Life doesn’t usually fall apart all at once.

It’s the small stuff that causes the most stress.

A flat tire.

A medical copay.

A laptop that suddenly dies.

A few weeks between paychecks.

An “Oops” fund is emergency cash for exactly those moments—so a minor surprise doesn’t turn into a financial emergency.

And here’s the part most people underestimate:

Even $500 can change how stressful money feels.

- What Is an “Oops” Fund?

- Why Even $500 Makes a Real Difference

- Common Myths That Stop People From Starting

- Step-by-Step Emergency Fund Starter Plan

- Short Quiz

- How to Fund Your Oops Account Without “Finding” Money

- When to Use (and Not Use) Your Oops Fund

- How Big Should Your Emergency Fund Eventually Be?

- The Hidden Benefit: Confidence and Optionality

- Common Mistakes to Avoid

- Case Study: How Andre’s Oops Fund Did Exactly What It Was Supposed To Do

- Emergency Fund Starter Plan →

- FAQ

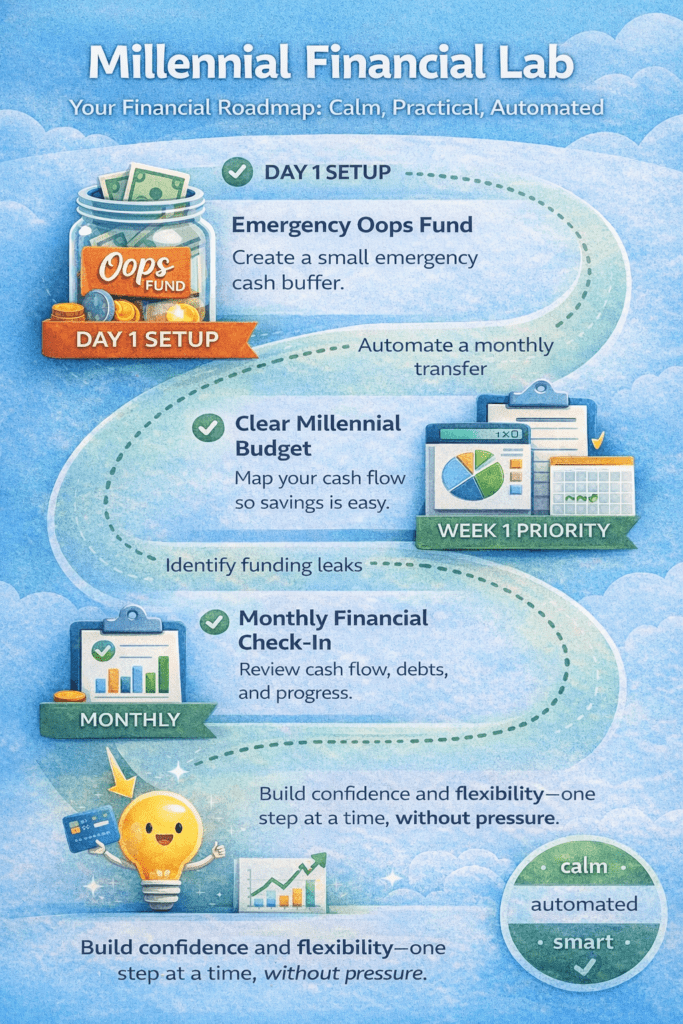

You don’t need a perfect plan to get started. In your first day inside the Millennial Financial Lab, focus on just one system: your emergency cash.

-

Choose your setup

Decide between the Beginner option (one savings account) or the Advanced option (money market + Roth IRA). -

Open the account(s)

This can usually be done online in 10–15 minutes. -

Pick a monthly amount

Start with what’s comfortable—even $25 or $50 works. -

Automate the transfer

Set it once. Add it to your budget as a fixed expense. -

Stop thinking about it

Your Oops fund now grows quietly in the background.

Completing this step alone puts you ahead of most people—because you’ve created a buffer between life and financial stress.

