Last updated on October 17th, 2024 at 02:34 pm

You love to start each morning with a frappuccino cafe latte or other fancy coffee drink. That coffee costs you about $5 and that’s only if you have one each day. Plus that 20% tip to the barista. Some have an iced coffee drink for lunch or later in the day. I was one of you until I determined that $150 per month or more just for coffee was over the top. Coffee and your budget are part of what we will discuss here.

That was many years ago. I am among you coffee drinkers but one a day is good for me. Starting the morning with a cappuccino is perfect. I do not do the sugar drinks, just a perfect cappuccino when I can get one starts my day.

You are about to find out how your financial health is directly connected to your cold brew at the local shop. It seems that we look at buying our morning coffee as one of life’s bare necessities. Don’t worry, I am not going to tell you to forgo good coffee. As fellow coffee lovers, we need a solution that does not have a big impact on our lifestyle or budget.

Considering the cost of the drink and the fact that more often than not the “baristas” do not have a clue about how to make a perfect cappuccino (1/3 expresso, 1/3 foam, 1/3 milk), I looked for another solution. What I found was that I could buy an expresso machine, and use my own coffee beans and milk to make my daily coffee.

Granted, the cost of the match that uses fresh milk to make a fully automatic cappuccino was a large amount of money. I ran the numbers and found that my financial situation would improve with the machine.

$1,000 expresso machine saves money

The $1,000 Italian coffee maker can be set to make exactly what I want. No mess and quick. Just plug in the milk container from the refrigerator and punch the button for a cappuccino. The machine allows for tweaking of the process to change the amount of coffee or milk. This way I get my daily caffeine fix and change my spending habits at the same time. I have had my machine for over 10 years. Almost every morning I make a Cappucino for myself and on occasion for my wife.

Using current costs for a large bag of Starbucks Expresso beans and milk, I have determined that the cost of a 16-ounce cup (a grande in Starbucks terms) has a cost of just less than $1. This cost of one dollar takes into consideration the depreciation of the machine at a rate of five years.

Since it has lasted 10 years, my actual cost is far less. Do you see where I am going with this? In the long run, making your daily latte will help you with that budget issue.

The reason that I bring up this topic of coffee is to demonstrate an important point about a budget that many do not comprehend. Spending big bucks on fancy coffee is a big deal and just the start of the bad habits you can get into with managing money. Those of you who smoke or vape add even more to the cost of living.

No need to give up that cappuccino

At no point have I suggested that you give up that hot coffee, on the contrary, you need these small things to make your day bearable. You do not need other things such as tobacco and vaping. You need fuel for your car and eggs for breakfast. These needs can also be satisfied with a budget.

As I mentioned above, I buy Starbucks beans. The main reason is that they are well-priced at Costco in large bags. I often use the Sams and Costco Expresso coffee beans and find them to be satisfying. A good cup of coffee comes from not only beans but the milk and how it is made. Also, I usually drink from my own mugs except when I am on the go then I use a paper cup.

Those little things can be important but they can be expensive as well. There are ways you can satisfy your needs a little bit by paying attention to the cost and looking for alternatives. Since I started talking about your budget (and coffee), let’s explore this topic a bit more.

What can you do with the extra money you save each day by reducing the additional cost of buying your favorite drink of coffee? I spend $30 per month on my perfect best coffee vs the $150 that I would otherwise spend.

Spending on morning fancy coffee can have other effects

Let’s look at how spending on your morning coffee has an effect on other areas of your life and your budget.

- Daily Habit Impact: Regularly buying fancy coffees, which can cost anywhere from $4 to $7 per cup, can add up quickly. For example, spending $5 daily on coffee amounts to $1,825 per year. For young people with limited budgets, this expense can represent a significant portion of discretionary spending.

- Lifestyle Choices: Fancy coffee purchases are often seen as part of a broader lifestyle choice. It may indicate a preference for spending on small luxuries, which can reflect a larger pattern of spending on non-essential items. This behavior can strain budgets, especially for those who are not tracking expenses closely.

- Opportunity Cost: Money spent on daily coffee could be saved or redirected toward other financial goals, such as paying off debt, investing, or building an emergency fund. For those on tight budgets, reallocating this money could have a more significant positive impact on financial health.

