Last updated on December 8th, 2025 at 07:52 am

You’ve made the exciting decision to start a business after retirement, and now it’s time to take the next crucial step—creating a budget. This article, number seven in our comprehensive Starting a Business After Retirement series, will guide you through the budgeting process so you can confidently manage your finances from the very beginning.

If you’ve read the previous articles, you already understand the fundamentals of choosing a business, structuring it properly, and securing funding. Now, we shift our focus to financial planning—ensuring your new venture is sustainable, profitable, and well-managed. But before we start plugging numbers into spreadsheets or budgeting software, there are a few critical things you need to know.

Many new small business owners overlook key financial elements, often leading to surprises down the road. Taxes, tax strategies, unexpected expenses, and hidden costs can quickly turn an exciting venture into a stressful one.

In this article, we’ll highlight these often-missed details and introduce budget-friendly ways to set up and manage your financial plan—without breaking the bank on expensive software or unnecessary tools. We will give you some outside resources such as A guide to Advancing Your Career with Essential Business Skills from Harvard Law School through out this article. The purpose is to support what we are presenting here.

This is just a preview. In the following sections, we’ll walk through the full budgeting process, step by step, and even provide you with a business budget tool to simplify the process. So, let’s get started—your business’s financial success starts here!

Creating an Effective Budget for a Successful Business After Retirement

For many baby boomers, retirement is no longer just about relaxation—it’s a perfect time to explore retirement business ideas that provide extra income and keep them engaged. Whether starting an online business, offering consulting services, or investing in real estate, older entrepreneurs have the advantage of years of experience to help build a successful business.

However, to ensure financial success, it is essential to have a solid business plan that includes a well-structured budget.

Many small business owners jump into their new businesses without proper financial planning, which can lead to unnecessary financial risk. A budget helps manage startup costs, track expenses, and ensure that personal retirement savings and retirement funds remain secure.

Whether launching a home-based business, a part-time business, or renting retail space, a carefully crafted budget is the foundation of financial stability. Bank of America’s article How to Create a Budget for Your Business can help round out our offering.

Key Budgeting Elements for a Business After Retirement

Regardless of the type of business, a well-structured budget should include:

- Startup Costs & Initial Investment

- Business registration (LLC, sole proprietorship, etc.)

- Website and online store setup

- Equipment, materials, and inventory

- Professional fees (legal, accounting, tax advisor)

- Fixed & Variable Expenses

- Credit cards and loan payments

- Insurance (business, liability, health)

- Rent and utilities (if applicable)

- Retirement plan contributions

- Market research and advertising

- Revenue Projections & Income Planning

- Estimated monthly revenue

- Pricing strategy and customer demand

- Potential impact on retirement account withdrawals and Social Security

- Emergency & Contingency Fund

- Cover unexpected costs such as equipment breakdowns

- Plan for slow business months

- Tax Considerations & Financial Guidance

- Consult a tax advisor to understand tax obligations

- Work with a financial advisor to protect financial resources

- Consider credit unions for business financing

- 1099’s for contractors and employees (read this article)

- Article on taxes for business after retirement click here

How the Budget Varies by Business Type

The type of business you start will influence how your budget is structured:

- Online Business & Online Store

- Lower startup costs

- Focus on website development, digital tools, and marketing

- Minimal overhead expenses

- Consulting Services & Service Provider Businesses

- Low initial investment, but higher marketing needs

- Potential travel expenses for in-person services

- Professional certification costs (if required)

