Last updated on December 8th, 2025 at 09:16 am

Are you considering a second career after retirement? Are you aware that more people over age 50 are starting businesses than younger Americans? This ultimate guide to starting a business after retirement is based on real-world experiences. Let’s discuss what you need to know before you can decide to start a new business. I did it, and so can you. A free gift awaits you: an evaluation to determine if starting a business after retirement is for you. Click the button at the end of this article.

About the Author

Click here to read About the AuthorThis article is the first in a series of articles on the topic of “Starting a Business After Retirement“. The series is extensive; this article is a warm-up. Each article explains the knowledge you need to decide and then implement your dream. Read through this article to the bottom and click the button to reach our index of articles.

About terms. Retiree, Senior, Younger, Older, these are just terms. Retirees come of all ages from the late 40s through the 80s. I use the terms interchangeably. My daughter told me that I should not use “seniors” in every instance because many people in their early 50s are retired from the military, fire, law enforcement, or other companies that only require 20-30 years of employment. This article, “Redesigning Retirement,” provides more insight.

So, the upshot is that these articles are for those of you who are considering a second career or a major change in circumstances. I will tend to use “retirees” more often. Thank you for taking the time to read these articles.

Retiree entrepreneurs often create new businesses because they want to and not because they have to. Senior entrepreneurship is hot today. There are a few reasons why so many seniors are considering a new venture. Let’s explore a short list:

Top 10 reasons why retirees create a business after retirement:

- Financial Stability or Supplement Income

- Many retirees want to supplement their retirement income, social security, or pensions to maintain their lifestyle. A business can provide additional earnings.

- Pursuing a Passion or Hobby

- Retirement gives seniors the opportunity to turn lifelong passions or hobbies into a business, such as crafting, consulting, or teaching. Check out another perspective here

- Staying Active and Engaged

- Running a business helps seniors stay mentally and physically active, which is vital for maintaining health and reducing boredom.

- Utilizing Decades of Experience

- Seniors bring valuable skills, knowledge, and professional experience, which they can leverage to create a consulting or service-based business.

- Desire for Personal Fulfillment

- Starting a business can provide a sense of purpose, accomplishment, and pride, which is crucial for mental well-being post-retirement.

- Flexibility and Control

- Unlike traditional jobs, a business allows seniors to set their own hours and work at their own pace, giving them freedom and control.

- Leaving a Legacy

- Many seniors want to create something meaningful, such as a family business, to pass down to their children or leave a lasting impact on their community.

- Combating Loneliness

- Businesses that involve collaboration, networking, or community interaction can help seniors stay socially connected and combat isolation.

- Adapting to Longer Life Expectancy

- With people living longer, many retirees see a business as a way to stay productive and make their savings last longer.

- Responding to Market Opportunities

- Seniors often identify unmet needs in their community or industries and see retirement as an opportunity to address those gaps.

You may check one or many of the ten items listed above. Most of us who start a business after retirement expect to earn a profit, but that’s not the only reason for many seniors. I find that after talking to others who have started a business after retirement, they are pursuing a passion project.

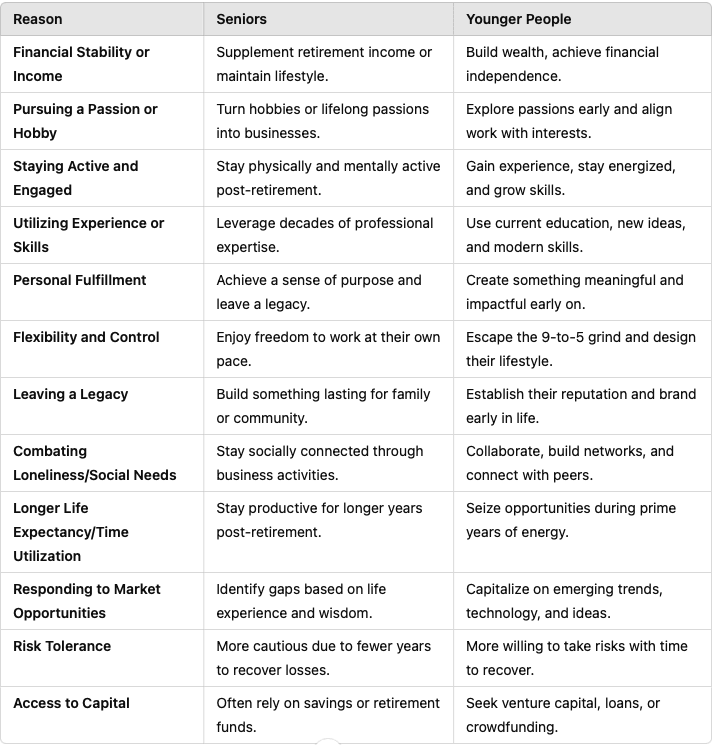

Why do Retirees vs Younger people start more businesses

Key differences between retirees starting businesses and younger people starting businesses are significant.

