Last updated on October 23rd, 2025 at 11:57 pm

Good news, if you are a senior, you may not be required to file a federal return for tax year 2024 (in 2025). If you decide to file your tax return on the 2024 1040-SR form, this article shows you how to use this special form just for Seniors. Our example below shows a married couple filing jointly, paying zero federal income taxes.

This article will be updated in January 2026 for the tax year 2025. This article still contains valuable tax planning benefits for 2025 that you need to implement before December 31, 2025.

I want you to understand the entire process, including many not-so-obvious things about our tax policy. Watch the YouTube video near the end of this article; it will take you through the entire filing process.

Your taxes are delinquent if they have not already been postmarked by April 15, 2025. File as soon as possible to mitigate the fees. The IRS charges interest on any amount due that was not paid by April 15, 2025.

IRS form 1040-SR

this special form was created just for seniors and contains a method to obtain that “extra” senior deduction.

This article will help you understand how to complete your 2024 senior income tax return and file it early. Remember, tax avoidance is legal and almost a duty. Tax evasion is illegal and a crime. You should never pay more taxes than you are required to pay, and to ensure that, we provide detailed information about the process below.

Congress recognized that many seniors do not have complex financial issues that require the traditional long form 1040. If you are 65 years old and you are required to file a federal tax return, you can use the simpler Form 1040-SR. You can prepare your return during tax season; you may not need the assistance of tax professionals if your income, for example, only comes from Social Security Benefits and perhaps a small pension.

Tax Returns – Automatic Extension Due

The 2017 tax law reduced seniors’ income tax

I recommend filing a return the year after you retire, even if your income does not require you to file. Why? Because the IRS does not know that your income dropped. They may request a return if you did not file one. In a perfect world, this would not happen, but the government is far from perfect. Another great reason is that if you intend to buy a house or finance something, you may be asked for an income tax return.

Are you aware that Social Security income is taxable? You have already paid taxes once, and you may pay taxes twice on the same income. If you exceed the income limit of $30,700 when filing jointly as seniors, you may be subject to federal taxes (and possible state taxes) on a portion of your income.

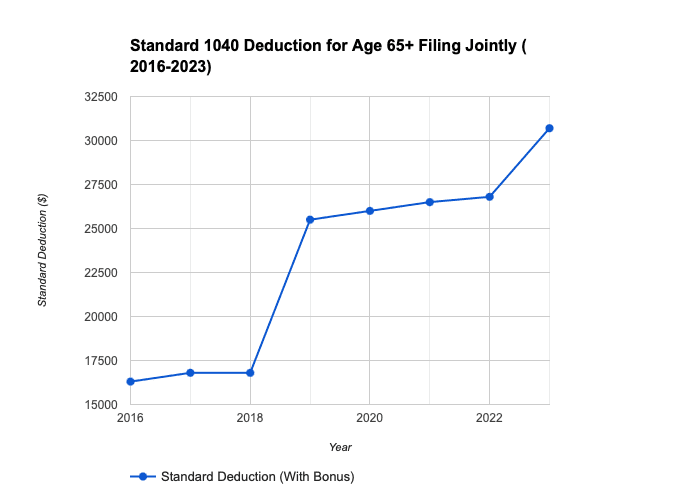

Congress 2017 passed a large tax reduction bill that went into effect in 2018. The new law reduced tax liability for the majority of Americans, and in some cases by a substantial amount.

One of the major changes was offering a larger standard deduction, about double the old standard deduction. The reason for the larger standard deduction was to simplify the process by eliminating the need for most Americans to itemize their deductions.

