Last updated on December 8th, 2025 at 11:58 am

Have you ever dreamed of owning your own small farm? How about a farm after retirement? I have (not after retirement but as a child), I carved out a patch of soil in my parents’ yard and planted vegetables. Every day, I tended to that little garden. It gave me a sense of purpose, of building something with my own hands. That small effort planted the seed for something much bigger.

Many people retire from a long career—some fulfilled, while others are not. But what’s often missing after that final paycheck isn’t money—it’s meaning. A sense of ownership. Of creating something lasting. Something that could serve your needs now and possibly those of future generations.

Starting a farm after retirement may be just what you need to satisfy your desire to be useful, creative, and productive again. There’s no need to consider a sprawling operation with major labor demands.

A small-scale family farm on just five to twenty acres might be enough to create a satisfying new chapter in your retirement years—whether as a personal retreat, a family business, or a source of additional income.

Small farms can generate income streams

In this article, we’ll explore how small farms can offer income streams, community connection, and even a form of succession planning. We’ll outline real examples of retirement farm models, from hobby farms to market gardens, and show you how to turn your next step into a lifestyle—and possibly even a farm business.

Along the way, we’ll share insights about financial planning, social security benefits, off-farm income, and how to pass your new venture on to the younger generation.

I always wanted a tractor

Before we move on, I must tell you that when I acquired my house on 2 acres on the Mississippi Gulf Coast, I bought a hybrid tractor to mow the lawn and tow my trailer around. I always wanted a tractor, and while this was not a John Deere, it has been fun to use.

While I have not planted crops, I have planted many fruit trees and landscaped the property. The tractor has come in handy. If you are one of those people who, as a kid, always wanted a tractor, start your small farm and buy one.

💡 This article is part of our “Starting a Business After Retirement” series. For more ideas, check out How to Build a Website for Your Retirement Business.

A Personal Legacy Rooted in the Land

My mother’s family was a farming family in Illinois, beginning in the early 1800s after arriving from Germany and Ireland. My father’s ancestors were already tilling the soil in Pennsylvania in the early 1700s. Farming wasn’t just a profession—it was a way of life for farm families across America.

And in 1776, the year of our nation’s independence, most people in the United States were engaged in agricultural activities of one kind or another.

🇺🇸 This article also ties into our 250th Anniversary of the Declaration of Independence series. Farming, after all, was the original American business system.

Whether it’s the older generation passing land to next generation farmers or a retiree choosing open spaces over spreadsheets, there’s something profoundly American about returning to the land. Maybe your ancestors were farmers, too—and maybe now, they’re encouraging you to revive that legacy.

Why So Many Retirees Are Returning to the Land

Over the past decade, a quiet shift has been taking place across rural areas in the United States. While much attention is paid to younger farm operators, it’s the older generation—many of them newly retired—who are breathing life into small farms and farm households once again.

✅ Reclaiming Purpose After a Career

A lot of times, people retire with a solid nest egg but a nagging question: What now? For some, travel or golf satisfies that curiosity. But for others, the answer lies in farm work—in planting, building, harvesting, and seeing the fruits of their labor.

This return to the land offers a kind of social interaction, creativity, and accomplishment that a financial planner can’t measure on a spreadsheet.

Many retirees say their decision to farm is driven by health reasons—both mental and physical. Working outdoors, even on small plots, provides structure, physical movement, and connection to nature. The physical demands may be real, but so are the rewards. Farming in retirement is less about yield per acre and more about quality of life.

🧠 Medical and Psychological Benefits of Farming for Retirees

Scientific research backs up what many farm families have experienced firsthand for generations: working the land is good for your health. I wrote a blog article, “Landscaping is a Great Cathartic Experience.“ explaining how just simple landscaping, working with the land, helps me decompress. I can only imagine what it would be like to have a farm.

✅ Physical Health Benefits

- Increased mobility and flexibility: Light agricultural activities like weeding, planting, and feeding animals keep joints moving and improve circulation.

- Cardiovascular health: Routine chores like raking, digging, and hauling provide low-impact aerobic exercise that’s recommended for older adults.

- Sunlight exposure: Moderate time in the sun increases Vitamin D, which is crucial for bone health and immune function in older adults.

✅ Mental & Emotional Health Benefits

- Reduced anxiety and depression: Studies show that “green care” activities, such as gardening and farming, lower cortisol levels and promote emotional regulation.

