Credit card debt can feel like a weight you carry every single day. The good news? With the right plan, you can pay it off faster than you think — and save thousands in interest along the way.

This guide walks you through proven strategies, free tools, and mindset shifts to help you become debt-free — and stay that way.

Why Paying Off Credit Cards Matters

- High interest eats your income. Most cards charge 18–30% APR. Balances grow fast if you only make minimum payments.

- Debt slows your goals. Whether you want to buy a home, invest, or just breathe easier, credit card debt holds you back.

- Peace of mind. Life without revolving debt means freedom, confidence, and control over your money.

No program works without dedication. You must first accept responsibility for your debt — and commit to fixing it. Don’t cut up your cards; that can hurt your credit utilization ratio (the percentage of available credit you’re using). Instead, learn to control your spending.

This article — and the free payoff tools linked below — will help you create and stick to a plan. You should also read our companion guide on the best ways to use credit cards so you’ll know how to turn credit from a burden into a benefit once your balances are gone.

Step 1: Take Inventory of Your Debt

Most people underestimate what they owe. Gather every card and list:

- Balance

- APR (interest rate)

- Minimum payment

- Credit limit

- Rewards or perks

👉 Tip: Log in to each card’s website or app — don’t rely on memory.

Want help? Use our Credit Card Manager + Payoff Simulator to enter your cards and see totals, interest, and payoff projections.

Step 2: Pick Your Payoff Strategy

Two proven methods work:

Avalanche Method (fastest, saves the most money)

- Pay the minimum on every card.

- Put all extra money toward the card with the highest APR.

- After it’s gone, move to the next-highest APR.

Snowball Method (best for motivation)

- Pay the minimum on every card.

- Put all extra money toward the card with the smallest balance.

- Once it’s gone, roll that payment into the next balance.

👉 Avalanche = maximum savings. Snowball = maximum motivation. Choose the one you’ll stick with.

Step 3: Lower the Cost of Your Debt

While paying down balances, look for ways to reduce interest:

- 0% Balance Transfer Offers — Move debt to a card with 12–18 months no interest. Pay as much as you can during the promo period.

- Debt Consolidation Loan — Combine cards into a single lower-rate loan.

- Call Your Issuer — Ask for a lower APR; loyal customers often get reductions.

Pro tip: Use our simulator to calculate which cards cost you the most. Pay those down first, then put them away in a safe place. Don’t close the accounts — just keep them open by charging a small purchase occasionally and paying it off right away.

Balance Transfer Savings Calculator

Compare staying with your current APR vs. moving to a 0% promo card. Includes transfer fee and break-even analysis.

Enter your details and click “Calculate Savings” to see if a 0% balance transfer beats staying on your current card.

Step 3a: Contact Your Credit Card Company for Help

If you’re struggling to make payments, call your issuer. Many credit card companies offer hardship programs that reduce interest, waive fees, or lower minimums for a time. These programs are free — you don’t need to hire a third party.

👉 Always reach out before you miss a payment. Issuers prefer to work with you rather than risk default, and being proactive helps protect your credit score.