- Risk Tolerance:

- Younger people tend to be more risk-tolerant, whereas seniors often seek lower-risk, stable ventures.

- Motivations:

- Seniors often focus on fulfillment, legacy, and activity.

- Younger entrepreneurs are often driven by ambition, innovation, and financial independence.

- Skills and Knowledge:

- Seniors bring experience and wisdom but may need to learn new technologies.

- Younger people are tech-savvy and often innovate with cutting-edge tools.

- Financial Needs:

- Seniors focus on supplementing retirement income.

- Younger people aim to create wealth and fund future goals (e.g., buying a home).

Similarities:

- Both groups want freedom, personal fulfillment, and the ability to pursue their passions.

- Both recognize and respond to market opportunities to solve problems and meet demands.

Frequently Asked Questions

Is it a good idea to start a business after retirement?

Absolutely for many. If you are in good health, and have time to devote, funds are available for start-up—why not?

What are the best business ideas for retirees?

Many retirees like to start businesses that offer flexible hours, possibly work from home, and require a minimal investment. Consulting, dog walking, blogging, and selling on the internet are some examples.

How much money do I need to start a business after retiring?

That depends upon the type of business. At the minimal end, you will need business cards, a website, office furniture, and funds to form the business through the state. Possibly as little as $1,000 to start. Costs scale up from there. If you are carving wood to sell the finished product, you will need an inventory of materials and tools.

Can I start a business if I’m living on a fixed retirement income?

Yes. Take walking dogs or pet sitting, for example. This requires little or no upfront investment. Make some money and create a website to gain more business. There are many types of businesses that require very little to get started.

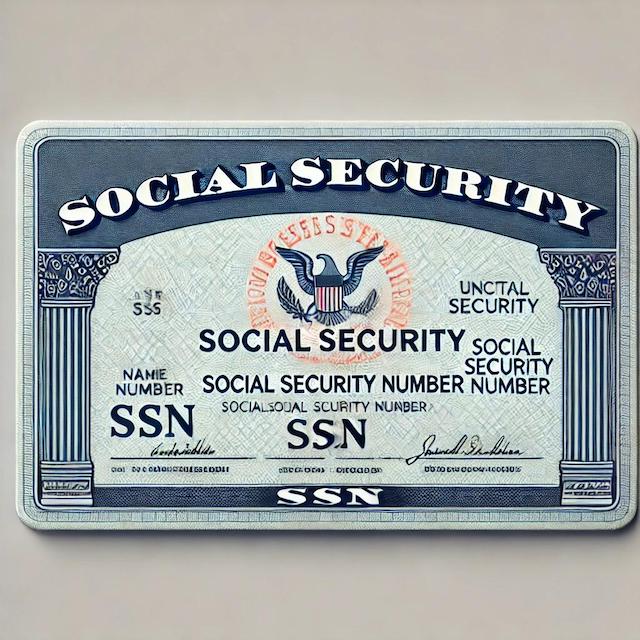

Keep in mind that if you take Social Security at any age below the full retirement age, you will pay a penalty for income earned until you reach the full Social Security age.

What are the benefits of starting a business in retirement?

Additional income, social aspects, keeping busy, giving back, and much more.

How can I learn more about starting a business after retirement?

Continue to read our additional articles on this topic. This is Part 1. Each article in our index (click here) will dive into a specific aspect of how to start a business after retirement.

Can I start a business without experience?

Yes, if you teach yourself to become an expert in the thing you want to do. For example, creating a dog walking business. Learn from others how they do it—keeping dogs from barking, the distance to walk, what time of the day to walk, and much more. Read, digest, and learn to become excellent at it.

Can I start a business with no money?

Yes, although it may be difficult if you do not have some funds. In the example above of dog walking, you may need to invest in dog food, water bowls, and things necessary to be successful. It may only take a few dollars before you receive your first income.

What are the best types of businesses for retirees?

RetireCoast created an entire article on this topic. We did not want to skip over it with a few notes. Click here (The best businesses I can start after retirement) to read that article and get a full answer.

How can I plan for an exit strategy or succession plan?