- Cognitive stimulation: Managing a farm business after retirement, even on a small scale, keeps the mind sharp by requiring problem-solving, planning, and new learning.

- Improved sleep and mood: Physical exertion paired with time in nature is a proven combination for better rest and improved outlook.

🧠 A 2019 review published in the journal International Journal of Environmental Research and Public Health found that older adults who engage in gardening and farming showed improved quality of life, physical activity levels, and mental health outcomes. [Source: NCBI Study on Gardening Benefits for Older Adults]

🏡 A Different Kind of Retirement Planning

Retirement used to mean withdrawing completely from work. Now, for a growing number of people, it means transitioning into something new—like managing your own operation on a few acres. Some are turning their current home into a family farm, while others are buying affordable land as a new investment aligned with their financial goals.

The rise in land values in some areas has made full-scale agricultural production harder for young entrants, but retirees—many with farm assets or income from mutual funds, social security income, or individual retirement accounts—can start small and scale slowly. In some cases, the farm even becomes a source of monthly income to supplement social security benefits.

🤝 Returning to Our Roots, Together

The move to the land is not always a solo endeavor. Many family members join in—children and grandchildren helping on weekends or holidays. Some retirees work alongside next-generation farmers, offering their time and knowledge in a collaborative effort to build a family business that will support future generations.

📊 According to the U.S. Department of Agriculture, the average age of American farmers is now over 57, and many new farm businesses are started by people in their 60s or older.

This renewed interest in farming reflects more than a lifestyle trend—it’s a business decision for some and a legacy project for others. In either case, it’s a chance to reimagine what retirement looks like—and to turn hard-earned experience into a new kind of wealth.

Business, Lifestyle, or Legacy? Choosing Your Farming Path

Not all retirees return to farming for the same reason. For some, it’s a passion project. For others, it’s a calculated business decision. And for many, it’s about leaving something meaningful for the next generation. Understanding your motivation will shape everything—from the land you buy to the tools you use, and how you plan for your farm’s future.

Let’s break it down into three distinct paths—though they often overlap.

✅ 1. The Lifestyle Farm: A Personal Way of Life

Many older farmers are not looking to turn a profit—they’re looking to turn the soil. The lifestyle farmer is focused on health, joy, and reconnection with nature. For them, small-scale farming is a daily rhythm, not a spreadsheet line item.

- Grow vegetables and herbs for personal use

- Raise chickens for fresh eggs or goats for milk

- Enjoy the physical demands and structure that farm life brings

- Invite family members to participate in seasonal chores or harvest celebrations

While this model may not generate retirement income, it offers social interaction, improved health, and a powerful sense of purpose—often missing in traditional retirement.

✅ 2. The Business Farm: Building Income from the Land

If you’re interested in turning your land into a working farm business, your model might resemble a sole proprietorship or family business. This could mean selling at farmers markets, offering off-farm income through tours or workshops, or even creating value-added products like jams, baked goods, or crafts.

I live in a community on the Mississippi Gulf Coast, and most of the small towns along the coast have a farmers market every Saturday. These markets are flooded with shoppers looking for homegrown fruits and vegetables, and many of the vendors are retirees just like you—business owners who’ve transformed small farms after retirement into steady income streams.

Some of the sellers I see each weekend make jam, honey, and baked goods using the produce from their own land. Depending on the time of year, everything is fresh-picked, and the demand only seems to grow. Every year that I’ve lived here, I’ve noticed how these small businesses are thriving. Many have become staples of their local communities, adding charm, flavor, and economic resilience to our region.

Business-minded retirees in this space should consider:

- Local regulations, business licenses, and zoning

- Whether the farm qualifies for tax deductions or a conservation easement

- Managing farm equipment, input costs, and monthly income

- Local marketing, especially through social media and community events

If structured properly, your farm could help offset living costs, cover property taxes, or supplement your social security benefits.

🔍 Talk to a trusted financial planner or investment firm to align your farm with your broader financial considerations, and explore whether your farm expenses could be tax deductible.

✅ 3. The Legacy Farm: Preparing for Succession

Farming may begin as a personal venture, but for some retirees, it becomes a family business with long-term potential. If you’re hoping your farm continues into the next generation, early succession planning is essential.

Questions to consider:

- Will young people in your family continue the farm?

- Are they involved now, or will you need to transition slowly?

- Have you considered the legal advice needed to transfer land or farm assets?

- Does your life insurance policy support this vision?

- Is there a plan in place to ensure a successful transition?