- Real Estate & Retail Space Businesses

- High initial investment but significant earning potential

- Small Business Administration (SBA) financing options

- Costs for property maintenance, leasing, and legal fees

- Buying an Existing Business

- Often requires a larger financial investment

- May come with established revenue and customers

- Important to assess financial health before a purchase

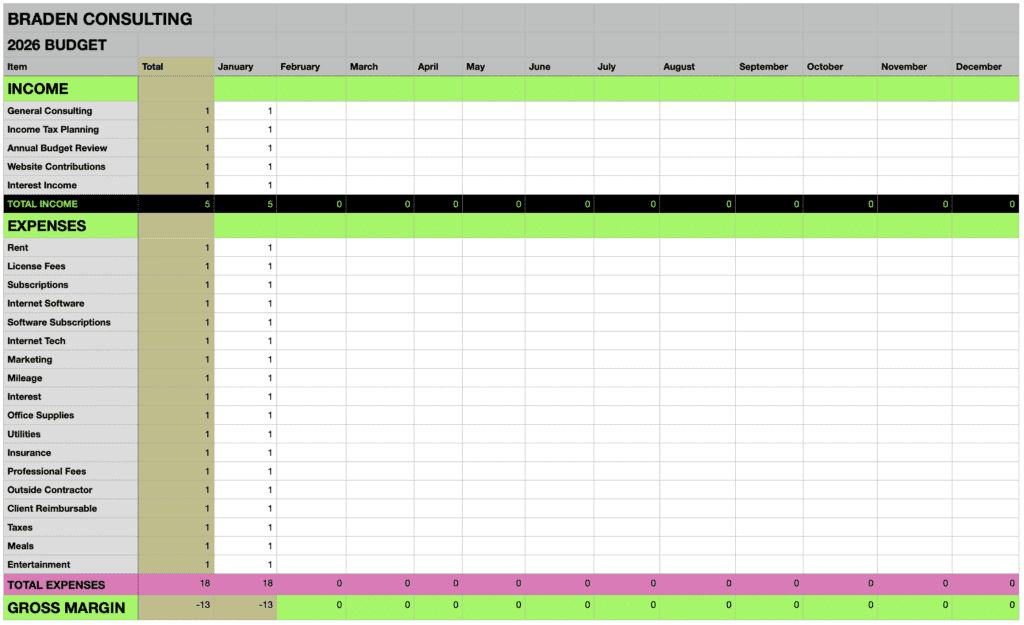

The best way to start the budget creation process is to use a spreadsheet or budget tool. It’s important that you get everything on paper or screen. If you have worked for a big company and worked with budgets, you know they are usually set in concrete by late January. This is not true for people starting a business after retirement. Your budget will be a guide only, subject to perhaps many revisions.

Key Categories of a Business Budget – for an LLC

1. Revenue (Top Line of the Budget)

Revenue includes all sources of income your business generates. This could be from:

- Sales of products or services

- Consulting or contract work

- Subscriptions or membership fees

- Affiliate income or partnerships

2. Expenses (Divided into Fixed and Variable Costs)

Expenses are the costs associated with running your business. They are categorized into:

A. Fixed Costs (Recurring, Predictable Expenses)

These expenses remain stable month-to-month:

- Rent or Mortgage (if applicable)

- Utilities (Electricity, Internet, Phone, etc.)

- Software and Subscriptions (QuickBooks, CRM, website hosting)

- Insurance (Business liability, health, professional, etc.)

- Salaries and Wages (if you hire employees or contractors)

- SEP IRA Retirement Account Funding (fund your own account as an expense)

B. Variable Costs (Fluctuate with Business Activity)

These costs may increase or decrease depending on your business operations:

- Marketing and Advertising

- Office Supplies and Equipment

- Travel and Networking Costs

- Cost of Goods, inventory

3. Gross Margin (Revenue – Expenses = Gross Margin)

This is the money left after covering your business expenses. As an LLC owner, this gross margin serves two primary purposes:

- Reinvesting in the Business (expansion, marketing, equipment, or hiring)

- Paying Yourself (your personal income as a business owner)

4. Taxes on Your Earnings

Since your business is an LLC, you will report your business income on your personal tax return:

- Self-employed business owners must pay estimated quarterly taxes.

- Consider setting aside 25-30% of your earnings for taxes.

- Tax deductions (home office, mileage, software, etc.) can help lower your taxable income.

If you are forming a subchapter S corporation or a Corporation, the budget line items will differ somewhat. Particularly when you get to the bottom. The gross margin will generally include retained earnings (money you use for expansion or working capital). Your earnings will have been listed above. The following is an example of how either type of corporation budget would look like:

Budget C Corporation vs. LLC

1. Revenue

Revenue remains at the top of the budget in both business structures. This includes income from product sales, service fees, consulting work, or other revenue-generating activities.

Example:

- Monthly revenue: $50,000

- Annual revenue: $600,000

2. Expenses

A. Fixed Expenses (Common to Both)

Both an LLC and a C Corporation have standard fixed costs such as:

- Office rent or mortgage

- Utilities (electricity, internet, phone)

- Software subscriptions and tools

- Business Insurance

- Marketing and advertising

B. Owner Compensation – Key Difference Between LLC and C Corporation

LLC Owner Compensation (Pass-Through Taxation)

- In an LLC, owners (members) do not receive a salary in the same way employees do. Instead, profits flow through to the owners’ personal tax returns.

