Last updated on December 5th, 2025 at 12:07 pm

Military veterans are 45% more likely to start a business after retirement or after military service than non-veterans. You can be one of those veterans who account for 8.1% of all U.S. businesses. This article and our entire series “Starting a Business After Retirement” will provide you with decision-making tools.

After researching many other articles about veterans starting businesses, I have concluded that almost all of them are just lists of referrals that take you to other referrals. You will get the “meat” here because it is coming from a veteran who has started many successful businesses.

Real-world experience distilled so you can understand it is much better than sending you down the road to yet another resource. Of course, we will provide outside resources when it makes sense and those resources can do something for you.

Many resources are a list of other resources, with little substance

Just to clear the air, many of the so-called “resources” offer little but listings of things to do. There is no free money or a quick way to make money when you start your own business. It takes intelligent work, study, and a methodic approach.

I have had the opportunity to work with many active duty and veterans helping them particularly in the real estate investment business but in another endeavor as well. Bear with me as I go through some basics that you just can not ignore if you want to be successful.

I want you to be in the 10% of startup businesses that succeed after the first year. Another source tells me that 76% will succeed after the first year. Don’t be concerned about this except to wonder why the ones that failed did fail. This will be covered as well. No need to sugarcoat starting a business after the military or retirement.

Our company policy: Always hire veterans first

Our focus will be on how you will be one of the success stories. Over the years, I have owned a number of businesses. The last big business grew to a business with many employees across the country. It was our company policy that we would search out veterans to fill the jobs.

This was not because I was a veteran, it was because it’s a proven fact (my company proved it) that veterans do a better job. They have learned a work ethic that’s hard to teach. When I wanted to get a job done and done correctly, my veteran employees came through. This is why I believe that veterans are uniquely suited to be the best entrepreneurs.

The list below includes some good reasons why being a veteran is a good first start in creating your veteran-owned businesses.

first in our extensive series click above

Why Veterans Excel in Business Ownership

1. Strong Leadership and Problem-Solving Skills

The military background of veterans equips them with problem-solving skills, adaptability, and resilience—traits essential for business ownership. Whether forming a sole proprietorship, limited liability company (LLC), or a nonprofit organization, veterans apply their military experience to strategic decision-making and overcoming challenges.

2. Access to Veteran-Specific Business Resources

The U.S. Small Business Administration (SBA) and other federal government agencies provide exclusive loan programs, mentorship programs, and training programs designed for veteran business owners. The Veterans Business Outreach Center (VBOC) and Patriot Boot Camp offer educational resources and business training to help veterans launch and grow their businesses.

3. Government Contracts and Funding Opportunities

Veteran-owned businesses, especially service-disabled veterans, qualify for government programs such as the Service-Disabled Veteran-Owned Small Business (SDVOSB) certification. These businesses can secure government contracts through the federal services sector, ensuring a steady income stream.

Additionally, organizations like the National Center for Veteran Entrepreneurship help veterans find small business loan options and venture capital.

Before diving into a business plan, you should take time to consider what type of business you want to start. Conducting market research is essential to understand the demand for your business idea, identify potential competitors, and determine a viable target market.

Research strategies include:

- Using the internet to explore whether similar business ventures exist in their area.

- Contacting a successful veteran business in another state that has done the same thing but will not be a competitor.

- Evaluating business growth trends in their desired industry.

- Assessing local and federal government programs that support their business ownership journey.

Only after determining their business idea and confirming their commitment should they proceed with deeper analysis and business creation. Next is goal setting. You must have goals if you are to achieve them. In football, there is a goalpost and finish line. Look at your business concept in the same way.

Setting Goals Before Writing a Business Plan: The Foundation of a Successful Business Venture

Before a first-time entrepreneur begins drafting a business plan, it is essential to set clear and measurable goals. These goals form the foundation upon which all aspects of business development, from financial projections to marketing strategies, will be built.

Many successful entrepreneurs understand that setting goals helps streamline decision-making and ensures that their venture aligns with their unique set of skills, experiences, and target audience.

Defining Your Business Goals

Entrepreneurs should begin by asking themselves fundamental questions about their future business ventures:

- Will this be a full-time or part-time business?