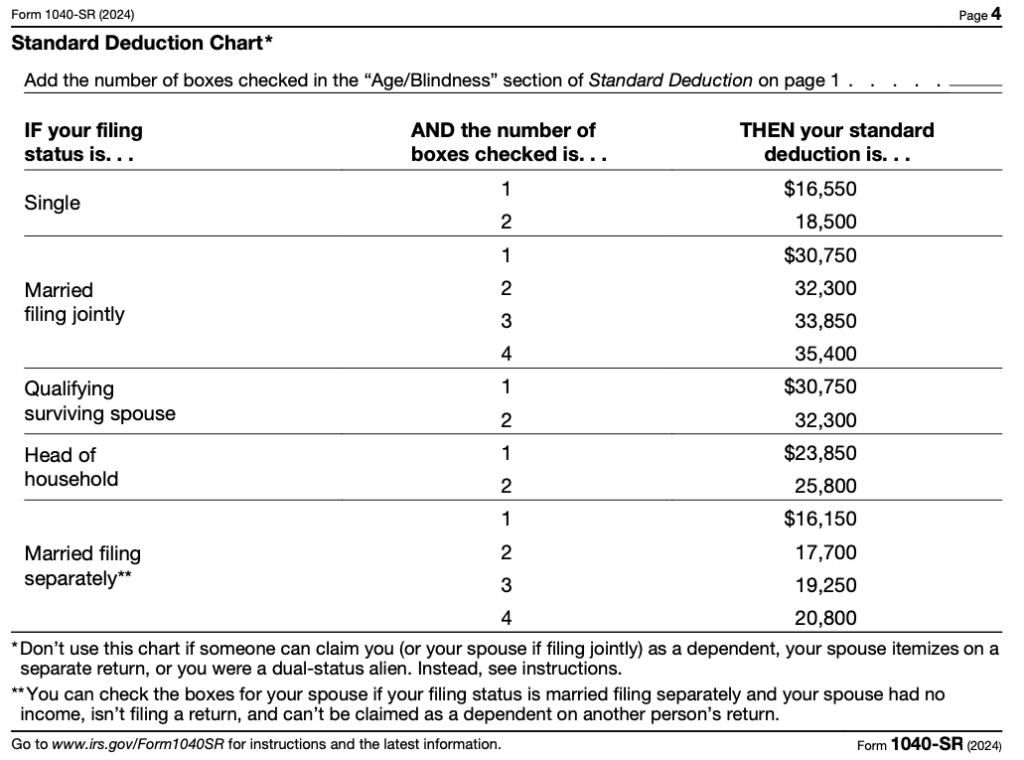

Standard deductions for tax year 2024

The 2024 standard deduction for senior couples is now $30,750

The higher standard deduction for 2024 for a married, senior couple is now $30,750. Most people will find it difficult to exceed this deduction by filing an itemized return. Take, for example, your largest deductions which are for mortgage interest and property taxes.

The law now puts caps of $10,000 on each category, which means that if you live in a high-cost state, the maximum in all government taxes you can deduct is $10,000. These caps will usually mean that you no longer need to itemize your deductions, as they are unlikely to exceed $30,750 for a married senior couple filing a joint tax return.

A substantial number of seniors, including those who are retired and live on Social Security Income alone, will pay zero income taxes under the new law. Married taxpayers supplement their Social Security with pension income and may or may not owe taxes. You may qualify for a total disability tax credit if you qualify. Some people who have permanent disabilities will have to meet specified income limits to be eligible for this deduction.

Another change to the law includes charitable contributions. At this point, you’d best make charitable donations because you want to help rather than to obtain a deduction. The tax law effectively wiped out the charitable deduction for individuals.

Yes, you still read about using this or that to gain tax benefits from your donation. Businesses can still donate and receive a business tax deduction, but Seniors need to find other venues to reduce taxable income.

Congress changed the tax code in 2017 as a result:

Many seniors will not pay income tax on their 2024 income. Note: THE NEW STANDARD DEDUCTIONS WILL EXPIRE AFTER THE 2025 TAX YEAR UNLESS CONGRESS REAUTHORIZES THE ACT

You can contribute to an IRA and receive a tax credit

Medical bills and dental expenses, along with other qualified medical expenses, can be deducted; however, you can not deduct any of these unless they exceed 7.5% of your adjusted gross income. Most seniors will not be able to use this deduction due to the larger standard deduction than the 7.5% threshold.