- Owners pay self-employment taxes on their earnings.

- Instead of salaries, LLC members take owner draws from the company’s gross margin.

C Corporation Owner Compensation (Salary & Dividends)

- In a C Corporation, owners (shareholders) must pay themselves a salary if they actively work in the business.

- Salaries are deducted as a business expense, reducing taxable income for the corporation.

- The corporation also pays payroll taxes on these salaries (Social Security, Medicare, unemployment taxes).

- If there are remaining profits, the corporation can distribute them as dividends to shareholders, but these are subject to double taxation (once at the corporate level and again on the owner’s personal tax return).

Example:

- CEO salary (C Corporation): $100,000/year (subject to payroll taxes)

- LLC owner draw: $100,000/year (subject to self-employment tax)

3. Taxation Differences

LLC Taxes (Pass-Through Taxation)

- The LLC does not pay corporate income tax.

- The owner’s income is taxed at the individual level.

- Self-employment taxes (15.3%) apply to all earnings.

C Corporation Taxes (Corporate & Dividend Taxation)

- The corporation pays a flat corporate tax rate (currently 21% at the federal level).

- Salaries are deducted as a business expense before corporate taxes.

- If the corporation distributes dividends, shareholders pay capital gains tax on them, leading to double taxation.

4. Example Budget Comparison

| Category | LLC | C Corporation |

|---|---|---|

| Revenue | $600,000 | $600,000 |

| Total Fixed Expenses | $100,000 | $100,000 |

| Owner Salary | Not applicable (Owner Draw) | $100,000 (W-2 Salary) |

| Payroll Taxes | Self-Employment Tax (~15%) | Paid by corporations (Social Security, Medicare, etc.) |

| Corporate Income Tax | N/A (Pass-through) | 21% on net income |

| Net Profit After Expenses | $500,000 (flows to owner) | $400,000 (before tax) |

| Dividend Tax (If Paid Out) | N/A | Additional tax for shareholders |

5. Reinvestment & Growth

- In an LLC, profits can be reinvested tax-free into the business, but owners still owe taxes on their share of earnings.

- In a C Corporation, retained earnings stay in the business and aren’t taxed until distributed as dividends, making it more advantageous for reinvesting profits into business growth.

Choosing Between an LLC and a C Corporation for Budgeting

- An LLC is simpler for small business owners, with pass-through taxation and fewer payroll tax complications.

- A C Corporation is ideal for businesses planning to scale, attract investors, and reinvest profits, but it comes with corporate tax obligations and the risk of double taxation.

At this point, since this is the seventh article in our series, presenting all of this information on business structures is somewhat academic the reason it’s here is that these business types each have different budget requirements.

As you noted above rather than pass income along from the LLC to the individual tax return, the corporation budget is different. I continue to discuss the LLC as the preferred business structure for those who are starting a business after retirement because it is easier and less expensive.

The types of businesses below work well for various types of professional businesses. Perhaps you have been a doctor in a large practice for years and have retired. You have decided to open a small specialized practice and it may be best for you to consider one of the formats below. If by this point you have already created a business structure, you can always make changes. Microsoft has a list of free budget templates at this address: https://create.microsoft.com/en-us/templates/business-budgets

Types of Non-Corporate Business Structures: LLPs, LLCs, and Professional Variations

When starting a business, choosing the right structure is critical to managing liability, taxation, and business operations. While corporations such as C Corporations and S Corporations are common, several business structures exist outside of the corporate framework that offer flexibility and liability protection.

These include Limited Liability Partnerships (LLPs), traditional Limited Liability Companies (LLCs), and professional variations of LLCs. Below is an overview of these structures and how they differ.

Key income and expense categories

Let’s dive into the Key business income and expense categories listed at the beginning of this article. Starting with revenue. Some businesses have one line for revenue, that works when the business is very simple. If you want to track various revenue sources, create a line for each major category.

Keep in mind that the structure of your budget will translate into how your accounting system is set up. In the chart of accounts (a listing of types of expenses and revenues), you will list the multiple revenue streams.

When you view your accounting reports, you will see how the revenue from each line item adds to the total at the top. Some spreadsheets can show the percentage of each to the total revenue.

This will tell you where you are making money and in some cases where you may not be. A major reason for your budget is to determine where to improve your business. Perhaps you are spending time on tasks that are not yielding sufficient revenue.

Business startups often go through these growing pains. That is why you need to set a budget at the beginning of each year and work against that budget.

