Dave Ramsey for those of you who do not know him is a financial expert who provides financial advice (The Dave Ramsey Show) about personal debt, personal finance, and similar topics. He has a radio program and is a guest on many other radio stations and TV shows. I love Dave Ramsey but….. Read on to learn where Dave and I differ in our financial philosophies.

His “Dave Ramsey Plan” provides great advice to his listeners. His financial success starts with looking at a person’s financial situation. While I agree with many of his ideas, it’s important to describe his general audience and explain why I disagree with him on some key aspects of financial management.

Dave is a cash guy. He wants you to save up and buy your car with your monthly income. Dave wants you to save up to buy your house. He likes paying cash for everything including investment property. In concept, he is correct for those who have the financial resources to do that.

Why pay interest

Why pay interest? He and I abhor payday loans for example which shows poor planning. He and I agree that creating a household budget can do great things.

Again, we both agree on hard work is the right way to get ahead of the money game. Achieving financial security is a goal we both share.

I would argue that a substantial number of people perhaps much more than half of the population are poor money managers (particularly young people). His words should reach all of those individuals and they should pay attention to him. So many people have built large debts and don’t know the best way to get ahead of that debt. They need help like the type provided by the Dave Ramsey show.

We are in complete agreement on most of his advice primarily because of who his real audience is. Dave Ramsey’s baby step approach is a well-structured way to communicate to the financially disadvantaged. Dave’s advice about doing a little bit at a time is good.

Financial education is critical

I am a passionate advocate of financial education in high school. The best thing that a high school student can do is become literate about the use of money. Extra money should be invested in retirement accounts for the long term. Kids need to learn this. Preferably from parents but if not from school.

If more kids learned financial security in school, Dave could almost shut down his radio show. Consider how few people would have obtained student loans they struggle now to pay. How about a reduction in ruined marriages because the couple could not work out their finances. Life revolves around money and to ignore that principle is to set up our children for failure.

Fortunately, people like Dave Ramsey are around for the majority who need simple rules and a bit of handholding to move forward. His approach has helped lots of people who were in dire need of assistance. His total money makeover is brilliant.

I strongly encourage OPM

For the smaller portion of the population that has the discipline to manage money properly, I strongly encourage the OPM principal. “Other Peoples Money”. A case in point: Most people have a hard time saving enough money to make a down payment on a house. While you are saving to buy the house, the price of homes is going up and the money you have saved is worth less over time. It can be done and Dave is right, with an almost superhuman effort, you can buy a house with cash. If you are lucky.

Buying that house is one of the first things you can do to build wealth. Even Dave would agree that homeownership is important. He would not agree that it is as important as I believe it is for future wealth development. It’s home ownership that represents the majority of individual wealth in this country.

Dave hates credit cards

Another thing he hates is the use of credit cards. No one wants credit card debt that can not be paid off each month. I agree again, most people can not control their spending so they pay interest on the cards making all of those deals that they used the cards for null and void.

You should have credit cards and use them, BUT pay them off at the end of each month. Do not carry a balance. It’s the part of the population that Dave appeals to who have financial problems because they do not exercise common sense when it comes to credit card usage.

Use the credit to buy everything including food, utility bill payments, etc. Always use cards that give you points or the equivalent in cash. This is free money and great use of OPM. Most of Dave’s listeners probably do not have the discipline to avoid carrying a balance. On credit cards, chalk up another case of I love Dave Ramsey but.

Dave does not believe in a credit score

Dave does not in general believe in the need to have a good credit score because he does not believe in credit. The fact is that life is better with the managed use of credit. One of my favorite examples is Apple Inc. This company is the wealthiest in the country. They have billions of dollars in cash reserves. And, I mean real cash or equivalents. Why do they issue credit instruments and pay for the use of that credit? This is another case where I love Dave Ramsey but

Apple has a very large debt on their books that they could pay off with their cash. So again, why would they borrow? Simple, Apple can earn more on the cash they have invested than it costs them to borrow. The difference hits their bottom line as pure profit.

Your life is not the same as Apple’s experience but you should by now know what I am talking about. You should always use credit when the spread between the cost of money and the potential income from the use of that money generates its income.

Borrow to make a profit

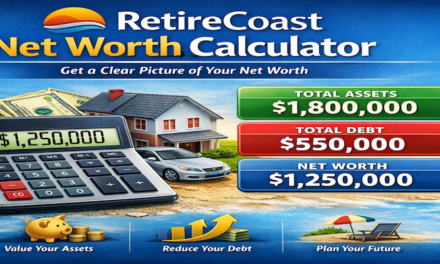

Another example: You want to buy a vacation rental property. The property has a cost of $125,000 and you need to invest another $25,000 to fix it and furnish the house. A total investment of $150,000. You could use all your cash to make this happen. Or, you can borrow 75% or more of the amount you need to buy the property and fix it at an interest rate of less than 5%.

