Last updated on December 8th, 2025 at 12:07 pm

Taxes Made Easy: Start Your Business After Retirement is your go-to guide for understanding how to manage your tax responsibilities when launching a new business in retirement. Starting your own business after retirement can be a rewarding way to stay active, pursue a passion, and supplement your retirement income. But along with this exciting new chapter comes a new set of responsibilities, particularly when it comes to taxes.

In the United States, taxable income from a new business must be reported properly to avoid penalties and ensure compliance with the Internal Revenue Code. Whether you’re receiving Social Security benefits, pension payments, or taking required minimum distributions from traditional IRAs or a qualified retirement plan, your financial situation changes when you begin earning business income. That means your tax liability changes too.

Fear of Taxes

Time to address the elephant in the room. Some people actually fear the IRS, state tax boards, and other government agencies. This is often due to complex regulations, which we will try to explain in simple terms in the article. We have written an entire article about the fear of starting a business after retirement, which includes taxes. Time to clear the air. Please read on.

Common Taxes New Business Owners Must Pay

1. Federal Income Taxes

All business income earned by self-employed individuals is subject to federal income taxes. This includes income from services, products, or consulting—even if you’re receiving retirement savings from a Roth IRA, qualified retirement plan, or other retirement accounts. If your gross income increases significantly, you could move into higher income tax brackets, which might also affect the taxable portion of your Social Security benefits.

💡 Tip: Working with a trusted tax advisor or financial advisor is a great way to understand the tax implications of combining retirement funds with new business startup income.

2. Self-Employment Taxes

Self-employment taxes cover Social Security and Medicare contributions that are normally handled by an employer. If you’re running a sole proprietorship or S corporation, you’ll need to account for this additional tax when planning cash flow.

3. State Income Taxes

Depending on your home state, your state income taxes may vary based on your type of business, earnings, and even your investment products or after-tax contributions. Some states have no income tax at all, while others have complex rules that impact small businesses and self-employed individuals differently.

4. Local Taxes

Cities and counties may impose local taxes on business operations—these can include sales tax, business licenses, or special fees for operating within city limits or offering a service trade.

Tip: You need to incorporate taxes into your budget. They must be planted for just like any other expense. Please read our article about budgeting click here.

Planning Ahead for Tax Efficiency

Understanding the tax implications of your new income streams—whether from mutual funds, retirement assets, or your new business—can help you plan ahead. Using taxable accounts, tracking lump sum payments, and making smart decisions about provisional income and ordinary income rates will affect your net investment income tax and overall tax position for the calendar year.

📌 Note: This article is for informational purposes only. Be sure to seek legal advice or consult tax professionals to understand your specific situation and make the best option choices for your financial institution, defined contribution plan, or life insurance policies.

Smart Tax Planning Tips for Business Owners in Retirement

Once your business idea becomes a reality, smart tax planning can make a big difference in reducing your overall tax burden, especially if you’re also relying on retirement income or retirement assets.

1. Track All Income Sources

Whether you receive income from Social Security benefits, traditional IRAs, Roth IRAs, qualified plans, mutual funds, or your new business, it’s important to track every dollar. Combining these can increase your gross income and push you into higher ordinary income tax rates or result in additional taxes like the net investment income tax.

2. Maximize Available Deductions and Credits

As a small business owner, you may be eligible for a wide range of tax deductions and tax credits. These can include deductions for startup costs, home office expenses, business travel, and even employer contributions to retirement accounts for any family member employees.

Explore deductions available to your type of business—whether it’s an S corporation, C corporation, or sole proprietorship—as well as your state-level tax incentives.

3. Use Retirement Contributions Strategically

Continue funding your retirement account even after retirement. You may still contribute to a Roth IRA or traditional IRA, depending on your income and age. These after-tax contributions or pre-tax contributions can offer valuable tax advantages and help lower your taxable income for the tax year.

💼 Tip: Consult with a financial advisor to determine if contributing to a qualified retirement plan while earning business income makes sense for your specific circumstances.