Personal Experience

You will be making financial decisions for the future based on what has happened in the past. Many years ago, before people had access to desktop databases and analytical capability, I worked for a large corporation and I was testing out a new database product.

My staff hand-entered marketing research which we paid for about sales in all major markets in the United States. We would go to a meeting each month put on by the research organization and look at their slides.

After I had the data work within our PC database, I began to sort it by market share and found that our largest market share was in the OH, PA, MA, and IN areas and not in the South East as we were led to believe. We were spending more in the South East to advertise than in any other market when our biggest market was receiving very little.

You could argue that if the South East was not the largest market it may make sense to advertise there. Possibly but there is more that I will not cover here. The point that I want to make is that we did not know we were putting efforts into the wrong place.

This is what budgets and data provide, a road map to success. Don’t find yourself a victim of an accident, know what direction you are going in and get there in a profitable way.

Expenses

There are two categories of expenses. Fixed and variable. Fixed expenses are things like leases and contracted amounts you are obligated to pay at a fixed rate. The payment on your car at $500 per month is a fixed expense. It’s best to put these in a group under expenses, they are not the ones that you will be paying the most attention to.

Financial benefits come from controlling variable expenses. These are things such as utilities, fuel, and expenses that grow with the business. If you are doing mail campaigns, your cost to mail out 1,000 letters is X$ and that will grow when it’s 2,000.

Understanding Cost of Goods Sold (COGS) and Its Relationship to Revenue

What Is the Cost of Goods Sold (COGS)?

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods or delivering services. This includes expenses that fluctuate based on the level of sales or production. COGS is a crucial budget category because it directly affects gross profit, making it a key factor in business planning and pricing strategy.

Key Components of COGS:

- Raw Materials & Inventory Costs – The cost of purchasing goods that will be resold or materials used in production.

- Manufacturing or Production Costs – Includes labor, factory utilities, and direct expenses related to creating products.

- Software or Platform Fees – Subscription-based tools required to deliver services (e.g., online course platforms, hosting fees).

- Contractor or Supplier Payments – Outsourced work directly related to fulfilling customer orders.

- Shipping & Fulfillment Costs – Packaging, transportation, and delivery costs.

Example of COGS Calculation for a Retail Business:

A business selling handmade furniture incurs the following costs:

- Wood and materials: $300 per unit

- Manufacturing labor: $100 per unit

- Packaging and shipping: $50 per unit

If the business sells 100 units per month, then:

COGS per unit = $450

Total COGS per month = 100 x $450 = $45,000

How COGS Relates to Projected Revenue in the Budget

COGS is directly tied to revenue because it increases as sales increase. The more products or services a business sells, the higher the cost of fulfilling those sales.

Formula:

Gross Profit=Total Revenue−COGSGross Profit=Total Revenue−COGS

This means that if a business does not properly manage its COGS, increasing revenue does not necessarily mean higher profit. Businesses must ensure that COGS remains a reasonable percentage of revenue to maintain profitability.

COGS-to-Revenue Ratio (Gross Margin Percentage)

A key financial metric is the COGS-to-Revenue Ratio, which indicates how much of each dollar earned goes toward production costs.

COGS-to-Revenue Ratio=(COGSRevenue)×100COGS-to-Revenue Ratio=(RevenueCOGS)×100

For example, if:

- COGS = $45,000

- Revenue = $100,000

Then:

(45,000100,000)×100=45%(100,00045,000)×100=45%

A lower percentage is ideal because it means more revenue is retained as gross profit. Most businesses aim for a COGS-to-revenue ratio of 30-50%, depending on the industry.

Strategies to Optimize COGS and Improve Profitability

- Negotiate Better Supplier Rates – Bulk purchasing discounts or switching to lower-cost suppliers.

- Reduce Waste & Inefficiencies – Streamline production processes to lower material waste and labor costs.

- Increase Pricing Strategically – If COGS is too high, the business might need to adjust prices to maintain a healthy gross margin.

- Leverage Technology & Automation – Reducing manual labor in production and fulfillment.

- Optimize Inventory Management – Avoid overstocking (which ties up cash flow) or understocking (which leads to lost sales).

Understanding GAAP and IRS-Recognized Accounting Methods

When starting a business, financial decisions (1) play a crucial role in long-term business success. One of the first steps in managing finances properly is choosing the best way (1) to track and report income and expenses. The Generally Accepted Accounting Principles (GAAP) provide standardized rules that businesses follow to ensure financial transparency.

