the enterprise.

This article is part 5 of our series “Starting a Business After Retirement,” and this comes after you have gained an understanding of the topics discussed above and in our articles. Check out our Index and read the preceding articles if you have not already; they prepare you for this step.

This Best Step-by-Step Guide includes key elements that are explained as you read on. The index is a great way to select any topic in this article and go right to it. The following are the essential steps required to start your business. This article will help you consider and explain each step in detail below.

Steps to Start a Business

- Step 1: Choose a Company Name

- Step 2: Check Name Availability

- Step 3: Register the Business

- Step 4: Prepare Business Formation Documents

- Step 5: Develop a Marketing Plan (website, email address, logo)

- Step 6: Open a Business Bank Account

- Step 7: Set Up Accounting and Financial Systems

- Step 8: Obtain Necessary Licenses and Permits

- Step 9: Create Business Contracts and Legal Agreements

- Step 10: Get Business Insurance

Set up an office at home or elsewhere

It’s a good idea to set up an office or area in your home to organize all of the elements required to go from just thinking about starting a new business to the follow-through, which includes this article. If you are very familiar with software, you can go digital with your documents.

Most seniors, however, are probably more comfortable buying file folders and organizing their new enterprise in an “old school” manner. Your previous work experience organizing and managing an office will help.

To get started, be sure to obtain a desktop computer or a laptop with a large screen attached. Your mobile phone will not be the best for viewing some of the documents you need to enter. Be sure that you have a color printer. A laser or inkjet will work.

Buy a label maker or printer for folder labels and sending letters. Buy a box to hold your files or a file cabinet. At some point, you can go digital when you feel comfortable.

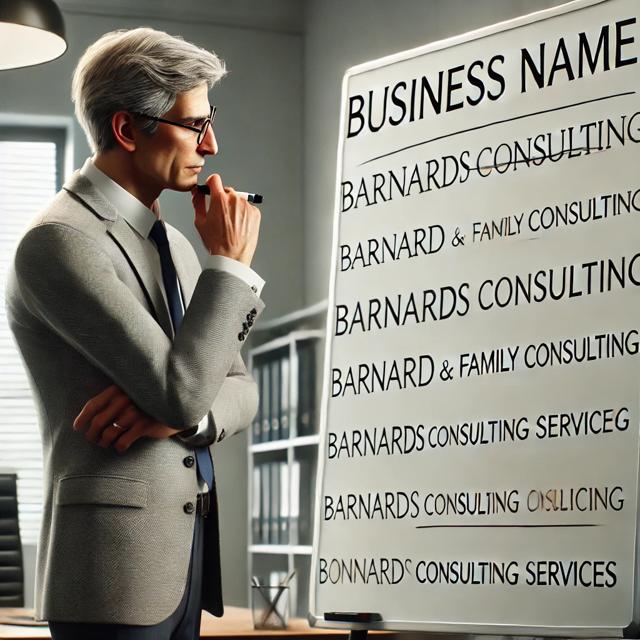

Your company name

Your company name is important, you have an opportunity to make your business stand out. Before you create a business name using your own name, consider our list of things to consider here:

1. Purpose & Brand Identity

- Reflects your business’s purpose or industry

- Aligns with your personal brand or expertise

- Communicates trust and professionalism

2. Simplicity & Memorability

- Easy to pronounce and spell

- Short and catchy (preferably 2-3 words)

- Avoids complex words or abbreviations

3. Uniqueness & Availability

- Not already in use by another business

- Check domain name availability (e.g., .com, .net, .biz)

- Verify social media handle availability

4. Legal Considerations

- Complies with state and federal naming regulations

- No trademark conflicts (search via USPTO.gov or a legal service)

- Suitable for incorporation (LLC, S-Corp, etc.)

5. Future Scalability

- Allows room for business expansion (avoid overly specific names)

- Not tied to a single location unless necessary

- Works for both online and offline branding

6. Target Audience Appeal

- Resonates with your ideal customer base

- Evokes positive emotions and credibility

- Not offensive or confusing in different languages

7. SEO & Digital Presence

- Keywords related to your industry can improve search rankings

- Domain names should be easy to type and remember

- Avoids numbers and hyphens unless necessary

8. Personal Preference & Longevity

- Feels meaningful and motivating to you

- Easy to say repeatedly in marketing and networking

- Stands the test of time without feeling outdated

The best way to determine if a business in your vicinity is using the same name or a similar one is to go to Google and check. If you are offering services that anyone anywhere can use, such as consulting, then widen your search area.

This is why a little market research in advance will help not only with the name but the product marketing as well. We discuss marketing in another future installment of “Starting a Business After Retirement”.

