Last updated on March 30th, 2025 at 06:56 pm

Stop renting now. Gen-Xers need to buy their home to create financial stability and prepare for retirement. Rich people almost always own their homes. Rental properties have one thing in common, rents increase over time. A fixed-rate mortgage creates a locked-in payment for up to 30 years. Homeownership is possible for most Gen-Xers.

How Gen-Xers can build wealth through homeownership vs renting is #4 in the Generation X 20 Years to Retirement Series. Reach the series by clicking the button at the bottom of this article and join our interest list for the new educational course “Generation X Preparing for Retirement”

Countdown to Retirement

There are many Gen-Xers who have not experienced homeownership. There are many reasons to buy the house that you live in. The primary reason is to help you prepare for retirement. This article is part of our series "Generation X 20 years to retirement".

If you are one of those Gen-Xers who own a house, good move, you have already experienced the benefits of homeownership. This series will cover a number of factors that deal with retirement including property and other assets. It's great that you have a good start.

Homeownership will help with financial independence

If you seek financial independence, owning a home will set you in the right direction. Perhaps this will be your first home or perhaps you owned a home years ago. You know of course that the American dream requires you to own a house. Did you know that the vast majority of Baby Boomers own their own homes? Some who do not have recently sold and started to rent, are part of a strategy.

The point is that older generations understand the need to be involved with the housing market.

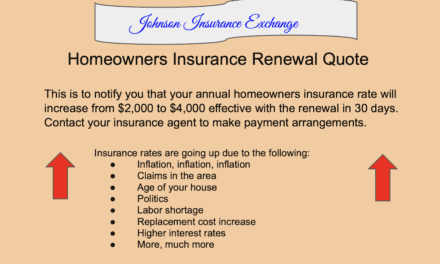

One of the main reasons for Gen-Xers to experience homeownership today is to prepare for retirement. Your rent payment will only go up, and your principal and interest will remain the same for the entire home loan. Yes, insurance and property taxes will go up over time. The rate of increase is usually slower than rent increases.

Rent vs Buy - An example

Every month that you make a mortgage payment, you are reducing the debt owed on the house and increasing the equity in the house. Further, property generally appreciates in value meaning that it will be worth more in time.

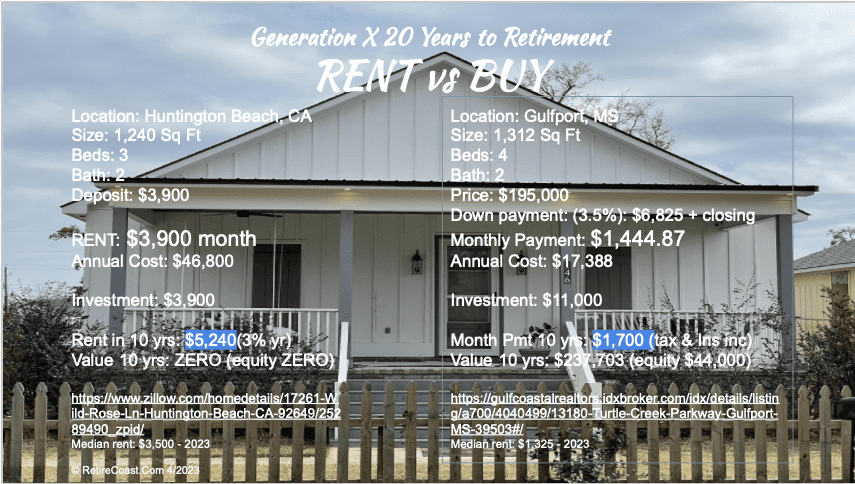

Take the infographic above, I found a rental house in Huntington Beach, CA for a monthly rental of $3,900 per month. The median rent for a house is $3,500 so it's close. Actually, I could not find anything for less when I looked. This is a small house with three bedrooms and two bathrooms.

