Last updated on November 21st, 2025 at 06:20 pm

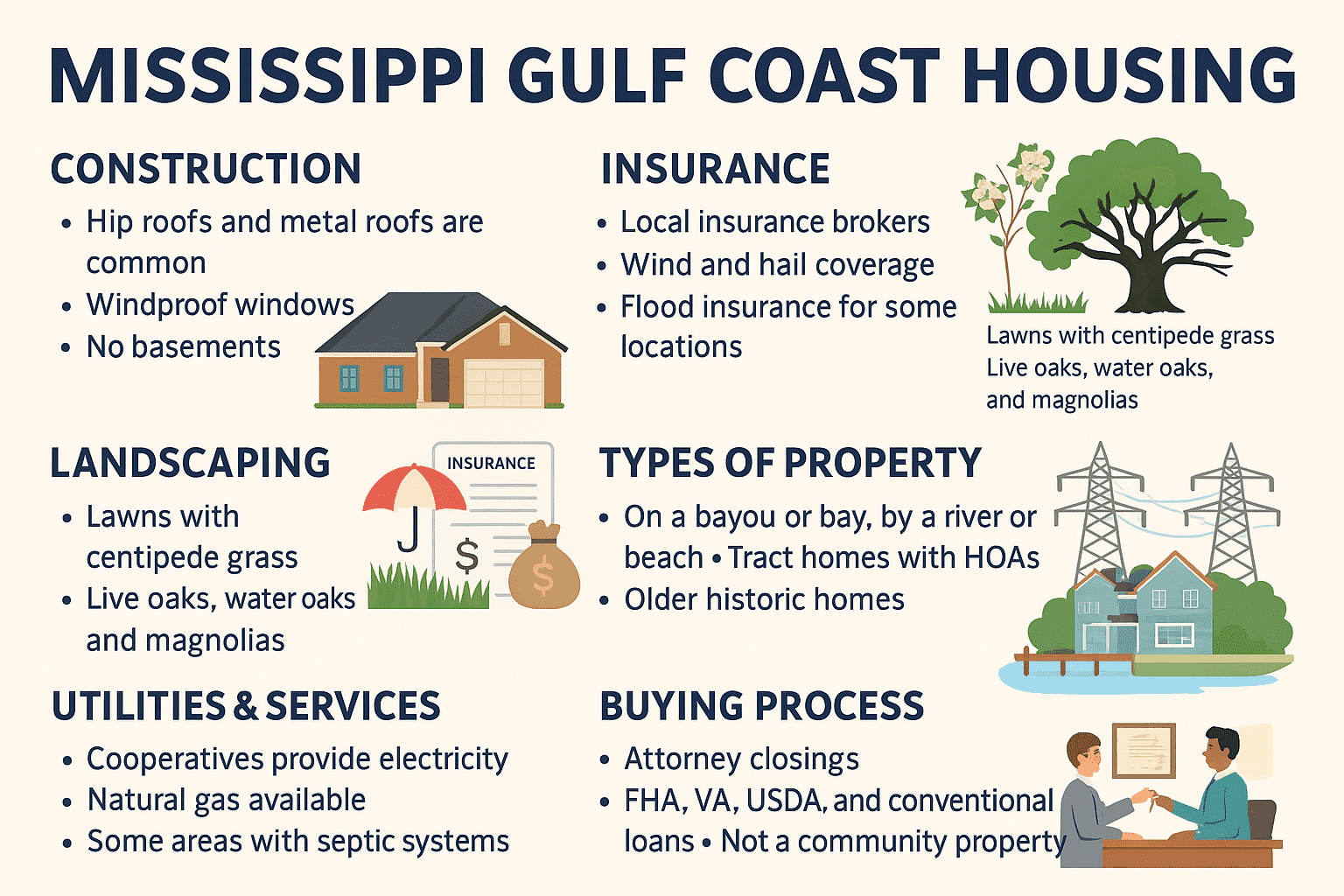

If you’re considering Mississippi Gulf Coast housing, you’ll quickly discover that homes here are different from what you may be used to in other parts of the country. From the way properties are landscaped to how roofs are built, the Gulf Coast has unique features shaped by its climate, soils, and storm history.