When naming your business, it’s important to consider long-term ownership and exit strategies. Using your personal name can create strong brand recognition, but it also has limitations, especially when it comes time to sell or pass down your business.

Why Using Your Name May Not Be Ideal for Resale

If you plan to sell your business in the future, a name like “Sally’s Consulting” ties the brand identity directly to you. This can be a challenge for a new owner because:

- Customers may associate the business solely with you, making the transition difficult.

- The brand may lose credibility or recognition without you being actively involved.

- A buyer might need to rename the business, which could require rebranding and marketing expenses.

A more transferable name—such as “Main Street Consulting”—creates an identity that can stand on its own, making it more attractive to potential buyers. It allows for continued brand value without reliance on a single person.

When to Consider Using Your Name

Using your name may work if:

- Your business is a personal brand (e.g., coaching, speaking, art, or law).

- You don’t plan to sell and want your name to remain part of your legacy.

- You plan to pass the business to family and want your name to carry weight in the next generation.

Adding Family for a Multi-Generational Business

If you plan to keep the business in the family, consider names like:

- “Sally & Sons Consulting”

- “Johnson & Family Accounting”

- “Anderson & Co. Realty”

This not only signals continuity but also makes it easier for future generations to take ownership without completely rebranding.

Thinking About the Business as an Asset

When naming your business, think beyond your immediate role:

✔ Would this name make sense if I step away?

✔ Does this name create value independent of me?

✔ Will customers still trust the business if I’m not involved?

By choosing a name that is scalable and brandable beyond you, you’re increasing the potential resale value and ensuring that the business remains strong even in your absence.

Name Availability

Now that you have selected at least four prospective names in order of importance to you, it’s time to determine if that name is available for use. Assuming you have done a Google search, you should have found that the name seems to be unused. People register names regularly and never use their name so your search on Google is not definitive.

It’s time to check with your state. RetireCoast will do this for you (for a fee) if you request this service. If you want to look on your own, you will need access to your state’s Secretary of State website and navigate to name availability.

There may be a fee for the search. If you plan to have another party, such as RetireCoast, obtain your name and register your company, it’s best not to go further and reserve it. Just contact RetireCoast and let us know that the name is available.

Selecting a Business Name: Secretary of State Requirements

When registering a business name with the Secretary of State, it is crucial to understand naming requirements, especially regarding the inclusion of entity designators like LLC, Corp, or Inc. These designators indicate the legal structure of the business and can affect its legal standing.

1. Entity Designators: LLC, Corp, Inc., Etc.

Most states require certain designators to be included in the business name if the company is structured as an LLC or Corporation. Here’s a breakdown:

- Limited Liability Company (LLC): Must include “LLC,” “L.L.C.,” or “Limited Liability Company” in most states.

- Corporation (Corp or Inc): Must include “Corporation,” “Incorporated,” “Inc.,” or “Corp.”

- Limited Partnership (LP or LLP): Must include “Limited Partnership” (LP) or “Limited Liability Partnership” (LLP).

- Professional Entities: Some states require professional corporations to use “Professional Corporation” (PC) or “PLLC” (Professional LLC) for licensed professionals (lawyers, doctors, accountants).

Example:

- If you register “Main Street Consulting” as an LLC in a state that requires “LLC,” you must file it as “Main Street Consulting LLC.”

- If the state does not require the tag, you may file it simply as “Main Street Consulting” without the “LLC” designation.

2. What Happens If You Don’t Include an Entity Tag?

- If you submit a business name without an entity designator, and the state requires one, your application may be rejected.

- If the state does not require a designator, your business will be registered without it, meaning the name will stand alone.

- In some states, you may be required to file an amendment later if you wish to add the designator.

3. States That Require or Do Not Require Designators

- Most states require LLCs and Corporations to include their respective designators.

- Some states, such as New Mexico, allow LLCs to register without “LLC” in their name.

- Some states, like California and Texas, are stricter and require explicit use of “LLC” or “Inc.” for clarity in business operations.

4. Checking Name Availability

Before filing, check the Secretary of State’s website:

✅ See if your desired name is available

✅ Verify if your state requires the entity designator

✅ Ensure compliance with naming regulations

RetireCoast can for a fee, check name availability for you and secure the name should you decide to move forward and register your business. Click here for more information

Most states offer an online business name search tool to check for conflicts before submitting an application.

5. Trademark & Legal Considerations

- Registering a business name with the Secretary of State does NOT grant trademark protection.

- If you want exclusive rights to the name nationwide, consider filing a trademark with the USPTO (United States Patent and Trademark Office).

- Even if a name is available at the state level, it could be trademarked federally by another business.

Final Considerations

✔ Know your state’s specific naming rules before submitting an application.