This kind of farm succession often requires creating a formal plan—one that protects both the retiring farmer and the incoming farm operators. Many universities, such as Rutgers University, offer tools and templates to help guide these complex discussions.

👉 Rutgers Farm Succession Planning Resource

💬 Which One Are You?

While these categories offer a helpful framework, many retirees find themselves blending them over time—starting with a lifestyle focus, expanding into income generation, and eventually thinking about legacy and land values.

Each path has its own time requirements, financial goals, and emotional rewards. The best way forward is the one that matches your current health, financial resources, and long-term vision.

Next up:

We’ll walk through two real-world models—a 5-acre lifestyle farm and a 20-acre family farm—showing how each supports different levels of involvement and ambition.

🏡 Sample Farm Models for Retirement

The 5-Acre Lifestyle Farm

When I’m not writing articles like this, I work as a real estate broker. A couple of my clients recently approached me with a question that caught my attention: “Could I buy a small farm and create something of my own after retirement?” That simple question planted the seed for this article.

The first thing I did was dive into the listings. I researched what was available near the Gulf Coast, how close it was to shopping, and how rural the setting really was. What I discovered surprised even me. Within just 10 miles of the beach—still close enough to get groceries or see a doctor—I found wonderful parcels in areas that felt like true “country.”

We’re talking rural roads bordered by open spaces, but with full utilities, internet access, and in many cases, cable TV. The most common lot size in these areas? Five acres.

Some properties already had houses. A few came with barns or sheds. And one or two were functioning small farms, complete with fenced areas, small farm equipment, and fruit trees. Larger properties—up to 20 acres—sometimes featured a pond, creek, or even a bayou along the edge, which adds both serenity and land value.

A friend of mine knows someone just 15 miles from my home who owns a 300-acre ranch. He raises cattle and does no agricultural production at all. He’s retired, and this is simply what he enjoys doing—it gives him purpose and keeps him physically active. Of course, most of us don’t need hundreds of acres to achieve the same satisfaction.

📏 What Can You Do with 5 Acres?

A 5-acre farm is the ideal starting point for a retiree looking for manageable space that still offers income streams, exercise, and pride of ownership. Here’s how a typical 5-acre plan might be arranged:

| Area | Use | Description |

|---|---|---|

| 1 acre | Vegetable garden & herb beds | Focus on seasonal crops like tomatoes, lettuce, okra, squash, and basil. Rotate crops for soil health. |

| 1 acre | Orchard or fruit trees | Grow citrus, figs, blueberries, or even muscadines depending on your climate and soil. |

| 1 acre | Chickens, bees & small livestock | Coop for 12–15 hens, 2–3 goats for milk or brush control, and a few beehives for honey production. |

| 1 acre | Greenhouse or hoop house | Extend your growing season. You can even use it to start plants for sale at farmers’ markets. |

| 1 acre | Guest cottage or workshop Family Home | Create a place to host family, run a craft business, or generate rent income via short-term stays. |

