Last updated on August 16th, 2025 at 04:23 am

2025 is here; it’s time to start creating an income tax strategy for 2025. The purpose of this article is to help you reduce your taxable income and take advantage of the lower Federal Income Tax Brackets. Many seniors over age 65 have retirement accounts that consist of traditional IRAs and/or holdover workplace retirement plans. It’s time you work on deleting your taxable retirement savings accounts.

Great News

The 2025 “One Big Beautiful Bill Act” increased your standard deduction

The 401(k) and the IRA were designed for people with earned income who were making regular contributions during their working life. Your regular IRA contributions probably stopped when you retired. Now you are faced with paying federal income taxes on funds you withdraw from those retirement plan contributions you made years ago.

It’s time to plan a sensible program to make scheduled withdrawals over time to reduce the income tax you pay on what you do withdraw.

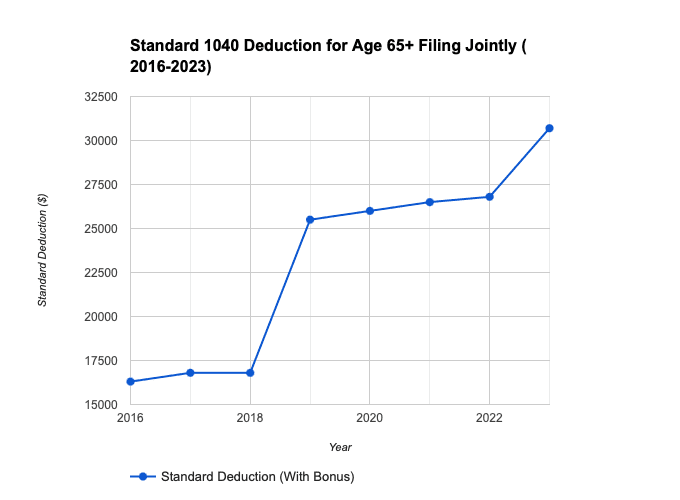

Congress gave you a bonus in 2017

Fortunately, Congress gave you a bonus in 2017 when the new tax reform law went into effect. The good news is that the One Big Beautiful Bill Act, passed in 2025, takes the standard deduction to new heights. $23,750 for a single person and $46,700 for a married couple.

The tax laws now make it easy to stop keeping track of receipts for donations and other expenses. Most seniors will not have sufficient deductions to exceed the standard deduction amount of $46,700 for married couples in 2025. The IRS added the 1040-SR to make it easier for those who no longer need to file an itemized return

High-income earners, those seniors with a huge amount of income from their investments, may want to file their income tax returns on the standard 1040 form. This article is, however, written for the majority of seniors who, for the coming year, will not have deductions exceeding the standard deduction amount.

Read our companion article about filing your 2024 tax return

If you have not filed your taxes for the year 2024 when you read this, I suggest that you read our article about filing Seniors’ Taxes. This article was created to help you prepare your 2024 1040-SR tax return form. When you have completed that form and sent it to the IRS, you will need it to help with your new tax strategy planning discussed here.

Your previous year’s tax return is very important for planning for the following year, which is 2025. The Internal Revenue Service will change some things, such as tax rate, income limits, and other aspects of completing the tax year 2024 form, which may also be changed. Tax planning can be done with some assumptions about where the IRS will be with their new tax tables for 2024. The differences between calendar year 2023 and 2024 should be minor.

Let’s get the Roth IRA out of the way. You will not pay taxes on funds removed from a Roth IRA account as long as you follow the rules. This means it is not taxable and irrelevant to our discussion, except that we strongly encourage you to use the Roth IRA to move any assets from your Traditional IRA up to the IRS maximum contribution limits.

Married couples can contribute $16,000 to a Roth IRA

The maximum contribution limit for a Roth IRA is $7,000 per year per person in 2024, plus an additional catch-up contribution of $1,000 for anyone 50. A total of $8,000. A married couple filing jointly can save as much as $16,000. An added benefit is available for anyone with a business.

If, for example, you rent apartments or houses, create a business such as an LLC. At this point, you can become an employee of the LLC, and then the LLC can permit you to save up to $8,000, plus the LLC can make a sizable contribution to the Roth IRA also.

Our plan will involve, as I mentioned above, a method to withdraw funds from your taxable retirement accounts at the least cost in taxes to you based upon your tax situation. I mentioned the benefits of the high standard deduction, which is good, but the tax code also created a 12% tax bracket and eliminated the 15% tax bracket.

