Handymen services are in demand everywhere. People who need to complete small jobs often find independent contractors to do the work at their homes and places of business. If you are a handyman who fails to report the income you earn from your small business you can damage the future of your business.

This article was not created to explain the obvious legal issues about not reporting income. Tax evasion is a crime but you know that already. Let’s focus on some not-so-obvious things that can not only damage your business but prevent it from growing. And, keep it going.

I will start with personal experience. Many years ago when I was in my late 20’s, I left a good-paying job to start my own business. It was not a handyman business but what I experienced applies to handyman work. Starting my own business required putting in just about all that the capital I could find. My business was repairing automotive electrical equipment.

I struggled to earn enough to survive

For a period of about four years, I struggled with my business and brought in sufficient income but not enough to also pay income taxes.

There was an accounting trick to avoid paying income taxes legally same as Social Security. Years later when Social Security started to release reports about what I would receive at retirement, I realized what had happened. Social Security uses past wages to determine your future benefit. I noticed that a four-year hole with zero income was reported.

This loss of Social Security deposits for four years impacted my benefit for the following 35 years.

Many individual handymen or contractors manage their businesses as sole proprietorships and it’s common for these business owners to accept cash to repair a leaky faucet for someone. Before they know it, much of their income is “under the table” or not exposed as income subject to income tax.

I have met many people who provide a wide range of services to small business owners and homeowners. Some of these people flaunt tax laws and fail to report their income or even prepare zero returns.

If you pay cash, I will give you a discount

I recall one time when I wanted to have a deck built on the back of my house. The handymen/contractors told me that If I paid cash they would give me a discount. The first thing that came to mind was that they did not want to accept a credit card. When the job was done, I handed him a check. The local handyman said that he wanted cash. I said a check was cash. He then told me that he meant actual bills. As a homeowner, I saw no problem doing this so I gave him cash.

The reason he asked for cash was to avoid a tax situation. I understood that from the beginning. This self-employed handyman was cheating himself by not reporting income and paying into Social Security. The biggest problem is that most of these people who are younger don’t fully understand what they are doing. I have learned later that many don’t file an individual income tax return because they don’t claim any income.

When this goes on for many years without paying payroll taxes on self-employment income, they are failing to achieve the maximum benefit that they could receive from Social Security when they decide to retire. Often the same people have a hard time obtaining credit cards and often don’t own their own homes.

You need tax returns to finance a house

Mortgage companies want to see a pattern of income through copies of tax returns substantiating business income. They want to see self-employment tax paid every year.

Social Security uses the last 35 years of employment to determine your benefit. If you work as a handyman until you are for example 45 then get a w-2 job with a company, you will have to work for at least 35 more years to obtain the maximum benefit. That’s age 80. This means that your Social Security benefit will come up far short of what it could have been.

Imagine that you can no longer work after age 70, full retirement. You are short a full 10 years of benefits trying to live on a Social Security check that may not even pay your rent. This is because you were borrowing from the future to support the present. Not a smart move. The link below will permit you to actually see how you are doing with your future Social Security pay out. Check it periodically to see if you are on track for higher benefits.

Real estate agents who work with handymen by referring them to their clients often can’t sell a home to their own handymen. They simply don’t qualify not because of the type of work they do but because they don’t claim any income. The amount of taxes that they think they are saving is very minor in many cases compared to twenty or thirty years of receiving Social Security benefits.

Most young handymen can’t conceive of retirement

They are short-sited on this topic. Unfortunately, most of the ones that I have met are worried about putting food on the table this week and can’t conceive of retirement.