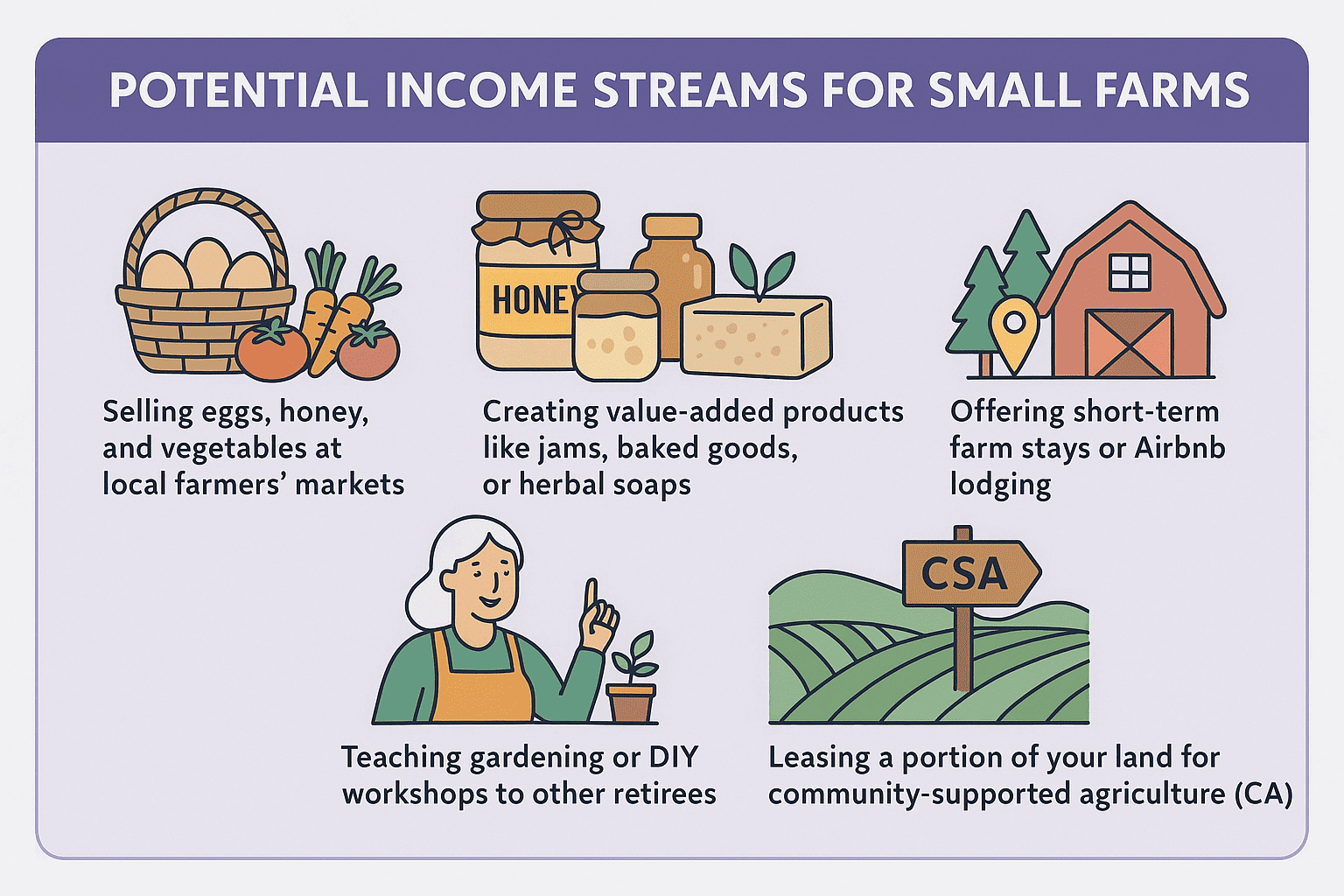

💰 Potential Income Streams

Even if you’re not trying to build a large farm business, your 5-acre property can still support off-farm income or modest sales that help offset property taxes, utilities, or hobby expenses.

Some typical avenues include:

- Selling eggs, honey, and vegetables at local farmers’ markets

- Creating value-added products like jams, baked goods, or herbal soaps

- Offering short-term farm stays or Airbnb lodging

- Teaching gardening or DIY workshops to other retirees

- Leasing a portion of your land for community-supported agriculture (CSA)

Depending on your location, soil quality, time commitment, and marketing, your income could range from a few thousand to $15,000+ per year—enough to supplement your social security benefits or monthly income from individual retirement accounts or mutual funds.

✅ Why It Works for Retirees

- Manageable size for one or two people

- Limited farm equipment needs

- Lower real estate purchase cost

- Easy to fence, irrigate, and maintain

- Proximity to rural communities and farmers’ markets

- Live on the farm, build a custom house, or buy a farm with a house.

🌱 A 5-acre farm offers the best of both worlds: freedom to farm and flexibility to rest.

🌾 The 20-Acre Family Farm: Scaling for Legacy

For retirees with a bit more energy, ambition, or support from family members, a 20-acre farm opens the door to something larger—a working farm that balances lifestyle, income, and legacy. While not everyone will want this level of commitment, it’s a strong option for those looking to create a family business with potential to support future generations.

🧩 What Can You Do with 20 Acres?

A 20-acre property can support more substantial agricultural activities, small-scale livestock, and even succession planning that involves children or grandchildren. If planned well, it can also offer more comfortable accessibility options—like wider lanes, accessible housing, and utility buildings for storage, workshops, or seasonal workers.