Why a Tax Advisor Is Essential for Retired Business Owners

A seasoned tax advisor can help you:

- Understand how your retirement funds and business startup earnings interact for tax purposes

- Minimize early withdrawal penalties if you’re tapping into retirement accounts

- Ensure compliance with federal, state, and local taxes

- Estimate quarterly payments to avoid surprises and maintain a steady cash flow

- Choose the right business structure for tax savings

They can also offer investment advice and help you decide if a defined contribution plan, life insurance, or other investment products can enhance your tax strategy.

Retirement and Business Income: How They Affect Each Other

Starting a business while drawing retirement savings introduces complexity, but also opportunity. For example:

- Provisional income, a calculation that determines whether your Social Security benefits are taxable, includes business income, taxable accounts, and half your Social Security. If your provisional income exceeds certain thresholds, up to 85% of your benefits could be taxed.

- Taking large distributions from traditional IRAs or other qualified retirement plans in the same year as earning business income can result in higher income and more taxes owed at ordinary income rates.

- A growing new business can also affect eligibility for certain tax credits, and may change the timing of minimum distributions or cause you to reevaluate your financial situation.

🔎 Before making any big moves, consult with tax professionals and legal advisors who understand how small businesses and retirement income intersect.

Conclusion: Be Proactive, Not Reactive

Starting a business after retirement is a great way to stay financially active—but understanding your tax liability is crucial for long-term success. From federal income taxes to local taxes, knowing what applies to your situation can help you avoid pitfalls and take full advantage of available tax benefits.

Your specific situation deserves a tailored plan. Work with a trusted financial advisor and tax advisor to make sure your personal finances, business income, and retirement savings work together—so you only pay what is truly owed.

