2018 changes to federal income taxes exposed state and local taxes as potentially unreasonable. Many of us probably think that it’s federal taxes that are the most onerous when in fact, your combined tax burden at the state and local level may be greater than federal income taxes. Now we know, it is all about hidden state and local taxes: your tax burden is exposed.

High-tax state bureaucrats and legislators are still complaining about how the 2018 federal tax rates will cost their residents more money. When the 2018 tax reforms went into effect, they saved the average taxpayer on their overall tax bill. States that have the highest income, property, and other tax rates were exposed. Their residents had a higher tax bill.

It was possible before 2018 to write off most real estate taxes and mortgage interest on primary and secondary residences including interest paid on lines of credit. Along with these nearly unlimited write-offs were unlimited state and local income tax write-offs.

Your tax burden exposed

The 2018 federal tax law has replaced those unlimited deductions with a fixed $24,000 maximum for a couple (higher if one or both are over 65) which includes about everything that most people were itemizing in the past.

The crux of the tax issue is that for the first time high tax states and local governments who for years told people to write off the higher costs had to change their pitch. No longer could a person buying that high-cost home fully deduct the mortgage interest, taxes, or insurance. The new limit is a maximum of $10,000. If that was not bad enough, it also included any government taxes such as state income tax and local taxes.

The $10,000 limit was a drop in the bucket. A person who owned a tract home in Orange County, CA worth about $850,000 would have a tax bill of about $10,000 per year. They would probably owe state taxes of about $15,000 or more than pay upwards of $30,000 in mortgage interest. $55,000 with only a $10,000 deduction. Think some residents realized what was going on?

The point of this article is to discuss local and state taxes

The point of this article is to discuss local and state taxes, we will revisit how the new federal taxes affect you if you live in a high cost and tax state. California has been selected as a high-cost state for comparison and the Mississippi Gulf Coast area as a low-cost area based on the author’s personal experience. There are many other high-cost states and other lower-cost states as well.

To be clear, taxes are necessary for a functioning democracy. I do not object to taxes and neither should you. What we all want to know is how are we taxed, how much and where is the money going. We do object to waste or unnecessary costs. Read further to see some examples of taxes and fees either hidden or not property disclosed to the public.

The Author

Start with sales taxes. For example, the sales tax rate in California is about 8% some cities add to that. Fees charged for everything from vehicle registrations to personal property tax added to your tax burden. If you live in Orange County and have a boat, you will pay personal property taxes on it each year along with annual registration fees for the boat and trailer.

Taxes are usually added to your cable, electricity, water, and other utility bills as well. Some fees added to utilities are substantial including “public service” fees. Most taxpayers are not aware that their trash bills contain “franchise fees” charged to the trash hauler which are passed along in a higher trash bill.

These trash franchise fees can exceed 10% of your trash bill and yet, the communities often do not inform you that this “tax” is included. Often a portion of these “franchise fees” are given to favored non-profit businesses. Did you know that? Whether you call an amount you have to pay a government agency a fee or a tax, it is still a payment you are generally compelled to make.

Taxes on businesses are passed along: your tax burden exposed

Lots of taxes are passed along to businesses as well in the form of fees for permits, inspections, etc. Some businesses will require multiple permits with substantial annual fees. Some county and city agencies are fully funded by the fees they charge local businesses all of which are pushed along to consumers generally without their knowledge included in the goods and services they purchase.

All taxes, fees, and other amounts paid by businesses to the government are included in the prices they charge for their goods and services. A tax on a business is a tax on consumers.

Some states have large regulatory bodies such as California, which add significant financial burdens to businesses, passing along the cost to consumers without any specific notice.

For example, California maintains its own Housing Department. Mississippi defers to the federal agency HUD. How much more will it cost taxpayers when a state in essence recreates the wheel. California taxpayers receive no credit from the federal government because the services of HUD are performed by the state bureaucracy. This duplication of effort exists with Cities creating departments that the County already has. Layer upon layer of the additional cost.

If you live in California your taxes went up in 2018

I am using the Golden State as an example because I am familiar with some of the tax and fee structures. If you live in California you received a very large increase in the cost of gasoline and diesel fuel in 2018 (with subsequent increases scheduled yearly for years to come). Did you know a federal tax is included in the price of gas and that the state charges sales tax on the federal tax?

California is one of only a few states that charge sales tax on fuel (not to be confused with the excise tax they also charge for each gallon). One of the hidden effects of the recent rise in fuel taxes is the one on diesel fuel. While most people do not have a diesel-fueled vehicle, virtually all delivery trucks run on diesel. This is an example of hidden state and local taxes: your tax burden exposed.

