Owning a home is one of the largest financial commitments most people will ever make, yet many homeowners underestimate the ongoing responsibility required to protect that investment. Homeownership is not just about paying a mortgage—it is about continuous maintenance, planning for inevitable repairs, understanding how insurance companies view your home, and staying ahead of both deterioration and rising costs. Effective home maintenance planning helps homeowners protect property value, reduce insurance risk, and turn unpredictable repairs into manageable monthly expenses.

Homes Age Whether We Want Them To or Not

Homes age whether we want them to or not. Systems wear out. Exterior elements deteriorate. Insurance standards tighten. The homeowners who experience the least stress are not lucky—they are prepared. Proper maintenance is not just about appearance; it protects your home’s value, reduces emergencies, lowers insurance risks, and ensures safety.

New homeowners often assume that newer homes require minimal maintenance, but even the best-built home begins to age immediately. Paint fades, fasteners loosen, caulking shrinks, concrete cracks, and roofs begin their life cycle countdown the moment they are installed. Understanding—and planning for—these realities is the key to responsible homeownership.

Homeowners who want additional guidance on ownership responsibilities and long-term planning can also review consumer resources provided by the Consumer Financial Protection Bureau.

This article explains why maintenance matters, how insurance companies really think, why entropy makes ongoing care unavoidable, and how you can convert large, unpredictable repairs into a manageable monthly plan using the Home Maintenance Budget Calculator.

Why Home Maintenance Is Not Optional

Regular home maintenance preserves value, improves safety, prevents unexpected failures, and avoids the “snowball effect” where a small problem turns into a major repair. Deferred maintenance is one of the biggest financial risks for homeowners. A $200 repair today can easily become a $2,000 emergency tomorrow.

Older homes, coastal properties, and homes surrounded by mature trees require even more attention. But even brand-new homes need maintenance. The belief that new homes are “maintenance-free” is not realistic over the long term.

Neglected maintenance can also directly impact insurance coverage. Many homeowners are surprised when their insurer requires a roof replacement, tree trimming, electrical upgrades, or other repairs as a condition for continued coverage.

If you haven’t seen it, RetireCoast has a helpful breakdown of how landscaping and tree neglect affects insurance:

👉 https://retirecoast.com/trim-your-trees-now-or-lose-homeowners-insurance-coverage/

Homeowners Insurance, Inspections, and Reality

Insurance companies expect homeowners to maintain their homes. Today, insurers use:

- Aerial roof inspections

- Satellite imagery

- Automated property-condition databases

- Drive-by inspections

- Claims history modeling

If your property shows signs of deterioration, they may:

- Increase premiums

- Exclude certain types of coverage

- Require repairs before renewal

- Cancel or non-renew the policy altogether

This is especially true for roofs, exterior surfaces, trees, and out-of-date systems.

Insurance companies increasingly rely on the homeowner’s maintenance habits as a predictor of risk. Even when they pay a claim, future premiums may rise. In other cases, they may only pay a partial replacement cost using depreciation—especially for items that have exceeded their expected useful life.

Home warranties also use depreciation and exclusions, often paying far less than homeowners expect. For many people, a better strategy is planning and saving, not relying on warranty loopholes.

From an insurer’s perspective, consistent home maintenance planning lowers claim risk and signals responsible ownership.

Case Study: Planning Ahead Prevented an Insurance Cancellation

Susan and Brian purchased a 1970s home a few years ago, fully aware that the roof was in poor condition. Their real estate agent warned them that the insurance company would eventually catch up with them and either drop roof coverage or cancel the homeowners insurance unless the roof was replaced.

Brian called multiple roofing companies and compared experience, service quality, and pricing. The best quote came in at $16,000. Even though the roof was aging, Susan believed they could delay replacement for about three more years.

Instead of ignoring the problem, they entered the total roof replacement cost into their home maintenance budget. Dividing $16,000 by 36 months told them they needed to save approximately $445 per month—a number they could reasonably afford.

Three years later, just as they contacted their chosen roofer to begin the job, they received a call from their insurance broker. A recent aerial inspection by the insurance company flagged the roof as unacceptable and issued a warning: replace it immediately or lose wind and hail coverage—possibly followed by full policy termination.

Fortunately, Susan and Brian had saved the full amount. The roof was installed promptly, the roofer supplied photographic documentation, and their insurance broker confirmed that the policy was safe.

Planning ahead turned what could have been a crisis into a routine project.