- Some entrepreneurs start part-time while maintaining other employment, while others commit full-time from the outset. Defining this early will impact funding strategies, operational planning, and time management.

- Will the business be a for-profit or a non-profit organization?

- A clear distinction between a for-profit business and a non-profit is crucial, as each has different legal structures, tax obligations, and funding sources. Non-profits may rely on grants, donations, and specific resources such as the U.S. Census Bureau for demographic research, while for-profits often seek venture capital or traditional funding.

- What is the primary mission of the business?

- Crafting a mission statement helps entrepreneurs focus on their core objectives and communicate their purpose to potential investors, business professionals, and customers.

- Who is the target audience?

- Understanding the target audience allows for effective marketing and product/service development. A business catering to veteran women, for example, may benefit from specialized funding opportunities such as disadvantaged business utilization programs.

- What are the financial goals?

- Entrepreneurs should outline their revenue expectations, pricing models, and financial projections. Whether securing venture capital, obtaining grants or self-funding, having a clear financial roadmap is critical.

- Will the business leverage a military background or unique experiences?

- Veterans of all eras possess leadership skills, discipline, and strategic thinking that can be valuable assets in entrepreneurship. Military academies and veteran support organizations often provide mentorship and funding opportunities.

You do not need experience to start a business

The answer to question #6 may indicate that your military background is important and it is but you need not have experience in the business you intend to start. You can learn and you can work with others. Let’s discuss for a moment the idea of a partnership.

Many years ago when I started my first business not long after leaving the U.S. Air Force, I was thinking of going into business for myself. One of the things I did was take a self-assessment of what I had learned.

I was working in the retail business part-time when I was in high school and learned much. During my time in the Air Force, I learned some of the same things as you have plus my career field. My last job was management of the base housing office and transient officers and enlisted quarters.

I had a skill that made became a perfect fit

Basically, I was in the hotel business. So far, two major areas to consider when starting a business. I did neither, instead, a friend asked If I wanted to join him in an automobile parts wholesale business. This appealed to me because when I was in high school, I took an automotive repair class plus worked on my car and those of my friends. It was those skills that made the move into my own business a perfect fit.

Success would have eluded me if it were not for my friend who partnered with me. I had learned much about business management in the retail business and working in the base housing office but I still had a lot to learn about the business side of the business. At this point, I want to get into the business of running a business.

The Business Side of Business: More Than Just Your Skillset

For many veteran small business owners, the transition from military service to entrepreneurship is driven by expertise in a specific field—whether it’s landscaping, construction, consulting, or another trade. However, being excellent at a craft does not automatically translate into running a successful business.

A veteran-owned business, or any small business, must be built on a solid foundation that includes financial management, legal compliance, marketing strategies, and business development. Without these key elements, even the most talented landscaper will struggle to grow beyond a one-person operation.

Beyond the Military Service: Understanding How a Business Functions

Many first-time entrepreneurs assume that doing what they love—whether it’s cutting lawns, baking cakes, or offering consulting services—will naturally lead to a thriving business. The reality is that technical skills alone will not sustain a business. To succeed, a small business owner must understand:

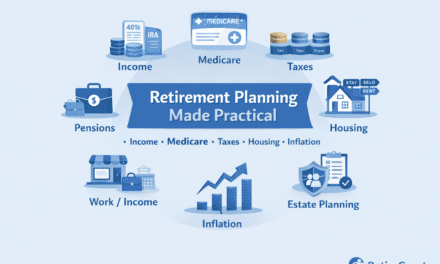

- Managing Money & Financial Projections

- A business owner must track income and expenses, set pricing that ensures profitability, and forecast future earnings. Whether self-funded, seeking venture capital, or using grants such as those available for disadvantaged business utilization, understanding cash flow is critical.

- Taxes & Legal Issues

- Businesses must comply with federal, state, and local tax laws. Veteran-owned businesses may qualify for tax incentives, but owners must keep accurate records, understand deductions, and plan for quarterly tax payments. Check out our article on taxes

- Choosing the right business structure (LLC, corporation, sole proprietorship, or partnership) impacts tax liability, personal risk, and regulatory requirements.

