Last updated on February 19th, 2026 at 02:17 pm

Tax season is already underway, and for many retirees, the biggest concern isn’t filling out forms — it’s understanding what the final tax number may look like before anything is submitted to the IRS. RetireCoast’s Form 1040-SR tax forecast tool will help.

If you file Form 1040-SR, your income may come from several sources: Social Security, retirement account withdrawals, pensions, or part-time work. While the form itself is designed to be more senior-friendly, the actual tax outcome often isn’t obvious until everything is totaled.

That’s why we created the Form 1040-SR Tax Forecast Tool — a practical way to estimate federal taxes owed for the most recent tax year, payable to the IRS by April 14, 2026, and to begin planning intelligently for the year ahead.

Why Estimating Taxes Before Filing Matters

Many retirees don’t realize they may owe additional federal taxes until they are already deep into the filing process. At that point, options are limited, and surprises can be stressful.

Using a tax calculator before you file can help you:

- Estimate whether you’re likely to owe taxes or receive a refund

- Understand how different income sources affected your tax bill

- Prepare financially for an IRS payment, if needed

- File with more confidence and fewer last-minute questions

Clarity ahead of time makes tax season far more manageable.

Use the Form 1040-SR Tax Forecast Tool

👉 Try the Form 1040-SR Tax Forecast Tool

(link to your calculator page)

This RetireCoast tool is designed specifically for retirees who file Form 1040-SR. It helps estimate last year’s federal tax outcome using common retirement income scenarios — without requiring full tax software or complex spreadsheets.

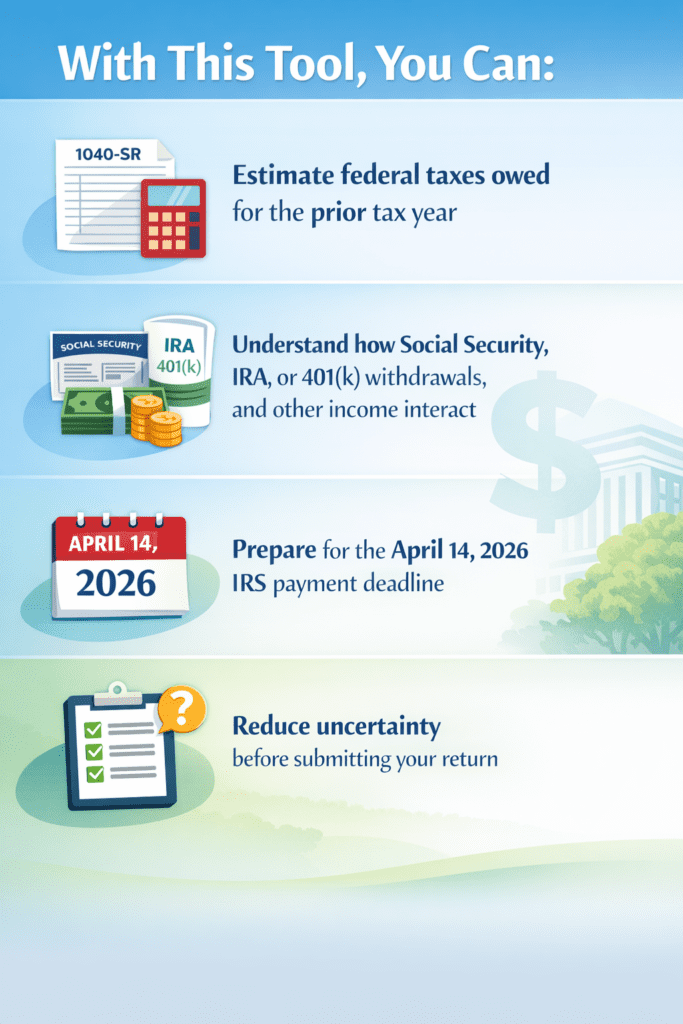

With this tool, you can:

- Estimate federal taxes owed for the prior tax year

- Understand how Social Security, IRA, or 401(k) withdrawals, and other income interact

- Prepare for the April 14, 2026, IRS payment deadline

- Reduce uncertainty before submitting your return

Because the 2025 tax changes are now locked in, future IRS updates are expected to reflect inflation adjustments only. That means you can safely use our Form 1040-SR 2025 Tax Forecast Tool throughout 2026 to help plan ahead for 2027 taxes.

Be sure to check back later in the year as we update this tool with newly released IRS tables.

Just as important, we continue to expand our free Calculators Hub with new tools. Our upcoming subscription hub will offer more advanced, in-depth analytical tools for those who want to take a deeper dive into their finances and long-term planning.

This Tool Can Also Be Used for Current-Year Tax Planning

In addition to estimating last year’s taxes, this calculator can also be used as a planning tool for the current tax year, with taxes payable by April 2027.

While the IRS has not yet released final tax tables for next year, this tool provides a reliable baseline for planning purposes. We will update it later this year when the IRS publishes new brackets, deductions, and thresholds.

Using the tool now to model income scenarios, withdrawal timing, or retirement decisions is a smart planning habit — especially because:

- Recent tax law changes enacted in 2025 are expected to be active in 2026

- Many of those changes are projected to benefit the average taxpayer

- The IRS typically adjusts deductions and allowances for inflation

In most years, inflation adjustments mean things improve rather than worsen for retirees.

Retirement Income Can Make Taxes Less Predictable

Unlike a traditional paycheck, retirement income often comes from multiple sources — each taxed differently. That can lead to unexpected results when:

- Social Security benefits become partially taxable

- Required minimum distributions increase taxable income

- One-time withdrawals push income into higher ranges

Understanding how these pieces interact — both for last year and the year ahead — can help reduce surprises and improve decision-making.