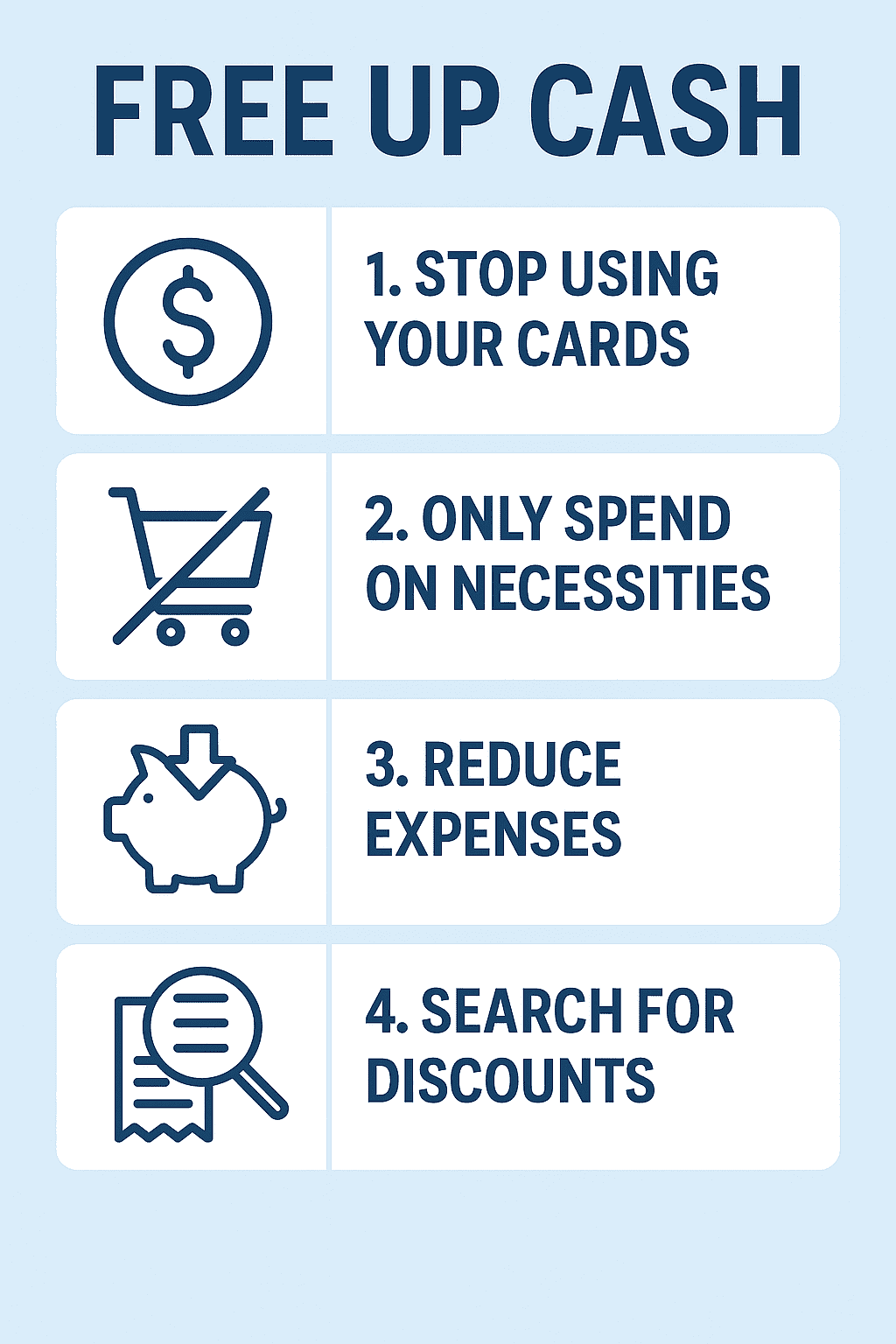

Step 4: Free Up Extra Cash

To make real progress, you’ll need more than minimum payments:

- Trim subscriptions and extras — Cancel services you don’t need daily.

- Sell unused items — Furniture, electronics, and clothing can bring quick cash.

- Boost income temporarily — Side jobs or overtime can cut years off your payoff timeline.

- Apply windfalls — Send tax refunds or bonuses straight to your highest-priority card.

Step 5: Stop Adding New Debt

Most payoff plans fail because people keep swiping. Until you’re in control:

- Use debit or cash for everyday spending.

- Remove saved cards from online shopping accounts.

- Keep one low-interest card for true emergencies only.

Watch for hidden leaks. Many people have forgotten about automatic charges hitting their cards. Review the last six months of statements and cancel anything you don’t truly need (not just want). Redirect those dollars to your payoff plan.

Step 6: Track Your Progress

- Update your spreadsheet or simulator each month.

- Celebrate when a card hits $0.

- Share your plan with a partner or friend for accountability.

Motivation compounds, just like interest.

Step 7: Build Habits for Life After Debt

Once balances are gone, stay debt-free:

- Pay in full every month.

