Last updated on January 15th, 2026 at 06:26 pm

Several years ago, I wrote an answer to a question on Quora.com, “What happens when you finish paying off your house?” Little did I know that this question would grow in popularity and be one of my most-read responses. It’s time to let you know more about what happened to me when I paid off my house. I hope you can gain some insight from my experiences.

My wife and I had decided to buy a new house that was closer to my office. We lived in southern California and my commute was horrendous. Not many miles but lots of time both ways.

We had planned to get a mortgage as it’s almost always been my philosophy that I wanted to gain the most from my money. Putting the minimum down and financing freed up valuable capital that I could use in my full-time business or buy properties.

- We found a new house to buy

- There is no such thing as no house payment

- Let me tell you what I did several years later.

- I signed up for a mortgage on my paid-off house

- My plan was to obtain a real estate license

- The first investment acquisition with the mortgage loan money

- Real Estate Transaction Overview

- 🏠 What Happened After We Sold Our Home and Paid Off Debt

- Obtaining a first mortgage on a house without a mortgage is called “a refinance”, why?

- I borrowed from one house and bought two more

- $182,000 profit on $107,000 invested.

- Some people, after paying off their house, borrow against it in the future

- Risk

- Protect your assets

- Frequently Asked Questions: What Happens When You Pay Off Your House

We found a new house to buy

We found a new house that the builder had just reduced significantly, it was already built and they had trouble at that time selling them. After signing a contract we proceeded to get a mortgage loan. My credit was great, in the low 700’s. I had just sold my company to a large corporation and continued to manage it for them.

During the process, they were supposed to make some payments on credit cards that were in my name. They failed to do that and they showed up during the process as being greater than 30 days late.

“The ache for home lives in all of us, the safe place where we can go as we are and not be questioned.”

Maya Angelou

The loan fell through and I was faced with losing the house (they had a backup offer) or paying cash for it. The last thing I wanted to do was to use my extra funds and tie them up in a home loan. Well, you know what happened, I closed after paying cash.

Ok, it was nice not having to send a monthly payment and pay mortgage interest. I just put the monthly payment money back into my investment account. For the next three years, I left the situation as it was, zero loan balance. Was it nice not to have a mortgage?

I have to say that it was interesting. Since I would have invested the money and therefore would have had it to pay off the loan should I wanted in the future, it was just interesting.

There is no such thing as no house payment

Incidentally, there is no such thing as no house payment. When you pay off your house, consider taxes and insurance. If you do not set up your own escrow account for homeowners insurance and property taxes, you will have to dig deep to make those annual or semi-annual payments.

When I was in California without a house payment, I was paying about $3,500 twice per year for property taxes plus over $1,000 per year for insurance.

Of course, property taxes in CA go up each year so you need to save every month from your income to cover these costs. My costs came to about $650 per month, a sizable amount. Granted, with no P&I payment.

If you pay off your house, you lose the interest deduction on your taxes but the standard deduction more than doubled in 2018 so that helps offset. The last thing you want is a mortgage just to get a small tax deduction.