Most Americans do not qualify to use medical deductions at all for the same reasons, even when they are working and making a larger income.

A married couple filing a joint return will see some benefits by making contributions to a qualified traditional IRA. Many retired people do not have excess income to contribute to an IRA. If you have a source of income e.g. job or self-employment, you can reduce your tax bill by making a contribution to a qualified IRA up to the specified limit.

This is a good way to reduce your tax rates. The IRS also has a catch-up contribution program that allows you to add more than the general limit for seniors and others who qualify.

2024 IRS Income Tax Rate Table

| Rate | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | Up to $11,000 | Up to $22,000 | Up to $15,700 |

| 12% | $11,001 – $44,725 | $22,001 – $89,450 | $15,701 – $59,850 |

| 22% | $44,726 – $95,375 | $89,451 – $190,750 | $59,851 – $95,350 |

| 24% | $95,376 – $182,100 | $190,751 – $364,200 | $95,351 – $182,100 |

| 32% | $182,101 – $231,250 | $364,201 – $462,500 | $182,101 – $231,250 |

| 35% | $231,251 – $578,125 | $462,501 – $693,750 | $231,251 – $578,100 |

| 37% | Over $578,125 | Over $693,750 | Over $578,100 |

Required Minimum Distributions Age 72+

In the event that you have not yet reached age 72+, you should know that the IRS wants you to start taking minimum distributions from your individual retirement accounts unless you are still working. As with most tax laws, there are always more details to consider, including the fine print.

Most retirement plans provide for pre-tax deposits into a fund. This means your government is loaning you the amount of taxes that are due at the time. They want their money back, and this is how the mandatory distribution has come into being.

Many people are unaware of mandatory distributions. Your retirement program provider should automatically send you an annual distribution if you do not request one during the year that equals or exceeds the minimum. If you are fortunate and have invested well, you may be able to beat them at their own game.

Assuming you do not need the funds, the IRS makes you take a distribution. That amount should, if everything goes well, be less than what you have earned on the investment in interest and dividends during the year.

RMD Calculations

The IRS Required Minimum Distributions are calculated using a table found on the IRS website. The process is simple. The IRS has determined how long you are likely to live based on its actuarial tables and determined that you need to take out those funds to pay tax on them. According to Appendix B Table 1 “Single Life Expectancy” table, a person who is age 73 is expected to live 16.4 years.

Determine the balance of your taxable IRA fund at the end of the tax year and divide that balance by 16.4 to determine how much of that fund you must withdraw by April 15. If you had $200,000 in your account, you would be required to withdraw $12,195.

Most fund managers will make an automatic distribution to you and deduct federal taxes unless you make a withdrawal of at least the minimum required. The automatic distributions usually occur in March or April. It is your responsibility to make sure the RMD happens before April 15. The penalty for not withdrawing on time is severe.

Earn the highest return to compensate for mandatory withdrawals

If this is the case, your retirement funds will remain at or close to the level that you contributed. You can then remove what you want in subsequent years at your own pace. The key takeaway with all of this discussion about mandatory withdrawals is that the funds you remove from a traditional IRA and 401 (k) will be subject to income tax at the federal level and possibly by the local government in the form of state income taxes.

The state you work in and the location of your primary residence will have an impact on if you are required to pay state income taxes. Having a principal residence in state X does not preclude state Y from charging state income tax if you work from your residence in state x and your office is in the other state y.

I know of someone who lives in one state and works from home. The office is in another state that claims it wants income tax from the employee working from home in that other state. You would think this should be illegal, but it is not. Just something to consider if you plan to move.

California charges state income tax on retirement income

Some states have very high state income tax rates and even charge state income tax on Social Security income. Just when you thought that you were exempt from federal taxes, you may find that you owe taxes to your state. A few states do not charge state income tax or tax on retirement income.

Mississippi for example, charges zero state tax on disability income, offers income tax credits, and permits deductions similar to the federal tax system. Something to consider if you are contemplating a move.

