Last updated on October 1st, 2024 at 07:06 pm

The recession right around the corner. Mortgage rates are fluctuating. Buyers are trying to find ways to buy their dream home and paying discount points seems a good idea. Wait, paying mortgage discount points can be a big mistake for many buyers. Before you leap, read this article, and be fully informed.

There are two types of points. Mortgage discount points which is a fee you pay to reduce the interest rate and origination points are fees you pay the lender to set up the loan. Origination points (Underwriters fees) are required although you can negotiate the amount of discount points are your choice.

Generally, the interest rate quoted for a mortgage loan has zero discount points. This is not always true depending upon a person’s credit. Your mortgage broker can offer you a list of options regarding your mortgage interest rate. For example, reducing the rate by 1/8 percent will cost X$ in points.

Mortgage Discount points require cash to purchase upfront

You buy discount points upfront at closing to receive the lower rate. The mortgage lender offering the lower interest rate in exchange for upfront cash as part of closing costs will provide a lower interest rate which means a lower mortgage payment.

Your monthly mortgage payments will drop from where they would have been if you accepted the initial zero-point offer. Keep in mind that we are still talking about the mortgage loan payment and not property taxes or insurance.

Why do lenders offer a lower possibility of paying for mortgage discount points? Your payment for a lower interest is profitable for them or they would not do it. There are some good reasons however why a buyer should be interested in getting the lowest rate. First is the debt-to-income ratio.

When a buyer is close to the limit e.g. 40% debt to income, reducing the monthly payment may bring the ratio into compliance. Without buying the interest rate down the buyer would not qualify to obtain the mortgage.

Retired people buy down the rate to match their income with expenses

Sometimes people who are going to retire or are retired live on a fixed income but hold cash in investments. They want to align their monthly obligations with their income so they buy down the interest rate.

Many more buyers should think carefully about the cost of discount points. That lump sum you put down does not buy equity in your house. If you plan to move shortly or to refinance, buying down the rate may be a mistake. Even when buyers think that their dream home will be their long-term home, things happen. Most buyers sell their homes between 5-10 years after purchasing them.

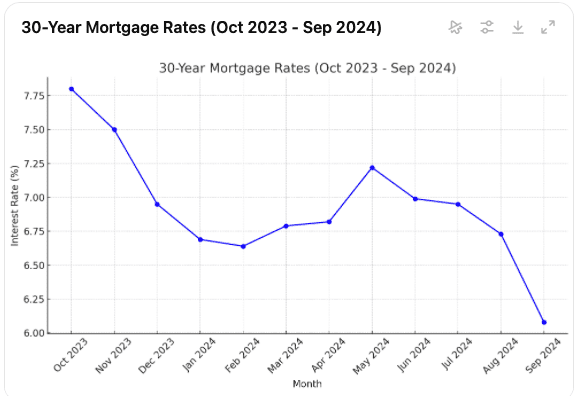

Something else to consider: Mortgage rates at the end of 2024 dropped. Consider that if you buy down your mortgage now, avoiding a buy down if you can afford it may put you in a good position to refinance when rates drop and most experts expect them to fall from the high of about 7.5% to somewhere in the 5-6% range. Here are a few forecasts:

- Wells Fargo: 5.85% by the fourth quarter of 2024 – Close not there yet

- Capital Economics: 6.25% by the end of 2024 – Lower than their forecast

- Freddie Mac: 6.7% by the end of 2024 – Market beat their estimates

- Fannie Mae: 6.8% by the end of 2024 – Market beat their estimates

Use our calculator below to determine the value of buying down the interest rate. The right time to consider this is before you commit to a loan product. The calculator will permit you to enter the amount to be financed, the starting interest rate without points, and the length of the mortgage. You will have to obtain the cost of points from your lender or the internet.

Run the calculations at your home so you can try various combinations. For example, if the standard rate for a $200,000 mortgage is 6% and buying down the rate by a 1/4 of a point will cost $2,000 you can calculate the new monthly payment and savings. The calculator will also tell you how many months and years you must own the house to break-even point with the cost of the points.

Paying for mortgage discount points varies with each individual. The location of the home and your credit score will determine your cost for each point.

The amount you pay for discount points is tax deductible but

Don’t buy a house for a tax deduction. When the 2017 tax changes went into effect, it negated many previously great deductions. Many real estate agents would encourage people to buy a house because they could deduct the interest and property taxes. While this is still true, the government decided to give everyone a very large standard deduction north of $20,000 for a couple.

Many people don’t have enough deductions even with their mortgage and taxes to overcome this threshold. Lots of deductions went away including charitable deductions which makes it hard to accumulate enough to exceed the threshold. Another point is that there is a limit of $10,000 on property taxes that you can deduct regardless of your real tax bill. Read this article for more about this issue.

