Last updated on November 30th, 2025 at 11:51 pm

Introduction — The Spirit of 1776 and the Power of Legacy

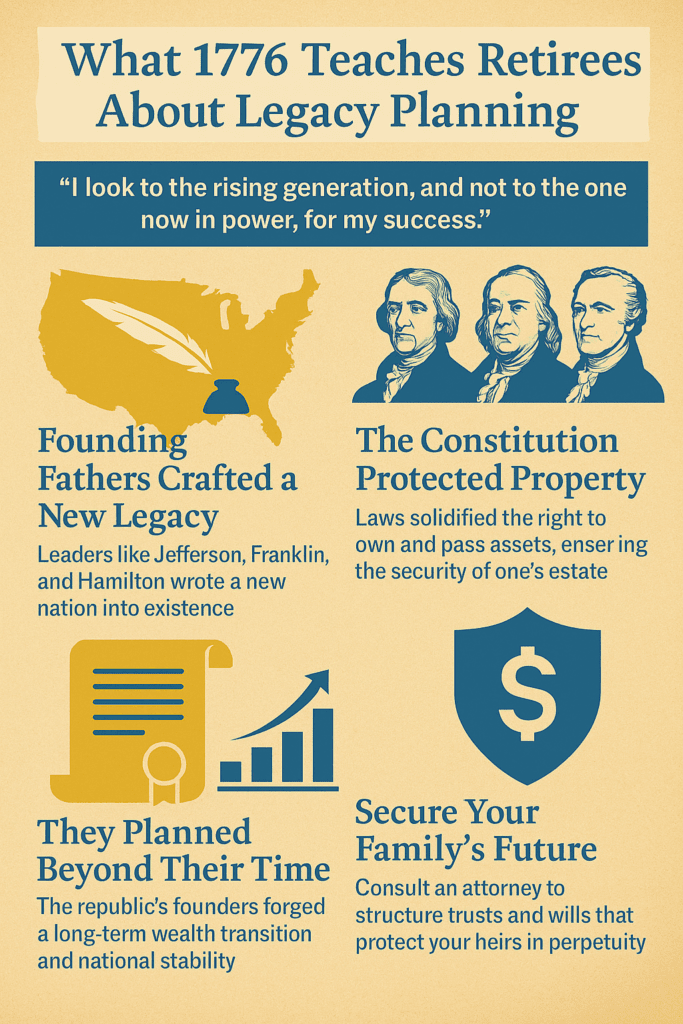

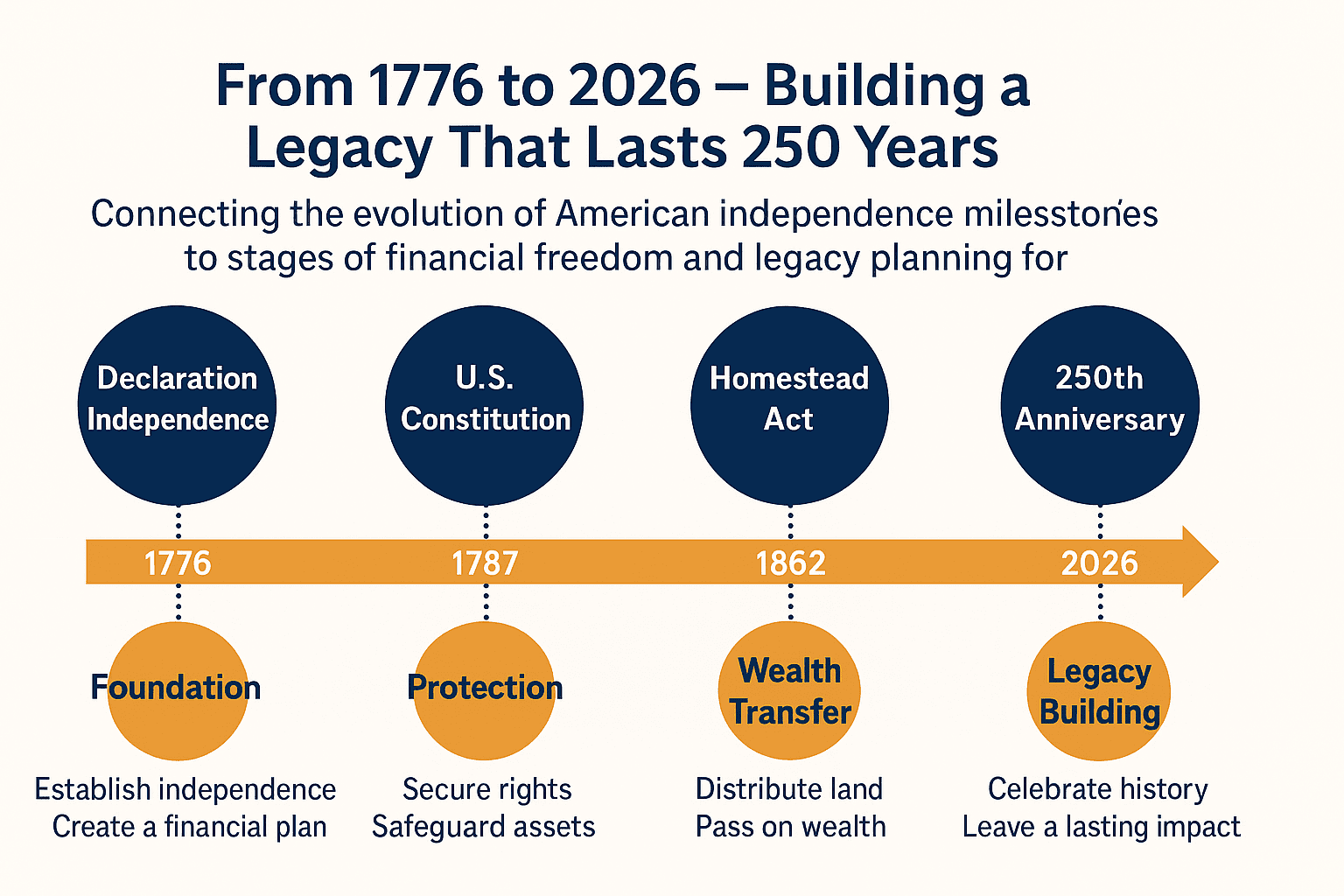

In 1776, the Founding Fathers didn’t simply declare independence from Great Britain —they crafted an enduring framework for freedom and inheritance that still shapes modern life. That same spirit defines legacy planning for retirees today. Just as the signers of the Declaration of Independence envisioned a nation capable of governing itself for centuries, retirees design their own personal constitutions to protect family, freedom, and financial security.

This article is one chapter in the RetireCoast 250th Anniversary Series, exploring how the vision of 1776 still guides modern Americans toward independence—financial, personal, and generational. As we approach July 4, 2026, each installment connects the founding ideals of liberty and self-reliance to today’s opportunities for retirees, business owners, and families building a legacy of their own.

This article—“What 1776 Teaches Retirees About Legacy Planning”—connects the principles of Thomas Jefferson, Benjamin Franklin, John Adams, and George Washington to the goals of modern estate planning. Independence is not a one-time event; it is a system sustained by clarity and discipline.