- Budget Awareness: Younger people who frequently buy coffee may not be fully aware of the cumulative impact on their budgets, especially if they aren’t actively managing their finances. This lack of awareness can lead to overspending in other areas as well.

- Cultural Influence: Social and cultural factors often play a role, with coffee shops serving as social hubs and symbols of lifestyle, making it more tempting for young people to spend on these small but frequent indulgences.

- Budgeting Tools: Those who budget effectively can accommodate regular coffee purchases without significant financial strain. However, for those who don’t track their spending or are living paycheck to paycheck, frequent coffee purchases can exacerbate budgetary issues.

In summary, while spending on fancy coffees is just one element of overall financial behavior, it can reflect broader spending habits that impact young people’s budgets, especially when combined with other discretionary spending.

Invest to make money

Consider the impact on your personal finances if you were to save $120 per month times multiple items. When you go shopping, how often do you buy name-brand products? Stop. Do you really think that there is a factory for each product on the shelf? Grocers buy products with their own names from the same brand name producers who sell at a higher price. Most of the time the product in the container is the same.

Think about spaghetti for example. You can buy the store brand or you can buy a name brand. Take a close look at the products in the packages. Do you see a big difference? The fact of spaghetti is that you will be buying or making a sauce that will disguise the real taste of noodles anyway.

The good news is that there are alternatives for almost every brand-name product you buy. Several years ago, I started trying some of Walmart’s own products. About 90% of the time I was impressed that they were as good if not better than the brand name products that I had been buying for years.

Change buying habits

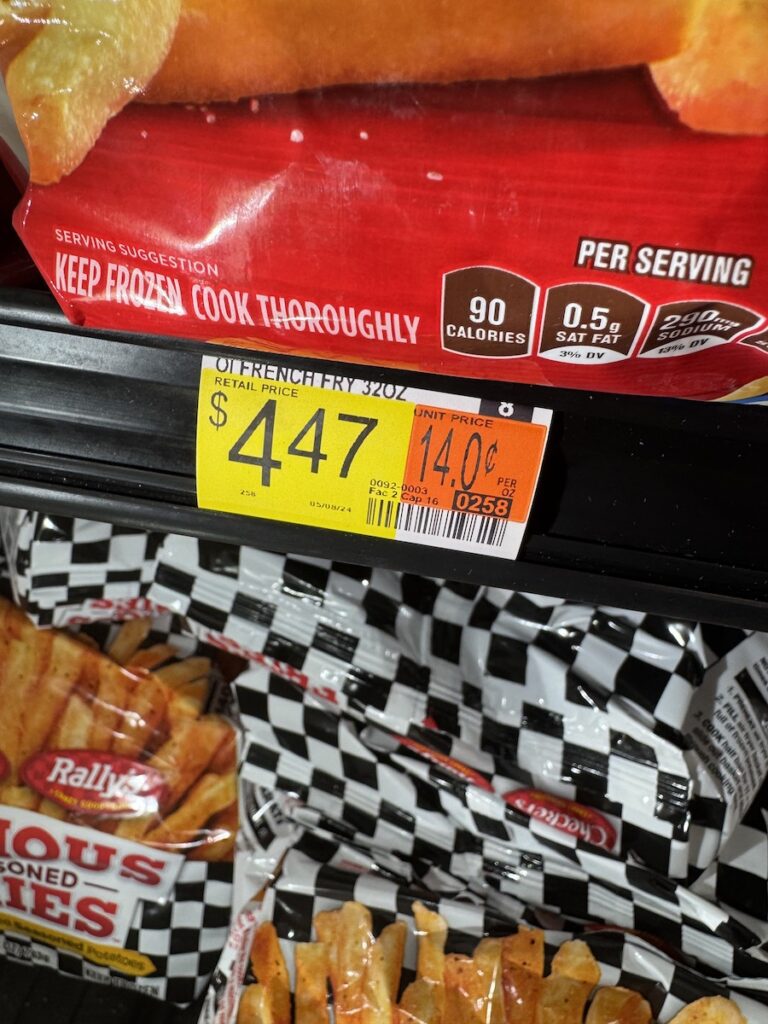

We bought an air fryer and found that the cost to buy french fries was high in those small bags made by burger firms and sold even at Walmart. After trying the Walmart brand of steak fries a single time, I decided it was time to change most items that I bought.

