Last updated on March 4th, 2025 at 02:28 pm

Starting a business after retirement will usually require an investment. Financing your new business is a critical component you need to put into place during the formation stage. This is part 4 in the RetireCoast “Starting a Business After Retirement” series that RetireCoast has created to help Seniors consider starting a business after retirement. This article assumes that you have decided what type of business you want to start after retirement.

Depending upon the type of business you are starting you may want to avoid the sole proprietorships route. Consider creating an LLC or Subchapter S corporation (C corporation if you want to issue stock). We will cover this in more detail in a future article.

Financial planning in advance of spending any money even for business cards is very important. Remember that business plan we discussed in the first installment of this series The Ultimate Guide to Starting a Business After Retirement. Creating your budget will tell you how much startup capital you will need to fund your new company.

Have enough money to start

Be liberal when determining how much financing you will need. Create that rainy day fund. There is no problem with budgeting for some areas that you are unsure of. Be sure that you will have enough money to meet your clear goals.

Consider potential risks in your financing strategy. This is a good time to run your ideas by a trusted friend or two with some background in business. Perhaps they can point out a financial risk that you have overlooked.

Don’t be too concerned about obtaining a business loan if you need one and your forecast shows you can accommodate the cost of the loan. Sometimes people will avoid a funding source because they think the interest rate is too high.

It’s a tax write-off!

This topic will be covered in other articles in this series but I wanted to bring it up early. You have heard of the term “It’s a tax write-off”. People use this excuse for spending on things that are not necessary for the business. It’s a way to justify their inner pangs for doing something that would otherwise feel wrong.

You decide that you can rent a floor buffer for your cleaning business and spend $100 doing so. The cost of a new one is $800. You do not use floor buffers very often and based on your estimated usage, it would take you three years to do 8 jobs. You think why not buy a buffer instead of renting one? It’s a tax write-off.

That decision may be a good one over time but the decision was based on the faulty premise that buying something because it is a tax write-off is a good thing. It’s not usually. Make all of your financial decisions based on being profitable. Tax write-offs do not generate profit. Virtually everything you spend money on in a business is a tax write off but you have to earn income for something to write off.

Frequently Asked Questions

Q1: What are the best financing options for starting a business after retirement?

The best financing options for retirees include personal savings, small business loans, SBA loans, retirement fund rollovers (ROBS), angel investors, and crowdfunding. Many retirees also use home equity loans or lines of credit (HELOCs) for startup funding.

Q2: Can I use my retirement savings to start a business?

Yes, you can use your 401(k) or IRA through a ROBS (Rollover for Business Startups) plan without paying early withdrawal penalties. However, this option has risks, so consulting a financial advisor is recommended.

Q3: Are there business grants available for retirees?

Yes, retirees may qualify for small business grants, including federal, state, and private grants. Websites like Grants.gov and SBA.gov offer information on available funding.

Q4: What is the best loan for retirees starting a business?

The SBA 7(a) loan and SBA Microloan are excellent options for retirees. Traditional bank loans, credit union business loans, and peer-to-peer lending are also viable choices.

Q5: Is it smart to take a loan to start a business after retirement?

It depends on your financial situation and risk tolerance. If you have a solid business plan and manageable repayment terms, a loan can be a great tool. However, relying solely on debt without a clear repayment strategy can be risky.

Q6: Can I get a business loan with no income?

Yes, but it may be challenging. Lenders often require proof of income or collateral. Alternative options include secured loans, microloans, and loans based on credit score or retirement assets.

Q7: How can I start a business with no money?

You can start a business with no upfront investment by using bootstrapping methods such as offering services, freelancing, dropshipping, or using crowdfunding platforms like Kickstarter or GoFundMe.

Q8: Do banks lend money to retirees for starting a business?

Yes, banks provide small business loans to retirees if they have a strong credit score, collateral, or business plan. Some banks also offer special financing options for older entrepreneurs.

Q9: What are alternative ways to finance a business in retirement?

Alternatives include business partnerships, angel investors, venture capital, crowdfunding, seller financing, and leasing equipment instead of purchasing.

Q10: How do I decide which financing option is right for me?

Consider factors like risk tolerance, loan repayment ability, interest rates, and personal financial security. Consulting a financial advisor or SBA business counselor can help guide your decision.

Make financial decisions based on sound principals

The way to consider buying the buffer is by looking at the time it takes to drive to the hardware store to rent the buffer and the time to return it. Time is money and you should always value your time. Work out the numbers on paper or a computer. If your time is considered and the possibility that with a buffer you could increase your output, well then buy the buffer. Analyze first then buy or avoid buying.