As Adams wrote to Abigail on July 3, 1776, “Posterity! You will never know how much it costs the present generation to preserve your freedom.” Those words speak to every retiree who plans not just for today, but for generations to come.

Thomas Jefferson’s words still ring true: “The generation which commences a revolution can rarely complete it. It is the work of successive generations.” Legacy planning is the continuation of that revolution—a structured transfer of freedom, values, and resources.

📖 Read Jefferson’s letter to Adams (1814) via the National Archives.

Freedom and Financial Independence: Echoes of 1776

When Jefferson wrote that “all men are created equal,” he defined a core principle of autonomy. After decades of hard work, retirees experience their own revolution as they achieve financial independence. Yet freedom—whether political or personal—survives only when protected by structure.

The Founding Fathers did not stop with a declaration; they built systems—the Articles of Confederation, then the U.S. Constitution—to preserve what they had earned. Similarly, retirees should draft revocable living trusts, asset protection trusts, and wills to safeguard their independence.

| Founders’ Values (1776) | Modern Legacy Principles (2025) |

|---|---|

| Independence | Financial Freedom in Retirement |

| Accountability | Clear Estate Documentation |

| Common Good | Charitable Legacy |

| Continuity of Government | Long-Term Family Trust Structure |

“Freedom isn’t inherited—it’s maintained.”