- Marketing & Customer Acquisition

- Even the best services won’t sell themselves. A strong brand, online presence, and networking strategies are essential for reaching the right target audience.

- Digital marketing, search engine optimization (SEO), and social media campaigns are critical tools for competing in today’s market.

- Legal Protection & Liability Management

- Contracts, liability insurance, and compliance with labor laws are all part of running a business. A landscaping company, for example, must consider employee safety regulations and insurance for property damage claims.

Next Steps: Business Structure Before the Business Plan

Most new entrepreneurs jump directly into writing a business plan, but an often-overlooked step is determining the legal and structural foundation of the business first. The business plan should be a collaborative effort among all involved parties.

One major decision is whether to operate as a sole proprietor or bring in a partner(s). This decision affects tax obligations, liability, profit sharing, and daily management.

- Sole Proprietorship: Full control, but personal liability for debts.

- Limited Liability Company (LLC): Offers liability protection and tax flexibility.

- Partnership: Shared responsibilities and risks, but requires a clear operating agreement.

- Corporation (S-Corp or C-Corp): Suitable for larger ventures that need formal structures and external funding, such as venture capital.

Partnerships: Weighing the Pros and Cons

Bringing in a business partner can be beneficial but also complex. If you plan to operate with other veteran entrepreneurs or business professionals, consider:

- How responsibilities and profits will be divided.

- What happens if a partner wants to exit the business.

- Legal agreements to protect each owner’s interests.

Time to discuss partnerships. I bring this up because many small businesses start with a single person who has the idea and then approaches friends about joining the enterprise. More often these friends may be other military veterans who are not happy with civilian life.

I had decided when forming my first business that I wanted partners to share responsibility and more than anything, to add their brains to mine so that we could innovate. Of course, you would have to weigh this as it is not an easy decision. Here are some things to consider:

Pros and Cons of having a veteran entrepreneur business partner

✅ Pros of Having a Business Partner

1. Shared Responsibilities & Workload

Running a business is demanding, and a partner can help distribute responsibilities, reducing individual stress.

2. Complementary Skills & Experience

A partner can bring a unique set of skills that complement yours—whether in finance, marketing, operations, or business development.

If one partner excels in operations (e.g., a former military logistics specialist) and the other in sales, the business benefits from both strengths.

3. Financial Contributions & Investment

Partners can contribute capital, reducing the financial burden on a single individual.

This may also improve your ability to secure venture capital or loans, as lenders often prefer businesses with multiple stakeholders.

4. Accountability & Motivation

Having a partner fosters accountability and shared motivation to push the business forward.

Veterans of all eras understand the value of teamwork, making partnerships potentially smoother than solo entrepreneurship.

5. Stronger Network & Connections

A partner may bring valuable business connections and specific resources, such as relationships with suppliers, investors, or marketing experts.

6. Risk Mitigation

Sharing risks can lessen individual liability—especially if structured as an LLC or corporation rather than a sole proprietorship.

Partners can provide additional support during challenges, such as financial downturns or unexpected operational issues.

7. More Opportunities for Growth

With more people contributing ideas and solutions, a partnership can foster business innovation and expansion more quickly.

8. Enjoying the Fruits of Success

A partnership allows more flexibility for time off, as responsibilities can be shared.

Business owners who work solo often struggle to take vacations or even short breaks without disrupting operations. With a reliable partner, you can take a step back to enjoy the benefits of entrepreneurship, such as:

- Taking vacations or traveling without worrying about business continuity.

- Spending more time with family and enjoying life outside of work.

- Avoiding burnout, which is common among solo entrepreneurs.

Having a partner means the business can continue to operate smoothly even when one person needs time away.

❌ Cons of Having a Business Partner

1. Shared Responsibilities & Workload

Running a business is demanding, and a partner can help distribute responsibilities, reducing individual stress.

2. Complementary Skills & Experience

A partner can bring a unique set of skills that complement yours—whether in finance, marketing, operations, or business development.

If one partner excels in operations (e.g., a former military logistics specialist) and the other in sales, the business benefits from both strengths.