✔ Decide whether you want the entity designator included—some states allow the choice.

✔ Ensure name availability and avoid trademark conflicts.

✔ Understand the long-term implications of your business name choice (e.g., future branding, potential sale, or expansion).

Registering Your Business with the Secretary of State:

Key Considerations

When starting a business, registering it with the Secretary of State (SOS) is a crucial step to ensure legal compliance, liability protection, and legitimacy. This process formalizes your business as a legal entity, such as an LLC (Limited Liability Company), Corporation, or Limited Partnership (LP). RetireCoast can register your company in your state. Click here for more information.

1. Why You Should Register in the State Where Your Business Operates

It’s generally recommended to register your business in the state where it primarily operates and generates income. Here’s why:

- Legal Compliance: Most states require businesses to be registered where they have a physical presence, employees, or conduct significant operations.

- Tax Obligations: Registering in your home state ensures you meet state tax requirements, such as income tax, sales tax, and franchise tax. Check out our article on taxes here

- Avoid Additional Fees: If you register in another state but do business in your home state, you may be required to file as a foreign entity and pay additional fees.

🚨 Example: Many business owners register in Delaware, Nevada, or Wyoming due to tax benefits. However, if they operate in California, they must also register as a foreign corporation and pay additional fees.

2. Foreign Corporations & Additional Fees

If you register in a state other than where you conduct business, you are considered a foreign entity in your home state and must file for foreign qualification. This comes with extra fees and compliance requirements.

🔹 Example: California’s $800 Minimum Franchise Tax

- Even if you register your LLC in Delaware or Nevada, if you do business in California, you must register as a foreign LLC in California and pay the $800 annual franchise tax (even if you don’t make money).

🔹 Other States with High Foreign Entity Fees:

- New York: Requires publication in local newspapers, which can cost $1,000+.

- Massachusetts: Charges a $500+ annual report fee for foreign entities.

- Texas: Requires foreign LLCs to register and file an annual report.

💡 Best Practice: If you’re a small business or sole proprietor, register in your home state to avoid unnecessary fees and paperwork.

3. Fees & Annual Renewal Requirements

Each state has different initial registration fees and annual renewal fees for LLCs and corporations. Here’s a general breakdown:

| State | LLC Filing Fee | Annual Renewal Fee | Foreign Entity Fee |

|---|---|---|---|

| California | $70 | $800 (Franchise Tax) | $800 + $20 |

| Texas | $300 | No annual fee, but franchise tax applies | $750 |

| Delaware | $90 | $300 | $200 |

| Nevada | $425 | $350 | $425 |

| New York | $200 | $9-$4,500 (based on revenue) | $250 + publication fees |

| Florida | $125 | $138.75 | $125 |

| Illinois | $150 | $75 | $150 |

✅ Annual Requirements:

- File an Annual Report (renewal of your business registration).

- Pay any State Franchise Tax (if applicable).

- Maintain a Registered Agent (someone to receive legal documents).

- Keep your Articles of Organization/Incorporation updated.

The most efficient way to start your business is to work with a company such as RetireCoast to accomplish most of the tasks required to get to the sales phase. When planning for the cost of starting your business, create a budget just for start-up and include fees from the table above and for the cost to have RetireCoast or someone else do the work.

4. General Requirements to Register a Business

When filing with the Secretary of State, you typically need:

1️⃣ Business Name – Must be unique in that state (check the SOS database).

2️⃣ Entity Type – Choose LLC, Corporation, LLP, etc.

3️⃣ Registered Agent – A person or service authorized to receive legal notices.

4️⃣ Articles of Organization (LLC) or Articles of Incorporation (Corp) – Legal documents outlining your business structure.

5️⃣ Operating Agreement (LLC) or Bylaws (Corp) – Internal governance documents (some states require them).

6️⃣ EIN (Employer Identification Number) – Needed for tax purposes (issued by the IRS).

7️⃣ Business Licenses & Permits – Varies by industry and state.

5. Services Available for Registration

Navigating the business registration process can be complex, especially when dealing with multiple state requirements, foreign entity registrations, and annual compliance rules. This is where business formation services like RetireCoast can help streamline the process.

How RetireCoast Can Assist with Business Registration

RetireCoast offers a comprehensive business formation service that ensures your company is properly registered in the correct state while complying with all legal requirements.

✅ Business Name Search & Registration – RetireCoast will check for name availability and secure the business name with the Secretary of State.

✅ LLC & Corporation Formation – Whether you’re forming an LLC, S-Corp, C-Corp, or Partnership, RetireCoast will file the necessary documents in your state of choice.

✅ State Compliance Handling – Ensures the business meets all Secretary of State filing requirements, including Articles of Organization, Registered Agent requirements, and more.