A personal estate plan functions like the Federalist Papers (Library of Congress): it records intent and clarifies values for posterity. Legal protections for wills and trusts uphold that vision today (Cornell Law School: Fiduciary Duties).

📘 National Constitution Center — The Constitutional Convention

Similar articles: [Estate Planning Readiness Calculator] | [Strategic Wealth Transfer Guide] | [250th Anniversary Series Home]

Planning for Posterity: The Founders’ Long-Term Vision

At the Second Continental Congress, leaders such as Jefferson, Adams, and Franklin were not merely rebelling—they were planning for posterity. Their debates at the Constitutional Convention under James Madison, Alexander Hamilton, and President George Washington created the legal blueprint for generational continuity.

Benjamin Franklin, ever the planner, left money in trust to grow for two centuries—an early form of a charitable remainder trust (Massachusetts Historical Society). Modern retirees can mirror this approach through structured gifting and philanthropy that reinforces values.

| Historical Principle | Modern Equivalent |

|---|---|

| Federalist Papers on duty | Estate plans clarifying purpose |

| Constitutional checks and balances | Living trusts with oversight |

| Franklin’s 200-year fund | Charitable trust planning |

| Jefferson’s equality ideal | Family mission statements |

Washington’s Last Will and Testament (Mount Vernon Digital Archive) shows how ethical principles can guide financial decisions. He freed many enslaved people and provided for their well-being—an early example of values-based inheritance.

📈 Kiplinger — The Great Wealth Transfer Is Coming

Similar articles: [Strategic Wealth Transfer Guide] | [Family Meeting Planner] | [Who We Were in 1776]

From the King’s Decree to the People’s Property: How the Constitution Protected Legacy

Under a monarchy, colonial land was held only “in tenure” from the Crown. A colonist might farm a thousand acres, build a home, and raise a family—yet still hold no permanent title. Property existed at the pleasure of the king or his appointed governors. This fragile system made the concept of generational wealth nearly impossible.

A notorious example occurred in Virginia in the 1760s, when Governor Francis Fauquier, acting under royal prerogative, revoked a family’s land grant along the Potomac River after decades of cultivation. The land, originally deeded to a settler named Thomas Bryan Martin, was reclaimed and reassigned to another man favored by the governor’s council.

The Martins petitioned King George III for justice, but royal authorities upheld the governor’s decision—demonstrating that all property was ultimately the king’s to give or take. (Colonial Virginia Charters and Grants Archive)

Similar abuses occurred in Massachusetts, where colonial officials confiscated the estates of suspected dissenters during the aftermath of the Stamp Act protests. Merchants who supported independence lost warehouses and ships seized “for the Crown’s use,” with no recourse in court because the courts themselves answered to London. (Massachusetts Historical Society – Colonial Property Confiscations)

These incidents convinced colonial leaders that political freedom would be hollow without property security. The right to own and bequeath property, regardless of social rank, became central to the new American philosophy of liberty.

At the Constitutional Convention of 1787, delegates, including James Madison, Alexander Hamilton, and Benjamin Franklin, resolved to end centuries of hereditary privilege. Madison wrote in Federalist No. 10,

“A government is instituted to protect property of every sort.”

(Library of Congress – Federalist No. 10)

This new framework replaced royal favor with the rule of law. The U.S. Constitution, ratified the following year, gave citizens legal ownership that could not be revoked by decree. Early Supreme Court rulings—such as Fletcher v. Peck (1810) and Dartmouth College v. Woodward (1819)—cemented these protections (National Archives).

| Old System: British Rule | New System: U.S. Constitutional Law |

|---|---|

| Land held by royal tenure | Contracts and wills are legally binding |

| Succession via royal favor | Inheritance guaranteed by legal instruments |

| Titles revocable at will | Rights are limited to elites |

| Legacy at the king’s whim | Expanding rights for all citizens |

| Legacy at king’s whim | Legacy safeguarded for every family |

Over time, amendments such as the Thirteenth, Fourteenth, and Fifteenth broadened these guarantees, enabling people of African descent and others to own property and pass it forward. The Founders’ transformation of ownership from royal privilege to civic right laid the groundwork for modern estate planning and legacy planning for retirees.

For today’s retirees, that heritage means something tangible: every trust, deed, and will you create is protected not by favor but by law—a direct legacy of the revolution that turned subjects into citizens.