3. Financial Contributions & Investment

Partners can contribute capital, reducing the financial burden on a single individual.

This may also improve your ability to secure venture capital or loans, as lenders often prefer businesses with multiple stakeholders.

4. Accountability & Motivation

Having a partner fosters accountability and shared motivation to push the business forward.

Veterans of all eras understand the value of teamwork, making partnerships potentially smoother than solo entrepreneurship.

5. Stronger Network & Connections

A partner may bring valuable business connections and specific resources, such as relationships with suppliers, investors, or marketing experts.

6. Risk Mitigation

Sharing risks can lessen individual liability—especially if structured as an LLC or corporation rather than a sole proprietorship.

Partners can provide additional support during challenges, such as financial downturns or unexpected operational issues.

7. More Opportunities for Growth

With more people contributing ideas and solutions, a partnership can foster business innovation and expansion more quickly.

8. Enjoying the Fruits of Success

A partnership allows more flexibility for time off, as responsibilities can be shared.

Business owners who work solo often struggle to take vacations or even short breaks without disrupting operations. With a reliable partner, you can take a step back to enjoy the benefits of entrepreneurship, such as:

- Taking vacations or traveling without worrying about business continuity.

- Spending more time with family and enjoying life outside of work.

- Avoiding burnout, which is common among solo entrepreneurs.

Having a partner means the business can continue to operate smoothly even when one person needs time away.

The best way to use the list is to look at the “Con”

The best way to use the list above is to look at the Cons. Can you overcome all of the cons with a good operating agreement and understanding up front? In my case, I was able to successfully overcome these with one exception. I had a partner in one of my consulting businesses who just could not stop spending money on small unimportant things.

It bothered me along with other issues. We had a meeting and since this partnership was about 80% mine in creating, innovation, etc. should I walk away the business would collapse. My partner agreed to leave.

In all of the other businesses, things worked out very well. The term “skin in the game” comes to mind. As long as my partners understood that they had to work as hard as I was because it was “Their” business, all would be well. When we put our minds to a problem it was always resolved and the business continued to grow until I sold it and my partner benefited. So let’s talk about the best structure for you.