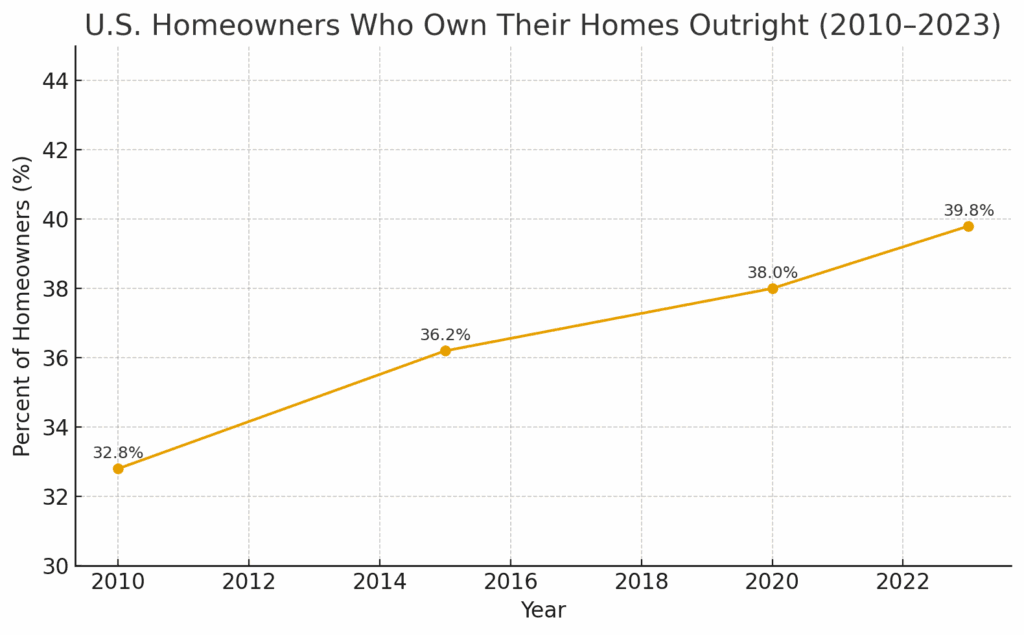

As of 2023, approximately 39.8% of U.S. homeowners own their homes outright—up from approximately 32.8% in 2010. This change is largely attributed to older homeowners, especially baby-boomers, having had more time to pay off their mortgages.

I never had the “final mortgage payment” experience that some have indicated because I paid cash for my new house upfront.

Now that you’ve freed up your monthly mortgage payment, this is a powerful opportunity. Consider redirecting that money into fully funding tax-advantaged retirement plans such as a 401(k), Traditional or Roth IRA, and HSA. This shift can accelerate wealth building and help secure your long-term retirement.

Learn how tax-advantaged accounts work →Let me tell you what I did several years later.

I had worked on my retirement plan and we had decided to relocate from California to a place where it was very affordable to live. A place where we could have the lifestyle we wanted. Yes, we could have afforded to retire in California but why spend three times more on property tax, four times more on fuel, etc? I think you get the point, we wanted to be comfortable and live somewhere with the amenities we desired.

So, a few years after we purchased our house without a mortgage, we decided to buy a house on the beach in Mississippi. I have written a whole account of how that happened you can read about it here.

We decided to buy the retirement house using my veterans benefit so zero down. The builder covered closing costs so zero out of our pocket. Our interest payment was very reasonable around 3.5%.

We were able to buy our retirement house in Mississippi while still living in Southern California. Remember, I had no mortgage so financing was easy. We would move several years later but wanted to get this initial task out of the way.

I signed up for a mortgage on my paid-off house

After we closed on the house in Mississippi, I incurred mortgage debt by financing my principal residence which as mentioned above, I had no mortgage loan on. The mortgage lender was charging about 3.5% also and for the first time on this house, I had monthly mortgage payments. Keep up with me now.

I gain a loan effectively for as little as 3.5%. Initially, I put the funds into real estate investment trusts averaging around 9-12% dividends. My investment style was not to get ahead of myself and commit to buying a property before I had the funds. Cash is king and a great tool for leveraging a purchase.

We moved to Mississippi and I became a real estate agent. I had wanted to become a real estate agent for many years. I had been a real estate investor on the side of my full-time business for many years. One of the first things that I confirmed is that there is no national housing market. Forget what you hear unless the information comes from a local source where the property is located. Check out this article.

My plan was to obtain a real estate license

After receiving my real estate license it was time to look for bargains. I had also decided to bring a few close friends in on my good fortune so we formed several limited liability companies for our investments. My job was to find, acquire, and manage them. With the financial stability of several individuals with credit scores in the mid 700’s it was time to find something.

We had decided to make a down payment of as much as 20% and work with a single mortgage broker who would manage our loans. Our plans were set on a five-year basis and we agreed to buy only income properties that would generate income in excess of the average stock market returns.

The first property I found was a beautiful house built in 1910 with a view of the beach. The house was fully stocked with furnishings and furniture. The owners had used the home as a vacation home after years of remodeling. I made an offer contingent on leaving everything in the house as it was. They accepted but wanted the dining room table. That was a good idea because we needed a table that would hold up better.

The first investment acquisition with the mortgage loan money

As the house was already set up, we decided to make it a vacation rental. It was listed on the main sites, and within two days of closing, it had its first guest. I will get into the deal, but first, you should understand that this house is a three-minute walk to the beach.

People could sit on the porch in rocking chairs and see the water and sand. The property taxes were very low relative to any place I had ever purchased in the past.

