Last updated on January 26th, 2026 at 02:44 pm

A Thoughtful Transition for Older Adults and Their Families

Selling a home to move into senior living is one of the most significant decisions many older adults and their families will ever make. It is rarely just a real estate transaction. More often, it is part of a broader life transition shaped by health considerations, financial planning, emotional attachment, and the desire for a lifestyle that feels supportive and connected.

For many people, the family home has been their current house for a long time — sometimes decades. Letting go can feel overwhelming, even when the decision is clearly the right one. Whether you are the homeowner or one of the adult children helping a parent through this process, understanding why the move makes sense is often just as important as understanding how the sale will happen.

- A Thoughtful Transition for Older Adults and Their Families

- Why Social Connection Is Often the First Reason Seniors Choose to Move

- Case Study: Paula and Dave — Planning Ahead for the Next Chapter

- Why Selling the Family Home Often Becomes the Right Next Step

- Why Selling a Home to Move Into Senior Living Is Often the Turning Point

- Planning the Transition: When Life Stages Meet Real-World Timing

- Are You Ready to Sell and Move to Senior Living?

- Choosing the Right Real Estate Agent for This Stage of Life

- Preparing the Home for Sale Without Overwhelm

- Pricing the Home and Navigating Negotiations With Confidence

- What to Do With the Proceeds of the Sale

- Bringing It All Together: A Thoughtful Transition Into Your Next Chapter

- Senior Living Decision Checklist

- A Closing Note for Adult Children

- Questions Adult Children Should Ask

- Author Bio

- Resources

- Podcast

- FAQ’s

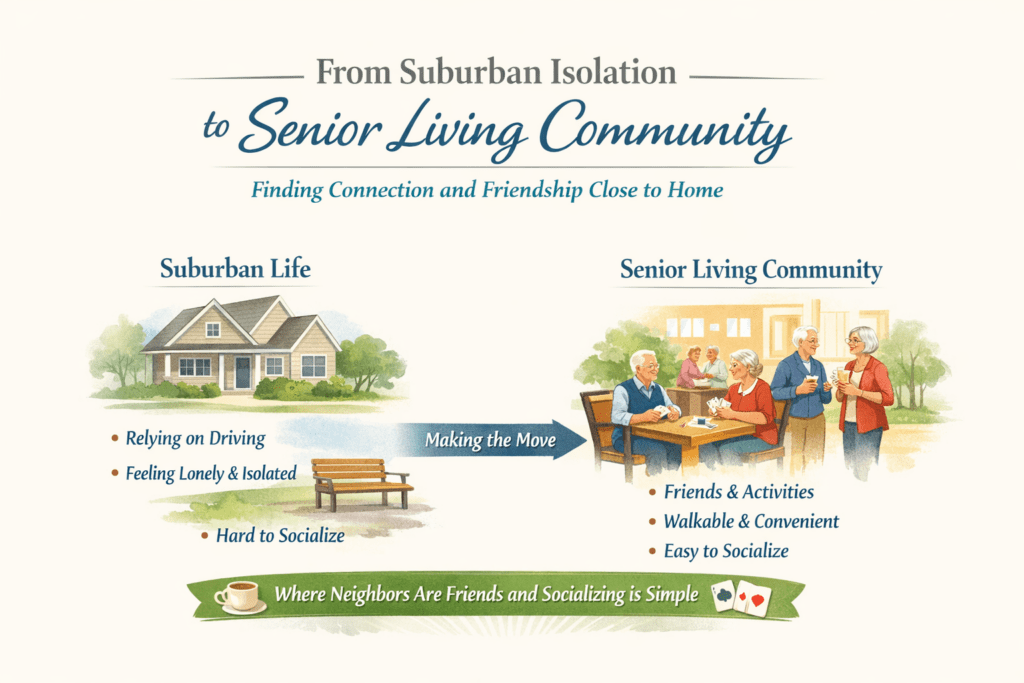

For many older adults, the reason begins with something fundamental: connection.

Most Baby Boomers and Gen X adults spent much of their lives in suburban neighborhoods designed around driving. While those communities offered privacy and space, they often made everyday social interaction difficult.

Unlike densely populated cities where people can walk to cafés, parks, or neighborhood gathering places and naturally get to know their neighbors, suburban living typically requires getting in a car for nearly everything.

Over time — especially as driving becomes less comfortable or practical — this lifestyle can become isolating. Relying on family members, close friends, or scheduled transportation to socialize can quietly limit independence. Even when support is available, the effort required to connect with others can reduce spontaneity and shrink daily social life.

Years ago, my brothers, sister, and I began to worry about our mother. She could no longer drive, and most days she sat alone in front of the television while my sister was at work. Our father had passed years earlier, and although we visited as often as we could, it became clear that something important was missing.

Our mother had always been a social person. She loved to talk, share stories, and connect with others—especially about things that were familiar to her. Without regular companionship, she became quieter and, over time, clearly depressed. It wasn’t because she lacked care or love from her family; it was because she lacked daily connection.

As a family, we came to the conclusion that helping our mother move to a senior living community would give her something we could not provide on our own: constant opportunities to be around others, to talk, to laugh, and to feel engaged again.

We found the perfect location near my sister’s home. The move itself was surprisingly easy. Once she settled in, everything changed. She became busy, social, and genuinely happy. We visited often, grandchildren included, and instead of worrying about her being alone, we saw her thriving.

Looking back, the move wasn’t about taking something away. It was about giving her back the life she loved—one filled with people, conversation, and purpose.

Senior living communities change that dynamic.

At places like Summerfield Senior Living of Gulfport, residents live in close proximity to people with similar backgrounds, shared life experiences, and familiar rhythms. Socializing no longer requires planning or travel. Conversations happen naturally. Meals in a shared dining room become daily opportunities to connect. Activities and events make it easy to meet new friends and maintain an active, engaged lifestyle.

For many residents, this everyday sense of connection becomes one of the most meaningful improvements in quality of life. It is often the moment when moving to senior living no longer feels like giving something up — but rather like choosing a lifestyle that supports comfort, independence, and peace of mind.

That realization often leads to the next important step: thoughtfully planning the sale of a long-time family home in a way that protects both financial security and emotional well-being.

Why Social Connection Is Often the First Reason Seniors Choose to Move

For many older adults, the decision to move into a senior living community begins with something simple but deeply important: the desire for connection.

Most Baby Boomers and Gen X adults spent much of their lives in suburban neighborhoods designed around driving. While those communities offered privacy and space, they often made everyday social interaction difficult. Unlike densely populated cities where people can walk to cafés, parks, or neighborhood gathering spots and naturally get to know their neighbors, suburban living usually requires getting in a car for nearly everything.

Over time, especially as driving becomes less comfortable or practical, this lifestyle can become isolating. Relying on family members, close friends, or scheduled transportation to socialize can quietly limit independence. Even when support is available, the effort required to connect with others can reduce spontaneous interaction.

Senior living communities change that dynamic.