Your monthly budget can improve significantly if you focus on value rather than advertising for your choices. Not just in food but in other things as well. Young people spend more on name-brand clothing than any other group.

We all know that regardless of the brand most clothing is made in a sweatshop in China. How do you think department stores can have a 50% sale? If you really have to wear only name brands, look around for them on sale. You will achieve your financial goals faster if you realize that you don’t need everything that others have.

You can buy clothing for a fraction of the cost if you buy from big stores or when they are on sale. Do you think your friends will leave you if you do not wear brand X shirts? If that were the case, have them buy your clothing. Perhaps you are all in the same situation and do not talk about it. Imagine a conversation at a bar.

“I was going to buy a cool shirt at Costco but I was worried that you guys would think I was cheating out”. Then another person in the group would say, wow, I thought about that too. I can afford to buy a few of those shirts vs one of brand X.

Mr. Wonderful inspired this article

I must admit that the idea for this article came from an interview with Mr. Wonderful, Mr. Kevin O’Leary. He talked about the morning coffee and how much people can save by focusing on purchases (to improve their budget). I completely agree with him. Lots of people think they will change the next day and that next day never comes.

The economy is terrible for many people including those who are doing the coffee shop experience. There are many who complain about inflation and how badly it has affected them.

Consider this. If you are one of those who feel that they need to tip 18,20,25,30% when going to a restaurant, think again. I appreciate the fact that people who work on tips need to earn. The best thing about working in a tipping environment is that as long as business is good, their income increases with inflation.

Give 15% of a $50 bill which is $7.50. When the state increases sales tax, that can go up to $7.75. When the bill goes up to $60 because of inflation, their income goes from $7.50 to about $9 plus the additional amount for state taxes. You see there is no need to continue to hike up the percent.

Yet, I see young people picking the box with higher percentages when it comes up on the screen. Why? Do you think you are doing better than the waiter? What about when the tip thing comes up on the screen at a self-service place? Do you tip when all you did was walk in and pick up your pizza to go? Can you really afford to do that? If you are having trouble paying rent and your car payment you need to stop giving your hard-earned money away.

Tipping have you considered it?

If you want to give higher tips, take it from your coffee fund. Why? because you are not allowed to print money. If you are not making enough why give it away? This holds true for overpaying at the grocery store for those brand-name hot dogs. People do not get wealthy by overspending. They get wealthy by budgeting their income and expenses and living well but not extravagantly. All of that comes later along with real problems such as where I spend my billions.

When you go to grocery stores and places where credit cards are used, are you prompted to donate? Round up to the next dollar? Stop. Do you know what the funds are for or who they go to? Those retailers get credit for giving the money, you get nothing for your money. If you are inclined to donate money, give it to a charity or cause that you support and know where the money is going.

Donations, hold off

It bothers me when a retailer says they gave x million dollars last year to a cause. Not true in some cases, it was your money and they get credit for your donation. Before you give money away consider your situation, can you afford to? There will be a time later when you will have disposable income you can donate. Just wait until that happens. This is why you see older people who have made it in life donate money and time to worthy causes. Your time will come.

Take a look at your cell phone plan. Are you paying too much? Are you paying for someone else’s cell phone? That monthly payment is getting to be big for many people. Avoid impulse purchases and watch that credit card debt.

Sit down and create a budget. Understand that you are not the government. You must live within your means. Don’t borrow what you can not afford to repay. Create a savings account and use it. Also, create an emergency fund perhaps from what you save on coffee expenses as part of your budget.

I started talking about coffee and now we have moved on to spending and saving money. That’s the point here. It’s the little things that eat away at your hard-earned income. How many subscriptions do you have to TV services? They will creep up on you, that $5 per month special rate for six months then it goes to $15.

How much are you paying for applications?

Do you pay for the Microsoft suite of applications? How many other apps are you paying for? Most of these are annual subscriptions you pay but the companies keep charging your credit card. It may be time to cut ties with some of these in favor of free stuff. Yes, I said free stuff.

You have to love the new model. A company produces a product on the internet and offers a free version and a pro version. If you stay with the free version great but many tend to upgrade because of offers. Stop. Consider using free Google Drive for storage, or Google Docs instead of a paid app for word processing.

I even use a free accounting system that I have recommended for years overpaying for a monthly subscription to a “popular” application. You can save hundreds of dollars each year by cutting out those apps you really do not need and replacing them with free stuff.