✅ Registered Agent Services – If your business is registered in a state where you don’t reside, RetireCoast can act as your registered agent and handle all official legal documents.

✅ Modest Fees – RetireCoast provides these services for a modest fee, in addition to the state registration fees, making it an affordable and hassle-free solution.

The Role of a Registered Agent

A Registered Agent is a person or business entity designated to receive official legal documents on behalf of a company. Every state requires businesses (LLCs and Corporations) to have a registered agent to maintain compliance.

✔ Legal Compliance – Ensures the business maintains good standing by receiving and responding to legal and tax-related documents.

✔ Privacy & Convenience – If you register your business in another state, the registered agent receives legal notices on your behalf, preventing unwanted solicitations or lawsuits from being served at your home or office.

✔ State-Specific Requirements – Some states require the registered agent to have a physical address (not a P.O. box)within the state where the business is registered.

✔ Annual Report Reminders – Many registered agent services remind business owners of required state filings to avoid penalties.

RetireCoast provides registered agent services for businesses that operate in states where the owners do not have a physical presence. This ensures compliance, privacy, and convenience, allowing business owners to focus on growth while remaining compliant with state laws.

6. Key Takeaways

✔ Register where you operate to avoid unnecessary foreign entity fees.

✔ Foreign corporations must register and pay extra fees if operating in another state.

✔ Some states (CA, NY, NV) have high annual fees, so factor that into your decision.

✔ Stay compliant with annual filings and tax payments to maintain your business in good standing.

✔ RetireCoast can help with business name registration and entity formation, and act as your registered agent if needed.

Required Business Formation Documents Based on Business Type

When forming a business, specific documents must be prepared depending on the business structure (LLC, Corporation, Partnership, etc.). Some of these documents are required by the state, while others are necessary for banking, financial transactions, and real estate purchases.

To simplify the process, RetireCoast offers document preparation services tailored to each state’s legal requirements. For a modest fee, RetireCoast can assist with the preparation and filing of all necessary business formation documents, ensuring full compliance and easy access to banking and financial services. For your financial security, it is important that your membership documents reflect the will of the organizers.

The last thing you want is to find yourself in court and tell the judge that you only had a handshake. Small business owners who have been around a while will tell you how important these documents are. Successful businesses all have a well-written business foundation document.

RetireCoast can prepare these documents for you based on the state where the business is located. If your business owns assets such as real property, you may need to transfer this real property to your business. RetireCoast can do this as well.

1. Limited Liability Company (LLC) Documents

A Limited Liability Company (LLC) is one of the most popular business structures due to its flexibility and liability protection.

Documents Required by the State:

✔ Articles of Organization – This formal document must be filed with the Secretary of State to officially register an LLC. It typically includes:

- Business name

- Business address

- Registered Agent information

- Member or Manager structure

- Business purpose (some states require this)

💡 State Requirement: Every state requires the Articles of Organization to form an LLC.

📌 RetireCoast Can Prepare & File: RetireCoast will draft and file the Articles of Organization with the correct state agency to ensure your LLC is properly registered.

Documents Required for Banking, Real Estate, & Internal Use:

✔ Operating Agreement – Defines ownership and management structure, including:

- Roles and responsibilities of members

- Ownership percentages

- Profit/loss distribution

- Voting rights and decision-making procedures

- Process for adding or removing members

💡 State Requirement: Some states, including California, New York, Missouri, and Delaware, require an Operating Agreement. Even in states where it’s not required, banks and real estate lenders typically require it to verify ownership and financial authority.

📌 RetireCoast Can Prepare: RetireCoast can draft a customized Operating Agreement based on your state’s rules and your business structure.

✔ Membership Agreement (if applicable) – For multi-member LLCs, detailing:

- Member contributions (cash, property, services)

- Profit-sharing agreements

- Exit strategies and buyout clauses

✔ EIN (Employer Identification Number) – Issued by the IRS, required for tax purposes, banking, and business credit.

📌 RetireCoast Can Assist: RetireCoast can obtain an EIN on your behalf, streamlining the process of opening a business bank account and complying with tax requirements.

✔ Banking & Real Estate Transactions: Banks and lenders require the Operating Agreement and Articles of Organization before approving accounts, loans, or property purchases.

📌 RetireCoast Can Help: If you plan to purchase real estate through your LLC, RetireCoast will ensure all required documents are in place.

2. Corporation (S-Corp, C-Corp) Documents

Corporations are more complex than LLCs and require additional documentation for legal compliance.

Documents Required by the State:

✔ Articles of Incorporation – Similar to the Articles of Organization for an LLC, but specific to corporations. It must include:

- Business name

- Number of authorized shares

- Registered Agent information

- Directors and Officers (in some states)

💡 State Requirement: Every state requires Articles of Incorporation for corporate registration.