Case Study: When a Small HVAC Repair Became a Costly Insurance Claim

Bill and Zooey also learned the hard way about delaying maintenance. They owned a home with an aging HVAC system. During an inspection, they noticed a loose wire inside the outdoor compressor unit—very close to the metal housing.

They called an HVAC technician, who confirmed the issue and explained that it could be repaired for $250. He warned that if the wire contacted the housing, it could short out the compressor motor.

They procrastinated.

On a cold, windy day, the loose wire shifted and struck the metal housing. The compressor motor shorted out, and the entire HVAC system stopped working.

Their insurance company agreed to cover the repair—but their deductible was $1,000, four times the cost of the initial fix. Worse still, the compressor was on backorder, leaving them without a fully functional HVAC system for months.

Six months later, their homeowners insurance renewal increased due to the recent claim.

A simple $250 repair turned into a $1,000 deductible, months of inconvenience, and a long-term premium increase.

Entropy: Why Everything in Your Home Requires Constant Maintenance

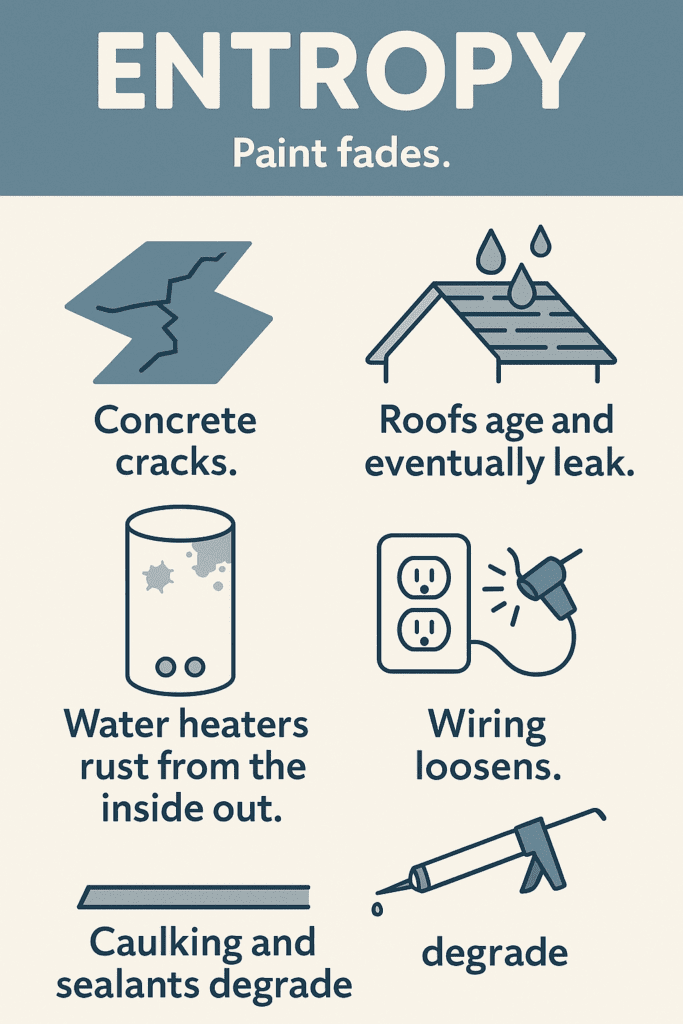

The term entropy, often discussed in physics classes, is not something most people think about daily. Yet entropy applies to homes better than almost anything else.

Entropy means that everything naturally moves toward disorder unless energy is put in to maintain it.

That is the story of homeownership.

Paint fades.

Concrete cracks.

Roofs age and eventually leak.

Water heaters rust from the inside out.

Wiring loosens.

Caulking and sealants degrade.

Appliances fail.

Even when you buy a brand-new home, thinking that it requires no maintenance is not a viable long-term strategy. Entropy teaches us that everything requires ongoing attention.

The moral of the story is simple:

You cannot stop entropy, but you can stay ahead of it.

This is why the concept of preventative maintenance is so important. Addressing small issues before they become major failures is the key to minimizing cost and stress.

In the HVAC case study above, a loose wire led to a major failure. Had I encountered a similar situation, I would have immediately secured the wire with electrical tape as a temporary safety measure and called a contractor for proper evaluation and repair.

Entropy makes home maintenance planning essential, because deterioration never pauses—even in well-built or newer homes.

Every dollar spent on preventative maintenance can reduce or delay far more expensive replacements. The $750 difference between repairs and insurance deductible could have gone into their maintenance savings plan—directly into the fund for the next major HVAC replacement.