$31,250 is the down payment plus $25,000 in cash for repairs and about $6,000 in closing costs. Get the seller to pay the closing costs and you end up providing $56,250 for the investment. The interest each month is about $235. If you are not making $500 or more net after all expenses including the mortgage, you probably made a bad investment.

What this usually comes down to is the difference between waiting until you have saved up $150,000 or until you have saved $56,250. During the time you wait (years) to save the difference the price of the property would go up and you lose the income for the time you waited.

On occasion real estate investors will ask my opinion about saving to buy their investment property. You can guess what my response is. You can try but the goal will almost always seem further down the road. If you can borrow profitably why not?

Dave would have you sink $150,000 into a property that would earn for example $30,000 per year when you can invest $56,250 and earn the same amount. Which do you think is the best return on your investment. You earn 20% ROI by paying cash and 53% if you borrow. And that difference is exclusive because you used OPM.

Yes there is more risk with OPM

Yes, there is more risk if you use OPM. There are very few people who have become rich without taking risks. There are risks and then there are risks. Take the road to the least risk investments and then cover yourself with insurance and other strategies that make the risk to borrow nearly the same as the risk to pay cash. Paying cash does not eliminate risk. Your property could burn down and the insurance company may fail to pay the full value etc. This is called mitigation.

It’s great when you can agree to disagree with someone. I do not know Dave Ramsey other than to listen to him. He would be based on what I know of him, disagree with my approach but he would recognize the difference of opinion. His approach will get you to where you want to be but in a much longer time frame. My approach will get you there sooner. Both concepts work. Use your own money or someone else’s money.

Incidentally many would agree with my approach to OPM. Wow, I guess that Apple agrees with it since they are employing much of what I am explaining here. Using OPM is a proven plan that works if well executed. Going back for a minute to Dave’s core constituency, I agree with Dave to keep preaching his brand of financial advice to the majority of the public.

Do not use OPM if you lack credit discipline

Many who will read this article will not have the discipline to manage credit. Do not under any circumstances proceed with my suggestions about OPM if you can not manage credit. What I mean here is not the skills perse but the emotional capability of not spending more than you have the capability of preparing. Using OPM means that you need to follow the rules. Only pay interest when you need to e.g. a mortgage or a short-term project.

If you have worked out a plan to absorb interest over a short term on a project and you can be profitable go for it. A good example is a house flip. You can borrow hard money for the flip or use your business credit card. You decide to use the business credit card because you have a six months interest-free check. Good decision. Complete the job and pay off the card.

I am not sure what approach is more difficult. It’s a grind to earn enough to pay cash for everything and it’s as much a grind to obtain and retain good credit. You have to work at both methods to make either work for you. I have built companies from nothing using only my own money for much of my career.

It’s not that I wanted to use my own money

It’s not because I wanted to use my own money as much as it’s difficult to obtain credit if you are self-employed. I generally suggest that people retain their day job when they first start investing in real estate. You do not start as a Warren Buffett.

That job permits you to obtain loans because of your record of W2 income. It’s far easier to obtain a loan when you have a full-time job showing earnings and tax returns. There are ways to finance properties that can be learned which will save you years by owning now rather than later. I do not see an issue with debt as long as it is the right kind of debt and you are earning money on the borrowing.

I have written about credit and how to use it. One time in a response to a Quora question that I responded, a person told me that I should have at least $100,000 in credit card lines. At the time I was advocating $75,000. I thought about it for a while and responded he was correct. What was I thinking? You can only use 10% before your credit score takes a hit. Why not, I am responsible.

My story of OPM, Dave Ramsey may not approve

Years ago, I started one of my most successful companies. I invested $10,000 of my own cash and hired my first employee. I needed a truck so I leased one based upon my personal credit because the business was new. Later, I needed another truck and the same occurred. As the business was growing, I soon realized that the receivables were building and I needed money.

I obtained an American Express business card which of course used my personal credit to qualify. The thing about American Express is that they require you to pay the card every month. That was great discipline for me. It was a struggle some months but it permitted me to shift my scarce cash to payroll and use the AMEX card for fuel, supplies and to pay creditors.

Over time, I convinced most of my creditors who never accepted credit cards to take AMEX. I even helped them work it out with their banks. As the years went by, AMEX continued to permit me to spend more and more on the card. Before long the monthly bill was in the hundreds of thousands of dollars.