What Is an “Oops” Fund?

An Oops fund is a small, separate cash savings account designed to handle everyday surprises.

It’s not:

- A vacation fund

- An investment account

- A long-term savings goal

It is:

- A buffer between you and panic

- A way to avoid credit cards for emergencies

- A confidence booster when life throws a curveball

Calling it an “Oops” fund matters. It reframes saving as practical—not intimidating.

You can build your Oops fund using a traditional savings account, a higher-yield money market account at a brokerage, or a combination of both.

I suggest using two accounts—not to complicate things, but to give you flexibility and interest income.

First, open a money market account at a brokerage firm such as :Charles Schwab. Set your regular bank account to automatically send funds there each month.

Second, open a Roth IRA and keep a portion of your emergency savings there as it grows. In a true emergency, you can transfer money from the Roth IRA into your money market account. From there, funds can typically be sent electronically back to your bank account within about two days.

The advantage of this setup is long-term: continue contributing to the Roth IRA. Any growth inside a Roth IRA is never taxed, which gives your emergency savings a powerful secondary benefit over time.

Why Even $500 Makes a Real Difference

$500 doesn’t solve everything—but it solves enough.

It can cover:

- A car repair or tow

- A medical or dental copay

- Emergency travel

- A short income gap

- A critical home repair

More importantly, it buys time and options.

With emergency cash on hand, you’re no longer forced into high-interest debt or rushed decisions. You move from panic mode to problem-solving mode.

Common Myths That Stop People From Starting

“I don’t make enough yet.”

That’s exactly when a buffer matters most.

“I’ll start after my debt is gone.”

Emergencies don’t wait for debt-free milestones.

“$500 won’t be enough anyway.”

True—but it’s enough to stop the bleeding.

Waiting for the “perfect” time often costs more than starting small.

- One separate savings account

- Automated monthly transfer

- Easy access, low stress

Best if you’re just getting started or want maximum simplicity.

- Money market account at a brokerage

- Roth IRA for long-term, tax-free growth

- Emergency access with a short transfer delay

Best if you want interest income, flexibility, and future upside.

Step-by-Step Emergency Fund Starter Plan

Step 1: Choose the Right Place for Your Oops Fund

Open a separate savings account used only for emergency cash.

Look for:

- Easy access when needed

- Separation from daily spending

- No temptation to dip into it casually

The goal is visibility without friction.

Step 2: Set a Micro Goal (Not the Final Goal)

Forget “3–6 months of expenses” for now.

Start with:

- $250

- Then $500

- Then one month of essentials

Small milestones create momentum. Momentum builds habits.

Step 3: Automate the Process

Automation beats motivation every time.

Decide on an amount you can comfortably afford—even if it feels small.

Weekly, bi-weekly, or monthly all work. The schedule matters less than consistency.

Step 4: Automate Your Oops Fund With a Separate Savings Account

One of the easiest ways to build your emergency fund is to open a separate savings account just for your Oops fund.

Set up a monthly transfer from your checking account for what you can afford—for example, $50 per month.

Add this transfer to your budget as a fixed expense, just like rent or utilities.

At $50 per month, you’ll have a $500 emergency fund in just 10 months—without reminders, willpower, or constant decision-making.

Once it’s set up, the fund grows quietly in the background.

- Choose your emergency fund setup (Beginner or Advanced)

- Open the correct savings or money market account

- Set up an automated monthly transfer

- Add the transfer to your budget as a fixed expense

This step creates immediate financial breathing room—even before long-term goals.

Short Quiz

How to Fund Your Oops Account Without “Finding” Money

Use a Budget to Find Leaks

One of the most effective ways to fund your emergency savings is to create a clear, realistic budget.

Use our Millennial Budget to comb through all of your expenses—subscriptions, fees, and small recurring charges that often go unnoticed.

Many people discover they already have enough monthly “leaks” to fully fund their Oops account without cutting essentials or changing their lifestyle.

Redirecting money you’re already spending is often easier than saving new money.