What Is GAAP?

GAAP is a set of accounting standards used primarily in the United States to ensure consistency, reliability, and comparability in financial statements. These principles are recognized by the IRS and required for public companies. While small businesses and business startups (1) may not be legally required to follow GAAP, it is a viable option for ensuring professional and accurate financial reporting.

Accrual vs. Cash Accounting: What’s Best for Your Business?

The IRS recognizes two primary accounting methods for business operations (2):

- Cash Accounting – Income is recorded when received, and expenses are recorded when paid.

- Accrual Accounting – Income is recorded when earned, and expenses are recorded when incurred, regardless of cash flow timing.

Each method has advantages depending on your business operations (2), skill set, and target audience.

| Accounting Method | Best for Business Type | Key Advantage | Considerations |

|---|---|---|---|

| Cash Method | Small businesses, sole proprietors, side hustles, and retired people with a business in their spare time | Simple and easy to manage | May not show long-term financial health accurately |

| Accrual Method | Established businesses, businesses with inventory, commercial banking activities, and businesses seeking a business loan | Provides a clearer financial picture | Requires more bookkeeping and expertise |

The cash method is often used by small businesses and self-employed individuals, such as a retired teacher starting a passion project in pet sitting. The National Association of Professional Pet Sitters recommends cash accounting for independent pet sitters due to its simplicity.

However, larger businesses with inventory or those planning to scale should consider the accrual method, which provides a more accurate picture of financial business operations (2).

Creating a Chart of Accounts: The Foundation for Your Budget

Before drafting a budget, it’s essential to establish a Chart of Accounts (COA). This framework categorizes every financial transaction and ensures that budget line items align with the accounting system. A well-structured COA prevents confusion and helps businesses track taxable income (2), expenses, and cash flow effectively.

Typical Chart of Accounts Categories

A Chart of Accounts includes the following major categories:

- Assets – Cash, savings accounts, office space, business loans

- Liabilities – Credit card balances, business loans, taxes owed

- Equity – Owner investments and retained earnings

- Revenue – Sales, consulting income, trade names, commercial banking activities

- Expenses – Rent, utilities, marketing, payroll, personal interest, health issues

Why the Chart of Accounts and Budget Must Be Comparable

A common mistake in business startups (1) is creating a budget that does not align with the Chart of Accounts. If the budget has different expense categories than the accounting system, financial tracking becomes difficult, making it harder to analyze spending (1) and plan for taxable income (2).

For example, if a business startup (1) includes “Marketing and Advertising” in the budget but records “Digital Ads” and “Print Ads” separately in the COA, it may cause confusion. A well-structured COA should match budget line items, ensuring business success.

Braden Consulting – Chart of Accounts

| Account Name | Account Category |

|---|---|

| Assets | |

| Current Assets | |

| Cash | Current Asset |

| Accounts Receivable | Current Asset |

| Prepaid Expenses | Current Asset |

| Fixed Assets | |

| Office Equipment | Fixed Asset |

| Computer Equipment | Fixed Asset |

| Accumulated Depreciation | Fixed Asset |

| Liabilities | |

| Current Liabilities | |

| Accounts Payable | Current Liability |

| Salaries Payable | Current Liability |

| Unearned Revenue | Current Liability |

| Long-Term Liabilities | |

| Loans Payable | Long-Term Liability |

| Equity | |

| Owner’s Equity | Equity |

| Retained Earnings | Equity |

| Owner’s Draw | Equity |

| Revenue | |

| Consulting Revenue | Revenue |

| Service Revenue | Revenue |

| Expenses | |

| Operating Expenses | |

| Rent Expense | Operating Expense |

| Utilities Expense | Operating Expense |

| Marketing Expense | Operating Expense |

| Administrative Expenses | |

| Salaries Expense | Administrative Expense |

| Office Supplies Expense | Administrative Expense |

| Depreciation Expense | Administrative Expense |

Example – Chart of Accounts for Braden Consulting

Braden Consulting – Chart of Accounts

Assets (1000 – 1999)

- 1000 – Cash – Operating Account

- 1010 – Cash – Savings Account

- 1020 – Petty Cash

- 1100 – Accounts Receivable

- 1200 – Prepaid Expenses

- 1300 – Office Equipment

- 1400 – Computer Equipment

- 1500 – Accumulated Depreciation (Contra-Asset)

Liabilities (2000 – 2999)