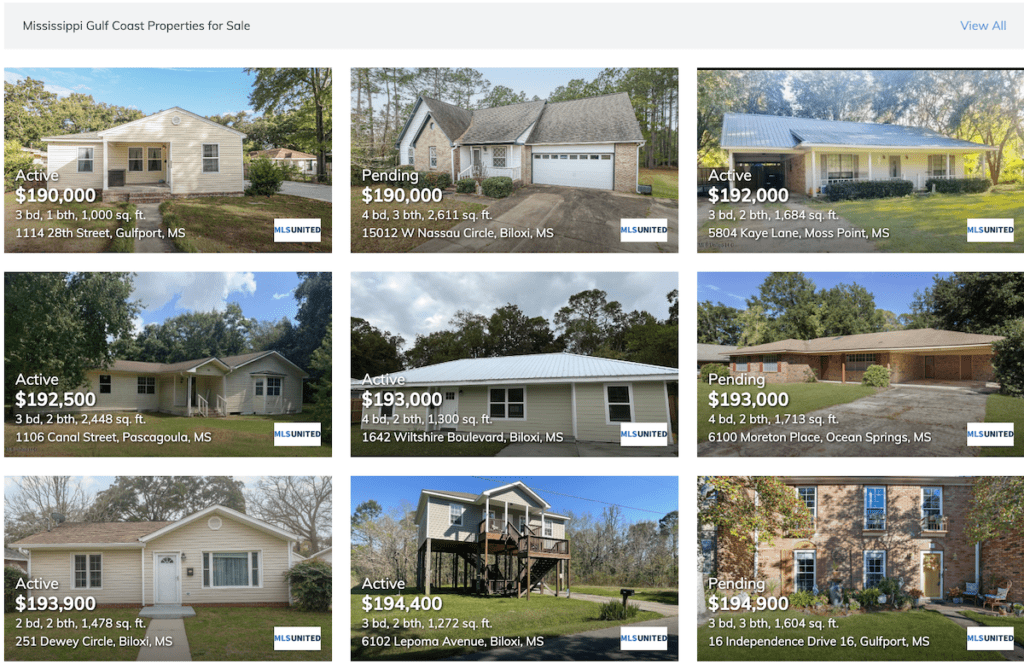

I found a house in Gulfport, MS on the Mississippi Gulf Coast (above) that would match the Huntington Beach Rental except it is slightly larger with 4 bedrooms. The selling price is $195,000. With a 3.5% down payment, the mortgage including principal, interest, taxes, and insurance will be about $1,450 per month

Compare the rental property at $3,900 per month to the house you are buying at $1,450 per month. A giant savings of $2,450 per month. Did you know that if you bought this house ten years before retirement and moved into it, you would have saved $294,720 ($2,450 x 120 months)?

Starting your retirement with $294,000 in savings plus the equity of about $44,000 you would have earned in the house is a great way to start your retirement.

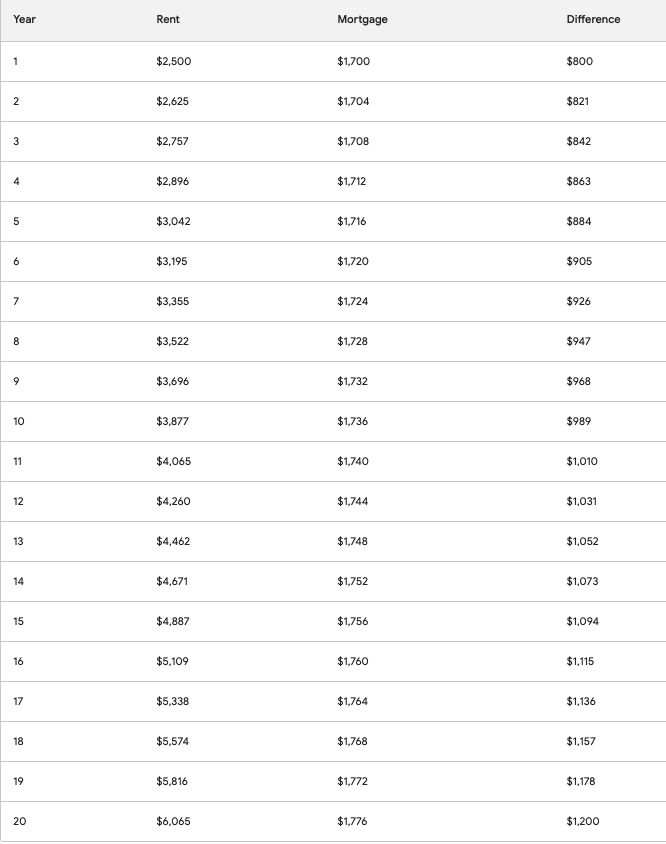

Gen Xer Rent Vs Mortgage A Monthly Comparison for the Next 20 Years

You will benefit if you own property in the following ways:

- Appreciation - Your house will increase in value over time partly due to inflation. A house costing $200,000 today may be worth $800,000 or more in 20 years.

- Equity - Every month you own more of your house as you reduce the debt. The difference between what you owe on the mortgage and what the property is worth is considered equity, which includes appreciation.