For deeper guidance, these RetireCoast resources may also be helpful:

- Tax-Advantaged Retirement Accounts

https://retirecoast.com/tax-advantaged-retirement-accounts/ - Tax Planning for Gen X and Retirees

https://retirecoast.com/tax-planning-gen-x-retirees/ - Senior Income Taxes in 2026

https://retirecoast.com/senior-income-tax-2026/ - Tax Benefits of Owning a Home

https://retirecoast.com/tax-benefits-owning-home-2025/ - Tax-Free Retirement Withdrawal Calculator

https://retirecoast.com/tax-free-retirement-withdrawal-calculator/ - Retiring in a State That Won’t Tax Retirement Income

https://retirecoast.com/retire-in-a-state-that-wont-tax-retirement-income/

Each of these topics directly affects how much you ultimately owe — or keep — in retirement.

Explore More Retirement and Tax Planning Tools

The Form 1040-SR Tax Forecast Tool is part of a broader collection of planning resources designed to help retirees and near-retirees make informed decisions.

👉 Explore more tax and retirement planners in our Calculators Hub:

https://retirecoast.com/calculators-hub/

You’ll find tools covering retirement income, withdrawals, tax strategy, and long-term planning — all designed to provide clarity without unnecessary complexity.

Official IRS Resources for Tax Tables and Form 1040-SR Filing

While the Form 1040-SR Tax Forecast Tool is designed to help with estimation and planning, the IRS remains the official source for tax tables, filing instructions, and form updates.

These IRS resources may be useful:

- IRS Tax Tables and Tax Rate Schedules

https://www.irs.gov/instructions/i1040tt

This page contains the official federal tax tables and rate schedules used to calculate income tax. These tables are updated annually and reflect inflation adjustments and statutory changes. - Form 1040-SR (U.S. Tax Return for Seniors)

https://www.irs.gov/forms-pubs/about-form-1040-sr

This page includes the official Form 1040-SR, instructions, and IRS guidance specific to senior filers.

The IRS typically releases updated tables later in the year for the upcoming filing season. Once those updates are published, the Form 1040-SR Tax Forecast Tool will be revised to reflect the new thresholds.

How to Use IRS Guidance Together With This Tool

Many retirees find it helpful to use both:

- The RetireCoast Form 1040-SR Tax Forecast Tool for scenario planning and estimation, and

- IRS resources for final confirmation and filing reference

Using the tool first helps you understand where you’re likely headed. Reviewing IRS tables afterward helps confirm official figures before filing.

This approach reduces surprises and makes tax season far less stressful.

Important Note

This tool is intended for planning and estimation purposes only. It does not file your return or replace professional tax advice. However, it can help you understand your situation more clearly before finalizing your return or planning for the year ahead.

Take Action Before the Deadline — and Look Ahead

If you’re filing Form 1040-SR and want to understand what you may owe the IRS by April 14, 2026, now is the right time to estimate — not after your return is submitted.

At the same time, using this tool to plan for the current tax year is a smart way to reduce surprises and approach April 2027 with confidence.

👉 Use the Form 1040-SR Tax Forecast Tool

A little clarity now can make both this tax season — and the next — far more manageable.0-SR Tax Forecast Tool.

Frequently Asked Questions (FAQ)

1. What is Form 1040-SR?

Form 1040-SR is the IRS federal income tax return designed specifically for seniors, generally age 65 and older. It uses larger print and a simplified layout while following the same tax rules as the standard Form 1040.

2. What does the Form 1040-SR Tax Forecast Tool do?

The tool helps estimate your federal income taxes based on common retirement income sources such as Social Security, IRA or 401(k) withdrawals, pensions, and other income. It’s designed to give you a clearer picture before you file or make a payment.

3. Can this tool estimate what I owe for the current tax season?

Yes. You can use this tool to estimate last year’s federal taxes, which are payable to the IRS by April 14, 2026, if you are filing a 2025 return using Form 1040-SR.

4. Can I also use this tool to plan for the current tax year?

Yes. In addition to estimating last year’s taxes, the tool can be used for current-year planning, with taxes payable by April 2027. It’s a helpful way to model income and withdrawal scenarios before filing season arrives.

5. Will this tool be updated when the IRS releases new tax tables?

Yes. The IRS typically releases updated tax tables, brackets, and thresholds later in the year. Once those updates are available, the Form 1040-SR Tax Forecast Tool will be revised to reflect the new information.

6. Does this tool account for recent tax law changes?

The tool reflects current tax rules and provides a strong planning baseline. Recent tax law changes enacted in 2025 are expected to be active in 2026, and many of those changes are projected to benefit the average taxpayer.

7. Why might my retirement taxes be higher or lower than expected?

Retirement income often comes from multiple sources that are taxed differently. Social Security benefits may become partially taxable, required minimum distributions can increase taxable income, and one-time withdrawals may affect tax brackets.

8. Is this tool a replacement for tax software or a tax professional?

No. This tool is intended for planning and estimation purposes only. It does not file your return or replace professional tax advice. Many retirees use it to prepare for filing or to have more informed conversations with a tax professional.

9. How accurate is the estimate from this calculator?

The estimate is designed to be realistic based on the information you enter, but final tax liability depends on official IRS calculations, updated tax tables, and individual circumstances. The tool helps reduce surprises, not eliminate them entirely.

10. Where can I find additional retirement and tax planning tools?

You can explore more retirement and tax planning calculators, including withdrawal and income tools, in the RetireCoast Calculators Hub at:

https://retirecoast.com/calculators-hub/

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.