Take emotions out of your financial decisions if you want to become successful. It’s ok to pay taxes, if you are successful, you will be a big-time tax payer. Taxes provide defense, police, libraries, etc. We will get more into this in the article about taxes. Never pay more than you must by law. Never pay less than you owe.

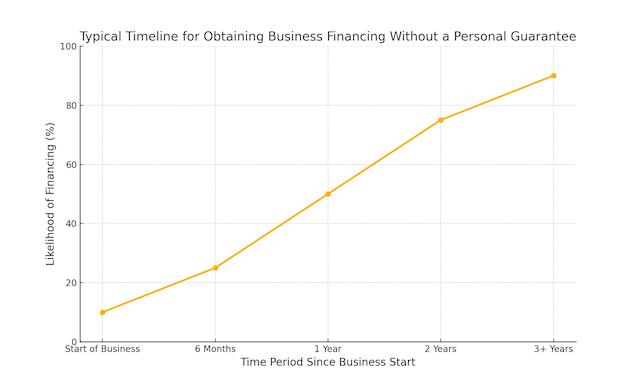

New businesses have limited access to financing

In starting a new business after you retire, your financial resources will be somewhat limited to only those lenders who will take our personal credit profile into consideration. Don’t expect business financing using your business as the secured party until you have been in business for years.

It took about three years before I could lease trucks and buildings in the name of the business and up to eight years before everything else went from my name into the company name.

Many business startups use retirement savings, their Roth IRA or other retirement funds to get started. The following is a list of potential financing options should you not have secured what you need to start your business at this point:

Funding a new business after retirement can involve a mix of personal and conventional sources of capital. Prospective business owners need to consider the following:

Sources of financing capital

Personal Sources

- Savings

- Personal savings accounts.

- Emergency funds, if appropriate.

- Retirement Accounts

- 401(k): Use a ROBS (Rollover for Business Startups) plan to avoid early withdrawal penalties.

- Traditional or Roth IRA: Withdrawals may be subject to taxes and penalties depending on the account type and age.

- SEP IRA/SIMPLE IRA: Self-employed retirement accounts that may have restrictions.

- Home Equity

- Home equity loans or lines of credit (HELOC).

- Liquidation of Assets

- Selling stocks, bonds, or other investments.

- Downsizing or selling real estate.

- Inheritance

- Funds received from family estates.

- Cash Value of Life Insurance

- Borrowing against or withdrawing cash value from whole life or universal life insurance policies.

- Pensions or Annuities

- A portion of these income streams will be used to fund the business.

Conventional Sources

- Small Business Loans

- SBA Loans: Backed by the Small Business Administration, offering favorable terms.

- Traditional bank loans.

- Business Credit Cards

- Useful for managing short-term expenses and cash flow.

- Lines of Credit

- Offered by banks or credit unions.

- Vendor Financing

- Agreements with suppliers to delay payments.

- Equipment Financing

- Loans or leases specifically for purchasing equipment.

Alternative Sources

- Crowdfunding

- Platforms like Kickstarter, Indiegogo, or GoFundMe.

- Angel Investors

- Individuals willing to invest in exchange for equity or returns.

- Venture Capital

- Rare for small retirement businesses but possible for innovative ideas.

- Peer-to-Peer Lending

- Platforms like LendingClub or Prosper for personal or business loans.

- Grants

- Targeted grants for small businesses, often industry-specific or for veteran, minority, or female entrepreneurs.

- Franchise Financing

- If starting a franchise, some companies offer in-house financing.

Family and Friends

- Borrowing from or entering partnerships with family or friends. Formal agreements are essential to protect relationships.

Income Streams

- Part-Time Work

- Supplementing initial capital with income from consulting, freelancing, or a part-time job. Self-financing.

- Social Security

- Excess income from Social Security payments is used if applicable.

Key Considerations

- Evaluate the risk of using personal funds, especially retirement savings, to ensure long-term financial security.

- Diversify funding sources to minimize reliance on a single stream.

- Consult financial advisors or accountants to weigh tax implications and penalties for using retirement funds.

This mix of sources allows flexibility and aligns with various financial situations retirees may face when starting a business.

Considering that the failure rate for small business startups is high, it would be prudent for you to tap only a portion of critical retirement funds. Some businesses need little capital and you can possibly fund your enterprise without outside capital. Your startup costs may be small enough that your individual retirement account can manage the amount.

If you are starting a business that will take tens of thousands of dollars, it’s best that you seek that capital from 3rd parties such as those listed above. Using other people’s money is smart when the interest rate you pay can be easily overcome by the profit you will make in the business. Using other people’s money reduces your personal risk.

Business Credit Cards

I want to relate my own experience with business credit cards to help fund the business. First, let’s discuss what a real business credit card is vs a personal credit card:

Difference Between a Business Credit Card and a Personal Credit Card

When starting a new business, understanding the differences between a business credit card and a personal credit card is essential for managing finances effectively.

