Last updated on December 22nd, 2025 at 05:09 pm

Introduction

Tax-Advantaged Retirement Accounts: A Complete Guide to How 401(k)s, IRAs, Roths, and HSAs Work Together

Most Americans don’t retire on a pension anymore. They retire on a collection of tax-advantaged retirement accounts—including 401(k)s, traditional and Roth IRAs, and increasingly, Health Savings Accounts (HSAs). Each of these tax-advantaged retirement accounts comes with its own rules, tax treatment, contribution limits, and withdrawal requirements. What’s rarely explained clearly is how these tax-advantaged retirement accounts work together—and how to use them strategically as part of a single, coordinated retirement system.

That gap in understanding is exactly why this article is written as a guide, not a quick explainer.

Contribution Limits Snapshot (Update This Each Year)

This article is evergreen. We update this “limits” block annually so the rest of the guide stays timeless.

| Account | 2025 Limit | Catch-Up |

|---|---|---|

| 401(k) employee deferral | $23,500 | $7,500 (age 50+) |

| Traditional / Roth IRA | $7,000 | $1,000 (age 50+) |

| HSA (self-only HDHP) | $4,300 | $1,000 (age 55+) |

| HSA (family HDHP) | $8,550 | $1,000 (age 55+) |

Limits change over time. Confirm with the IRS and your plan provider before making decisions.

- Introduction

- Tax-Advantaged Retirement Accounts: A Complete Guide to How 401(k)s, IRAs, Roths, and HSAs Work Together

- Why This Guide Focuses on Tax-Advantaged Retirement Accounts

- The Questions Most People Have About Tax-Advantaged Retirement Accounts

- An Evergreen Guide You Can Return To

- Who This Guide Is For

- How This Guide Is Structured

- Section 1: The 401(k) — The Foundation of Tax-Advantaged Retirement Accounts

- 401(k) Contribution Limits (Update Annually)

- What Is a 401(k), What Does It Do, and How Do You Actually Use It?

- Section 1a: The IRS Rule of 55 — Early Access to 401(k) Funds Without Penalties

- Key Requirements to Qualify

- ⚠️ Important Warning Before Rolling Over a 401(k)

- Other Common Early Withdrawal Exceptions (401(k) & IRA)

- Key Takeaway

- Why the 401(k) Often Comes First

- This case illustrates why the 401(k) works best as a foundation, not a stand-alone solution.

- Step 1: Identify the Biggest Bottleneck

- Step 2: Use the Bonus to Front-Load the 401(k)

- Step 3: Redesign Cash Flow for the Rest of the Year

- Step 4: Think Beyond This Year

- Why This Case Study Matters

- 🔍 People Also Ask: Is There a Limit on How Much My Employer Can Match?

- Section 2: Traditional IRAs — The Bridge Between Jobs and Long-Term Tax Planning

- What Is a Traditional IRA and Why Does It Exist?

- How a Traditional IRA Works

- The Rollover IRA: How Most Traditional IRAs Are Created

- Investment Control: More Freedom, More Responsibility

- Case Study: Sandy Miller — Using a Rollover IRA to Maintain Momentum After a Job Change

- Mini Timeline: Sandy’s Rollover IRA Strategy

- People Also Ask: Traditional & Rollover IRAs

- Why Traditional IRAs Matter in the Bigger Picture

- Related RetireCoast Guides

- Authoritative External Resources

- Section 3: Roth IRAs — Tax-Free Growth, Flexibility, and Strategic Optionality

- What Is a Roth IRA and How Does It Work?

- Why Roth IRAs Matter in a Long-Term Strategy

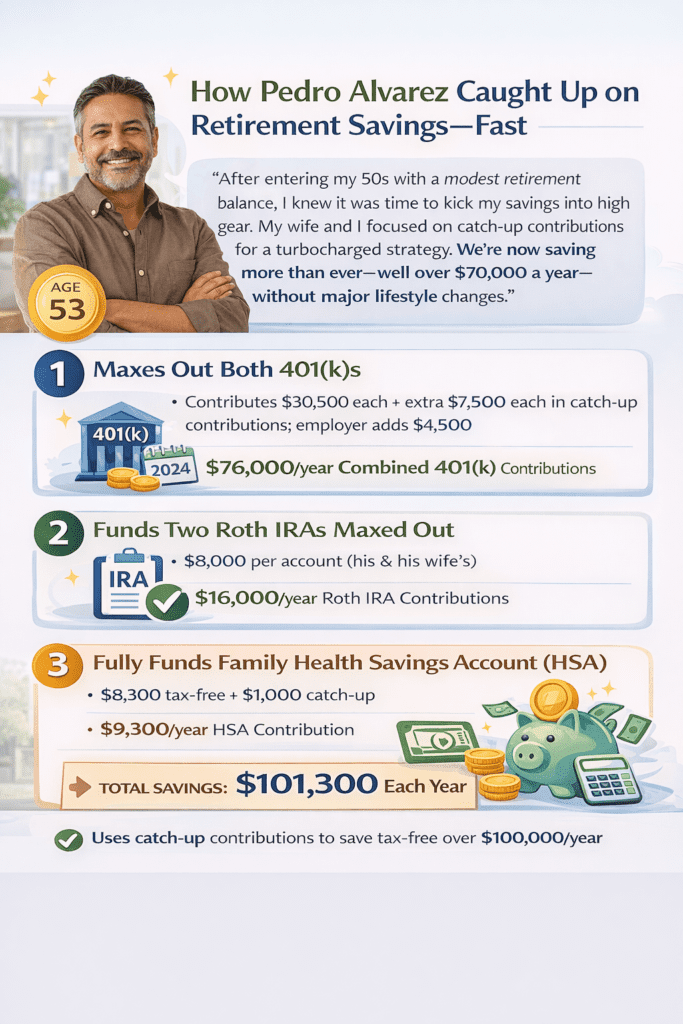

- Case Study: Pedro Alvarez — Choosing a Roth IRA Early

- 🔔 RetireCoast Callout: Roth IRAs Are Part of a Larger System

- People Also Ask: Roth IRA Questions

- Why Roth IRAs Matter Later in Life

- Section 4: Opening a Roth IRA for a Minor — Building Financial Literacy and Lifetime Wealth

- What Is a Custodial Roth IRA?

- The One Rule That Matters Most: Earned Income

- Who Acts as the Custodian?

- Choosing the Age of Control: Why Many Families Select 25

- Why Starting Early Is So Powerful

- 💡 RetireCoast Insight: Why I Opened Custodial Roth IRAs for My Grandchildren

- What Happens When the Child Takes Over the Account?

- Important Considerations and Cautions

- Key Takeaway

- Section 5: Health Savings Accounts (HSAs) — The “Triple Tax Advantage” Account That Can Power Retirement