Here’s a sample breakdown:

| Area | Use | Description |

|---|---|---|

| 5 acres | Orchard or specialty crops | Fruit trees, nut trees, or crops like lavender, cut flowers, or mushrooms for local restaurants or CSAs. |

| 5 acres | Rotational livestock grazing | Cows, sheep, or goats—ideal for pasture management and supplemental farm income. |

| 3 acres | Event space or educational programs | Set up a covered barn or garden venue for tours, retreats, or weddings. Can also support agritourism. |

| 2 acres | Bee yard, chickens, small livestock | Free-range poultry, bee colonies, and small ruminants provide diversified products. |

| 3 acres | Wooded buffer or conservation | Leave some acreage natural for wildlife habitat or to enroll in a conservation easement program. |

| 2 acres | Housing & infrastructure | Main home, workshop, barn, cold storage, or a small second dwelling for young people or guests. |

💰 Potential for Multi-Stream Income

While a 20-acre farm requires more farm work, it also offers greater income potential—especially if you’re building something to last.

Here are potential income streams:

- Selling farm products directly to customers, stores, or online

- Offering short-term rentals or event hosting (birthdays, weddings, photography)

- Running a farm stand, online CSA, or weekend workshop series

- Leasing land to local beginning farmers or 4-H groups

- Applying for grants and USDA support programs for older farm operators

Depending on the model and marketing, some 20-acre farms can earn $25,000–$50,000 annually in gross revenue, with reinvestment into farm assets, housing, or business systems.

🧬 Building for the Next Generation

A 20-acre farm is ideal for retirees who want to pass on their values, not just their property. Whether your children or grandchildren are interested in farming now—or might be later—you can start by creating a successful transition plan that protects your land and ensures equal access for young people in your family.

This includes:

- Consulting a financial planner and legal advisor about inheritance and structure

- Using life insurance and trusts to cover property taxes or capital gains

- Establishing the farm as a sole proprietorship or LLC to protect farm assets

- Preparing for accessibility issues as you age by building walkable paths, raised beds, and modern facilities

- Enrolling in farm succession or retirement workshops through organizations like Rutgers University or your local cooperative extension

🌳 A 20-acre farm gives you enough land to experiment, scale, and include others—without needing a commercial farming operation.

⚖️ Is 20 Acres Right for You?

Five acres may be enough for a peaceful retirement. But if your goals include providing for future generations, maximizing financial benefits, and handing down a true farm legacy, then 20 acres might be your ideal canvas.

- You’ll need more time, capital, and energy—but the long-term payoff can be profound.

- It’s not just a place to live—it’s a way of life, a business, and a heritage.

🌱 Are You a Future Farmer?

After seeing what can be done with a 5-acre lifestyle farm or a 20-acre legacy farm, you might be wondering: Is this really something I can do—even if I’ve never farmed before?

The answer is: Yes, you can. In fact, many people who start small farms in retirement have no previous experience with agricultural activities. They begin with curiosity, a love of the outdoors, and a willingness to learn. If that sounds like you, you’re already well on your way.

🔍 What Do You Really Need to Know?

You are probably wondering what you need to know about being a farmer, even with just a small five-acre lot. Actually, you can start with no more knowledge than the average consumer. There are solutions for almost everything you need to do, and resources in every local area—from county agricultural extension offices to master gardener programs, online tutorials, and experienced farmers’ market vendors who are happy to share what they’ve learned.

What is the most important thing you need? Desire.

Yes, there are some physical demands, such as planting a tree or digging a trench, but there are also tools and methods to make the work easier. For example, I live in a home on two acres. I wanted to plant fruit trees, so I bought a gas auger. It made short work of drilling holes in the soil. I still use a shovel now and then, but I also use raised beds, cart-based water tanks, and electric fencing—simple tech that helps small farm businesses thrive without breaking your back.

🧭 Start with a Farm Business Plan

Before we dive into the details of land selection, zoning, or equipment, you need to do one essential thing: create a farm business plan.

Even if you don’t plan to turn your farm into a major source of retirement income, planning is crucial. Whether your goal is selling farm products, teaching workshops, or just growing enough produce for your family, having a clear plan will save time, money, and frustration later.

📝 Creating a plan for your farm business after retirement is no different than for any other small business. It defines your goals, evaluates your needs, and gives you a roadmap to move forward.

In the next section, we’ll show you exactly how to begin that process—with sample frameworks, free resources, and key decisions to make early. You’ll also find links to additional resources from Rutgers University, the U.S. Department of Agriculture, and others who support beginning farmers in retirement.

🛠️ Getting Started: What You Need to Know Before You Buy or Build

So, you’ve caught the vision. Maybe it’s the joy of growing your own food, the idea of building a family business, or simply the thought of living a healthier, more engaged life. Before you take the leap, there are a few foundational steps that every aspiring small farm owner—especially retirees—should consider carefully.