1. Reporting to Credit Agencies

- Personal Credit Cards: Activity is reported directly to the three major consumer credit reporting agencies—Experian, Equifax, and TransUnion.

- Impact: A high balance or high credit utilization ratio (balance vs. credit limit) can negatively affect your personal credit score, even if you make payments on time.

- This makes personal credit cards less desirable for funding business expenses, especially if you plan to carry a balance.

- Business Credit Cards: Typically, they do not report to personal credit reporting agencies unless the account defaults or the card issuer explicitly states otherwise.

- Impact: A high balance on a business credit card generally won’t harm your personal credit score, allowing you to manage business expenses without affecting your personal credit utilization.

- Some issuers report to business credit bureaus (like Dun & Bradstreet), helping build the business’s credit profile over time.

2. Issuance and Responsibility

- Business Credit Card:

- Issued in the name of the business but often requires the business owner to provide a personal guarantee.

- Startups and small businesses, particularly those without an established credit history, must rely on the owner’s personal credit to qualify.

- If the business cannot pay, the owner becomes personally liable for the debt.

- Personal Credit Card:

- Issued based solely on the individual’s personal credit history and does not involve a business guarantee.

3. Features and Benefits

- Business Credit Cards:

- Designed specifically for business use, offering perks like higher spending limits, cashback, or rewards tailored to business expenses (e.g., office supplies, travel, shipping).

- Many cards provide expense management tools, such as detailed spending reports and the ability to issue cards to employees with customizable spending limits.

- Offers tax-friendly benefits, such as itemized reports to simplify tracking and deduction of business expenses.

- Help with financing of your business giving critical cash flow coverage.

- Personal Credit Cards:

- Rewards and benefits are aimed at personal use, such as cashback on groceries, gas, or entertainment.

- May not provide tools for managing business expenses efficiently.

4. Liability and Legal Separation

- Business Credit Cards:

- Help maintain financial separation between personal and business expenses, a critical factor for legal and tax purposes.

- While the business itself is the primary account holder, personal liability remains if the business lacks a credit history or defaults.

- Personal Credit Cards:

- Using a personal card for business expenses can blur the line between personal and business finances, complicating tax filings and limiting liability protection.

5. Building Business Credit

- Using a business credit card responsibly can help your business establish its own credit profile, improving its ability to secure loans, lines of credit, or better terms from suppliers.

- Personal credit cards do not contribute to business credit history.

Key Takeaways

- A business credit card shields your personal credit score from fluctuations caused by high business expenses, as it doesn’t report activity to personal credit agencies.

- However, most startups must rely on the owner’s personal creditworthiness to obtain one, requiring a personal guarantee.

- While a business card helps establish credit for the business and keeps finances separate, it’s crucial to manage it responsibly, as personal liability still exists in case of default.

Now for my personal experience. Many years ago, I started a corporation and applied for an American Express business credit card. There are some key reasons for deciding on American Express they are as follows:

Using an American Express business credit card offers several advantages that can make it a smart choice for a business. Here’s why businesses often opt for American Express cards, especially those with no preset spending limit:

1. No Preset Spending Limit

- Flexibility for Business Growth: A card with no preset credit limit adjusts based on your spending patterns, financials, and credit history, giving businesses the flexibility to manage larger or fluctuating expenses.

- Eases Cash Flow Management: This feature is particularly beneficial for businesses with high upfront costs, seasonal spending, or irregular revenue streams.

2. Build Business Credit

- American Express reports business activity to commercial credit bureaus, helping establish and build your business’s credit profile.

- Responsible usage can improve your company’s ability to secure financing or better terms in the future.

3. Generous Rewards and Perks

- Tailored Rewards: Many American Express business cards offer cashback or points specifically aligned with common business expenses (e.g., travel, advertising, office supplies).

- Travel Benefits: Cards often include perks like airport lounge access, travel insurance, and discounted rates on flights or hotels.

- Membership Rewards Program: Points earned can be redeemed for travel, gift cards, merchandise, or statement credits, providing additional value to the business.

4. Enhanced Expense Management

- Employee Cards: American Express allows you to issue additional cards to employees with customizable spending limits, enabling better control over team expenses.

- Detailed Reports: Provides robust expense tracking tools and end-of-year summaries to simplify accounting and tax preparation.

5. Superior Customer Support

- American Express is known for its exceptional customer service, offering 24/7 support for business owners.

- Access to dispute resolution services, fraud protection, and extended warranties adds an extra layer of security and peace of mind.

