Last updated on September 23rd, 2025 at 03:54 am

Inflation affects everyone—retirees, investors, workers, and families. Rising prices reduce the buying power of your money and can change how you save, spend, and invest. According to the Bureau of Labor Statistics, the Consumer Price Index has shown steady increases in recent years, making everyday essentials like food, housing, and transportation more expensive.

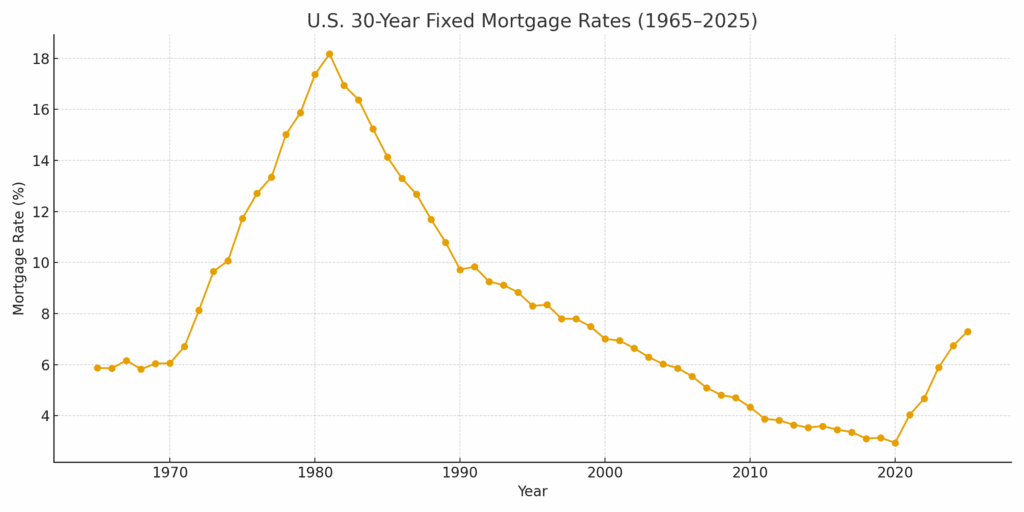

Even the Federal Reserve acknowledges inflation as one of the most important. Before I get to what Inflation is or what it will do for or to you, let’s first talk about some history. I bought a house years ago and paid 13% interest.

That was a bargain because just one year before that time, interest rates to buy a home was at 17%. These rates were a direct result of very high inflation which increased the cost of everything. 5.4% seems tame compared to the good old days of 15% inflation.

A Quick History of Inflation

I bought my first house decades ago and paid 13% interest. That seemed like a deal because just a year earlier mortgage rates had hit 17%—a direct result of double-digit inflation in the late 1970s and early 1980s.

By comparison, today’s rates and inflation seem tame, but even a 5%–7% annual increase erodes purchasing power much faster than people realize. This perspective helps explain why many older Americans remain cautious whenever inflation heats up.

Gen X vs. Millennials on Inflation & Homebuying

Many buyers expect mortgage rates to “go back to 3%.” History says that was an aberration. Use the chart above (1965–2025) to see how rare sub-3.5% rates were and why waiting for them may delay homeownership indefinitely.

Gen X (born 1965–1980)

Many Gen X buyers purchased in the late 1990s–2000s and refinanced during the ultra-low-rate decade. They remember double-digit rates from parents’ stories, but personally felt “normal” around 6–7%.

What to do:

- Prioritize a fixed-rate loan to lock payment stability.

- Consider a shorter term (20/15-year) if cash flow allows.

- Leverage equity into investment property as an inflation hedge.

Millennials (born 1981–1996)

Many set expectations during the 2012–2021 period. Waiting for 3% can be costly if home prices and rents keep rising faster than wages.

What to do:

- Run total cost scenarios (rate, taxes, insurance); use our budget calculator.

- Consider “buy now, refi later” if monthly payment fits a conservative budget.