At places like Summerfield Senior Living of Gulfport, residents live in close proximity to others with similar backgrounds, shared life experiences, and familiar rhythms. Socializing no longer requires planning or travel. Conversations happen naturally. Meals in a shared dining room become daily opportunities to connect. Activities and events make it easy to meet new friends and maintain an active social life.

For many residents, this sense of everyday connection becomes one of the most meaningful improvements in quality of life. It is often the moment people realize that moving to senior living is not about giving something up — it is about choosing a lifestyle that supports comfort, engagement, and well-being.

And for many families, this realization becomes the emotional foundation for the next step: thoughtfully planning the sale of a long-time home.

Case Study: Paula and Dave — Planning Ahead for the Next Chapter

Paula and Dave used to joke that they were “just kids” when they turned 60. But even then, they understood something many people don’t fully appreciate until much later: retirement doesn’t happen all at once. It unfolds in stages, and the decisions made early on can dramatically shape the quality of life in later years.

Paula built a successful career as a CPA, while Dave managed a portfolio of apartment communities. Both were disciplined planners. Early in their 60s, they made a conscious decision to work until age 70, allowing them to maximize their Social Security benefits and continue building retirement savings. They also committed to fully funding their 401(k) plans throughout their remaining working years.

At the same time, they began thinking beyond finances. They toured several senior living communities and identified one they felt strongly about—one that offered social connection, independence, and a lifestyle that aligned with how they envisioned their later years.

Putting the Plan Into Motion

Ten years later, just as they had envisioned, Paula and Dave felt ready. They were healthy, active, and financially prepared. The next step was selling their long-time home.

Rather than rushing the process, they took time to find a real estate agent with experience working with retirees—someone they trusted and who understood both the emotional and financial dimensions of selling a home after decades of ownership. With thoughtful preparation and realistic pricing, their home went on the market and sold successfully.

Because there was a waiting list at their chosen senior community, Paula and Dave made a strategic interim move into a nearby apartment. This gave them flexibility, reduced stress during the sale, and allowed them to move forward without pressure.

A Smooth Transition

When an opening became available at the senior community, the transition was seamless. Thanks to careful planning earlier in life, they could comfortably afford the monthly costs. The equity from their home sale, combined with well-funded retirement accounts, provided both security and peace of mind.

Because they were still active and independent, Paula and Dave added a new dimension to their retirement lifestyle: travel. They purchased an RV and began exploring the country, often returning to their community to reconnect with neighbors and friends. Their days were filled with a balance of adventure, routine, and social engagement.

Family remained central to their lives. Their children and grandchildren visited often, and Paula and Dave traveled to see them as well—on their own terms, without the burden of maintaining a large home.

Looking Back — and Forward

Reflecting on the transition, Dave summed it up simply:

“This new chapter in our lives may be the best one yet.”

Their story highlights an important truth: successful retirement transitions rarely happen by accident. They are the result of purposeful planning, realistic expectations, and the willingness to adapt as life evolves. By thinking ahead, Paula and Dave didn’t just move into senior living—they moved into a lifestyle that supported connection, freedom, and lasting fulfillment.

For Gen X readers, Paula and Dave’s experience offers an important reminder: the most successful retirement transitions don’t begin at retirement—they begin years earlier. Thoughtful planning reduces stress later, not only for parents, but for the entire family.

- Planning ahead creates choices instead of last-minute decisions.

- Understanding housing options early helps avoid crisis-driven moves.

- Protecting home equity and retirement savings supports lifestyle flexibility.

- Clear planning allows adult children to focus on support—not emergency problem-solving.

For Gen X, the lesson is clear: the decisions you make today may one day make your role as a son or daughter much easier—and your parents’ later years far more secure and fulfilling.

Why Selling the Family Home Often Becomes the Right Next Step

Once the decision to move into a senior living community feels settled, attention naturally turns to the family home. For many older adults, this has been their current house for a long time — sometimes decades — and deciding what to do with it can feel like one of the most difficult decisions in the entire process.

While some families initially consider keeping the home, many ultimately decide that selling it best supports the goals that led them to senior living in the first place: simplicity, flexibility, and peace of mind.

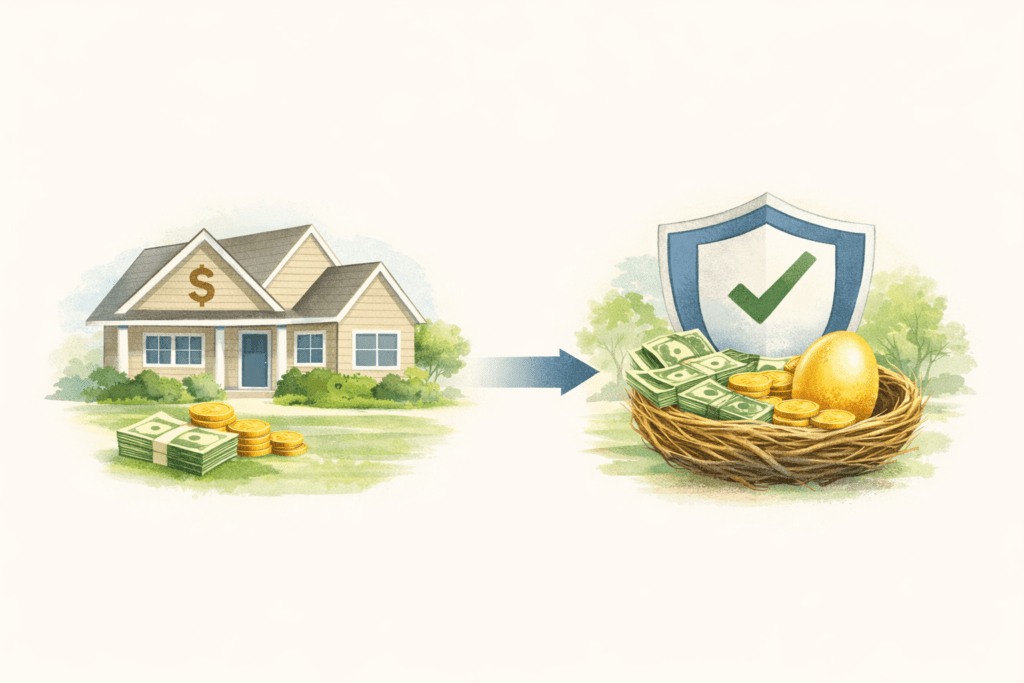

Turning a Long-Time Home into Financial Security

For many retirees, the family home represents their largest financial asset. Over time, mortgage balances may have been reduced or eliminated, and the home’s value may have increased significantly. Selling the home converts that value into accessible funds that can be used intentionally.

Proceeds from the sale of your home are commonly used to:

- Help cover senior living expenses and ongoing monthly costs

- Reduce financial uncertainty during major life transitions

- Support healthcare needs and future planning

- Create flexibility for family support or gifting

Understanding how this income may be taxed is an important part of the decision-making process. These resources can help clarify what to expect:

- Will I Owe Taxes Now That I’m Retired?

https://retirecoast.com/i-am-retired-will-i-owe-taxes/ - Senior Income Tax Planning for 2026

https://retirecoast.com/senior-income-tax-2026/ - Tax-Free Retirement Withdrawal Calculator

https://retirecoast.com/tax-free-retirement-withdrawal-calculator/

Many families find that reviewing these topics with a financial advisor or other financial expert before listing the home provides reassurance and prevents surprises later.