6. Exclusive Benefits

- Partner Discounts: Many American Express cards come with discounts or offers on services commonly used by businesses, such as shipping, advertising, software, and travel.

- Purchase Protections: Includes features like extended warranty coverage, purchase protection, and return protection.

7. Prestige and Trust

- American Express is widely recognized as a premium credit card provider, and using one can enhance your business’s image and credibility with vendors and clients.

Considerations

- Full Balance Payment: Many American Express business cards, especially those with no preset limit, require you to pay the balance in full each month. This ensures you’re not accumulating long-term debt but requires disciplined cash flow management.

- Acceptance: While widely accepted, some small vendors may not take American Express due to higher processing fees.

Why I prefer American Express

Over time, the amount that I needed to fund my business continued to grow. There were times when I needed to charge more than $30,000 for a single transaction. The first time this happened, I called the company and told them what I was doing. This opened the door for approval.

Incidentally, I am not being paid to say anything about American Express. So let me tell you how critical American Express was to my business success.

I invested $10,000 in my new business startup. After about six years, our monthly charges on the American Express credit card exceeded $250,000. Their terms are net 30 days. We always paid their bill on time. The key here is that we were able to be paid often by our clients before we had to pay American Express.

The credit card provided liquidity at zero interest

This situation gave us liquidity. In effect for a period of about 15 years, we carried a balance with American Express of about $200,000 per month and paid zero interest for the use of their money.

This free loan saved my company about $350,000 over the time we used the American Express Card. And now for the even better icing on the cake.

I earned millions of points and my wife and I used to take at least two trips to Europe each year flying first class. The value of each ticket was about $3000. I personally saved thousands using American Express points.

I recommend that any new small business owner acquire a true business credit card immediately. A friend who started a small handyman business was using his personal credit cards to buy supplies.

When he went to buy a house, it was difficult because of the high balances on his cards. He followed my recommendation and obtained two business credit cards and now those high balances do not show up on his personal credit reports.

What will I need to present to a lender for a loan?

Obtaining a loan from a bank or other lender is a time-consuming process. New business owners must jump some hurdles to get a loan from any established banking institution. The Small Business Administration is a good start.

To obtain an SBA loan, you will need to approach a financial institution that works with the SBA. The SBA does not actually loan funds, they provide backup to the lending institution if you fail to make payments. The following is a list of things you will need for any loan and also for an SBA loan.

Applying for a loan

Obtaining a business loan from a lender or the Small Business Administration (SBA) requires careful preparation. Here’s a list of essential items and documents a new business owner will typically need to apply:

1. Business Plan

- Executive summary

- Description of your business

- Market analysis

- Marketing and sales strategies

- Operational structure

- Financial projections (income, expenses, and profitability)

2. Financial Documents

- Personal and business financial statements

- Personal and business tax returns (usually the last two to three years, if applicable)

- Current balance sheet

- Income statement (profit and loss statement)

- Cash flow projections (typically for 12-24 months)

- A budget outlining the loan’s intended use

3. Loan Application Form

- Specific to the lender or SBA program

- Include detailed information about the loan amount and purpose

4. Collateral

- Description of assets you can pledge as collateral (real estate, equipment, inventory, or other assets)

5. Credit History

- Personal credit report

- Business credit report (if applicable)

6. Proof of Business Registration and Legitimacy

- Business licenses or permits

- Articles of incorporation (for LLCs or corporations)

- Partnership agreement (if applicable)

- Doing Business As (DBA) certificate (if using a trade name)

7. Employer Identification Number (EIN)

- Issued by the IRS for tax purposes

8. Resumes of Business Owners

- Demonstrates relevant experience, skills, or qualifications

9. Legal Documents

- Lease agreements (if your business operates in a leased location)

- Franchise agreements (if applicable)

- Contracts with suppliers or customers

10. Proof of Identity

- Government-issued photo identification for each business owner

11. Equity Injection

- Proof of personal investment or owner contributions to the business (often required for SBA loans)

12. Debt Schedule

- List of existing business debts (if any), including loan amounts, creditors, terms, and monthly payments

13. SBA-Specific Documents (if applying for an SBA loan)

- SBA Form 1919: Borrower Information Form

- SBA Form 413: Personal Financial Statement

- SBA Form 912: Statement of Personal History (if applicable)

- SBA-specific eligibility questionnaires

14. Market Research

- Evidence of your industry’s growth potential and your business’s competitive position

- Show how the financing will help your business grow

15. Other Supporting Documents

- Bank statements (usually the last 6-12 months)

- Insurance policies (e.g., business liability, property insurance)

- Tax returns showing you have paid taxes with nothing due

By organizing these documents and items, you can increase the likelihood of loan approval and demonstrate that you’ve thoroughly planned your business and its finances. If applying for an SBA loan, be prepared to work with an SBA-approved lender and comply with additional requirements.