We have you covered. This article discusses the exit strategy, and it is woven into our other articles as well. Anyone starting a business should have an exit strategy regardless of age. Read our complete series to get a full understanding of what an exit strategy is and how to create one.

What marketing strategies work best for a new business?

There are discussions in our articles about marketing, but our article on marketing will provide more details. Don’t worry about your experience with marketing; there are plenty of low-cost ways to acquire help with marketing.

Will I lose income from Social Security by starting a new business?

Only if you have elected to take Social Security at age 62 and before full retirement at age 66-67. Even with a loss of a portion of your benefits by taking Social Security at age 62, you may be able to make up the difference with your new business. Starting after full retirement means no penalties for the income you earn. You may pay income taxes on a portion of your Social Security income depending upon your total annual income.

Is my age a factor in obtaining a business loan?

No. Federal law prohibits discrimination based on age. You can obtain a business loan with a 20-year amortization, for example, even if you are 100 years old. The amortization period is just to help reduce the monthly payment.

Goals

The discussion about the reasons why you want to start a business in retirement vs younger people is to help you understand why you want to do this. It’s important that before you decide to create a business you create goals for your new enterprise. Also, will this business become a “side hustle” (part-time operation), or will it be a full-time business? Take a look at the following list of goals:

1. Financial Goals

Financial stability is a primary focus for any startup.

- Break-Even Point: Aim to cover all operating costs within a set time frame.

- Revenue Targets: Set monthly, quarterly, and annual income goals.

- Profit Margin Goals: Define a target percentage for profitability.

- Funding Goals: If seeking investment, determine how much capital is needed to launch or expand.

Example: Achieve a break-even point within the first 12 months of operations.

2. Customer Acquisition Goals

Gaining and retaining customers is essential for growth.

- Target Audience: Define who your ideal customers are.

- Customer Count: Set goals for acquiring a certain number of customers.

- Conversion Rates: Aim to convert a specific percentage of leads into paying customers.

- Customer Retention: Develop strategies to keep customers coming back (e.g., loyalty programs).

Example: Acquire 100 paying customers within the first 6 months.

3. Product or Service Goals

Ensure your product or service is ready, functional, and valuable.

- Product Development: Set milestones for completing your product or service offerings.

- Quality Goals: Ensure your product meets quality standards and solves customer problems.

- Pricing Strategy: Establish competitive and profitable pricing.

Example: Launch a fully tested MVP (minimum viable product) within 4 months.

4. Marketing and Branding Goals

Establish your presence in the market and attract attention.

- Brand Awareness: Build recognition through social media, content, and ads.

- Website Traffic: Set measurable goals for visitors to your website.

- Social Media Growth: Increase followers and engagement on platforms.

- Email Subscribers: Grow an email list for marketing purposes.

Example: Gain 5,000 website visitors and 1,000 social media followers within 3 months.

5. Operational Goals

Streamline day-to-day operations to ensure efficiency.

- Business Systems: Implement accounting, inventory, or CRM systems.

- Team Building: Hire essential staff and define roles and responsibilities.

- Location Setup: If needed, secure a physical office, store, or production space.

Example: Hire two key team members and implement accounting software within 6 weeks.

6. Legal and Compliance Goals

Ensure your business operates legally and meets all regulations.

- Business Structure: Register your business as an LLC, corporation, or other entity.

- Licensing and Permits: Obtain all necessary legal permits and certifications.

- Trademarks and Intellectual Property: Protect your business name, logo, or ideas.

- Tax issues: Be sure to comply with all tax laws, tax planning is critical.

Example: Complete business registration and acquire necessary licenses within 3 weeks.

7. Customer Service Goals

Deliver excellent service to build trust and loyalty.

- Response Time: Set a standard for quick and helpful customer support.

- Customer Feedback: Implement systems for collecting and analyzing feedback.

- Satisfaction Ratings: Aim for high ratings in surveys or reviews.

Example: Maintain a 90% customer satisfaction rate during the first year.

8. Growth and Scaling Goals

Plan for future business expansion.

- Market Expansion: Enter a new market or geographical location.

- Product Line Growth: Add complementary products or services.

- Partnerships: Collaborate with other businesses for mutual growth.

Example: Expand into two new cities by the end of Year 2.

9. Personal Development Goals

Strengthen your own skills as a business owner.

- Learn Key Skills: Improve in marketing, leadership, or finance.

- Networking: Build relationships with mentors, investors, or peers.

- Time Management: Focus on productivity and delegation.

Example: Attend 3 business conferences and complete a leadership course in the first year.