Not only are homes built differently than in many areas of the nation, but landscaping is also unique. For example, basements are virtually nonexistent here due to the high water table. Roof styles, siding choices, and open yards all reflect life on the Coast.

Landscaping on the Mississippi Gulf Coast

Unlike the xeriscaped yards of the Southwest, Mississippi Gulf Coast homes often feature green lawns and lush gardens. The region receives enough rainfall to keep most vegetation watered naturally.

- Lawns: Centipede grass is the most common, thriving with little care.

- Gardening: Azaleas, camellias, citrus, magnolias, and live oaks grow well in the local climate.

- Forest Legacy: Before settlement, the Coast was covered with pine forests and hardwoods. Many properties today still have large trees, adding shade and beauty.

If you enjoy gardening, the Gulf Coast is a paradise for homeowners. Read more: Landscaping is Cathartic and Best Flowers: Azaleas and Camellias.

Cost of Housing on the Mississippi Gulf Coast

The cost of Mississippi Gulf Coast housing is among the lowest in the country. Homes can cost 40–60% less than in Orange County, California, or Cook County, Illinois. Lower home prices also mean lower property taxes.

Comparison of Housing Costs

| Location | Median Home Price* | Effective Property Tax Rate** | Estimated Annual Taxes |

|---|---|---|---|

| Mississippi (state average) | ~$190,755 | ~0.76% | ≈ $1,450 |

| Orange County, CA | ~$1,400,000 | ~0.69% | ≈ $9,600–$10,000+ |

| Cook County, IL | ~$300,000 | ~2.07% | ≈ $6,000+ |

Prices fluctuate, but the relative difference has stayed consistent over time.

Style and Construction

Mississippi Gulf Coast homes are built with storms and climate in mind.

Roofs and Materials

- Hip Roofs: Sloped on all sides, reducing uplift in hurricanes.

- Gable Roofs: Common nationwide, but more vulnerable here without reinforcement.

- Metal Roofs: Gaining popularity near the water for durability and wind resistance.

- Asphalt Shingles: Standard nationwide, but less storm-resistant.

- Roof Straps & Impact Windows: Newer homes must include roof straps, and many feature windproof glass for safety.

Siding and Elevation

Brick, vinyl, and hardboard are common siding materials; stucco is rare. Near waterways, homes may be elevated on pilings to meet flood insurance requirements.

Fences

Unlike suburban neighborhoods elsewhere, Mississippi Gulf Coast housing often features open yards. Privacy fences are less common, and decorative picket fences remain a classic choice.

Types of Property

The variety of Mississippi Gulf Coast homes is impressive:

- Waterfront: Bayou, river, bay, or beachfront properties with docks and boating access.

- Inland: Small farms, pond-front homes, and multi-acre estates just minutes from the beach.

- HOA Communities: Tract homes in subdivisions with sidewalks and amenities.

- Historic Homes: From 1800s cottages to mid-century ranches.

- New Construction: Modern, storm-resistant homes in growing developments.

Whether you want a cottage, condo, or custom estate, Mississippi Gulf Coast housing offers endless choices.

Housing Market Overview

The Mississippi Gulf Coast housing market is balanced, with a steady supply of homes. Buyers find the Coast more affordable and less congested than Florida, with plenty of options from Bay St. Louis to Ocean Springs.

Utilities and Services

Utilities are reliable and generally affordable:

- Gas & Water: Natural gas in most neighborhoods; propane and wells in rural areas.

- Sewer: Public sewer in most areas; septic tanks in the countryside.

- Electricity: Provided by cooperatives, keeping rates low.

Mississippi State Energy Profile

Quick Facts:

- The Grand Gulf Nuclear Power Station is the largest single-reactor nuclear plant in the U.S., generating 16% of Mississippi’s electricity.

- The state has one-fourth of the U.S. natural gas storage capacity in underground salt caverns.

- The Pascagoula refinery processes 356,000 barrels of oil daily.

- Natural gas powers 76% of Mississippi’s electricity.

- Mississippi has low gasoline prices, though consumption is high.

- Mississippi is a net exporter of electricity, unlike California, which imports power.

