Last updated on September 27th, 2025 at 04:40 am

Many families in the Golden State — including my own — are starting to look ahead, and what they see is troubling. California’s population grew for recent decades, but in recent years, the trend has reversed. With housing costs at record highs, the nation’s highest state income tax rate, and the overall cost of living well above the national average, many California residents fear they will not be able to retire in place.

Even those who can remain in their homes will often be “house poor,” with no flexibility to handle natural disasters, rising gas taxes, or unexpected expenses. Baby Boomers are already talking to their Gen X family members about moving to a different state where they can find lower costs, lower taxes, and a better quality of life.

This is the point of the article: to take a closer look at why the California exodus is accelerating, and why some of the best places to relocate may not be the ones most people first think of.

California’s Population Loss: What the Data Shows

The U.S. Census Bureau confirms that California’s population has declined in recent years, following a long history of growth (U.S. Census Bureau). For decades, the state grew thanks to booming industries, new residents from across the United States, and foreign immigration. But the trend has shifted dramatically.

The California Department of Finance reported a net loss of more than 342,000 residents last year, following a small increase the previous year (California Department of Finance). That’s not a blip — it’s part of a consistent downward slide in population growth.

Why is this happening? The Public Policy Institute of California points to multiple main reasons: a falling fertility rate, rising income inequality, persistent affordability issues, and an outflow of former Californians leaving for other states (PPIC).

- In recent decades, the state attracted talent with its job opportunities and natural beauty.

- But recent data shows major cities like Los Angeles, San Francisco, San Diego, and San Jose now lead in population loss.

- These areas face a housing crunch so severe that even one-bedroom apartments command prices well above the national average.

This population loss represents more than just numbers. It erodes tax revenue, undermines social services, and shifts political and economic power to other regions of the country.

Why It’s a Difficult Decision

Leaving California is not easy. For many, it’s home — a place of natural beauty, world-class beaches, mountain ranges, and a thriving music scene. The Bay Area, Southern California, and Silicon Valley are globally recognized hubs of culture and innovation. Walking away from all that isn’t a casual choice — it’s a difficult decision.

But sentiment alone cannot erase the realities:

- High taxes and rising income taxes weigh heavily on households.

- Housing markets are so constrained that home ownership is increasingly out of reach.

- Violent crime rates, safety concerns, and social polarization leave many uneasy.

- Climate change brings annual wildfires, worsening drought, and rolling blackouts.

- Even after paying into the system for years, residents find social services stretched thin.

This contrast — between the promise of the American dream in California and the daily grind of high costs and strict regulations — is pushing families to reconsider.

The Cost of Staying: Taxes, Housing, and More

When comparing the overall cost of living, California stands out. The median household income in the state is roughly $91,000, but the median home value is about $785,000 (U.S. Census Bureau). That’s nearly nine times income, compared to the traditional home affordability rule of 3–4 times.

In places like Orange County, the problem is even worse. With average home values near $900,000, property taxes run around $6,000 per year — even with Prop 13 protections. Add in some of the highest gas taxes in the nation, rising utility costs, and expensive healthcare premiums, and it’s clear why many residents see no path forward.

One of the unseen problems is the direction the state is heading. Everything is already higher, but what’s worse is that the trend toward overspending continues to climb. California recently voted to spend more than ten billion dollars on a high-speed rail project often called the “train to nowhere.” It is already a decade late and obscenely over budget (California High-Speed Rail Authority).

As residents look to the future, all they see is more government spending and regulations that force businesses to raise their prices just to keep up. The trajectory is unmistakable — higher costs, fewer incentives, and less relief for ordinary families. Look at the trend, and it’s shocking.

The Electric Car Dilemma in California

Another factor driving frustration in the California exodus is the way the state has handled the push for electric cars. For years, California aggressively promoted EVs, offering generous taxpayer-funded incentives to take gas and diesel-powered vehicles off the road. Carpool lanes were opened to electric vehicles, federal subsidies sweetened the deal, and utilities even offered reduced electric rates for at-home charging.