This means that the increased cost of fuel is passed along to consumers from every part of the economy. Grocery stores pay more to bring products to their stores etc. [This section does not factor in the 2022 run-up in costs except to say that California’s yearly mandated tax increase on fuel will go into effect in 2022 regardless of the price of fuel.]

Maintaining a full-time legislature is a very high cost

Comparing California on the topic of legislator cost. Most know that California has a full-time legislature, perhaps one reason for so many taxes and regulations. According to Ballotpedia, California legislators receive $107,241 per year plus $184 per day in per diem when they are in session.

Mississippi is an example of a more fiscally conservative state

Mississippi as an example of a more fiscally conservative state has a part-time legislature where the average legislator receives between $40 and $50,000 per year and that includes per diem. Because they are part-time, they do not have time to pass bills just to fill in the available time. Taxpayers in effect are paying more than 50% higher costs for their state government just on this one item of legislator cost.

Did you know that you do not have to accept higher taxes? If you are mobile e.g. can work from your home or are about to retire, consider relocating to a lower tax county in your state or a state that can give you a similar or better quality of life than living in, for example, a higher cost and crowded city or suburban area.

The low unemployment rate has created opportunities for many to change jobs and possibly work from home. Considering a physical move is now a possibility for some. Southern states in general have a lower cost of living. These “cheapest states” are attracting many people.

Several states do not tax retirement income including 401k, IRA, defined pension payments, and other forms of qualified retirement income (to be fair California does not charge state income tax on Social Security income but does charge on most other forms of retirement income including 401k withdrawals).

Your retirement funds in Mississippi are yours to keep (no state tax)

Mississippi is one of those states that does not bother your retirement funds. In fact, according to U.S. News, Mississippi has the lowest cost of living in the nation. USA Today reiterates the view that Mississippi is the most affordable. So let’s use Mississippi as an example of a state with a verified low cost of living. Let’s focus on the Mississippi Gulf Coast which is more comparable to some of the areas mentioned above in California, Washington, New York, etc.

Problem with a down payment in California, good luck finding an Agent

An article that appeared on Realtor.com written by Lance Lambert discussed the typical down payment required in various markets around the country. The article focused on areas of dense population. The amount required for a down payment seems to be in relationship with the temperature of the market. In California, if you do not have a higher down payment (above 17% according to the article), you are unlikely even to draw the interest of a real estate agent.

The good news is that not all markets are like California. The Mississippi Gulf Coast market is very normal meaning that while prices increase moderately, financing is available and there are fewer homes involved in bidding wars.

A large home builder is offering their financing package with 10% down. There is a separate program where the builder will pay for private mortgage insurance for a slightly higher interest rate on that 10% down. Of course, VA and other programs are available.

20% of $200,000 is less than 20% of $800,000

It is far easier to put down the standard 20% for a home costing $200,000 than it is to come up with 20% for a home costing $800,000. 97% of federally sponsored loans are available along the Mississippi Gulf Coast. Another point is that most homes on the Mississippi Gulf Coast receive conforming loans while many in Southern California require non-conforming loans.

You may choose to rent rather than buy. Rent a two-bedroom, two-bath high-rise condo on the beach for $2,000 per month or less in Biloxi or Gulfport (Mississippi Gulf Coast). Rent a four-bedroom, two-bath home is available for rent at $1,400 per month in Ocean Springs. There are few actual single-family homes in most of Orange County for rent at less than $2,000 per month but not many and none on the beach. It would be humorous to attempt a comparison here.

Mississippi residents 65 and older get a break on property taxes

Property taxes for property owners under 65 in Mississippi are about 1% of the real property value. If you are in a California Mello-roos area, you will pay upwards of 2% on the value of the home, almost twice the base rate.

Because your home on the Gulf Coast will be substantially less expensive, the tax dollars you pay will be commensurately lower as well. In retirement, it comes down to dollars, not percentages the same applies to those saving for retirement.

At age 65 (in Mississippi), you are entitled to a significant reduction in your property taxes ($75,000 off the assessed value). Your rate may be lower than 1% of the actual value of the home compared to the minimum California tax rate of 1.1-2% of the actual value of the home. In California (the base property tax rate is about 1.1%, and local bonds and Mello-Roos bonds will increase that rate).

Property taxes are based on the value of property

On a new 1,900 sq. ft. home described above in Ocean Springs, your estimated property taxes would be 1,900 per year if you were under 65 about $1,400 per year. Compare this to the Garden Grove, CA home above selling for $719,000 at the tax rate of 1.1%, annual taxes would be $7,909.