10. Sustainability and Social Responsibility Goals

Build a socially conscious and eco-friendly business.

- Sustainability Practices: Reduce waste, use eco-friendly products, or support green initiatives.

- Community Engagement: Give back to your local community through volunteering or donations.

Example: Implement eco-friendly packaging by the end of Q2.

By setting these clear and actionable goals, you’ll create a roadmap for success. Regularly review and adjust these goals to keep your business on track as you grow

Many seniors decide to start a business based on their professional network built over the years when they were employed. Also, life experience comes to bear on the reasons why a specific business was selected. Many seniors have a significant advantage over younger people who need income, vs seniors who may have a living income.

If you have a defined benefit pension plan and/or a healthy 401 (k), you may be set to fund your business idea. Also, as you start your business, you may not need immediate income to support yourself. Perhaps retirement savings can be used to launch your business. Young people may not have access to capital to the extent that people do in their senior years.

Startup Costs for your new business

Startup costs vary, of course, depending upon the type of business and the scale you desire. Are you interested in starting up a part-time business that can grow into a full-time effort? Perhaps you want to keep it simple and create an online business that does not require any employees.

Regardless of the type of business you start, there will be some costs to consider. The following provides some insight into what typical start-up costs are for various types of businesses. Consider this article from SCORE Small Business Retirement: Investing in the Future

Typical Startup Investment Ranges

- Home-Based or Online Business

- Investment: $2,000 to $10,000

- Examples: Consulting, freelance work, e-commerce, or content creation.

- Service-Based Business

- Investment: $10,000 to $50,000

- Examples: Cleaning services, coaching, or landscaping.

- Retail or Franchise Business

- Investment: $50,000 to $250,000+

- Examples: Opening a store or purchasing a franchise.

- Larger Businesses (e.g., Manufacturing)

- Investment: $100,000 to $500,000 or more

- Examples: Custom production or tech startups.

Factors Influencing Investment Costs

- Business Model:

- Online or service-based businesses typically cost less than physical locations or franchises.

- Industry:

- Industries like tech and manufacturing require higher initial investments.

- Location:

- Costs vary significantly by region, especially for brick-and-mortar businesses. Consider the Mississippi Gulf Coast, rated the #4 state to start a new business.

- Initial Scale:

- Starting small and scaling later can significantly reduce upfront costs.

- Marketing and Branding:

- Initial costs for building a brand, website, and advertising.

- Licenses and Legal Fees:

- Obtaining permits, legal structures, and insurance adds to the investment.

Insights for Retirees

- Retirees often fund their startups using personal savings, retirement funds, or home equity loans.

- Some choose low-cost models, like consulting or freelancing, to minimize risk.

- The average investment for retirees tends to range between $10,000 and $50,000, depending on the scope.

Business Plan

Please start by reading our full article on the Business Plan by clicking here. Now that we have discussed why you want to start a small business, let’s discuss creating a business plan. A successful business usually starts with a business model.

After you have decided upon a business model, create that plan. The beauty of a business plan is that it can be changed. Our template below is provided so that you can get a sense of what goes into a good business plan:

Executive Summary

The executive summary introduces your business plan. It should be clear, concise, and engaging, as it’s the first section investors or stakeholders read.

- Include:

- Business name, location, and mission statement

- A brief description of your product/service

- Business goals and vision

- Financial highlights (if relevant)

- Why your business will succeed

- Tip: Write this section last, as it summarizes the entire plan.

2. Business Description

Provide details about your business and what it does.

- Include:

- Business structure (LLC, partnership, corporation, etc.)

- Industry background and trends

- Target market and unique value proposition

- Your product or service and its problem-solving capability

- Tip: Explain what makes your business unique compared to competitors.

3. Market Research and Analysis

Show that you understand your target audience and the market conditions.

- Research Areas:

- Target Market: Who are your customers (age, income, location, etc.)?

- Industry Trends: What’s the demand? Are there growth opportunities?

- Competitors: Identify direct and indirect competitors.

- SWOT Analysis: Strengths, Weaknesses, Opportunities, and Threats.

- Tip: Use data and statistics to make your analysis credible.

4. Products or Services

Describe your offerings in detail.

- Include:

- The problem your product/service solves

- Unique features or advantages

- Pricing strategy

- Development or production plans (if applicable)

- Tip: Focus on the benefits to the customer, not just the features.

5. Marketing Strategy

Outline how you will attract and retain customers.

- Include:

- Pricing Strategy: What will you charge?