If you live in California, withdrawals from 401k, IRA, and other retirement plans are subject to state income tax. There are actually many states that require taxes to be paid on retirement income. Cities can and do charge income tax. New York City and cities in Pennsylvania are places I know that charge local taxes. Be sure to check if they require an actual tax return to be filed.

I have mentioned married filing jointly throughout this article; single taxpayers are entitled to deductions as well, which are generally one-half of those for married, but not always. Single filers are classified as either single or heads of households.

See the tables provided by the IRS on taxes owed in a taxable year by your filing status. Tax breaks are similar to all classes, but there are some special breaks for children and dependents. A dependent care credit, for example, is available to those who qualify.

Large withdrawals from retirement accounts can be taxable

April 15 is the deadline to file federal taxes. You can ask for an extension of time in some cases, but keep in mind, you should pay what you think you owe by April 15 to avoid penalties. Tax planning does not stop on the last day of the tax year; the IRS allows deposits for some things until April 15, such as IRA contributions for the prior year. You should, however, get ahead of the planning process long before the end of the year.

The main thing for older adults is to plan for those IRA deductions. Taking out a large amount in a tax year can expose you to a large tax liability. In an ideal world, you want to wait to withdraw a large amount for income tax purposes until you have large tax deductions to apply against what will be new income. This is not an issue if you are withdrawing funds from a Roth IRA.

Don’t withdraw large amounts from a traditional IRA at the end of the year. If you can wait until next year, you will have at least 12 and up to 15 1/2 months before the tax amount is due. I recommend that you seek advice from your tax advisor, who should be a CPA, if you have complex investments and tax issues.

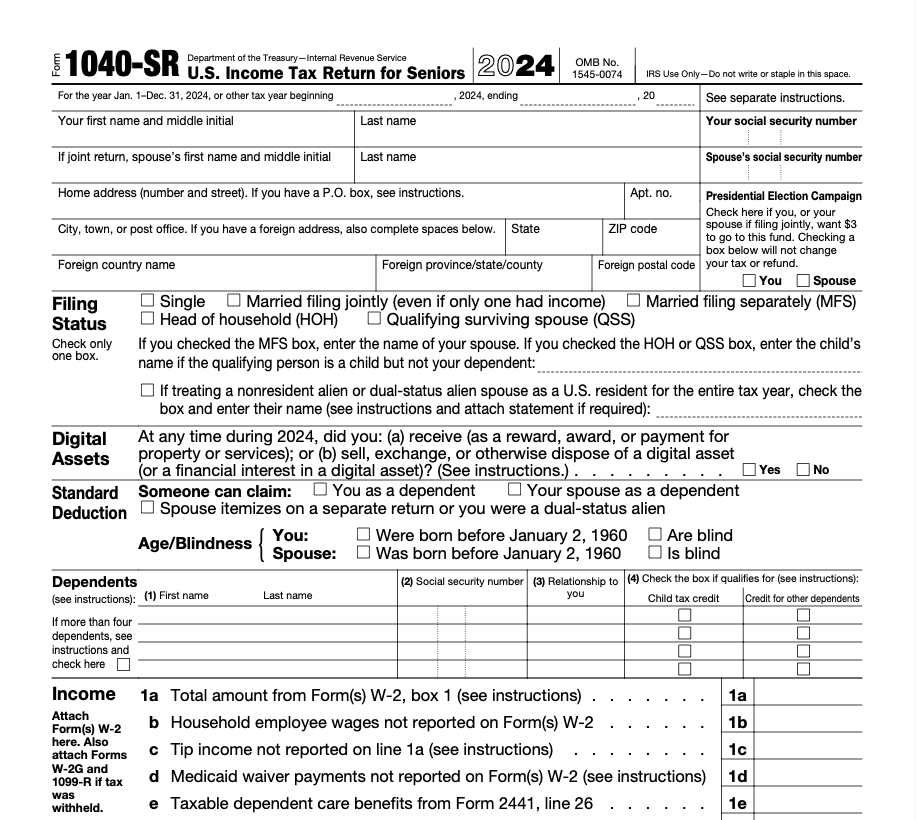

Time to look at the 1040 senior’s income tax form. Watch our YouTube video also to learn how to complete your 1040 seniors’ income tax form and determine if you owe anything.