Your actual tax dollar savings would be $542 per month between the two examples. The average person receives less than $1,500 per month in Social Security income. An average couple would receive an average of $3,000 in Social Security income in retirement. The $542 property tax savings would represent 21.9% of total Social Security income for couples living in Garden Grove. In Ocean Springs that couple would pay only 3.8% of their monthly income for property taxes.

You could pay cash on the Mississippi Gulf Coast from the proceeds of your California home

The example above would put $198,000 into your savings for retirement if you moved to Ocean Springs and for the next 20 years enjoyed the $542 monthly savings in property taxes. You could sell your Garden Grove home and pay cash for a home in Ocean Springs.

California law (prop 13) permits local authorities to raise property taxes by 2% per year and this is done every year when property values are equal to or higher than they were the previous year. Mississippi counties must evaluate property values at least every four years.

A reminder at this point, the article is not intended to argue against lower taxes or complain that the taxes mentioned are too high, wasteful, etc. The reader can make their judgments about taxes. Remember, taxes are necessary for some essential services so before you decide that paying taxes is a bad thing. Consider calling 911 and no one answers.

As some famous person once said, “To avoid taxes is as American as apple pie, to evade taxes is a crime”. Some would say that you have a responsibility to avoid taxes and ensure what taxes you do pay are being well spent.

Back to the new federal tax law

Back to the new federal tax law. If you live in Orange County you can deduct the $7,909 (example in property taxes on your federal return above). That leaves you with $2,091 in deductions remaining for state income tax, personal property tax, sales tax on new vehicles, etc. If you moved to Ocean Springs, you would have $8,600 remaining to use against other taxes (use the example above).

Did I mention that state income tax in Mississippi is 5% or less except on retirement income which is not taxed at all? If you live in California and receive a pension benefit and/or withdraw from your 401k, you could easily pay more than 5% income tax even in retirement. Let’s use an example.

If you lived in California and earned $50,000 per year in retirement income (other than social security) and other income e.g. you worked a part-time job then your income tax would be just over $1,000.

If you lived on the Gulf Coast, your tax from the retirement portion of your income would be $0. Let’s say that the $50,000 includes $10,000 of part-time work in Mississippi. You would then pay $300 only on the earned income. A savings over California of $700. Again, these examples are for state income tax and they are examples only (consult your tax professional for advice).

You can deduct most of the state income tax in Mississippi compared to half paid in California

If you decided to move to the Gulf Coast while you are still working (you work from home or transfer to or start another job), your maximum state income tax burden would be 5% (the average is only 3%). Californians pay as much as 13% state tax. If you and your spouse earn more than $250,000 (a modest income) after deductions in California, you will pay about $25,263 according to the Forbes Advisor.

If you lived on the Gulf Coast, your state tax bill would be about $12,500. Consider that with the new federal tax law, you can deduct most of the state income tax paid in Mississippi but less than half of that paid in California. ($10,000 maximum).

It’s time to explore other aspects of taxation and how they apply to both California and Mississippi. Many people living on the Mississippi Gulf coast choose to buy a boat. In addition to the Gulf of Mexico, there is a myriad of inland waterways to explore. These include several large rivers that travel many miles inland. There are large bays and inlets along with islands in the Gulf. (Pardon the advertising)

Personal property taxes on boats, yet another tax

So you buy a boat when you arrive on the Gulf Coast (it seems that everyone does). You will pay boat registration once every three years. If your boat is for example a 26′ model, the current rate is $47.00. If you buy a boat in California you will pay $49.00 every two years. (For three years $73.50 in California vs $47.00 in Mississippi). If you register a boat in California and live in one of many counties that charge a personal property tax such as Orange County, you will pay several hundred dollars per year more.

While the personal property tax amount on a boat drops every year, you will probably not own the boat long enough to outlive the county personal property tax. You must pay sales tax on your boat in both states. In California, you will pay 8% or more, and the current rate in Mississippi is 7%.

You don’t pay sales taxes on the trade-in

You buy a $40,000 car in California. The trade-in value is $30,000. You still pay sales tax on the full purchase price of $40.000. If you buy that car in Mississippi, you pay sales tax on the difference between the full sales price and the trade value. So you pay sales tax on $10.000. It gets better. The sales tax rate on vehicles is 5% in Mississippi. So in California, you pay 8% x $40,000 = $3,200.00 in sales tax. In Mississippi, you pay 5% x $10,000 = $500.00. A savings of $2,700 or 84% lower taxes.