🧭 1. Land Selection: Not All Acreage is Equal

Choosing the right real estate for your farm business after retirement is the first major decision—and one that will shape everything that follows.

Here’s what to consider:

🌊 Flooding & Drainage

- Does the land flood during heavy rain or major storms?

- Is it in a FEMA-designated flood zone, and will that impact property taxes or insurance costs?

- Does the land drain well, or are there areas where water collects?

- Where does the drainage go—and is it affecting nearby roads or properties?

🟫 Land Level & Soil Conditions

- Is the land relatively level, or will you need grading?

- Does it hold water or drain too quickly for crops or pasture?

- Has the land been used for farming before? If so, what crops were grown and when?

- Ask the seller or listing agent for soil test results or request your own. Local agricultural extension offices can assist with this.

🏠 House and Outbuildings

- Do you want raw land or something with a house, barn, workshop, or utility buildings already in place?

- Renovating existing structures can be rewarding, but also expensive—have a real estate agent help you assess the value and condition.

🧾 Fees, Taxes & Easements

- Beyond annual property taxes, are there special fees for land use, zoning, or agricultural exemptions?

- Does the land have utility easements—areas where a power company or local government has the right to access or develop infrastructure?

- Are there any private easements? For example, do neighbors have a legal right to cross your land via a shared road or path?

- Ask about land restrictions, zoning overlays, and any conservation easements that may limit building or activity.

💧 Water and Utilities

- Is there access to well water, city water, or irrigation lines?

- Is electricity already on-site? What about internet, septic systems, and trash services?

- Some rural areas may appear remote but have full modern utilities, while others may require off-grid solutions.

🚗 Access & Location

- Is the land accessible by a maintained road? Will you be able to bring in farm equipment, trailers, or visitors?

- Is the property within a reasonable distance of stores, hospitals, or supply vendors? This becomes increasingly important as accessibility issues emerge with age.

📌 Land may look beautiful on a sunny day, but its long-term suitability depends on many invisible factors—always perform due diligence before purchasing.

📝 2. Create Your Farm Business Plan

As discussed earlier, your next step should be drafting a farm business plan. Even if your farm is a lifestyle choice, creating a plan will help with everything from tax deductions to determining your workload and equipment needs.

A solid plan should include:

- Your goals (business income, family use, education, hobby)

- Description of your land and proposed layout

- Anticipated crops or livestock

- Time commitment and labor support (paid or volunteer)

- Budget for farm equipment, structures, fencing, and tools

- Revenue projections (even for break-even hobbies)

- Marketing strategy (if applicable)

💡 Not sure where to start? Check out the USDA’s free Farm Business Planning Tools or Rutgers’ beginner farm worksheets.

Farm Business Plan Template

Down load the Farm Business Plan Template below and start creating your farm business plan.

⚙️ 3. Equipment and Infrastructure Basics

You don’t need a tractor to start a small farm—but you will need some farm equipment, tools, and possibly outbuildings.

Here’s a basic starter kit for most retirees:

- Raised beds, irrigation hoses, and compost bins

- A gas auger or post-hole digger for trees and fencing

- Battery-powered tools (saws, drills, hedge trimmers)

- A small garden shed or converted shipping container for storage

- Optional: greenhouse, hoop house, chicken coop, or goat shelter

You may also want a UTV or ATV for hauling, and don’t overlook insurance coverage—especially if guests or customers will be visiting your land.

💰 4. Financial Planning & Legal Considerations

Even if your farm is primarily a lifestyle decision, there are still financial benefits and responsibilities to consider.

- Will this be a sole proprietorship or a family LLC?

- Are you using any portion of the land as a rental, business, or for generating off-farm income?

- Do you want to protect your land through conservation easements or plan for farm succession?

- Will you be investing in improvements that could be tax-deductible?

Talk with a financial advisor, especially if you’re drawing social security income, have individual retirement accounts, or are managing mutual funds. Some retirees structure their small farms to reduce property taxes, offset life insurance costs, or support future generations through planned inheritance of farm assets.

📘 This may also be a good time to draft a basic succession plan or estate strategy—particularly if you hope your farm will continue on after you.

🤝 5. Find Help and Mentors

No one builds a farm alone—especially not in retirement. Thankfully, the modern beginning farmer has access to more resources than ever before.