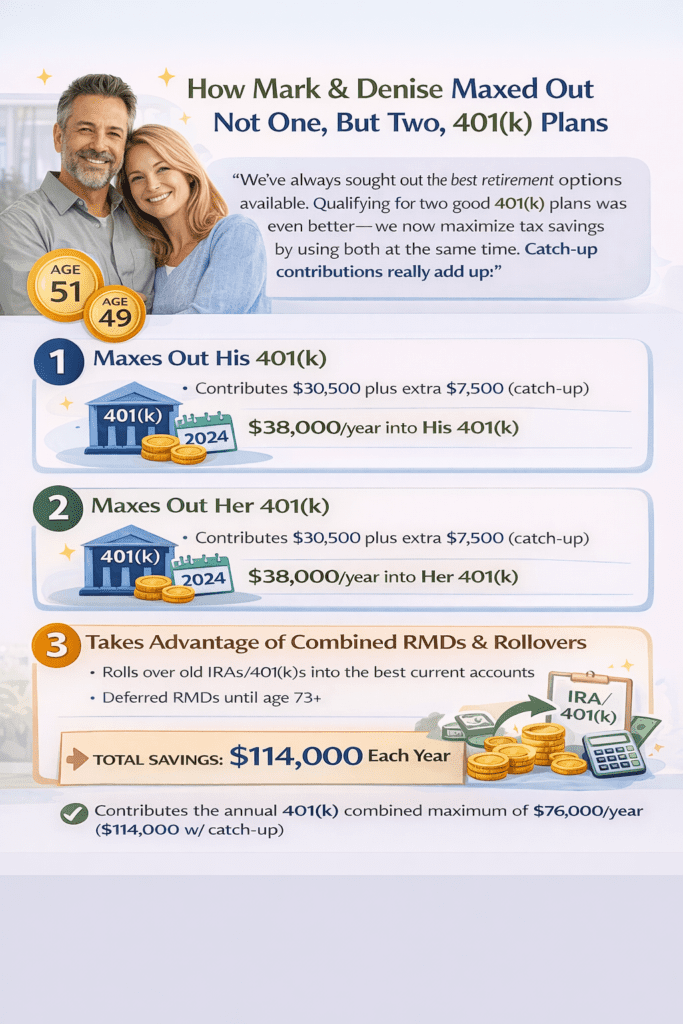

- HSA Case Study: Mark and Denise Carter (Gen X)

- Section 6: How Tax-Advantaged Accounts Work Together — A Coordinated Retirement System

- Final Conclusion: Turning Tax-Advantaged Accounts Into a Working Retirement System

Why This Guide Focuses on Tax-Advantaged Retirement Accounts

When people think about retirement savings, they often focus on a single account—usually a 401(k). In reality, successful retirement planning depends on understanding how different tax-advantaged retirement accounts complement one another. The tax rules that apply when you contribute, when your money grows, and when you eventually withdraw it can dramatically affect how long your savings last.

This guide is designed to show how tax-advantaged retirement accounts function individually and as a system.

The Questions Most People Have About Tax-Advantaged Retirement Accounts

If you’re like many Gen X households, you’re likely asking practical questions such as:

- What is the difference between traditional and Roth tax-advantaged retirement accounts?

- How much can I contribute each year to different tax-advantaged retirement accounts?

- Is an HSA really a tax-advantaged retirement account, or just a healthcare savings tool?

- How do tax-advantaged retirement accounts interact from a tax-planning perspective?

- In what order should I prioritize funding tax-advantaged retirement accounts?

These questions come up repeatedly because the answers are not intuitive—and because the stakes are high.

An Evergreen Guide You Can Return To

About 90% of what you’ll learn in this guide to tax-advantaged retirement accounts is evergreen. The fundamental rules governing 401(k)s, IRAs, Roth accounts, and HSAs rarely change. Where updates do occur—such as annual contribution limits or income thresholds—they are clearly marked, supported by charts, and reinforced with calculators.

This structure allows this guide to remain a long-term reference while still reflecting current rules.

Who This Guide Is For

This guide to tax-advantaged retirement accounts is written for:

- Gen X professionals managing peak earning years

- Couples coordinating multiple retirement accounts

- Workers rolling over old employer plans

- Anyone who wants to reduce lifetime taxes, not just save more

You don’t need to be a financial professional to benefit from this guide—but by the end, you’ll understand tax-advantaged retirement accounts far better than most people who already use them.

How This Guide Is Structured

Throughout this article, you’ll see:

- Clear explanations of each major tax-advantaged retirement account

- Charts comparing how different tax-advantaged retirement accounts are taxed

- Calculators to model contributions and growth

- Real-world case studies

- Audio explanations for complex topics

- A comprehensive FAQ answering the most searched questions about tax-advantaged retirement accounts

Next: We’ll begin by defining what tax-advantaged retirement accounts actually are—and why thinking about them as a coordinated system, rather than isolated accounts, is the foundation of smarter retirement planning.

Section 1: The 401(k) — The Foundation of Tax-Advantaged Retirement Accounts

For most working Americans, the 401(k) is the starting point—and often the largest component—of their tax-advantaged retirement accounts. It is an employer-sponsored plan designed to help employees save consistently for retirement while receiving meaningful tax benefits along the way.

A traditional 401(k) allows workers to contribute a portion of their paycheck before income taxes are applied, reducing current taxable income while allowing savings to grow on a tax-deferred basis. Many plans also offer a Roth 401(k) option, which uses after-tax contributions but provides tax-free withdrawals later.

While investment options and plan rules vary by employer, the 401(k) remains the most widely used workplace retirement vehicle in the United States.

What makes the 401(k) especially powerful is not just tax deferral—it’s how the plan interacts with other tax-advantaged retirement accounts over time.

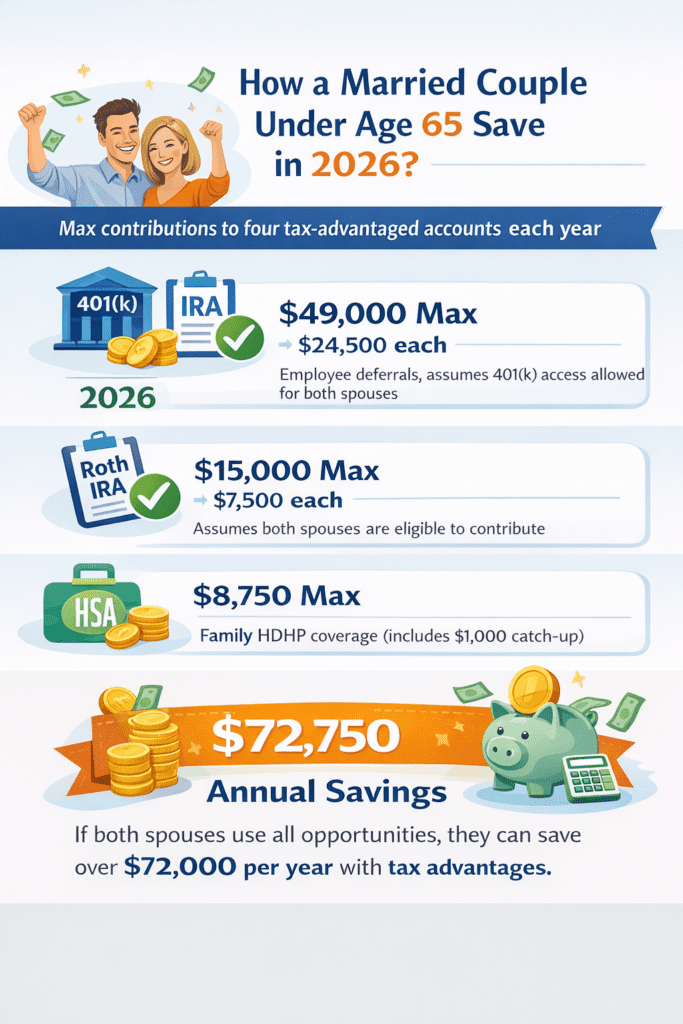

401(k) Contribution Limits (Update Annually)

- Employee deferral limit (2025): $24,500

- Catch-up (age 50+): $8,000

- Total 401(k) contribution cap (employee + employer): governed by IRS overall limits (plan-dependent)

Employer matches do not reduce your personal deferral limit, but they do count toward the overall plan limit.

What Is a 401(k), What Does It Do, and How Do You Actually Use It?

The 401(k) account was created by Congress to permit employees to build a retirement plan—using this account and other savings methods—to supplement Social Security. Social Security was never intended to be the sole source of retirement income, and the 401(k) exists to help close that gap.