Further Reading:

- National Archives – U.S. Constitution Transcript

- Bill of Rights Institute – Property and the Founders

- Cornell Law School – Property Law Overview

- Library of Congress – Constitutional Debates on Property

- Federal Judicial Center – Contracts and Property Rights Cases

Imagine if your entire estate—which you had planned to pass to your children—was taken from you because local officials wanted to give it to their friends?

This is a key difference between the United States Constitution our Founding Fathers created and many “modern” countries today where these protections do not exist.

The Great Wealth Transfer: Retirees as the New Founders

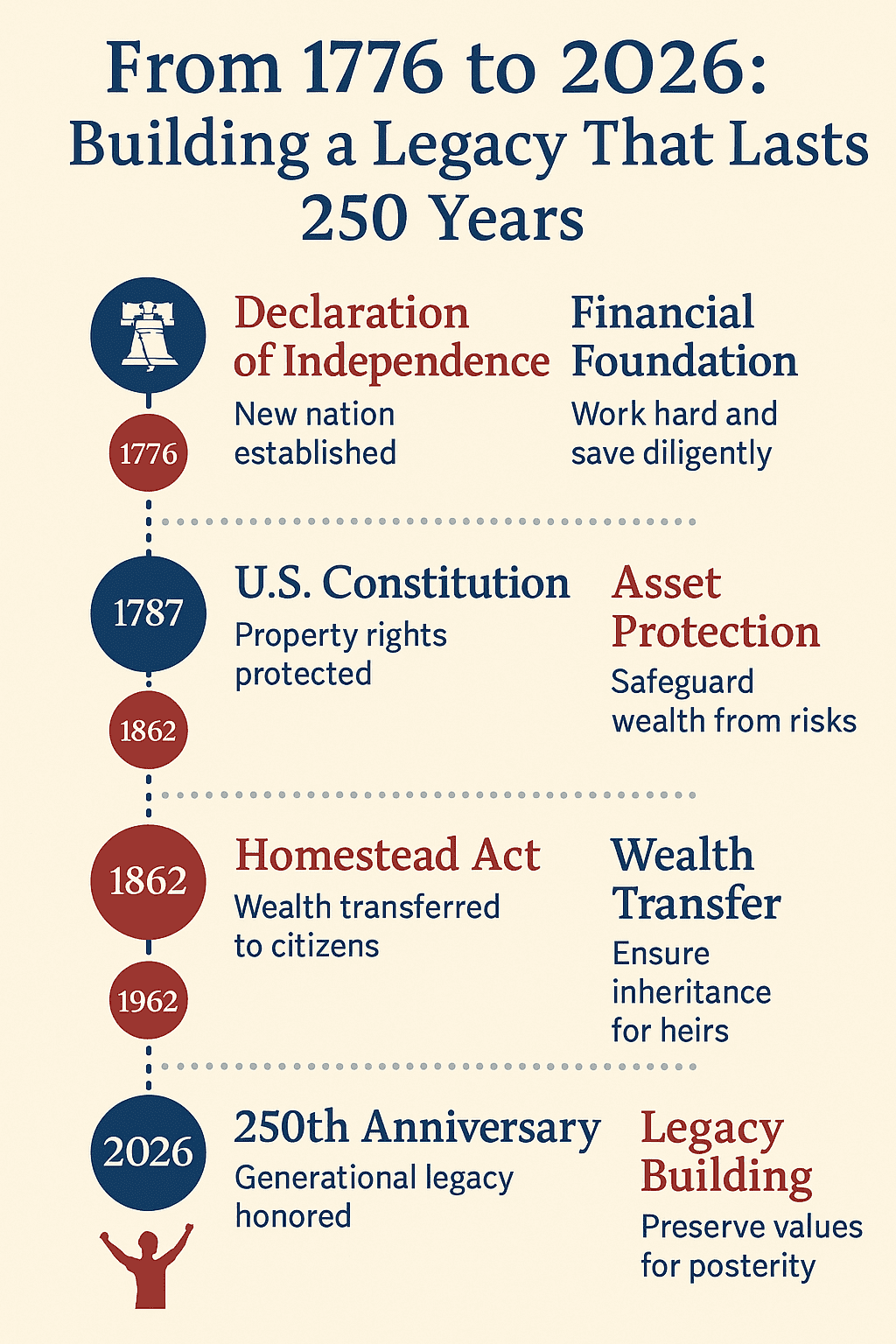

Historians often describe the American Revolution as the most profound transfer of power in modern history. When the colonies severed allegiance to King George III, ownership of land, production, and decision-making shifted from royal governors to the people. Two and a half centuries later, a different kind of transfer is reshaping the United States — an economic revolution now known as the Great Wealth Transfer.

