Last updated on October 23rd, 2024 at 08:56 pm

Why are politicians talking about increasing corporate tax rates and capital gains rates? Why should I be concerned about how high either of these taxes are? Exactly how do corporate taxes and capital gains taxes affect me and my family? You need to know the truth about all of the promises made by people trying to get your vote. You, your family, your community, and your country are affected by tax policy.

It does not make a difference if the tax policy is initiated by a state or the federal government, it all comes directly to your door. The purpose of this article is to clear the air and explain why everyone is affected by good and bad tax policies. Let’s assume that you are retired and pay little or no income taxes.

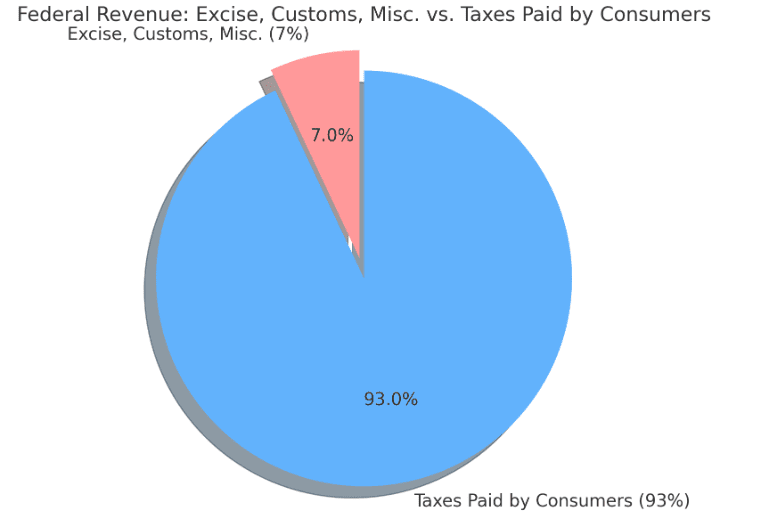

Does this mean that corporate taxes will not affect you? The answer is a qualified no. You pay taxes with almost every dollar you spend. These taxes are either in the form of sales taxes, excise taxes, or other fees which you can see.

How Corporate Taxes Impact Consumers

Taxes you don’t see

It’s the taxes that you do not see that are always discussed by politicians. When you hear that a politician wants to raise corporate taxes to pay their “fair share”, you should wince. Let’s start with corporate taxes. You should know that taxes are paid by businesses on their profits. This is called taxable income. The lower the corporate tax, the more profit. Guess where profits go.

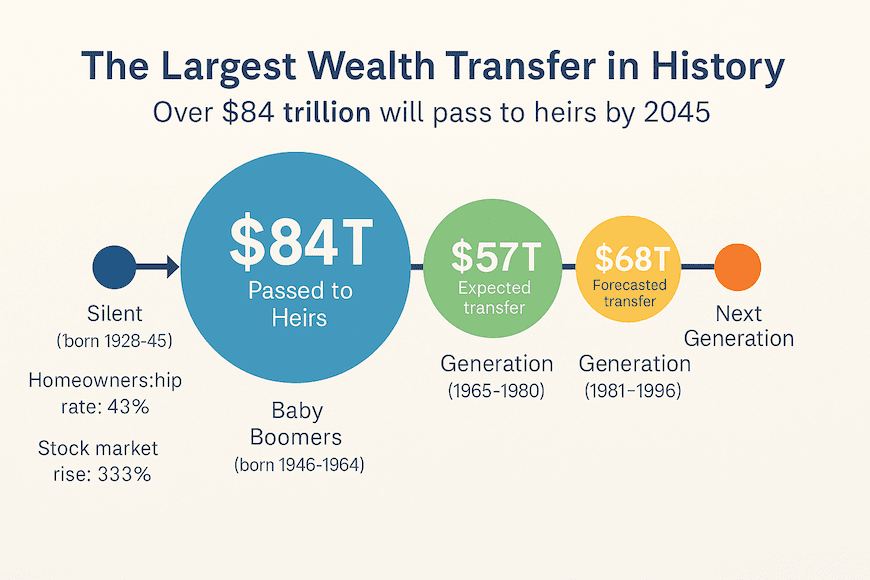

Profits go to shareholders which means that if you have a 401(k), IRA, or brokerage account, you will be paid profits in either the form of dividend income or a higher value for the stock due to the higher profits.

Higher taxes means that you the shareholder will earn less on your investment. Corporations are not people, they only earn money when they sell goods or services. The more profitable a corporation is, the more it invests in the business to have it continue to grow.