For many retirees, selling a long-time home can simplify life and provide financial flexibility, while renting may offer income but requires ongoing management. Choosing the right path depends on lifestyle goals, health, and the desire for peace of mind.

Selling vs. Renting: Choosing the Path That Simplifies Life

Some families explore renting the home instead of selling it, either as a short-term rental or a longer-term income property. While this approach can make sense in limited situations, it often requires ongoing attention that works against the goal of simplifying life.

Renting typically involves:

- Managing maintenance and repairs

- Handling tenants or property managers

- Staying current with property taxes and insurance

- Coordinating yard work and unexpected issues

For many older adults, these responsibilities can become burdensome — particularly when health, mobility, or distance are factors. A detailed comparison is available here:

- Selling vs. Renting in Retirement

https://retirecoast.com/selling-vs-renting-in-retirement/

For those seeking fewer obligations and more predictability, selling the home is often the better choice.

Aligning the Home Sale With the Purpose of the Move

One of the most important considerations is that the sale of the home should support the purpose of the move — not complicate it. Senior living is often chosen to reduce responsibility, create social opportunities, and make daily life easier.

When handled thoughtfully, selling the family home becomes an extension of that goal: converting a long-time property into a resource that supports independence, comfort, and confidence in the next chapter.

For families looking for broader planning tools and checklists that support this transition, RetireCoast’s Practical Retirement Guides provide step-by-step insights across housing, finances, and lifestyle planning:

https://retirecoast.com/practical-retirement-guides/

With this foundation in place, the next step is planning how and when the sale should happen.

Many adult children notice something before a parent ever says it out loud: the days get quieter. A parent who used to be social starts spending long stretches alone. If they can’t drive, even simple things—coffee with a friend, a quick errand, attending church or a community event—can become difficult without help.

This kind of isolation isn’t always dramatic. It can look like more television, fewer phone calls, less interest in hobbies, or a reluctance to “be a bother.” And even if you visit often, it may still feel like you’re trying to replace a daily social world that used to happen naturally.

One of the most effective changes isn’t simply increasing check-ins—it’s changing the environment. In a senior living community, connection is built into the day: people are nearby, meals are shared, and activities create easy conversation. The goal isn’t to take independence away; it’s to give your parent a setting where companionship is accessible again.

If you’re exploring this option, look for a community close enough to visit regularly. Many families find that once a parent settles in, they become more engaged, more confident, and noticeably happier—because companionship isn’t scheduled, it’s simply part of everyday life.

- They rarely leave the house unless you drive them

- They seem less talkative or less interested in routines

- They say “I’m fine” but your gut says they’re not thriving

- They mention feeling like a burden or not wanting to ask for help

Why Selling a Home to Move Into Senior Living Is Often the Turning Point

After families come to terms with the emotional side of the transition, attention usually shifts to the practical reality: selling a home to move into senior living. This step is often the true turning point in the process, because it connects lifestyle goals with financial security.

For many older adults, the family home has served its purpose well for a long time. It provided space, stability, and independence during years of active life. But when daily routines change, maintaining that home can become more work than benefit. At that stage, selling a home to move into senior living is less about giving something up and more about aligning resources with current needs.

Selling a Home to Support the Next Chapter

One of the most important reasons families choose selling a home to move into senior living is financial clarity. The equity built up over many years can be redirected to support:

- Senior living expenses and predictable monthly costs

- Healthcare and future care needs

- Reduced financial stress during major life transitions

- Greater flexibility and peace of mind for both seniors and adult children

Instead of worrying about repairs, property taxes, insurance, and upkeep, families often find relief in knowing that selling a home to move into senior living simplifies both finances and daily responsibilities.

Why Timing Matters When Selling a Home to Move Into Senior Living

Timing plays a major role in whether selling a home to move into senior living feels stressful or manageable. The ideal scenario allows the move to happen without rushing the sale or settling for less than the home’s value.

Some families choose to move first, then sell. Others prefer to sell first and use the proceeds to fund the transition. Both approaches can work, especially when guided by an experienced real estate agent who understands the local market and the unique needs of seniors.

In either case, the goal of selling a home to move into senior living is the same: create a smooth journey that protects health, finances, and dignity.

Selling a Home to Move Into Senior Living Is About Simplification

At its core, selling a home to move into senior living is about simplifying life. Senior living communities are designed to remove daily burdens—maintenance, isolation, and logistical challenges—so residents can focus on connection, comfort, and independence.

When the home sale is handled thoughtfully, it becomes an extension of that same philosophy. Selling the home reduces responsibility, unlocks resources, and allows older adults to fully embrace the benefits of their new environment.

For many families, this is the moment when everything begins to feel aligned. The move makes sense. The numbers work. And the next chapter no longer feels uncertain—it feels intentional.

Stages of Retirement: How Life Evolves Over Time

As the graphic above illustrates, retirement is not a single chapter—it unfolds in stages. Depending on how young you are when you retire and, most importantly, your health, there may be three or even four distinct phases. Understanding these stages can help you make thoughtful decisions that protect both independence and quality of life.

Stage One: Early Retirement — Active and Engaged

When you first retire, many retirees are healthy, with only minor issues, and can do almost anything they want to do. This stage is often filled with energy and curiosity. Most people choose to stay busy by starting a business after retirement, volunteering at places like the zoo or a local school, mentoring others, or pursuing hobbies such as woodworking, gardening, or even selling items online.

During this phase, retirees typically remain independent drivers. They balance projects and passions with travel, RV trips, and regular visits with children and grandchildren. Life feels full, flexible, and largely self-directed.

Stage Two: Simplifying — Focusing on Comfort and Connection

The next stage often arrives quietly. One day you decide to slow down. You may want to reduce your activity schedule or step away from physically demanding tasks such as working around the house, fixing a sink, or maintaining a car.

Time with family becomes more important. Travel may continue, but on a more limited basis. Many people at this stage strongly consider selling the house and either renting an apartment near the beach or moving to a senior living community where daily life is easier and social interaction is built in.

One common trigger during this phase is the loss of a spouse. The need for emotional support, companionship, and peers who understand life’s transitions becomes more important than ever. This part of life can be just as rewarding as any other—if you embrace it.

Stage Three: More Support — Planning for Health Changes

The next stage often begins when health issues emerge. Poor eyesight may make driving difficult or impossible. Mobility challenges or medical conditions may require help from outside professional providers.

At this point, many people consider moving into an assisted living environment where support is available as needed. Some communities, such as Summerfield Senior Living of Gulfport, offer full-service living for healthy adults age 55, with the ability to transition seamlessly into higher levels of care later on.

In these communities, a move during the second stage can be a smart long-term decision. You enjoy independence now, with the reassurance that additional care is available later—without needing another disruptive move.

Most of these facilities operate on a rental or lease basis, meaning there is no need to purchase another home. For many retirees, this flexibility makes the second and third phases of life more predictable and far less stressful.