- Monthly savings - Most mortgage payments including property taxes and insurance will be at or less than the rent you will pay at the start of your mortgage. For example, if your mortgage, taxes, and insurance amount to $2,000 per month compare to local rent at $2,000 per month. In year two, your house payment is about the same (slight increase in insurance and taxes) but the rent is now $2,100. In year three, rent is now $2,300, etc. Consider what the rent will be in 20 years.

- More living space - Your house will typically be larger than an apartment possibly with a yard and a garage. You can have a pet if you want. No fighting for parking space. How about that garden?

- Potential future income - You may decide to rent your house as you get older and move into a small apartment. Or, you may decide to buy another house and continue to rent the existing house for income.

Your house is not part of your investment strategy

Of course, there are many more reasons to own your own home. While I usually explain that the principal residence is not part of your investment strategy, nor is it investment property at least initially, it does become a place where you are banking money each month and over time saving on paying higher rents.

Single-family homes offer owners so many benefits over renting at least in your younger years. There may well be a time to rent as you get much older and have determined that you do not want a larger home. As I say this, there is a bit of a trend for Baby Boomers to actually buy larger houses. Some do this to house family members who come to visit. Others just want what they want.

The reasons above as I have mentioned are not all-inclusive for buying a house. I love the fact that I can work in my garden. Lawn care and even pulling weeds are cathartic. My home is my refuge, it's my hobby, and it's so much more because it's mine. True, I have a mortgage lender, but that's because my strategy called for a low-cost mortgage.

There are some good reasons to rent but not many

To be fair, there are reasons for some Gen-Xers to rent vs homeownership. One may be that a job keeps them at a specific location and they will not stay there when they leave for retirement. Another may be the idea that you can pick up and move when you want. There are more but let's tackle these two reasons.

My job. Ok, there is nothing wrong with renting but every year that you pay rent rather than participate in the home values parade, you fall behind. I know a few members of the military who have moved to my area for a one-two year tour of duty. They have decided to buy because they want a home for several reasons and the other is they understand paying rent only enriches the property owner.

Several of these people were first-time homebuyers when I met them. Most were not worried about how things would work out because they could sell their house or rent it when the duty station changed. This leads me to the second statement about being tied down with a house. That is not true, most people have a 12-month lease that can not be broken without penalty. It may take 60 or more days to get clear of a rental.

Offer your house for sale then make an offer on another

If you list your property with a real estate broker, it may take a month or less to find a buyer and another month to close. A fairly short time. If you can afford to buy another house while yours is closing, you can move sooner and permit the house to complete the selling process. As I mentioned, there may be a time for rental property but not at age 50 for most Gen Xers.

One key reason why some Gen-Xers have not experienced homeownership is that they do not have the funds to close. There are many ways to solve this problem. One is to find an excellent mortgage loan broker. There are programs that do not require a down payment, some that require only a few percent, and still, others that provide down payment assistance.

I am a real estate broker and I can tell you that more than once my colleagues have found a path to homeownership for first-time buyers and others. Often these Gen-Xers think that it's impossible to pursue homeownership. You can read articles about surveys that say Gen-Xers will never experience homeownership for this or that reason. Yet, it happens every day, another Gen-Xer is buying a house.

You must have good credit to buy a house

Yes, you must have good credit. Your credit score has to be at least 640 and your debt-to-income ratio must be under 50%. As long as you can produce evidence of income to support the monthly mortgage payment and these other items are in order, you should be good to go. Not forgetting of course that the home purchase does require the closing costs and down payment (only if they apply).