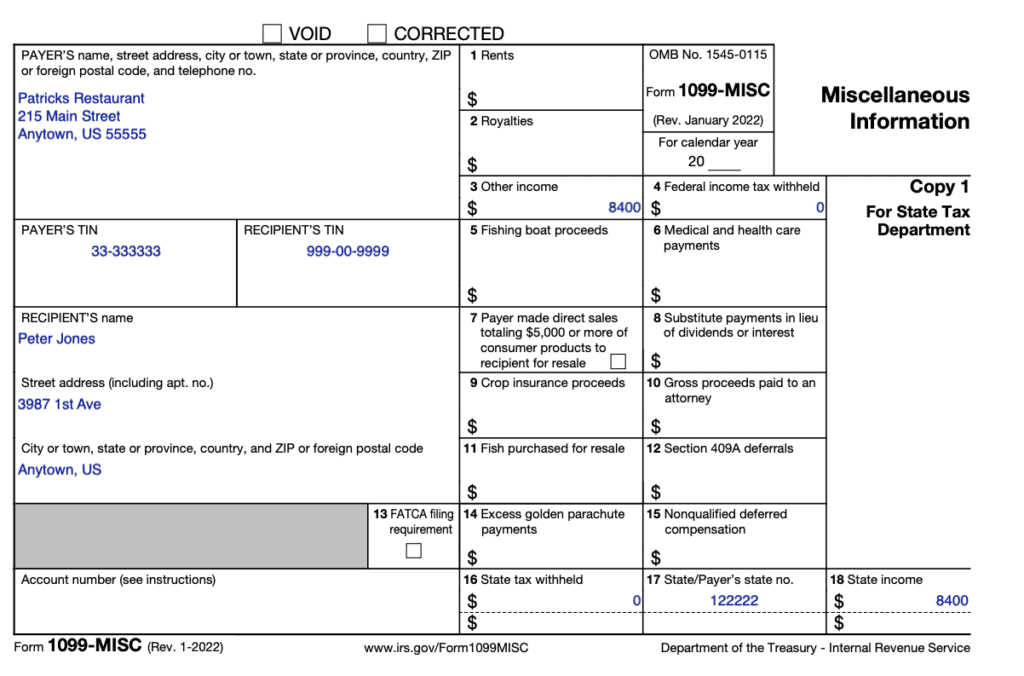

Most handymen are unlicensed contractors and they can do fairly well in the local economy but some businesses will issue 1099-misc forms which can cause an audit by IRS of your business. They will want to know why you did not file an income tax return and make tax payments. It’s difficult for many businesses who would want to hire a handyman but cannot because they don’t have liability insurance or company minimum requirements for contractors.

Recently the IRS ramped up it’s demand that entity paying compensation greater than $600 issue an IRS 1099-misc form. This will make life difficult for many handymen even those who do minor repairs. I tell all of the independent handymen that work for my companies that they will receive a 1099-misc form at the end of the year if and when the income exceeds $600.

Many handymen think they can avoid a 1099-Misc

As a general rule, most handymen think that because they usually charge less than a fully licensed company with workers’ compensation insurance they can avoid the 1099-misc. Not true.

I choose people to work on my properties that are qualified even if they do not have a handyman license. I look at their years of experience and their references. Yes, I do consider that I may be paying less than calling a company that advertises on TV but I want the same or better quality of work. I can’t control what they do with the money that I pay them for the handyman jobs but I do tell them they should report it.

If you are a handyman and you really want to build a sustainable business that can actually be sold at some time, you need to pay attention to the basics. I will take the remainder of this article to help guide you on the right path that will accomplish the following:

- Earn the maximum Social Security benefit

- Avoid legal complications with the IRS, report taxable income

- Provide a retirement program

- Develop a business that has future value

- Create an exit strategy to sell your business in the future

Look to the future

Ok, you will not get all of the fine details on the items above, the point is to explain what they are and set you on the right path. Develop a business plan and set goals. Stop looking at the next dollar only, lift your head, and look way out there, to the future. It’s probably that time and you know it.

Study and receive a contractor’s license in your areas of expertise. If you do electrical work, for example, become the best at that work and offer prospective customers your contractor’s license as a carrot. The license which is not required in most cases is what will separate you from all of the other handymen. That contractors license requires work to obtain and it is something that you can be gratified in earning.