According to economists, more than $84 trillion in family wealth will move from Baby Boomers and early Gen-X households to their heirs by 2045 (Kiplinger Report). This transition may be the largest financial hand-off since the birth of the republic. Just as the Founders debated the structure of their new government, today’s retirees must decide how their assets — homes, investments, and businesses — will be governed once they are gone.

Another significant transfer of wealth was completed by the government when it created the Homestead Act and gave away hundreds of thousands of acres of land back to the people, starting with those who had served in the Continental Army and continuing through the 1800s in Oklahoma and beyond.

The King lost his property during the Revolution, but the new government gave it to the people — to have and to hold legally in perpetuity.

📜 National Archives – Homestead Act of 1862

President George Washington modeled prudence by drafting a detailed will that reflected both moral duty and legal order. He freed many enslaved people, provided for free African Americans, and ensured support for his family members. His example remains the template for responsible estate planning: freedom paired with accountability.

| Era | Transfer Type | Driving Force |

|---|---|---|

| 1776 – 1790 | Power & property from Great Britain to the United States | Political independence & property law reform |

| 1862 – 1900 | Public land to citizens via Homestead Acts | Economic expansion & reward for service |

| 2025 – 2045 | Wealth from retirees to heirs | Demographics, estate planning, tax policy |

For modern retirees, the same logic applies. A family trust is to your household what the Constitution was to the nation: a living charter that outlines authority, clarifies succession, and minimizes conflict.

Using tools such as revocable living trusts, asset protection trusts, and carefully worded wills allows you to manage your estate through the transitions of life and law — just as amendments refined the nation’s founding document.

“The spirit of enterprise, so natural to man, must be protected,” wrote Alexander Hamilton while arguing for stable credit and contracts in early Federalist Papers (Library of Congress).

Practical Takeaway: Create a Family Constitution. List trustees, define amendment procedures, and attach an ethical preamble summarizing your goals — education, charity, stewardship. When generations understand the why, they are more likely to honor the how.

🔗 Internal Links: [Strategic Wealth Transfer Guide] | [Estate Planning Readiness Calculator] | [Family Meeting Planner]

Passing on Values, Not Just Valuables

When the delegates of the Constitutional Convention laid out the framework of the United States, they weren’t just codifying laws — they were preserving ideals. Their purpose was to ensure that liberty, responsibility, and the pursuit of happiness would outlast them. For today’s retirees, legacy planning for retirees carries the same responsibility: to pass on principles, not just property.

1. The Moral Wealth of a Nation and a Family

Benjamin Franklin, the ultimate pragmatist, wrote in Poor Richard’s Almanack that “a good example is the best sermon.”

He lived by that lesson, mentoring apprentices, funding schools, and leaving a charitable trust that grew for two centuries. Similarly, a retiree’s example — steady work, integrity, service, and thrift — is the true capital that compounds across generations.

John Adams argued in a 1778 letter that the new nation must rest on “a moral and religious people” because virtue sustains liberty. Your family legacy must rest on that same foundation. While money can be spent or misused, values endure when they’re written, discussed, and modeled.

Modern Application: Consider writing a Family Mission Statement that defines purpose beyond wealth. Include goals such as education, service, or community engagement. Store it with your will or trust as a preamble — your own Bill of Rights for your heirs.

📘 Forbes — Passing on Values Through Family Mission Statements

2. From Inheritance to Stewardship

When President Washington freed enslaved people in his will, he turned an inheritance into a statement of conscience. That single act reframed legacy from possession to stewardship. In today’s terms, it means designing your estate so it does more than enrich — it uplifts.

Examples of Modern Stewardship:

- Establish a Donor-Advised Fund to support education or environmental causes.

- Include a charitable remainder trust that provides income during retirement and funds your chosen nonprofit afterward.