- 2000 – Accounts Payable

- 2100 – Credit Card Payable

- 2200 – Payroll Taxes Payable

- 2300 – Sales Tax Payable (if applicable)

- 2400 – Deferred Revenue (Unearned Income)

- 2500 – Business Loan Payable

Equity (3000 – 3999)

- 3000 – Owner’s Capital

- 3100 – Owner’s Drawings

- 3200 – Retained Earnings

Income (4000 – 4999)

- 4000 – Consulting Revenue

- 4100 – Project-Based Fees

- 4200 – Retainer Income

- 4300 – Speaking Engagements

- 4400 – Reimbursed Client Expenses

Cost of Goods Sold (5000 – 5999)

- 5000 – Subcontractor Fees

- 5100 – Software & Tools Used for Client Work

- 5200 – Materials & Supplies

Operating Expenses (6000 – 7999)

- 6000 – Salaries & Wages

- 6100 – Payroll Taxes

- 6200 – Employee Benefits

- 6300 – Rent & Utilities

- 6400 – Internet & Hosting Fees

- 6500 – Professional Development & Training

- 6600 – Office Supplies

- 6700 – Travel & Lodging

- 6800 – Meals & Entertainment

- 6900 – Marketing & Advertising

- 7000 – Insurance (General, Liability, etc.)

- 7100 – Business Licenses & Permits

- 7200 – Legal & Professional Fees

- 7300 – Accounting & Bookkeeping

- 7400 – Software Subscriptions

- 7500 – Depreciation Expense

- 7600 – Bank & Merchant Fees

Keeping the Chart of Accounts Manageable

It’s tempting to create an overly detailed Chart of Accounts by adding new things for every minor expense, but this can overcomplicate bookkeeping. Instead:

✅ Keep it simple – Use broad categories to cover multiple expenses.

✅ Avoid excessive detail – Instead of tracking every minor cost, group similar expenses together (e.g., “Office Supplies” rather than listing individual purchases).

✅ Review regularly – Adjust as needed, but avoid excessive changes.

For instance, a retired teacher starting a passion project in tutoring may initially track “Workbooks” separately. However, in recent years, businesses have simplified COAs by grouping minor items under “Educational Materials.”

Chart of accounts vs budget names

The Chart of Accounts will contain every possible income and expense item. When creating the budget, you should use the chart of account names for line items so you can match them. Not all items on the chart of accounts will appear on the budget. Only those items from the chart of accounts that are going to be used should be transferred to your budget.

Managing Cash Flow – A critical function

What is cash flow? It’s the movement of money into and out of your business. Positive cash flow means more money is coming in than going out, while negative cash flow means you are spending more than you are earning.

For retirees starting a business, managing cash flow is crucial because your business may supplement Social Security, pensions, or retirement savings. Without a solid budget, unexpected expenses or slow income periods could impact your overall financial security.

Step 1: Creating a Business Budget After Retirement

A well-structured business budget for retirees serves as a roadmap for tracking expenses, revenue, and profits. It helps prevent overspending and ensures you have enough funds to sustain your venture.

Setting Up Your Budget: Fixed vs. Variable Costs

Fixed Costs (Consistent Monthly Expenses)

- Business insurance

- Website hosting & software subscriptions

- Office rent (if applicable)

- Utilities & internet

- Loan repayments (if you took out a small business loan)

Variable Costs (Fluctuate Based on Business Activity)

- Marketing and advertising

- Travel and networking events

- Inventory or materials

- Business development and training

- Contractor or employee wages (if hiring)

Revenue Projections

Estimate your expected business income based on the services or products you offer. Be realistic—overestimating revenue can lead to cash shortages.

Pro Tip: Use budgeting software for small businesses like QuickBooks, Wave, or Xero to track income and expenses easily.

Step 2: Tracking Business Income and Expenses

Many small business owners focus on profits but ignore cash flow timing. Even if your business is making money on paper, late payments from clients can cause a cash crunch.

Best Practices for Tracking Cash Flow

- Use a Cash Flow Statement – Monitor income and expenses weekly.

- Automate Payments – Set up automatic bill payments to avoid missing due dates.

- Invoice Clients Promptly – The sooner you bill, the faster you get paid.

- Offer Multiple Payment Options – Accept credit cards, PayPal, and direct transfers for faster transactions.

By tracking real-time business expenses, you ensure that your small business remains profitable and sustainable.