After many years of being in business, the company was on a continuous growth curve. More and more clients had net 60-day terms which required the company to use profits to finance receivables. It was necessary after 15 years in business to seek outside funding.

Banks will ask if they can help when you are established

The business bank had in recent years been asking if they could be of assistance and offered the SBA program. Funny how this happens. When you first start it’s very hard to obtain funding as a business. After you are a proven entity, they will flock to you.

The Ultimate Guide to Starting a Business After RetirementWe finally obtained an SBA loan. It was not too difficult because our bank knew us and had much of the data they needed. The loan was secured and our receivable issues were solved.

Granted, we had to pay interest something we had not paid in 15 years but our new pricing reflected the cost of money. Not long after, I sold the company as part of my long-term exit strategy also discussed at https://retirecoast.com/the-ultimate-guide-to-starting-a-business-after-retirement.

Your business bank accounts

After forming your business, it’s important to open a business bank account. You should open both checking and savings accounts. When shopping for a financial institution there are a number of factors to consider.

Do not just open an account because you have your personal account at a bank. Not all financial institutions are equal when it comes to support for small businesses.

For my large corporation, we used a local bank for the reasons listed below. For my current business on the Mississippi Gulf Coast, I use a combination of two local credit unions and American Express Bank. Obtaining a business VISA or MasterCard is important.

Be sure that the institution offering the business credit card is actually offering a real business card. There are some cards out there that have a business name on them but they report to the credit reporting agencies.

It’s nice when you have a credit card with the same bank that you have a checking and savings with. Often the credit card can act as a backup in case you need to write a check without funds. Also, the same bank may give you a line of credit. Check out the following:

Choosing a financial institution

This is a comprehensive list of items to consider when choosing a financial institution for opening a new business account, along with the differences between credit unions, traditional brick-and-mortar banks, and American Express Bank:

Key Factors to Consider:

- Business Account Features:

- Monthly Fees: Are there monthly maintenance fees, and can they be waived (e.g., with a minimum balance)?

- Transaction Limits: Does the account limit the number of free transactions (deposits, withdrawals, transfers)?

- Online Banking: Do they offer robust online and mobile banking features, including bill pay and mobile check deposits?

- Integration: Can the account integrate with accounting software like QuickBooks?

- Access to Credit Products:

- Business Credit Cards: Are business credit cards available? Look for features like rewards, cash back, or 0% introductory APR.

- Lines of Credit: Do they offer flexible lines of credit to support cash flow?

- Loans: Are SBA loans or other business loans available for new businesses to help with financing?

- Deposit and Interest Options:

- Certificates of Deposit (CDs): Are business CDs available, and what are their interest rates?

- Interest on Checking/Savings Accounts: Do they offer competitive rates for interest-bearing accounts?

- Payment Services:

- ACH Payments: Can you send ACH payments to creditors and receive ACH transfers from clients? What are the fees?

- Wire Transfers: Are domestic and international wire transfers supported? What are the costs?

- Funds Availability Policies:

- Holds on Deposited Funds: How long are funds held before becoming available? Are there expedited options for large checks?

- Customer Service and Support:

- Is there a dedicated relationship manager or business banking team for personalized support?

- What are the hours and accessibility of support (e.g., 24/7 phone or chat support)?

- Physical vs. Digital Access:

- Are there local branches or ATMs available? If not, how robust are their digital banking tools?

- Fees and Costs:

- Look for fees associated with overdrafts, wire transfers, excess transactions, and cash deposits.

- Compare overall costs with the level of service provided.

Differences Between Financial Institutions:

- Credit Union:

- Pros:

- Often offer lower fees and higher interest rates on deposits.

- Personalized service and a community-focused approach.

- May offer business credit cards and lines of credit, though options may be more limited.

- Tend to have flexible terms for loans, including SBA loans.

- Cons:

- Limited branch locations and ATMs.

- May have fewer advanced digital tools.

- ACH & Loans: Credit unions often support ACH payments and deposits. They typically cater to small business loans, including SBA programs.

- Pros:

- Brick-and-Mortar Banks:

- Pros:

- Full-service options, including business credit cards, lines of credit, loans, CDs, and SBA loans.

- Wide branch and ATM networks.

- Often provide advanced technology and financial management tools.

- Cons:

- Tend to have higher fees and stricter requirements for loans and credit products.

- Larger banks may lack personalized service.

- ACH & Loans: Most major banks allow ACH payments and deposits, often with more automation options. SBA loans are widely available.

- Pros:

- American Express Bank:

- Pros:

- Known for business credit cards with excellent rewards and flexible terms.