Ultimately, every stage of retirement is about the same goal: quality of life.

A personal reflection on recognizing the stages of retirement and why planning for each phase—before you need it—can make all the difference.

Planning the Transition: When Life Stages Meet Real-World Timing

Once you recognize which stage of retirement you’re in, the next step is planning the transition in a way that supports your health, finances, and peace of mind. This is where many families begin to feel uncertain—not because they don’t know what they want to do, but because they’re unsure when and how everything should happen.

Selling a long-time home and moving into senior living is rarely a single event. It is a process that unfolds over time, shaped by personal readiness, family considerations, and practical realities.

Why Timing Feels So Complicated

Several factors often overlap at this point:

- Health changes that make waiting uncomfortable or risky

- Emotional readiness to leave a long-time home

- Move-in availability at a senior living community

- Conditions in the housing market

- The need to coordinate with adult children or other family members

It’s common for retirees to feel pressure to “get it right.” But there is no single perfect timeline—only a thoughtful one that reflects your current stage of life.

Selling First or Moving First: Two Valid Paths

Families typically consider one of two approaches.

Some choose to sell the home first, using the proceeds to fund the move and eliminate uncertainty. This approach can feel clean and decisive, especially when the housing market is favorable.

Others move first, then sell the home once they are settled. This can be especially helpful when health issues make daily upkeep difficult or when showings would be disruptive. In these cases, having the home vacant or lightly staged can actually make it easier for buyers to visualize the space.

Both paths can work well. The key is choosing the one that best supports your comfort and dignity during the transition.

Coordinating With Family Without Losing Independence

Adult children are often deeply involved at this stage, helping with logistics, research, and decision-making. Their support can be invaluable—but it’s important that the process still reflects the wishes and priorities of the person making the move.

Clear communication helps avoid misunderstandings and reduces stress for everyone involved. When expectations are aligned early, families are better able to move forward together with confidence.

A Transition, Not a Deadline

One of the most important mindset shifts is letting go of the idea that this move must happen all at once. Retirement transitions are not emergencies—they are evolutions.

When planned thoughtfully, selling a home and moving into senior living becomes a steady, manageable journey rather than a rushed event. That perspective alone can make the process feel far less overwhelming.

With a realistic timeline in mind, the next critical decision is choosing the right professional to guide the sale.

Years ago, my brothers, sister, and I began to worry about our mother. She could no longer drive, and most days she sat alone in front of the television while my sister was at work. Our father had passed years earlier, and although we visited as often as we could, it became clear that something important was missing.

Our mother had always been a social person. She loved to talk, share stories, and connect with others—especially about things that were familiar to her. Without regular companionship, she became quieter and, over time, clearly depressed. It wasn’t because she lacked care or love from her family; it was because she lacked daily connection.

As a family, we came to the conclusion that helping our mother move to a senior living community would give her something we could not provide on our own: constant opportunities to be around others, to talk, to laugh, and to feel engaged again.

We found the perfect location near my sister’s home. The move itself was surprisingly easy. Once she settled in, everything changed. She became busy, social, and genuinely happy. We visited often, grandchildren included, and instead of worrying about her being alone, we saw her thriving.

Looking back, the move wasn’t about taking something away. It was about giving her back the life she loved—one filled with people, conversation, and purpose.

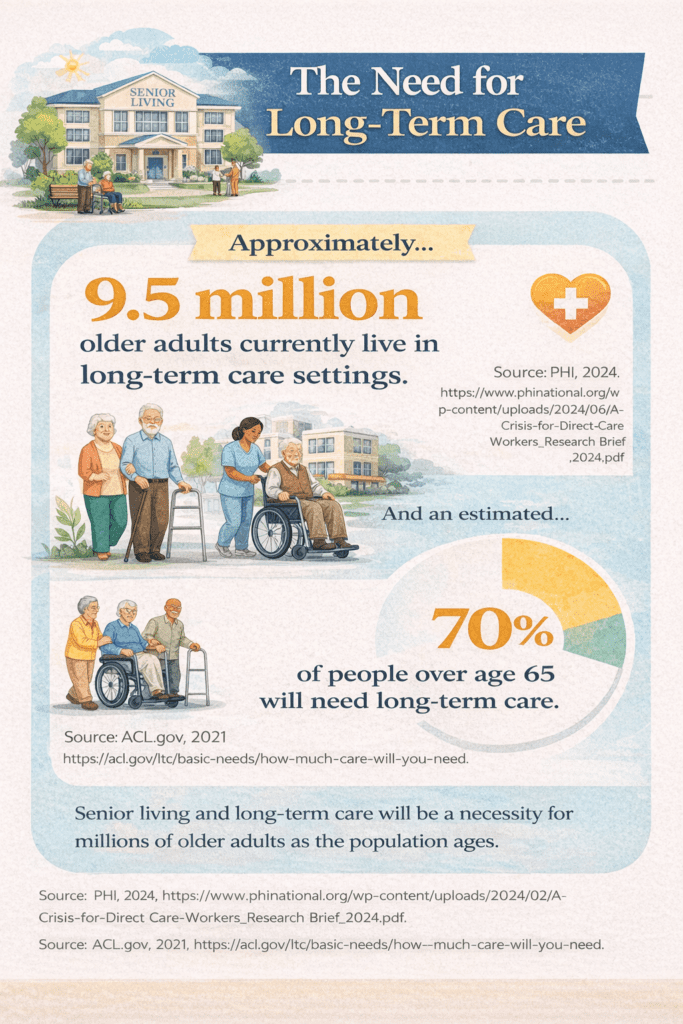

Growing demand for senior living and long-term care, based on data from PHI and the U.S. Administration for Community Living.

Are You Ready to Sell and Move to Senior Living?

- ☐ I feel less comfortable keeping up with home maintenance, repairs, or yard work.

- ☐ I no longer enjoy managing a large home and would prefer a simpler living arrangement.

- ☐ Driving is becoming difficult, stressful, or something I avoid when possible.

- ☐ I spend more time alone than I’d like and would benefit from daily social interaction.

- ☐ I want to be closer to family, or in a setting where help is available if needed.

- ☐ I like the idea of selling my home to reduce financial uncertainty and free up equity.

- ☐ I would feel more comfortable knowing additional care options are available in the future.

- ☐ I’m open to exploring senior living now, rather than waiting for a crisis to force a move.

There’s no “right” number of checkmarks. This list is meant to start a conversation—with yourself, with family members, or with trusted professionals—about what kind of living arrangement best supports your quality of life today and in the years ahead.

I am a licensed real estate broker and have worked with seniors and their families for many years. I understand that selling a home later in life is not just about price—it’s about trust, timing, and making the process as stress-free as possible.

I can help you get your home listed regardless of where it is located. Realtors work within a reciprocal system, which allows experienced brokers to collaborate across markets. That said, I do not simply hand a referral to just anyone.

Before I would ever bring another Realtor to you for a listing agreement, I first interview them carefully. I want to know how they work, how they communicate, and whether they truly understand the needs of seniors and families going through this stage of life.