People are employed by corporations and people pay taxes. Over-taxing a corporation means less money trickles down to the middle class and others. This means of course that lower rates on corporate taxes will mean more money in your pocket.

Corporations pay YOUR share

Can you see where this is going? It is illogical for anyone to make a statement that corporations don’t pay their fair share. This is nonsense. The tax code requires corporations to pay taxes on their earnings which most do. Remember you pay taxes on earnings not on gross income. This means if a corporation earns one million dollars in revenue and it costs $900,000 to operate the business, they have an income tax burden of $100,000.

Almost 1/2 of the population of the United States pay

zero income taxes

The taxable event occurs when the corporation declares an income of $100,000. A corporation can not deduct dividends paid to shareholders. This means that not only are there corporate taxes on the $100,000 earned but if all of it was paid to shareholders, there would be a tax bill due by the corporation. And you will also pay taxes on income that was already taxed. That’s correct double taxation. The politicians never tell you about this, do they?

If the corporate tax rate were to increase, the example of the $100,000 would shrink meaning that shareholders get less. You are correct, the government gets more to spend.

Investors can be big losers

This is what happens to retired people, their income is reduced because the source of the income in their investments was reduced. This is only the start. Corporations must achieve a reasonable return on the capital they have invested. They have bills to pay and employees to support.

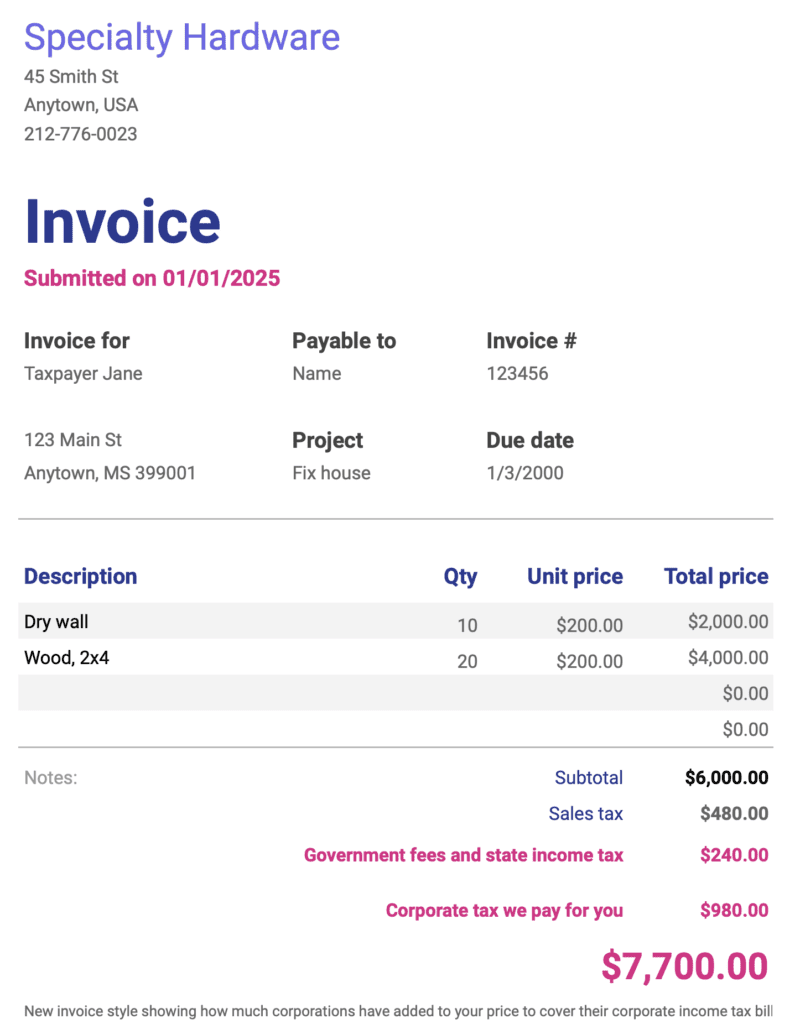

When the government takes more from the corporations, they will have to find a way to make up the difference. Guess where that money comes from? You and everyone else who buys their goods or services.

We all know about what happened in California. The state raised the minimum wage significantly. This caused restaurants (most corporations) to raise their prices. This example indicates that the companies did not pay the additional amount in wages, you and your family did. As I mentioned above, corporations are not people, their profits are usually passed along unless some are reinvested for future growth.

2017 Tax bill made the U.S. competitive again

The United States was until the 2017 tax cuts the highest-taxed country in the world regarding corporate taxes. This made our businesses less competitive with others around the world who could make things at a lower cost. The higher price of United States-made products has caused companies to close and move offshore. This is in large part due to our tax policy.