- High-yield savings accounts and CDs with competitive rates.

- Advanced online tools and customer service tailored to businesses.

- Cons:

- Limited to online banking; no branches or ATMs.

- May not offer traditional checking accounts or loans (e.g., SBA loans).

- ACH & Loans: ACH services are supported for credit card payments and other transactions, but business loans are not their primary focus.

- Pros:

Questions to Ask Each Institution:

- Do you offer business credit cards? What rewards and benefits are included?

- Can I open a line of credit or get a loan for a new business?

- What are your interest rates for savings accounts, checking accounts, and CDs?

- What are the fees for ACH payments, wire transfers, and other transactions?

- What is your policy on fund holds for large deposits?

- Do you provide SBA loans, and what are the eligibility criteria?

By carefully considering these factors and evaluating the differences between credit unions, banks, and institutions like American Express Bank, you can select the financial institution that best aligns with your business needs.

Structure of lending for Small business

I have mentioned the idea that you should not be too concerned about the interest rate you are paying if you are making money on the loaned funds. This is mostly true however, you must obtain the lowest interest rate while at the same time receiving the best loan terms. Loan terms are as if not more important than the interest rate.

For example, most banks and financial institutions that offer lending for businesses offer it at a variable interest rate. Some offer credit on interest-only terms with a balloon payment in X years. The amortization rate for the average long-term business loan is usually not more than 20 years.

Remember the length of the loan term means the lower the payment the higher the total interest paid over the course of the loan. Some lenders have an early termination fee. If you borrow X dollars for a term of five years and pay it off in two years there may be a penalty.

Loans that are rolled into new loans are usually exempt from early termination fees. As a reminder, you will probably have to sign a personal guarantee to borrow funds for your business. If you live in a community property state, your spouse may be required to sign also.

More on lending terms and conditions:

When a new business seeks financing, it’s essential to understand the various loan terms, repayment structures, and associated costs. Here’s a breakdown of loan terms and considerations:

Loan Terms for New Business Financing

- Repayment Structures:

- Interest-Only Payments:

- Borrowers pay only the interest on the loan for a specified period (e.g., the first 1–5 years).

- Principal repayment begins after the interest-only period ends, often resulting in higher payments later.

- Useful for businesses needing lower initial cash outflows during a startup phase.

- Balloon Payments:

- Borrowers make smaller regular payments (covering interest or partial principal) throughout the loan term.

- A large, one-time payment (“balloon payment”) is due at the end of the loan term.

- Suitable for businesses expecting significant cash flow in the future or planning to refinance.

- Fully Amortized Loans:

- Equal periodic payments that cover both interest and principal over the loan term.

- Payments gradually reduce the principal, ensuring the loan is fully paid off by the end of the term.

- Short-Term Loans:

- Typically have a term of 1–3 years.

- Higher monthly payments due to the condensed repayment period.

- Often used for immediate, smaller capital needs.

- Interest-Only Payments:

- Loan Terms Specific to Business Loans:

- Amortization Period:

- Often shorter than typical home mortgages (e.g., 5–10 years instead of 15–30 years).

- Shorter terms result in higher monthly payments but lower total interest paid.

- Adjustable vs. Fixed Rates:

- Adjustable-rate loans may have lower initial rates but can increase over time.

- Fixed-rate loans provide stability, at the same rate throughout the term.

- Amortization Period:

- Specialized Loan Types:

- SBA Loans:

- Loan terms vary based on the program (e.g., SBA 7(a) loans can go up to 25 years for real estate, and 10 years for equipment or working capital).

- May offer competitive rates but requires extensive documentation and processing time.

- Equipment Financing:

- The loan term typically matches the useful life of the equipment being financed (e.g., 5–7 years).

- Working Capital Loans:

- Short-term loans meant to cover operational expenses, often repaid within 1–3 years.

- SBA Loans:

Costs Involved in Obtaining a Loan

- Origination Fees:

- A percentage of the loan amount (e.g., 1–3%) charged for processing the loan.

- Deducted from the loan proceeds or added to the loan balance.

- Underwriting Fees:

- Covers the lender’s cost to evaluate creditworthiness and risk.

- Application Fees:

- Upfront fees for applying, regardless of whether the loan is approved.

- Closing Costs:

- Fees for legal documentation, credit checks, and other administrative expenses.

- May include title insurance, lien filings, or appraisals if the loan is secured by collateral.

- Loan Guarantee Fees (for SBA Loans):

- SBA charges a fee for guaranteeing part of the loan, typically 2–3% of the guaranteed portion.

- Collateral Appraisal Fees:

- If the loan is secured, an appraisal of the collateral (e.g., real estate, equipment) may be required.