The same system applies to trade-ins for boats, RVs, and other vehicles. Mississippi believes that you already paid sales tax on the vehicle you are trading in, so why would they charge you twice? Why indeed? (Assume you buy 6 vehicles in 20 years at the savings in the example, you can put aside another $16,200 in retirement savings if you live in Mississippi compared to California)

Ok, enough with the hard-hitting stuff, let’s look at daily life. What do you do in the summer when it gets hot? You turn on the AC. Have you examined your electricity bill lately? Your bill may include numerous taxes, fees, and add on’s mostly applied to the bill through regulation. You are paying for others who cannot pay their bill, you are paying to advertise social issues that you may not agree with and you are supporting the taxing agency. Another example of hidden state and local taxes: your tax burden exposed.

The electrical rate on the Mississippi Gulf Coast is lower

The electrical rate in Ocean Springs (According to an actual bill from Singing River Electric Cooperative, is $0.12 per kWh. The rate from Southern California Edison starts a $0.17. The utility rate average for two people is $0.25 rate and then up to $0.33 with high usage during the summer. It’s difficult to compare someone’s bill because of family size, location, etc.

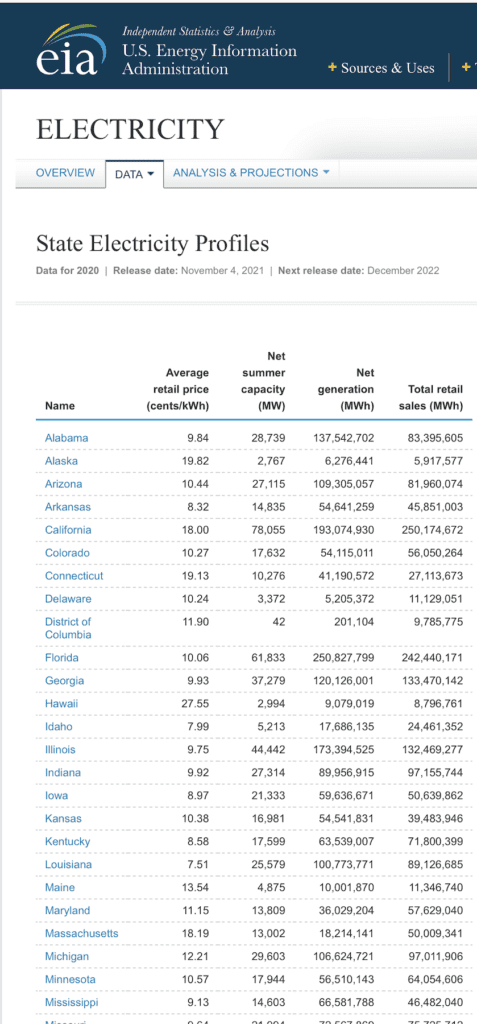

These were 2018 rates. The chart below outlines the vast difference in the electricity charges between California and Mississippi. Note other high-cost states have high electricity rates as well.

You can see that the rate on the Mississippi Gulf Coast is lower and for those of you paying several hundred dollars per month for power, there could be significant savings if you lived on the Mississippi Gulf Coast rather than in Southern California (specifically the SCE service area). Power costs contribute to the overall cost of living and they are lower in Mississippi than in most states.

The cost of water is 40% lower

The cost of water is about 40% lower on the Gulf Coast than almost anywhere in Southern California (my own experience). This includes sewer and standby charges as well. The water in Ocean Springs is naturally soft so for those of you who spend money to support a soft water system, there can be saved there as well. In Ocean Springs you have to cut back on detergent and soap (another savings).

The comparison above does not take into consideration that there are two line items on the property tax bill for water. Strange why these amounts are not combined on a water bill. Could it be that the water rate would show the true amount? One of those “hidden” charges. If they spread them out, perhaps you do not notice.

There is also no shortage of water on the Mississippi Gulf Coast due to the high water table and abundant water sources. A separate discussion for another time is the very hard water in Southern California compared to Ocean Springs. Hard water damages most items connected to it including faucets, toilets, etc. Maintenance of a home is yet another discussion but suffice to say, if you have a lower mineral content in your water your plumbing will last longer with less maintenance.

You pay taxes called “fees”

There are other ways that you pay what some call as “fees”, “advanced deposits” or something as simple as a bottle fee. Fees are taxes when collected by a government agency (my personal opinion, yours may differ) Take the bottle fees charged by several states. Every time you buy a bottle you are charged five cents or more. In theory, you can take that bottle to a site where you can receive that five cents back.

According to Investopedia: “Taxation is a term for when a taxing authority, usually a government, levies or imposes a financial obligation on its citizens or residents. Paying taxes to governments or officials has been a mainstay of civilization since ancient times”

Not exactly true. In California, the independent recycling facilities will only take a small number of bottles back at face value e.g. 50 at a time. The remainder will be weighed and you will receive less than five cents back. Mississippi does not have a bottle tax. Does that mean that Mississippi residents do not recycle bottles, no?