The Buying Process on the Mississippi Gulf Coast

Closing on a home works differently across the U.S., and if you’re new to Mississippi Gulf Coast housing, the process may surprise you.

- Closings:

- In the Western states, closings are typically handled at an escrow office where the buyer and seller never meet.

- In much of the Midwest and East, closings are done at an attorney’s office.

- On the Mississippi Gulf Coast, all parties meet in person at the attorney’s office, often sitting across the table from each other as documents are signed and funds exchanged. This face-to-face process can feel more personal and direct than in many other states.

- Financing Options:

Buyers here have access to FHA, VA, USDA, and conventional loans. Many areas along the Gulf Coast qualify for USDA loans, which—like VA loans—offer the option of no down payment for eligible buyers. This makes homeownership even more accessible. - Ownership and Title:

Mississippi is not a community property state, which means spousal rights differ from those in states like California or Texas. Most married couples choose to have both names placed on the deed to simplify ownership and inheritance.

Property Taxes on the Mississippi Gulf Coast

Property taxes in Mississippi are relatively low compared to most states, which makes the Mississippi Gulf Coast housing even more affordable.

- Payment Schedule: Taxes are paid in arrears and are due no later than February 1 each year.

- Homestead Exemption: Owner-occupants can apply for a reduction in property taxes.

- Senior Exemption: Homeowners age 65 and older receive a $75,000 reduction in assessed value on their primary residence.

- Disabled Veterans: Homeowners who are 100% disabled veterans pay zero property taxes on their primary residence.

Tax Rates and Assessment

- The average effective property tax rate on the Mississippi Gulf Coast is between 0.7% and 1% of the actual market value of the home.

- Counties are required to review property values and tax rates at least once every four years.

- Historically, Mississippi has used a millage-based system (a formula tied to assessed values), but counties are shifting toward a system more directly tied to market value assessments.

These exemptions and relatively low tax rates make Mississippi especially attractive to retirees, veterans, and anyone relocating from high-tax states.

📊 Property Tax Comparison

| Location | Average Effective Tax Rate | Notes |

|---|---|---|

| Mississippi Gulf Coast | 0.7% – 1.0% | Low rates; senior and homestead exemptions; 100% disabled veterans pay no property tax. |

| California | ~0.69% | Prop 13 limits increases, but high home values keep bills large. |

| Illinois (Cook County) | ~2.07% | One of the highest tax rates in the nation, especially around Chicago. |

Mississippi counties review and update property values at least every four years. The system is shifting from a millage-based formula to one more directly tied to market value.

Insurance

Insurance is one of the biggest considerations in Mississippi Gulf Coast housing.

- Inland homes: $1,300–$2,000 per year.

- Coastal homes: $3,000–$5,000 per year.

- Flood insurance: $1,000+ annually in AE or velocity zones.

💡 Important Insurance Tip

Always work with a local insurance broker. National carriers often don’t provide the wind and hail coverage required in coastal counties. A broker can secure a complete package.

Flood insurance is mandatory in AE zones or velocity zones. Even if optional, many buyers choose it for protection.

👉 Read more: Property Insurance Rates Going Up

Waterfront Living on the Mississippi Gulf Coast

Some of the most beautiful Mississippi Gulf Coast homes are located on the water. These properties are generally more expensive than inland homes, but compared to waterfront housing in other states, they are still a remarkable bargain.

For example, you can buy a waterfront home for about $500,000 on a bay in Biloxi, while a similar-sized home on the water in Orange County, California, could cost several million dollars. The Gulf Coast offers the same stunning views, boating access, and lifestyle benefits at a fraction of the cost.

Things to Consider Before Buying Waterfront Property

- Insurance Costs: Always factor in the cost of flood insurance plus wind and hail coverage. These policies are often required by lenders and can significantly affect your budget.

- Deep Water Access: If you plan to keep a boat, confirm that the water remains deep enough for navigation even at low tide. Listings that mention “deep water homes” usually mean you can take a boat out at any time.

- Boat Maintenance: Don’t leave your boat in the water for long periods. Salt and brackish water quickly attract barnacles, which damage hulls and props. Most owners use a boat lift or remove their boat after each trip.