Smart Projects That Protect Value and Reduce Risk

Some home upgrades and maintenance tasks deliver strong returns in safety, home value, and insurance protection. Consider reviewing these resources:

👉 Smart Home Projects That Add Value

https://retirecoast.com/smart-home-projects-that-add-value/

* Best Tools & Tips for Trimming Trees and Shrubs

https://retirecoast.com/best-tools-tips-trimming-trees-shrubs/

👉 Why Seniors Need a Handyman for Home Repairs Now

https://retirecoast.com/why-seniors-need-a-handyman-for-home-repairs-now/

Solar Panels Are Not Maintenance-Free

Many consumers believe solar panels require no maintenance at all. That’s not accurate. Dust, pollen, salt spray, leaves, and debris reduce the efficiency of solar panels significantly if they are not cleaned periodically.

Cleaning must be done safely. Roofs are slippery, and solar panels can be dangerous if handled improperly.

If you have any concerns about safety, hire a professional cleaning service.

Learn more:

👉 Are Solar Panels Worth It for Seniors?

https://retirecoast.com/seniors-free-advice-are-solar-panels-it-worth-it/

Home Maintenance Planning: Your Monthly Plan

Every home contains components that will eventually need replacement. The question is not if, but when.

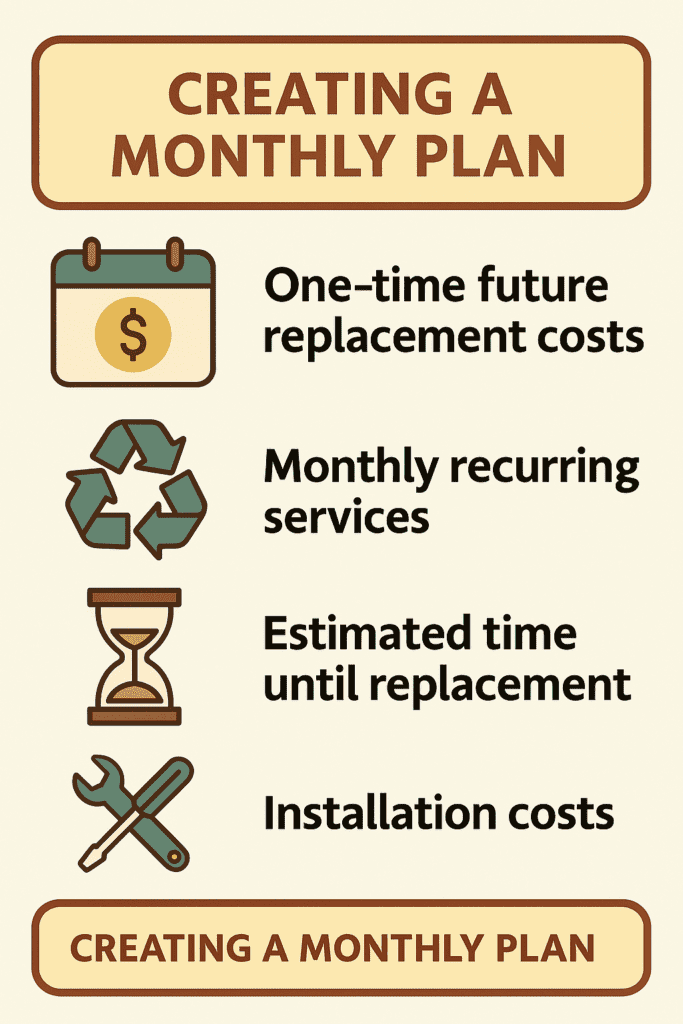

The best way to prepare is to convert large, irregular repair expenses into a single consistent monthly savings plan.

Instead of reacting to emergencies, you prepare for them in advance.

This is exactly why the Home Maintenance Budget Calculator was created. It allows you to enter:

- One-time future replacement costs

- Monthly recurring services

- Estimated time until replacement

- Installation costs

It then calculates how much you should save each month so you never face a financial surprise. The goal of home maintenance planning is not perfection, but predictability—turning large future expenses into a controllable monthly savings strategy.

When you click the Home Maintenance Budget Calculator button on this page, you’ll go to a dedicated calculator with a full explanation of how it works. You can enter your own items, adjust costs and time frames, and then print or save the finished worksheet as a PDF using the built-in print button. It’s designed so you can review it later, share it with a spouse, or discuss it with a financial advisor or contractor.

Home Maintenance & Insurance FAQ

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.