Early Payment Penalties

- Prepayment Penalties:

- Charged if the loan is paid off before the agreed term.

- Typically calculated as a percentage of the remaining loan balance or a set amount based on time (e.g., 3% in year 1, 2% in year 2, and 1% in year 3).

- Designed to protect the lender’s expected interest income.

- Lockout Period:

- Some loans prohibit early repayment for a specified period (e.g., the first 2 years).

Key Considerations for New Businesses

- Affordability:

- Assess cash flow to ensure the business can handle payments, especially for interest-only or balloon loans.

- Flexibility:

- Look for loans with minimal restrictions on early repayment and reasonable prepayment penalties.

- Collateral Requirements:

- Determine whether personal or business assets need to be pledged.

- Loan Costs:

- Factor in origination fees, closing costs, and other expenses when evaluating the true cost of the loan.

Understanding these terms and costs will help ensure a new business secures the right financing without unnecessary financial strain.

Investment Strategy – Cash Management

You wonder why we included this section about investment strategy. Simple, you may have funds that will be used in the business but are at this point in the form of cash. If you invested for example $50,000 into your business, why let that sit in a checking account? The same goes for funds from financing activities.

At the minimum transfer working capital to a money market account. At the time of this writing, large brokerage companies are paying over 4%. Remember, money has to work for a living.

Another reason for opening at least an interest-paying savings account is to transfer funds you will have to pay on taxable income next quarter into the account. Never, never, never borrow money from the government. Make quarterly deposits if you are not paying taxes elsewhere. More on this in another article where we discuss taxes in more detail.

Getting Paid

You will want to accept credit cards if you have a retail business or you simply want to get paid sooner. The following is a guide on how to get started accepting clients’/customers’ credit cards. Most people do not write checks anymore. Businesses take credit cards or use a cash application on the phone:

To accept credit cards as a small business, there are two main approaches: integrating a payment processor directly into your website or using a separate service like Stripe. Here’s how each option works:

1. Using Your Website to Accept Credit Cards

Overview

This option involves integrating a payment gateway directly into your website. The payment gateway acts as the bridge between your customer, your business, and the credit card companies.

How It Works

- Payment Gateway Integration: You integrate a payment gateway like PayPal, Square, or Stripe into your website. Many website builders (e.g., WordPress, Shopify, Wix) offer plugins for this.

- Checkout Process: Customers enter their credit card details directly on your website during checkout.

- Data Encryption: The payment gateway encrypts the card details and securely sends them to the payment processor for validation.

- Transaction Approval: The payment processor verifies the card information with the issuing bank. If approved, the payment is completed.

- Funds Transfer: The gateway deposits the funds into your business account, minus a processing fee (typically 2.9% + $0.30 per transaction).

Advantages

- Seamless integration with your brand.

- Customers stay on your website during checkout, enhancing trust.

Considerations

- Requires SSL certificates for security.

- You may need developer assistance for setup.

- Ongoing fees include processing rates and possible subscription costs for the payment gateway.

2. Using a Separate Service like Stripe

Overview

Stripe is a comprehensive payment processing platform that allows you to accept credit cards without complex website integrations. It offers APIs for advanced users and pre-built options for those without coding expertise.

How It Works

- Account Setup: Create a Stripe account and link your business bank account.

- Integration Options:

- Use pre-built checkout pages hosted by Stripe.

- Embed a payment button or integrate Stripe’s API into your website.

- Payment Processing:

- Stripe handles all backend processes, including data encryption, card verification, and fund settlement.

- Customers can pay via a secure Stripe-hosted page if they use their hosted checkout.

- Funds Transfer: Stripe deposits the payment into your account (typically within 2–7 business days), deducting the processing fee (2.9% + $0.30 per transaction).

Advantages

- Easy setup with minimal technical requirements.

- Transparent pricing with no hidden fees.

- Supports various payment methods, including Apple Pay, Google Pay, and international cards.

Considerations

- Customers might leave your website to complete payment on Stripe’s hosted page (optional).

- You still need to ensure your website is secure if integrating Stripe directly.

Key Differences

| Feature | Website Integration | Stripe or Separate Service |

|---|---|---|

| Ease of Use | May require technical setup | User-friendly, minimal setup |

| Customer Experience | Seamless on-site checkout | Hosted or embedded options |

| Flexibility | Customizable for branding | Offers APIs for customization |

| Cost | Varies by gateway | Standard fee: 2.9% + $0.30 |

Final Tips

- Start Simple: For small businesses just starting, Stripe’s hosted checkout or similar services (e.g., PayPal) can be an excellent choice due to ease of use.

- Focus on Security: Always use SSL/TLS certificates and comply with PCI DSS (Payment Card Industry Data Security Standards).