Here are some excellent places to start:

- County extension offices (through land-grant universities)

- USDA New Farmer programs

- Veteran-to-Farmer initiatives

- Local Master Gardener and Master Naturalist programs

- Rutgers University Farm Management Center

- State conservation or farmland preservation offices

- Online communities like Homesteading Today, FarmHack, and SmallFarmNation

🙋 We’ll list a few more under “Additional Resources” at the end of this article.

🌾 Real Farm Property Listings

Two examples of rural properties available within 20–25 miles of the Mississippi Gulf Coast are shown here to help you understand what kind of land and amenities are available for those interested in small-scale farming, homesteading, or creating a retirement lifestyle in nature. Both listings reflect the diversity of properties—from established farms to country homes with room to grow.

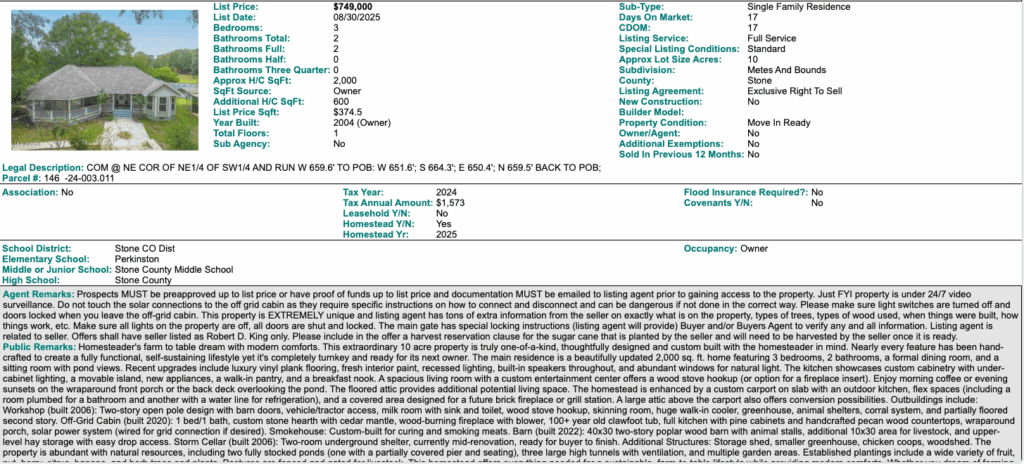

🏡 Listing #1: Homesteader’s Dream on 10 Acres

📍 Stone County, MS

💰 Price: $749,000

📐 Size: 10 acres

🛏️ Beds: 3 🛁 Baths: 2 🏠 Living Area: 2,000 sq. ft.

🛖 Includes: Separate Off-Grid Cabin, Barn, Greenhouse, Animal Shelters, Pond, and more

This unique, custom-built homestead is thoughtfully designed with self-sufficiency in mind. The main home features 3 bedrooms, 2 bathrooms, an open kitchen with custom cabinetry, and a spacious living/dining room with pond views. The wraparound porch is perfect for enjoying country sunsets.

Beyond the main house, the property includes:

- Off-Grid Cabin with solar setup (1 bed, 1 bath, wood stove)

- Workshop (built 2006) with plumbing and finishing potential

- New Barn (built 2022) 40×30 with loft and livestock stalls

- Other Structures: Root cellar, greenhouse, chicken coops, outdoor kitchen pad

- Energy Sources: Grid electric + solar with batteries

- Unique Features: Sugarcane field, pond, 24/7 video surveillance

This is a fully functional and updated homestead ideal for retirees seeking a rural, productive lifestyle. It includes every structure and utility needed to start farming or maintain a vibrant garden and livestock program immediately.