Step 3: Planning for Slow Months & Unexpected Expenses

Business revenue can fluctuate—especially if you are starting a business in retirement. To stay financially secure, plan for low-income periods and unexpected costs.

How to Prepare for Financial Uncertainty

- Build a Cash Reserve: Save at least three to six months of business expenses.

- Reduce Unnecessary Expenses: Cut non-essential costs during slow months.

- Diversify Income Streams: Offer multiple services, passive income, or digital products.

Step 4: Managing Receivables & Getting Paid Faster

One of the most common cash flow problems for small businesses is late payments from clients. If your business depends on service-based income, delayed payments can disrupt your budget.

Tips to Improve Cash Flow

✔ Send invoices immediately after completing work

✔ Request a deposit upfront for large projects (30-50%)

✔ Offer early payment discounts to encourage fast payments

✔ Charge late fees to prevent overdue payments

Accept credit card payments. Stripe is one of the providers, check their own take on creating a budget for your start up

By optimizing your invoicing process, you ensure steady cash flow and financial stability for your business.

Step 5: Budgeting for Business Growth & Expansion

As your retirement business grows, you may want to invest in new tools, hire freelancers, or expand your product line. However, scaling too quickly without a financial plan can lead to cash shortages.

Smart Growth Strategies for Retired Entrepreneurs

- Reinvest only a percentage of profits instead of all available cash.

- Test new products or services before making large investments.

- Use business credit wisely – Consider small business loans or lines of credit if needed.

Step 6: Tax Planning & Retirement Considerations

Running a business in retirement has tax implications that could impact Social Security benefits and retirement savings.

What Retired Entrepreneurs Need to Know About Taxes

- Choose the right business structure (LLC, Sole Proprietorship, S-Corp)

- Track deductible expenses (home office, mileage, business meals)

- Understand how business income affects Social Security

- Work with a CPA or use tax software for better compliance

Proper tax planning for retirees with small businesses can help reduce liabilities and maximize savings. Read this “Year-round tax planning pointers for taxpayers” authored by the U.S. Internal Revenue Service

Step 7: Reviewing & Adjusting Your Business Budget

A business budget is not static—it should evolve as your business grows. Set a quarterly review to analyze cash flow trends, expense patterns, and revenue projections.

How Often Should You Review Your Budget?

✔ Monthly: Track expenses and cash flow

✔ Quarterly: Adjust for growth, slow seasons, and economic changes

✔ Annually: Plan major investments and tax strategies

By regularly updating your budget, you ensure that your business remains financially healthy throughout retirement.

Using Budgeting Tools

Using Budgeting Tools to Manage Your Business After Retirement

Starting a business after retirement can be both exciting and challenging. While you have the time and experience to make your venture successful, managing finances effectively is crucial to avoid unnecessary stress. One of the best ways to stay on top of your finances is by using budgeting tools and software that help track income, expenses, and overall cash flow.

Gone are the days of manually tracking finances on paper. Today’s budgeting apps for small businesses provide automation, real-time tracking, and financial forecasting, making it easier to manage cash flow, create reports, and stay profitable. Let’s explore how the right budgeting tools can simplify financial management for your retirement business.

Why Budgeting Tools Are Essential for Your Business

When running a business in retirement, every dollar counts. Unlike a traditional job with a steady paycheck, your business income may fluctuate. A good business budgeting tool helps you:

✔ Track Income & Expenses – Automatically categorize transactions and monitor where your money goes.

✔ Create a Cash Flow Plan – Ensure you have enough cash to cover bills, taxes, and unexpected expenses.

✔ Set & Stick to a Budget – Plan monthly expenses and prevent overspending.

✔ Generate Reports for Better Decision-Making – View profit and loss statements, cash flow reports, and financial trends.

✔ Prepare for Taxes – Easily track deductions, organize receipts, and calculate estimated tax payments.

By using budgeting software for small businesses, you save time, reduce errors, and gain better financial control.

Choosing the Right Budgeting Tool for Your Retirement Business

With so many options available, selecting the right budgeting tool for a small business depends on your needs, technical comfort level, and business type. Here are some of the best options:

1. QuickBooks Online – Best for Comprehensive Business Budgeting

💡 Ideal for: Small businesses needing in-depth financial tracking

📌 Features:

- Tracks income & expenses automatically

- Integrates with banks & credit cards for real-time updates

- Generates detailed reports for budgeting & forecasting

- Helps manage payroll & taxes

Why Use It? QuickBooks is a powerful tool for tracking cash flow, but it has a learning curve. If you prefer automation and detailed reporting, it’s a solid choice.