The property was about 3/4 acre with a giant yard and RV plugins. Perfect for large parties. And guests had many large parties and weddings at the house. It was sold just short of five years after the purchase. Here are the details:

Real Estate Transaction Overview

- Purchase Price: $215,000

- Down Payment: 20%×$215,000=$43,000

- Closing Costs: $6,000

- Seller Credit: $5,000

Initial Investment: $43,000+$6,000−5,000=$44,000

- Selling Price: $330,000

- Mortgage Payoff: $158,048

- Real Estate Commissions: $19,800

Net Profit Calculation:

Net Profit=Selling Price−(Mortgage Payoff+Real Estate Commissions)Net Profit=Selling Price−(Mortgage Payoff+Real Estate Commissions)

$330,000−($158,048+$19,800)=$152,152

Return on Investment (ROI):

ROI ≈ 345.8%

A nice return for a few years. I almost forgot the $50,000 rental income for each of several years, which brought down the mortgage balance, paid the bills, and generated a nice income. We exceeded our initial goal. Just on this deal, with the lower interest rate on my home, I covered two years of mortgage payments.

Our calculator hub located here contains several investment calculators you may want to use

🏠 What Happened After We Sold Our Home and Paid Off Debt

After we moved to Mississippi, we sold our original home in California. You may recall that I had borrowed against that home—based on our estimated equity—to fund real estate acquisitions. As it turned out, we sold the house for more than expected, which gave us even more capital to work with.

You may be wondering what I did with the remaining proceeds. Those funds were used to purchase several additional properties, most of them financed. One property, however, was purchased entirely in cash.

Before you assume this was a step backward, hear me out. This was a unique opportunity—a house that needed only modest improvements. A friend needed liquidity quickly, and we were able to close the deal in just two days.

I invested an additional $25,000 to modernize the home and fully furnish it as a vacation rental near the beach. In its first full year, the property generated $48,000 in rental income.

With that income documented, I then approached my mortgage servicer and discussed placing a first mortgage on the property—turning an all-cash purchase into a leveraged, income-producing asset.

Obtaining a first mortgage on a house without a mortgage is called “a refinance”, why?

For some reason, they call it a refinance, but since there was no mortgage, I call it a first mortgage. Before I did anything, I listed the house on the MLS for $189,000. I will go into the details below. I took down the listing after three days.

Now, I have two things going for me. A former listing at $189,000 and significant income on the books. I found a house down the street near the beach for sale. The owner had received free money from the government 10 years prior to providing housing for low-income people after Katrina. When the house was 10 years old, it was his free and clear. As soon as I saw the listing, I knew it was a great deal.

I made a full-price offer and found the house next door, the same size but with a different floor plan, was also for sale. I made an offer on that one, too. My mortgage broker gave me a new 30-year mortgage on the original house when the appraisal came in at $189,000. I got a new mortgage on each of the two houses, putting 20% down, and all three were financed as business loans, not personal loans.

I borrowed from one house and bought two more

The loan servicer moved the money around using the loan to make the down payments and closing costs for all three. I received a big check for the balance, which I used to repaint and do minor remodeling to the two houses, including setting them up as vacation rentals with furniture and furnishings.

They started renting as soon as the deal was closed. The cash flow for all three was very good, enough to pay the bills and leave extra income, which I retained in the business accounts.

The interest rate at the time was a higher interest rate at 4.75% (compared to rates today, that’s great). Regardless, the analysis that I ran on each property indicated that they would generate a net profit plus an increase in value. The loan term on each loan was 30 years. Because they all met my financial goals, I did not need extra cash to keep them going in the slow winter months.

$182,000 profit on $107,000 invested.

I was going to show the math for the three-house deal and realized it was a bit complex, so this is the upshot. I purchased all three for $341,000. They are worth $630,000. My original cash investment was $82,000 for the original house and another $25,000 for rehab costs. $107,000 invested.

About $182k return on $107k invested. All of this came from my home loan plus more, considering the excess cash I took away and invested in another project.

My financial advice to anyone who asks is that your situation is not the same as mine. Do what is best for you. Make financial decisions about your primary residence based on what makes you comfortable if you want to see that last payment, paying off your house may be the best thing for you.