But in recent years, the picture has changed dramatically:

- Last summer’s power shortages forced the state to ask residents not to charge their electric cars, even as leaders continued mandating an all-electric future.

- Utility companies, once offering charging subsidies, have since ended those programs after being hit with tens of billions in lawsuits over fire liability.

- The federal subsidy for EV purchases expired, while the carpool incentives disappeared, removing one of the most visible perks for commuters.

- At the same time, EV prices remain higher than gasoline vehicles — and without subsidies, they are now often more expensive to operate as well.

This contradiction — a state pushing residents into electric vehicles while simultaneously discouraging charging during peak demand — highlights the growing sense of policy disconnect. Many residents, like my son who purchased an EV under these programs, now feel betrayed: the incentives that made ownership attractive are gone, and the ongoing high cost of living makes running an EV less affordable than a traditional car.

For families already squeezed by housing costs, high taxes, and energy bills, this is yet another example of how strict regulations and shifting policies add to the burden. Instead of reducing costs, many programs end up making life more expensive and unpredictable.

Electric Vehicles vs. Gasoline Cars in California

| Factor | Electric Vehicles (Then) | Electric Vehicles (Now) | Gasoline Cars (Now) |

|---|---|---|---|

| Purchase Price | Higher than gas, but offset by federal subsidy + state rebates | Still higher, federal subsidy gone, state rebates limited | Lower upfront purchase cost |

| Fuel/Charging Cost | Utilities offered reduced charging rates; cheaper than gas | Subsidies ended; home charging rates at normal or higher levels | Gas prices high, but often cheaper than charging at CA electricity rates |

| Carpool Lanes | Free access for EVs; a major incentive for commuters | Carpool lane perk ended; EVs treated like any other car | No access unless carpooling |

| Federal/State Incentives | Up to $7,500 off federal plus CA state rebates | Federal subsidy expired, CA programs cut back | Few incentives beyond MPG ratings |

| Operation/Practicality | Seen as cheaper and eco-friendly option with perks | More expensive to operate, limited range, charging discouraged during shortages | Reliable, easier refueling, lower upfront cost |

My Son’s Story: From Perks to Penalties

When my son bought his electric car in California, it felt like a smart move. The federal subsidy helped with the purchase price, he received a utility discount to charge at home, and he zipped past traffic in the carpool lanes without paying tolls. At the time, it made financial sense.

Fast forward to today: those incentives are gone. His electric bill went up when the charging subsidy ended, the federal rebate expired, and EVs no longer get special treatment in the carpool lanes. Add in the state’s warning last summer not to charge cars during power shortages, and suddenly that “smart move” looks like another example of how fast-changing strict regulations make life harder, not easier.

Like many California residents, he now faces the reality that his EV costs more to operate than a traditional gasoline car — and that’s on top of the high cost of living already straining families.

Why Businesses and Companies Are Leaving Too

It isn’t just families. Major companies are also leaving. Over the last year, headlines have been dominated by firms shifting headquarters to the Lone Star State, Florida, and even North Carolina.

- Tesla, Oracle, and Hewlett Packard Enterprise moved to Texas.

- Chevron relocated executives to Houston.

- Charles Schwab and Palantir set up outside of California.

The Los Angeles Times reports that California had a higher rate of corporate exits than arrivals in 2023 (LA Times). Forbes calls it an acceleration of the California exodus, citing high costs, strict regulations, and liberal politics as major factors (Forbes).

When enough companies leave, they take job opportunities, innovation, and tax revenue with them. That, in turn, worsens affordability issues for those who remain.

Popular Destinations: Pros and Cons

The best places to move from California are often assumed to be Texas, Arizona, Nevada, Washington State, and North Carolina. These southern states and urban areas attract young professionals and retirees alike, promising lower costs and greener pastures.

But close attention is needed:

- Texas housing markets are overheated. In Austin, average home values doubled in recent years, leaving many priced out (Bloomberg).

- Colorado, another popular destination, faces a surge of new residents, strained infrastructure, and a political climate mirroring California’s.