2024 IRS Income Tax Forms

Retired Taxpayers – Sally and Paul Jones are an example

How would the 2017 tax law affect retired taxpayers who are drawing Social Security and receiving dividends from their retirement accounts? Let’s explore that process A common misconception for those years from retirement is that they will not pay taxes in retirement.

This may be true for the lowest-income retirees, but for many who have planned and saved, they will earn enough in Social Security, investments, and other income streams to pay income taxes to the federal government and perhaps to their state and even city government.

I will go through the Form 1040-SR line by line and describe what you should indicate in each box. A fictitious couple over 65 years old, named Sally Jones and her husband Paul Jones, are filing their 2023 1040-SR form. Follow along below:

Filing Status

Select the correct filing status. If your spouse passed during the year, you may want to check QSS by clicking here for instructions on QSS and other filing statuses. For this example, our fictitious married couple, Sally and Paul Jones, are filing as Married filing jointly.

Sally and Paul have entered their names and addresses. Be sure to enter your correct Social Security numbers; this is how the IRS processes your return. Funding the federal election, you are not donating, nor will this come from your refund. If you do not check, that’s ok.

An important note: If one or both seniors are blind, be sure to check the Age/Blindness box both for your age being born after January 2, 1959, and that you are blind. Each box checked provides one additional deduction. If one of the couple were blind, three boxes would be checked, indicating that the standard deduction would be $32,200 instead of the $30,700 standard deduction.

Extra Deduction for the Blind

Seniors receive an extra deduction and seniors that are blind receive an additional deduction for each married individual who is blind

Digital Assets

This is new. The IRS is attempting to track “Bitcoin” and other crypto or digital currency transactions. The Joneses checked no. If you check yes, the IRS will expect you to complete other forms related to the transaction. See the IRS instructions for more information on this.

Sure, here is the graph:

Standard Deduction

No need to check any boxes here; you get the standard deduction automatically on this form. Check the boxes if one applies. If you are a senior and a caregiver, such as your son or daughter is claiming you as a dependent, you would check the box that applies. Check with your tax advisor about this if you check a box. The IRS does not allow both you and someone else to claim you as a deduction.

Check the age boxes that apply. Only check the blind boxes if they apply. You must check the boxes here to calculate your taxes on the form. The IRS could have made this easier by keeping the age and blind boxes separate. You should know that seniors’ income tax form includes in the standard deduction an extra deduction for those over 65. Your friends and neighbors under 65 have a lower standard deduction.

Dependents

If you provide the majority of support for someone, you can list them as a dependent. Be careful here, if the person is earning income that will offset what you pay in support. The rules are basically (check for specifics) these:

You must provide 50%+ for support of children aged 19 or younger, or age 24 if a student and younger than you and your spouse. They can not file a tax return. They must live with you for more than half of the year. The IRS may check on these details, be clear about them, and have documentation.

Adults supporting their senior parents can consider that person a dependent, or if they are disabled. Other family members and individuals can qualify as well. Be sure to check out the specifics of the current IRS rules before you list anyone as a dependent on your tax return.

I skipped over the child tax credit and other credits here because most seniors will not be using these boxes. If you have a complicated situation, consult the IRS or a CPA for more information.

Income

The Smiths have no W-2 income or earned income. The Smiths are fully retired and do not have jobs that would provide a W-2 form. I am skipping b, c, d, e, f, g, h, i, and z. No need to do anything with those boxes unless they apply to you. They do not apply to the Joneses.

Lines 2a and 3a refer to tax-exempt interest and qualified dividends. You will know if you have any because you will receive 1099-Int and 1099-OID forms from providers. All you need to do is enter the amounts if they are below $1,500 into the 1040-SR form. If the amount is more than $1,500, you must use Schedule B, which is nothing more than a list of the vendors and amounts plus boxes to check about any foreign accounts and trusts. Simple.