The bill was paid in full each month

The bill was always paid off at the end of every month on time. We acquired other lines of trade credit because we paid the bill every month on time (with the AMEX card). Our credit built over time basically because of the AMEX card. By the time that I sold the company, we had a monthly bill with AMEX of about $200,000. The interest I I would have paid on that amount had it been borrowed over the years would have been significant. I literally built my business on this free credit.

Remember that “mitigating risk” statement

Remember what I said above about mitigating risk? Dave’s big concern for most people and he is right, taking on debt can be a bad thing. Taking on responsible debt, projects with a strong return on that debt can work for you. Borrowing to spend on vacations etc. is also not a good idea and I agree with Dave on that point. Save your money for vacations.

Obtaining debt to acquire tangible property where you can see and touch it can be a good move. Taking on debt for transitory things such as restaurant meals without funds to pay off the debt at the end of the month is not the correct way to utilize credit. Keep in mind that you actually should use your credit card for vacations and restaurants when you have funds to pay the bills at the end of the month. Earning points is an important step in wealth building.

Dave does not believe in buying gold or cryptocurrencies. I agree with him. Neither will ever build wealth for the average person. Cryptocurrencies are gambling at this point. I could be proved wrong in five years but I doubt it. Most of the people that I know who dabble in Crypto do so for fun, sport. Even the Chinese government thinks they are risky for their reasons and it’s probably the only point where I agree with them.

I have not learned how to mitigate risk with cryptocurrencies. The only way to make money with cryptocurrencies is to sell your coins to someone for more than you purchased them for. Sounds like a pyramid scheme from the 1970’s to me. Gold on the other hand while not the best investment is tangible. It will always have a value and you can sell it when you like.

Acquire “safer” equities

You can safely invest in the equities market if you acquire safe equities. Even the word “safe” is not quite accurate, buying Apple stock is safer than stuffing your mattress and better than Cryptocurrencies but stock is not without its types of risk. Most of us do invest through our 401k and IRAs into stocks and bonds.

Putting some of your wealth into those instruments is probably a safe bet in general as long as you diversify. I guess then the term “safer” should be used. As buying equities of big U.S. companies is “safer” than putting money under the mattress.

I prefer real estate. Real estate is also not without risks but you can minimize them. Remember that “mitigation” concept. You can develop it into a full-blown strategy to help prevent the worst from happening.

The basic issue that Dave tries to get across is, I believe, risk. Paying cash for what you buy is an excellent way of mitigating risk, probably the best. Unfortunately, most of us need to take some risk to make higher returns on our investments and this starts to deviate from Dave’s concepts. On risk, yes cash is an excellent mitigator but not taking risk is another are where I love Dave Ramsey but…..

Life would be easier if

Life would be easier if we could get a good job, make great money then decide what we wanted to accomplish. We create a plan and then turn everything over to a person like a parent who makes the mini-decisions for us and makes us stay with our budget. Years later, we have the things we wanted without any debt. Nice idea but not workable for most people.

Dave Ramsey and I have the same goal for ourselves and others, to achieve financial independence. Most people can not afford to hire financial advisors. This is where Dave’s advice comes in. He helps people think like financial planners.

We also agree on the fact that student loans are often taken without any consideration of the income the person will earn to pay them off. We again both agree that student loan debt should be paid off as part of the holistic planning process. Everyone should achieve financial freedom.

Two points of view

I hope that this article helps you understand at least two points of view when it comes to managing your money. Both actually work, the difference is in the timing. If you run your life strictly on what you can afford to buy with cash, things will be difficult for you. What happens when you need a credit card to rent a car at the airport? Dave’s theories are not that simple for many of us.

I know a person who can not handle any type of credit. He should listen to Dave. His life is already hard because he lives hand to mouth. Without a credit card to buy fuel between payments for his services, he is constantly “scrounging” for a few dollars. When he does a job for someone he wants them to come up with cash in a credit society. It’s hard for his customers.

Think how hard life would be if you had zero credit. Perhaps you do and that is why you are trying to sort out if Dave or my approach is best. Remember, that both approaches to live will work. Dave’s is harder but in the end the best if you have no discipline with money. If you do, use OPM as often as you can.

The wealthiest of people have gained success through the OPM strategy. In conclusion, I love Dave Ramsey but we disagree on the general use of credit. Dave does not differentiate between those who have the discipline to use OPM and those who do not. I suppose this is yet another are where I love Dave Ramsey but…

Learn more about Credit Cards

Thank you for reading this article. Click on this link for an article about using credit cards, you may find it interesting. This article will get you started with a great budget tool Click here. If you currently have credit issues, try this article about credit repair.

Check out our podcasts on similar topics by clicking here.

Please leave comments about this article below.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

Great article really gives you various points of view and in this world I think k we need that.

Thank you for your kind words.