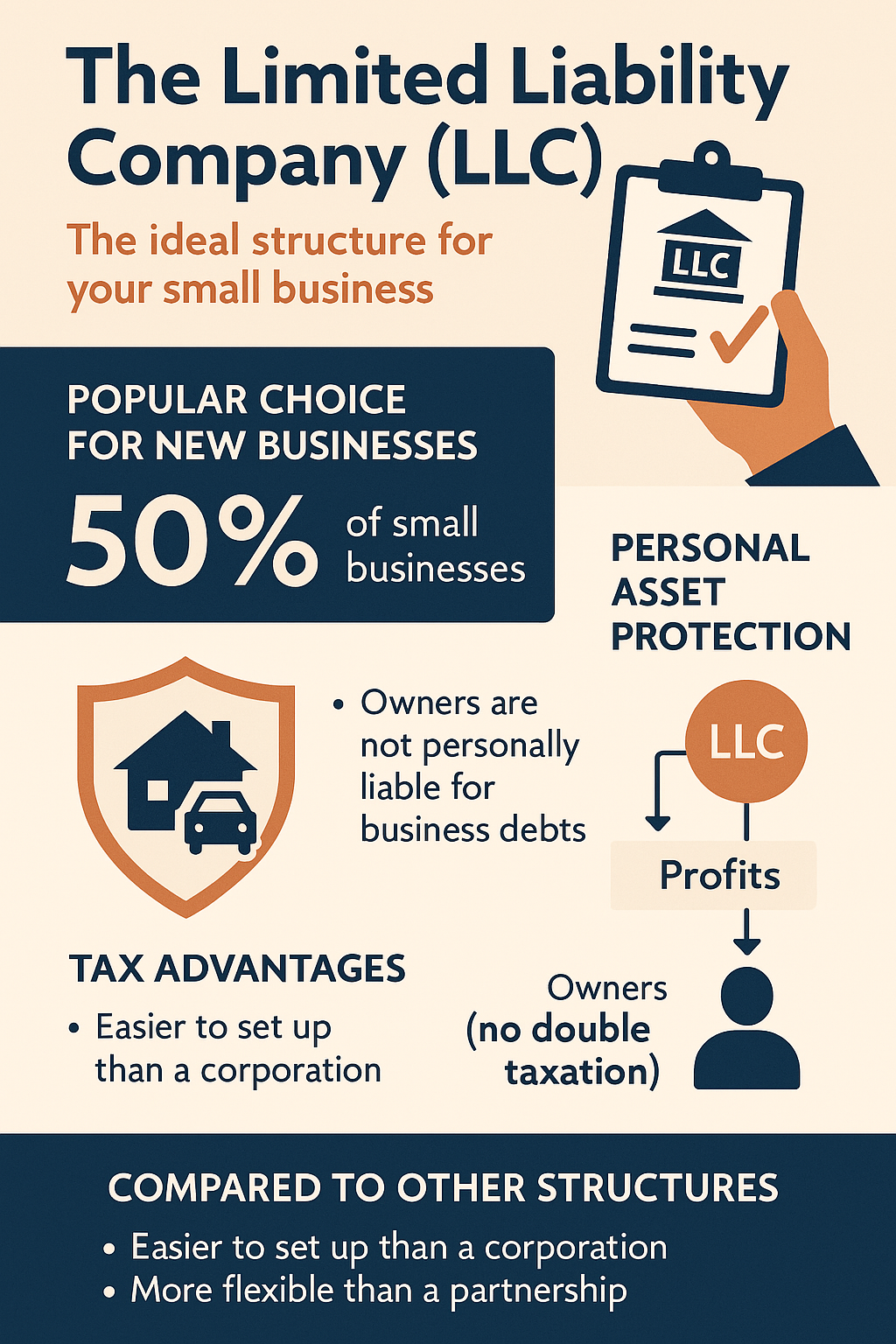

There are three basic structures for most veterans. A limited liability company, a Subchapter S corp, and a C corp.

Choosing the Right Business Structure: LLC vs. S-Corp vs. C-Corp for Veterans Starting a Business

One of the most critical decisions for a veteran entrepreneur starting a business after retirement or transitioning from military service is selecting the right business structure. The structure chosen will impact taxes, liability, management, and overall business flexibility.

While there are several options, the Limited Liability Company (LLC) is often the best choice for veterans starting a business. Let’s explore the differences between LLC, S-Corp, and C-Corp, and why an LLC is typically the best fit for veteran entrepreneurs.

Understanding the Three Main Business Structures

1. Limited Liability Company (LLC)

An LLC is a hybrid structure that combines elements of a sole proprietorship, partnership, and corporation. It provides personal liability protection while allowing flexibility in taxation and management.

✅ Pros of an LLC:

- Limited Liability: Personal assets (house, retirement savings, etc.) are protected from business debts and lawsuits.

- Pass-Through Taxation: Profits and losses are passed through to the owner’s personal tax return, avoiding double taxation.

- Fewer Formalities: Unlike corporations, LLCs have fewer regulations, reporting requirements, and paperwork.

- Flexible Ownership: Can be a single-member LLC or have multiple members without strict corporate structures.

- Easier Profit Distribution: Owners can distribute profits in ways that work best for them, rather than following strict corporate dividend rules.

🚫 Cons of an LLC:

- Self-Employment Taxes: Unless structured as an S-Corp for tax purposes, LLC members must pay self-employment taxes (Medicare and Social Security).

- State-Specific Rules: Each state has its own regulations for LLCs, which can vary in terms of fees and compliance requirements.

2. S Corporation (S-Corp)

An S-Corp is a special type of corporation designed to offer tax advantages while maintaining limited liability. It avoids double taxation by allowing profits to be taxed at the individual level, similar to an LLC.

✅ Pros of an S-Corp:

- Tax Benefits: Owners only pay self-employment taxes on their salaries, not on total business profits.

- Limited Liability Protection: Just like an LLC, personal assets are protected from business debts.

- Credibility & Growth: More attractive to potential investors than an LLC.