2024 Federal Income Tax Brackets

| Filing Status | Taxable Income | Tax Rate |

|---|---|---|

| Single Filers | Up to $11,600 | 10% |

| $11,601 – $47,150 | 12% | |

| $47,151 – $100,525 | 22% | |

| $100,526 – $191,950 | 24% | |

| $191,951 – $364,200 | 32% | |

| $364,201 – $609,350 | 35% | |

| $609,351 and above | 37% | |

| Married Filing Jointly | Up to $23,200 | 10% |

| $23,201 – $94,300 | 12% | |

| $94,301 – $201,050 | 22% | |

| $201,051 – $383,900 | 24% | |

| $383,901 – $578,125 | 32% | |

| $578,126 – $731,200 | 35% | |

| $731,201 and above | 37% | |

| Heads of Household | Up to $16,550 | 10% |

| $16,551 – $63,100 | 12% | |

| $63,101 – $100,500 | 22% | |

| $100,501 – $191,950 | 24% | |

| $191,951 – $364,200 | 32% | |

| $364,201 – $578,125 | 35% | |

| $578,126 and above | 37% |

Tax brackets go from 10% to 12% then 22%

The tax benefits that can accrue due to this change in the tax provisions can help you stay at the lower 10% or jump to a still-low 12% before going off the cliff of a 22% tax bracket.

Congress passed an extension of the 2017 Tax Bill

Not only were most provisions made permanent some were increased

Current rules require that anyone having a birthday after April of the year in which they turn 72 must make minimum distributions from their taxable retirement accounts if they are no longer employed and contributing to the plans.

The good news is that we are ahead of this requirement by working through a tax strategy that considers this distribution. Since you have to remove funds anyway at age 73, the more you remove in the earlier years from age 65 to age 72, the less you will be required to remove.

Example of calculation for RMD at age 72+

To calculate the RMD for a 74-year-old with a $200,000 IRA, we need to consider the following:

- Life expectancy factor: According to the IRS Uniform Lifetime Table for 2023, the life expectancy factor for a 74-year-old is 14.3.

- Withdrawal formula: The RMD is calculated by dividing your account balance (as of December 31) by your life expectancy factor.

Therefore, for this example:

RMD = Account balance / Life expectancy factor RMD = $200,000 / 14.3 RMD ≈ $13,993

This means the 74-year-old with a $200,000 IRA must withdraw at least $13,993 from their IRA by December 31st of the current year.

Visit the IRS life expectancy chart here. The calculation is very simple, as shown above. Just look at the correct table for your circumstances e.g., “single life expectancy, Appendix B”. Use the life expectancy number and perform the calculation as shown above.

You want to remove as much as possible from the IRA and 401(k), but not more than you can afford to lose through federal taxes you must pay. Incidentally, while we are focused on tax strategies based primarily on federal taxes, you may be subject to state and even local taxes. For example, California requires that you subject your IRA and 401(k) withdrawals to state taxes.

Some states charge income tax on retirement income

This is not the case where I live in Mississippi and many other states that do not charge income tax on retirement accounts. Part of your tax strategies may be a relocation to a lower-cost state, one where the state does not tax retirement income. You may want to read this article on our site about that topic.

The video that is embedded in this article goes through the process of how to work out the ideal tax scenario for your situation. The spreadsheet that is used in the video is part two of a two-part video series on

Senior tax returns for 2023 can be found at the end of the article. Just click the button (Social Security Benefits Worksheet 2023) to download it to your computer. To make the process of calculating how much you can withdraw from your IRA without paying taxes (or an amount of taxes you can afford), we have included a video on this page.

Use our example spreadsheet and video

We have created an example for you that involves a fictitious couple, Sally and Paul Jones. They are filing jointly for purposes of our video and our sample spreadsheets. Single filers are not left out; they just need to follow the instructions for completing Form 1040-SR and use the correct tax tables to determine their tax liability if any.

You should read our article about completing the 2025 IRS Form 1040-SR and the accompanying video (also included here at the bottom of this article) that takes you through all of the steps in the process to complete your return. This article is a companion to “Seniors’ Income Tax 2023: Deductions and how to file them.”

To reiterate, we are not concerned with tax deductions in this exercise because we are using the large standard deduction. Approximately 22 million people are eligible to file the 1040-SR form for the year 2023. This is the group that our article is focused on. We want to help you lower that tax bill through some good planning.

2025, your year to plan

Next year, 2025, you can file using our suggestions. During 2025, run the calculations and determine, using the 2024 tax return, what, if any, tax burden you will have at the end of the year. If it looks like you will not earn enough to pay federal income taxes, withdraw the maximum funds from your taxable IRA or 401 (k).