Before you do, consider that if you find you do not have the ability to leave that money in your house and you are tempted to borrow later, there will be costs. A mortgage company would be happy to give you a new first mortgage with interest costs.

Some people, after paying off their house, borrow against it in the future

Lots of people pay off their home and get a mortgage a few years later for a variety of reasons, but most often it’s to buy something or expend that lump sum payout. Investing the money is one thing, a good thing because the income generated will help pay the bills.

If you are considering paying off yourhouse today just to borrow against it in five years, that may not make sense. No one knows what interest rates will be. This is particularly true for those of you who have very low interest rates now.

Again, your financial situation will dictate where you are and if it makes sense to pay off your mortgage. Perhaps feeling good is a reason to do it, as some have commented on my Quora article. If that is what you need to manage your financial affairs, go for it. Don’t forget to factor in the opportunity cost of money. Check with a financial advisor before you make a move. Read more articles from actual financial experts.

Many people think that paying off their home mortgage is a lifelong dream. It is for some people. Everyone knows of someone who bought a home 30 years ago, never refinanced it, and then one day it was paid off.

Case Study: When Paying Off the Mortgage Isn’t the Best Move

Sarah and Bobby grew up believing that the ultimate financial goal was to get a 30-year mortgage and pay it off as quickly as possible. When Sarah received a very large bonus from her tech company after it went public, they suddenly had enough cash to pay off their mortgage in full.

They first used the money to pay off all of their smaller debts and then wrote a final check to eliminate the mortgage. Friends and relatives encouraged this move and praised them for being “debt free.” Sarah and Bobby felt proud and relieved, but they never stopped to seriously consider alternative uses for that money.

At the time, their mortgage rate was 4.5%. Instead of paying off the loan, they could have invested the funds in a diversified mix of equities and real estate with a reasonable expectation of earning 7% or more over the long term. They did not run the numbers or look at the decision from a rational financial perspective; they simply followed the familiar advice that “you should pay off your mortgage as soon as you can.”

Five years later, life changed. Bobby lost his job, and Sarah’s company was sold. The new owners downsized, and she was laid off as well. With both of their incomes gone, their savings account started shrinking quickly.

Their home was paid off, but most of their former bonus was now “locked” in home equity. Their only practical option was to take out a new mortgage—this time at 7% plus closing and financing costs. They had gone from a comfortable position with a low-rate mortgage and a large cash cushion to a stressful situation with a higher-rate mortgage and very little liquidity.

Had Sarah and Bobby invested the money instead of paying off the mortgage, the portfolio could have helped cover their existing 4.5% mortgage payments and still provided extra funds to live on during their employment gap. In other words, being “debt free” came at the cost of flexibility and long-term financial resilience.

Key Lessons from Sarah & Bobby’s Story

- Paying off a low-interest mortgage can reduce flexibility if it drains your cash reserves.

- Big financial decisions should consider expected investment returns, not just emotions or social pressure.

- Liquidity matters. Having access to cash or investments can be critical if income drops unexpectedly.

- “Debt free” is not always the same as “financially secure.”

Risk

It would be irresponsible of me not to mention the risks involved in any decision you make. The items listed below are the pros and cons for your review. These items are non-emotional items. They do not take into consideration the psychological benefits and reduced stress of being mortgage-free.

Case Study: Choosing Certainty Over Leverage

Cathy and Nathan faced a difficult decision after Nathan received an inheritance from his parents. The amount was large enough to either pay off their mortgage entirely or be invested for long-term growth. Rather than rushing into a decision, they sat down together and carefully ran the numbers.

Their mortgage carried a relatively high interest rate of 7.5%. Based on historical market performance and their own risk tolerance, they estimated they could earn approximately 7% by investing the funds in a diversified equities portfolio.

On the surface, the decision appeared to be a near breakeven. However, as they dug deeper, they realized an important distinction: when you pay a mortgage, the principal portion of the payment is essentially money you are paying back to yourself, while the interest portion is the true cost of borrowing. Regardless of whether the mortgage existed, they would still need to pay property taxes and insurance.

When they isolated the interest cost of the mortgage and compared it to their expected investment return, the numbers leaned slightly toward paying off the loan. More importantly, eliminating a large monthly mortgage payment would significantly reduce their fixed expenses and improve their monthly cash flow.