A 401(k) is offered and administered by your employer. Importantly, the employer pays the cost of maintaining the plan, which can be substantial. This includes recordkeeping, compliance, reporting, and access to professional plan administrators. As an employee, you gain access to this infrastructure simply by participating.

You fund a 401(k) through automatic payroll deductions, contributing a portion of each paycheck. This makes saving consistent and removes the temptation to skip contributions when other expenses arise.

What Does a 401(k) Do?

At its core, a 401(k) is designed to build wealth for your future years.

Contributions grow over time through investment returns, and—if you are using a traditional 401(k)—those contributions reduce your taxable income in the year they are made. Over decades, this combination of tax deferral, compounding, and consistency is what turns routine paycheck deductions into meaningful retirement savings.

How Do You Actually Use a 401(k)?

This is where many guides fall short. They explain what a 401(k) is—but not how to use it.

RetireCoast takes a practical approach.

We are not going to tell you what to invest in. Instead, we’ll explain how the investment side of a 401(k) works so you understand the role you play.

As funds accumulate in your 401(k), your employer provides a menu of investment options selected and vetted through the plan administrator. These typically include:

- Mutual funds (often covering stocks and bonds)

- Money market or stable value funds

- Target-date or balanced funds

- In some cases, company stock

These options are usually designed to sit in the middle of the risk–reward spectrum. The goal is to make investing simpler for employees who may not have the time, interest, or expertise to manage individual investments. In effect, your employer is trying to make investing approachable and reasonably safe.

Section 1a: The IRS Rule of 55 — Early Access to 401(k) Funds Without Penalties

One of the most overlooked advantages of an employer-sponsored 401(k) is a special IRS provision known as the Rule of 55. This rule can significantly change retirement timing decisions—especially for Gen X workers considering early retirement, layoffs, or career transitions in their mid-50s.

What the Rule of 55 Does

The Rule of 55 allows certain individuals to take penalty-free withdrawals from their 401(k) or 403(b) if they leave their job in or after the year they turn age 55.

- The 10% early withdrawal penalty is waived

- Ordinary income taxes still apply

- The rule applies only to employer-sponsored plans, not IRAs

This can provide a critical income bridge between leaving work and reaching age 59½.

Key Requirements to Qualify

- Applies only to your current employer’s plan

(Not to old 401(k)s unless consolidated, and not to IRAs) - Timing matters

You must leave your job in the calendar year you turn 55 or later

(For example, if you turn 55 in July, leaving in March of that year still qualifies.) - Plan rules matter

Your employer’s plan must allow Rule of 55 withdrawals. Some plans opt out. - Taxes still apply

While the 10% penalty is avoided, withdrawals are still taxed as ordinary income.

⚠️ Important Warning Before Rolling Over a 401(k)

If you roll your current employer’s 401(k) into a Traditional or Rollover IRA, the Rule of 55 no longer applies.

Once funds are in an IRA:

- Early withdrawals generally trigger the 10% penalty until age 59½

- The Rule of 55 advantage is permanently lost for those funds

This is why understanding the Rule of 55 before initiating a rollover is critical.

Other Common Early Withdrawal Exceptions (401(k) & IRA)

In addition to the Rule of 55, the IRS provides other penalty exceptions that may apply depending on circumstances:

Applies to 401(k) and IRAs

- Permanent disability

- Unreimbursed medical expenses exceeding 7.5% of adjusted gross income (AGI)

- Substantially Equal Periodic Payments (SEPPs / Rule 72(t))

- IRS levy

- Qualified Domestic Relations Order (QDRO) in divorce

- Military reservists called to active duty for 180+ days

IRA-Specific Exceptions

(Some do not apply to 401(k)s unless the plan allows)

- First-time home purchase (up to $10,000 lifetime)

- Higher education expenses

- Health insurance premiums while unemployed for 12+ weeks

Key Takeaway

The Rule of 55 is a powerful planning tool—but only if you know it exists before making retirement or rollover decisions.

Always review your employer’s Summary Plan Description (SPD) and consult a qualified tax professional to understand how these rules apply to your specific situation.

For many Gen X workers, the Rule of 55 can mean the difference between a flexible early retirement and unnecessary penalties.

What If You Want More Control?

Some plans offer expanded investment options through the plan administrator—such as firms like Charles Schwab or similar providers. Depending on the plan, this may allow access to:

- Broader equity portfolios

- Specialized funds

- Precious metals funds

- In limited cases, alternative investments

If you have investing experience, you may choose to explore these options within the boundaries of your employer’s plan.

Built-In Support Is a Unique Advantage of the 401(k)

One feature that makes the 401(k) unique among tax-advantaged retirement accounts is employer-sponsored support.

Many plan administrators provide:

- Educational resources

- Access to support staff who can answer questions

- In some cases, guidance based on your age and general financial situation

This support can be invaluable, especially for employees who do not consider themselves confident investors.

As you’ll see later in this guide, Roth IRAs and HSAs do not come with this kind of employer assistance. Those accounts place more responsibility on you to understand investments and manage decisions independently. The good news is that investment firms holding Roth IRAs and HSAs also provide education and support—but the employer is no longer acting as an intermediary.

How a 401(k) Builds Retirement Wealth

(Pre-tax or Roth)

Free money

Mutual funds • target-date funds • other options

Tax-deferred growth

Withdrawn strategically

Over time, this system turns small, consistent paycheck contributions into long-term retirement wealth.

Why the 401(k) Often Comes First

When used correctly, the 401(k) serves as the core accumulation engine during your earning years. Payroll deductions make saving automatic, contribution limits are higher than most individual accounts, and—most importantly—many employers provide matching contributions.

This combination makes the 401(k) difficult to replace with any other single retirement account.

Employer Match Is Free Money

Yes — absolutely free money added to your retirement account simply for making a contribution. Many employers are permitted to match a portion of your annual salary with their own funds.

For example, an employer may match 6% of your salary if you contribute at least that amount to your 401(k). That match is deposited directly into your retirement account and becomes part of your long-term savings.

Not contributing enough to receive the full match means you are leaving money on the table.

This case illustrates why the 401(k) works best as a foundation, not a stand-alone solution.

Case Study (Full Narrative): How Samantha Decided What to Do With Her Bonus

When Samantha Treanor received her $28,000 bonus in February, she and her husband Mark made a deliberate decision before the money ever hit their checking account: the bonus would be used to strengthen their long-term retirement plan—not lifestyle spending.

Like many Gen X households, Samantha and Mark already had a retirement plan on paper, but funding it consistently was the challenge. Monthly cash flow had to cover a mortgage, family expenses, and everyday life. Retirement contributions were happening—but not at the pace they wanted.

The bonus created a rare opportunity to change the structure of their savings, not just add to it.

Step 1: Identify the Biggest Bottleneck

Their first question was simple:

What is preventing us from fully funding our retirement accounts each year?

The answer wasn’t lack of income—it was monthly payroll pressure. Regular 401(k) contributions reduced take-home pay, which limited how much they could simultaneously contribute to a Roth IRA and an HSA.

Rather than spreading the bonus thin across multiple accounts, Samantha focused on removing that bottleneck entirely.

Step 2: Use the Bonus to Front-Load the 401(k)

Samantha decided to use the bonus to fully fund her annual 401(k) contribution early in the year.

This accomplished several things at once:

- Her full employee contribution was completed upfront

- She guaranteed she would capture her employer’s entire 6% match

- Her taxable income for the year was reduced

- Future paychecks were no longer reduced by 401(k) deferrals

On a $90,000 salary, the employer match alone added $5,400 of free money to her retirement account—money they did not have to save themselves.

Step 3: Redesign Cash Flow for the Rest of the Year

Once the 401(k) was fully funded, something important happened:

Samantha’s take-home pay increased for the remainder of the year.