You are paying between 20-30% in embedded taxes passed along from companies in the form of consumer products and services. This means that as a retired person who is paying little or no federal income taxes, you still have a substantial tax burden. No amount of tax planning can help reduce these taxes except when you reduce spending.

Let’s talk about capital gains taxes. If you own stocks, mutual funds, and many other financial instruments you will be subject to long-term or short-term capital gains taxes. Yes, even if you are retired. Most people do not know this, their tax advisor works it out. Again this is an area where politicians want to get from the rich their “fair share”. Lots of people agree with that concept. Those rich people should be paying more.

Who pays taxes?

In the U.S., a significant portion of federal taxes is paid by the wealthiest individuals. According to data from the IRS and other sources, the top 1% of income earners contribute a substantial share of federal income taxes:

- Top 1% of income earners**: This group pays around 40% of all federal income taxes. Despite making up a small portion of the population, their contribution is large due to their high incomes and the progressive nature of the tax system.

2. Top 10% of income earners**: The top 10% pay about 70% of all federal income taxes.

3. Top 50% of income earners**: The top half of income earners contribute nearly 97% of all federal income taxes, while the bottom 50% pay around 3%.

These figures reflect federal income taxes specifically and may not include other types of federal taxes, such as payroll taxes, which are less progressive and impact a broader portion of the population.

These percentages may vary slightly from year to year due to changes in tax laws and economic conditions.

When politicians want to raise capital gains taxes, they affect the average investor and the wealthy. When the wealthy are already paying an overwhelming part of their wealth in taxes, why does anyone think they are not paying their fair share? In addition to the wealthy paying more than their share of federal income tax, they pay state taxes, property taxes, and many more fees and taxes that are hidden from the public.

What do wealthy people do with their money?

Let’s discuss what the wealthiest people do with their money. Most museums and many public places in the country were donated by wealthy people. Universities receive funds to support scholarships. A substantial portion of the wealthy give generously to charitable causes. People are helped who could not get help from their government.

New businesses are started through loans from rich people. Look at Eldon Musk; people worldwide in rural areas have access to the internet due to his Starlink company. Electric cars were introduced into the economy. Bill Gates created computers and software to revolutionize the world.

The stories can go on and on. If the government had taken their money in the start-up phases when the stock was first sold, these inventions would have died.

Wealthy have to spend it, they can’t take it with them

Remember, the wealthy have to spend their money. They hire millions of people. They buy expensive homes that someone has to build. What about the aircraft they buy, lots of people are employed. They support artists, poets, and writers and they buy failing businesses to improve them.

Yet, politicians want more and more from the rich and corporations. Their excuse is that business income is ill-gotten or the fair market value of their property is not high enough. Right in the middle of all of this talk about rich people are small business owners. If we want economic growth, it will come from small businesses. If the taxable capital gain rates are too high, it will smother small businesses.

Small business owners risk everything to grow their businesses. When a politician states that anyone earning more than for example $400,000 should pay more, they are not considering what $400,000 means. A small business that earns $400,000 can not keep that much. Many small business (sole proprietorships) owners eat two meals a day because they need that $400,000 to make salaries.

It can take decades for small business owners to become rich

It takes many years and even decades for a small business owner to keep a large part of their earnings. Tax treatment for pass-through businesses helps small businesses use much of their income to make their business grow. Yet, people say they are using “tax loopholes”

Even if you moved that number to $ 1 million, many small business owners will earn less than a retired person on Social Security. Politicians and others do not understand the difference between “Income” or “Gross Income” and profit. They use the term income to explain profit. If a business has an income of ten million dollars that is not profit.

They have to cover costs to earn that income. After all of the bills are paid which are usually tax deductible, the profit is what is left over. Also, look at the source of the criticism of business. It often comes from professional politicians who have never held a private sector job.

Many politicians have no business or economic background

Unfortunately taking political science courses in college does not substitute for business courses as an understanding of how wealth is generated and how the economy works. When the corporate tax burden is so high that businesses close their doors, what happens to the taxes? Tax revenue dries up.

This is happening in California and other states where the real tax generators are leaving the state for states with more favorable tax policies. California lost $39 billion in tax revenues in 2022 and considerably more as some big tech companies have moved out in 2023-2024.

The consequence of bad tax policy assuming that corporations can be taxed to death so to speak is that they will move. Yes, they pack up and move. We have seen this with states, that Musk is moving his companies from California to Texas. When it’s the federal government doing the taxing, corporations move to other countries where they will pay less capital gains and corporate tax.