I should also note that this is the first time I have mentioned my real estate practice within a RetireCoast article. RetireCoast has always been focused on education and guidance—not advertising. I chose to include this information here only because this topic directly impacts seniors and families facing a major life transition where experience and trusted guidance truly matter.

My goal is to make sure the person representing you is the right fit—for you and for me—so that the sale of your home supports your larger transition and protects your peace of mind.

Choosing the Right Real Estate Agent for This Stage of Life

Once the decision to sell begins to feel real, the next—and arguably most important—step is choosing the right real estate agent. At this stage of life, selling a home is not just about price. It is about trust, communication, and reducing stress for everyone involved.

Not every agent is well suited for this kind of transition.

Why Experience With Seniors Matters

Selling a long-time home later in life often comes with unique challenges:

- Health or mobility limitations

- Emotional attachment to the home

- Adult children helping from a distance

- The need for flexibility around timing and access

An agent who regularly works with older adults understands that this is not a typical transaction. They know how to slow the process down when needed, explain options clearly, and handle logistics without requiring constant involvement from the homeowner.

Many families look for an agent with experience as a Senior Real Estate Specialist (SRES®) or someone who has worked extensively with retirement-age sellers. While credentials matter, temperament and communication style matter just as much.

What a Good Agent Should Be Willing to Handle

A good agent at this stage should be comfortable managing much more than paperwork. This often includes:

- Coordinating inspections, minor repairs, and clean-up

- Advising on what truly needs fixing—and what does not

- Managing showings with minimal disruption

- Communicating regularly with adult children when appropriate

- Guiding decisions without pressure

In many cases, the best agent becomes a steady presence—someone who removes friction from the process rather than adding to it.

Selling Without the Owner Needing to Be Present

For some older adults, leaving the house during showings is difficult or impossible. This can be due to health issues, mobility challenges, or simply the stress of frequent disruptions.

An experienced agent can manage the sale so that:

- The home can be shown freely

- Appointments do not depend on the homeowner’s schedule

- Privacy and dignity are preserved

- The seller remains informed without being overwhelmed

In fact, homes that are vacant or lightly staged often show better and allow buyers to focus on the space itself. When handled thoughtfully, this approach can reduce stress and improve outcomes.

Asking the Right Questions Before You Commit

Before choosing an agent, it’s reasonable—and wise—to ask questions such as:

- How often do you work with older homeowners?

- How do you handle situations where the owner cannot be present?

- How will you communicate with family members if needed?

- What is your approach to pricing in the current market?

The right agent will welcome these questions and answer them patiently.

A Relationship, Not Just a Transaction

At this stage of life, selling a home is part of a broader transition. The right real estate agent understands that their role is not just to close a sale, but to support a process that affects health, finances, family relationships, and peace of mind.

When you feel heard, informed, and unpressured, you are far more likely to experience the sale as smooth—and even reassuring.

With the right professional in place, the final piece becomes understanding how to prepare the home without overextending yourself.

Preparing a home for sale does not mean fixing or replacing everything. In fact, unnecessary improvements can waste money and add stress without increasing the final sale price. The goal is to present a clean, safe, and well-maintained home—nothing more.

- Do not remodel the kitchen or bathrooms unless something is broken or unsafe.

- Do not replace blinds or cosmetic finishes unless they are damaged or missing.

- If mechanical systems work, leave them alone. This includes air conditioning, heating, and appliances.

- Do not upgrade “just in case.” Buyers often prefer to choose their own upgrades.

Instead, focus on what matters most to buyers and inspectors:

- Cleaning is the most important improvement. A clean home feels cared for.

- Pay attention to first impressions. Clean the front door and door hardware.

- Landscaping and curb appeal matter. Simple trimming and tidying go a long way.

- Address safety issues immediately. Missing outlet covers, loose railings, or trip hazards should be fixed.

- Replace burned-out light bulbs, especially in ceiling fixtures.

A home inspector will almost certainly visit the property. While no home is perfect, the fewer small items they find, the stronger your negotiating position will be.

The point of these small, low-cost fixes is simple: reduce the leverage a buyer can use to discount the price after you’ve already negotiated. Small details can have an outsized impact on how confident a buyer feels about their offer.

Preparing the Home for Sale Without Overwhelm

Once the right real estate professional is in place, attention turns to preparing the home. For many older adults, this is the point where the process can feel daunting—but it doesn’t have to be.

Preparing a long-time home for sale is not about perfection. It’s about making thoughtful, manageable decisions that help buyers see the home’s potential while protecting your energy, comfort, and well-being.

Focus on What Matters Most

At this stage of life, the goal is not to renovate or modernize everything. In most cases, buyers are far more responsive to a home that feels clean, cared for, and functional than one with extensive upgrades.

Priorities typically include:

- Addressing obvious maintenance issues that affect safety or function

- Ensuring the home is clean, well-lit, and welcoming

- Making small, high-impact improvements rather than major renovations

An experienced agent can help identify what truly matters in your local market—and just as importantly, what can be left alone.

Minor Repairs Can Make a Big Difference

Small repairs often have an outsized impact on how a home is perceived. Things like a dripping faucet, loose handrails, or damaged screens can quietly signal neglect to prospective buyers—even if the home has been lovingly maintained for years.

When these items are addressed, buyers tend to focus on the space itself rather than distractions. The key is to keep repairs limited to what improves confidence and first impressions.

Cleanliness and Light Over Remodeling

Deep cleaning is often more effective than remodeling. Clean floors, fresh-smelling rooms, clear windows, and uncluttered surfaces allow buyers to imagine themselves in the home.

In many cases, simply rearranging existing furniture or removing excess items can make rooms feel larger and more comfortable—without spending additional money.

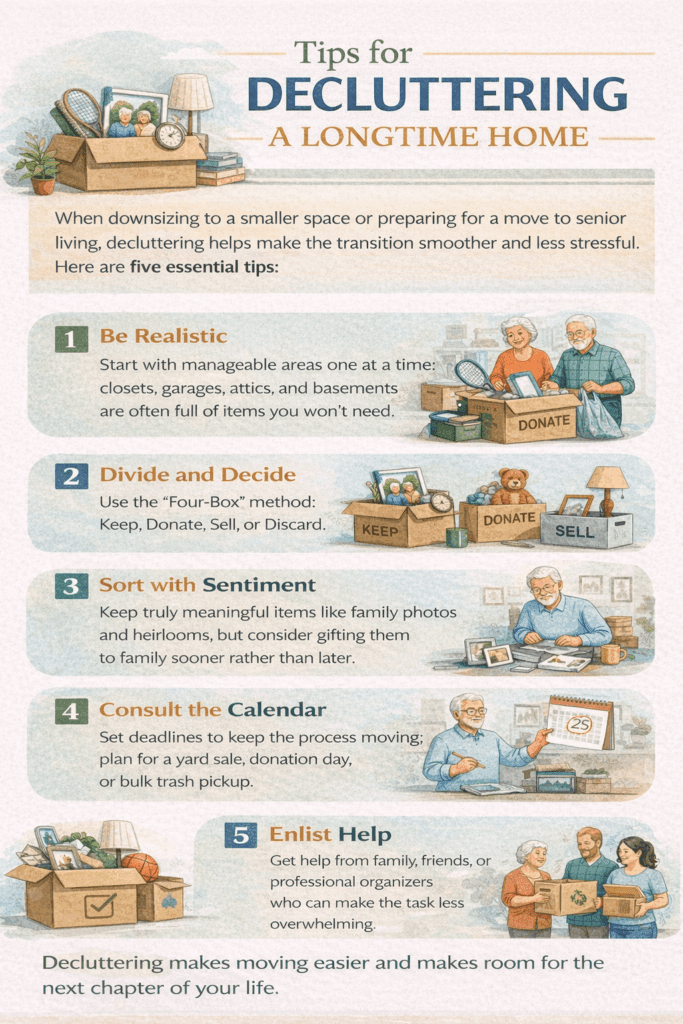

Decluttering at a Comfortable Pace

Decluttering is often the most emotionally charged part of preparation. A home that has been lived in for decades naturally holds a lifetime of belongings and memories.