Instead of treating that extra cash flow as discretionary income, Samantha and Mark reassigned it intentionally:

- Part went into a Roth IRA, building future tax-free income

- Part went into an HSA, creating a dedicated pool for healthcare costs in retirement

The key insight was that the bonus didn’t just fund one account—it restructured how every paycheck worked going forward.

Step 4: Think Beyond This Year

Samantha and Mark weren’t just solving for the current year. They were also thinking ahead.

By maximizing pre-tax savings now and building Roth and HSA balances alongside it, they were:

- Diversifying future tax exposure

- Creating flexibility for early retirement years

- Reducing the risk of large required distributions later in life

The bonus became the catalyst for a multi-account strategy, not a one-time deposit.

Why This Case Study Matters

Samantha’s decision wasn’t about chasing returns or timing the market. It was about using a windfall to permanently improve their retirement system.

Instead of asking, “Where should this money go?”

They asked, “How can this money remove friction from our plan?”

That shift in thinking is what allowed one bonus to:

Improve cash flow for the rest of the year

Fully fund a 401(k)

Capture maximum employer match

Enable Roth and HSA contributions

Samantha’s Bonus → Retirement Strategy Timeline

One bonus didn’t just add money — it permanently improved how every paycheck worked.

In the next section, you’ll hear Samantha explain this strategy in her own words—and why front-loading her 401(k) changed how they think about retirement planning.

🎧 Case Study Audio: Samantha Explains Her 401(k) Strategy

In this short audio clip, Samantha Treanor explains exactly how she used her bonus to fully fund her 401(k), capture her employer match, and redirect future paychecks toward a Roth IRA and an HSA. This is a real-world example of how tax-advantaged retirement accounts can work together in practice.

Duration: ~2–3 minutes • Optional listen

🔍 People Also Ask: Is There a Limit on How Much My Employer Can Match?

Is there a limit on how much my employer can match in my 401(k)?

There is no specific dollar limit on how much an employer can contribute as a match to an employee’s 401(k). Employers set their own matching formulas—such as matching 50% or 100% of employee contributions up to a certain percentage of salary—and they can be as generous as they choose, subject to plan rules.

However, all 401(k) contributions are subject to an overall IRS cap under Internal Revenue Code Section 415(c). This limit applies to the combined total of employee salary deferrals, employer matching contributions, and any other employer contributions.

For the 2025 tax year, the total contribution limit is the lesser of:

- $70,000, or

- 100% of the employee’s compensation

For employees age 50 or older, the limit increases to $77,500, which includes the standard $7,500 catch-up contribution. Some plans allow higher “super catch-up” contributions for ages 60–63, increasing the total limit to $81,250.

Employer matching contributions count toward this overall limit, but they do not count against the employee’s personal deferral limit, which is $23,500 for 2025 (plus applicable catch-up contributions).

In practice, most employers match between 3% and 6% of salary. Some employers, however, offer significantly more generous matches.

These limits are adjusted periodically for inflation (for example, the base limit is expected to rise to $72,000 for 2026). Always review your employer’s plan documents and consult IRS guidance or a tax professional for details specific to your situation.

Why the 401(k) Should Be the Core Retirement Account During Working Years

Generation X—and many retirees who are still earning income on a W-2 basis—should strongly consider the 401(k) as their core retirement savings strategy during their working years. The reason comes down to two powerful advantages. First, funds deposited into a traditional 401(k) are not subject to income tax at the time they are contributed, allowing savers to reduce current taxable income while those funds grow tax-deferred. Second, employer matching contributions represent free money added to the retirement account simply for participating in the plan.

Over time, however, a 401(k) should not be viewed as a permanent holding account. Retirees and near-retirees should have a deliberate plan to gradually reposition 401(k) assets into more tax-efficient vehicles such as Roth accounts and, where appropriate, Health Savings Accounts (HSAs). With careful tax planning, this process can begin as early as age 59½—even while still employed—allowing distributions to be taken over time to help avoid a large, single-year tax event later in retirement.

⚠️ WARNING: Do Not Leave an Old 401(k) Behind

When you leave an employer where you currently have a 401(k), do not forget about that account. Many employees leave old plans behind, lose track of them, and years later discover the funds have been turned over to the state as unclaimed property because no action was taken.

Here is what to do instead:

-

If your new employer has a 401(k):

Contact the new employer’s plan administrator. Provide the details of your old 401(k) and request a

direct rollover of the funds or investments into your new employer’s plan.

Never ask for the funds to be sent to you directly. Doing so will trigger income taxes and potential early withdrawal penalties.

-

If your new employer does not have a 401(k):

You have two choices:

- Leave the funds with the old employer if permitted — but make sure you do not forget them. Request both email and paper statements so you receive ongoing reminders.

- Roll the funds into a Traditional IRA (Rollover IRA). Open an account first with a brokerage firm such as Charles Schwab, then provide the old employer’s plan administrator with the new account information. They will handle the rollover for you.

In all cases, never take possession of the funds directly. Always use a direct rollover.

Mini Flow: What To Do With an Old 401(k) When You Change Jobs

Never have the check made out to you.

- Leave it with the old plan (and don’t forget it), or

- Open a Rollover IRA and request a direct rollover.

Key Takeaway for the 401(k)

The 401(k) is not just a savings account—it is the anchor of most tax-advantaged retirement strategies. Used properly, it accelerates accumulation during peak earning years and later becomes a funding source for more flexible, tax-efficient income.

In the next section, we’ll examine Traditional IRAs, which often enter the picture through rollovers and play a critical role in long-term tax planning flexibility.

Section 2: Traditional IRAs — The Bridge Between Jobs and Long-Term Tax Planning

For many people, a Traditional IRA enters their retirement picture not because they planned for one—but because their career changed.

Job changes, layoffs, retirements, or benefit restructurings often force a decision about what to do with an existing 401(k). When that happens, the Traditional IRA—most commonly in the form of a Rollover IRA—becomes the natural next step.

Within the universe of tax-advantaged retirement accounts, Traditional IRAs serve a unique role. They are rarely the starting point, but they are often the account that shapes future tax planning, Roth conversions, and retirement income decisions.

In this short audio commentary, the author explains why the Roth IRA is often unmatched when it comes to long-term income growth, especially when compared to traditional tax-deferred accounts. The discussion focuses on compounding, tax-free withdrawals, and why Roth IRAs can dramatically improve retirement flexibility.

Author note: Audio insights are provided to add real-world perspective and help readers think beyond contribution limits and rules.

Traditional IRA Contribution Limits (Update Annually)

- Annual IRA limit (2025): $7,000

- Catch-up (age 50+): $1,000

Deductibility may depend on income and whether you (or your spouse) are covered by a workplace plan.

What Is a Traditional IRA and Why Does It Exist?

A Traditional Individual Retirement Account (IRA) was created to give individuals a way to save for retirement outside of an employer-sponsored plan. Unlike a 401(k), which is offered and maintained by an employer, a Traditional IRA is owned and controlled entirely by the individual.

Traditional IRAs serve two primary purposes:

- Providing retirement savings access for individuals without a workplace plan

- Acting as a rollover destination for employer plans such as 401(k)s, 403(b)s, and 457 plans

For Gen X and retirees, the second purpose is by far the most common.

How a Traditional IRA Works

A Traditional IRA allows funds to grow tax-deferred. You do not pay taxes on interest, dividends, or capital gains while money remains inside the account. Taxes are generally paid when withdrawals are taken.

Contributions may be tax-deductible depending on:

- Income level

- Whether you or your spouse are covered by a workplace plan

- IRS deduction limits

Even when contributions are not deductible, tax-deferred growth alone can provide meaningful long-term benefits.

The Rollover IRA: How Most Traditional IRAs Are Created

A Rollover IRA is simply a Traditional IRA that receives funds from a former employer’s retirement plan.