📌 RetireCoast Can Prepare & File: RetireCoast can draft and submit the Articles of Incorporation, ensuring compliance with your state’s corporate laws.

Documents Required for Banking, Real Estate, & Internal Use:

✔ Corporate Bylaws – Establishes internal corporate rules, including:

- Board of Directors roles and responsibilities

- Officer duties

- Shareholder meetings and voting procedures

- Corporate governance policies

💡 State Requirement: Some states mandate that corporations maintain bylaws, though they do not require filing. Banks and lenders often require them for financial transactions.

📌 RetireCoast Can Draft: RetireCoast will prepare custom corporate bylaws, ensuring your corporation meets both legal and banking requirements.

✔ Shareholder Agreement – Defines the relationship between shareholders, including:

- Stock ownership rights

- Restrictions on share transfers

- Dispute resolution processes

✔ EIN (Employer Identification Number) – Required for tax filings, payroll, and banking.

📌 RetireCoast Can Obtain: RetireCoast can apply for an EIN on behalf of your corporation.

✔ Meeting Minutes & Corporate Resolutions – Many financial institutions and real estate transactions require a corporate resolution authorizing officers to sign contracts or open accounts.

📌 RetireCoast Can Assist: RetireCoast can draft corporate resolutions and meeting minutes as needed.

3. General Partnerships & Limited Partnerships (LP, LLP)

A Partnership is an agreement between two or more individuals operating a business together. While partnerships have fewer state requirements, key documents should still be prepared.

Documents Required by the State:

✔ Certificate of Limited Partnership (for LPs and LLPs) – Required in most states if the business is structured as a Limited Partnership (LP) or Limited Liability Partnership (LLP).

📌 RetireCoast Can File: RetireCoast will prepare and submit the Certificate of Limited Partnership for your business.

Documents Required for Banking, Real Estate, & Internal Use:

✔ Partnership Agreement – Though not always required by the state, this document is highly recommended and outlines:

- Partner ownership percentages

- Profit and loss distribution

- Decision-making authority

- Exit and buyout clauses

📌 RetireCoast Can Draft: RetireCoast will create a customized Partnership Agreement that protects all partners’ interests.

✔ EIN (Employer Identification Number) – Required for opening a business bank account. Your state will also issue a state tax ID number, which may or may not be required at your bank.

📌 RetireCoast Can Obtain: RetireCoast can secure an EIN for your partnership.

✔ Real Estate Transactions: If a partnership purchases property, lenders often require a Partnership Agreement and a resolution authorizing a partner to sign on behalf of the entity.

📌 RetireCoast Can Assist: RetireCoast ensures all documents are properly prepared for real estate transactions.

4. Sole Proprietorship Documents

A Sole Proprietorship is the simplest business structure and does not require formal registration in most states. However, these documents may be necessary:

✔ DBA (Doing Business As) Registration – Required if the business operates under a name different from the owner’s personal name.

📌 RetireCoast Can Register: RetireCoast can handle the DBA filing in any state.

✔ EIN (if hiring employees) – Otherwise, the owner uses their Social Security Number for taxes.

📌 RetireCoast Can Obtain: RetireCoast can file for an EIN if needed.

✔ Business Licenses & Permits – Varies by industry and location.

📌 RetireCoast Can Research & File: RetireCoast will identify and assist in obtaining any necessary licenses.

5. Key Takeaways

✔ LLCs & Corporations require formal state registration (Articles of Organization/Incorporation).

✔ RetireCoast can prepare and file all required formation documents based on state-specific rules.

✔ Operating Agreements and Corporate Bylaws are essential for banking and real estate transactions.

✔ Banks, lenders, and title companies often require legal documents before approving accounts or property purchases.

✔ RetireCoast can act as your Registered Agent, obtain an EIN, and assist with compliance filings.

The Marketing Plan

Our previous articles discussed the Marketing Plan, so you should be familiar with it. The intent of this section is to introduce you to the various aspects of the marketing plan that you will need to accomplish. If you started a business back in the 1990s, computers and electronic systems were not a factor.

Mobile phones had not been adopted in large numbers. If you went to college and obtained an MBA 40 years ago, you can forget much of what you learned.

This is a new year, decade, and century. Social media and the web have become major factors in creating a marketing plan. Let’s get you started. By the way, your life experience never gets old. Starting new businesses means learning new things.

We are not going to get deep into the marketing plan, that is a separate article because it involves many things. Let’s skim the surface and deal with the key items you need to know and the article about the marketing plan will cover the details.