- House-hack or buy a small multi-unit to offset payments with rent.

Key takeaway: Historically, 6–7% mortgages are closer to the long-run average. Rather than waiting for 3% to return, focus on buying well, managing cash flow, and letting time + amortization work for you.

Tip: If rates drop later, refinance. If they don’t, you’ll be glad you bought the payment you could afford while prices kept rising.

Millennials (born 1981–1996) have little or no memory of mortgage rates above 8%. Gen Xers who bought homes in the late 1990s or early 2000s recall rates in the 6% range. Millennials came of age during a period when 30-year mortgages dropped as low as 3% after the Great Recession and again during the pandemic.

That 3% era is what many people now use as a mental benchmark for “normal.” In fact, many Millennials remember their parents buying homes—or still holding mortgages—at rates in the 3% range. Understandably, this makes both cohorts reluctant to buy when rates hover around 6–7% today.

But here’s the reality: those ultra-low rates were an aberration. If you look at the historical data, average mortgage rates since 1965 tell a different story. The 1970s and early 1980s saw rates spike above 15% as inflation spiraled out of control. Even into the 1990s, homebuyers paid between 7% and 10%.

By comparison, today’s 6–7% range is close to the long-term average. The chart below illustrates just how unusual the 3% years were in the broader historical context.

📊 See the chart: U.S. 30-Year Fixed Mortgage Rates (1965–2025)

Understanding this history matters. If younger buyers wait for rates to “return” to 3%, they may be waiting forever. Housing affordability in an inflationary environment isn’t just about interest rates—it’s about wages, home prices, and long-term financial planning.

Buy Now vs. Wait — Mortgage Impact

Compare a purchase today with waiting for rates to change. The tool also projects a future home price based on your expected appreciation. (Tip: Historically, 6–7% mortgages are closer to the long-run average—sub-3.5% was an aberration.)

Why this matters: Many Gen X and Millennial buyers anchor to 3% mortgages, but that period was an aberration. See our historical mortgage-rate chart (1965–2025) to understand how rare sub-3.5% was.

Root Causes of Inflation

Government policies can powerfully influence inflation. When spending grows far faster than the real economy and large amounts of liquidity enter households and businesses (via direct payments, subsidies, or ultra-easy credit), demand can surge faster than supply.

The COVID period is a clear example: massive transfers and stimulus put cash into the system while factories, logistics, and labor were constrained. The result was too much money chasing too few goods—a classic recipe for rising prices.

Four primary drivers (and how policy interacts)

- Demand-pull inflation: Aggregate demand exceeds the economy’s capacity to produce. Policies that boost spending (stimulus checks, expanded benefits, easy credit) can intensify demand-pull forces.

- Cost-push inflation: Input costs (energy, wages, materials, insurance, shipping) rise and businesses pass them on. Regulations, tariffs, or supply disruptions can amplify cost pressures.

- Monetary conditions & expectations: Prolonged low interest rates and rapid money/credit growth can fuel risk-taking and price pressure. If households and firms expect inflation, they accelerate purchases and push for higher wages, embedding inflation.

- Supply shocks: Wars, pandemics, natural disasters, and bottlenecks (ports, chips, housing) restrict supply. Even neutral policy can’t immediately fix sudden shortages, so prices jump.

Why stimulus can be inflationary

Large, rapid transfers raise household balances and spending power. If supply is constrained—because of labor shortages, factory shutdowns, or broken logistics—prices adjust upward to clear the market. That’s why the same dollar bought less after the COVID stimulus than before: demand snapped back faster than supply could. Inflation affects everyone.

Inflation is cumulative (it compounds)

Inflation doesn’t “reset” each year; the price level builds on itself. For example, if prices rise 2% in Year 1, 6% in Year 2, and 9% in Year 3, the compounded increase is:

(1.02 × 1.06 × 1.09) − 1 = 17.85%

That’s why even “moderate” annual increases can significantly erode purchasing power over just a few years.