Apple Inc.

Apple was a great example. As part of that 2017 tax bill, Apple repatriated $38 billion and paid the new lower tax. Before repatriation, they had paid none because the income was not earned in the U.S.

You, your family, and your friends do not have the luxury of moving your funds out of the country, you need them to live on. And many companies can not move their liquid assets offshore because they need the funds to reinvest in their businesses.

There is nothing illegal about corporations moving their assets around yet when they exercise their legal ability to do so, politicians call them tax cheats.

What happens when Corporations are overtaxed?

When corporations are overtaxed, it can lead to several negative consequences:

- Reduced Investment: High corporate tax rates can discourage businesses from investing in new ventures, research and development, and capital improvements. This can hinder economic growth and job creation.

- Increased Costs: When corporations face higher taxes, they may pass on those costs to consumers in the form of higher prices, reducing affordability and purchasing power.

- Job Loss: If businesses find it less profitable to operate due to excessive taxation, they may choose to downsize or relocate, leading to job losses.

- Tax Shelters and Evasion: High tax rates can incentivize corporations to engage in tax avoidance strategies, such as shifting profits to low-tax jurisdictions or exploiting loopholes, which can reduce government revenue.

- Loss of Competitiveness: If a country’s corporate tax rates are significantly higher than those of its trading partners, it can make its businesses less competitive on a global scale.

Messing with the capital gains tax rate can have negative consequences. The same happens with changes to the long-term capital gains tax. It’s not enough that politicians without a grounding in economics want to distort the economy by raising corporate income taxes and capital gains taxes.

A new way to increase tax revenue is to tax unrealized gains. No country on the planet has implemented an unrealized gains tax for some excellent reasons as follows:

Implementing an unrealized gains tax—where individuals or businesses are taxed on the increase in the value of their assets before those assets are sold—could have significant economic and social consequences.

What is an unrealized gains tax?

Assume you have accumulated a value of $100,000 in your 401(k). You originally invested $50,000 so you have $50,000 in unrealized gains. This is the amount that you have earned but not removed from the 401(K). You are not taxed on that amount today unless you take it out.

With an unrealized gains tax, you would have to pay tax on the profit regardless if you have taken it out of your 401(k). How would you do this? Give up a significant portion of the profit as tax. Next year when the market drops, do you ask for the taxes back? Good luck, it works only one way. Your 401(k) would probably be exempted.

Corporations that have earned a profit but are using that profit to buy equipment to hire more people would have to pay taxes on that profit even though they have not distributed it to shareholders. Read the following and see what a mess this would be. Except for those “income equality” believers:

What happens if a tax is levied on unrealized gains?

1. Impact on Investment Behavior:

- Reduced Incentive to Invest: Taxing unrealized gains could discourage investment, as investors may be less inclined to hold assets that could trigger taxes before they are sold. This could reduce capital inflows into the stock market, real estate, and other asset classes.

- Increased Liquidity Needs: Investors may need to sell assets earlier than planned to generate liquidity for paying taxes, potentially leading to market volatility.

2. Market Volatility:

- Forced Sales: Investors who do not have the cash to pay taxes on unrealized gains might be forced to sell assets, leading to increased market activity and potentially driving down asset prices.

- Short-Term Focus: The tax might encourage a shift from long-term to short-term investment strategies, as investors may try to avoid holding assets that could be taxed on unrealized gains.

3. Complexity and Compliance Issues:

- Valuation Challenges: Accurately valuing assets, especially illiquid ones like real estate, private equity, or art, can be difficult and subjective. Implementing an unrealized gains tax would require regular asset valuations, increasing complexity, and compliance costs.

- Increased Administrative Burden: The tax system would need to track asset values on an ongoing basis, requiring more extensive record-keeping and reporting, both for taxpayers and tax authorities.

4. Impact on Wealthy Individuals:

- Higher Tax Burden: Wealthy individuals, who typically hold a large proportion of their wealth in unrealized assets like stocks, would bear a significant portion of the tax. This could reduce wealth accumulation and shift capital allocation decisions.

- Asset Flight: High-net-worth individuals might seek to move assets to jurisdictions without such taxes, leading to potential capital outflows and tax base erosion.

5. Economic Efficiency:

- Distortion of Asset Allocation: By taxing unrealized gains, the government may distort investment decisions, pushing capital away from certain assets or sectors. This could lead to inefficiencies in the allocation of resources in the economy.

- Impact on Startups and Innovation: Startups and innovative companies, which often see rapid increases in valuation without immediate liquidity events, could be disproportionately affected. Founders and early investors may face tax bills without having the cash to pay them.