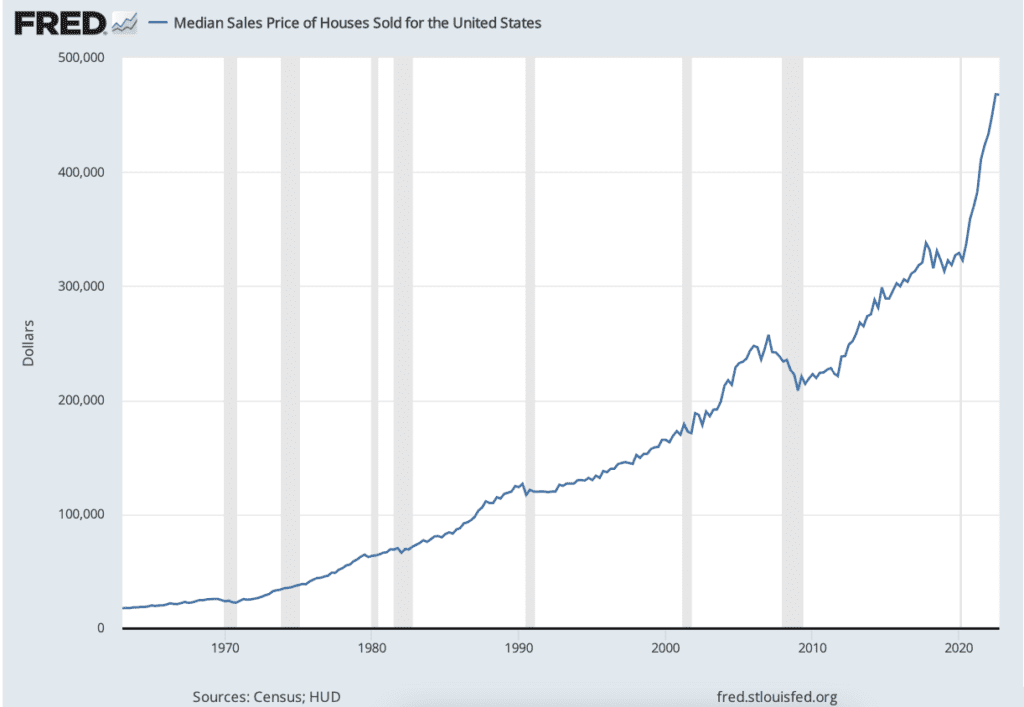

Housing prices have varied over the past few years but one thing is certain, they will always continue to increase. There are a few bumps in the road such as the great recession of the early 2000s and then again in the late 2000s. Regardless of home prices, people are continuing to buy their favorite homes. Previous generations had to contend with interest rates above 17%. yet they bought homes.

Take a closer look at how buying a house affects retirement plans

Let's take a closer look at how buying a home will positively affect a typical Gen X retirement plan. For example, say you are 50 and you have decided after reading this article you would buy your first house. You have checked housing costs and property values. As one of the many Gen-Xers who have experienced homeownership, you understand the importance of homeownership to retirement.

Further, you have been working on your retirement plan and have decided the following:

- Buy a new house at the age of 50, it's the right time. You will buy in your current location because you are working a job that requires you to visit the office often.

- At age 60, you will have saved a substantial amount in your retirement accounts. Your income is significant because you are still working. Your employer will permit you to work remotely at least part-time.

- You have decided that you can not afford to retire where you currently live based on your planning.

- Buying a retirement house on the Mississippi Gulf Coast will save you a substantial amount every month in living cost

- You buy the house on the Mississippi Gulf Coast and rent it on a 12-month lease to a nice retired couple. Their payment will cover all of your mortgage and costs plus provide a small profit.

- For the next 10 years, you perform some home improvement projects on your Mississippi house and bank the income each month. During this time, that house mortgage debt is being reduced.

- You retire and move to the Mississippi Gulf Coast. You sell your old house and invest the income. The real estate market may be such that you will sell this house and buy another on the Mississippi Gulf Coast and/or buy investment rental property. You become one of those Gen-Xers who have experienced homeownership.

- Depending on the mortgage rate at your Mississippi Gulf Coast house, you may refinance for a lower monthly payment.

- Years later you may determine that you no longer can keep up with the demands of home ownership and decide to rent or sell your house and rent a condo on the beach.

- Part of your decision-making process involves estate planning, you should have a large nest egg after selling your principal residence. If you decide to rent your home, the profit will help offset your rent.

This is a rough plan that involves using the equity you have built in your house to make life comfortable for you as you age. As the cost of living increases, you should be able to keep up with it.

Rental rates are going up, there is a shortage of units

Getting into the details about buying a home, there is something that you should know. There are more renters than ever before and there is a severe shortage of rental units. This does not apply everywhere, real estate is not national, it is local. Having said that, assuming that where you are living there is a shortage of rental properties, it makes sense that rent rates will rise due to demand.

Another fact that should help in your decision-making process. According to the chart below, housing prices have been on the rise since before 1965. Yes, as I have mentioned, they will take a dip on occasion. This has happened as you can clearly see on the graph but this is key, prices have always gone back up. Meaning that regardless of where they are now, they will eventually go up.

If you pay higher mortgage rates now, they are likely to go down later and you can refinance. In the long run, parts of the country will recover and probably go into another dip. You can get ahead of all of this by maintaining the lowest interest rate on your 30-year mortgage, keeping your property well-maintained, and making mortgage payments on time.