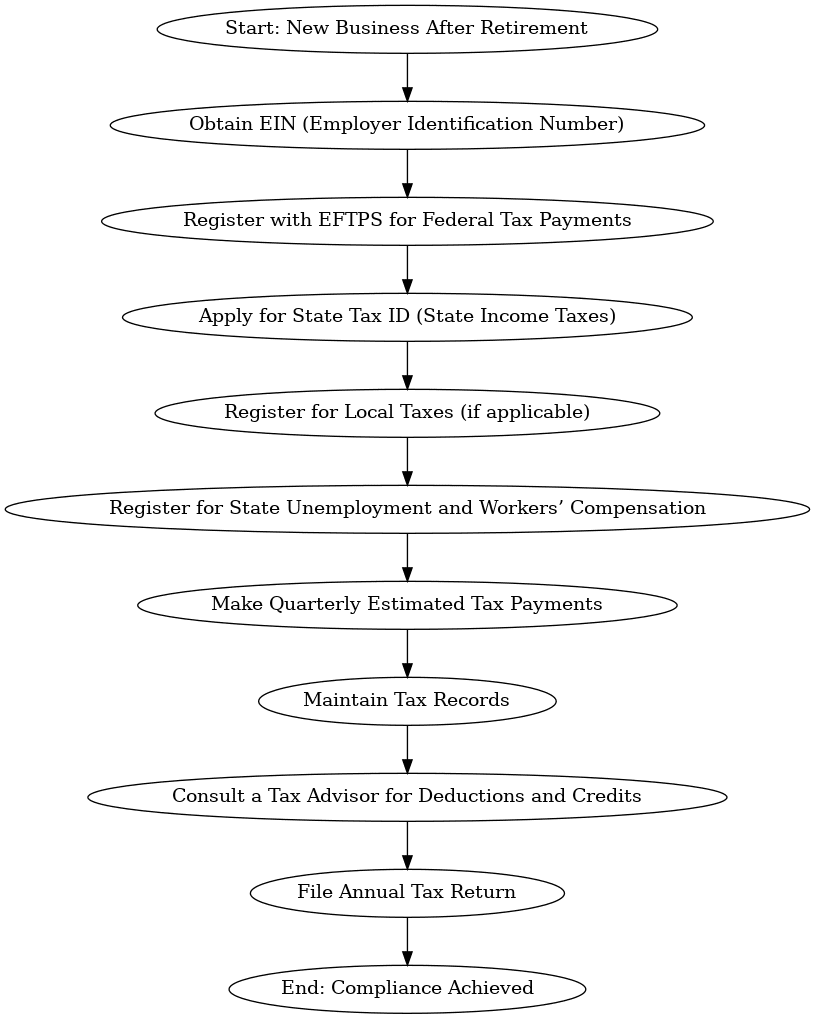

Tax Registration Flow Chart

How to Get Set Up to Pay Federal, State, and Local Taxes for Your New Business

Starting a new business can be an exciting step, but understanding the tax implications is essential to avoid unnecessary tax liability. This guide will help small business owners register for federal income taxes, state income taxes, and local taxes, using Mississippi as an example. Whether you operate a sole proprietorship, an S corporation, or a C corporation, it’s crucial to follow these steps to remain compliant.

🏢 1. Obtain a Federal Tax Identification Number (EIN)

Your business will need a Federal Tax Identification Number (EIN), often referred to as an Employer Identification Number. This is used for reporting taxable income, managing retirement accounts, and making federal tax payments.

✅ How to Apply for an EIN

- Go to the IRS website: Apply for an EIN Online

- Provide your business information and type of business (e.g., sole proprietorship, S corporation, or C corporation).

- You will receive your EIN immediately for tax purposes.

🛡️ 2. Set Up to Pay Federal Taxes

To manage your federal income taxes, register with the Electronic Federal Tax Payment System (EFTPS). The IRS also uses this system to track estimated self-employment taxes and other business income taxes.

✅ How to Register for EFTPS

- Visit the EFTPS website: EFTPS.gov

- Enroll using your EIN and financial institution information.

- Use EFTPS to pay taxes quarterly and avoid additional taxes or early withdrawal penalties.

Tip: Work with a tax advisor to calculate estimated payments and reduce your tax burden.

🌎 3. Obtain a State Tax Identification Number

State income taxes apply to most businesses. In your home state, like Mississippi, you will need to register with the Mississippi Department of Revenue (MDOR) for state taxes.

✅ How to Apply for a Mississippi State Tax ID

- Go to the Mississippi TAP (Taxpayer Access Point)

- Complete the Mississippi Tax Registration Application.

- Provide details about your business startup, cash flow expectations, and ownership structure (S corporation, C corporation, or sole proprietorship).

Note: Be mindful of state level tax credits and deductions you may qualify for to lower your tax liability.

👷 4. Register for State Unemployment and Workers’ Compensation

If you have employees, you must register for State Unemployment Insurance (SUI) and obtain workers’ compensation insurance. Employer contributions are necessary to cover unemployment benefits and ensure compliance with state laws.

✅ State Unemployment Insurance (SUI)

- Register with the Mississippi Department of Employment Security (MDES) at mdes.ms.gov.

- Report your gross income and pay SUI taxes quarterly.

✅ Workers’ Compensation Insurance

- Obtain coverage through a private insurer or the Mississippi Workers’ Compensation Commission (MWCC).

- Visit MWCC for further details.

🏘️ 5. Check for Local Tax Requirements

Local taxes may apply depending on your business location. Check with your city or county for information on local taxes, licenses, and permits.

✅ How to Find Local Requirements

- Contact your city’s tax department to determine applicable local taxes and fees.

- Report taxable income and ensure accurate filings to minimize your tax burden.

Tip: Tax advisors can provide specific advice for your home state’s regulations.

💰 6. Understand Tax Implications and Benefits

Taxable income from your business can impact your personal finances. Federal and state taxes may apply to self-employed individuals and small businesses. Consider the following to optimize your tax savings:

- Tax Credits and Deductions: Maximize deductions for business startup expenses, retirement account contributions, and qualified retirement plans like 401(k)s or traditional IRAs.