Your logo

A blast from the past, as they say, you will probably need a logo for two reasons. Your business card, which is still used, and the key use will be your website (we will get into that). Your consulting business for example needs a presence on the internet or web. The company logo is your signature. No need to worry if you are an artist, we will for a very modest price design a logo for you. It’s enough here to say you need one.

Website

Your website is you on the web. Everyone searches Google to find a business or service they need. Many others and I use it to determine if the business or person is real and credible, and to gain information about their goods or services. At this point in our evolution, if you have a business and do not have a web presence, are you real? Business ventures usually launch a website at the time their business goes live.

Depending upon the type of business you are creating, you may need an online store. Your solid business plan can translate to a great website. You do not need to know anything about graphic design to create a website. In the article about the marketing plan, we will offer an organizer to use in creating the website.

RetireCoast can create a website for you. With our business knowledge, your site will stand out.

Your best ideas put down on paper or on a word processor will help to ensure all essential elements of your business are exposed. More business opportunities will open up with a great website.

Before you can set up a website, you must create a name for your website. It may be possible to use the name of your business

Email address

Let’s discuss this a bit. We strongly recommend that your email be established with the hosting company for your website. There are some great reasons discussed below. Don’t panic, we can help you set up your website and email for a modest fee. (RetireCoast can create your email address)

1. Professionalism and Credibility

A domain-based email instantly makes your business look more professional and established. When customers see an email from [email protected], they know they’re dealing with a legitimate business rather than an individual using a free email account.

- Perception Matters: People are more likely to trust a business with a professional email address.

- Avoid Looking Like Spam: Emails from Gmail.com or Yahoo.com can sometimes be perceived as untrustworthy, especially in business transactions.

2. Branding and Marketing

Every time you send an email, you promote your business. A branded email reinforces your business name and keeps it top of mind for customers.

- Consistent Branding: Using your domain in your email matches your website, business cards, and other marketing materials.

- Word-of-Mouth Recognition: If your email is [email protected], people automatically associate your name with your company.

3. Better Security and Control

Free email services are convenient but can pose security risks. With a domain-based email:

- You Control User Access: If you hire employees, you can create and manage their email accounts under your domain. If they leave, you can easily disable access.

- Enhanced Security: Business-grade email services (such as Google Workspace or Microsoft 365) offer stronger security measures like two-factor authentication (2FA), encryption, and phishing protection.

- No Risk of Losing Access: If a free email provider suspends your account, you could lose critical business communications.

4. Avoiding Customer Confusion

Using a free email service like [email protected] can confuse customers, especially if your website is SmithCorp.com. They may wonder if they’re dealing with an official representative of your business or a scammer.

- Consistent Identity: A business email using your domain ensures customers are reaching the right person.

- Trust in Communication: Customers are more likely to open and respond to emails from a business address than from a generic Gmail or Yahoo account.

5. Improved Deliverability and Reduced Spam Filtering

Many email providers treat free email accounts as personal rather than business accounts. This means:

- Emails from Business Domains Are Less Likely to Go to Spam: Some corporate email filters automatically flag emails from @gmail.com or @yahoo.com as potential spam.

- Higher Open Rates: A professional email address increases the likelihood that customers and partners will open your emails rather than ignore them.

6. Integration with Business Tools

With a domain-based email, you can integrate seamlessly with business tools such as:

- Google Workspace or Microsoft 365: Professional email hosting with additional tools for collaboration.

- Customer Relationship Management (CRM) Systems: Many CRMs require a domain-based email to ensure legitimacy.

- Marketing Automation Tools: Email marketing platforms like Mailchimp and HubSpot often prefer domain-based emails to reduce spam risks.

- Conclusion: A domain-based email address is a small investment that provides big advantages in professionalism, credibility, branding, security, and deliverability. It ensures that your business looks legitimate, builds customer trust, and integrates smoothly with business tools. Instead of using [email protected], upgrade to [email protected] and present your business in the best possible light. Would you like guidance on setting up your business email with your domain?

Business Checking Account

This is an easy task after you have completed the main tasks above and have the following documents for the financial institution. Before selecting a bank, read our series of articles that include how to choose the financial institution based on your needs.

Business Banking Checklist

- Articles of Organization (issued by the state after the business is registered)

- Certificate of Good Standing (issued by the state, this may not be required)

- Federal Tax ID Number (SS4 form required, giving just the number is insufficient)

- Agreements (operating agreement, by-laws depending on business structure)

- Minutes of meeting (for partnerships and corporations to approve bank account opening)

- Initial deposit (cash or check to open the account)

- Identification (driver’s license or other ID)

- Completed forms (required by some financial institutions, like credit unions)

- Who will sign checks (based on agreements and meeting minutes)

- Checks (order from the bank or online for a lower price, e.g., Costco)

Accounting/Financial Systems

You need not be a wiz at bookkeeping. The easiest way to track your finances (deposits and payments) is by using an online service. You may find that writing checks is what people used to do, but most businesses pay using their online system.