🚫 Cons of an S-Corp:

- Strict Ownership Rules: Limited to 100 shareholders, and all must be U.S. citizens or permanent residents.

- Rigid Profit Distribution: Profits must be distributed based on ownership percentages rather than customized agreements.

- Increased Paperwork & Compliance: Requires corporate bylaws, board of directors, and annual shareholder meetings.

3. C Corporation (C-Corp)

A C-Corp is a traditional corporation that operates as a separate legal entity from its owners. This structure is used by large businesses and companies seeking outside investors.

✅ Pros of a C-Corp:

- Strong Liability Protection: Owners (shareholders) are completely separate from the business, making lawsuits and debts only the responsibility of the company.

- Unlimited Growth Potential: Unlike S-Corps, a C-Corp can have unlimited shareholders, making it easier to raise venture capital.

- Tax-Deductible Employee Benefits: Health insurance, retirement plans, and other benefits can be deducted as business expenses.

🚫 Cons of a C-Corp:

- Double Taxation: The corporation pays corporate income tax, and then shareholders pay personal tax on dividends.

- More Complex & Expensive to Run: Requires formal board meetings, record-keeping, and extensive regulatory compliance.

- Not Ideal for Small Businesses: Unless planning to scale into a large company with investors, a C-Corp is usually too complex for small, veteran-owned businesses.

Why LLC is the Best Choice for Veterans Starting a Business

For most veteran entrepreneurs, an LLC offers the best balance of liability protection, tax benefits, and ease of management. Here’s why it’s often the ideal choice:

✅ Simplicity & Flexibility – LLCs require less paperwork and fewer formalities than corporations, making them easy to set up and manage.

✅ Tax Efficiency – Unlike C-Corps, LLCs avoid double taxation, and owners can choose to be taxed as an S-Corp if they want to reduce self-employment taxes.

✅ Liability Protection – Veterans often use personal savings, retirement funds, or VA business loans to start their businesses. An LLC protects personal assets from being seized if the business faces lawsuits or debts.

✅ Perfect for Small & Medium Businesses – Most veteran entrepreneurs aren’t looking to build a massive corporation with shareholders; they want a business that offers financial independence and personal freedom. An LLC supports this goal without the red tape of a corporation.

✅ Great for One-Person or Partnered Businesses – Whether launching as a sole member or with business partners, an LLC allows for flexible ownership and profit-sharing arrangements.

When Should a Veteran Consider an S-Corp or C-Corp Instead?

- Choose an S-Corp if:

- You plan to pay yourself a salary and want to save on self-employment taxes.

- You have multiple owners who meet the S-Corp requirements.

- You’re okay with more paperwork but want tax savings.

- Choose a C-Corp if:

- You plan to raise venture capital or eventually sell shares.

- You need a strong separation between personal and business finances.

- You’re building a large-scale business with employees and external investors.

A Note on LLCs and Business Partnerships

If you are considering having business partners, as discussed earlier, forming an LLC (Limited Liability Company)provides significant advantages in structuring your partnership. Unlike an S-Corp or C-Corp, which require strict profit distribution based on ownership percentages, an LLC allows flexibility in how ownership and responsibilities are divided among members.

One of the key benefits of an LLC is that each member’s ownership percentage can be customized based on their investment, contributions, or agreement with other partners. For example, one partner might contribute more capital, while another contributes industry expertise, and their ownership shares can reflect this arrangement.

The LLC Operating Agreement plays a crucial role in defining how the business operates.

This document outlines:

- Ownership percentages for each member.

- How profits and losses are distributed.

- How decisions are made, including major business changes, daily operations, and financial matters.

- What happens if a member wants to leave or if a new member wants to join?

- Dissolution procedures, should the business close in the future.

This flexibility reduces stress and potential disputes among partners by clearly detailing everything you have agreed to from the start. Instead of dealing with misunderstandings or legal battles down the road, an LLC allows veteran entrepreneurs to focus on building and growing their businesses together with confidence.

If you plan to have business partners, taking the time to draft a comprehensive LLC Operating Agreement ensures a smooth working relationship and a solid foundation for long-term success.