- Retirement Savings: Contribute to tax-advantaged accounts like a Roth IRA, which offers tax benefits and grows tax-free.

- Social Security Benefits: Be mindful of how business income can affect your social security benefits and provisional income.

- Investment Products: Consult a financial advisor to explore defined contribution plans, mutual funds, and other retirement funds that offer tax advantages.

- Estimated Taxes: Pay quarterly taxes to avoid penalties and additional taxes at the end of the tax year.

📑 7. Work with a Tax Advisor

A qualified tax advisor or financial advisor can help you understand tax brackets, tax cuts, and capital gains tax rates. They provide personalized tax advice for your specific situation, including minimizing your tax liability.

- S Corporation and C Corporation Structures: Understand the tax implications for your type of business.

- Taxable Accounts and Ordinary Income Tax Rates: Evaluate whether after-tax contributions or traditional IRAs offer the best option.

- Local Taxes and Tax Savings: Ensure compliance with state income taxes and local tax laws.

Note: Legal advice and investment advice from tax professionals can further optimize your financial situation. Read our series of articles about Starting a Business After Retirement

🚀 Summary

Starting a new business is a great way to take control of your financial future. Ensure compliance by obtaining your EIN, registering for state and local taxes, and making timely tax payments. With the right planning, small businesses can reduce their tax burden, maximize tax benefits, and grow their retirement savings.

Need more personalized guidance? Consult a tax advisor or financial advisor for tailored advice on your specific circumstances.

The 2017 Tax Cuts and Jobs Act (TCJA)

introduced several provisions that benefited small business owners by reducing their tax burden and simplifying certain tax processes. The 2017 tax bill provided significant tax savings and simplified compliance for many small businesses. However, some provisions, like the 20% QBI deduction and 100% bonus depreciation. This bill will sunset at the end of 2025 unless Congress reauthorizes it. Contact your congressional representative.

Here are the key ways the TCJA helped small businesses:

✅ 1. 20% Qualified Business Income (QBI) Deduction

- Who it Applies To: Pass-through businesses (sole proprietors, partnerships, LLCs, and S-corporations).

- Benefit: Eligible business owners could deduct up to 20% of their qualified business income from their taxable income.

- Limitations: Income limits applied (starting at $182,100 for single filers and $364,200 for joint filers in 2024), especially for specified service businesses like law, accounting, or consulting.

💡 Example:

A small business owner with $100,000 in qualified business income could deduct $20,000, lowering their taxable income to $80,000.

✅ 2. Lower Corporate Tax Rate

- Who it Applies To: C-corporations.

- Benefit: The corporate tax rate was reduced from a maximum of 35% to a flat 21%.

- Impact: Provided significant savings for incorporated businesses, especially those retaining profits for reinvestment.

✅ 3. Expanded Section 179 Deduction

- Who it Applies To: Businesses that purchase equipment, vehicles, or software.

- Benefit: Allowed businesses to immediately deduct the full purchase price of qualifying assets (up to $1.16 million in 2024).

- Bonus Depreciation: Increased to 100% for qualifying property through 2022, gradually phasing out until 2026.

💡 Example:

If a small business purchased $50,000 worth of machinery, they could deduct the full amount rather than depreciating it over several years.

✅ 4. Increased Bonus Depreciation

- Who it Applies To: Businesses making capital investments.

- Benefit: Bonus depreciation was increased to 100% for qualified property, allowing businesses to write off expenses faster.

✅ 5. Simplified Accounting Methods

- Who it Applies To: Small businesses with average annual gross receipts under $27 million (adjusted for inflation).

- Benefit: More businesses were able to:

- Use the cash method of accounting.

- Avoid inventory accounting rules.

- Be exempt from complex interest deduction limitations.

✅ 6. Limitations on Certain Deductions

While there were benefits, the TCJA also placed limitations on certain deductions:

- State and Local Tax (SALT) Deduction: Capped at $10,000.