- Florida offers lower taxes and affordable housing in some regions, but natural disasters like hurricanes and rising insurance rates create risks.

- Washington State now has high costs and liberal politics similar to California, turning away some would-be transplants.

In short: not all different states provide the escape families are hoping for.

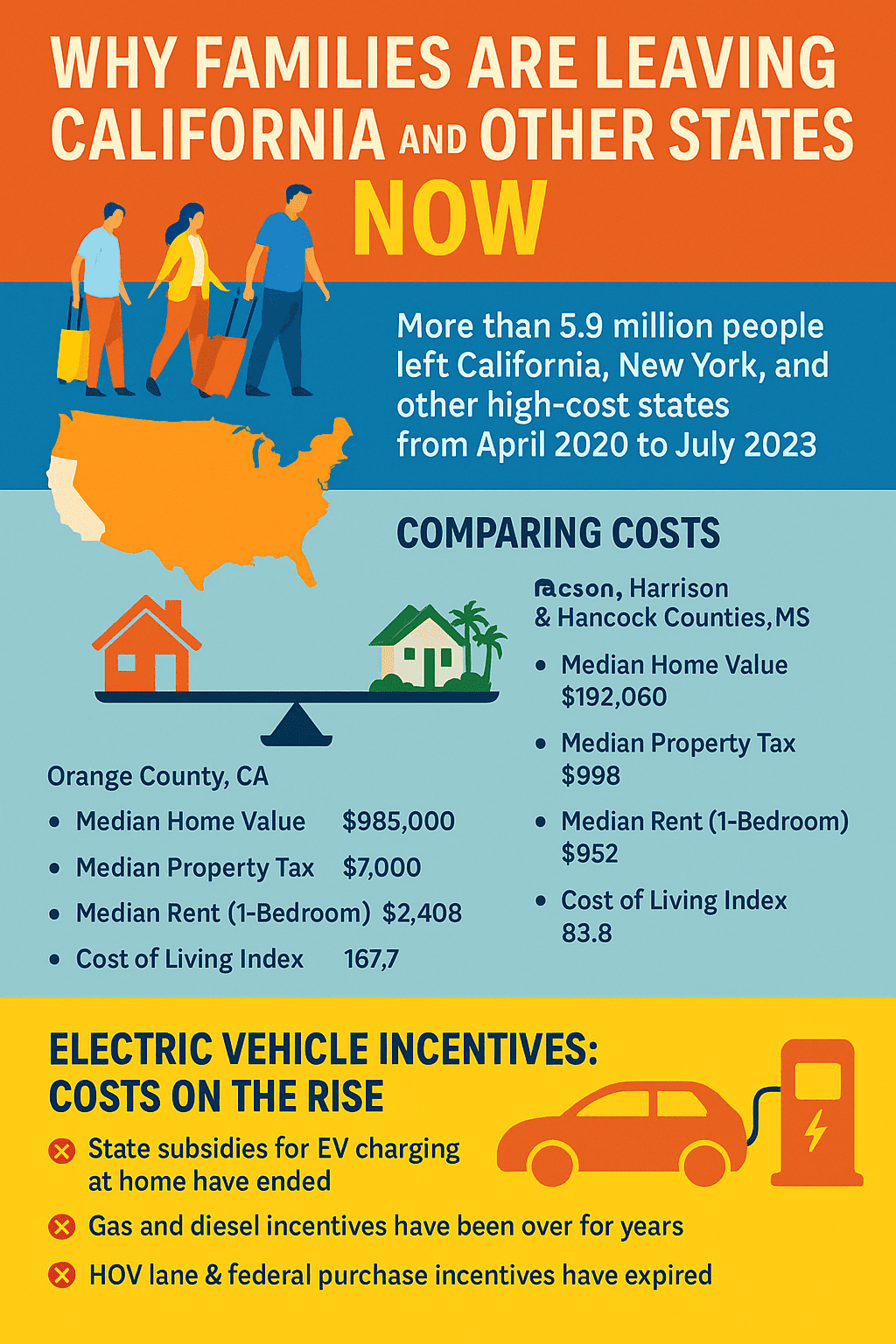

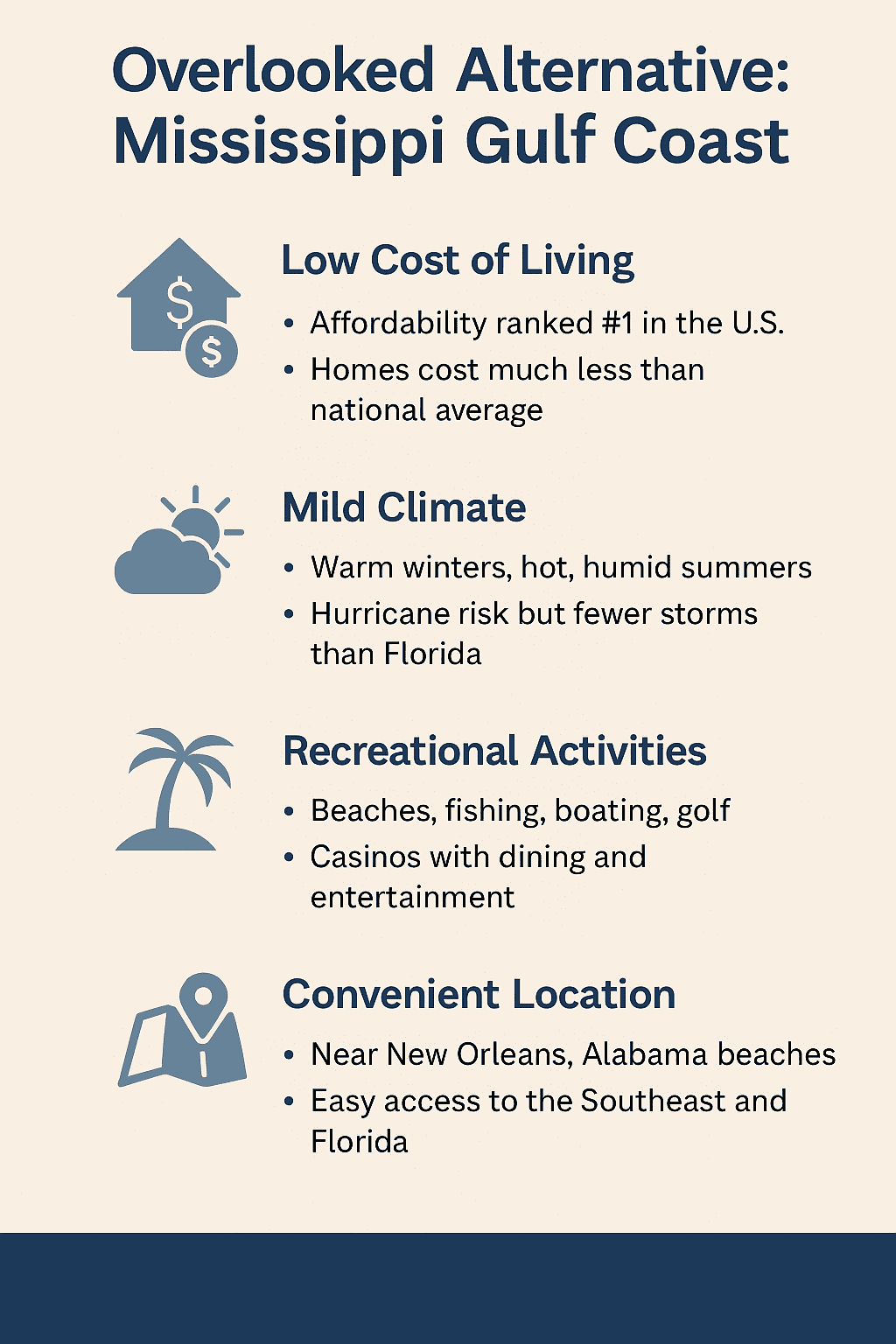

An Overlooked Alternative: Mississippi Gulf Coast

While headlines focus on popular destinations, the Mississippi Gulf Coast deserves a closer look. It combines affordable housing, a low cost of living, and strong quality of life.