I have a friend who has been a handyman in a specific area for many years. It’s not his full-time job but he wants it to be. He has struggled as have many would-he handymen to earn enough and then pay taxes. His plan now is to do it right and pay taxes.

He studied and passed his specialty contractors license. This was a great step, it put him ahead of nearly all of his handymen competitors and helped raise him to the level of the big contractors. He moved forward with the suggestions outlined above and explained below.

Create a business plan

Create a business plan. This is not hard to do. The Small Business Administration has an excellent article about how to do this and actual business plan formats which are free. At the bottom of this article you will find a link to their site along with links to other resources. I decided not to include it here because you may be tempted to jump right in and not finish reading this. There is more you need to know.

Why a business plan? This plan is essentially a path forward. It allows you to think about where you want the business to go. Set goals and compare your progress to the goals. If you are like most handymen, you probably don’t have a college degree and think that something like a business plan is for those college people.

Not true at all. It’s always good to know where you are going. Planning ahead for success is essential. Read more about business plans at the SBA website listed below.

Start by creating a name for your business so that it can be sold at a later date. Calling your business Joe Smith’s Handyman Services will not help you when you are 65 and want to sell your business. “Handyman Services LLC” for example will make it easy for someone to see the value of your business as a stand-alone entity. Be thinking one step ahead, create an exit plan even if you are only 25 years old.

Don’t use your own name for the business

Let’s take a minute to discuss that business name. Many handymen use their own names. There is no crime in doing this but ask yourself, if you were buying your business and your name was Smith and the business name was Jones, what would you do? Part of the value of a business is it’s name. People will ask if you are Jones and you will have to tell the story.

The name of your business should reflect what you do. Search the internet for articles about how to pick a business name that fits the business you are in. For example, if you are in the landscaping business you would want to use words such as “lawn service”, “tree trimming”, “home maintenance” etc.

You can put a word ahead of the term such as a regional name “Gulf Coast”. Don’t get too narrow with geography in the name if you want to expand further than that area in the future.

Buy business cards. You can obtain a free phone number from Google. Do this for your business phone, the Google number will ring to your mobile phone. The system has good scam protection and helps to separate your business from your personal calls. It’s free so why not. See our references below.