It’s important to take this process slowly:

- Work one room at a time

- Decide what to keep, gift, donate, or discard

- Allow time for breaks when decisions feel heavy

For some families, an estate sale, professional organizer, or senior move manager provides welcome structure and support. Accepting help here is not a sign of weakness—it’s a way to protect your time and energy.

Preparing the Home Without Living in It

If you have already moved—or plan to move—into a senior living community before the sale, the preparation process often becomes much easier. A vacant or lightly staged home can be cleaned, repaired, and shown without disruption.

This approach also preserves privacy and dignity, especially if frequent showings would be stressful or physically challenging.

Progress, Not Pressure

The most important thing to remember is that preparation does not need to happen all at once. This transition is not a race. With the right guidance, it can unfold in a way that feels steady and manageable.

When the home is ready, the final step is understanding how pricing and market conditions affect the sale—and how to approach that decision with confidence.

- Replace missing or broken outlet and switch covers

- Secure loose handrails or steps

- Ensure GFCI outlets work in kitchens, baths, and laundry areas

- Replace burned-out light bulbs (especially ceiling fixtures)

- Check that smoke and carbon monoxide detectors are installed where required

- Fix dripping faucets and running toilets

- Ensure drains flow freely and don’t back up

- Check under sinks for visible leaks or moisture

- Secure loose toilets or fixtures

- Replace HVAC filters

- Make sure air conditioning and heating systems turn on and operate normally

- Confirm thermostat works properly

- Do not attempt upgrades—only verify functionality

- Ensure doors and windows open, close, and lock properly

- Tighten loose handles, hinges, and knobs

- Repair torn screens where practical

- Touch up obvious scuffs or peeling paint

- Clean the front door and door hardware

- Trim bushes and remove overgrowth near the house

- Clear walkways and driveways

- Check exterior lighting for proper operation

Buyers often use inspection reports to request price reductions—even for small issues. Addressing these items in advance reduces that leverage and helps protect the price you negotiated.

Pricing the Home and Navigating Negotiations With Confidence

With the home prepared and inspection risks minimized, the focus turns to pricing—and this is where many sellers feel the most uncertainty. Pricing a long-time home is both a financial decision and an emotional one, especially when it is part of selling a home to move into senior living.

The goal is not simply to “list high” or “sell fast.” The goal is to price the home correctly for the local market so it attracts serious buyers, generates strong offers, and supports a smooth transition into the next stage of life.

Why Correct Pricing Matters More Than Ever

Homes that are priced accurately from the start tend to:

- Receive more attention from qualified buyers

- Spend less time on the market

- Generate cleaner negotiations

- Reduce the likelihood of price reductions later

Overpricing often works against sellers. Today’s buyers are well informed, and homes that linger on the market tend to invite deeper scrutiny and tougher negotiations after inspections.

An experienced real estate agent will evaluate recent comparable sales, current market conditions, and buyer demand to recommend a price that reflects both value and momentum.

Pricing Based on Your Goals — Not Guesswork

A professional real estate agent should never recommend a selling price in a vacuum. Pricing should be based on your goals and how quickly—or patiently—you want the home to sell.

Most sellers fall into one of three categories:

- A fast sale, often to align with a move or reduce uncertainty

- A normal sale timeline that reflects typical market behavior

- Holding out for the highest possible price, even if it takes longer

Each approach is valid. What matters is understanding the trade-offs before the home goes on the market.

If your goal is a fast sale, your agent should show you comparable homes that sold quickly because they were priced at—or just slightly below—market value. Homes priced this way tend to attract more buyers early, which often results in stronger offers, cleaner negotiations, and fewer complications later.

Understanding Market Conditions Without Chasing the Market

Markets change—sometimes quickly.

Your agent should explain whether you are in a seller’s market, a balanced market, or a buyer-favored market, and how that affects pricing strategy. The “right price” is not a single number; it is a range informed by timing, competition, and buyer behavior.

For sellers planning a move into senior living, stability often matters more than squeezing out every last dollar. A well-priced home reduces uncertainty and helps align the sale with move-in plans and financial needs.

Using Incentives Strategically

In some cases, pricing alone is not enough. Strategic buyer incentives can strengthen an offer without dramatically reducing your bottom line. Common examples include:

- Paying a portion of the buyer’s closing costs

- Offering to buy down the buyer’s interest rate

For homes in lower price ranges, contributing toward closing costs can be especially attractive to younger buyers using FHA loans with minimal down payments. Making those upfront costs disappear can materially improve affordability and help your home stand out.

With higher-priced homes, buyer behavior is often different. Even when a home is fairly priced, buyers may still submit offers below list price as part of their negotiation strategy. A good agent will prepare you for this by explaining the typical difference between listing price and final sale price in your local market—so you are not surprised or pressured when offers arrive.

Time on Market and Buyer Perception

If your preference is to hold the property longer in hopes of achieving a higher price, your agent should clearly explain how long similar homes have stayed on the market and what that means in practical terms.

Extended time on the market can have consequences:

- Some buyers may wonder why the home has not sold

- Others may assume a substantial discount will eventually be required

- Negotiating leverage can gradually shift toward buyers

Waiting is not wrong—but it should be a deliberate decision, not an accidental one.

Negotiations: Protecting the Deal You’ve Earned

Once an offer is accepted, negotiations continue—often through inspections and requests for concessions. This is where your preparation pays off.

When small issues have already been addressed, there is less room for renegotiation. Your agent’s role is to:

- Distinguish between reasonable requests and leverage tactics

- Keep negotiations focused and professional

- Protect the price and terms you agreed to

- Prevent minor issues from derailing the transaction

The strongest deals are often not the highest initial offers, but the ones most likely to close smoothly.

Keeping the Bigger Picture in Focus

It is easy to get caught up in the details of offers and counteroffers. But the larger goal remains the same: a successful sale that supports your quality of life and next chapter.

Selling a home to move into senior living is not just about maximizing price. It is about reducing stress, maintaining dignity, and creating financial clarity. When pricing and negotiations are handled intentionally and with good information, the entire process feels steadier and more predictable.