Now it’s time to discuss forming a business and the steps you must go through including forming your LLC or other business. You understand after reading the above how which type of business you want which is helpful to the other stages of the process. My business RetireCoast.Com can help you create your LLC and do what is necessary (see below) to get your new business legal.

Step-by-Step Guide to Starting a Business

Starting a business requires a structured approach to ensure all legal, financial, and operational aspects are in place. Below is a comprehensive checklist to guide you through the process, beginning with choosing a business name and incorporating the business plan and goals discussed earlier.

Here is the best thing about the list below, we have articles written on all of the topics that step you through the process. Some of the articles come with tools and calculators.

If you decide to actually start your business, click on the link in each section where we can help you for a modest fee. Frankly, since much of this is first-time stuff your time is better spent on the business plan and the marketing plans.

Don’t forget to carefully consider the location for your new business. First the state then the local area. Review rules and regulations that can help promote or hinder business growth. No one said you need to start a business after retirement where you currently live.

1. Choose a Business Name

- Brainstorm at least three potential business names that reflect your mission, industry, and branding.

- Check name availability with your state’s business registration office.

- Ensure the name isn’t already trademarked by searching the U.S. Patent and Trademark Office (USPTO) database.

- RetireCoast’s Article on Business Name. Article on Trademarks here

2. Secure a Website Domain Name

- Once you have your business name options, check for a matching or similar domain name.

- Use domain registration sites like GoDaddy, Namecheap, or Google Domains to check availability.

- Secure the domain as soon as possible to avoid losing it.

- RetireCoast’s article on Website Domain Name

3. Create a Business Plan (Incorporating Your Goals)

Your business plan should include the goals you previously set, including:

✅ Business structure (LLC, S-Corp, or C-Corp).

✅ Mission statement (your business’s purpose and direction).

✅ Target audience (who your business serves).

✅ Financial projections (start-up costs, revenue expectations, funding needs).

✅ Marketing strategy (how you will reach and retain customers).

✅ Operational plan (how the business will function daily).

RetireCoasts article on Creating a Business Plan

4. Form Your LLC and Create an LLC Operating Agreement

If you have partners, an LLC is the most flexible and beneficial structure.

- File for an LLC in your state through the Secretary of State’s website.

- Draft an LLC Operating Agreement, outlining:

- Ownership percentages of each member.

- Profit and loss distribution.

- Decision-making processes.

- Procedures for adding or removing members.

- Dissolution process in case the business closes.

- Have all partners review and sign the agreement to avoid future disputes.

- RetireCoast’s article about creating an LLC

5. Register the Business with the State

- File the necessary documents with the Secretary of State or relevant state agency.

- Pay the required LLC registration fee (varies by state).

- Once approved, you will receive a Certificate of Formation or Articles of Organization

- RetireCoast can register your business check this article.

6. Obtain an EIN (Employer Identification Number)

- Apply for an EIN (Tax ID Number) through the IRS website (free of charge).

- The EIN is needed to:

- Open a business bank account.

- File business taxes.

- Hire employees (if applicable).

- RetireCoast can obtain an EIN for you check the full article here

7. Set Up a Business Bank Account

- Use your LLC registration documents and EIN to open a separate business bank account.

- This ensures the separation of personal and business finances.

8. Apply for Business Licenses & Permits

- Check with your state, county, and city to determine the required licenses and permits.

- Common licenses include:

- General business license.

- Industry-specific permits (e.g., contractor licenses for construction businesses).

- Home-based business permits, if operating from home.

9. Set Up an Accounting System

- Choose an accounting software like QuickBooks, FreshBooks, or Wave.

- Track expenses, income, and tax deductions from day one.

- Consider hiring a CPA or accountant to ensure compliance.

- Read the RetireCoast Article on Finances and Budget

10. Obtain Business Insurance

- Protect your business with general liability insurance.

- If you have employees, you may need workers’ compensation insurance.

- For professional services, consider professional liability insurance.

11. Establish a Marketing & Branding Strategy

- Design a logo and branding materials.

- Create social media accounts and a business website.

- Develop a marketing plan that includes digital and traditional strategies.