The word “rollover” describes how the account was funded, not how it operates.

Common rollover sources include:

- 401(k) plans

- 403(b) plans

- Government and nonprofit retirement plans

When executed properly as a direct rollover, the transfer:

- Preserves tax-deferred status

- Avoids taxes and penalties

- Places the account under your direct control

This moment is often when people first realize that they—not an employer—are now fully responsible for investment decisions.

Investment Control: More Freedom, More Responsibility

One of the defining differences between a Traditional IRA and a 401(k) is investment flexibility.

Traditional IRAs typically allow access to:

- Individual stocks and bonds

- Broad mutual funds and ETFs

- Money market funds

- In some cases, alternative investments (depending on the custodian)

This freedom can be empowering—but it also introduces risk for those without investment experience. There are no default funds, no employer vetting, and no built-in guidance unless you seek it out.

For some, this control is an advantage. For others, it can lead to inaction or poorly diversified portfolios.

Case Study: Sandy Miller — Using a Rollover IRA to Maintain Momentum After a Job Change

When Sandy Miller started a new job, she quickly discovered that her new employer did not offer a 401(k). At her previous job, she had accumulated meaningful retirement savings—but she could not leave the account indefinitely.

Her former employer required her to close or move the 401(k) within six months.

Rather than cashing out or leaving the funds unattended, Sandy chose to act.

Preserving Her Savings

Sandy opened a Rollover IRA with a brokerage firm and coordinated a direct rollover from her former employer’s plan. The funds transferred without triggering taxes or penalties, preserving their tax-deferred status.

Replacing Payroll Discipline

Without payroll deductions, Sandy worried that saving might become inconsistent. To prevent that, she worked with her IRA provider to establish automatic monthly transfers from her checking account.

Initially, those contributions were directed into a money market fund, giving her time to evaluate long-term investment choices without rushing decisions.

Funding Multiple Accounts

At the same time, Sandy contributed the same monthly amount to a Roth IRA, ensuring she continued building tax-free retirement income alongside tax-deferred savings.

Looking ahead, Sandy planned to use a future pay raise—expected after one year with her new employer—to begin funding an HSA, further expanding her tax-advantaged strategy.

Her approach ensured that a job change did not interrupt her retirement momentum.

Mini Timeline: Sandy’s Rollover IRA Strategy

Sandy’s Job Change → Retirement Strategy Timeline

Must move her 401(k) within six months.

Direct rollover preserves tax deferral.

Checking → IRA automation replaces payroll deductions.

Same monthly amount builds tax-free income.

Planned funding using future pay raises.

People Also Ask: Traditional & Rollover IRAs

Is a rollover IRA different from a Traditional IRA?

No. A rollover IRA is a Traditional IRA. The term only indicates that the account was funded with money from an employer plan.

Can I contribute to a rollover IRA?

Yes. Rollover IRAs can receive both rollover funds and regular annual IRA contributions, subject to IRS limits.

Should rollover funds be invested immediately?

Not necessarily. Many people temporarily use money market funds while developing an investment plan.

Does a rollover trigger taxes?

No—provided it is a direct rollover between custodians. Taxes typically apply only when funds are paid directly to the individual.

Why do rollover IRAs matter for tax planning?

They often become the source of future Roth conversions, retirement income, and Required Minimum Distributions.

Why Traditional IRAs Matter in the Bigger Picture

Traditional IRAs sit at the center of long-term tax planning. They influence:

- Future tax brackets

- Medicare premiums

- Social Security taxation

- Roth conversion opportunities

They are rarely the final destination—but they are often the launch point for more advanced strategies.

Related RetireCoast Guides

- Gen X Retirement Planning: A 20-Year View

- Tax Planning for Gen X and Retirees

- Fixing Retirement Gaps for Gen X

- The Complete Gen X Retirement Guide

- Medicare Premiums, Gaps & Long-Term Care

Authoritative External Resources

- IRS — Retirement Plans: https://www.irs.gov/retirement-plans

- Social Security Administration — Retirement Benefits: https://www.ssa.gov/retirement

- Charles Schwab — IRA Overview: https://www.schwab.com/ira

In the next section, we’ll examine Roth IRAs—how they create tax-free income, when they should be funded, and why they often become the most flexible account in retirement.

Section 3: Roth IRAs — Tax-Free Growth, Flexibility, and Strategic Optionality

Within the broader universe of tax-advantaged retirement accounts, the Roth IRA occupies a unique and often misunderstood position. Unlike Traditional IRAs and 401(k)s, which focus on tax deferral, Roth IRAs are built around a different promise: pay taxes now, eliminate them later.

For many savers—especially Millennials and Gen X—Roth IRAs serve not just as retirement accounts, but as strategic tools that provide flexibility across multiple life stages.

Roth IRA Contribution Limits (Update Annually)

- Annual IRA limit (2025): $7,500

- Catch-up (age 50+): $1,100

- Eligibility note: Roth IRA contribution ability is subject to income limits

If income limits restrict direct Roth contributions, other strategies may exist (with planning).

What Is a Roth IRA and How Does It Work?

A Roth Individual Retirement Account (Roth IRA) is funded with after-tax dollars. Contributions do not reduce your current taxable income. However, in exchange for giving up that immediate deduction, Roth IRAs offer powerful long-term benefits:

- Tax-free growth

- Tax-free qualified withdrawals

- No Required Minimum Distributions (RMDs) during the owner’s lifetime

This structure makes Roth IRAs particularly valuable for individuals who expect to be in the same or a higher tax bracket in the future—or who want to manage taxable income carefully in retirement.

Why Roth IRAs Matter in a Long-Term Strategy

Roth IRAs are not designed to replace 401(k)s or Traditional IRAs. Instead, they complement them.

They are often used to:

- Create tax-free income in retirement

- Reduce future Required Minimum Distributions from other accounts

- Provide withdrawal flexibility without increasing taxable income

- Serve as a hedge against future tax rate increases

For many households, the Roth IRA becomes the account they are most reluctant to spend—because of its long-term value and optionality.

Case Study: Pedro Alvarez — Choosing a Roth IRA Early

When Pedro Alvarez began thinking seriously about retirement, he was still early in his career. As a Millennial, Pedro understood one powerful advantage he had on his side: time.

Pedro had heard about Roth IRAs and was immediately drawn to the idea of tax-free compounding over decades. With many years before retirement, he recognized that growth—not just contributions—would play a critical role in his financial future.

Evaluating His Options

Pedro’s employer did not offer a workplace retirement plan such as a 401(k). Without access to payroll deferrals or employer matching, Pedro evaluated two options:

- Opening a Traditional IRA and deferring taxes now

- Opening a Roth IRA and investing after-tax dollars for future tax-free withdrawals

His decision was quick and deliberate.

Why Pedro Chose the Roth IRA

Pedro chose the Roth IRA for three reasons:

- Compounding Over Time

With decades until retirement, Pedro believed tax-free growth would outperform the value of an upfront deduction. - Tax Certainty

Rather than guessing what future tax rates might look like, Pedro chose to pay taxes now—at rates he understood—and remove that uncertainty. - Flexibility for Near-Term Goals

Pedro knew he planned to buy a home within the next ten years. He understood that Roth IRA contributions (principal) can generally be withdrawn without taxes or penalties, making them a potential source for a future down payment if needed.

Pedro did not view his Roth IRA as a short-term savings account. Instead, he viewed it as a dual-purpose asset—primarily for retirement, but flexible enough to support major life milestones.

🔔 RetireCoast Callout: Roth IRAs Are Part of a Larger System

Don’t Think of a Roth IRA in Isolation

A Roth IRA is most effective when used as part of a coordinated retirement strategy that may also include a 401(k), a rollover IRA, and a Health Savings Account (HSA).