You can pay for services such as Quicken or try one of the free online platforms, including accounting systems such as Waveapps.com. There are plenty of videos on how to use anything you choose.

At the end of the year, your CPA can grab the transactions and file your income tax. Don’t be afraid of trying out, for example, Waveapps.com, it’s free. You can download all transactions from your bank and then identify each of them with drop-down boxes. It’s easy.

If you do not presently have any federal or state taxes taken from income, you will need to sign up with the IRS to make quarterly deposits of your estimated tax due. This process is also easy, and there are good instructions on the IRS website.

Licenses and Permits

It’s possible you will need no permits or licenses. Small businesses in some communities may be required to obtain a business license. The fees are usually small. The fees are usually dependent upon the kind of business and the annual income. If you hire people, you should check with your state about taxes you must collect from payroll checks. In today’s world, it’s best not to ignore any requirements for permits.

The first step is to check with your city, usually the public works department. If you are located in an unincorporated area of the county, check with the county. The next step is to check with the state. Most states do not require permits; it’s a local thing.

Some states do charge franchise taxes, and some local governments do as well. A great option here is to have the public agent take the permit fee from your checking account when it’s due.

Contracts and legal agreements

Starting a small business requires careful legal planning, including drafting and signing various contracts and agreements to protect your business, ensure compliance, and clarify responsibilities. Here are some essential contracts and legal agreements that a new small business may need. You can consult with RetireCoast’s in-house attorney about legal agreements our modest fee can get you going quickly.

1. Business Formation Documents

- Articles of Incorporation (for Corporations) or Articles of Organization (for LLCs) – These documents register your business as a legal entity with the state.

- Operating Agreement (for LLCs) – Defines the ownership structure, management roles, and rules governing the business.

- Bylaws (for Corporations) – Establishes the internal rules for managing a corporation.

2. Business Ownership & Partnership Agreements

- Partnership Agreement – Outlines the roles, responsibilities, profit-sharing, and dispute-resolution methods between business partners.

- Shareholder Agreement – Defines the rights and obligations of shareholders, including ownership transfers and buyout provisions.

3. Employment & Independent Contractor Agreements

- Employment Agreement – Specifies job responsibilities, compensation, benefits, termination clauses, and confidentiality expectations for employees.

- Independent Contractor Agreement – Defines the relationship with freelancers or consultants, including payment terms and scope of work.

- Non-Disclosure Agreement (NDA) – Prevents employees, contractors, or business partners from sharing confidential business information.

- Non-Compete Agreement – Restricts employees or contractors from starting a competing business within a specific timeframe and geographic area.

4. Customer & Client Agreements

- Service Agreement – Outlines terms for providing services, payment details, liability limits, and dispute resolution.

- Sales Agreement – Covers the terms of selling products, including warranties, return policies, and payment terms.

- Terms and Conditions (for Websites or Online Services) – Establishes the rules for users interacting with your website or digital platform.

- Privacy Policy – Required for businesses collecting customer data, explaining how personal information is stored, used, and shared.

5. Vendor & Supplier Agreements

- Purchase Agreement – Defines the terms of purchasing goods or services from a supplier, including delivery timelines and payment obligations.

- Lease Agreement (for Commercial Property) – Details the terms of renting office or retail space, including rent, maintenance, and lease duration.

- Equipment Lease Agreement – If leasing equipment, this contract outlines payment terms, responsibilities, and usage restrictions.

6. Financial & Investment Agreements

- Loan Agreement – If borrowing money, this contract specifies repayment terms, interest rates, and collateral (if required).

- Promissory Note – A simple agreement outlining a loan repayment between two parties.

- Investor Agreement – Defines the rights and responsibilities of investors, including return expectations and business control.

7. Intellectual Property Agreements

- Trademark Registration – Protects your brand name, logo, or slogan from being used by competitors.

- Copyright Agreement – Grants ownership rights to original content, such as website content, marketing materials, or software.

- Patent Agreement – Secures legal rights over inventions and innovations.

- Intellectual Property Assignment Agreement – Transfers ownership of intellectual property from employees or contractors to your business.

8. Insurance Agreements

- Business Insurance Policy – Outlines coverage details for liability, property, workers’ compensation, or professional errors.

- General Liability Waiver – Protects your business from claims due to injury or damage caused by your products or services.

9. Exit Strategy & Succession Planning Agreements

- Buy-Sell Agreement – Defines how ownership interests can be sold or transferred in case of a partner’s departure, death, or retirement.