Make that move, leave the high-cost rental behind

The case for buying vs renting is made. Clearly buying is the best-case scenario for most people leading up to retirement. Your house is a bank if you are willing to make the move. It's nice to live in expensive California, Washington, Illinois, and New York but at some time you will no longer be able to afford it. So make the move early if you can.

I suggest that you consider living near the beach on the Mississippi Gulf Coast. You have seen just one example above of the difference in the price of just the house vs renting in California. What would you think if I told you that the cost of living in Mississippi is the lowest in the nation? True. Many other costs are lower.

The homes above are just a sample of houses on the market. Note that three are pending out of nine. The market is in good condition, and lower-priced houses such as these sell quickly. Go to the Logan-Anderson Gulf Coastal Realtors website by clicking on the photos above.

Check out the prices. You thought that you could not afford to buy in Illinois and that's true but on the Mississippi Gulf Coast, much is possible. Homeownership for Gen-Xers is more than possible.

Frequently Asked Questions (FAQ

1. Is it better for Gen-Xers to rent or own a home?

Owning a home can build equity over time while renting offers flexibility. The best choice depends on your financial goals, stability, and local housing market conditions.

2. How can homeownership build wealth for Gen-Xers?

Homeownership builds wealth through property appreciation, equity growth, and potential tax benefits. Over time, homes often increase in value, providing a significant financial asset.

3. What are the financial advantages of renting for Gen-Xers?

Renting can be cheaper upfront, with no maintenance costs or property taxes. It also provides flexibility for those unsure about long-term living plans or facing unpredictable expenses.

4. How does equity growth benefit homeowners?

Each mortgage payment contributes to equity growth, which is the difference between your home's market value and the remaining mortgage balance. Equity can be accessed for major expenses or reinvested in future properties.

5. Can Gen-Xers use homeownership as a retirement strategy?

Yes, many Gen-Xers use home equity to supplement retirement savings. Downsizing, selling, or taking a reverse mortgage can provide additional retirement income.

6. What are the tax benefits of homeownership?

Homeowners may qualify for tax deductions on mortgage interest, property taxes, and mortgage insurance premiums. Consult a tax advisor to maximize your deductions.

7. How can Gen-Xers decide between a fixed-rate or adjustable-rate mortgage?

Fixed-rate mortgages offer stability with consistent payments, while adjustable-rate mortgages (ARMs) often start with lower rates. Consider your long-term plans and financial flexibility when choosing.

8. What role does credit score play in homeownership?

A good credit score qualifies you for lower mortgage rates, saving you thousands in interest. Gen-Xers should monitor their credit and address any issues before applying for a loan.

9. Are there hidden costs to homeownership Gen-Xers should consider?

Yes, homeowners are responsible for property taxes, insurance, repairs, and maintenance. Budgeting for these expenses is essential to avoid financial strain.

10. How can renting help Gen-Xers save money?

Renting allows you to allocate funds to other investments like stocks or retirement accounts. It also eliminates the financial burden of home maintenance and repair costs.

11. Should Gen-Xers invest in real estate instead of owning a primary home?

Real estate investment can generate passive income and long-term growth. If you prefer to rent your primary residence, investing in rental properties may still provide wealth-building opportunities.

12. How does inflation impact homeownership vs. renting?

Homeownership acts as a hedge against inflation since fixed-rate mortgage payments remain stable, while rent prices often increase. Owning can provide financial security in inflationary periods.

13. Can Gen-Xers build wealth through house hacking?

Yes, house hacking involves renting out part of your home to offset mortgage costs. This strategy can accelerate wealth building and reduce housing expenses.

14. What factors should Gen-Xers consider before buying a home?

Evaluate your job stability, savings for a down payment, credit score, and local market conditions. A financial advisor can help determine if buying is the right decision.

15. Is it ever too late for Gen-Xers to become homeowners?

No, it’s never too late. Homeownership remains a viable option for Gen-Xers in their late 40s and 50s, especially with strong financial planning and understanding of available mortgage products.

Generation X 20 Years to Retirement

This article is number 4 in our series on Generation X 20 Years to Retirement. You can find links to all of the other articles in this series by clicking here or on the title above. In addition to our series, we are producing YouTube videos with the same titles and supplemental podcasts.

Most of our series will have videos embedded but you can always to go YouTube RetireCoast. Try our Facebook page as well.

Don't forget to sign up to receive notice of our blog articles. Go to the top right, and enter your email address. That's all.

Please read our other articles on a wide variety of topics related to retirement, fun on the Mississippi Gulf Coast, and life in general.https://retirecoast.com/retirecoast-blog-series-directory/

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.