Bottom line, forget paying discount points to get a tax deduction, you probably don’t need it anyway.

Don’t forget the use of cash means reducing income from where the cash came

As you can see in the calculator, we added a section that tells you how much you are losing in interest by taking the cash from an investment and using it to buy points. Enter the interest rate you are currently earning. You see, this is a hidden cost not usually factored in by buyers.

I have bought down the interest rate a few times when it made sense for the investment. I retained the property for 14 years and sold it. My break-even was about 6 years so I did well by buying down the rate. On another occasion, I bought the rate and sold the property in two years, not a good decision. You should have a good reason behind buying down the interest rate such as not qualifying unless you do.

If you had bought your rate down by 1/2 point in October 2023 and waited

By september 2024 rates were down 1.5 points to 5.53% without a buydown

Use the calculator to determine how much of an impact buying down the rate has on your monthly payments and your budget. You will probably notice that the amount of difference between rate points e.g. 1/4, 1/2, 3/4% is very low. At the time this is written, the economy is entering a recession with very high inflation. A time when cash is king.

You may consider holding on to that cash and financing your home for today. You can always refinance later if rates drop and if they go up, then your current rate will turn out to be a good one. Another reason to consider not paying the mortgage is for mortgage discount points.

Paying for mortgage discount points can be a mistake

Buying down the interest rate takes a lot of money. Combine the extra cash it takes for closing costs on that 30-year mortgage and you will see buying a home is expensive even when the down payment is low. That reduced interest rate may not have much impact on your budget over time as it appears that income continues to rise. It depends on how much money you can afford to put out to buy the house.

Back to your credit. If you have higher credit scores you can avoid a higher rate on your loan and some required origination fees. I mentioned above that most loans start without origination fees but there are financial products that require origination fees unless you have a high credit score.

In addition to the origination fees, your mortgage interest rate is likely to be higher because the interest rate will be higher if your credit report shows lower credit scores and issues.

Well before you make a move to write a contract, consider your financial situation. What will happen if you lose your job in the recession? Do you have sufficient reserves to cover all living and mortgage costs for several months?

I ask these questions because one of the options people have to “fit” into a 30-year fixed-rate mortgage is to put more money down and reduce the total cost of buying including lower monthly payments. Assuming you can afford to put 20% down or even more on your new home. Also, assume you can qualify for a lower down payment at a somewhat similar interest rate.

Mortgage Calculator

Use our calculator below to determine your total mortgage payment including mortgage insurance and other costs.

Now compare the difference between putting more money down and seeing the monthly savings. Look at your interest rate and calculate if you are better off leaving the money in investment rather than using it for a long-term loan.

You may find the feeling of security knowing that your savings and investments leave you in a strong position in case of loss of income. If you have extra money earning a lower annual percentage rate then you may want to use that cash to reduce your mortgage payment.

Another thing to consider is putting down less than 20% of the purchase price. You may find an FHA loan that only requires 3.5% down but will require a mortgage insurance premium for the life of the loan. If you use a conventional loan with 10% down, you will be required to pay private mortgage insurance as long as the property has less than 20% equity.

Use our calculator below to determine the total loan cost and interest rate between three different mortgage brokers. You need to enter origination charges and the rate quote you received from different lenders. When you sample rates you can compare the difference between their underwriter costs and their origination fees if they have any.

Also, compare the interest rate. You may get a better deal by using these comparisons. Negotiate with the loan officer for the best deal. Be sure to compare the type of loan.

Compare costs from multiple loan brokers

Don’t compare a 30-year fixed from one lender and enter a 15-year fixed with another. Also, do your comparisons before you start to discuss buying the rate down with discount points. Having this discussion before you have settled on a lender with the best rates and costs is premature.

It is very possible that when you compare one loan estimate with another you will be able to save money. Market conditions determine the latitude that mortgage lenders can negotiate with you. And that credit score will have a lot to do with the final numbers.

Don’t worry about multiple credit checks. Credit reporting agencies will usually permit multiple checks within 30 days and count them as one. Your home purchase is perhaps the biggest purchase you will ever make. Use our calculator to shop around for the best loan broker.

I hope this article helps you in the decision-making process. Paying mortgage discount points can be a big mistake for some and a must-do for others. Take time to evaluate the information provided here and use our calculators. Please visit RetireCoast.com for other articles about real estate, investing, living on the Mississippi Gulf Coast, and more.

Listen to our podcast which you can find to the right of this article, and select your favorite player. If you are considering the possibility of relocating to a great place, consider the Mississippi Gulf Coast. Low cost, lots of things to do, beautiful beaches, and much more. Read this article for more information on why you may want to move here. https://retirecoast.com/why-i-decided-to-retire-in-ocean-springs-mississippi/

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.