Cathy and Nathan also fully understood the tradeoff they were making. If they ever found themselves in a situation where they needed access to cash, they could refinance the home or tap into home equity. That option remained available, even though they hoped they would never need it.

In the end, two factors became the tie breakers. First was the breakeven analysis, which showed little advantage to investing at a return lower than their mortgage rate. Second was peace of mind. Knowing they no longer carried a high-interest mortgage and had dramatically reduced their monthly obligations allowed them to sleep better at night.

Key Takeaways from Cathy & Nathan’s Decision

- When mortgage rates are high, paying off the loan can outperform modest investment returns.

- Breakeven analysis helps remove emotion from large financial decisions.

- Principal payments build equity, but interest represents the true cost of debt.

- Reducing fixed monthly expenses can provide peace of mind and financial stability.

- Paying off a mortgage does not eliminate future access to liquidity through refinancing.

Pros of Paying Off Your Mortgage

- Financial Freedom:

- Eliminates a major recurring expense.

- Frees up monthly cash flow for other investments or needs.

- Risk: Liquidity Risk – Tying up cash in a house makes it unavailable for emergencies or other opportunities.

- Interest Savings:

- Saves money on interest over the life of the loan.

- Risk: Opportunity Cost – You might miss higher returns from investments elsewhere.

- Peace of Mind:

- Reduces financial stress and provides a sense of security.

- Risk: Overcommitment – Paying off the mortgage could strain your finances if done too quickly or without proper planning.

- Improved Cash Flow in Retirement:

- Reduces expenses during retirement when income is often fixed or limited.

- Risk: Inflation Impact – You may lose the ability to grow wealth against inflation by prioritizing paying off a low-interest mortgage.

- Asset Ownership:

- Gives you full ownership of your home, increasing net worth.

- Risk: Asset Concentration – Most of your wealth could be tied up in one asset, limiting diversification.

Cons of Paying Off Your Mortgage

- Reduced Liquidity:

- Home equity is not easily accessible without selling or refinancing.

- Risk: Emergency Risk – This could create financial strain if unexpected expenses arise.

- Opportunity Cost:

- Extra funds could be invested in higher-yield opportunities (e.g., stocks, bonds).

- Risk: Lost Growth Potential – You could miss out on better long-term gains.

- Tax Implications:

- Mortgage interest deductions reduce taxable income if you itemize deductions.

- Risk: Higher Taxes – Paying off the mortgage may increase your taxable income.

- Low Borrowing Costs:

- Mortgages often have low interest rates compared to potential investment returns.

- Risk: Underperformance – Your investments might not outperform your mortgage interest rate.

- Inflation Hedge:

- Mortgage payments become less burdensome over time as inflation increases your income (if not retired).

- Risk: Missed Inflation Benefit – You might pay off cheap debt in today’s dollars that could feel cheaper over time.

Risks of Paying Off Your Mortgage Early

- Cash Flow Tightening:

- If you divert too much to pay off the mortgage, you might lack funds for emergencies or lifestyle needs.

- Loss of Financial Flexibility:

- Paying off the mortgage is irreversible unless you take a home equity loan or refinance.

- Market Opportunity Costs:

- Missing out on potentially higher returns in the stock market or other investments.

Risks of Not Paying Off Your Mortgage Early

- Long-term Interest Costs:

- You may end up paying significant interest over the life of the loan.

- Economic Downturns:

- If your income decreases, the mortgage payment could become a burden.

- Uncertainty in Retirement:

- Fixed mortgage payments in retirement can strain a limited income.

📊 Tools to Help You Decide — Now and in the Future

Deciding whether to pay off a mortgage or invest excess funds is not a one-time calculation. Market conditions change, interest rates shift, and personal circumstances evolve. These calculators can help you analyze today’s decision and revisit it confidently in the future.

Full Mortgage Calculator

See a complete picture of payments, interest, and loan costs over the life of your mortgage.

Mortgage Payoff Calculator

Compare early payoff options, interest savings, and the timeline to becoming mortgage-free.

Home Maintenance Budget Calculator

Plan for ongoing costs that remain even after a mortgage is paid off, including repairs and replacements.

🔍 Tip: Revisit these calculators anytime your income, interest rates, or long-term goals change.

Final Considerations

The decision depends on:

- Your current financial health.

- Your risk tolerance.

- The interest rate on your mortgage compared to potential investment returns.