- Scalability: If you plan to scale your business, ensure the payment solution can handle increased traffic and transaction volume.

This setup ensures your small business can start accepting credit cards efficiently, enhancing customer convenience and boosting sales.

Getting paid by cash application

Your bank can offer one of several cash applications that you use your mobile phone to activate. You can receive or send funds in cash in smaller amounts, there are limits e.g. $500.00. The following is a description of how these services work:

Small businesses can leverage cash transfer applications like Cash App, Venmo, and Zelle to simplify payment processes, reduce costs, and improve customer convenience. Here’s how these apps work for businesses:

1. What Are Cash Transfer Applications?

Cash transfer apps are digital platforms that allow users to send and receive money quickly and securely using mobile devices. These apps are commonly used for peer-to-peer payments but can also be adapted for small business transactions.

Popular apps include:

- Cash App

- Venmo for Business

- Zelle

- PayPal

2. How Small Businesses Can Use Cash Transfer Apps

a. Accepting Payments

- Setup: Create a business account or dedicated profile for your business within the app. This keeps transactions organized and separates personal and business finances.

- Payment Requests: Share your username or QR code with customers for quick payments.

- Transaction Process: Customers can pay by sending money directly to your business account through the app.

- Receipts: Most apps allow you to include a note for the payment or generate basic receipts.

b. Selling Products or Services

- In-Person Sales: Accept payments on-site by having customers scan your QR code or input your business handle.

- Online Sales: Provide your payment details during checkout on your website or social media platforms.

- Invoice Integration: Some apps, like Cash App, offer features to send digital invoices to customers for formal payment requests.

c. Payroll and Expense Management

- Paying Contractors: Use the app to pay freelancers, vendors, or contractors for their services.

- Splitting Expenses: Easily split business-related costs with partners or collaborators.

3. Advantages of Using Cash Transfer Apps

- Ease of Use:

- Minimal setup requirements.

- User-friendly interfaces that customers already trust.

- Fast Transactions:

- Payments are typically instant or processed within one business day.

- Low or No Fees:

- Some apps charge no fees for basic transactions between individuals.

- Business accounts may incur small fees (e.g., Cash App charges 2.75% per transaction for business payments).

- Convenience:

- Apps work on mobile devices, making it easy for small businesses without dedicated point-of-sale systems to accept payments.

- Integrated Marketing:

- Apps like Venmo allow customers to share payments publicly, effectively promoting your business through word of mouth.

4. Key Considerations for Businesses

- Payment Limits:

- Apps may limit daily or monthly transaction amounts.

- For example, Cash App has a sending limit of $7,500 per week (which can be increased with verification).

- Tax Reporting:

- Apps now report business transactions over $600 to the IRS due to updated tax laws.

- Security:

- Use two-factor authentication and monitor transactions regularly to protect your account.

- Lack of Features:

- These apps may not offer advanced point-of-sale features or inventory tracking.

- Pair with other tools or systems if you need robust reporting or CRM capabilities.

5. Best Practices for Businesses

- Use a Business Account: Apps like Venmo and Cash App have specific business account options with added features like analytics and customer tagging.

- Communicate Clearly: Display your payment handle and QR code prominently in your store, on your website, or on invoices.

- Combine with Other Payment Methods: While cash transfer apps are convenient, they offer alternatives like credit card processing or PayPal to reach a broader customer base.

- Track Transactions: Regularly download transaction histories for bookkeeping and tax purposes.

Conclusion

Cash transfer apps provide small businesses with a low-cost, accessible way to accept payments and streamline financial transactions. They are particularly well-suited for service providers, freelancers, small retailers, and businesses with modest payment processing needs. By adopting these tools, small businesses can improve cash flow and provide a modern, convenient payment experience for their customers.

Dont leave funds in your checking account

Try not to leave more than you need in your checking account when you can earn interest in a money market account. There are bills you need to pay once per quarter or once per year. It’s a good idea to transfer amounts monthly or weekly into the savings account to pay these periodic bills. This way you will not be blindsided with a large expense.

One last thing before I wrap up this article. You will need to potentially create a new retirement plan based on how your new business changes things. If it evolves into a financial success, then you are in effect no longer retired. All of the hard work you put into your new business will without a doubt require some reevaluation of your plans for the future.

Click on the button below to read other articles in our series: Starting a Business After Retirement

Starting a new business after retirement, consider the Mississippi Gulf Coast. According to Swoop Funding, Mississippi is the #4 best state to start a business.

Disclaimer

As always with RetireCoast.com your use of this information is your decision. What we provide here is a guide to helping you make decisions. We are not responsible for the outcome of those decisions. Of course, we do what we can to ensure the information we communicate is accurate but things change over time.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.