- Entertainment Deductions: Entertainment expenses are no longer deductible, though meals remain 50% deductible.

✅ 7. Estate Tax Changes

- Who it Applies To: Family-owned small businesses.

- Benefit: The federal estate tax exemption was doubled to approximately $13.61 million per individual in 2024, reducing concerns about estate taxes when transferring a family business.

TAX FORM USED FOR MULTI-MEMBER LLCS

Understanding Taxation for Small Businesses After Retirement

Starting a small business after retirement can be a rewarding experience, but it’s essential to understand the tax implications involved. Most retirees who start businesses choose to form Limited Liability Companies (LLCs) due to their simplicity and flexibility. While an LLC may generate tax liability, the business itself does not pay federal taxes on its net income or loss. Instead, the income and expenses are passed through to the owners and reported on their individual tax returns.

Filing Taxes as an LLC

For LLCs, the U.S. Internal Revenue Service (IRS) requires the submission of Form 1065, U.S. Return of Partnership Income. This form is used to report the business’s income, deductions, and other financial information. Even if your LLC consists solely of you and your spouse, it is generally treated as a partnership unless elected otherwise.

Understanding the Schedule K-1 Form

After Form 1065 is completed, each owner of the LLC will receive a Schedule K-1 (Form 1065), which details their share of the business’s income, deductions, and credits. The allocation of income and expenses is based on ownership percentages. For example, if you and your spouse own the LLC on a 50/50 basis, each Schedule K-1 will report half of the total income and expenses listed on Form 1065.

The information from Schedule K-1 is then transferred to your personal tax return using Form 1040. You will be responsible for any taxes due based on your share of the LLC’s income.

Taxation for Single-Member LLCs

If you operate as a single-member LLC, the IRS classifies your business as a disregarded entity for tax purposes. This means you will report the LLC’s income and expenses directly on Schedule C (Form 1040) as part of your personal tax return. While Form 1065 and Schedule K-1 are not required for single-member LLCs, you will still be subject to self-employment taxes on the business income.

Subchapter S Corporation Election

Some LLC owners choose to file an election to be taxed as an S Corporation by submitting Form 2553. This election can provide tax advantages, especially if the business generates significant income. Similar to an LLC, S Corporations pass income and expenses to shareholders via a Schedule K-1. However, owners who are actively involved in the business must also be paid a reasonable salary, which is subject to payroll taxes.

Consulting a Tax Professional

Navigating business taxes can be complex, especially when managing multiple forms and tax elections. Consulting with a CPA or tax preparer is highly recommended. They can provide personalized guidance on how to properly file your taxes, maximize deductions, and ensure compliance with IRS regulations.

Starting a business after retirement can bring financial rewards and personal fulfillment. Understanding the taxation process for LLCs will help you manage your responsibilities effectively and keep your finances in order.

The cost of not filing your tax return on time or at all

| Type of Violation | Penalty | Details |

|---|---|---|

| Failure to File | 5% per month | Up to 25% of the unpaid tax. Minimum penalty may apply after 60 days. |

| Failure to Pay | 0.5% per month | Also up to 25% total. Interest continues to accrue until paid in full. |

| Combined Failure to File & Pay | Max 5%/month | Filing penalty reduced by the amount of the paying penalty (usually 4.5% + 0.5%). |

| Underpayment of Estimated Taxes | Varies | Based on the amount underpaid and how long the money was unpaid. |

| Dishonored Check | $25+ | Or 2% of the check amount if over $1,250. |

| Negligence or Substantial Understatement | 20% of underpaid tax | Applies if you don’t make a reasonable attempt to follow tax rules. |

| Civil Fraud | 75% of underpaid tax | For willful intent to evade tax. |

| Criminal Fraud (e.g., tax evasion) | Up to $100,000 fine and 5 years in prison | Must be proven beyond a reasonable doubt. |

| Willful Failure to File (Criminal) | Up to $25,000 fine and 1 year in prison per year not filed | Includes intent to evade. |

| Making a False Statement or Return | Up to 3 years in prison | Includes submitting false documents or misreporting income. |

Accounting for Taxes

Taxes are a significant business expense, and every business that started after retirement needs to account for them in its financial records. Proper tax planning is essential to managing your cash flow and avoiding unexpected tax liabilities.