Most homes have a recycling bin. It’s just that they need not be coerced into recycling as they are in California.

What happens to the unredeemed bottle fees?

Ever wonder what happens to the fees charged for bottles when they are not redeemed? Those fees are used to pay a large bureaucracy to manage the program. Another hidden tax.

California recently enacted a bill that prohibits stores from giving customers plastic bags. It does not stop there, the stores are required to charge you if you want to buy a paper bag or some other non-disposable bag, they are not permitted to give it to you.

If you shop in Mississippi you can have a bag at no charge. These types of charges are sometimes visible and more often hidden in the cost you pay for goods and services. Politicians and advocates have what they believe are good reasons for forcing behavior on citizens. This is a topic for another discussion. Mississippi is one of the least expensive states to live in.

Future tax policy is important

To wrap up the discussion about taxes, it is important to evaluate the course of future tax policy in the state or local area you plan to live in regardless of your status, working, or deciding to retire. Does the political climate indicate that taxes will continue to increase or decrease? Then by how much? Is your state or prospective home state conservative about taxing or liberal about taxing? You can look to history as a guide.

Let’s start with Mississippi. The state legislature passed the largest tax reduction in state history that took effect in Jul 2017. California passed the largest state tax reduction in what year? This is not a real question.

There are discussions in Mississippi about increasing the state gas excise tax (not sales tax), by $0.10 per gallon. There is strong pushback about this but it may pass because the last time that Mississippi increased the gas tax, was when Ronald Regan was first elected president. By comparison, California increased gas taxes in 1983, 1990, 2010, 2013, 2018, 2019, 2020, 2021, and 2022 and the next round is on the way.

California has a long history of raising taxes

California has a long history of raising taxes. The state income tax was increased a couple of years ago on a “temporary” basis, the legislature recently decided to extend the “temporary basis”. Sales taxes were increased often by temporary increases which then became permanent. Registration fees on vehicles were reduced when a governor was recalled and the new one was elected on a reduction platform. Those were the old days, fees just increased again.

The proposed major tax increase in California 2022 (click here)

So to sum up, it would seem that if you decide to live in California you will have to accept the fact that tax increases and all those hidden fees that push up the cost of goods and services will continue to go up. California’s Constitution permits referendums. Due to many referendums over the past decades, the state’s debt burden has continued to rise.

Every time voters approve yet another bond, the cost to taxpayers increases. These bonds add to the high cost of housing. California has the highest cost of living (Hawaii may be higher).

According to Forbes, as of 2018, the California public employees trust fund is owed just $1,000,000,000,000, yes this is correct, one trillion dollars. If you leave California, your $26,000 portion of this unfunded liability will have to be paid by someone else.

You should not be obligated to pay ever-higher taxes

As you move toward retirement or at least plan for it, it’s time to think outside of the box. You probably donated to causes all of your working careers, paid your taxes, and were otherwise an upstanding member of your community. You made your investment, you should not be obligated to pay higher taxes if you choose not to.

It’s one thing if you work and pay 50% or more of your income in taxes and can live on the remainder, it’s another thing when you are living on a fixed income. When you can no longer afford the luxuries of higher taxes and other costs? Is it time to plan for the future?

Consider this

Consider this: You can afford to live where you do and pay all of those taxes because you have a great job making lots of money. When you retire the economics change. Why wait? Every year that you rationalize paying 35% more by living in a high-cost state, that’s 35% you could be saving for retirement. I have spoken to many in their 40s and 50s that admit they can not afford to retire in for example California. So why wait?

Read this article about the total tax burden by state

Just as you may downscale the size of your home, you can downscale the cost of taxes and fees. By selecting the right place to live with a lower overall tax burden. Don’t discount other environmental factors such as less crowding, fewer cars on the road, and better schools for your family when they follow you to your new home on the Mississippi Gulf Coast and the beaches.

UPDATE: This article was originally written in June 2018. The costs of homes in both Ocean Springs and in California have gone up and in some cases, significantly. The concepts discussed here are still valid. I decided to make minor revisions for now. The relative comparisons are still accurate. Gas prices are much lower than in California etc.

This article written in Forbes supports some of the statements made here.

Should you consider moving to the Mississippi Gulf Coast, you may want to visit the Logan-Anderson, Gulf Coastal Realtors website for more articles and to view available homes. Please read other articles on our site that relate. Two of our most popular articles are: “Why I decided to retire in Ocean Springs, Mississippi” and “Why you need to retire on the Mississippi Gulf Coast.”

PODCAST FOLLOWS

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.