- Dissolution Agreement – Lays out how assets and liabilities will be divided if the business closes.

These agreements are critical for protecting your business from legal disputes, ensuring smooth operations, and maintaining professional relationships with employees, clients, and vendors. RetireCoast can help you with most of the agreements listed above.

Insurance

Not all small businesses need separate insurance coverage. You should determine your specific needs based on the type of business and where it is physically located e.g. office building or home. You do not want your years of hard work to go away if someone sues you and you do not have protection.

Insurance is a good start, there are other things you can do to protect your assets. They include using deeds and trusts. Read more about this in our series of articles.

The following details the various types of insurance you may need to consider to ensure business success stays a business success. This is a perfect time to consider financial planning for financial stability in your “retirement years” and beyond. Your insurance broker can discuss with you how and where your business is located and then propose a policy that covers all perils.

Check out this guide from the Small Business Administration if you need more information. The U.S. Chamber of Commerce has published a great article on “How to Choose Small Business Insurance”.

General Business Insurance Types:

- General Liability Insurance – Covers third-party bodily injury, property damage, and legal fees.

- Professional Liability Insurance (Errors & Omissions – E&O) – Protects against claims of negligence or inadequate work (essential for service-based businesses).

- Business Owner’s Policy (BOP) – A bundled package that includes general liability and property insurance.

- Workers’ Compensation Insurance – Required if you have employees; covers medical expenses and lost wages for work-related injuries.

- Commercial Property Insurance – Covers business property like offices, equipment, and inventory.

- Cyber Liability Insurance – Protects against data breaches and cyberattacks.

- Commercial Auto Insurance – Covers vehicles used for business.

- Product Liability Insurance – Protects against claims related to defective products causing harm.

- Business Interruption Insurance – Covers lost income due to unforeseen disruptions.

- Health and Disability Insurance – Provides benefits for illness or injury.

- Employment Practices Liability Insurance (EPLI) – Covers lawsuits related to employee issues (discrimination, harassment, wrongful termination).

The following are some potential coverages for just two types of business, as an example.

Insurance Needs by Business Type

Consulting Business (e.g., Business, Financial, or Marketing Consultant)

- Professional Liability (E&O Insurance) – Protects against client claims of inaccurate advice or financial loss due to your recommendations.

- General Liability Insurance – Covers third-party injuries at your office or during meetings.

- Cyber Liability Insurance – Important if handling client data or digital assets.

- Business Owner’s Policy (BOP) – Combines liability and property coverage.

- Workers’ Compensation Insurance – Needed if you hire employees.

- Commercial Auto Insurance – If using a vehicle for client visits.

Dog Walking Business

- General Liability Insurance – Covers dog-related incidents like bites or injuries to third parties.

- Animal Bailee Insurance – Protects against injury, loss, or death of a client’s pet while in your care.

- Professional Liability (E&O Insurance) – Covers claims of negligence (e.g., lost pets, improper care).

- Commercial Auto Insurance – If transporting pets.

- Workers’ Compensation Insurance – If you have employees.

- Business Owner’s Policy (BOP) – If operating from a commercial location.

Having the proper insurance and additional financial protection in place can help you retain your retirement savings in your golden years. RetireCoast makes business insurance coverage available to you. Visit our Business Formation page for details.

Budget template for start-up costs

Use our template to calculate your start-up costs. Incorporate these into your budget template, which is located in our articles.

Startup Costs Budget

| Cost Item | Amount (USD) |

|---|---|

| Check Name Availability | |

| Registration of Business | |

| Prepare Formation Documents | |

| Insurance | |

| Franchise Tax Fee | |

| License Fees | |

| Minutes and Resolutions | |

| Initial Deposit in Checking | |

| Create Contracts | |

| Create Client Agreement | |

| By-laws for Corporation | |

| DBA Registration | |

| Website Development | |

| Marketing and Branding | |

| Office Equipment & Supplies | |

| Legal and Professional Fees | |

| Software and Subscriptions |

Total Cost: $0.00

Please read all of our articles, which together form a template on how to consider if a business is what you want to do. What type of business to start, creating goals and a business plan, then on to the actual act of creating your business. Press the button above to reach our article index.

Rent vs. Buy: A Practical Housing Decision for Millennials – RetireCoast

- Rent vs. Buy: A Practical Housing Decision for Millennials

- Weapons Used In 1776: Revolutionary War Weapons, Tools, and Uniforms

- Shamrock Shenanigans and Southern Charm: A Guide to St. Patricks Day on the Mississippi Gulf Coast

- Who We Were in 1776: The People Who Became Americans

- 11 Best 2026 Tax Changes Millennials and GEN Z Should Understand NOW!

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.