Why It Works

- Affordable housing: Homes in Jackson, Harrison, and Hancock counties cost a fraction of those in California cities.

- Lower taxes: Seniors often pay less than $1,800/year in property taxes.

- Lower cost of living: Everyday expenses fall below the national average.

- Lifestyle: Beaches, boating, fishing, and casinos provide recreation.

- Job opportunities: Shipyards, NASA, military bases, and healthcare fuel economic growth (Governing.com).

The region has avoided the housing crunch and affordability issues plaguing San Diego or the Bay Area. For former Californians, it offers not just a cheaper life but a new home and community.

Orange County vs. Mississippi Gulf Coast

| Category | Orange County, CA | Gulf Coast (Jackson + Harrison + Hancock) |

|---|---|---|

| Average Home Values | ~$862,900 | ~$199,000–$220,000 |

| Property Taxes | ~$6,000/year | ~$1,200–$1,800/year |

| Median Household Income | ~$110,000 | ~$55,000–$60,000 |

| Overall Cost of Living | ~38% above national average | Among the lowest in the United States |

| Housing Crunch | Severe, limited supply | Ample, more land |

| Safety Concerns | Violent crime rates higher in major cities | Lower in smaller coastal towns |

Even though Mississippi counties sometimes have higher property tax rates, the actual dollar cost is dramatically lower. That’s the main reason why former Californians are taking a closer look at this southern state.

Conclusion: The California Exodus Is About Families

The California exodus is no longer a blip — it’s a fundamental shift. Baby Boomers are leading, but they’re asking their Gen X children and even Millennials to follow. This isn’t just about escaping high costs. It’s about protecting wealth, preserving the American dream, and ensuring home ownership is possible for the next generation.

Leaving behind Los Angeles, San Francisco, San Diego, or San Jose is a difficult decision. But the data is clear: population loss, rising income taxes, housing costs, and strict regulations are eroding the state’s future. New residents aren’t replacing those leaving, and census data shows California risks long-term decline.

The story of my son’s electric car is a perfect example. When he bought it, the subsidies, discounts, and perks made it seem like a smart investment. Today, the incentives are gone, the carpool lane access is over, electricity costs more, and even the state warns against charging during power shortages. What once looked like a forward-thinking choice now costs more to own and operate than a traditional car.

California itself is following the same path. The perks of staying — job opportunities, social programs, lifestyle benefits — are fading, while the costs keep rising. Families are left paying more for less.

Call to Action: Don’t wait until the last incentives disappear. Take a closer look at states with a lower cost of living, like Mississippi. Use the equity from your California home to build a new home where your family members can live well without constant financial strain. Just as with electric cars, the longer you wait, the more expensive staying becomes. The time to plan your exit is now.

FAQs: Leaving California & Moving to Lower-Cost States

1) What is the “California exodus” and why is it happening?

2) Is leaving California mostly about politics or money?

3) How do I know if moving makes financial sense for my family?

4) What are the most common mistakes people make when relocating?

5) How do housing costs really compare between coastal California and the Mississippi Gulf Coast?

6) Are property taxes actually lower outside California?

7) What about income taxes and sales taxes?

8) Will I lose out on job opportunities if I leave a major California city?

9) How do utilities and insurance costs compare?

10) What’s the deal with electric vehicles and incentives changing?

11) How long should I “test live” in a new state before buying?

12) Are crime and schools better outside big California metros?

13) What relocation costs do families underestimate?

14) How will moving affect my healthcare access and insurance?

15) How do I evaluate flood, wind, fire, and other natural-hazard risks?

16) What’s a smart order of operations for a cross-state move?

17) How can retirees protect cash flow after moving?

18) What if I want to bring adult children or aging parents?

19) How do I avoid buying in an overheated “new hot spot”?

20) Why consider the Mississippi Gulf Coast specifically?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.