You can open more than one type of retirement account and, in many cases, fund more than one in the same year—as long as you stay within the contribution limits for each program.

The goal is not to choose a single “best” account, but to use each account for what it does best at different stages of your life.

People Also Ask: Roth IRA Questions

Can I withdraw money from a Roth IRA before retirement?

Yes. Roth IRA contributions can generally be withdrawn at any time without taxes or penalties. Earnings are subject to the 5-year rule and qualifying conditions.

Can I have a Roth IRA and a 401(k) at the same time?

Yes. You can contribute to both in the same year if you meet eligibility rules and contribution limits.

Can a child have a Roth IRA?

Yes. The IRS allows custodial Roth IRAs for minors with earned income.

What happens when a custodial Roth IRA transfers to the child?

The account becomes a regular Roth IRA, retaining its original start date and investments.

Where can I find official IRS rules?

The IRS outlines custodial Roth IRA rules in

IRS Form 5305-RA (Custodial Roth IRA Agreement):

https://www.irs.gov/pub/irs-prior/f5305ra–2016.pdf

Why Roth IRAs Matter Later in Life

Roth IRAs often become more valuable—not less—as retirement approaches. They can:

- Reduce taxable income in retirement

- Help manage Medicare premium thresholds

- Provide flexibility during market downturns

- Serve as a tax-efficient legacy asset

Many retirees ultimately view their Roth IRA as the last account they want to spend, because of what it represents: tax-free optionality.

One of the most common misunderstandings about Roth IRAs involves what can be withdrawn, when, and under what conditions. Knowing these rules can prevent unnecessary taxes and penalties.

Withdrawing Your Contributions (Principal)

- No waiting period

- Contributions (what you put in) are always accessible

- Withdrawals are tax-free and penalty-free at any age

Withdrawing Earnings (Growth)

Earnings are subject to the 5-Year Rule:

- The clock starts on January 1 of the year you made your first-ever Roth IRA contribution

- To withdraw earnings tax- and penalty-free, you must satisfy the 5-year rule and meet one of the following:

- Be age 59½ or older

- Be disabled

- Use up to $10,000 for a first-time home purchase

- Be a beneficiary after the owner’s death

Withdrawing Converted Funds

- Roth conversions from Traditional IRAs follow a separate 5-year rule

- Each conversion has its own clock

- Taxes are paid at conversion, but penalties may apply if withdrawn too early

Summary of Waiting Periods

- Contributions: None

- Earnings: 5 years from your first Roth contribution

- Converted principal: 5 years from each conversion

If you’d like to see how different account types compare using the same assumptions, you can use our interactive Roth vs Traditional vs 401(k) After-Tax Calculator to model contributions, growth, withdrawal tax rates, and employer matching.

Compare Roth vs Traditional vs 401(k) After Taxes

See how the same investment performs across different account types once taxes and employer matching are considered.

Launch the CalculatorYou can also explore our full collection of retirement tools in the RetireCoast Calculators Hub , including our Roth vs Traditional vs 401(k) comparison calculator .

Section 4: Opening a Roth IRA for a Minor — Building Financial Literacy and Lifetime Wealth

Within the broader discussion of tax-advantaged retirement accounts, one of the least understood—but most powerful—strategies is opening a Roth IRA for a minor.

Yes, the IRS allows adults to open a custodial Roth IRA for a child of any age. When done correctly, this approach can create decades of tax-free growth while also serving a far more important purpose: teaching financial literacy early in life.

What Is a Custodial Roth IRA?

A custodial Roth IRA is a Roth IRA opened in a child’s name, managed by an adult custodian (usually a parent or grandparent) until the child reaches a designated age.

Key characteristics:

- The account legally belongs to the child

- An adult acts as custodian and controls the account

- All standard Roth IRA rules apply

- Control transfers to the child at a predetermined age

You can open a custodial Roth IRA for:

- Children

- Teenagers

- Even very young minors

Age is not the limiting factor.

The One Rule That Matters Most: Earned Income

The IRS requires that the child must have earned income to contribute to a Roth IRA.

Earned income can include:

- Wages from a job

- Income from family businesses

- Babysitting, lawn care, tutoring, or similar work

- Modeling or acting income

Unearned income—such as allowances, gifts, or investment income—does not qualify.

Contribution Limits for Minors

The annual contribution limit is the lesser of:

- The child’s earned income for the year, or

- The standard Roth IRA contribution limit

This means parents or grandparents can fund the account, as long as the contribution does not exceed what the child earned.

Who Acts as the Custodian?

Typically, the custodian is:

- A parent

- A grandparent

- A legal guardian

The custodian:

- Opens the account

- Manages contributions

- Selects investments

- Ensures compliance with IRS rules

The custodian remains in control until the child reaches the termination age, which is set at account creation and varies by state and provider.

Choosing the Age of Control: Why Many Families Select 25

While some custodial accounts transfer at 18 or 21, many families choose a later age—often 25.

The reasoning is practical:

- Financial maturity tends to improve with age

- It reduces the risk of impulsive decisions

- It aligns better with post-education and early career stability

At the transfer age, the custodial Roth IRA becomes a standard Roth IRA, with investments remaining intact and the original Roth start date preserved.

Why Starting Early Is So Powerful

Time is the single greatest advantage in investing.

A custodial Roth IRA:

- Allows decades of tax-free compounding

- Locks in an early Roth “start date”

- Builds familiarity with statements, markets, and growth

- Turns abstract money concepts into real-world learning

Even modest early contributions can grow into meaningful assets over 40–50 years—without future tax erosion.

💡 RetireCoast Insight: Why I Opened Custodial Roth IRAs for My Grandchildren

Why I Opened Custodial Roth IRA Accounts for My Grandchildren

I opened custodial Roth IRA accounts for my grandchildren for one key reason: it was part of teaching and improving their financial literacy.

It’s extremely important that children get an early start understanding money and how to manage it. Every few months, I get together with them—on the phone or in person—and we go over their account statements.

I felt it was important to have the statements sent directly to their homes so they could open the mail themselves and see the results. It made everything real.

The money at the end was the carrot—but it wasn’t the most important part. The learning was.

Reference (IRS): Form 5305-RA (Custodial Roth IRA Agreement)

What Happens When the Child Takes Over the Account?

When the child reaches the designated age:

- Custodial restrictions end

- The account becomes a regular Roth IRA

- Investments remain unchanged

- The Roth IRA’s original start date carries forward

This means the 5-year Roth clock may already be satisfied long before retirement—an enormous advantage.

Important Considerations and Cautions

Custodial Roth IRAs are powerful, but they require thoughtful planning:

- Contributions must be tied to earned income

- Income should be documented

- The account ultimately belongs to the child

- Once control transfers, the child decides how funds are used

This strategy is best used as part of an intentional education and planning process, not simply as a gift.

Key Takeaway

Opening a Roth IRA for a minor isn’t about creating instant wealth.

It’s about creating time, discipline, and understanding.

For families and grandparents who want to leave more than money behind, this may be one of the most impactful long-term financial decisions they ever make.

n the next section, we’ll examine Health Savings Accounts (HSAs)—often called the most tax-efficient account available—and how they integrate with 401(k)s, IRAs, and Roth strategies.

Section 5: Health Savings Accounts (HSAs) — The “Triple Tax Advantage” Account That Can Power Retirement

When people think about tax-advantaged retirement accounts, they usually start with a 401(k) or IRA. But if you’re eligible, the Health Savings Account (HSA) can be one of the most valuable accounts you’ll ever fund—especially for Gen X and retirees planning for healthcare costs, Medicare, prescriptions, and long-term care.

An HSA is often called the only account with a triple tax advantage, and when coordinated with a 401(k), IRA/rollover IRA, and Roth IRA, it can meaningfully improve your retirement flexibility.