Whether you operate a sole proprietorship, S corporation, or C corporation, your accounting system should include a Chart of Accounts that lists each type of tax you may owe. These may include:

- Federal Income Taxes

- State Income Taxes

- Local Taxes

- Self-Employment Taxes

- Payroll Taxes (if applicable)

- Sales Tax (if applicable)

Cash vs. Accrual Accounting for Taxes

Depending on your business’s accounting method, taxes are recorded differently:

- Cash Basis Accounting: Taxes are recorded when payments are made. Estimated quarterly tax payments will be recorded as an expense when the payment is sent.

- Accrual Basis Accounting: Taxes are recorded when incurred, not when paid. You will estimate your tax liability and record it as a liability until payment is made.

Recording Estimated Quarterly Tax Payments

Here’s how estimated tax payments would be recorded using a simple double-entry bookkeeping system:

Example 1: Cash Basis Accounting

When a quarterly tax payment is made:

- Debit: Estimated Tax Expense (to record the expense)

- Credit: Cash (to reflect payment)

Journal Entry:

Debit: Estimated Tax Expense $2,000

Credit: Cash $2,000Example 2: Accrual Basis Accounting

When taxes are estimated but not yet paid:

- Debit: Tax Expense (to recognize the liability)

- Credit: Taxes Payable (to establish the liability)

Journal Entry:

Debit: Tax Expense $2,000

Credit: Taxes Payable $2,000When the tax is paid:

- Debit: Taxes Payable (to reduce the liability)

- Credit: Cash (to reflect payment)

Journal Entry:

Debit: Taxes Payable $2,000

Credit: Cash $2,000Summary

Accurately tracking your tax payments and liabilities will ensure smoother tax filing and prevent penalties. Many accounting software platforms like QuickBooks, Xero, or Wave allow you to set up a dedicated chart of accounts for tax expenses. Working with a tax advisor can also help you plan your quarterly payments and stay compliant.

Deadline to File the Extension – Federal Taxes 2024: How to File an IRS Tax Extension and New Due Date

If you’re not ready to file your federal income taxes by April, don’t worry — you can request more time. In this article, we’ll explain the 2024 IRS tax extension process, including:

- The deadline to file a federal tax extension

- How to file IRS Form 4868

- How long the extension lasts

- Important IRS rules you need to know

🗓️ What Is the Deadline to File a Federal Tax Extension for 2024?

The IRS deadline to file a tax extension for your 2024 return is:

📌 April 15, 2025

This is the same date your original tax return and payment are due. Filing an extension gives you more time to file your return — not more time to pay taxes owed. You must still estimate and pay any amount due by April 15 to avoid interest or penalties.

🧾 How to File a Federal Tax Extension (Form 4868)

To get an automatic 6-month extension, you must file IRS Form 4868. You can do this in three easy ways:

✅ 1. File Online via IRS Free File or Tax Software

- Visit IRS Free File to e-file Form 4868

- Use tax software such as TurboTax, H&R Block, or TaxAct

✅ 2. File by Mail

- Download IRS Form 4868 (PDF)

- Mail the completed form to the IRS address listed in the instructions for your state

- Must be postmarked by April 15, 2025

✅ 3. Make a Tax Payment Online

- Pay your estimated taxes via IRS Direct Pay or the Electronic Federal Tax Payment System (EFTPS)

- Select “extension” as the reason for payment

- This counts as a valid extension request — no need to file Form 4868 separately

⏳ How Long Does a Tax Extension Last?

If you file for a 2024 tax extension, the IRS will grant you six additional months to submit your return.