Other Easy Funding Sources

- Tax refunds or bonuses

- Side income or irregular pay

- Cash-back rewards

- Rounding up spare change

The source matters less than consistency.

When to Use (and Not Use) Your Oops Fund

Use it for:

- True, unexpected expenses

- Things that must be paid now

- Situations that would otherwise cause debt

Don’t use it for:

- Planned expenses

- Lifestyle upgrades

- “Good deals” or impulse buys

After using it, simply restart your automation and rebuild.

That’s how the system stays strong.

How Big Should Your Emergency Fund Eventually Be?

The classic advice—3 to 6 months of expenses—is a destination, not a starting point.

Your ideal size depends on:

- Job stability

- Household size

- Health considerations

- Income variability

The progression matters more than the endpoint.

The Hidden Benefit: Confidence and Optionality

An Oops fund does more than protect your bank account.

It gives you:

- Confidence to say no

- Flexibility to handle change

- Less reliance on credit cards

- More control over your decisions

Emergency cash creates breathing room—and breathing room changes behavior.

Common Mistakes to Avoid

- Keeping emergency cash in risky investments

- Mixing it with everyday spending

- Stopping contributions once you hit $500

- Feeling “behind” instead of building momentum

Progress beats perfection.

Case Study: How Andre’s Oops Fund Did Exactly What It Was Supposed To Do

Andre didn’t think of himself as “bad with money.”

He paid his bills on time, avoided overdrafts, and tried to save when he could. But like a lot of people, his savings lived in the same account as everything else—and it never seemed to grow.

After running his numbers with a budget, Andre realized something important:

his monthly cash flow was tight, but not broken. There were a few variable expenses—car maintenance, medical copays, and irregular work expenses—that kept knocking him off balance.

So Andre decided to try a simple experiment.

He opened a separate savings account and set up an automatic transfer of $50 per month. He labeled it his Oops Fundand added the transfer to his budget like any other bill.

Ten months later, his Oops fund quietly hit $500.

A few weeks after that, Andre’s car wouldn’t start. The repair came out to just under $400—exactly the kind of expense that used to go straight onto a credit card.

This time, he paid for it from his Oops fund.

There was no panic, no juggling bills, and no lingering balance to pay off with interest. Andre restarted his automatic transfer the next month and began rebuilding the fund without changing anything else.

What surprised him most wasn’t the money—it was the feeling.

Having the Oops fund didn’t make Andre rich.

It made him calm.

For the first time, a financial surprise stayed just that: a surprise, not a setback.

Emergency Fund Starter Plan →

You don’t need a perfect budget or a big paycheck to start.

Start with:

- A separate savings account

- A small automated transfer

- One realistic goal

Even $10 is a start.

Set it up once—and let your Oops fund quietly do its job in the background.

If you’re wondering why even a small emergency fund matters, the Conumer Financial Protection Bureau https://www.consumerfinance.gov/consumer-tools/emergency-fund/ explains how having dedicated emergency savings helps households avoid high-cost debt when surprises hit. Recent research from the Federal Reserve: https://www.federalreserve.gov/publications/2023-economic-well-being-of-us-households-in-2022.htm also shows that many U.S. households would struggle to cover an unexpected expense, which is exactly why planning ahead with a budget and an Oops fund can reduce stress and improve financial stability.

Use the Millennial Budget Calculator to uncover expense leaks and find a realistic amount you can automate into your emergency fund—without changing your lifestyle.

Try the Millennial Budget CalculatorPart of the Millennial Financial Lab

FAQ

1) What is an “Oops” fund?

2) How much should I save first?

3) What’s the best way to build it fast?

4) Should my Oops fund be in checking or savings?

5) Savings account vs money market account—what’s the difference?

6) When should I use my Oops fund?

7) What do I do after I use it?

8) How do I find money to fund it if my budget is tight?

9) Is it okay to use a Roth IRA in an emergency?

10) What’s the next step after my Oops fund is automated?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.