- Flood History: Ask your real estate agent to check whether the property has a history of flooding. Even if a home is in an “X” flood zone (low risk), it’s wise to know the local patterns.

Why Waterfront Living is Worth It

Mississippi’s waterfront homes combine affordability, natural beauty, and lifestyle. Whether you choose a bayou with a private dock, a home on the Biloxi Bay, or a cottage along the Pascagoula River, you’ll enjoy a lifestyle that is out of reach in many other states.

✅ What to Verify Before You Make an Offer (Waterfront)

Insurance & Risk

Water, Depth & Access

Permits, Zoning & Associations

Property Condition (Storm-Ready)

Numbers & Documents

Tip: Use a local insurance broker and a local marine contractor (for docks/lifts/bulkheads) to validate costs and permits before finalizing your offer.

Buying vs. Renting on the Mississippi Gulf Coast

All signs point to buying often being the better long-term financial choice on the Mississippi Gulf Coast. Rents have climbed quickly: a 3-bedroom that rented for about $1,000/month three years ago can now be $1,600–$1,800/month. If you’re moving from a higher-cost market, local rents may still look low—but when you put 20% down on a home, your monthly payment can be comparable to (or better than) renting, while building equity.

Example Comparison (Illustrative)

The figures below are ballpark and will vary by address, lender, insurance quotes, and taxes. They’re designed to help you frame the decision.

Sample 3-Bedroom Scenario — Buy vs. Rent

| Assumption | Inland Purchase | Coastal Purchase | Renting |

|---|---|---|---|

| Home Price | $250,000 | $250,000 | — |

| Down Payment (20%) | $50,000 | $50,000 | — |

| Loan Amount | $200,000 | $200,000 | — |

| 30-yr Principal & Interest* | $1,135–$1,400/mo | $1,135–$1,400/mo | — |

| Property Taxes (~0.7%–1.0%) | $145–$210/mo | $145–$210/mo | Included in rent |

| Homeowners Insurance | ~$110–$170/mo (inland) | ~$250–$420/mo (coastal, wind/hail) | Included in rent |

| Flood Insurance (if required) | Often $0 for many inland X-zones | ~$80–$150/mo typical AE/velocity | Included in rent |

| Estimated Monthly Total (Buyer) | ~$1,390–$1,780 | ~$1,610–$2,180 | ~$1,600–$1,800 (current market) |

*Principal & interest range reflects typical mortgage rate swings; your lender quote will determine the exact payment. Figures are illustrative, not offers.

How to Use This

- Run the numbers on specific addresses. Get quotes for wind/hail and flood (if applicable) from a local broker and confirm the tax estimate with the county.

- Compare to the current rent. If the total monthly PITI (Principal, Interest, Taxes, Insurance) is similar to rent, buying often wins because you’re building equity and can benefit from potential appreciation.

- Think long-term. Rents tend to rise over time; a fixed-rate mortgage keeps your principal & interest steady.

Final Thoughts

The Mississippi Gulf Coast housing market blends affordability, variety, and a relaxed coastal lifestyle that’s hard to find elsewhere. From hip-roof, storm-ready homes to historic cottages shaded by live oaks—and from bayou docks to acreage just minutes inland—you can match your budget to the lifestyle you want.

Keep three things front and center as you shop: insurance (wind/hail and, where applicable, flood), property taxes (low effective rates with senior and homestead exemptions), and construction details (roof straps, impact windows, elevation).

Work with a local real estate professional, a local insurance broker, and (if you’re waterfront) a local marine contractor to verify depth, permits, and costs. Do that, and you’ll be set up to enjoy the value, the views, and the everyday ease that make the Coast special.

Mississippi Gulf Coast Housing — FAQs

1) Why are basements rare on the Mississippi Gulf Coast?

2) What roof types perform best in coastal wind?

3) Do I really need flood insurance if I’m not “on the beach”?

4) How do property taxes compare to other states?

5) Who should I call for homeowners insurance?

6) Is it cheaper to buy than to rent right now?

7) What types of properties can I find on the Coast?

8) Why do so many yards have centipede grass and few front fences?

9) How do closings work on the Mississippi Gulf Coast?

10) What should waterfront buyers verify before making an offer?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.