The author has used both brands of drain cleaner and both worked as advertised, they cleaned the drains.

Your car, buy a new one or keep the old one?

Are you considering buying a new car? Time to reconsider. Read the analysis below of holding on to a five-year-old car that is paid off vs buying a new one at $30,000 and financing it.

Let’s break down the costs associated with purchasing a new car:

- Purchase Price: $30,000

- Sales Tax: 8% of $30,000 = $2,400

- Total Cost: $30,000 + $2,400 = $32,400

Now, let’s consider the potential costs of keeping your older car:

- Maintenance and Repairs: While it’s difficult to predict exact costs without knowing the specific condition of your car, you can estimate based on past expenses or industry averages.

- Insurance: Insurance costs for older cars might be lower than those for newer models.

- Lost Value: Your older car continues to depreciate.

Assuming your maintenance and repair costs are reasonable and your insurance savings offset the depreciation, you could potentially save the entire $32,400 by keeping your older car.

However, this is a simplified calculation. Factors such as:

- Reliability: Is your older car reliable enough to meet your needs?

- Safety: Does your older car meet your safety standards?

- Desire for a new car: Do you simply want the features and benefits of a newer model?

I bought a new car every two years

I was the type of person who bought a new car every two years just because I could. Finally, I came to my senses when planning future retirement and decided that this was crazy. I was throwing away thousands of dollars because that new car smelled good and looked good. Why do we do these things? Because we can at least for a while. When hard times hit, we look for ways to reduce our expenses and make ends meet, and that $500 per month car payment just spoils the whole process.

Consider how long it will take for you to keep your older car running versus buying a new one. Recently I had my wife’s car repainted. It is 12 years old with about 90,000 miles and is in excellent condition inside and out. The paint was fading. I spent $2,500 on the paint job. I spend about $500 per year on maintenance for the car on average including tires, brakes, oil changes, transmission changes, etc. Her car looks and works as if it were brand new. We love not having a car payment.

That storage facility

For those of you who have a garage full of “stuff” and I say that instead of “junk”, it’s time to have a sale. List on Facebook Marketplace or Craigs List or have a garage sale. Clear it all out. If you have a storage facility get rid of it. So many people have full storage units of things they don’t need.

The author has eaten both French Frys and they taste good. No difference except in the price.

Those hundreds of dollars per month should be put towards credit card debt or savings. About 14.6 million households use storage facilities. I can tell you stories from friends and relatives of paying storage costs for many many years just to finally sell or dispose of the contents.

Top 10 things people waste money on

- Subscription Services: Many people subscribe to multiple streaming services, gaming platforms, or other services without fully utilizing them.

- Eating Out: Frequent restaurant meals can add up quickly, especially when opting for expensive items or dining out with a group.

- Impulse Purchases: Buying items on a whim without considering their necessity or long-term value can lead to unnecessary spending.

- Brand Loyalty: Paying a premium for branded products can be costly, especially when generic or store-brand alternatives offer similar quality.

- Latte Factor: Small, seemingly insignificant expenses like daily coffee or snacks can accumulate over time.

- Unused Items: Buying items that are rarely used or go unused altogether is a waste of money.

- Cruises and vacations: Reduce the number of cruises and expensive vacations and find other ways to “experience” things

- Fashion Trends: Following fleeting fashion trends can lead to unnecessary purchases that quickly go out of style.

- Gadgets and Tech: The latest gadgets and tech devices can be expensive, and they often become obsolete quickly.

- Expensive Hobbies: Engaging in expensive hobbies or collecting items can drain your finances.

- Keeping Up with the Joneses: Trying to match the lifestyles of others can lead

- Streaming Service: Stop adding more streaming services. You will forget you have them and the services continue to charge your credit card

The Latte Factor

Do you see the “Latte Factor” above? How much money do you spend on these items? I am not suggesting you switch to instant coffee but if you can not afford that expresso matching now, it may be a good short-term way to start budgeting. If you can afford to see a financial advisor that may be a good step for some of you. My younger readers may not have the cash to pay someone to tell them how to stop buying tech gadgets.