6. Revenue Generation:

- Potential for Increased Revenue: In theory, taxing unrealized gains could generate significant revenue for the government, especially from wealthy individuals with large asset portfolios. However, this would depend on the structure of the tax and its enforcement.

- Revenue Uncertainty: The tax could result in unpredictable revenues, as market fluctuations would cause significant variability in asset values and thus tax liabilities.

7. Fairness Considerations:

- Debate Over Equity: Proponents argue that taxing unrealized gains would address wealth inequality by ensuring that the wealthiest individuals contribute more to public finances, as they often avoid taxes by holding onto assets. Critics argue that it is unfair to tax gains that have not been realized and that the tax could disproportionately affect those with illiquid assets.

8. Impact on Retirement Savings:

- Effect on Retirement Accounts: Taxing unrealized gains in retirement accounts, such as 401(k)s and IRAs, could reduce the growth of retirement savings, affecting individuals’ long-term financial security.

9. Legal and Constitutional Issues:

- Potential Legal Challenges: In some jurisdictions, taxing unrealized gains could face legal challenges, as it may be seen as unconstitutional. In the U.S., for example, the Constitution requires taxes on income, and there could be debates over whether unrealized gains constitute income.

10. Behavioral Responses:

- Tax Avoidance Strategies: Individuals and businesses may seek out tax avoidance strategies, such as restructuring asset ownership or moving assets offshore, to minimize the impact of the tax.

Implementing an unrealized gains tax could have far-reaching and complex consequences. While it may help address “wealth inequality” and increase government revenues, it could also lead to significant economic distortions, compliance challenges, and unintended market impacts. The design and implementation of such a tax would require careful consideration of these factors.

Governments are spending more

For the last few decades, federal and state governments have sought greater revenue rather than reducing spending. Governments have grown their number of employees by 8.8% over the last 20 years. Considering how computers and rapid communication should have reduced the number of government employees, they continue to grow.

About 14% of the federal budget is paid to employees. By all measures, this part of the budget should have shrunk. This is just one area where the growth of spending is demanding more and more income from the private sector.

This article has been provided for informational purposes. At the end of this year, unless Congress reauthorizes the 2017 tax act, all of our taxes will increase, not just the top rate. Individuals and married couples will get hammered.

Tax Loopholes

You often hear politicians calling the use of “tax loopholes” by corporations and rich people as wrong, illegal, unethical, etc. All of these descriptions are inaccurate. Want to know what a tax loophole is:

Tax Loophole: A Legal Way to Reduce Tax Liability

A tax loophole is a provision in the tax law that allows individuals or businesses to reduce their tax liability in a way that is legal but often seen as unfair or unintended. These loopholes can be exploited to reduce tax payments, sometimes significantly.

How do tax loopholes work?

- Exploiting specific provisions: Taxpayers may find ways to structure their financial affairs to take advantage of specific deductions, exemptions, or credits in the tax code.

- Unintended consequences: Sometimes, loopholes arise as unintended consequences of tax laws. These can be due to unclear language, complex regulations, or unforeseen circumstances.

- Aggressive tax planning: Taxpayers and their advisors may employ sophisticated strategies to minimize tax liability, often pushing the boundaries of legal interpretations.

Examples of common tax loopholes:

- Charitable deductions: Misusing charitable deductions for personal gain.

- Business expenses: Claiming personal expenses as business deductions.

- Offshore tax havens: Holding assets in countries with low or no taxes.

- Investment strategies: Using complex financial instruments to defer or avoid taxes.

My suggestions in closing are:

1. Contact your federal elected officials, and tell them to reauthorize the 2017 tax cuts

2. You disagree with higher taxes on wealthy and corporate taxes

3. Explain that they need to create a balanced budget, cut spending to reduce inflation

4. State and local governments stop borrowing money to balance budgets. If there is a worthwhile project, bring it to the people for a funding vote.

We need to pay taxes

Our society would not function without tax revenue. Everyone needs to pay income taxes. I will leave out the “fair share” for you to decide. If this article gave you the sense that it was wrong to pay income taxes or that the government should not be spending our tax money, let’s correct it here. The purpose of this article was to clear the air on who is paying what.

Don’t let anyone convince you that corporations are not paying their “fair share”. As long as corporations follow the law and pay corporate taxes that are due, they are paying their “fair share”. You could say that with nearly 1/2 Americans not paying income tax, some individuals are not paying their “fair share”.

Thank you for reading this article. Do not forget to vote for the individuals who will spend less, tax less, and leave us to retain as much as we can. Taxes are important, we need police, national security, and more but the government is not our parents.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.