2. Wave – Best Free Budgeting Tool for Small Businesses

💡 Ideal for: Freelancers & solo entrepreneurs needing a simple, free tool

📌 Features:

- Free income & expense tracking

- Invoice generation & receipt scanning

- Basic financial reports

Why Use It? If your business has minimal expenses and doesn’t require advanced features, Wave’s free accounting software is a great starting point.

3. YNAB (You Need A Budget) – Best for Strict Budgeting & Cash Flow Control

💡 Ideal for: Retired business owners wanting hands-on budgeting

📌 Features:

- Zero-based budgeting method (assigns every dollar a purpose)

- Helps reduce overspending & control cash flow

- Bank account syncing & mobile access

Why Use It? If you need to closely monitor spending and want a proactive approach to budgeting, YNAB is excellent for cash flow planning.

4. Excel free online software or Google Sheets – Best for Custom Budgeting

💡 Ideal for: DIY business owners who prefer custom spreadsheets

📌 Features:

- Fully customizable budgeting templates

- No software fees

- Can track income, expenses, and cash flow manually

Why Use It? Excel or Google Sheets work best for those comfortable with manual tracking. If you prefer hands-on budgeting, you can create a personalized financial tracker.

5. Xero – Best for Growing Businesses with Payroll & Inventory

💡 Ideal for: Retirees running a business with employees or inventory

📌 Features:

- Automated accounting & invoicing

- Tracks cash flow, payroll, and tax payments

- Bank reconciliation & financial forecasting

Why Use It? Xero is perfect for scaling a retirement business, especially if you’re hiring staff or managing inventory.

How to Effectively Use a Budgeting Tool

Once you choose the right budgeting software for your small business, follow these steps to make the most of it:

1. Set Up Your Budget Categories

- List all income sources (product sales, consulting fees, rental income, etc.)

- Create expense categories (marketing, utilities, supplies, payroll)

- Allocate funds to each category based on expected revenue

2. Automate Expense Tracking

- Connect your bank accounts, credit cards, and PayPal for real-time updates

- Set up automatic expense categorization (e.g., categorize software fees under “Technology”)

3. Monitor Cash Flow Weekly

- Check income vs. expenses every week to avoid surprises

- Adjust spending if cash reserves are low

4. Set Financial Goals & Forecast Trends

- Use reports to analyze profit margins & spending patterns

- Adjust your budget seasonally if your business has slow months

5. Review & Adjust Monthly

- At the end of each month, compare budgeted vs. actual expenses

- Adjust for unexpected costs and update financial goals

Benefits of Using Budgeting Tools for a Retirement Business

✅ Saves Time: Automates financial tracking, so you don’t have to record everything manually.

✅ Prepares for Tax Season: Helps track deductions and estimate quarterly taxes.

✅ Prevents Overspending: Keeps business expenses in check and avoids cash shortages.

✅ Improves Decision-Making: Provides real-time financial insights for better planning.

✅ Reduces Stress: Ensures your business stays financially stable without impacting your retirement savings.

Click the button below to visit our Starting A Business After Retirement Index of articles

The RetireCoast.Com blog was intended to support those who are planning their retirement years and others who want to live on the Mississippi Gulf Coast. In the process of writing articles, the idea of creating a series about starting a business after retirement came to me. I have been advised that it’s best to create a separate website to manage this entire concept. StartingaBusinessAfterRetirement.Com was created.

For now, the major articles in the series will be available at both sites. The new site StartingaBusinessAfterRetirement.Com will be the central repository for all of our tools already created and to be created for your use. You will be able to purchase services and products from us to help you move your dream of starting a new business to reality.

Click the button below to see all of our articles and visit our new site. Please come back to RetireCoast.Com for additional articles. Eventually, we will move all of our new articles to the new site and make referrals from RetireCoast.com. Thank you for following us. please leave comments.

RETIRECOAST PODCAST

Rent vs. Buy: A Practical Housing Decision for Millennials – RetireCoast

- Rent vs. Buy: A Practical Housing Decision for Millennials

- Weapons Used In 1776: Revolutionary War Weapons, Tools, and Uniforms

- Shamrock Shenanigans and Southern Charm: A Guide to St. Patricks Day on the Mississippi Gulf Coast

- Who We Were in 1776: The People Who Became Americans

- 11 Best 2026 Tax Changes Millennials and GEN Z Should Understand NOW!

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.