HSA Contribution Limits (Update Annually)

- Self-only HDHP (2025): $4,400

- Family HDHP (2025): $8,750

- Catch-up (age 55+): $1,000

You must be enrolled in an eligible HDHP to contribute. Once enrolled in Medicare, you generally can’t contribute.

What an HSA is—and why it exists

A Health Savings Account (HSA) is a tax-advantaged account available to individuals enrolled in an HSA-eligible High-Deductible Health Plan (HDHP). It was designed to help people save for qualified medical expenses, but it has evolved into something much bigger for long-range planning.

Unlike many workplace benefits, an HSA is portable. You keep it if you change jobs, and it can remain in place for decades.

The Triple Tax Advantage

HSAs have a unique tax structure:

- Contributions can be pre-tax (or tax-deductible if made outside payroll)

- Growth is tax-free (interest/dividends/capital gains inside the account)

- Withdrawals are tax-free when used for qualified medical expenses

That’s why HSAs frequently outperform “regular” taxable investing for healthcare funding.

HSAs Don’t Replace 401(k)s or Roth IRAs—They Strengthen Them

A strong retirement strategy usually combines multiple account types: 401(k) for core savings (and employer match), IRAs for consolidation and flexibility, Roth IRAs for tax-free withdrawals, and HSAs for tax-free healthcare funding.

The goal is not to “pick one best account”—it’s to use each account for what it does best.

The “retirement move” with HSAs

Most people use HSAs like checking accounts for co-pays. But many high-performing retirement plans use an HSA differently:

- Pay current medical costs out-of-pocket (when feasible)

- Save receipts

- Leave the HSA invested to grow

- Reimburse yourself later—often in retirement

This creates a future “bucket” of tax-free reimbursement that can reduce pressure on taxable withdrawals later.

Investing inside an HSA: what to know

Many HSA providers (including Fidelity, Schwab, HealthEquity, Optum Bank) allow investing once your cash balance reaches a minimum threshold (often $1,000–$2,000, though some providers may allow investing with no minimum). Common investment options may include mutual funds, ETFs, target-date funds, and sometimes individual stocks.

Practical rules of thumb:

- Keep some cash available for near-term expenses

- Remember investments may need to be sold and settled before reimbursement

- Invested balances are generally not FDIC-insured like cash

- Investments carry risk, including loss of principal

Provider rules vary—fees, investment menus, minimums, and settlement timing are not uniform.

HSA Case Study: Mark and Denise Carter (Gen X)

Mark and Denise Carter are a Gen X couple in their early 50s. They already contribute to Mark’s employer 401(k) (capturing the match) and Denise funds a Roth IRA each year. But they hadn’t built a system for healthcare—until they realized that healthcare costs could become one of their largest retirement expenses.

What changed their approach:

- They saw how Medicare still leaves gaps

- They recognized prescription costs and out-of-pocket exposure

- They realized taxable withdrawals could raise taxes and potentially affect Medicare-related costs

Their new HSA strategy:

- Maxed HSA contributions annually (within limits)

- Paid current medical expenses out-of-pocket when possible

- Saved receipts digitally for future reimbursement

- Invested the HSA balance instead of leaving it idle in cash

How it connected to their broader plan:

- 401(k): core retirement accumulation + employer match

- Roth IRA: future tax-free withdrawals

- HSA: future tax-free healthcare funding

Their biggest takeaway was simple: every dollar they could pull tax-free from the HSA in retirement is a dollar they may not need to pull from a taxable account.

Some of our articles that readers may enjoy:

- https://retirecoast.com/tax-planning-gen-x-retirees/

- https://retirecoast.com/gen-x-retirement-planning-20-year-guide/

- https://retirecoast.com/medicare-premiums-gaps-prescriptions-long-term-care/

We like to provide other informative sources so check out these for more detailed information on each program:

HSAs and Medicare: the rule you can’t ignore

Once you enroll in Medicare, you generally can’t contribute to an HSA anymore. But you can still use the HSA you built. That’s why HSAs are especially valuable in the years leading up to Medicare eligibility—when you can still fund them.

People Also Ask: HSA Questions

Is an HSA a retirement account?

It can function like one. HSAs are designed for healthcare expenses, but because contributions can be tax-advantaged

and growth can be tax-free, many people use them as long-term retirement healthcare accounts.

Can I invest money in my HSA?

Many providers allow investing once you keep a minimum cash balance. Options vary by provider and may include mutual funds,

ETFs, or target-date funds. Invested balances are not FDIC-insured and can lose value.

Should I spend my HSA each year or save it?

Many people spend it as needed. Others pay medical costs out-of-pocket (when feasible), save receipts, and allow the HSA

to grow for retirement reimbursement later. The right choice depends on cash flow and priorities.

Can I contribute to an HSA after I enroll in Medicare?

Generally, once you are enrolled in Medicare, you can no longer contribute to an HSA. You can still use existing HSA funds.

In the next section, we’ll bring everything together and show how these accounts work as a coordinated system—including typical “priority order” decisions (match-first, HSA, Roth/IRA, then additional 401(k)), and how that priority often shifts as you approach retirement.

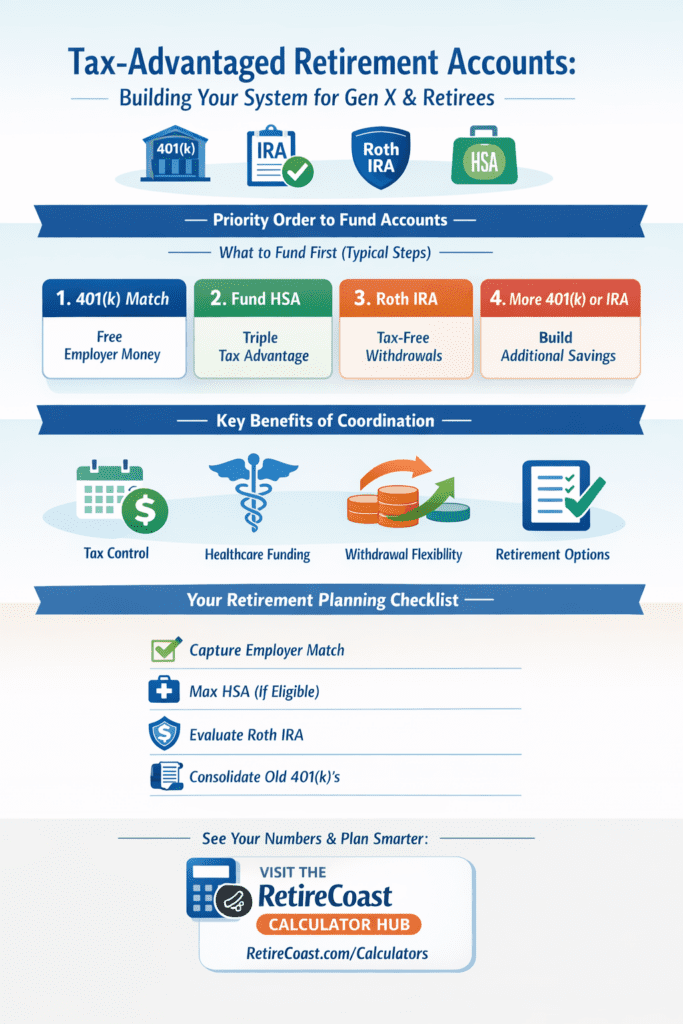

Section 6: How Tax-Advantaged Accounts Work Together — A Coordinated Retirement System

By now, one thing should be clear:

There is no single “best” retirement account.

The real advantage comes from how 401(k)s, IRAs, Roth IRAs, and HSAs work together over time—and how your priorities shift as income, taxes, healthcare needs, and retirement approach.