- Read the RetireCoast article on the Marketing Plan

12. Prepare for Business Launch

- Set a launch date and promote it.

- Finalize any partnership agreements.

- Start networking with industry professionals and potential clients.

One more thing and is a big one

Most other articles have a list like this one with 12 things to launch a business. A list of other references and lots of ads. There are some real resources and we provide a few below.

Everything is focused on one thing. Your credit score. Veteran or not, if your credit score is bad, it will be difficult for you to borrow money from the SBA or any other Veteran agency. Our articles highlighted above get into this topic.

I am going to wrap this up here because there are thousands of words we have already created included in the articles tied to each of the above topics. Take the time to read them, you will become an expert in the business of business quickly.

Don’t forget to sign up to receive notice of our newest articles.

Resources

- Creating a business, searching the name, filing the name, and obtaining the Federal tax I.D. – Click here

- United States Veterans Administration – Small Business Assistance – Click Here

- U.S. Small Business Administration – Veteran-Owned Businesses – Click Here

- Office of Small Business Programs (DOD) – Service-disabled veteran-owned business – Click here

FAQ VETERANS HOW TO START A BUSINESS

1. Why should veterans consider starting their own business?

Veterans possess leadership skills, discipline, and problem-solving abilities that make them well-suited for entrepreneurship. Owning a business allows veterans to apply their experience, gain financial independence, and create opportunities for others.

2. What are the best business ideas for veterans?

Some of the best business ideas for veterans include government contracting, security services, logistics, real estate, consulting, fitness training, and e-commerce. Choosing a business that aligns with your skills and interests increases the likelihood of success.

3. What funding options are available for veteran entrepreneurs?

Veterans can access funding through programs like the SBA Veterans Advantage Loan, Boots to Business Program, Hivers and Strivers Angel Fund, and Service-Disabled Veteran-Owned Small Business (SDVOSB) grants. Traditional business loans and crowdfunding are also options.

4. How do I get certified as a veteran-owned business?

To become a Veteran-Owned Small Business (VOSB) or Service-Disabled Veteran-Owned Small Business (SDVOSB), you must apply through the Veteran Small Business Certification (VetCert) program via the SBA. Certification helps with government contracts and funding.

Some public agencies require that a certain percentage of contracts go to veteran or disabled veteran businesses, while others offer a preference in the bidding process. This makes certification a valuable tool for securing government contracts.

5. What are the first steps to starting a business as a veteran?

- Identify your business idea and conduct market research.

- Choose a legal structure (LLC, corporation, sole proprietorship).

- Register your business and obtain the necessary licenses.

- Develop a business plan and secure funding.

- Set up operations, branding, and marketing strategies.

6. Are there business grants specifically for veterans?

Yes, grants such as the Warrior Rising Grant, StreetShares Foundation Grant, and Nav’s “Small Business Grant” cater to veteran entrepreneurs. These can provide startup funding without requiring repayment.

7. How can I leverage my military experience in business?

Military experience in leadership, logistics, risk assessment, and teamwork is highly valuable in business. Veterans can use these skills to manage operations, negotiate contracts, and build strong teams.

8. What online resources can help veterans start a business?

Websites like the Small Business Administration (SBA), SCORE for Veterans, Bunker Labs, and Patriot Boot Camp offer free business resources, mentoring, and networking opportunities.

Additionally, RetireCoast.com and StartingABusinessAfterRetirement.com offer many articles about all aspects of starting a new business, including essential tools. These platforms can also assist in setting up your business structure and guiding you through the process.

9. How do I market my veteran-owned business?

Leverage social media, networking, content marketing, and veteran business directories (e.g., Buy Veteran) to promote your business. Partnering with veteran organizations and using veteran-owned business certifications can also attract customers.

10. What tax benefits are available for veteran entrepreneurs?

Retired veterans in some states may qualify for discounted property taxes. Some states, such as Mississippi, offer zero property taxes for disabled veterans, along with other benefits such as free vehicle registrations and exemptions on certain business-related fees. It’s important to check with your state’s Department of Revenue or Veterans Affairs office to see what specific benefits are available in your location.

Read our entire collection of articles that can be found by clicking the button below

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.