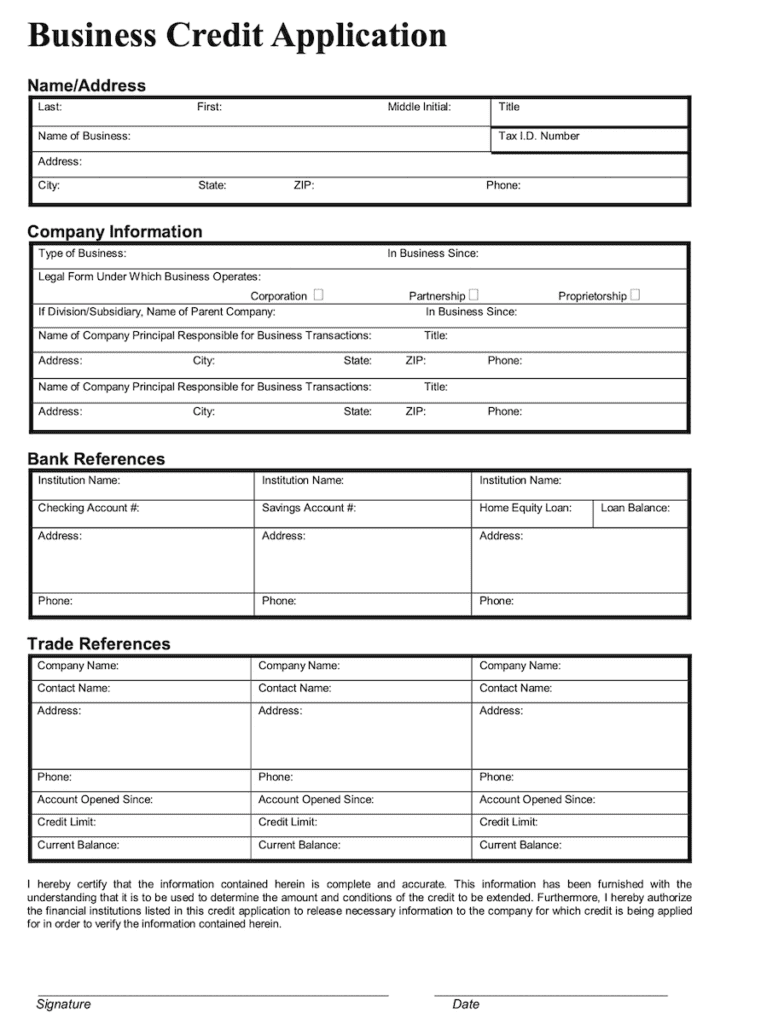

Create a limited liability company

Seek legal advice and create a limited liability company. Run all income and expenses through that entity. Draw your payment through the LLC. Obtain any necessary license for work in areas that require one. Check special rules for the work you are doing with the local planning commission. If you need a business license get it.

Setting up the LLC is a good step to help insulate your personal assets from your business assets. If you are sued for something that happened on the job, the liability stops with your company. They can not grab your house or your kids college fund. Another reason to create an entity is to separate your business life from your personal life.

Learn how to account for all income and expenses, there is a great free accounting program online that is easy to use (see resources). Find a CPA who can do your income tax return at the end of the year. The CPA can talk you through how to make quarterly deposits into the IRS as is required by law. The point of the quarterly deposits is to keep up with your tax liability all year.

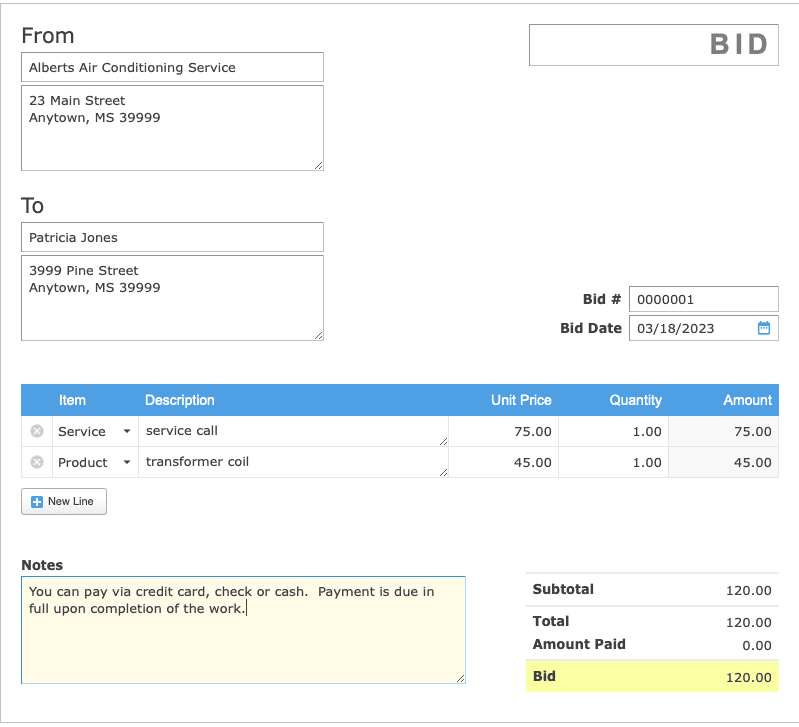

Learn how to prepare bids on paper. Have your client sign the bid sheet. Create paper invoices or email them to your clients. Learn to use the internet to simplify your business management tasks. That accounting system above allows your clients to pay via credit card.