Want the long view? Check out our companion table with the annual U.S. inflation rate for the past 60 years to see how today compares to history.

Annual U.S. Inflation Rate — Last 60 Years (1966–2025)

Values are the BLS CPI-U percent change from previous year (annual average). You can edit any cell to reflect revisions, export CSV, and compute cumulative inflation between any two years.

Cumulative formula: (1 + y₁/100) × (1 + y₂/100) × … × (1 + yₙ/100) − 1

| Year | Rate (%) | Notes |

|---|

Sources: BLS Historical CPI-U tables (percent change from previous year, annual average). See “Historical CPI-U: U.S. city average, all items, index averages.” Values through 2023 are official; 2024–2025 rows are blank pending final BLS annual averages.

Who Wins and Who Loses in Times of Inflation

Retirees on Fixed Incomes

If you’re living off Social Security or a pension, inflation can hit hard. When groceries, insurance, and gas climb each year but your income rises slowly—or not at all—your real standard of living shrinks. For example, a retiree living on $2,000 a month will lose $108 of buying power annually if inflation is 5.4%.

👉 Related reading: Retiree Tax Strategies: How to Keep More of Your Income

Borrowers with Fixed-Rate Debt

Borrowers often benefit from inflation. If you have a 30-year fixed-rate mortgage, your monthly payment remains the same while your income may rise. Over time, you’re effectively paying off your debt with “cheaper” dollars.

Savers and Lenders

Savers with large amounts of cash in low-interest accounts lose purchasing power. Similarly, lenders stuck with fixed-rate loans may receive less real value back than they loaned out.

Investors and Property Owners

Owning assets that rise in value—like real estate, stocks, or even rental property—can protect your wealth during inflation. Property values and rental income often climb faster than inflation.

👉 Related reading: Buying a First Investment Property: A Complete Guide

Why Inflation Feels Like a Tax

Economists often call inflation a “hidden tax.” That’s because it disproportionately hurts lower-income households that spend a higher share of their earnings on necessities. Unlike a progressive tax that scales with income, inflation cuts across the board—raising the cost of food, housing, and energy for everyone. Inflation affects everyone.

Corporations facing higher costs may raise prices, which means consumers ultimately bear the burden. Governments add to the problem when deficit spending increases the money supply, which can debase the currency.

👉 Related reading: Moving to Mississippi Can Reduce Your Cost of Living

Everyday Examples of Inflation

- Groceries: A gallon of milk that cost $3.50 might now cost $4.25.

- Housing: Rising construction costs increase both rents and home prices.

- Insurance: Home and auto insurance premiums climb as repair and replacement costs rise.

- Fuel: Gasoline prices are often the most visible signal of inflation for households.

Strategies to Protect Yourself from Inflation

- Own Real Assets: Real estate, rental properties, and commodities often rise with inflation.

- Invest in Equities and REITs: Stocks and real estate investment trusts can provide inflation-adjusted returns.

- Lock in Fixed-Rate Debt: Borrowing at today’s fixed rates means paying back loans with cheaper dollars.

- Budget Realistically: Adjust spending and anticipate higher recurring costs.

- Diversify Income: Side businesses, dividend stocks, or rental income can provide inflation protection.

Final Thoughts

Inflation affects everyone, but how you prepare determines whether you’re a winner or a loser in the process. By understanding how inflation impacts different parts of your life—retirement, investments, and everyday expenses—you can take smart steps to protect your money.

Inflation: Top 10 Questions Answered

1) What does “inflation affects everyone” actually mean?

2) What causes inflation?

3) How is inflation measured?

4) Why do retirees feel inflation more?

5) Are 3% mortgage rates normal?

6) Who tends to win or lose during inflation?

7) What investments can help during inflation?

8) How should I budget when inflation is high?

9) Does relocating help offset inflation?

10) What are my first steps today?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.