- Keep utilization under 30% (10% is even better).

- Use cards strategically for rewards, never for lifestyle upgrades.

- Set up autopay to avoid late payments.

Credit Fix / Debt Relief Companies

You may see ads for “fast” credit fixes or debt settlement. Be cautious:

- Many charge high fees to do things you can do yourself.

- You’ll hand over sensitive personal data like your SSN and bank info.

- Some ask you to stop paying credit cards, which hurts your credit and can trigger lawsuits.

👉 Safer option: use the free resources below or contact your card issuer directly.

Tools That Can Help You

- Budget apps like YNAB, Mint, or EveryDollar.

- Debt payoff calculators — start with our free

Credit Card Interest Tracker & Payoff Simulator

Enter your cards to see current monthly interest, then simulate Avalanche or Snowball and watch interest drop over time.

Line shows total interest charged each month. Dashed line shows total balance trend.

What to Do With the Money You Save

<div style=”border:2px solid #3b82f6; padding:16px; border-radius:12px; background:#eff6ff; margin:24px 0;”> <strong>What do you do with the savings after paying down your credit cards?</strong><br> As your credit card debt declines, transfer those freed-up dollars into a <em>Roth IRA</em>. Completely turn around your financial situation — from <em>paying interest</em> to <em>earning interest</em>. </div>

FAQ: Getting Help and Staying Debt-Free

1. Does calling my credit card company hurt my credit score?

No. Asking for lower rates or hardship help does not affect your score. Missing payments does.2. What is a credit card hardship program?

A free, temporary plan from your issuer to reduce interest, lower payments, or waive fees.3. Is debt settlement a good idea?

Usually no. It costs fees, hurts your credit, and often requires missed payments.4. How can I get professional help with credit card debt?

Contact a nonprofit credit counseling agency for a debt management plan (DMP).5. Will paying off my cards hurt my credit score?

No. It improves utilization. Keep accounts open with a $0 balance for maximum benefit.6. Should I close old credit cards once they’re paid off?

Usually no. Keep them open and occasionally active to protect credit history and utilization.7. What’s better: avalanche or snowball?

Avalanche saves money, snowball builds momentum. The best is the one you’ll stick to.8. How long will it take to pay off my debt?

Depends on balances, APRs, and extra payments. Use our simulator for your exact timeline.9. Can I negotiate my credit card debt on my own?

Yes. Call your issuer directly for lower rates or settlements. Avoid high-fee third parties.10. What should I do once my credit cards are paid off?

Redirect those payments into savings or a Roth IRA to build long-term wealth.References for Free Help

- Federal Trade Commission (FTC) – Coping with Debt

- National Foundation for Credit Counseling (NFCC)

- Consumer Financial Protection Bureau (CFPB) – Managing Credit Card Debt

- Financial Counseling Association of America (FCAA)

These organizations provide free or low-cost credit counseling, debt management plans, and educational resources. Always start with trusted nonprofit sources before considering paid services.

Final Thoughts

Paying off credit cards isn’t just math — it’s a mindset. You need commitment, discipline, and a plan. The strategies above give you the roadmap. Our free simulator shows your progress. The rest is up to you.

Start today: list your balances, choose your strategy, and make that first extra payment. In six months, you’ll already see the difference. In a few years, you could be debt-free for good. We hope our article on how to pay off credit cards provided some help for you.

Related Articles in This Series

Want to explore the full picture of home buying costs, benefits, and smart mortgage decisions? Check out the rest of our series:

- How Much Are Closing Costs? A Buyer’s Guide in 2025 — Learn what to expect at the closing table and how much you’ll need to budget.

- What Are the Tax Benefits of Owning a Home in 2025? — Understand deductions, exemptions, and long-term tax savings for homeowners.

- Should I Refinance My Mortgage in 2025–2026? — Find out when refinancing makes sense, how much you could save, and potential pitfalls to avoid.

- The Complete Guide to Home Buying Costs, Tax Benefits, and Mortgage Readiness — Our comprehensive pillar article that ties everything together.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.