- Teach heirs to manage their inheritance through mentorship rather than sudden transfers.

| Founders’ Example | Modern Practice |

|---|---|

| Washington’s moral estate | Ethical wills & value-based clauses |

| Franklin’s civic endowment | Donor-advised or educational trusts |

| Adams’ advocacy for virtue | Family mission & stewardship meetings |

📗 National Philanthropic Trust — What Is a Donor-Advised Fund?

George Washington’s Last Will and Testament

3. Educating Your Heirs

Thomas Jefferson founded the University of Virginia to ensure that knowledge, not inheritance alone, would sustain democracy. He believed that education was the surest safeguard of freedom. The same is true for your family. Financial education — from teaching compound interest to explaining estate documents — turns heirs into informed trustees rather than passive beneficiaries.

Action Steps:

- Hold an annual Family Legacy Meeting. Share updates, discuss the purpose behind your plan, and invite questions.

- Encourage heirs to attend estate-planning sessions with your attorney or advisor.

- Create a “legacy library” — digital or printed — containing deeds, letters, family history, and personal reflections.

📘 Investopedia — How to Talk to Your Children About Inheritance

🔗 Internal Links: [Family Meeting Planner] | [Wealth Transfer Guide] | [Who We Were in 1776 — 250th Anniversary Series]

4. Expanding the Circle of Legacy

The Founders’ generation did not initially extend liberty to all, yet over time, the nation fulfilled their words through constitutional amendments and civic reform. In the same way, a retiree’s legacy can evolve beyond the family circle — to community, faith groups, or social causes that align with personal convictions.

A modest endowment or scholarship in your name continues your story long after documents are settled. Just as the Homestead Act distributed land to those willing to cultivate it, your bequests can sow opportunity where it’s needed most.

📜 National Archives — Homestead Act of 1862

📘 Charity Navigator — Guide to Creating a Charitable Legacy

5. The Enduring Lesson of 1776

In 1776, ordinary people risked everything for principles they believed would outlive them. They didn’t wait for perfect conditions — they acted. Retirees planning their legacies are heirs to that same spirit. Whether through living trusts, philanthropic gifts, or ethical guidance, your plan declares independence from uncertainty and dependence on future generations’ virtue.

“We are in a continual state of improvement,” wrote James Madison in 1824, describing America’s evolving constitution. Legacy planning should mirror that improvement — updated, reviewed, and reaffirmed as life changes.

Your descendants may never know how much it cost you — in work, in saving, in love — to preserve their freedom and opportunity. But like Adams’ dream and Jefferson’s words, your plan can speak for centuries.

Conclusion & FAQ

Conclusion — Your Legacy Is America’s Legacy

In 1776, a group of determined citizens chose to secure freedom through planning and principle. They understood that a new nation could not survive on passion alone —it needed structure, vision, and written commitment. That same lesson applies to today’s retirees. Legacy planning for retirees is more than a financial exercise —it’s a continuation of the American experiment in self-determination.

Your will, trusts, and family plans are your own Declaration of Independence. They protect the values and resources you’ve built so that future generations can pursue their own dreams. Just as the Founders amended their Constitution to improve it, you can revise and strengthen your legacy plan to reflect changing circumstances without abandoning your core principles.

Every property title, trust document, and charitable gift is a quiet echo of the moment in Philadelphia when a few bold signatures secured a nation’s future. Now, you hold the pen.

“We have it in our power to begin the world over again.” — Thomas Paine, 1776

Your legacy is the freedom you give to others — freedom from confusion, from financial burden, and from uncertainty. And when you plan it well, you honor the promise of 1776 in your own family constitution.