With pricing and negotiations underway, the final consideration becomes coordinating the sale with your move so everything transitions smoothly.

What to Do With the Proceeds of the Sale

For many people, selling a home to move into senior living represents the largest single cash event of their lifetime. Most homeowners will never again receive such a significant sum of money at one time—often hundreds of thousands of dollars—delivered by wire transfer or check at closing.

Unlike earlier stages of life, when home equity was rolled directly into the purchase of another property, this time is different. The proceeds from the sale of your home are yours, free to be used, invested, or preserved in whatever way best supports your next chapter.

That freedom brings opportunity—but also responsibility. Planning ahead for where the money will go, even temporarily, is essential.

Where to Hold the Funds Initially

At closing, funds are typically wired directly into a bank account. While this is convenient, it’s important to understand the limits of bank insurance. Standard FDIC insurance covers up to $250,000 per depositor, per bank. Holding more than that in a single account introduces some risk, even if that risk is relatively low.

Because of this, many people choose to:

- Spread funds across multiple insured accounts temporarily, or

- Move funds quickly into a brokerage account

If you do not already have a brokerage account, this is often a good time to open one. Funds can be placed into a money market account, which offers liquidity, stability, and the ability to earn interest while you decide on longer-term plans. This allows your money to begin working for you immediately, rather than sitting idle.

Planning for Near-Term Expenses

Pre-planning also means recognizing that some of the proceeds will likely be used right away. Common uses include:

- Deposits and entrance fees for a senior living community

- Monthly rent or care fees during the transition period

- Paying off outstanding credit card balances or vehicle loans

Eliminating debt at this stage of life can simplify cash flow and reduce stress. Once those immediate needs are addressed, the remaining funds can be invested with a longer-term perspective.

Understanding Taxes on the Sale of Your Home

The good news for most seniors is that you may not owe income tax on the sale of your primary residence.

Under current tax rules:

- Up to $250,000 of gain is excluded for a single homeowner

- Up to $500,000 of gain is excluded for a married couple

As long as you have lived in the home for at least two of the last five years, most or all of the gain is often tax-free.

If the gain exceeds those limits, the excess is taxed at long-term capital gains rates, typically 15% or 20%, depending on income. For many seniors, however, the exclusion covers the entire gain.

For most people, the equity from their home represents the last major non-taxable financial event before they begin drawing from tax-advantaged retirement accounts such as traditional IRAs, which are taxable upon withdrawal. That makes this moment especially important from a planning perspective.

Investing With an Eye Toward the Future

This is also an ideal time to review your broader financial strategy. Many couples choose to:

- Invest remaining proceeds conservatively

- Adjust asset allocation to match income needs

- Fund tax-advantaged accounts

I often recommend that eligible couples consider maximizing contributions to a Roth IRA. Funds placed into a Roth grow tax-free and can be withdrawn without future tax liability, making them a powerful tool for long-term financial security.

More information on this topic can be found here:

https://retirecoast.com/tax-advantaged-retirement-accounts/

Protecting Your Assets With Proper Planning

Finally, selling a home and converting it into liquid assets is the right time to revisit—or create—important legal documents. If you do not already have them in place, consider:

- Creating or updating a will

- Establishing a revocable living trust

Once your wealth is no longer tied up in real estate, it becomes more vulnerable and more important to protect. These tools help ensure your assets are managed according to your wishes and provide clarity for family members down the road.

Handled thoughtfully, the proceeds from your home sale can provide stability, flexibility, and peace of mind for years to come—supporting not just where you live, but how you live.

- Confirm the exact amount of sale proceeds before signing final documents

- Verify wire instructions verbally with the title company (never rely solely on email)

- Confirm the receiving bank account name and number are correct

- Ask when funds will be available for use (same day or next business day)

- Request a final settlement statement (Closing Disclosure or HUD-1)

- Move funds out of a single bank account if balances exceed FDIC insurance limits

- Transfer funds into a brokerage or money market account if planned

- Set aside money for senior living deposits, rent, or care fees

- Pay off high-interest debts such as credit cards or vehicle loans

- Save digital and printed copies of all closing documents

- Store documents in a safe place accessible to a trusted family member

- Confirm how to access records online if provided by the title company

- Meet with a financial advisor or trusted professional if planned

- Review tax implications of the sale and capital gains exclusions

- Confirm senior living contracts, leases, or move-in dates

- Update beneficiary information if needed

Closing day is when the largest financial transition occurs. Taking these steps first helps protect your funds, reduces stress, and ensures the sale supports your next chapter rather than creating new complications.

Bringing It All Together: A Thoughtful Transition Into Your Next Chapter

Selling a long-time home and moving into senior living is not a single decision—it is a series of thoughtful steps that, when taken in the right order, create clarity, confidence, and peace of mind.

From preparing the home and pricing it correctly, to navigating negotiations, inspections, and finally managing the proceeds of the sale, each stage builds on the one before it. When handled intentionally, this process becomes far less stressful and far more empowering.

For many people, this transition marks a shift away from the responsibilities of maintaining a home and toward a lifestyle focused on connection, support, and quality of life. Senior living is not about giving something up—it is about gaining time, freedom, and access to community.

Finding the Right Senior Living Community

Just as choosing the right real estate agent matters, finding the right senior living community is equally important. Needs, preferences, and levels of care vary widely, and there is no one-size-fits-all solution.

A valuable starting point for exploring options nationwide is:

https://www.whereyoulivematters.org/find-a-community/

This resource allows you and your family to explore senior living communities, compare options, and learn more about different types of care and living arrangements. It can be especially helpful if you are beginning your search or assisting a loved one from a distance.

A Move Made With Intention

The most successful transitions are not rushed and not reactive. They are made with planning, professional guidance, and honest conversations with family members. Whether you are moving for social connection, safety, convenience, or support, the decision deserves care and respect.

Handled properly, selling your home to move into senior living can be one of the most positive and stabilizing decisions of your later years—freeing you from unnecessary burdens and opening the door to a new chapter filled with opportunity, comfort, and peace of mind.

If you are considering this transition, take the next step when you are ready. Ask questions. Gather information. And surround yourself with professionals who understand that this is more than a transaction—it is a life transition.