4a is for any distributions that you receive from an IRA (not a Roth). Total the amounts on the forms provided by your vendor and enter the information here. There are more instructions on this for more complicated transactions; you can review them if necessary. 4b is the taxable amount of the distribution. Usually, the entire distribution is taxable. There are some circumstances when this may not be true, so check with your IRA provider.

Attach forms 1099-R, which you will receive and use to complete 5a. These forms are important to show the IRS the taxes that were already taken out. If no taxes were deducted, don’t attach the form. There is a tax annuity worksheet in the 1040-SR instructions on page 28.

Social Security Worksheet

You will receive a 1099-R from Social Security for the amount of Social Security benefit you received, which is entered on line 6a. Go to line 32 in the IRS instructions to fill in the Social Security worksheet, or use our free Google Docs spreadsheet to do the work for you. Download the worksheet and use it on your own computer.

The Social Security worksheet will help you understand how to calculate if you have a tax liability from your Social Security payments.

Capital gains number 7. If all you have is standard capital gains, you can enter the amount here from the 1099-DIV form provided to you by your broker. Should you have some more complicated gains, such as deferrals, etc, you will be required to file Form 8949 or Schedule D. The Joneses have straight capital gains.

Line 8 involves lots of extra lines of other income that most people do not have. If you are curious, you can look at Schedule 1

Your total income before deductions

Line 9, as you can see, the $24,295 entered on line 9 is from the other lines above. Since there is nothing on line 10, the same number comes to line 11, adjusted gross income.

Your adjusted gross income means this is the total income before taxes are applied. This is the number that lenders want to see on loan applications. If you are ever asked about your income, this is the source for that information.

The standard deduction is found at the bottom of the 1040-SR form (scroll down above). I chose the amount under “married filing jointly” with two boxes checked. If your situation is different, select the box that best fits your filing status.

If you have a business, you will need to complete Form 8995 or Form 8995-A for business income and insert the total here. Many people have side businesses or even full-time businesses in retirement. That income flows into this form.

Line 14 just brings down the total to 30,700 from line 12. Line 15 in our example indicates -6,406, which means you have no taxable income.

It seems that Sally and Peter owe zero income tax. Line 15 is the key here.

Since there is nothing to enter from line 16 through line 32, bring the total due to zero to line 33. Go further to line 37 and enter zero again. The seniors’ income tax form indicates that Sally and Paul will owe zero taxes, and this is because they have more in deductions than they have earned in income.

A word about the lines we skipped in the payments section. Some distributions from IRAs and pension plans include a deduction for taxes, which is submitted to the IRS by your vendor. It’s important if you paid any taxes with these distributions that you list those taxes on the appropriate line, usually in 25b.

In this example, if you paid $500 in income taxes, which were deducted from your IRA plan and paid by the brokerage firm to the IRS, you would be entitled to a refund, and this would require filling in some of the blocks from line 25 through lines 33. Go to the refund lines 34 through 36 and enter the necessary information to receive a refund.

Your status may be different from our example. Go through the process with the senior’s income tax return form and see if you will owe taxes. If you do, you must file by April 15. File early.

Deadline to File the Extension – Federal Taxes 2024: How to File an IRS Tax Extension and New Due Date

If you’re not ready to file your federal income taxes by April, don’t worry — you can request more time. In this article, we’ll explain the 2024 IRS tax extension process, including:

- The deadline to file a federal tax extension

- How to file IRS Form 4868

- How long the extension lasts

- Important IRS rules you need to know

🗓️ What Is the Deadline to File a Federal Tax Extension for 2024?

The IRS deadline to file a tax extension for your 2024 return is:

📌 April 15, 2025

This is the same date your original tax return and payment are due. Filing an extension gives you more time to file your return — not more time to pay taxes owed. You must still estimate and pay any amount due by April 15 to avoid interest or penalties.