- Promotion Plan: Advertising, content marketing, social media, and SEO.

- Sales Strategy: Will you sell online, in person, or through partnerships?

- Customer Retention: Loyalty programs, follow-up plans, or CRM tools.

- Tip: Be specific about the channels you’ll use to market and sell.

6. Operational Plan

Explain the daily operations and logistics of your business.

- Include:

- Location(s) and facilities

- Technology, equipment, or software required

- Key suppliers or partnerships

- Operational processes (production, shipping, customer service)

- Tip: Highlight how operations will be efficient and scalable as you grow.

7. Management and Organization

Provide details about your leadership and team structure.

- Include:

- Bios of key team members, highlighting their skills and experience

- Ownership structure (who owns what)

- Roles and responsibilities

- Plans for hiring as the business grows

- Retirement plan

- Tip: Show that you have a competent team to execute your plan.

8. Financial Plan

Outline the financial health and projections of the business.

- Include:

- Startup costs: What funding do you need to launch?

- Revenue Model: How will you make money?

- Projected income statements, cash flow, and balance sheets for 1-3 years

- Break-even analysis

- Funding requests (if seeking investors)

- Tax strategies are important

- Tip: Use realistic and well-researched projections; back up your assumptions.

9. Appendix

Include supporting documents for reference.

- Examples:

- Licenses, permits, or legal documents

- Resumes of key team members

- Market research or surveys

- Contracts or product photos

- Tip: Only add essential and relevant documents to avoid overwhelming readers.

Final Tips for Success

- Keep it concise – Avoid overly long and complex plans; aim for 15-25 pages.

- Use visuals – Charts, graphs, and images make it easier to understand data.

- Focus on clarity – Write in plain language and avoid jargon.

- Update regularly – A business plan is a living document; revise it as your business evolves.

- Create a professional support team – You will need the help of professionals to set up and operate your business.

Baby boomers are the most likely candidates for starting small businesses in their retirement years at least as of this writing. Baby boomers may be financially secure and some may have already owned businesses in the past. Many were managers or executives of companies and came to their new business with years of experience. Some previous generations looked at retirement as a time to go fishing and walk on the beach.

Baby boomers and some Gen Xers grew up at a time when hard work provided financial security. They just can not sit around and do nothing after leaving their lifelong profession. They have a wealth of experience and many just want to share that experience. Starting a business venture seems to many the right thing thing to do. Many successful companies were started by older people.

Your Exit Strategy

Setting goals for your new business should also include one goal that most people do not think of when they start a business. What is your exit strategy? Yes, exit strategy. Every business owner will eventually sell or transfer their business to someone or an entity. The following are just examples of an exit strategy that is very important for seniors.:

What is an Exit Strategy?

An exit strategy is a plan for how business owners will sell, transfer, or close their business to realize a return on investment or minimize losses. It outlines the steps to transition ownership, whether due to achieving growth goals, financial gains, or unforeseen circumstances.

Having an exit strategy is necessary because:

- It ensures a smooth transition when you want to leave the business.

- It maximizes the business’s value when exiting.

- It provides clarity to investors or stakeholders about long-term goals.

- It prepares for unforeseen events like financial issues, burnout, or health concerns.

Types of Exit Strategies

- Selling the Business

- To Another Business (Acquisition): Larger companies might buy your business to acquire your products, customers, or market share.

- To a Competitor: A competitor may purchase your business to expand their operations.

- To a New Owner (Strategic Sale): Sell the business to an individual or entity that sees value in your operations.

- Merger

Combine your business with another company, where ownership and management are shared. This is ideal for scaling quickly and benefiting from new resources. - Initial Public Offering (IPO)

Taking the company public allows you to sell shares on the stock market. This option is for businesses with substantial growth and financial stability. - Passing the Business to Family Members or Heirs

Transfer ownership to a family member or trusted employee, maintaining the legacy of the business while stepping back from daily operations. - Selling to Employees (ESOP)

Create an Employee Stock Ownership Plan (ESOP) where employees buy ownership stakes. This maintains company culture and rewards loyal staff. - Liquidation

Selling off assets, paying debts, and closing the business. This is a last-resort option but ensures financial obligations are met. - Partnership Buyout

If co-owners exist, create an agreement where one partner buys out the other when exiting.

Steps to Create an Exit Strategy When Starting a Business

- Set Clear Long-Term Goals

- Determine why you’re creating the business (e.g., financial independence, building a legacy, or innovation).

- Establish timelines for when you may want to exit, e.g., in 5, 10, or 20 years.