Senior Living Decision Checklist

- ☐ Private apartment or condo

- ☐ Duplex or cottage-style residence

- ☐ Single-family home option

- ☐ Room with private bathroom

- ☐ Small kitchen or kitchenette

- ☐ In-unit washer & dryer

- ☐ Outdoor patio or balcony

- ☐ Storage space available

- ☐ Visitors welcome anytime

- ☐ Guest accommodations for overnight visitors

- ☐ Fitness center / gym

- ☐ Walking or nature trails

- ☐ Swimming pool (indoor or outdoor)

- ☐ Golf course nearby

- ☐ On-site restaurant or dining hall

- ☐ Café or coffee shop

- ☐ Community garden or planting area

- ☐ Green space or courtyard

- ☐ Pond, lake, or water feature

- ☐ Fishing access

- ☐ Beach access or beach shuttle

- ☐ Organized social activities

- ☐ Clubs (cards, crafts, gardening, book club)

- ☐ Fitness or wellness classes

- ☐ Movie nights or theater room

- ☐ Live music or entertainment

- ☐ Religious or spiritual services

- ☐ Hobby rooms or workshops

- ☐ Library or quiet reading areas

- ☐ Outdoor gathering spaces

- ☐ Opportunities to volunteer or mentor

- ☐ Scheduled transportation provided

- ☐ Transportation to grocery stores

- ☐ Transportation to medical appointments

- ☐ Transportation to local shops & dining

- ☐ Easy access to highways or public transit

- ☐ Parking available for residents

- ☐ Parking available for visitors

- ☐ Registered Nurse (RN) on staff

- ☐ 24/7 staff availability

- ☐ Emergency call system

- ☐ Medication management support

- ☐ Assisted living services available

- ☐ Memory care available (if needed later)

- ☐ On-site wellness checks

- ☐ Security or gated access

- ☐ Small pets permitted

- ☐ Dog walking areas

- ☐ Pet care support available

- ☐ Ability to personalize living space

- ☐ Space for hobbies or collections

- ☐ Barn or animal-friendly nearby options

- ☐ Gardening or planting allowed

- ☐ Transparent pricing

- ☐ Month-to-month or flexible contracts

- ☐ Clear exit or move-out terms

- ☐ Utilities included

- ☐ Maintenance included

- ☐ No long-term buy-in required

- ☐ Option to age-in-place

A Closing Note for Adult Children

Helping a parent sell a long-time home and transition into senior living is one of the most meaningful—and emotionally complex—roles you may ever take on. It is rarely just about real estate. It’s about honoring a lifetime of memories while helping someone you love move into a safer, more supported stage of life.

Many adult children find themselves balancing multiple responsibilities at once: careers, families of their own, distance, and concern for a parent’s health or well-being. It’s normal to feel uncertain, conflicted, or even overwhelmed at times. These feelings do not mean you’re doing anything wrong—they mean you care.

Support Without Taking Control

One of the most important things you can do is help without taking over. Your role is not to make decisions for your parent, but to help them make informed decisions with confidence. That may mean:

- Helping research senior living options

- Coordinating logistics from a distance

- Attending meetings or calls when requested

- Asking questions your parent may not think to ask

Respecting autonomy while offering guidance creates trust and preserves dignity—especially during a major life transition.

Focus on Safety, Stability, and Quality of Life

While finances and logistics matter, the heart of this transition is quality of life. Social connection, safety, routine, and access to support often become more important than square footage or possessions.

Many parents experience a renewed sense of purpose and connection once they move into a community where interaction is easy and help is available if needed. Seeing that change can be reassuring for families who have worried quietly for years.

Use Trusted Resources and Professionals

You do not have to figure everything out on your own. Experienced real estate professionals, financial advisors, senior move managers, and reputable senior living resources can remove much of the burden from your shoulders.

If you are helping search for a senior living community—especially from another city or state—a helpful national resource is:

https://www.whereyoulivematters.org/find-a-community/

Having reliable information allows conversations to be grounded in facts rather than fear or urgency.

A Transition Made With Care

When handled thoughtfully, selling a home and moving into senior living can reduce stress for everyone involved. It can bring clarity to finances, improve daily safety, and open the door to meaningful social connections for your parent—while giving you peace of mind.

Your involvement matters more than you may realize. By approaching this transition with patience, respect, and the right support, you are helping your parent move forward with confidence into the next chapter of their life.

Questions Adult Children Should Ask

- What do you enjoy most about your current lifestyle?

- What feels hardest about maintaining your current home?

- How important is daily social interaction to you?

- Would you prefer more independence now with access to care later?

- Do you feel safe living alone right now?

- Are there tasks that are becoming more difficult?

- What kind of help would make daily life easier?

- Would access to on-site support give you peace of mind?

- What concerns do you have about finances or monthly costs?

- Do you understand how selling the home may affect your income?

- Would meeting with a financial advisor be helpful?

- What expenses feel most uncertain to you?

- What worries you most about selling the house?

- Do you want to be involved in every step, or prefer support handling details?

- How important is timing versus price?

- Would you feel more comfortable moving first and selling afterward?

- Do you have a current will or trust?

- Who should be involved if decisions need to be made quickly?

- Are important documents organized and accessible?

These conversations work best when they happen early, gradually, and with empathy. The goal is understanding—not urgency—and helping your parent move forward with confidence.

Author Bio

Before becoming a real estate broker, Bill served as president of a national company that worked directly with cities and three of the country’s largest senior living organizations, encompassing hundreds of living units, to help older adults safely remove unwanted and potentially hazardous materials from their homes.

Through those years, Bill gained valuable perspective into the practical and emotional challenges seniors face—mobility and safety concerns, decision-making with family members, and the strong emotional attachment many feel to a family home. He now applies that experience in his real estate practice, working with older adults, adult children, financial professionals, and senior living communities to ensure home sales are handled thoughtfully, respectfully, and with minimal stress.

Bill’s focus is not simply on selling homes, but on protecting dignity, preserving financial security, and creating smooth transitions that support quality of life in the next chapter.

Resources

Our conversation provided valuable perspective on the emotional, social, and practical considerations older adults face—particularly around independence, social connection, and continuity of care. Her insights helped inform several sections of this article and ensured the guidance reflects both lived experience and professional understanding of senior communities.

- National Institute on Aging (NIH) – Federal research and guidance on aging, health, and quality of life.

- Administration for Community Living (HHS) – Programs and services supporting older adults and caregivers.

- Medicare (Centers for Medicare & Medicaid Services) – Official information on Medicare coverage and eligibility.

- U.S. Department of Housing and Urban Development (HUD) – Seniors – Housing options, counseling, and programs for older adults.

- Social Security Administration – Retirement – Retirement benefits, eligibility, and planning tools.

- IRS Publication 523 – Selling Your Home – Capital gains exclusions and tax rules related to home sales.

- Consumer Financial Protection Bureau – Retirement – Practical financial tools and consumer guidance for retirees.

- U.S. Census Bureau – Housing Data – National housing statistics and demographic trends.

- Federal Reserve – Survey of Consumer Finances – Research on household wealth, home equity, and retirement savings.

- Cornell University Cooperative Extension – Aging at Home – University-based guidance on home safety, transitions, and aging in place.

Podcast

FAQ’s

1) How do I know it’s the right time to sell my home and move to senior living?

2) Should I move first and sell later, or sell first and then move?

3) What is the first step I should take before selling?

4) How do I choose the best real estate agent for a senior move?

5) Do I need to remodel before selling?

6) What are the most important low-cost improvements before listing?

7) How do we declutter when there are decades of belongings?

8) How should we price the home if we need a fast sale?

9) What buyer incentives are most common today?

10) What happens after the inspection, and how do we avoid price reductions?

11) What should we do with the proceeds from the sale of the home?

12) Will I owe taxes on the sale of my home?

13) What legal documents should be updated after the sale?

14) How can adult children help without taking over?

15) Where can we search for senior living communities to compare options?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.