Apple just came out with a new iPhone 16. You have an iPhone 15. What do you do? Buy the new one or keep the old one. Apple is offering a generous trade and you can make interest-free monthly payments. After all, you are a great fan of the iPhone. It seems you have two choices, buy the new one or pass and keep using the perfectly good iPhone 15. That credit card is about to melt anyway because of your daily expresso drinks. Do you really need more debt?

That shiny new object

It may be time for you to avoid the next new shiny thing if you really want future success. In a couple of weeks, you will forget about the new iPhone if you pass on it now. Ask yourself, why do you need the new phone? You will possibly use one or two of the new features but is that worth the additional payment? Consider this. Wait for two more years until the iPhone 18 is out. You will have saved enough to buy that phone without a payment. The savings earned interest at that time too.

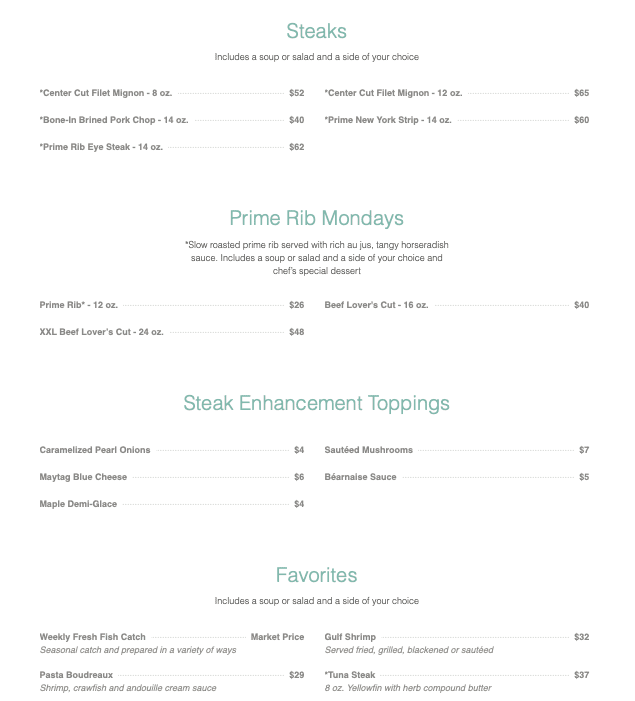

I briefly touched on the tips above. As our list above indicates eating out can be a big drain on your budget. I can testify to that because it is one of my things if you need to eat out for social or other reasons (just to get out of the house), ok? Order water instead of a soft drink. That will save you a few dollars plus the tax and tip.

I switched to water years ago for this reason and found that avoiding even diet soft drinks was better for me. We have also found that several of our favorite restaurants have “happy hour” for both drinks and food.

Order a less expensive item

Sometimes we go to a more expensive restaurant and I will order pasta which is generally less expensive (and I like pasta) than ordering a steak. Avoid ordering lots of sides that you can not finish. Get in the habit of taking food home with you that you can eat the next day. That helps mitigate the cost of the meal. I understand that some of my dining suggestions may seem a bit extreme, particularly for younger people but perhaps it’s time to think out of the box.

You can not give up everything, life should be enjoyable. Just think of “cut back” as a more appropriate way to look at budgeting. Consider your future self looking back 10 years. You will have wished you took some action to increase your savings and reduce your debt. I know people who love to go on cruises. Most are shorter ones but they are expensive. Usually, these people are enticed by offers of free this or that or reduced periods, etc. If you like cruises, save and pay for them. Don’t charge your vacation.

Charging your vacation and paying for it when you are on your next vacation is not a good strategy. When that vacation is over just remember the memories, not the bills each month. It’s harder to save and do things at the same time but it is less stressful. Consider those vacation bills like leftover coffee, distasteful.

Save even more on coffee

Drink black coffee with or without milk it’s even less expensive than home made cappuccino

Your budget and coffee

As I summarize this article, we are back to your budget and coffee. It seems that almost everyone drinks coffee so it’s a universal way to get into a budget discussion. Savings with your coffee can lead to savings in many other areas of your life. An article about budgets is not complete without helping the reader work with a budget. Click the button below to use our budget planning tool. This tool was created for an article about Gen X retirement but it works for everyone. Just save it on your computer and enter the data.

You will soon see how cutting back on coffee will help your budget along with other lifestyle changes. The following are some articles that do not focus on coffee and your budget but are very helpful for creating wealth and financial independence.

Get your Best Free Gen-X retirement budget planning tool-calculator

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.