- Identify Your Ideal Exit Strategy

- Evaluate options (sale, merger, IPO, etc.) based on your vision, industry, and personal preferences.

- Consider who might buy your business (competitors, larger companies, employees).

- Plan for Business Valuation

- Establish systems to track financial health: revenue, profits, and assets.

- Hire experts (like business appraisers) to assess the value of your company as it grows.

- Tip: Maximize business value by building a strong brand, loyal customers, and efficient processes.

- Prepare Legal and Financial Structures

- Choose a suitable business structure (LLC, corporation, etc.) that supports ownership transfers.

- Document contracts, intellectual property, and ownership agreements.

- Create buy-sell agreements if multiple owners exist, defining how exits will occur.

- Build a Strong Management Team

- Hire and train a leadership team that can manage operations when you exit.

- This increases the value of your business and ensures its sustainability.

- Develop a Timeline and Milestones

- Set specific milestones (e.g., revenue targets, market share growth) to indicate when your business is ready for sale or transition.

- Keep Investors and Stakeholders Informed

- Investors want to know how and when they’ll see a return on their investment. Outline your exit strategy clearly in your business plan.

- Plan for Personal Transition

- Define what comes next for you: starting a new venture, retiring, or working as a consultant.

Why is an Exit Strategy Necessary?

- Maximizes Value: A well-planned exit strategy ensures you leave the business on your own terms and secure the best possible return.

- Attracts Investors: Investors want a clear roadmap to profitability and exit.

- Reduces Risk: It prepares you for unexpected situations like financial downturns or health issues.

- Maintains Control: You control how the business transitions, rather than leaving it to unforeseen circumstances.

- Personal Goals: Whether retiring, pursuing new ventures, or creating generational wealth, it aligns the business with your long-term goals.

Final Tips for Crafting an Exit Strategy

- Start early – your exit strategy should be part of your original business plan.

- Be flexible – market conditions and business goals may change, so adjust accordingly.

- Seek professional advice – legal, financial, and business experts can ensure a smooth transition.

About the Author

Learn how I successfully launched multiple businesses after retirement

I’ve started many businesses throughout my life. Somehow, I also managed to squeeze in an enlistment in the Air Force, attending college after hours, and earning my private pilot’s license. Later in life, well, I’ll get to that. One of the many businesses I created was when I was 46 years old.

Within two years of starting that business, I was offered the opportunity to sell it to a very large corporation on a buyout basis. I sold 49% of the company, with a commitment from them to buy out the remainder within five years. That was my exit strategy.

Unfortunately, that company went into bankruptcy and couldn’t complete the buyout. Everything changed for me and my company. Without diving into the gritty details, my company almost went the way of the prospective buyer. I worked harder than I ever had in my life to turn things around.

My efforts paid off

My efforts paid off. The company not only succeeded but also grew. At that point, I decided on a new exit strategy: to sell to another large corporation, but this time, one that was much bigger. I courted my target company for about six years. During that time, they hired my company to fulfill contracts. Each year, more contracts came our way. Gradually, the target company became more and more intertwined with my own.

I was invited to speak at their company meetings, and we all felt that a merger was inevitable. One day, I got a call from one of their new Vice Presidents. From that call, we moved through the sale process, and I stayed on to manage the business for another seven years.

Initially, I didn’t plan to stay that long, but the compensation package allowed me to save more for retirement. I gave them a three-year notice of my intention to retire. By the time I made that decision, I was already planning my next steps.

I started a blog

First, my wife and I moved from crowded, expensive California to the Mississippi Gulf Coast. I had started a blog—this one—and about a year before my retirement, I partnered with a real estate agent to create a new real estate brokerage.

This was where I began leveraging my lifelong learning and previous work experiences into new enterprises. My thorough financial planning meant I didn’t need to overspend to get started. I purchased some investment properties, something I’d been doing for decades as a side gig. I knew the real estate investment business inside and out.

Before long, I was also in the real estate investment consulting business. I created a company to help people who’d never invested in real estate before. I guided them through getting started and finding the right properties. Other real estate agents began referring their clients to me for consulting. Once we found a property that met their investment goals, I’d contact their agent and discuss the offer.

The opportunity was there so I stepped in.

When an offer was accepted, I helped them create LLCs, set up business names, organize their accounting, and more. This wasn’t the type of business I’d planned on being involved in, but the opportunity was there, so I stepped in.

While building the consulting business, I put my property management experience to work. I partnered with my real estate partner’s brother to start a property management business. The first properties we managed were my own—I didn’t have the time or desire to handle them myself. Word got out, and soon we added more clients, including properties outside of my portfolio.