Always put it in writing, always

Avoid misunderstandings with clients, always, always put what you agree in writing. The bid is the start and the invoice is the finish. Lots of handymen are cheated because they used a handshake to seal the deal. Not wise or smart.

People forget what they have agreed to. Use your camera, take photos before and after. The biggest problem with small businesses is communication. Miscommunication can cause you to not be paid. Small businesses can not afford to hire an attorney to chase down a $500 invoice.

Read as much as you can about how to bid a job, how much to ask for in advance, when to obtain progress payments and much more. All of this to avoid payment issues and insure customer satisfaction when the job is done.

I know a person who does landscaping work, basically cutting lawns. He started by putting a lawnmower in the back of a pick-up truck and graduated to a small trailer and now has a large enclosed trailer full of equipment. In the future, he wants to have several trailers and employees who do what he does. He is about 25 years old and sees what he wants to do in the near future. This is great but he also needs to look out further in the future at his exit strategy.

A real business can apply for credit

After you have done all of the above and you are a real business, you will be able to apply for lines of credit and business credit cards to fund your business growth. That net profit can be pumped back into the business to make it grow or used to fund a SEP.

This special plan allows small companies like your LLC to establish a program of SEP contributions as if you were working for a big company. A first it can help you and then employees as you hire them.

You need to save for retirement. There are various ways that the IRS will allow your small business to create a retirement plan. Go to the SEP resource below and read more about how they work. Basically, you will not be taxed on a portion of what you and your busienss contribute. Social Security alone will not be sufficient for anyone to retire particularly with high inflation. You need a supplement.

Report that handymen income and file tax returns

After all of the above, I feel that I must reiterate, you need to report your income and expenses each year to the IRS and your state if they have an income tax return. Pay into Social Security by making quarterly deposits to the IRS for both income and Social Security. Have your company pay 1/2 of the Social Security amount for you which is tax deductable for the businesss. Your CPA can work this out for you.

If you want your business to be successful, stop focusing on the small stuff such as the taxes you are avoiding and build the business to pay higher income so that the taxes will seem minimal. The last thing you want to become involved in is an IRS audit and the fees and interest that they will add on to what you owe them. Eventually most people are caught not paying income taxes and Social Security. Don’t be one of them.

The Future

About the future of your business. Some small business owners (handymen) think that their kids will want to take over at some point in the future so they plan for this. Be prepared for a disappointment when your child or children decide to take another path and avoid running the family business. Not that this can’t happen but more often than not, children don’t want to pursue the same path their parents have created.

Create options for the future handover or sale of your business. Some joke about working for ever but that’s of course not possible. Think years ahead, put yourself in the position of a potential buyer, what would you want from a company you were buying? This is how you need to think from day one.

I mentioned an exit strategy above. This simply means how you will cash out of your business and have someone else run it. As I just mentioned, it may be great if your kids run the busiess but you will need some of the income to reture, how will they be able to carry on after paying you each month?

Resources

Business Plan Template:

https://keyladder.com/calculators/ go to the Business Plan block and click, you will be able to select the download button for the business template, it’s free.

Simplified Employee Pension Plan (SEP):

https://www.irs.gov/retirement-plans/plan-sponsor/simplified-eployee-pension-plan-sep this link will take you to the IRS website where you can read about the choices of pension and retirement plans.

Social Security Personal Report:

https://www.ssa.gov/myaccount/ create your Social Security account it’s free. This will allow you to see how much you will receive at retirement. As your income grows and you pay in year after year, you can visit this site and see the difference.

How to pay Income Taxes and Social Security for Self Employed:

https://www.irs.gov/businesses/small-businesses-self-employed/self-employment-tax-social-security-and-medicare-taxes instructions on how to make deposits for self employment income tax liability, Medicare and Social Security. Your CPA can help.

Residential rental property:

KEYLADDER.COM As a handyman, you have some skills to repair houses. Consider buying a fixer upper and doing the work yourself. Rent it for current income and future retirement. KEYLADDER can help.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.