- Your long-term goals, such as retirement, liquidity needs, or investment strategy.

Protect your assets

Should you decide to pay off your home, take some steps to protect your home from others who may want what you have. Should you be sued, the plaintiff can ask for your house to pay judgments. As you would have no mortgage, it’s an easy choice.

Create a revocable living trust. With the trust in place, create a mortgage where you owe the trust, for example, 80% or more of the market value. File the mortgage with the county. This way, if you are sued in court, your paid-off house is tied up, and a judge cannot make the trust sell it.

Read this article on this site for more information about protecting your assets.

I am not a professional financial advisor. The purpose of this article is to expose you, the reader, to what can be done with money that would otherwise pay off a home mortgage. Do not take this as financial advice without checking with a professional and reading more articles.

Frequently Asked Questions: What Happens When You Pay Off Your House

1. What actually happens when you pay off your house?

When you make your final mortgage payment (or if you buy a home with cash), your lender no longer has a claim on the property. The loan is marked as paid in full, the lien is released, and you (or your trust/LLC, if you use one) own the home outright. You’ll still have ongoing costs like property taxes, insurance, and maintenance.

2. Do I still have a “house payment” after the mortgage is gone?

Yes, in a way. There is no principal and interest payment, but you’ll still pay:

- Property taxes (often due once or twice per year)

- Homeowners insurance (usually annual)

- Any HOA or condo fees

- Repairs and long-term maintenance costs

Many homeowners create their own “escrow” savings account so they set money aside monthly for these expenses.

3. What happens to my escrow account when I pay off my mortgage?

If your lender has been collecting money for taxes and insurance in an escrow account, they will usually:

- Pay any outstanding tax or insurance bills that are already scheduled, then

- Refund the remaining balance to you within a set period (often 30–45 days).

After that, you are responsible for paying taxes and insurance directly.

4. Does paying off my mortgage affect my taxes?

Yes. Without a mortgage, you no longer have mortgage interest to deduct. However, many homeowners now use the higher standard deduction instead of itemizing, so the lost deduction may not have a big impact. You will still pay property taxes, and local rules vary. Always check with a tax professional for your specific situation.

5. Does my credit score go up or down after I pay off my house?

Paying off a mortgage is usually positive, but it can have a mixed effect:

- It removes a large installment loan, which may slightly change your credit mix.

- It shows a strong history of on-time payments, which is good.

In most cases, any small dip is temporary. Over time, being debt-free on a major loan is a positive factor.

6. Is it always a good idea to pay off your mortgage early?

Not always. It depends on:

- Your interest rate and remaining loan term

- Your other debts (especially high-interest credit cards)

- Your retirement savings and emergency fund

- Your comfort level with risk and leverage

Some people prefer the peace of mind of being mortgage-free, while others keep a low-rate loan and invest extra cash elsewhere.

7. Can I borrow against my home again after it’s paid off?

Yes. Many homeowners later:

- Take out a new first mortgage

- Use a home equity loan

- Open a home equity line of credit (HELOC)

These can provide funds for investing, renovations, or other goals—but they come with closing costs and interest, so you’re no longer “mortgage-free.”

8. What are the biggest risks of paying off my house?

The main risks are:

- Liquidity Risk: A lot of your money is tied up in the house and not easily accessible.

- Opportunity Cost: You might miss higher returns from other investments.

- Asset Concentration: Too much of your net worth may be in one property.

These may or may not matter, depending on your income, savings, and overall plan.

9. Should I use home equity to invest, like in rental properties or REITs?

Some homeowners successfully borrow at a low rate and invest in:

- Rental properties or vacation rentals

- Real estate investment trusts (REITs)

- Other income-producing assets

This can work well if you understand the risks, run the numbers carefully, and can handle vacancies, market swings, and extra debt. It’s not a one-size-fits-all strategy, so speak with a financial advisor before you leverage your home.

10. How can I protect my paid-off home from lawsuits or claims?

Once your mortgage is gone, your equity can become an attractive target in a lawsuit. Some people use tools such as:

- A revocable living trust to hold title

- Proper liability insurance and umbrella coverage

- In some cases, an internal mortgage or other planning strategies with professional advice

Laws are very state-specific, so always consult an attorney or estate-planning professional before making changes to title or liens on your home.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.