——————Additional Reading ——————

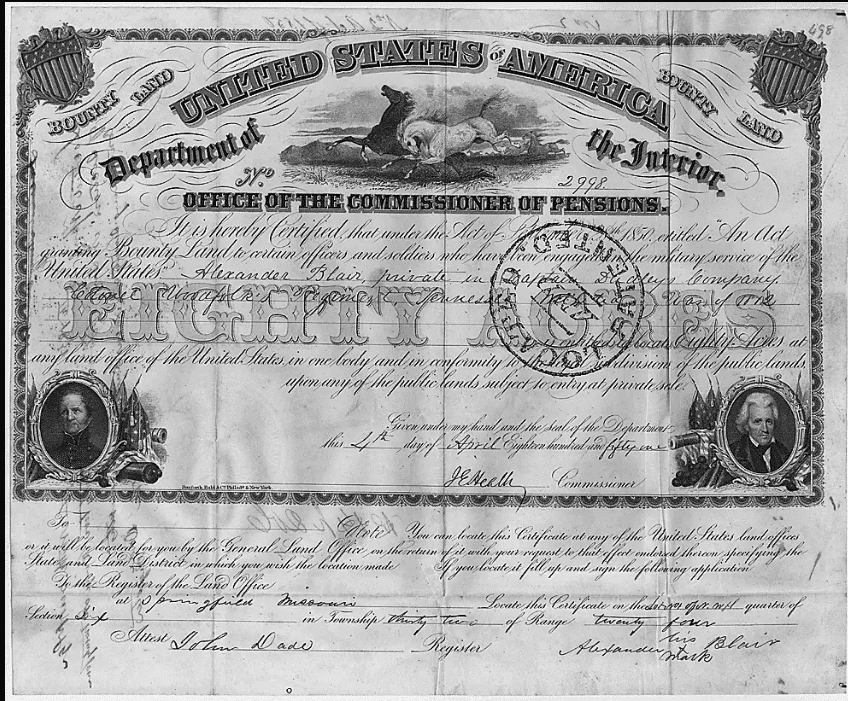

About the land, the largest family asset

You should know that land granted and purchased by the King of England prior to the formation of the United States in 1776 was never actually owned by individuals. It was granted for use and passing along to heirs, but still belonged to the King. The following is one of the first deeds after the war, granting full ownership.

Although this 19th-century U.S. Bounty Land Warrant resembles a modern deed, it was legally and philosophically different from colonial-era grants. Before the Revolution, all land in the American colonies was technically held “in tenure” from the Crown—meaning the land was not owned outright but enjoyed at the pleasure of the King. Title could be revoked or reassigned by royal authority, and colonists were obligated to pay quitrents acknowledging the monarch’s ownership.

By contrast, this U.S. bounty-land certificate symbolized the new nation’s promise of fee-simple ownership—the highest form of private property in American law. Once exchanged for a patent on specific land, the recipient and his heirs held permanent title in perpetuity, free from royal claim or revocation.

Under the Crown, a colonist held land at the King’s pleasure; under the United States, a citizen owned land by right.

FAQ

1. What is legacy planning for retirees?

Legacy planning for retirees combines financial, legal, and ethical steps—like wills, trusts, and family mission statements—to preserve both assets and values for future generations.

2. How does the U.S. Constitution relate to modern estate planning?

The Constitution institutionalized private property rights and succession laws, ensuring citizens—not monarchs—could own and pass assets. Every modern trust echoes that same legal protection.

3. What is the Great Wealth Transfer and why does it matter?

Between 2025 and 2045, more than $84 trillion will move from Boomers to younger generations. Proper estate planning ensures this massive shift builds family stability instead of disputes.

4. How can I pass on values, not just valuables?

Attach a Letter of Intent or Family Mission Statement to your estate documents. Share stories, principles, and expectations so your heirs understand the meaning behind their inheritance.

5. What professional help should I seek?

Work with an estate attorney for legal documents, a certified financial planner for asset management, and a tax advisor for gift and inheritance strategies. Review plans every 2–3 years.

6. Are charitable gifts an important part of legacy planning?

Yes. Philanthropy extends your impact beyond family and mirrors the Founders’ vision of public service. Consider donor-advised funds or charitable remainder trusts.

7. How do I start my own “Declaration of Legacy”?

Begin with a statement of principles, list beneficiaries and causes, and include legal tools like a revocable living trust. Review it regularly with your family and advisor.

8. Can digital assets be included in my legacy plan?

Absolutely. Include online accounts, domain names, and digital photos in a password-protected inventory or digital executor clause within your trust documents.

9. How does real estate fit into legacy planning?

Real estate is often a family’s largest asset. Use a trust or LLC to transfer property efficiently and avoid probate while protecting from liability and tax burden.

10. How does planning honor the Founders’ legacy?

By creating clarity and continuity for your family, you practice the same principles that built the nation — foresight, responsibility, and faith in posterity.

🇺🇸 Explore More in Our 250th Anniversary Series

This article is part of our ongoing RetireCoast historical series celebrating America’s 250th Anniversary. Visit the full hub page to explore more stories, research, and perspectives from 1776 to today.

🔗 Visit the 250th Anniversary HubDiscover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.