Invest those funds in a Roth IRA or other investments such as a brokerage account, real estate, and other vehicles that will produce income for you. In addition to creating a strategy to drain your IRA, you need equally good investment strategies. Seek out an investment advisor if you feel you need assistance.

When you are thinking of selling investments in your IRA, consider the tax consequences of the various investments. If you hold the investments for at least 12 months, you will be subject to long-term capital gains tax, which is lower than the taxes paid on investments sold in less than 12 months, considered ordinary income. Good planning will give you one year to work out the equities you may want to hold on to for a few months to let them “age” before you sell.

If you are still employed, some strategies may not apply

Check out the Investment Advisor Association; this is the only association of investment advisors that promotes the fiduciary concept. Fiduciaries are paid by the client and never earn income from 3rd parties for the decisions they make for their clients. Most other advisors work at no charge to you except that they earn commissions from the investments they make, putting them at a potential conflict of interest with their clients.

If 2024 is the first year you will take Social Security, calculate the benefit and enter it in our spreadsheet. Another reason to use our tools is to determine the amount of income taxes you will pay if you decide to work. While we blasted past line 1a, the W-2 form, you may need to use it.

This will change the calculations for you. Be sure to insert the amount of federal income taxes that were paid to the IRS for you by your employer. This is done on line 25a. A reminder, as long as you are still employed you can contribute to an IRA or a 401(k) even after age 72. Check the IRA contribution limit at the IRS website.

Use our tools to determine if it makes sense for you to work based on the added taxes you will pay if your total gross income pushes you to the 22% or higher tax bracket. I know we focused on withdrawing funds from your IRA as a basic strategy but those who are working and receiving a W-2 may earn too much for this strategy to work well at that time.

Sure, here is the graph:

Deductions are not what they were

Perhaps you are working a few hours per month and you have reached the 12% or 22% tax bracket, you may still want to take a look at the top of the bracket. If, for example, your income just pushed you into the 12% tax bracket, you can still remove funds from your IRA until you reach the top of the bracket.

A word about deductions. Many people deducted a qualified charitable distribution in the past. This may not be an enticement now because of the large standard deduction. It’s a matter of rethinking your reason for making donations.

“It’s a write-off!”

Everyone used to say, “It’s a write-off”. That is saying no is no longer valid for most 1040-SR filers. It’s time to rethink your finances. Charitable organizations, those that are 501(c)(3) organizations, can give you a receipt for a tax deduction. Your decision now must be to donate because you feel the need to do so, but not because it is a tax “write-off”. After all, that’s no longer the case for most seniors.

The IRS provided a personal exemption in the past, which went away in 2018. There is only one basic deduction now for individuals, and that is the standard deduction. There is a child tax credit available for providing care to dependents if you qualify.

Most of the credits went away, as did some deductions, even if you file an itemized return. Before 2018, you could deduct all of the state and local income and property taxes you paid. A $10,000 limit was added to the law in 2018, pushing many into filing using the standard deduction. Without a very big tax deduction, which for some could have been North of $20,000 per year, including all taxes, there is no longer any need to file the itemized deduction form A.

Steps to reduce Income taxes after age 64

- Complete your 2024 Federal Income Tax return using 1040-SR

- Use the Social Security Worksheet 2024 below to determine the maximum income before paying the tax

- Experiment with the worksheet to determine how much you want to remove from your IRA before paying taxes.

- Practice with various IRA deduction amounts to reach the tax bracket you feel comfortable with, e.g., 10%, 12%, or 22%

- Determine your mandatory withdrawal from IRA (birthday after April at age 72, then the next year)

- Compare the mandatory withdrawal to the amount you would like to remove from your IRA If it is less than your target, make note of this.

- If you are not yet subject to mandatory withdrawal, make a note of the amount you will withdraw from your IRA after using the spreadsheet.

- It’s time to determine where you will invest the funds that you remove. Subtract the amount from the maximum Roth IRA contribution amount of $16,000 for seniors over age 65 filing a joint return.

- Put the first $16,000 into the Roth IRA

- Deduct income taxes from any balance over $16,000 and, sometime during the year, make a deposit to the IRS.

- Put any balance into another type of investment.

- Check your state tax liability using the numbers in the spreadsheet and any worksheet provided on your state’s website. You will have to deduct sufficient funds from the proceeds to pay your state income taxes.

Please leave comments and return often to RetireCoast.com. Sign up to be notified of other articles created by RetireCoast.com

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.