I had the opportunity to engage my teenage son in my first consulting business. He started working with me using his computer skills to set up all of our systems including the internet which was new at the time. He was only 15 when he started after school, on weekends, and during the summer.

I encouraged my son to work for another company

A year after he graduated from high school, I encouraged him to find work with another employer to expand his experience. He found a great job with a very good salary, and at this writing, he is a director of the IT department for a mid-sized company. It was great working with my son and knowing that I helped launch his career.

After I created my largest company a few years later, my daughter came to work for our company. She traveled across the country as a sales representative and gained invaluable experience. I approached her in the same manner and told her it was time to work for another company.

She found a job quickly and started a new career. I am pleased that my children were able to work with me and encourage any readers to consider working with family.

Having a partner makes a big difference

I always intended to earn supplemental income but not to expend all my time. Thankfully, my partner manages the property management business well, so my involvement is minimal.

Life, as it tends to do, happened. We created a spin-off business to manage vacation properties. I bought several properties, set them up as vacation rentals, and that business took off. More clients approached us, and we eventually had to say no a few times because we had too many properties to manage.

My list of business start-ups

So far in my senior years, I’ve started a real estate brokerage, bought a building to house our headquarters (and rented part of it to an attorney), and launched a real estate financial consulting business, a property management company, and a vacation rental management business.

At the same time, I was writing articles for five websites, creating podcasts for four, and producing YouTube videos.

Just when I thought I couldn’t possibly take on more, I found myself helping individuals start their small businesses in home maintenance. All those properties I’ve mentioned need regular work. I assembled several small businesses to help our clients repair and maintain their properties.

These individuals were skilled and reliable but struggled with managing their businesses. I’ve essentially been teaching them the art of sole proprietorship. My efforts have helped them find more clients, including our property owners. They’ve set up real companies with the state, opened business checking accounts, acquired lines of credit, and purchased equipment.

Personal finances and financial risks

We’ve also spent a lot of time on personal finances and discussing financial risks. I’ve encouraged them to start thinking about retirement and setting aside funds now, even though they’re all in their 40s. Some have begun considering exit strategies, like passing the business to their children, while others are still grappling with the idea.

I hope my story illustrates that seniors can start successful businesses and make money. My journey is proof that lifelong learning, persistence, and adaptability can lead to meaningful success, even in retirement. If there’s one thing to take away from my experience, it’s this: always be ready to learn, grow, and seize opportunities as they come.

I hope that you have learned something from my travels through life. It’s absolutely true that seniors can start successful businesses and make money. My story is a good example. Here are the takeaways from my story:

Key Lessons from My Entrepreneurial Journey

1. Embrace the Unexpected Path

When you start down the road of entrepreneurship, your journey might not go exactly as planned. You’ll begin with one goal in mind, but unexpected opportunities may appear. Don’t be afraid to pivot and explore them—sometimes the detour becomes the main road to success.

2. Do What Makes You Happy

After years of working for others, it’s your time now. Start a business that excites you and brings you joy. If you’re not having fun or feeling fulfilled, it may be time to reassess. Entrepreneurship is hard work, but it should make you happy.

3. Be Cautious with Investments

Protect your future. Avoid business ideas that could jeopardize your retirement savings or financial stability. Risk is part of the process, but it should be calculated and manageable.

4. Get Legal and Protect Yourself

Take the necessary steps to legitimize and safeguard your business:

- Register your business with the State.

- Obtain appropriate licenses and insurance.

- Consult legal and financial experts when needed.

Protecting your business from day one will give you peace of mind as you grow.

5. Value Your Time

Time is the one resource you can never get back. Use it wisely.

- If you’re not having fun, find something else that sparks your passion.

- If you’re married or have a family, make time for your loved ones. Business success isn’t worth it if you lose valuable time with the people who matter most.

6. Plan Your Exit

Always think about what happens after the business is successful. At some point, health, age, or other priorities might push you to step away. Have an exit plan in place early so you can transition smoothly when the time comes.

7. Avoid Heavy Debt

While leverage can be a powerful tool, it’s best suited for those with decades to repay it. For later-in-life entrepreneurs, avoid taking on large amounts of debt that could burden your future.

8. Involve Your Family

Make your business a family affair. Include your children, grandchildren, or spouse where possible. They can offer help, support, and fresh perspectives. Plus, working together can be a meaningful and fun way to bond and share your journey. My grandson is working with me on my blog business while attending college.