🧾 How to File a Federal Tax Extension (Form 4868)

To get an automatic 6-month extension, you must file IRS Form 4868. You can do this in three easy ways:

✅ 1. File Online via IRS Free File or Tax Software

- Visit IRS Free File to e-file Form 4868

- Use tax software such as TurboTax, H&R Block, or TaxAct

✅ 2. File by Mail

- Download IRS Form 4868 (PDF)

- Mail the completed form to the IRS address listed in the instructions for your state

- Must be postmarked by April 15, 2025

✅ 3. Make a Tax Payment Online

- Pay your estimated taxes via IRS Direct Pay or the Electronic Federal Tax Payment System (EFTPS)

- Select “extension” as the reason for payment

- This counts as a valid extension request — no need to file Form 4868 separately

⏳ How Long Does a Tax Extension Last?

If you file for a 2024 tax extension, the IRS will grant you six additional months to submit your return.

📅 New Tax Return Due Date: October 15, 2025

This extra time can be especially helpful if you’re waiting for missing documents or working with a tax professional.

⚠️ Important IRS Tax Extension Reminders

- An extension gives more time to file, not to pay.

- You must still pay your estimated 2024 taxes by April 15, 2025 to avoid penalties and interest.

- If you’re expecting a refund, there’s no penalty for filing late — but filing an extension helps you stay compliant.

- Special rules may apply for taxpayers living abroad or active-duty military in combat zones.

🔍 Why File a Tax Extension?

You may want to file a tax extension if:

- You haven’t received all your tax documents yet (e.g., K-1, 1099s)

- You need more time to organize deductions or credits

- You’re waiting on a CPA or tax professional to help you file

- You’re experiencing a personal emergency or life event

✅ Summary: 2024 Federal Tax Extension Key Facts

| Requirement | Details |

|---|---|

| Extension Deadline | April 15, 2025 |

| IRS Form | Form 4868 |

| Extension Length | 6 months |

| New Filing Deadline | October 15, 2025 |

| Still Have to Pay? | Yes, by April 15, 2025 |

Need more help with your tax situation? Let us know in the comments or contact a trusted tax professional for personalized advice.

Checking on the status of your refund

You can check the status of your return at the IRS website by using this link. You may be able to file your senior’s income tax return for free if you qualify for assistance. Check out this link.

Seniors Income Tax 2025: Tax Strategies

Click the button below to view the YouTube video that is a companion to the one above. Now that you understand where you would be regarding refunds, taxes you owe, or the fact that you owe nothing, you can start there and begin to formulate a plan to increase the amount of funds taken from your taxable IRA and pay little or nothing in Federal income taxes.

This strategy works through December 31 for actions taken between the time you read this and the end of the year. If you have missed using the strategies for the 2024 tax year, plan for 2025. The major differences between the two years are likely to be only your higher Social Security income in 2024 and a higher standard deduction. Don’t wait until you pull out a large amount from your taxable IRA and end up paying a big tax bill.

People often ask, “I am retired, will I owe taxes? Check out this article.

Thank you for visiting our blog. Please leave comments below about this article and others on this blog site. Click on our links to similar articles, such as this one Why Florida? Consider the best alternative now before moving and Why I Decided to Retire in Ocean Springs, Mississippi. Retirement in five years: Don’t fail to plan now and Buy your retirement home before you retire

Disclaimer: This is not tax or financial advice. You are encouraged to consult the IRS website or seek assistance from a CPA if you require more information. If you are over 65, you are not required to use the Seniors Income Tax form 1040-SR; it is an option.

PODCAST

Weapons Used In 1776: Revolutionary War Weapons, Tools, and Uniforms – RetireCoast

- Weapons Used In 1776: Revolutionary War Weapons, Tools, and Uniforms

- Shamrock Shenanigans and Southern Charm: A Guide to St. Patricks Day on the Mississippi Gulf Coast

- Who We Were in 1776: The People Who Became Americans

- 11 Best 2026 Tax Changes Millennials and GEN Z Should Understand NOW!

- Behind the Lines of 1776: Camp Followers and the Forgotten Backbone of the American Revolution Episode

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.