Think of retirement planning not as a collection of accounts, but as a system.

The Core Principle: Different Accounts, Different Jobs

Each tax-advantaged account is optimized for a different purpose:

- 401(k) → Large-scale accumulation + employer match

- Traditional / Rollover IRA → Consolidation and tax deferral

- Roth IRA → Tax-free withdrawals and flexibility

- HSA → Tax-free healthcare funding (and retirement support)

Trying to force one account to do everything usually leads to inefficiency. Coordinating them creates options.

The Typical Priority Order (Why This Works)

While individual circumstances vary, many strong retirement strategies follow a general funding order that looks like this:

Step 1: Capture the Employer Match (401(k))

If your employer offers a 401(k) match, this is usually the first priority.

- Employer matches are free money

- Not contributing enough to earn the full match is leaving compensation on the table

- This step alone can dramatically improve long-term outcomes

Even conservative investors benefit from the immediate return created by the match.

Step 2: Fund an HSA (If Eligible)

For those enrolled in an HSA-eligible HDHP, HSAs often come next.

Why?

- Triple tax advantage

- Future healthcare costs are unavoidable

- Tax-free withdrawals reduce pressure on taxable income later

HSAs are especially valuable for Gen X households planning for Medicare gaps, prescriptions, and long-term care.

Step 3: Build Tax-Free Income With a Roth IRA

Roth IRAs add something no other account provides: certainty.

- Contributions grow tax-free

- Qualified withdrawals are tax-free

- No required minimum distributions (RMDs) during the owner’s lifetime

Roths are often used to:

- Balance future tax exposure

- Provide flexibility for large expenses

- Reduce the risk of future tax law changes

Step 4: Return to the 401(k) or Traditional IRA

Once the match, HSA, and Roth are funded (or reasonably addressed), many households return to:

- Increasing 401(k) contributions, or

- Funding a Traditional or Rollover IRA

This is where long-term accumulation accelerates.

Early in your career, maximizing growth often matters most. As retirement approaches, tax control, healthcare planning, and flexibility become more important. The best strategies evolve over time instead of locking into a single account forever.

Working Retirees and Late-Career Professionals

For Gen X and retirees who are still earning W-2 income:

- The 401(k) often remains the core savings engine

- Employer matches still matter

- HSAs can still be funded (if eligible)

- Roth conversions and strategic withdrawals may begin as early as age 59½

This phase is less about accumulation alone and more about positioning assets for retirement income.

Visualizing the System (Conceptual Model)

Think of your accounts as buckets with different rules:

- Some buckets are taxed on the way in (Roth)

- Some are taxed on the way out (Traditional / 401(k))

- Some are never taxed at all when used correctly (HSA)

The goal is to choose which bucket to draw from depending on:

- Tax brackets

- Healthcare needs

- Market conditions

- Required minimum distributions

- Medicare and Social Security interactions

People Also Ask: Funding Order & Strategy

Which retirement account should I fund first?

For most people, start with the 401(k) match, then consider HSAs and Roth IRAs before increasing traditional retirement contributions.

Can I contribute to more than one account at the same time?

Yes. You can fund a 401(k), IRA (traditional or Roth), and HSA in the same year as long as you stay within each account’s limits.

Is it okay not to max out one account?

Absolutely. Many effective plans spread contributions across accounts to improve flexibility and tax control.

Final Takeaway for Section 6

The most successful retirement plans are coordinated, not isolated.

Using tax-advantaged retirement accounts together:

- Improves after-tax income

- Reduces risk from future tax changes

- Helps manage healthcare costs

- Provides flexibility throughout retirement

This is why your strategy matters more than any single account.

In the final section, we’ll summarize how to put this system into action, point you to calculators and tools that help model outcomes, and outline next steps for building or refining your own retirement plan.

Final Conclusion: Turning Tax-Advantaged Accounts Into a Working Retirement System

Understanding tax-advantaged retirement accounts is only the first step. The real power comes from using them together—intentionally, consistently, and in a way that adapts as your life and income change.

401(k)s, IRAs, Roth IRAs, and HSAs were not designed to compete with each other. They were created to solve different problems at different stages of life. When coordinated, they provide something no single account can offer on its own: control.

Control over:

- When you pay taxes

- How much of your retirement income is taxable

- How healthcare costs are funded

- How flexible your withdrawals are in retirement

For Gen X and working retirees especially, this coordination becomes critical. You are often balancing peak earning years, college costs, aging parents, rising healthcare expenses, and a narrowing window to prepare for retirement.

The good news is that tax-advantaged retirement accounts give you options—if you use them deliberately.

The goal isn’t perfection.

The goal is progress, clarity, and adaptability.

Start Here: Where Should You Focus First?

- Does your employer offer a 401(k) with a match?

→ Yes: Contribute at least enough to earn the full match.

→ No: Move to the next step. - Are you eligible for an HSA?

→ Yes: Consider funding it early due to its triple tax advantage.

→ No: Continue to the next step. - Do you want tax-free income in retirement?

→ Yes: Evaluate a Roth IRA (or Roth 401(k) option if available). - Do you have old 401(k)s from previous employers?

→ Yes: Consider consolidating via a rollover IRA for simplicity and control. - Are you within 10–15 years of retirement?

→ Yes: Begin thinking about tax diversification, healthcare funding, and withdrawal sequencing.

Tax-Advantaged Retirement Planning Checklist

- ☐ I understand how my 401(k) works and whether my employer offers a match

- ☐ I am contributing enough to earn the full employer match (if available)

- ☐ I know whether I am eligible for an HSA

- ☐ I understand the difference between Traditional and Roth accounts

- ☐ I have evaluated whether tax-free income will benefit me in retirement

- ☐ I know where my old 401(k)s are and have a plan for them

- ☐ I understand contribution limits for the current year

- ☐ I have a strategy for healthcare costs in retirement

- ☐ I understand withdrawal rules and penalties

- ☐ I am using more than one account type to improve flexibility

This checklist is educational only and should be used alongside professional advice where appropriate.

Bringing It All Together With Calculators

Understanding concepts is helpful. Seeing the numbers is transformative.

That’s why RetireCoast builds calculators alongside in-depth articles—so you can test ideas using your own assumptions.

Use calculators to:

- Compare Roth vs Traditional vs 401(k) outcomes

- Model employer match impact

- Estimate after-tax retirement income

- Evaluate contribution strategies over time

Featured Calculator

👉 Roth vs Traditional vs 401(k) After-Tax Calculator

https://retirecoast.com/roth-vs-traditional-vs-401k-calculator/

Visit the RetireCoast Calculator Hub

Explore More Retirement Calculators

Visit our Calculator Hub for additional retirement planning tools, including calculators for 401(k)s, Roth IRAs, HSAs, and tax-free withdrawal strategies.

Final Thought

Retirement planning isn’t about chasing the perfect account.

It’s about building a system that works for you—one that balances taxes, income, healthcare, and flexibility over decades, not just years.

If you take one thing away from this guide, let it be this:

Tax-advantaged retirement accounts are tools.

Coordination is the strategy.

Frequently Asked Questions: Tax-Advantaged Retirement Accounts

1) Can I contribute to a 401(k), Roth IRA, and HSA in the same year?

2) What should I fund first: 401(k) match, HSA, or Roth IRA?

3) Is a Roth IRA better than a Traditional IRA?

4) How does a 401(k) help “supplement Social Security”?

5) What happens if I leave an old employer and forget my 401(k)?

6) Can I withdraw money from a Roth IRA anytime?

7) Is an HSA really a retirement account?

8) Can I invest the money inside my HSA?

9) Can I have a rollover IRA and a Roth IRA at the same time?

10) How do I compare Roth vs Traditional vs 401(k) after taxes?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.