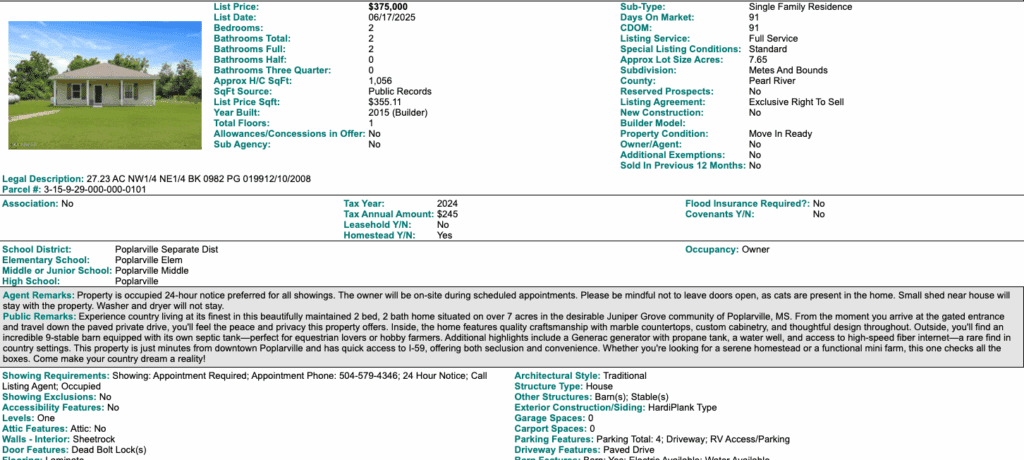

🏡 Listing #2: Turnkey Country Mini-Farm on 7.65 Acres

📍 Poplarville, MS

💰 Price: $375,000

📐 Size: 7.65 acres

🛏️ Beds: 2 🛁 Baths: 2 🏠 Living Area: 1,056 sq. ft.

Located just outside downtown Poplarville and 20 minutes to the beach, this charming home offers the peace of the countryside with quick access to shopping and healthcare. The updated 2-bed, 2-bath home features marble countertops, custom cabinetry, and a private paved drive with gated access.

Property highlights include:

- 9-Stable Barn with dedicated septic system

- Generator (Generac) with propane tank

- Water Well + Fiber Internet – a rare combo for rural properties

- Fully fenced with excellent privacy and room to garden or keep animals

This listing is ideal for hobby farmers or animal lovers looking for a peaceful country retreat that’s still connected to modern conveniences. It also has income potential through leasing stables or offering horse boarding services. These are provided courtesy of the author at Logan-Anderson Gulf Coastal Realtors

🌿 Conclusion: Cultivating More Than Just a Retirement Hobby

Farming after retirement isn’t just a hobby—it can be a way of life, a form of retirement planning, and even a living tribute to your family’s past and your country’s founding spirit. Whether you’re nurturing a 5-acre homestead, building a 20-acre farm business, or simply planting a few trees in your backyard, you’re engaging in something deeply meaningful.

For many, the choice to start a family farm after retirement is about more than tomatoes and goats. It’s about health, purpose, and the joy of creating something lasting. For others, it’s about smart use of real estate, land values, and tax strategies that support long-term financial goals. And for some, it’s a succession plan—a gift to the younger generation that reflects your values and vision.

🗽 In 1776, most Americans were farmers. Our Founders built the nation while building their farms—balancing liberty with labor. Today, you can do the same.

📚 Want to Keep Learning?

This article is part of a two-column series:

- ✅ Starting a Business After Retirement

Practical ideas and step-by-step advice for launching your second act. - 🇺🇸 The 250th Anniversary of the Declaration of Independence

Explore how the trades and traditions of 1776 still shape American lives today.

We encourage you to explore the rest of the series, including topics on:

- How Americans Worked in 1776

- Creating a Website for Your Retirement Business

- Planning for Farm Succession and Legacy (via Rutgers University)

🌿 What Can I Grow? Find Out in 2 Minutes!

🌱 Ready to Grow your small farm?

If you’re thinking seriously about starting your own small farm, here are your next steps:

- Visit farmers’ markets in your area and talk to local producers.

- Search for land listings and walk a few properties to get a feel for size, soil, and setting.

- Start your farm business plan, even if just for your own clarity.

- Talk to your financial advisor about how this lifestyle fits into your long-term goals.

- Get your hands dirty—volunteer at a farm, join a gardening club, or plant something today.

The land—and your next chapter—is waiting. And whether your goal is to build a business, leave a legacy, or just feel useful again, farming after retirement may be the best decision you’ve ever made.

FAQ

1. Do I need farming experience to start a small farm after retirement?

2. What size farm is realistic for one or two people?

3. Is farming physically too demanding for older adults?

4. Can a small farm provide retirement income?

5. Do I need to form a legal business to operate a small farm?

6. Is there help available for new or older farmers?

7. What should I grow or raise on a retirement farm?

8. How do I find affordable farmland near the Gulf Coast or in my area?

9. What is a conservation easement and should I consider one?

10. How do I create a farm business plan?

11. What financial considerations should I keep in mind?

12. Can I get tax deductions for farming in retirement?

13. What are the risks of buying rural property?

14. Can I involve my family or pass the farm down to them?

15. What’s the best first step to take right now?

Podcast “Farming After Retirement

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.