Notes about Social Security

If you are considering starting a business and you are not already receiving Social Security benefits you need to understand a few things. First, anyone taking Social Security under the age of full retirement 66-67 (criteria may change), will forfeit a portion of their benefit if they earn more than $22,320 in 2024.

The benefit will be reduced by one dollar for every two dollars earned if you earn more than $22,320 in 2024. It’s important that you check with the Social Security website to calculate your position regarding retirement and employment income.

If you wait until you are at full retirement age, there is no penalty. It may be in your best interest to postpone taking Social Security if you expect to have a successful business. If you are already taking Social Security and you started on or after age 62 but before full retirement, you may want to look at the reduction as a cost of doing business if your business is successful.

Ask your CPA about Social Security impacting taxes

Check with your CPA about your spouse’s Social Security benefit; it may be possible that the spouse’s benefit is not affected. Again, check with your CPA to be sure before you launch your business.

One of the first things to consider is how to set up a real business. This includes registering your business with the state, choosing the right legal structure (like an LLC or sole proprietorship), and obtaining necessary licenses and insurance. These foundational steps are critical to protecting your investment and giving your business legitimacy.

Another key aspect is financing your business. Whether you’re using savings, seeking loans, or exploring partnerships, understanding the financial implications and planning accordingly can make all the difference. For seniors, it’s especially important to balance the desire for growth with the need to protect retirement savings and maintain financial stability.

Building the Right Team and Scaling Up

We’ll also explore working with contractors and hiring employees, as well as integrating family members into the business. Including your daughter, son, or spouse can bring fresh perspectives and additional support, but it’s essential to set clear roles and boundaries to ensure harmony both at work and at home.

Scaling your business is another exciting challenge. You might want to grow your business from a small start-up to something larger, or perhaps you’d prefer to keep it at a manageable size that aligns with your retirement goals. We’ll discuss how to scale effectively while maintaining a balance that works for your lifestyle.

Many seniors are turning to popular business ideas that align with their skills and passions. Consulting, real estate, online sales, coaching, and crafting are just a few examples of businesses that seniors are starting. In upcoming articles, we’ll highlight these options and explore how to find the right fit for you.

Balancing Time and Giving Back

Time commitment is another critical factor. Remember, you’re retired and have already spent many decades working full-time. It’s important to create a business that fits your desired lifestyle and allows you to enjoy your retirement years. We’ll discuss ways to manage your time effectively and set boundaries so your business doesn’t take over your life.

For those who want to give back, the approach of helping others can be incredibly fulfilling. Starting a non-profit business or incorporating social impact into your for-profit venture can bring a sense of purpose and contribute positively to your community.

Finally, we’ll discuss additional educational opportunities to help you learn more about running your business successfully. From online courses to community workshops, there are countless resources available to enhance your skills and knowledge as a senior entrepreneur.

Your Path to Success

The journey of starting a business after retirement is filled with opportunities and challenges. Through this article and those to come, I hope to guide you through the process, inspire you to dream big and provide the tools and insights you need to make your business a success. Stay tuned as we dive deeper into each of these topics in the coming weeks. Don’t forget to organize your own financial life.

Try our quiz below.

Starting a new business as a senior is an exciting and rewarding venture. There is so much to communicate about how to get started and make your business work, and this article is just the beginning of the conversation. You may want to read “It’s time to Retire Retirement” from the Harvard Business Review. Another article to read is What you need to know about running a business in retirement.

I aim to help you start thinking about what’s possible and how to approach this new chapter in your life. In future articles, we’ll explore practical steps and strategies for turning your ideas into reality. If you would like to start a business on the Mississippi Gulf Coast, read this article

Read our entire series of articles on the topic of “Starting Your Own Business after Retirement”

Listen to our podcast and click on the green button below to take the next step in your journey to “Starting Your Own Business After Retirement”.

Rent vs. Buy: A Practical Housing Decision for Millennials – RetireCoast

- Rent vs. Buy: A Practical Housing Decision for Millennials

- Weapons Used In 1776: Revolutionary War Weapons, Tools, and Uniforms

- Shamrock Shenanigans and Southern Charm: A Guide to St. Patricks Day on the Mississippi Gulf Coast

- Who We Were in 1776: The People Who Became Americans

- 11 Best 2026 Tax Changes Millennials and GEN Z Should Understand NOW!

Subscribe below to receive notice of future postings

Please leave comments about this article and others below. Sign up to be notified of new articles. We appreciate your time in reading this information and hope that you will benefit from it.

Back to TopDiscover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.