📅 New Tax Return Due Date: October 15, 2025

This extra time can be especially helpful if you’re waiting for missing documents or working with a tax professional.

⚠️ Important IRS Tax Extension Reminders

- An extension gives more time to file, not to pay.

- You must still pay your estimated 2024 taxes by April 15, 2025 to avoid penalties and interest.

- If you’re expecting a refund, there’s no penalty for filing late — but filing an extension helps you stay compliant.

- Special rules may apply for taxpayers living abroad or active-duty military in combat zones.

🔍 Why File a Tax Extension?

You may want to file a tax extension if:

- You haven’t received all your tax documents yet (e.g., K-1, 1099s)

- You need more time to organize deductions or credits

- You’re waiting on a CPA or tax professional to help you file

- You’re experiencing a personal emergency or life event

✅ Summary: 2024 Federal Tax Extension Key Facts

| Requirement | Details |

|---|---|

| Extension Deadline | April 15, 2025 |

| IRS Form | Form 4868 |

| Extension Length | 6 months |

| New Filing Deadline | October 15, 2025 |

| Still Have to Pay? | Yes, by April 15, 2025 |

Need more help with your tax situation? Let us know in the comments or contact a trusted tax professional for personalized advice.

Frequently Asked Questions (FAQs)

1. Do I Need to Pay Taxes on My Business Income After Retirement?

Yes, all business income is taxable, even after retirement. You must report your earnings on your federal and state tax returns.

2. How Will My Business Income Affect My Social Security Benefits?

If you are receiving Social Security benefits, your business income may cause some of your benefits to become taxable. The IRS uses your provisional income to determine this.

3. What Is Provisional Income?

Provisional income includes your adjusted gross income (AGI), tax-exempt interest, and 50% of your Social Security benefits.

4. Can I Deduct Business Expenses?

Yes, small business owners can deduct eligible expenses such as office supplies, marketing, insurance, and business travel.

5. How Do I Report Business Income?

The way you report income depends on your business structure. Sole proprietors typically report income using Schedule C (Form 1040).

6. What Is the Best Business Structure for Tax Purposes?

Choosing between a sole proprietorship, S corporation, or C corporation depends on your financial situation. Consult a tax advisor for personalized guidance.

7. Do I Need to Make Estimated Tax Payments?

Yes, if you expect to owe $1,000 or more in taxes, you must make quarterly estimated tax payments to the IRS.

8. Can I Contribute to Retirement Savings While Running a Business?

Absolutely. You can contribute to a Solo 401(k), SEP IRA, or SIMPLE IRA to maximize tax advantages.

9. What Happens If I Take Early Withdrawals From Retirement Accounts?

Early withdrawals from traditional IRAs and qualified retirement plans before age 59½ may result in a 10% penalty plus income taxes.

10. How Do I Reduce My Tax Liability?

Take advantage of tax deductions, credits, and retirement account contributions. A tax advisor can help you identify additional opportunities.

11. Are There State and Local Taxes I Need to Pay?

Yes, state income taxes and local taxes may apply depending on your business location. Check with your state’s Department of Revenue.

12. How Does a C Corporation Differ from an S Corporation for Taxes?

A C corporation is taxed separately from its owners, while an S corporation passes its income through to shareholders, who report it on their individual tax returns.

13. Can I Hire Family Members to Reduce My Tax Burden?

Yes, hiring family members can provide tax deductions on wages while potentially reducing your taxable income.

14. What Tax Records Should I Keep?

Maintain records of all business expenses, income, bank statements, and receipts for at least three years for IRS audit purposes.

15. Do I Need a Tax Advisor or Financial Advisor?

While it’s possible to manage taxes on your own, a tax advisor or financial advisor can help you maximize tax savings, minimize liabilities, and plan for future expenses.

Want to know more about starting a Business after Retirement? Please go to our site specifically for this, loaded with articles. Click here to become an expert.

Note: Infographics may be used on other blog sites with credit given.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.